Dental Adhesive Market by Application (Denture, Pit & Fissure, Restorative), Denture Adhesive (Cream ,Powder), End-Use (Dental Hospitals & Clinics, Dental Academic & Research Institutes, Laboratories), and Region - Global Forecast to 2022

Dental Adhesive Market was valued at USD 1.82 Billion in 2016 and is projected to reach USD 2.57 Billion by 2022, at a CAGR of 6.02% during the forecast period.The scope of the report includes adhesives and sealants used in dental industry and dentistry applications. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

Objectives of the Study:

- To define, segment, and project the global dental adhesive market, in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To define, describe, and forecast the market based on application, denture adhesives, and end-use

- To analyze and forecast the market size, with respect to five main regions (along with their respective key countries), namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments such as capacity expansions, new product launches, alliances, expansions, joint ventures, and mergers & acquisitions in the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape of the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the dental adhesive market, and to estimate the size of various other dependent submarkets. The research study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, and Securities and Exchange Commission (SEC), among other government and private websites, to identify and collect information useful for a technical, market-oriented, and commercial study of the dental adhesive market.

To know about the assumptions considered for the study, download the pdf brochure

The dental adhesive market has a diversified and established ecosystem of upstream players, such as raw material suppliers, and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations. Key players operational in the market include Dentsply Sirona (US), 3M (US), KURARAY NORITAKE DENTAL (Japan), P&G (US), GSK (UK), and Tokuyama Dental Corp. (Japan).

Key Target Audience:

- Manufacturers of Dental adhesives

- Raw Material Suppliers

- Traders, Distributors, and Suppliers of Dental adhesives

- Government & Regional Agencies and Research Organizations

- Investment Research Firms

Scope of the Report:

The global dental adhesive market has been covered in detail in this report. Current market demand and forecasts have also been included to provide a comprehensive market scenario.

Dental Adhesive Market, By Application:

- Denture Adhesives

- Pit & Fissure Sealants

- Restorative Adhesives

- Others

Dental Adhesive Market, By Denture Adhesive:

- Cream/Paste

- Powder

- Others

Dental Adhesive Market, By End Use:

- Dental Hospitals & Clinics

- Dental Academic & Research Institutes

- Laboratories

Dental Adhesive Market, By Region:

- APAC

- North America

- Europe

- Middle East & Africa

- South America

The market has been further analyzed for key countries in each of these regions.

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the company. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the market based on denture adhesive and application

Company Information:

- Detailed analysis and profiles of additional market players

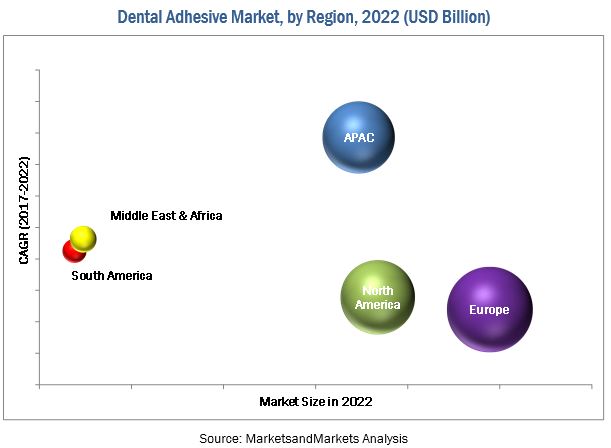

The increasing demand for dental adhesives across various end-use markets is driving the market growth. In terms of value, the global market size is estimated at USD 1.92 Billion in 2017 and is projected to reach USD 2.57 Billion by 2022, at a CAGR of 6.02% between 2017 and 2022. Note: The scope of the report includes adhesives and sealants used in dental industry and dentistry applications. Europe accounts for a major share of the overall dental adhesive market; major factors driving the growth in this region include the rising geriatric population, growing government expenditure on oral healthcare across Europe, and higher reimbursement rates for dental procedures in Europe as compared to other regions.

The dental hospitals & clinics segment is projected to be the largest and fastest-growing end-use segment of the dental adhesive market during the forecast period. Increasing dental tourism forms a major revenue pocket for hospitals & clinics in countries such as South Korea, Brazil, Hungary, China, and India. As compared to other regions, these countries have a large number of private clinics than public clinics and are known for their low treatment costs; they also have a large number of qualified dentists.

The pit & fissure sealants segment of the dental adhesive market accounts for the largest share of the overall market. The major drivers of pit & fissure sealants segment are improper food habits, young generation (age group 16 to 26 years) being more aware about dental care, and high buzz of oral care campaigns by governments and companies. Some of the major restraints of this market are low dental hygiene quotient in adults in age group of 30 to 40 years and high treatment costs in North American and European countries.

Europe is the largest market for dental adhesives. The increasing use of dental adhesives in the dental hospitals & clinics as well as dental academic & research institutes is expected to provide new growth opportunities to the market. With a large geriatric population in the region, the demand for various dental procedures and dental adhesives is expected to increase in Europe in the coming years. Moreover, Europe is the region of origin of implant dentistry; therefore, the penetration rate of dental adhesives is very high in this region.

However, the high prices of dental care treatments are expected to restrain the growth of the dental adhesive market during the forecast period.

Key manufacturers of dental adhesives include Dentsply Sirona (US), 3M (US), KURARAY NORITAKE DENTAL (Japan), P&G (US), GSK (UK), and Tokuyama Dental Corp. (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

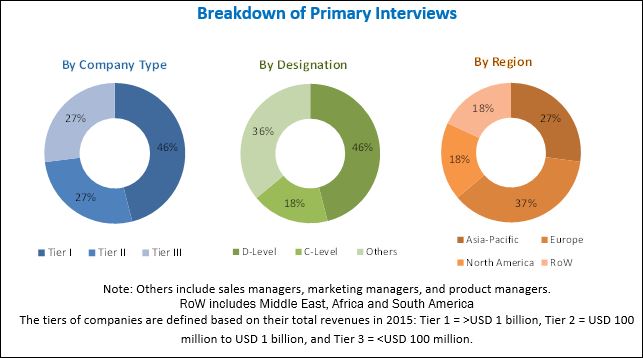

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

3.1 Introduction

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities for Market Players

4.2 Market, By Application

4.3 Market, By End User and Country in APAC

4.4 Market, By Country

4.5 Market, Developed vs Developing Countries

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Population, Income Level, and Health Awareness

5.2.1.2 Growing Dental Tourism in Emerging Markets

5.2.1.3 High Dmft Index in Developing Countries

5.2.1.4 Rising Demand for Cosmetic Dental Treatment

5.2.2 Restraints

5.2.2.1 High Cost of Dental Care Treatments

5.2.2.2 Shortage of Dental Professionals

5.2.3 Opportunities

5.2.3.1 Advancement in Dental Adhesive Systems and Procedures

5.2.3.2 Low Penetration Rate of Dentistry in Emerging Countries

5.2.3.3 Demography Influence in Dental Market

5.2.4 Challenges

5.2.4.1 Stringent and Time-Consuming Regulatory Policies

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

5.4 Patents in the Dental Adhesives Industry

5.4.1 Introduction

5.4.2 Details of Patents Registered Between 2016 and 2017*

5.5 Macroeconomic Overview and Key Trends

5.5.1 Introduction

5.5.2 Trends and Forecast of GDP

5.5.2.1 Economic Outlook of the US

5.5.2.2 Economic Outlook of Germany

5.5.2.3 Economic Outlook of China

5.5.2.4 Economic Outlook of India

6 Dental Adhesive Market, By Adhesive Type (Page No. - 45)

6.1 Introduction

6.2 Classification of Dental Adhesive Systems By Generation

6.3 Classification of Dental Adhesive Systems By Etching Technique

6.3.1 Total-Etch

6.3.2 Self-Etch

6.3.3 Selective Etch

7 Dental Adhesive Market, By Application (Page No. - 48)

7.1 Introduction

7.2 Denture Adhesives

7.3 Pit & Fissure Sealants

7.4 Restorative Adhesives

7.5 Other Applications

8 Dental Adhesive Market, By Denture Adhesive Type (Page No. - 55)

8.1 Introduction

8.1.1 Denture Adhesive Cream Or Paste

8.1.2 Denture Adhesive Powder

8.1.3 Other Denture Adhesives

9 Dental Adhesive Market, By End User (Page No. - 60)

9.1 Introduction

9.2 Dental Hospitals & Clinics

9.3 Dental Academic & Research Institutes

9.4 Laboratories

10 Dental Adhesive Market, By Region (Page No. - 67)

10.1 Introduction

10.2 North America

10.2.1 North American Dental Adhesive Market, By Application

10.2.2 North American Market, By Denture Adhesives

10.2.3 North American Market, By End User

10.2.4 North American Market, By Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3 Europe

10.3.1 European Dental Adhesive Market, By Application

10.3.2 European Market, By Denture Adhesives

10.3.3 European Market, By End User

10.3.4 European Market, By Country

10.3.4.1 Germany

10.3.4.2 Italy

10.3.4.3 Spain

10.3.4.4 France

10.3.4.5 UK

10.3.4.6 Rest of Europe

10.4 APAC

10.4.1 APAC Dental Adhesive Market, By Application

10.4.2 APAC Market, By Denture Adhesive

10.4.3 APAC Market, By End User

10.4.4 APAC Market, By Country

10.4.4.1 China

10.4.4.2 India

10.4.4.3 Japan

10.4.4.4 South Korea

10.4.4.5 Rest of APAC

10.5 South America

10.5.1 South American Dental Adhesive Market, By Application

10.5.2 South American Market, By Denture Adhesive

10.5.3 South American Market, By End User

10.5.4 South American Market, By Country

10.5.4.1 Brazil

10.5.4.2 Rest of South America

10.6 Middle East & Africa

10.6.1 Middle East & African Dental Adhesive Market, By Application

10.6.2 Middle East & African Market, By Denture Adhesive

10.6.3 Middle East & African Market, By End User

10.6.4 Middle East & African Market, By Country

10.6.4.1 Saudi Arabia

10.6.4.2 UAE

10.6.4.3 South Africa

10.6.4.4 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 104)

11.1 Introduction

11.2 Market Ranking of Key Players

11.3 Competitive Scenario

11.3.1 New Product Launch

11.3.2 Merger & Acquisition

12 Company Profiles (Page No. - 107)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 Dentsply Sirona Inc.

12.2 3M Company

12.3 Procter & Gamble Co. (P&G)

12.4 Glaxosmithkline PLC (GSK)

12.5 Ultradent Products, Inc.

12.6 Danaher Corporation

12.7 Ivoclar Vivadent AG

12.8 Tokuyama Dental Corporation Inc.

12.9 Voco GmbH

12.10 GC Corporation

12.11 Other Key Companies

12.11.1 Kuraray Noritake Dental Inc.

12.11.2 Dentaid

12.11.3 ICPA Health

12.11.4 Sun Medical Co., Ltd.

12.11.5 Mediclus Co. Ltd.

12.11.6 Detax GmbH & Co. Kg

12.11.7 Bisco Dental Products, Inc.

12.11.8 DMP

12.11.9 Pentron Clinical

12.11.10 Shofu Dental Corporation

12.11.11 Pulpdent Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 129)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (77 Tables)

Table 1 Dental Adhesives & Sealants: Market Snapshot

Table 2 Trends and Forecast of Real GDP, Annual Percentage Change

Table 3 US: Economic Outlook

Table 4 Germany: Economic Outlook

Table 5 China: Economic Outlook

Table 6 India: Economic Outlook

Table 7 Classification of Dental Adhesives Based on Generation and Etching Technique

Table 8 Market Size, By Application, 20152022 (USD Million)

Table 9 Market Size, By Application, 20152022 (Ton)

Table 10 Market Size in Denture Adhesives, By Region, 20152022 (USD Million)

Table 11 Market Size in Denture Adhesives, By Region, 20152022 (Ton)

Table 12 Market Size in Pit & Fissure Sealants , By Region, 20152022 (USD Million)

Table 13 Market Size in Pit & Fissure Sealants, By Region, 20152022 (Ton)

Table 14 Market Size in Restorative Adhesives, By Region, 20152022 (USD Million)

Table 15 Market Size in Restorative Adhesives, By Region, 20152022 (Ton)

Table 16 Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 17 Other Applications Market Size in Other Applications, By Region, 20152022 (Ton)

Table 18 Market Size, By Denture Adhesive Type, 20152022 (USD Million)

Table 19 Market Size, By Denture Adhesive Type, 20152022 (Ton)

Table 20 Denture Adhesive Cream Market Size, By Region, 20152022 (USD Million)

Table 21 Denture Adhesive Cream Market Size, By Region, 20152022 (Ton)

Table 22 Denture Adhesive Powder Market Size, By Region, 20152022 (USD Million)

Table 23 Denture Adhesive Powder Market Size, By Region, 20152022 (Ton)

Table 24 Other Denture Adhesives Market Size, By Region, 20152022 (USD Million)

Table 25 Other Denture Adhesives Market Size, By Region, 20152022 (Ton)

Table 26 Market Size, By End User, 20152022 (USD Million)

Table 27 Market Size, By End User , 20152022 (Ton)

Table 28 Market Size in Dental Hospitals & Clinics, By Region, 20152022 (USD Million)

Table 29 Market Size in Dental Hospitals & Clinics, By Region, 20152022 (Ton)

Table 30 Market Size in Dental Academic & Research Institutes, By Region, 20152022 (USD Million)

Table 31 Market Size in Dental Academic & Research Institutes, By Region, 20152022 (Ton)

Table 32 Market Size in Laboratories, By Region, 20152022 (USD Million)

Table 33 Market Size in Laboratories, By Region, 20152022 (Ton)

Table 34 Market Size, By Region, 20152022 (USD Million)

Table 35 Market Size, By Region, 20152022 (Ton)

Table 36 North America: Market Size, By Application, 20152022 (USD Million)

Table 37 North America: Market Size, By Application, 20152022 (Ton)

Table 38 North America: Market Size, By Denture Adhesives, 20152022 (USD Million)

Table 39 North America: Market Size, By Denture Adhesives, 20152022 (Ton)

Table 40 North America: Market Size, By End User, 20152022 (USD Million)

Table 41 North America: Market Size, By End User, 20152022 (Ton)

Table 42 North America: Market Size, By Country, 20152022 (USD Million)

Table 43 North America: Market Size, By Country, 20152022 (Ton)

Table 44 Europe: Market Size, By Application, 20152022 (USD Million)

Table 45 Europe: Market Size, By Application, 20152022 (Ton)

Table 46 Europe: Market Size, By Denture Adhesives, 20152022 (USD Million)

Table 47 Europe: Market Size, By Denture Adhesives, 20152022 (Ton)

Table 48 Europe: Market Size, By End User, 20152022 (USD Million)

Table 49 Europe: Market Size, By End User, 20152022 (Ton)

Table 50 Europe: Market Size, By Country, 20152022 (USD Million)

Table 51 Europe: Market Size, By Country, 20152022 (Ton)

Table 52 APAC: Market Size, By Application, 20152022 (USD Million)

Table 53 APAC: Market Size, By Application, 20152022 (Ton)

Table 54 APAC: Market Size, By Denture Adhesive, 20152022 (USD Million)

Table 55 APAC: Market Size, By Denture Adhesive, 20152022 (Ton)

Table 56 APAC: Market Size, By End User, 20152022 (USD Million)

Table 57 APAC: Market Size, By End User, 20152022 (Ton)

Table 58 APAC: Market Size, By Country, 20152022 (USD Million)

Table 59 APAC: Market Size, By Country, 20152022 (Ton)

Table 60 South America: Market Size, By Application, 20152022 (USD Million)

Table 61 South America: Market Size, By Application, 20152022 (Ton)

Table 62 South America: Market Size, By Denture Adhesive, 20152022 (USD Million)

Table 63 South America: Market Size, By Denture Adhesive, 20152022 (Ton)

Table 64 South America: Market Size, By End User, 20152022 (USD Million)

Table 65 South America: Market Size, By End User, 20152022 (Ton)

Table 66 South America: Market Size, By Country, 20152022 (USD Million)

Table 67 South America: Market Size, By Country, 20152022 (Ton)

Table 68 Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

Table 69 Middle East & Africa: Market Size, By Application, 20152022 (Ton)

Table 70 Middle East & Africa: Market Size, By Denture Adhesive, 20152022 (USD Million)

Table 71 Middle East & Africa: Market Size, By Denture Adhesive, 20152022 (Ton)

Table 72 Middle East & Africa: Market Size, By End User, 20152022 (USD Million)

Table 73 Middle East & Africa: Market Size, By End User, 20152022 (Ton)

Table 74 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 75 Middle East & Africa: Market Size, By Country, 20152022 (Ton)

Table 76 New Product Launch, 20122017

Table 77 Merger & Acquisition, 20122017

List of Figures (39 Figures)

Figure 1 Dental Adhesives & Sealants: Market Segmentation

Figure 2 Market: Research Methodology

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Market: Data Triangulation

Figure 6 Europe to Dominate the Market, 20172022

Figure 7 Pit & Fissure Sealants to Account for Largest Share of Overall Market, 20172022

Figure 8 Denture Adhesive Cream/Paste to Be the Largest Segment of the Denture Adhesives Market, 20172022

Figure 9 Dental Hospitals & Clinics to Be the Fastest-Growing End User of Dental Adhesives & Sealants, 20172022

Figure 10 APAC to Be the Fastest-Growing Market for Dental Adhesives & Sealants, 20172022

Figure 11 Emerging Economies to Offer Attractive Opportunities in the Market

Figure 12 Pit & Fissure Sealants to Dominate Overall Market Between 2017 and 2022

Figure 13 Dental Hospitals & Clinics Accounted for Largest Share of the Emerging APAC Market

Figure 14 China to Be the Fastest-Growing Market for Dental Adhesives & Sealants

Figure 15 Market in Developing Countries to Grow Faster Than in Developed Countries, 20172022

Figure 16 Factors Governing the Market

Figure 17 Market: Porters Five Forces Analysis

Figure 18 US Accounted for the Highest Number of Patents Between 2016 and 2017

Figure 19 Ivoclar Vivadent AG Registered the Highest Number of Patents Between 2016 and 2017

Figure 20 Pit & Fissure Sealants to Be the Largest Application of Dental Adhesives & Sealants, 20172022

Figure 21 Denture Cream to Account for Largest Share of Denture Adhesive Market By 2022

Figure 22 Rising Prevalence of Dental Hospitals & Clinics to Drive the Market, 20172022

Figure 23 Dental Hospitals & Clinics to Be the Largest End User Segment, 20172022

Figure 24 Regional Snapshot: Market in APAC to Register the Highest Growth Rate

Figure 25 APAC to Be Fastest-Growing Market, 20172022

Figure 26 Future Growth for Market Centered in APAC, 2017-2022

Figure 27 Europe Dominated the Global Market in 2016

Figure 28 North American Market Snapshot: US to Be the Largest Market During Forecast Period

Figure 29 European Market Snapshot: Germany Was the Largest Market in 2016

Figure 30 APAC Market Snapshot: China is the Most Lucrative Market

Figure 31 Dental Hospitals & Clinics Was the Largest End User in South America

Figure 32 Lucrative Opportunities for Key Players in the Middle East & African Market

Figure 33 Companies Adopted New Product Launches and Mergers & Acquisitions as Key Growth Strategies Between 2012 and 2017

Figure 34 Dentsply Sirona: Company Snapshot

Figure 35 3M Company: Company Snapshot

Figure 36 Procter & Gamble: Company Snapshot

Figure 37 Glaxosmithkline: Company Snapshot

Figure 38 Danaher: Company Snapshot

Figure 39 Tokuyama Dental Corporation: Company Snapshot

Growth opportunities and latent adjacency in Dental Adhesive Market