Digital X-ray Market Size, Growth, Share & Trends Analysis

Digital X-ray Market, By Portability (Fixed, Portable), Applications (General, Dental, Mammography, Cancer, Fluoroscopy), Technology (Direct, Computed), System (Retrofit, New), End Users, Price Range, Type, and Region Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global digital X-ray market, valued at US$5.51 billion in 2024, stood at US$5.76 billion in 2025 and is projected to advance at a resilient CAGR of 4.5% from 2025 to 2031, culminating in a forecasted valuation of US$7.50 billion by the end of the period. The global digital X-ray market is experiencing steady growth due to the ongoing shift from analog to digital radiography. Digital X-ray technology has become essential in the diagnostic field owing to its ability to provide faster image capture, enhanced image quality, reduced radiation exposure, and optimized workflow processes. This market is further supported by continuously improving diagnostic imaging procedures, an aging population at higher risk of cancers and orthopedic disorders, rising prevalence of chronic diseases and orthopedic disorders, and increasing cases of trauma and emergencies. Additionally, developing medical infrastructure, such as diagnostic centers and multi-specialty hospitals, continues to support demand for the digital X-ray market.

KEY TAKEAWAYS

-

BY TYPEBy type, the digital X-ray systems accounted for a 88.0% revenue share of the digital X-ray market in 2025.

-

BY TECHNOLOGYBy technology, direct radiography is expected to register the highest CAGR of 5.2% during the forecast period.

-

BY SYSTEM TYPEBy system type, the retrofit digital X-ray systems accounted for a 59.5% revenue share of the digital X-ray market in 2025.

-

BY PORTABILITYBy portability, the fixed digital X-ray systems accounted for the major revenue share of the digital X-ray market in 2025.

-

BY APPLICATIONBy application, the chest imaging segment held 36.1% of the digital X-ray market in 2025.

-

BY PRICE RANGEBy price range, the low-end digital X-ray systems accounted for a 39.2% revenue share of the digital X-ray market in 2025.

-

BY END-USERBy end user, hospitals accounted for the major revenue share of the digital X-ray market in 2025.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSCompanies such as Siemens Healthineers, GE Healthcare, Canon, and Philips were identified as some of the key players in the US digital X-ray market. Growth in digital X-ray is driven by expanding healthcare infrastructure, rising diagnostic demand, and rapid adoption of advanced digital and portable imaging technologies.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as JPI Healthcare Solutions, IBIS S.R.L, and BPL Technologies have established a presence among small players in the digital X-ray market. These players serve the growing demand for cost-effective digital imaging solutions and localized manufacturing by emerging healthcare facilities.

One of the most dominant trends in the digital X-ray market is the growing preference for direct digital radiography systems over computed radiography systems. This, in turn, reflects a broader shift toward a comprehensive digital environment. Healthcare facilities are now looking for systems that enable faster processing, fewer retakes, and a more efficient interface with hospital information systems. Another significant trend in this segment is the rising demand for optimized workflows and user-centric systems that minimize procedure downtime and maximize productivity. There is also a rise in technically advanced systems capable of delivering consistent image quality across a variety of applications. Additionally, innovations such as FPDs, AI integration with workflow management and image analysis, a rising preference for portable and mobile X-ray units, and integration with digital health networks (PACS/EHR) are facilitating greater adoption of digital X-ray systems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Healthcare providers are under pressure to balance diagnostic accuracy with operational efficiency and cost containment. This has driven a shift toward digital X-ray systems that support higher patient throughput, standardized imaging protocols, and reduced dependence on consumables. The increasing integration of digital X-ray systems with enterprise imaging platforms is transforming how imaging departments manage data, collaborate across care teams, and deliver diagnostic outcomes. Meanwhile, procurement decisions are increasingly based on total cost of ownership rather than system pricing in isolation. These dynamics compel customers to reassess vendor selection, service contracts, and long-term technology roadmaps, leading to disruption through traditional purchasing and upgrade cycles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising aging population and prevalence of chronic diseases.

-

Advantages of digital X-ray systems over conventional analog imaging

Level

-

High upfront and installation costs

-

Radiation exposure and related safety risks

Level

-

Advancement of AI-enabled digital X-ray technologies

-

Expansion of portable digital X-ray systems for remote and emergency care

Level

-

Reduced healthcare spending and budget constraints in hospitals

-

Growing preference for refurbished and pre-owned imaging systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising volume of X-ray scans at hospitals & imaging centers

The growth of the global digital X-ray market is driven by increased diagnostic imaging at hospitals and diagnostic centers. Rising chronic diseases, musculoskeletal disorders, and trauma boost the need for radiographic exams. Digital X-ray systems' technological benefits, lower radiation, faster images, and better diagnostic confidence promote adoption. Government efforts to enhance healthcare access and infrastructure also boost demand. Market growth is further supported by replacing old analog systems with modern ones and the push toward healthcare digitization.

Restraint: Radiation exposure and related safety risks

A major barrier to widespread X-ray use is radiation safety risks. Repeated or high doses raise health concerns for patients and staff. Safety regulations, patient awareness, and regulatory oversight compel healthcare providers to carefully manage radiation doses while maintaining diagnostic accuracy. This leads to increased spending on dose optimization, equipment calibration, and staff training, which improve safety but also raise costs and complicate operations. Consequently, radiation management is crucial in deploying digital X-ray systems.

Opportunity: Advancement of AI-enabled digital X-ray technologies

AI-driven digital X-ray systems are transforming diagnostic imaging to be more precise and faster. They improve image quality, boost lesion detection, and assist decision-making, enabling faster, more accurate diagnoses despite rising imaging volumes. AI algorithms now quickly examine X-ray images, detect abnormalities, flag urgent cases, and reduce errors. This relieves radiologists and clinicians from repetitive imaging and allows them to verify work quality and safety. AI devices also offer prediction, planning, and optimization features crucial for modern healthcare, such as early device failure alerts and workflow automation. Innovations like dose modulation and remote controls reduce patient stress. Providers aim to shift from reactive to proactive roles, lowering turnaround times, costs, and variability in diagnostics, while supporting AI market growth in medical imaging.

Challenge: Growing preference for refurbished and pre-owned imaging systems

Hospitals face tough choices between digital X-ray investments and other priorities due to limited budgets and high equipment costs. Without clear reimbursement, they often buy refurbished devices resold 40-60% cheaper than new, supporting demand for affordable, quality systems from independent suppliers. Many equipment makers, such as Siemens and Philips, have launched refurbishing programs, such as Siemens' Ecoline and Philips' Diamond Select, to tap into this market. Smaller manufacturers find the high demand challenging. To stay competitive, companies must either reduce prices or develop innovative, advanced technologies that meet unmet clinical and operational needs.

DIGITAL X-RAY MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Siemens Healthineers offers advanced x-ray systems used in both diagnostic and interventional applications. Their digital radiography solutions are designed to provide high-quality imaging, particularly in urgent care and outpatient settings. | Excellent image quality for faster, more accurate diagnoses | Reduced radiation dose and high patient throughput | Integration with other Siemens systems for seamless workflow in medical environments |

|

GE Healthcare's x-ray detectors are employed in a variety of healthcare settings, including hospitals, outpatient clinics, and imaging centers. They specialize in providing both analog and digital imaging solutions. | High-resolution imaging with advanced image processing capabilities | Enhanced diagnostic confidence with faster image acquisition | Cost-effective solutions for healthcare providers with flexible system integration |

|

Fujifilm provides digital x-ray detectors that support a broad spectrum of clinical examinations, including digital radiography (DR), fluoroscopy, and mobile imaging solutions. | Superior image quality with low radiation doses | High-speed image capture for better workflow efficiency | Enhanced diagnostic accuracy with reliable, scalable systems |

|

Canon Medical's digital x-ray detectors are used in a variety of diagnostic imaging applications, from emergency care to long-term outpatient monitoring, delivering precise and detailed images for various clinical procedures | High-quality images with reduced radiation dose | Fast workflow and seamless integration into existing hospital systems | Improved diagnostic confidence with advanced image processing and clarity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The players in the digital X-ray market ecosystem include component suppliers, system manufacturers, software providers, distributors, service providers, and end users. Detector manufacturers and imaging software developers are crucial to system performance and differentiation. Original equipment manufacturers integrate these components into complete imaging solutions, with installation, training, and after-sales services. Distributors and channel partners provide access to regional markets, especially in emerging economies. End users include hospitals, diagnostic imaging centers, specialty clinics, and ambulatory care facilities, each with distinct purchasing and utilization dynamics.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital X-ray Market, By Type

The digital X-ray market is divided into analog and digital systems; the latter segment projected to grow due to the shift from traditional to digital imaging, especially in hospitals and diagnostic centers. Digital systems offer fast image capture, real-time processing, eliminate film workflows, and reduce patient wait times. These advantages boost efficiency, patient throughput, and support quicker clinical decisions. Digital images can be stored, retrieved, and shared easily via electronic platforms, enabling seamless integration with electronic health records (EHR) and picture archiving and communication systems (PACS). This facilitates tele-radiology, remote consultations, and information exchange among healthcare providers.

Digital X-ray Market, By Technology

The digital X-ray market is divided into direct and computed radiography, with the direct radiography segment leading in 2025. Its growth is driven by the demand for fast, high-quality diagnostic images that improve diagnosis efficiency. Direct radiography provides immediate imaging, higher resolution, lower doses than traditional methods, and easy integration with hospital IT systems such as PACS and EHRs. Its quick and efficient diagnostic capabilities make it the preferred choice in hospitals.

Digital X-ray Market, By System Type

The digital X-ray market is segmented into retrofit and new digital systems, with the latter dominating in 2025. Healthcare providers favor new digital X-ray due to its advanced, efficient, and accurate imaging capabilities needed for increasing patient loads. Modern equipment offers higher resolution, faster capture, lower patient doses, and better integration with hospital systems. Emerging AI-based imaging, portable devices, and advanced detectors are prompting upgrades from older X-ray systems to modern digital solutions.

Digital X-ray Market, By Application

The digital X-ray market by end user includes hospitals, diagnostic centers, and dental care centers, with hospitals holding the largest share in 2025. Hospitals in the US are a major demand segment, focusing on upgrading diagnostic imaging for efficiency and patient care. They are shifting from analog to digital X-ray systems to benefit from quick image acquisition, high quality, low radiation, and integrated electronic health records (EHR) and PACS. This transition streamlines workflows and reduces turnaround times. Factors like increased patient load, demand for accurate diagnostics, government healthcare initiatives, and support for advanced clinical applications have driven US hospitals to adopt digital X-ray technology.

Digital X-ray Market, By End User

The digital X-ray market's end users include hospitals, diagnostic, and dental centers, with hospitals holding the largest share. Hospitals are a major demand segment due to their focus on upgrading diagnostic infrastructure to enhance efficiency and patient care. They are shifting from analog to digital X-ray systems to benefit from quick imaging, high quality, low radiation, and integrated electronic health records (EHR) and PACS, streamlining workflows and reducing turnaround times. Factors like increased patient volume, demand for fast, accurate diagnostics, government healthcare initiatives, and the need for advanced clinical applications drive hospitals to adopt digital X-ray technologies.

REGION

North America accounted for the largest share of the digital X-ray systems market

North America is the largest region in the global digital X-ray market, given its well-established healthcare infrastructure, high utilization rates of diagnostic imaging, and early adoption of digital technologies. Strong healthcare spending, favorable reimbursement frameworks, and a presence of leading imaging manufacturers further support the leadership.

DIGITAL X-RAY MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

Competition in the global digital X-ray market is dominated by established MNCs with strong portfolios and distribution channels worldwide. The best way for these companies to differentiate themselves is to innovate, emphasize reliability, and provide comprehensive services. Mid-market companies will focus on cost-effective, localized solutions, while smaller companies will concentrate on niches. The intensity of competition in this industry is high, and new product development, collaborations, and expansion are the major focal points of competition.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens Healthineers AG (US)

- Konica Minolta, Inc (Japan)

- GE HealthCare (US)

- Shimadzu Corporation (Japan)

- Agfa-Gevaert Group (Belgium)

- Canon Medical Systems Coproation (Japan)

- Carestream Health (US)

- FUJIFILM Corporation (Japan)

- JPI Healthcare Solution (Germany)

- Shanghai United Imaging Healthcare Co., LTD (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.51 Billion |

| Market Forecast in 2031 (value) | USD 7.50 Billion |

| Growth Rate | CAGR of 4.5% from 2025–2031 |

| Years Considered | 2023–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia-Pacific, Middle East & Africa |

WHAT IS IN IT FOR YOU: DIGITAL X-RAY MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Imaging OEM - MNC |

|

|

| Imaging OEM - MNC |

|

Installed base and unit sales of various digital X-ray system categories at regional level |

RECENT DEVELOPMENTS

- November 2025 : Canon Medical Systems Corporation began sales of Mobirex i9 / Smart Edition, a high-end mobile X-ray system with enhanced radiographic support functions.

- July 2025 : Canon Medical announced the release of Radrex i5 / Flex Edition, a general radiography system with high image quality and ease of use, designed with intelligent features for patient-friendly examination.

- July 2025 : GE HealthCare launched the Definium Pace Select ET, a novel floor-mounted digital X-ray system that enables access to cost-effective, high-quality medical imaging technology while easing workflow challenges in high-volume settings.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the digital X-ray market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial digital X-ray market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the digital X-ray market. The primary sources from the demand side include hospitals, orthopedic clinics, diagnostic centers, dental clinics and other end users. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

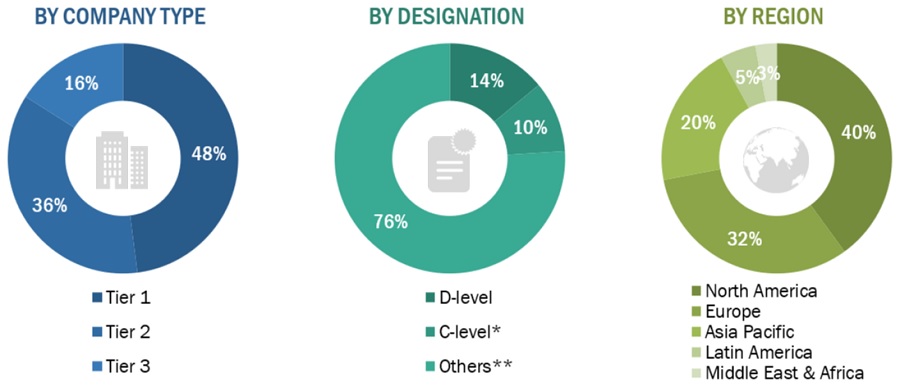

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2023: Tier 1 => USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

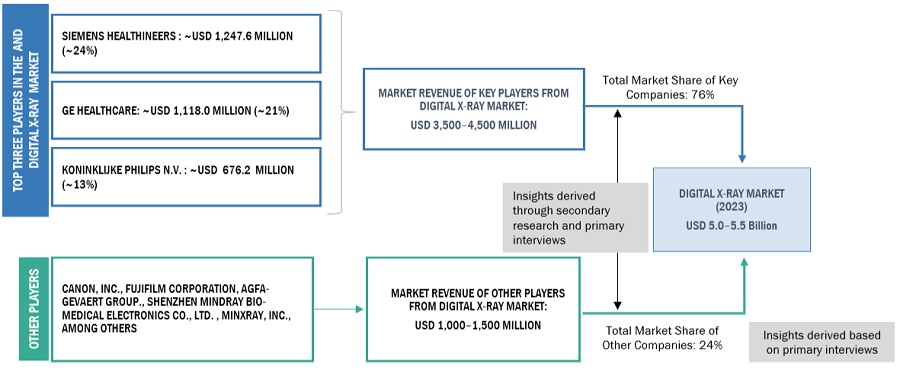

In this report, the digital X-ray market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the digital X-ray market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2023

- Extrapolating the global value of the digital X-ray market industry

Bottom-up approach

In this report, the size of the global digital X-ray market was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the digital X-ray business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Approach 1: Company revenue estimation approach

Segmental revenues were calculated based on the revenue mapping of major solution/product providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the digital X-ray market

- Mapping the annual revenues generated by major global players from the digital X-ray segment (or the nearest reported business unit/product category)

- Mapping the revenues of major players to cover at least 80–85% of the global market share as of 2022

- Extrapolating the global value of the digital X-ray industry

Market Size Estimation For Digital X-Ray: Approach 1 (Company Revenue Estimation)I

To know about the assumptions considered for the study, Request for Free Sample Report

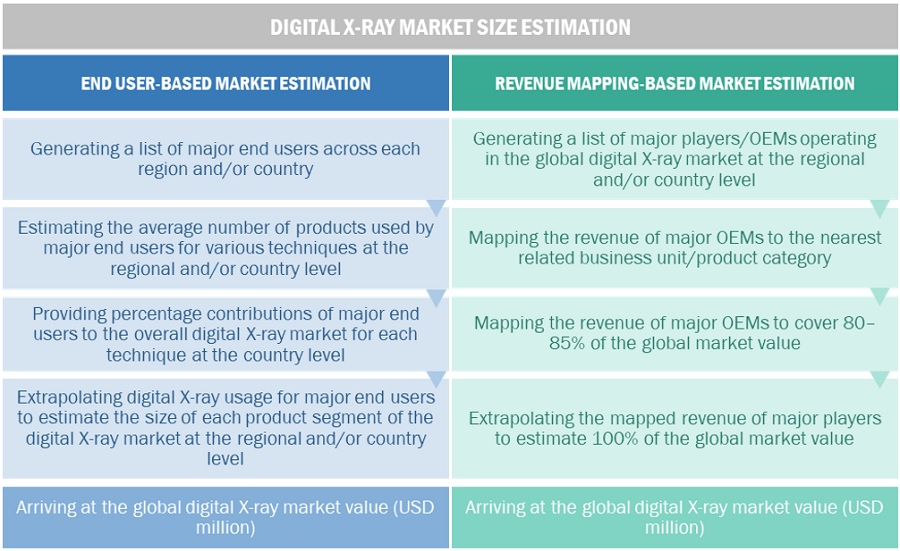

Approach 2: Customer-based market estimation

During preliminary secondary research, the total sales revenue of digital X-ray was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of digital X-ray product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall digital X-ray expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

- Identifying the percentage contributions of individual market segments and subsegments to the overall digital X-ray market at the regional/country level

Digital X-Ray Market Size Estimation: Bottom-Up Approach

Source: MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global digital X-ray market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the digital X-ray market was validated using top-down and bottom-up approaches.

Market Definition

The digital X-ray market encompasses a diverse range of medical devices designed to provide external support, stabilization, and relief for musculoskeletal conditions. These products include braces, supports, and orthoses tailored for various anatomical areas such as the knee, ankle, spine, wrist, and shoulder. The market addresses the growing demand for solutions related to orthopedic injuries, post-surgical recovery, and chronic musculoskeletal disorders, driven by factors such as an aging population, increased awareness of preventive healthcare, and advancements in materials and technology. With a focus on enhancing patient comfort and mobility, the digital X-ray market plays a crucial role in promoting non-invasive treatment options and comprehensive musculoskeletal care within healthcare settings.

Key Stakeholders

- Digital X-ray product manufacturers

- Original equipment manufacturers (OEMs)

- Suppliers, distributors, and channel partners

- Healthcare service providers

- Hospitals and academic medical centers

- Radiologists

- Research laboratories

- Health insurance providers

- Government bodies/organizations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists and other public-private funding agencies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the digital X-ray market based on technology, systems, portability, price range, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global digital X-ray market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe digital X-ray market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific digital X-ray market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of Latin America (RoLATAM), which comprises Argentina, Chile, Peru, Colombia, and Cuba

- Further breakdown of the RoW market into Latin America and MEA regions

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital X-ray Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Digital X-ray Market