Drilling and Completion Fluids Market by Application (Onshore and Offshore), Fluid System (Water-Based System, Oil-Based System, Synthetic-Based System), Well Type (Conventional and HPHT), and Region - Global Forecast to 2023

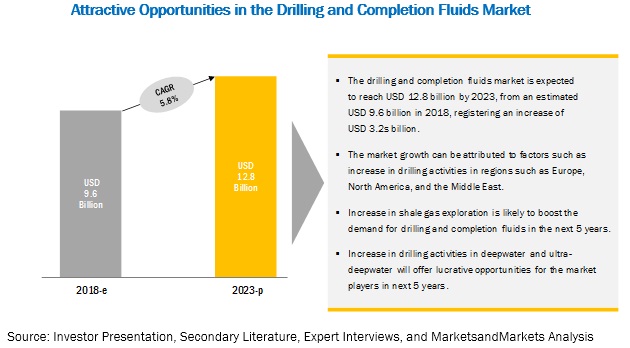

[135 Pages Report] MarketsandMarkets forecasts the drilling and completion fluids market to grow from USD 9.6 billion in 2018 to USD 12.8 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period. The major factors that are expected to be driving the Drilling and Completion Fluids market are increase in drilling operations in regions such as Europe, North America, and Middle East, new shale gas discoveries, and deepwater and ultra-deepwater drilling operations. The objective of the report is to define, describe, and forecast the Drilling and Completion Fluids market size based on fluid system (water-based, oil-based, synthetic-based, and others), well type (HPHT wells, conventional wells), application (onshore, offshore), and region.

By well type, HPHT is expected to grow at the fastest growth rate during the forecast period

The HPHT well type is estimated to be the fastest-growing segment of drilling and completion fluids market during the forecast period. The term HPHT is applied to wells that have only high pressure or high temperature or both these characteristics. HPHT wells faced challenges while well construction and production of oil & gas. The E&P activity increasingly involves operations in HPHT downhole conditions. Advancements in technologies during the past decade have allowed the operators to address numerous challenges of drilling HPHT wells. As the HPHT drilling activity continues to grow and well conditions become more severe, more advanced devices and materials will be required. The main aim is to reduce the drilling risk by enabling better well placement and improved borehole stability. In the current oil price scenario, the drilling of HPHT wells is economically less viable. However, as the oil prices increase, the drilling of HPHT wells would also increase.

By application, onshore segment is expected to record the highest CAGR during the forecast period

The onshore application is estimated to be the fastest-growing segment of drilling and completion fluids market during the forecast period. The growth of the onshore segment is mainly driven by the rise in demand for energy around the world and the growth in drilling activities. The increasing focus on unconventional resources such as coalbed methane (CBM), and tight oil reserves will also boost the growth of this market segment.

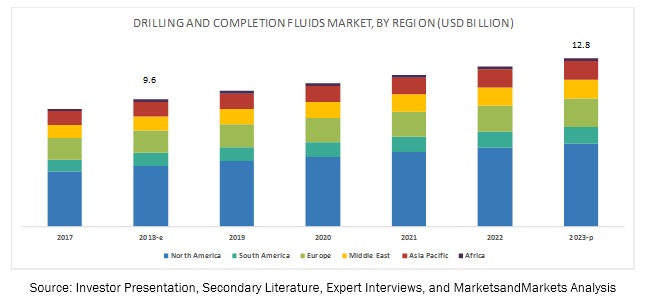

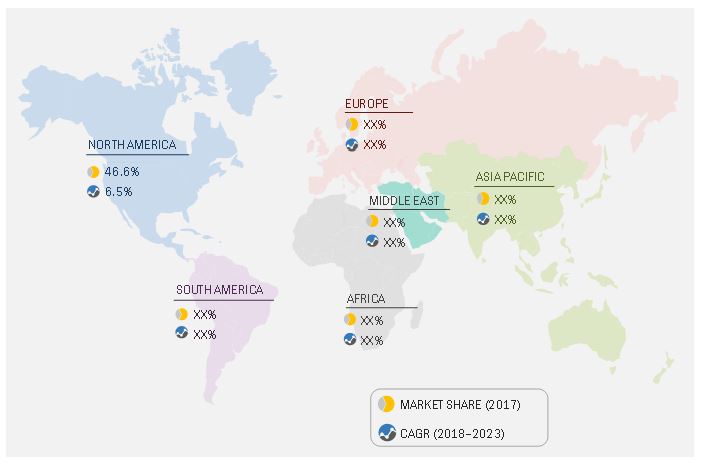

North America to account for the largest market size during the forecast period.

The North American region is estimated to be the fastest growing market for drilling and completion fluids during the forecast period. The North American drilling and completion fluids market is mainly driven by the rise in shale gas exploration and increase in drilling activity for oil and gas. The onshore activities have improved with the exploration of vast shale gas reserves in the North American region. Also, the governments in North America have formed policies and regulations for the prevention of the degradation of the environment.

Market Dynamics

Driver: Increasing in drilling activities

The increasing demand for crude oil has resulted in a rise in drilling activities. North America has the highest oil & gas production, followed by Europe, due to the continuous rise in onshore activities in Russia and offshore activities in the North Sea. The increase in drilling activities directly impacts the growth of drilling and completion fluids. Different types of drilling fluids are required depending on the geographic conditions, economic viabilities, etc. Technological advancements coupled with high demand are increasingly putting a pressure to increase the depth of wells. This drilling is carried out under high temperature and high-pressure conditions. Horizontal and deeper wells face a range of drilling, stability, pressure and other issues, which require a greater volume of drilling fluids and a more sophisticated drilling fluid system. An effective drilling fluid system facilitates reduced time to drill, helps to increase wellbore stability, and maximizes recovery from the reservoir, thus positively impacting the economic return of the well. Thus, increase in onshore and offshore drilling activities of wells is expected to propel the demand for drilling and completion fluids in the coming years.

Restraint: Impact of drilling fluids on the environment

Drilling operations require drilling fluids that contain additive chemicals injected through the drill string. These fluids, when mixed with stone cuttings, form residues, which when discharged result in detrimental effects on the surrounding ecosystem. The contaminants from this residue get mixed with groundwater and make the groundwater toxic. This causes serious water and soil pollution and disturbs the natural habitat of various organisms. Biodegradable chemicals are costly thus resulting in limited adoption. Various governments around the world have imposed severe regulations on the usage and discharge of drilling fluids to control pollution.

Opportunity: Increasing focus deepwater and ultra-deepwater drilling activities

The deepwater and ultra-deepwater drilling activities are expected to increase in the future, driven by new discoveries in Latin America, West Africa, and the Asia Pacific. A majority of the offshore activity is focused in deepwater regions, such as Angola, US, Brazil, Nigeria, Malaysia, and Norway. In addition, recent discoveries made in emerging frontier regions, such as the East Coast of Africa, the eastern Mediterranean Sea, and the west coast of Australia, would significantly boost the offshore reserves growth.

Several major projects that were approved before the industry downturn are expected to come onstream in 2018. Some of the projects include the Kaombo field offshore Angola and the Egina field offshore Nigeria, both operated by Total. In the Gulf of Mexico, Chevron’s Bigfoot, in the Walker Ridge area, is also expected to come onstream in 2018. These projects, among others, are expected to push deepwater production activities in the coming years. In regions with more than 10 floating rigs, utilization is the highest in South America, primarily Brazil – at 88.7%. This is due to long-term contracts that were signed before the downturn. Thus, the progress of long-term contracts is expected to propel the demand for deep and ultra-deepwater drilling activities, thus fostering the growth of drilling and completion fluids.

Challenge: Rise in cost of deepwater and ultra-deepwater drilling

Drilling in deepwater and ultra-deepwater is possible with the advancements in technology and floating production. Technological advancements have made new areas accessible, but deepwater projects require more investment and time compared to shallow waters or onshore developments. As a result, most nations with offshore assets operate in shallow water. Mud companies spend a substantial amount of capital on R&D to meet the challenges of drilling fluids. Deep drilling requires large and expensive rigs and low penetration rates.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Fluid system (water-based, oil-based, synthetic-based, and others), well type (HPHT wells, conventional wells), application (onshore, offshore), and region |

|

Geographies covered |

North America, Europe, Asia-Pacific, Middle East, Africa and South America |

|

Companies covered |

BHGE (US), Halliburton Company (US), Schlumberger (US), Newpark Resources (US), Weatherford, (Switzerland), Tetra Technologies (US), CES (Canada), National Oilwell Varco (US), Secure Energy Services (Canada), Q’max Solutions (US), Global Drilling and Chemicals (India), Sagemines (France), Scomi (Malaysia) |

The research report categorizes the Drilling and Completion Fluids to forecast the revenues and analyze the trends in each of the following sub-segments:

Drilling And Completion Fluids Market By Fluid System

- Water-based system

- Oil-based system

- Synthetic-based system

- Others

Drilling And Completion Fluids Market By Application

- Onshore

- Offshore

Drilling And Completion Fluids Market By Well Type

- HPHT

- Conventional

Drilling And Completion Fluids Market By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Africa

- South America

Key Market Players

BHGE (US), Halliburton Company (US), Schlumberger (US), Newpark Resources (US), Weatherford, (Switzerland), Tetra Technologies (US), CES (Canada), National Oilwell Varco (US), Secure Energy Services (Canada), Q’max Solutions (US),Global Drilling and Chemicals (India), Sagemines (France), Scomi (Malaysia)

Halliburton has established itself as one of the largest providers of products and services in the energy industry. The company helps its customers to enhance the value throughout the lifecycle of a reservoir by offering products and services such as locating hydrocarbons and management of local data, drilling & formation evaluation, well construction & completion, and optimizing the production throughout the life of a field. The company operates in two business segments including completion & production and drilling & evaluation. The drilling fluids business is carried out under its Baroid Industrial Drilling Products business unit, which provides a wide range of drilling fluid solutions.

Recent Developments

- In March 2018, Tetra Technologies completed the divestiture of its offshore heavy lift, decommissioning, cutting, diving, and other consulting services along with Maritech operations and offshore leases. TETRA will focus on increasing its profitability in fluids, production testing, and compression to support the company's growth and capabilities in technology-enabled services.

- In November 2017, Newpark Resources acquired Well Service Group (WSG), a containment and well site service company, and its affiliate, Utility Access Solutions (UAS). This acquisition will serve as a critical step in the execution of long-term mats strategy and allow Newpark to not only offer turnkey, bundled services, and increased value for their customers, but also continue to deliver industry-leading services and products.

- In October 2017, Halliburton introduced BaraShale Lite Fluid Systems, a high-performance water-based fluid designed to maintain full salt saturation with reduced density, help prevent lost circulation and minimize waste disposal costs

- In October 2017, OneStim, a joint venture between Weatherford and Schlumberger Ltd. received regulatory clearance from the US Department of Justice. OneStim will deliver completion products and services for the development of unconventional resource plays in the US and Canada land markets and offer one of the broadest multistage completion portfolios in the market combined with one of the largest hydraulic fracturing fleets in the industry.

- In May 2017, National Oilwell Varco entered into a joint venture agreement with Saudi Aramco, Saudi Arabia. Through its state-of-the art manufacturing and fabrication facilities and NOV’s market-leading drilling technologies, the agreement is expected to help manufacture high-specification land rigs, rig and drilling equipment, and offer certain aftermarket services. Additionally, the companies will establish a training center to develop Saudi technicians to maintain and operate the sophisticated drilling technology produced by the venture.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Drilling and Completion Fluids market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Drilling and Completion Fluids Market, 2018–2023

4.2 Market, By Region, 2018-2023

4.3 Market, By Application, 2018 & 2023

4.4 Market, By Fluid System, 2018 & 2023

4.5 Market, By Well Type, 2018 & 2023

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Surge in Drilling Activities

5.2.1.2 Increase in Shale Gas Exploration

5.2.2 Restraints

5.2.2.1 Environmental Impact of Drilling Fluids

5.2.2.2 Stringent Environmental Regulations

5.2.3 Opportunities

5.2.3.1 Increasing Focus on Deep and Ultra-Deep-Water Drilling

5.2.3.2 Focus on Developing Advanced Drilling Fluid Chemicals

5.2.4 Challenges

5.2.4.1 Rise in Cost of Deepwater and Ultra-Deepwater Drilling

6 Market, By Application (Page No. - 40)

6.1 Introduction

6.2 Onshore

6.3 Offshore

7 Market, By Fluid System (Page No. - 44)

7.1 Introduction

7.2 Water-Based

7.3 Oil-Based

7.4 Synthetic-Based

7.5 Others

8 Market, By Well Type (Page No. - 49)

8.1 Introduction

8.2 Hpht Wells

8.3 Conventional Wells

9 Drilling & Completion Fluids Market, By Region (Page No. - 53)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Norway

9.3.2 Russia

9.3.3 UK

9.3.4 Rest of Europe

9.4 Middle East

9.4.1 Saudi Arabia

9.4.2 UAE

9.4.3 Qatar

9.4.4 Oman

9.4.5 Kuwait

9.4.6 Rest of Middle East

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Venezuela

9.5.4 Rest of South America

9.6 Asia Pacific

9.6.1 China

9.6.2 Thailand

9.6.3 Indonesia

9.6.4 India

9.6.5 Australia

9.6.6 Rest of Asia Pacific

9.7 Africa

9.7.1 Angola

9.7.2 Egypt

9.7.3 Algeria

9.7.4 Nigeria

9.7.5 Libya

9.7.6 Rest of Africa

10 Competitive Landscape (Page No. - 90)

10.1 Overview

10.2 Market Ranking of Players and Industry Concentration, 2017

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 New Product Launches

10.3.3 Mergers & Acquisitions

10.3.4 New Product Launches

11 Company Profiles (Page No. - 95)

11.1 Competitive Benchmarking

(Business Overview, Products Offered, Recent Developments & MnM View)*

11.2 Bhge

11.3 Halliburton

11.4 Schlumberger

11.5 Newpark Resources

11.6 Tetra Technologies

11.7 CES

11.8 National Oilwell Varco

11.9 Secure Energy Services

11.10 Weatherford International

11.11 Q’max Solutions

11.12 Global Drilling and Chemicals

11.13 Sagemines

11.14 Scomi

*Details on Business Overview, Products Offered, Recent Developments & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 128)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports:

12.7 Author Details

List of Tables (79 Tables)

Table 1 Drilling and Completion Fluids Market Snapshot

Table 2 Total Wells Drilled

Table 3 International Recoverable Shale Gas Reserves, 2016

Table 4 Governmental Drilling and Completion Fluids Discharge Regulations, By Countries

Table 5 Drilling & Completion Fluids Market Size, By Application.

Table 6 Onshore: Drilling and Completion Fluids Market Size, By Region.

Table 7 Offshore: Drilling and Completion Fluids Market Size, By Region.

Table 8 Drilling & Completion Fluids Market Size, By Fluid System.

Table 9 Water-Based: Drilling and Completion Fluids Market Size, By Region.

Table 10 Oil-Based: Drilling and Completion Fluids Market Size, By Region.

Table 11 Synthetic-Based: Drilling and Completion Fluids Market Size, By Region.

Table 12 Others: Drilling & Completion Fluids Market Size, By Region.

Table 13 Drilling & Completion Fluids Market Size, By Well Type.

Table 14 Hpht: Drilling & Completion Fluids Market Size, By Region.

Table 15 Conventional: Drilling & Completion Fluids Market Size, By Region.

Table 16 Global Drilling & Completion Fluids Market Size, By Region.

Table 17 North America: Market, By Application.

Table 18 North America: Market, By Fluid Type.

Table 19 North America: Market, By Well Type.

Table 20 North America: Market, By Country.

Table 21 North America: Drilling and Completion Fluids Market, By Country.

Table 22 US: Market Size, By Application.

Table 23 Canada: Market Size, By Application.

Table 24 Mexico: Market Size, By Application.

Table 25 Europe: Drilling and Completion Fluids Market, By Application.

Table 26 Europe: Market, By Fluid Type.

Table 27 Europe: Market, By Well Type.

Table 28 Europe: Market, By Country.

Table 29 Europe: Market, By Country.

Table 30 Norway: Drilling and Completion Fluids Market Size, By Application.

Table 31 Russia: Market Size, By Application.

Table 32 UK: Drilling & Completion Fluids Market Size, By Application.

Table 33 Rest of Europe: Drilling & Completion Fluids Market Size, By Application.

Table 34 Middle East: Market, By Application.

Table 35 Middle East: Market, By Fluid Type.

Table 36 Middle East: Market, By Well Type, Million.

Table 37 Middle East: Market, By Country.

Table 38 Middle East: Market, By Country.

Table 39 Saudi Arabia: Market Size, By Application.

Table 40 UAE: Market Size, By Application.

Table 41 Qatar: Market Size, By Application.

Table 42 Oman: Drilling and Completion Fluids Market Size, By Application.

Table 43 Kuwait: Drilling & Completion Fluids Market Size, By Application.

Table 44 Rest of Middle East: Market Size, By Application.

Table 45 South America: Market, By Application.

Table 46 South America: Market, By Fluid Type

Table 47 South America: Market, By Well Type

Table 48 South America: Drilling and Completion Fluids Market, By Country

Table 49 South America: Market, By Country.

Table 50 Brazil: Market Size, By Application

Table 51 Argentina: Market Size, By Application

Table 52 Venezuela: Market Size, By Application

Table 53 Rest of South America: Market Size, By Application

Table 54 Asia Pacific: Market, By Application

Table 55 Asia Pacific: Market, By Fluid Type

Table 56 Asia Pacific: Drilling and Completion Fluids Market, By Well Type

Table 57 Asia Pacific: Drilling & Completion Fluids Market, By Country

Table 58 Asia Pacific: Market, By Country,

Table 59 China: Market Size, By Application,

Table 60 Thailand: Market Size, By Application

Table 61 Indonesia: Drilling and Completion Fluids Market Size, By Application

Table 62 India: Market Size, By Application.

Table 63 Australia: Drilling and Completion Fluids Market Size, By Application

Table 64 Rest of Asia Pacific: Market Size, By Application

Table 65 Africa: Drilling and Completion Fluids Market, By Application

Table 66 Africa: Market, By Fluid System,

Table 67 Africa: Market, By Well Type

Table 68 Africa: Market, By Country

Table 69 Africa: Market, By Country

Table 70 Angola: Market Size, By Application,

Table 71 Egypt: Market Size, By Application,

Table 72 Algeria: Market Size, By Application,

Table 73 Nigeria: Drilling & Completion Fluids Market Size, By Application,

Table 74 Libya: Market Size, By Application,

Table 75 Rest of Africa: Market Size, By Application,

Table 76 Contracts & Agreements,

Table 77 New Product Launches,

Table 78 Mergers & Acquisitions,

Table 79 Partnerships, Collaborations, Alliances, & Joint Ventures.

List of Figures (36 Figures)

Figure 1 Drilling and Completion Fluids Market Segments

Figure 2 Regional Scope

Figure 3 Drilling & Completion Fluids Market: Research Design

Figure 4 Breakdown of Primaries: By Company Type, Designation, and Region

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Assumptions of the Research Study

Figure 9 North America Dominated the Drilling and Completion Fluids Market in 2017

Figure 10 The Onshore Segment is Expected to Lead the Market, By Application, During the Forecast Period

Figure 11 Water-Based Fluid System Dominates the Drilling and Completion Fluids Market During the Forecast Period

Figure 12 Conventional Well Leads the Market During the Forecast Period

Figure 13 Increasing Drilling Activities are Expected to Drive the Market During the Forecast Period

Figure 14 North America and Asia Pacific are Expected to Be the Fastest Growing Markets for Drilling and Completion Fluids During the Forecast Period

Figure 15 The Onshore Application is Expected to Have the Largest Market Share During the Forecast Period

Figure 16 The Water-Based Fluid System is Expected to Lead the Market During the Forecast Period

Figure 17 The Conventional Well is Expected to Lead the Market During the Forecast Period

Figure 18 Market Dynamics: Drilling and Completion Fluids Market

Figure 19 Onshore Application Dominates the Market in 2017

Figure 20 Water-Based Fluid System is Estimated to Dominate the Market

Figure 21 The Conventional Well is Estimated to Dominate the Market in 2017

Figure 22 Regional Snapshot: Drilling & Completion Fluids Drilling and Completion Fluids Market, 2018–2023

Figure 23 North America: Drilling and Completion Fluids Market Snapshot

Figure 24 Europe: Drilling & Completion Fluids Market Snapshot

Figure 25 Key Developments in the Drilling and Completion Fluids Market, 2014–2017

Figure 26 Schlumberger Led the Drilling and Completion Fluids Market for Market in 2017

Figure 27 Bhge: Company Snapshot

Figure 28 Halliburton: Company Snapshot

Figure 29 Schlumberger: Company Snapshot

Figure 30 Newpark Resources Inc.: Company Snapshot

Figure 31 Tetra Technologies Inc.: Company Snapshot

Figure 32 CES Energy Solutions Corp.: Company Snapshot

Figure 33 National Oilwell Varco, Inc.: Company Snapshot

Figure 34 Secure Energy Services: Company Snapshot

Figure 35 Weatherford International: Company Snapshot

Figure 36 Scomi: Company Snapshot

Research Methodology

This research study involved the use of extensive secondary sources, directories, journals on drilling & completion fluids generation technologies, and other related rental markets; newsletters and databases such as Hoover’s, Bloomberg, Businessweek, and Factiva, among others, to identify and collect information useful for a technical, market-oriented, and commercial study of the global drilling and completion fluids market. The primary sources include several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of the major players in the drilling & completion fluids market

- Assessment of future trends and growth of end-users

- Assessment of the drilling & completion fluids market with respect to the solutions used for different applications at various drilling and completion fluids generation technologies

After arriving at the overall drilling and completion fluids market size, the total market was split into several segments and sub-segments. The figure given below illustrates the breakdown of primary interviews conducted during the research study based on company type, designation, and region.

Growth opportunities and latent adjacency in Drilling and Completion Fluids Market