Market for Disconnect Switch by Type (Fused, Non-Fused), by Mount (Panel Mounted, DIN Rail Mounted, Others), by Voltage (Low, Medium, High), by Application (Industrial, Commercial), and by Region - Global Trends & Forecast to 2020

[151 Pages Report] Global market for disconnect switch was valued at USD 8.56 Billion in 2014 and is projected to grow at a CAGR of 6.9% during 2015-2020. The growth in the disconnect switch market is attributed to the ongoing investments in the transmission and distribution, increasing industrialization & urbanization and growing safety concerns around the globe.

Disconnect switch is predominantly used to isolate the electrical circuit or equipment from its source of power to perform maintenance. It can also be used as a switching device when incorporated with a fuse. Disconnect switches are used in power distribution and industries to perform repair and maintenance on the machinery by disconnecting them from electrical energy source. Disconnect switch forms an essential part of switchgear in transmission and distribution lines and are used for varied applications.

The market in the study has been analyzed on the basis of its type (fused & non-fused), mount (Panel, DIN rail & others), voltage (low medium & high), application (Industrial & commercial) and region.

The years considered for the study are:

- Base Year: 2014

- Estimated Year: 2015

- Projected Year: 2020

- Forecast Period: 2015-2020

Research Methodology

This research study involves extensive usage of secondary sources, directories, and databases (such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial aspects of disconnect switch. The below explain the research methodology.

- Major players (manufacturers & suppliers) for disconnect switch were identified across the region

- Mapping of their offerings, distribution channel, regional presence is understood through in-depth discussions

- Also, average revenue generated by these companies segmented by region were used to arrive at the overall disconnect switch market size

- This overall market size is used in the top-down procedure to estimate the sizes of other individual markets/ segments via percentage splits from secondary and primary research

- The entire procedure includes the study of the annual and financial reports of the top market players and extensive interview of key insights from industry leaders, such as CEOs, VPs, directors and marketing executives

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data

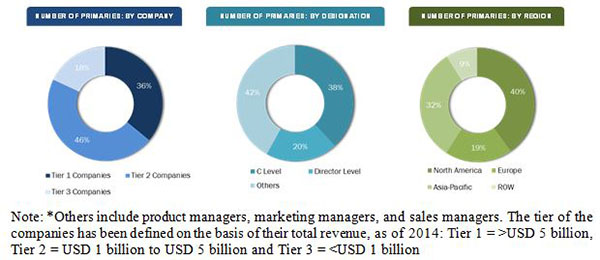

After arriving at the overall market size the total market has been split into several segments and sub-segments. The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

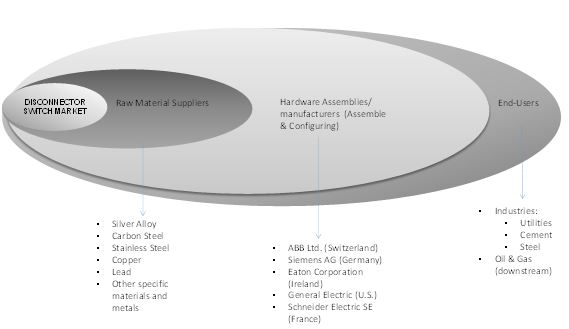

Market Ecosystem:

Disconnect switch market starts with raw material suppliers which include silver alloy, carbon steel, copper, lead and so on. In the later stage, manufacturing of disconnect switch takes place where all raw materials are assembled and configured in a single equipment. These devices are then distributed to large scale industries, utilities, and commercial facilities (end-users).

Stakeholders:

The stakeholder’s for the report includes:

Raw material suppliers- these include Saint Gobain (France), AGC Group (Japan), Corning Inc. (U.S.), Fairchild Semiconductor (U.S.), Analog Devices (U.S.), Rotex (India), and Deltrol Controls (U.S.) among others

OEMs/Disconnect switch Manufacturers - these include ABB Group (Switzerland), Siemens AG (Germany), Eaton Corporation (Ireland), General Electric (U.S.), AND Schneider Electric (France) among others

Scope of the Report:

- By Type:

- Fused

- Non-Fused

- By Mount:

- Panel

- DIN Rail

- Others

- By Voltage

- Low

- Medium

- High

- By Application

- Industrial

- Commercial

- By Region

- Asia-Pacific

- North America

- Europe

- ROW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of region/country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global market for disconnect switch is expected to grow at a CAGR of 6.89% from 2015 to 2020. The increasing transmission and distribution network expenditure, growing infrastructural and industrial developmental activities, and rising safety concerns are some of the key drivers of this market.

The demand for electricity is increasing in the developed nations in North America and Europe, as well as in fast-growing economies in Asia-Pacific. Thus, there has also been a consequent rise in the generation, transmission, and distribution of electricity to meet this increased demand. This in turn gives rise to the growth of the markets for the associated components, such as switchgear, circuit breaker, disconnector switch, and so on. The market for disconnect switch is expected to witness significant growth, especially in developing countries, where the transmission and distribution industry is in the growth stage. Disconnector switches are also used in transmission lines, substations, urban transportation, and heavy manufacturing.

The global market for disconnect switch has been segmented and analyzed by type into fused and non-fused. The market has also been segmented based on mounting techniques into panel mounted, DIN rail mounted, and others, where others include base mounted and floor mounted. The market has been segmented based on voltage into low, medium, and high. The major applications covered into this report are industrial and commercial. The industrial segment is further segmented into utility, inverter-based generation, manufacturing, and others, where others include infrastructure, and transportation. The regions considered in this report are Asia-Pacific, North America, Europe, and Rest of World (RoW). Information regarding the key countries in each region, such as the U.S., Canada, Mexico, China, India, Japan, Australia, Germany, the U.K., France, Brazil, Saudi Arabia, Kuwait, and the UAE, among others has also been included in this report.

The application areas vary with the specified voltage ratings of disconnector switches. The low voltage segment held the major share, as disconnector switches in this range are largely used in the distribution, photovoltaic, infrastructure, light commercial and light manufacturing applications.

This report offers a detailed analysis of key companies and a competitive analysis of developments recorded in the industry in the past four years. Market drivers, restraints, opportunities, and challenges have been discussed in detail. Leading players in the market, such as Siemens AG (Germany), ABB Ltd. (Switzerland), Schneider Electric SE (France), Eaton Corporation (Ireland), and General Electric Company (U.S.) have been profiled in this report.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Growth Opportunities in the Disconnector Switch Market

4.2 Disconnector Switch Market, By Type

4.3 Disconnector Switch Market in the Asia-Pacific Region, 2014

4.4 Asia-Pacific is the Fastest Growing Region for the Disconnector Switch Market From 2015 to 2020

4.5 Din Rail Mount is Expected to Be the Fastest Growing Type During the Forecast Period

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Mount

5.2.3 By Application

5.2.4 By Voltage

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth in Transmission and Distribution Network

5.3.1.2 Growth in Industrialization and Urbanization

5.3.1.3 Increasing Safety Concern

5.3.2 Restraints

5.3.2.1 Fluctuating Prices of Raw Material

5.3.2.2 Low Quality and Cheap Products

5.3.3 Opportunities

5.3.3.1 Rising Demand of Power

5.3.3.2 Increasing Focus Towards Renewables

5.3.4 Challenges

5.3.4.1 Price Competition Among Market Players

5.3.4.2 Executing Projects in Countries Where Political Issues are A Major Concern

5.4 Value Chain Analysis

5.5 Porter’s Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Disconnector Switch Market, By Type (Page No. - 46)

6.1 Introduction

6.2 Non-Fused Disconnector Switch

6.3 Fused Disconnector Switch

7 Disconnector Switch Market, By Mount (Page No. - 52)

7.1 Introduction

7.2 Panel Mounted Disconnector Switch

7.3 Din Rail Mounted Disconnector Switch

7.4 Other Disconnector Switch

8 Disconnector Switch Market, By Voltage (Page No. - 59)

8.1 Introduction

8.2 Low Voltage Disconnector Switch

8.3 Medium Voltage Disconnector Switch

8.4 High Voltage Disconnector Switch

9 Disconnector Switch Market, By Application (Page No. - 65)

9.1 Introduction

9.2 Industrial Disconnector Switch

9.2.1 Utility

9.2.2 Inverter Based Generation

9.2.3 Manufacturing

9.2.4 Other Applications

9.3 Commercial Disconnector Switch

10 Disconnector Switch Market, By Region (Page No. - 74)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 Australia

10.2.5 Other Asia-Pacific

10.3 North America

10.3.1 U.S.

10.3.2 Canada

10.3.3 Mexico

10.4 Europe

10.4.1 Germany

10.4.2 U.K.

10.4.3 France

10.4.4 Other European Countries

10.5 Rest of the World

10.5.1 Brazil

10.5.2 Saudi Arabia

10.5.3 Kuwait

10.5.4 UAE

10.5.5 Other RoW Countries

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Market Share Analysis, By Key Players

11.3 Competitive Situation & Trends

11.3.1 Joint Ventures

11.3.2 New Product/Technology Launches

11.3.3 Expansions

11.3.4 Mergers & Acquisitions

11.3.5 Contracts & Agreements

12 Company Profiles (Page No. - 113)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 ABB Ltd.

12.3 Eaton Corporation PLC.

12.4 General Electric Company

12.5 Siemens AG

12.6 Schneider Electric SE

12.7 WEG SA

12.8 Mersen S.A.

12.9 Littelfuse Inc.

12.10 Crompton Greaves Limited

12.11 Havells India Ltd.

12.12 Leviton Manufacturing Co., Inc.

12.13 Socomec

12.14 Driescher Gmbh

12.15 Delixi Electric Co. Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 143)

13.1 Insights From Industry Experts

13.2 Other Developments

13.3 Discussion Guide

13.4 Available Customizations

13.5 Introducing RT: Real Time Market Intelligence

13.6 Related Reports

List of Tables (75 Tables)

Table 1 Growth in Transmission & Distributon Network is the Key Driver ForThe Market

Table 2 Fluctuating Prices of Raw Material Acts as A Key Restraint for Thr Growth of Disconnector Switch Market

Table 3 Rising Demand of Power Provide High Growth Opportunities for Disconnector Switch Market

Table 4 Price Competition Among Market Players Can Be A Major Challenge for Market Players

Table 5 Disconnector Switch Market Size, By Type, 2013-2020 (USD Million)

Table 6 Non-Fused Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 7 Fused Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 8 Disconnector Switch Market Size, By Mount, 2013-2020 (USD Million)

Table 9 Panel Mounted Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 10 Din Rail Mounted Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 11 Other Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 12 Disconnector Switch Market Size, By Voltage, 2013-2020 (USD Million)

Table 13 Low Voltage Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 14 Medium Voltage Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 15 High Voltage Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 16 Disconnector Switch Market Size, By Application, 2013-2020 (USD Million)

Table 17 Industrial Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 18 Industrial Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 19 Industrial Disconnector Switch: Utility Market Size, By Region,2013-2020 (USD Million)

Table 20 Industrial Disconnector Switch: Inverter Based Generation Market Size , By Region, 2013-2020 (USD Million)

Table 21 Industrial Disconnector Switch: Manufacturing Market Size, By Region, 2013-2020 (USD Million)

Table 22 Industrial Disconnector Switch: Other Applications Market Size,By Region, 2013-2020 (USD Million)

Table 23 Commercial Disconnector Switch Market Size, By Region,2013-2020 (USD Million)

Table 24 Disconnector Switch Market Size, By Region, 2013-2020 (USD Million)

Table 25 Asia-Pacific: Disconnector Switch Market Size, By Type,2013-2020 (USD Million)

Table 26 Asia-Pacific: Disconnector Switch Market Size, By Mount,2013-2020 (USD Million)

Table 27 Asia-Pacific: Disconnector Switch Market Size, By Voltage,2013-2020 (USD Million)

Table 28 Asia-Pacific: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 29 Asia-Pacific: Industrial Disconnector Switch Market Size, By Application, 2013-2020 (USD Million)

Table 30 Asia-Pacific: Disconnector Switch Market Size, By Country,2013-2020 (USD Million)

Table 31 China: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 32 China: Industrial Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 33 India: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 34 India: Industrial Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 35 Japan: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 36 Australia: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 37 Other Asia-Pacific: Disconnector Switch Market Size, By Application, 2013-2020 (USD Million)

Table 38 North America: Disconnector Switch Market Size, By Type,2013-2020 (USD Million)

Table 39 North America: Disconnector Switch Market Size, By Mount,2013-2020 (USD Million)

Table 40 North America: Disconnector Switch Market Size, By Voltage,2013-2020 (USD Million)

Table 41 North America: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 42 North America: Industrial Disconnector Switch Market Size,By Application, 2013-2020 (USD Million)

Table 43 North America: Disconnector Switch Market Size, By Country,2013-2020 (USD Million)

Table 44 U.S.: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 45 U.S.: Industrial Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 46 Canada: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 47 Mexico: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 48 Europe: Disconnector Switch Market Size, By Type,2013-2020 (USD Million)

Table 49 Europe: Disconnector Switch Market Size, By Mount,2013-2020 (USD Million)

Table 50 Europe: Disconnector Switch Market Size, By Voltage,2013-2020 (USD Million)

Table 51 Europe: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 52 Europe: Industrial Disconnector Switch Market Size, By Application, 2013-2020 (USD Million)

Table 53 Europe: Disconnector Switch Market Size, By Country,2013-2020 (USD Million)

Table 54 Germany: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 55 Germany: Industrial Disconnector Switch Market Size, By Application, 2013-2020 (USD Million)

Table 56 U.K.: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 57 U.K.: Industrial Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 58 France: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 59 Other European Countries: Disconnector Switch Market Size,By Application, 2013-2020 (USD Million)

Table 60 Rest of the World: Disconnector Switch Market Size, By Type,2013-2020 (USD Million)

Table 61 Rest of the World: Disconnector Switch Market Size, By Mount,2013-2020 (USD Million)

Table 62 Rest of the World: Disconnector Switch Market Size, By Voltage,2013-2020 (USD Million)

Table 63 Rest of the World: Disconnector Switch Market Size, By Application, 2013-2020 (USD Million)

Table 64 Rest of the World: Industrial Disconnector Switch Market Size,By Application, 2013-2020 (USD Million)

Table 65 Rest of the World: Disconnector Switch Market Size, By Country,2013-2020 (USD Million)

Table 66 Brazil: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 67 Saudi Arabia: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 68 Kuwait: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 69 UAE: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 70 Other RoW: Disconnector Switch Market Size, By Application,2013-2020 (USD Million)

Table 71 Joint Ventures, 2015

Table 72 New Product/Technology Launches, 2011-2015

Table 73 Expansions, 2012-2014

Table 74 Mergers & Acquisitions, 2011-2015

Table 75 Contracts & Agreements, 2011-2015

List of Figures (57 Figures)

Figure 1 Markets Covered: Global Disconnector Switch Market

Figure 2 Disconnector Switch Market: Research Design

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown & Data Triangulation

Figure 5 Disconnector Switch Market Snapshot (2015 vs. 2020): Non-Fused to Lead the Market in the Next Five Years

Figure 6 Disconnector Switch Market By Voltage, 2015 vs. 2020

Figure 7 Disconnector Switch Market By Application, 2014

Figure 8 Asia-Pacific Led the Disconnector Switch Market in 2014

Figure 9 Disconnector Switch Market is Expected to Rise With an Impressive CAGR Between 2015 to 2020

Figure 10 Non-Fused Disconnector Switch Dominates the Overall Disconnector Switch Market During the Forecast Period

Figure 11 China Held the Largest Market Share in Asia-Pacific in 2014

Figure 12 Asia-Pacific is Expected to Remain the Largest and Fastest Growing Market During the Forecast Period

Figure 13 Market for Din Rail Mounting is Growing Faster Than OtherMounting Techniques

Figure 14 Disconnector Switch Market Segmentation: By Type

Figure 15 Disconnector Switch Market Segmentation: By Mount

Figure 16 Disconnector Switch Market Segmentation: By Application

Figure 17 Disconnector Switch Market Segmentation: By Voltage

Figure 18 Disconnector Switch Market Segmentation: By Region

Figure 19 Industrialization & Urbanization Along With Expansion in Transmission and Distribution Network Will Propel the Market

Figure 20 Global Power Consumption, 2010-2040 (Quadrillion BTU)

Figure 21 Global Renewable Electricity Production, 2008-2020 (TWH)

Figure 22 Disconnector Switch Market: Value Chain Analysis

Figure 23 Porter’s Five Forces Analysis: the Bargaining Power of Buyers is Moderate to High in the Disconnector Switch Market

Figure 24 Non-Fused Disconnector Switch is Expected to Dominate the Market With Highest Growth Rate & Maximum Market Share in 2014

Figure 25 Non-Fused Disconnector Switch Market is Expected to Grow in Asia-Pacific By 2020

Figure 26 Panel Mount is Expected to Dominate the Disconnector Switch Market

Figure 27 Panel Mounted Disconnector Switch Market is Expected to Grow in Asia-Pacific By 2020

Figure 28 Low Voltage is Expected to Dominate the Disconnector Switch Market

Figure 29 Low Voltage Disconnector Switch Market is Expected to Grow in Asia-Pacific By 2020

Figure 30 Industrial Segment is Expected to Dominate the Disconnector Switch Market By Application

Figure 31 Industrial Disconnector Switch Market is Expected to Grow in Asia-Pacific By 2020

Figure 32 Asia-Pacific is Expected to Dominate the Industrial Disconnector Switch Market in Utility During the Forecast Period

Figure 33 Regional Snapshot: Rapidly Growing Markets are Emerging as New Hot Spots

Figure 34 China – an Attractive Destination for All Product Categories

Figure 35 China is Expected to Dominate the Market in Asia-Pacific With Highest Growth Rate & Maximum Market Share

Figure 36 U.S. is Expected to Dominate the Market in North America During the Forecast Period

Figure 37 Germany is Expected to Dominate the Disconnector Switch Market in Europe During the Forecast Period

Figure 38 Companies Adopted Merger & Acquisitions and Expansions as the Key Growth Strategies From 2011 to 2015

Figure 39 Siemens AG Held the Largest Share in the Disconnector Switch Market, 2014

Figure 40 Market Evaluation Framework

Figure 41 Battle for Market Share: Mergers & Acquisitions Was the Key Strategy

Figure 42 Geographic Revenue Mix of Top 5 Players

Figure 43 ABB Ltd.: Company Snapshot

Figure 44 ABB Ltd.: SWOT Analysis

Figure 45 Eaton Corporation PLC.: Company Snapshot

Figure 46 Eaton Corporation PLC: SWOT Analysis

Figure 47 General Electric Company: Company Snapshot

Figure 48 General Electric Company: SWOT Analysis

Figure 49 Siemens AG: Company Snapshot

Figure 50 Siemens AG: SWOT Analysis

Figure 51 Schneider Electric SE: Company Snapshot

Figure 52 Schneider Electric SE: SWOT Analysis

Figure 53 WEG SA: Company Snapshot

Figure 54 Mersen S.A.: Company Snapshot

Figure 55 Littelfuse Inc.: Company Snapshot

Figure 56 Crompton Greaves Limited: Company Snapshot

Figure 57 Havells India Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Market