Emergency Lighting Market by Power System (Self-Contained, Central, and Hybrid), Battery Type (Ni–Cd, Ni–MH, LiFePO4, and Lead–Acid), Light Source (Fluorescent, LED, Incandescent, Induction), Offering, Application, and Geography - Global Forecast to 2022

Updated date -

The emergency lighting market size is expected to be valued at USD 6.68 billion by 2022, growing at a CAGR of 7.83% between 2017 and 2022. Emergency light is used as a safety precaution during power outages so that people can find their way out of a place and prevent accidents. Hence, these are essentially used in residential, commercial, and industrial applications. The base year considered for the study is 2016, and the forecast is provided for the period 2017–2022.

Selected Market Dynamics in emergency lighting Market

Combination of emergency lighting with esthetic lighting

One of the latest trends in the market is the inclination toward design-driven emergency lights. Manufacturers and lighting designers are now emphasizing on the esthetic aspect of emergency lights as it plays an important role, especially in places such as hotels, architectural buildings, and houses. End users are concerned about the positions and appearance of emergency lights. Vendors are increasingly introducing esthetically appealing emergency lights without compromising on safety. In March 2017, Eaton Corporation (US) provided a lighting solution to Go Air Trampoline Park in Cardiff that enhanced the esthetic appeal and comfort of the interior while maximizing energy efficiency. Manufacturers also offer customized products for customers and government agencies to develop emergency lights according to their requirements.

Design-related issues that may hamper the esthetic appeal of buildings

The provision of appropriate emergency lighting can present many challenges for architects, electrical consultants, and lighting designers. At the start of any emergency lighting design, the relevant information regarding the premises needs to be obtained either from drawings, a site survey, or the building in charge. If this information is not obtained correctly, it may lead to a poorly designed emergency lighting system. Emergency lighting products are mandated by law and are an essential building requirement, but poorly designed lighting products, are likely to spoil the esthetic appearance.

The main objectives of this study are as follows:

- To define, describe, and forecast the global emergency lighting market on the basis of power system, battery type, light source, offering, application, and geography

- To provide a detailed value chain analysis along with the technology and market roadmap for the emergency lighting market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

The emergency lighting market is expected to reach USD 6.68 billion by 2022, at a CAGR of 7.83% between 2017 and 2022. The demand for emergency lighting is increasing because of several factors such as technological advancements taking place in the lighting industry, declining average selling price of LEDs, and increased infrastructure growth in various developing countries such as India, China, and South Korea.

The report covers the market segmented on the basis of power system, battery type, light source, application, offering, and geography. The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges. It also profiles the key players operating in the emergency lighting market.

On the basis of power system, the emergency lighting market has been segmented into self-contained power system, central power system, and hybrid systems. The market for self-contained power system is expected to grow at the highest CAGR during the forecast period. Self-contained batteries provide the required emergency lighting from a decentralized source, independent of central battery system. Therefore, it is a highly economical solution when used in extensively.

On the basis of battery type, the market has been segmented into Ni–Cd, Ni–MH, LiFePO4 and lead–acid. The market for LiFePO4 battery is expected to grow at the highest CAGR during the forecast period. LiFeP04 is becoming the preferred choice for emergency lighting not only because the batteries are physically smaller but also they draw far less power when they are charging.

On the basis of light source, the emergency lighting market has been segmented into fluorescent, LED, incandescent, induction, and others. The market for LED is expected to grow at the highest CAGR during the forecast period. LEDs are energy-efficient and their price has been declining since last few years. Therefore, they are largely used for emergency lighting systems.

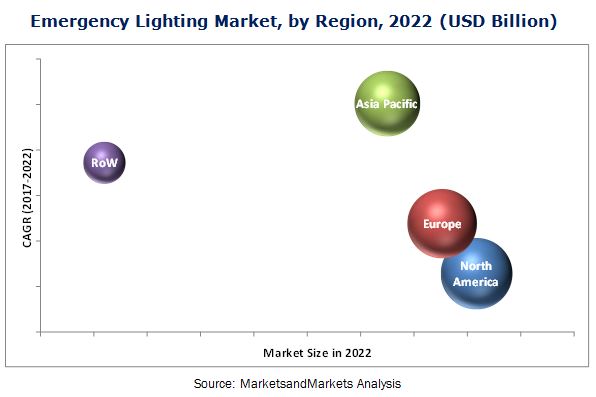

In terms of geography, North America held the largest share of the market in 2016, while the market in APAC is expected to grow at the highest rate during the forecast period. The rapidly growing urbanization and increasing awareness among people about safety are the factors driving the market in APAC.

The market is majorly dominated by North America; however, the market in APAC is expected to grow at the highest rate during the forecast period. The technological advancements in lighting industry and increasing awareness about safety are the factors responsible for the largest market share in North America. The increasing adoption of emergency lighting in developing countries, such as India and China, is driving the growth of the market in APAC.

Usage of emergency lighting in residential, commercial, and industrial applications drive the industry forward

Residential

The emergency lighting market for residential buildings is expected to have a huge potential in the future and is expected to witness a high growth rate. In the residential application, emergency lighting is typically installed in stairways, toilets, fire and first aid points, lifts and elevators, steps and ramps, exit doors, escalators, and large open areas. Most building codes mandate their installation in older buildings as well.

Commercial

Emergency lights are used in commercial buildings as a safety precaution to enable people to find their way out of a building or perform their activities without any interruption in case of power outages. The commercial end-use applications include hotels, offices, retail shops and malls, hospitals, and so on.

Industrial

Industrial emergency lights are suitable for warehouses, factories, and other spacious areas that require higher voltage or wattages for efficient illumination. In industrial settings, safety is a primary concern, and proper lighting and adequate illumination is a key factor in ensuring high productivity. Therefore, emergency lighting is installed in various industries to help workers deal with emergency situations and vacate the premises safely.

Critical questions would be:

- What are the upcoming developments in the emergency lighting market?

- Where will all the developments take the industry in the mid- to long-term?

High capital investment and operational cost, challenges related to design of emergency lighting, and lack of standardization are the factors restraining the growth of this market.

Some of the major players operating in the emergency lighting market are Philips Lighting Holding B.V. (Netherlands), Hubbell Lighting Inc. (US), Cooper Industries (Ireland), Schneider Electric SE (France), Emerson (US), Legrand S.A. (France), Acuity Brands (US), Beghelli S.p.A. (Italy), Daisalux (Spain), Zumtobel Group (Austria), OSRAM Licht AG (Germany), Digital Lumens (US), Fulham Co. Inc. (US), Arrow Emergency Lighting Limited (Ireland), Arts Energy (France), and Taurac (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.2 Secondary and Primary Research

2.2.1.1 Key Industry Insights

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.3.2 Top-Down Approach

2.3.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Major Opportunities in the Market

4.2 Market, By Power System

4.3 Market in APAC

4.4 North America Held the Largest Share of the Market in 2016

4.5 Emergency Lighting Market, By Application

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements in Lighting Industry

5.2.1.2 Combination of Emergency Lighting With Esthetic Lighting

5.2.1.3 Declining Average Selling Price of LEDs

5.2.1.4 Booming Construction Industry Globally

5.2.2 Restraints

5.2.2.1 High Capital Investment and Operational Cost

5.2.2.2 Design-Related Issues That May Hamper the Esthetic Appeal of Buildings

5.2.2.3 Lack of Standardization

5.2.3 Opportunities

5.2.3.1 Adoption of Better Safety Standards

5.2.3.2 Incorporation of Smart Technologies in Lighting Industry

5.2.4 Challenges

5.2.4.1 Rapidly Rising Testing Cost

5.2.5 Burning Issue

5.2.5.1 Initial Cost of Emergency Lighting Products

5.2.6 Winning Imperative

5.2.6.1 Geographic Expansion in Emerging Markets in APAC

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Product Developers

6.2.2 Lighting Chips and Packages

6.2.3 Key Technology Providers

6.2.4 Distributors

6.2.5 End Users

6.3 Regulatory Standards

6.4 Key Trends

6.4.1 Inclination Toward Design-Driven Emergency Lights

6.4.2 Self-Diagnostic System in Emergency Lighting Applications

7 Emergency Lighting Market, By Power System (Page No. - 50)

7.1 Introduction

7.2 Self-Contained Power System

7.3 Central Power System

7.4 Hybrid Power System

8 Emergency Lighting Market, By Battery Type (Page No. - 55)

8.1 Introduction

8.2 NI–CD

8.3 NI–MH

8.4 Lifepo4

8.5 Lead–Acid

9 Emergency Lighting Market, By Light Source (Page No. - 61)

9.1 Introduction

9.2 Fluorescent Lighting

9.3 LED

9.3.1 Types of LED

9.3.1.1 High-Brightness LED

9.3.1.2 Miniature LED

9.4 Incandescent

9.5 Induction

9.6 Others

9.6.1 Hid

9.6.2 Cold Cathode

9.6.3 Halogen Lamp

10 Emergency Lighting Market, By Offering (Page No. - 69)

10.1 Introduction

10.2 Hardware

10.2.1 Lights and Luminaires

10.2.2 Control Systems

10.2.3 Exit Signs

10.3 Software

10.4 Services

10.4.1 Pre-Installation Services

10.4.2 Post-Installation Services

11 Emergency Lighting Market, By Application (Page No. - 74)

11.1 Introduction

11.2 Residential

11.3 Commercial

11.3.1 Office Lighting

11.3.2 Retail Malls

11.3.3 Hospitality

11.4 Industrial

11.5 Others

11.5.1 Railways

11.5.2 Aircraft

11.5.3 Ships

12 Geographic Analysis (Page No. - 83)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Rest of Europe

12.3.4.1 Spain

12.3.4.2 Italy

12.3.4.3 Netherlands

12.4 APAC

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Rest of APAC

12.4.4.1 South Korea

12.4.4.2 Australia

12.4.4.3 Taiwan

12.5 Rest of the World

12.5.1 South America

12.5.2 Middle East and Africa

13 Competitive Landscape (Page No. - 113)

13.1 Introduction

13.2 Market Ranking of Players, 2016

13.3 Vendor Dive Overview

13.3.1 Vanguard

13.3.2 Dynamic

13.3.3 Innovator

13.3.4 Emerging

13.4 Market Ranking Analysis: Emergency Lighting Market

13.4.1 Product Offering

13.4.2 Business Strategy

*Top 25 Companies Analyzed for This Study are - Philips Lighitng Holding B.V.; Hubbel Lighting Inc; Eaton Corporation; Schneider Electric SE; Emerson; Legrand S.A.; Acuity Brands, Inc.; Beghelli S.P.A.; Daisalux; Zumtobel Group; Osram Licht Ag; ABB Group; Nvc Lighting Holding, Ltd.; R. Stahl; Ventilux; Emergency Lighting Products Ltd; Ams Ag; Iota Engineering, L.L.C.; Keysstone Technologies; Mcwong Internatinal Inc; Digital Lumens; Fulham Co., Inc.; Arrow Emergency Lighting Ltd; Arts Energy; Taurac

14 Company Profile (Page No. - 118)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

14.1 Introduction

14.2 Philips Lighting Holding B.V.

14.3 Hubbell Lighting, Inc.

14.4 Cooper Industries

14.5 Schneider Electric SE

14.6 Emerson

14.7 Legrand S.A.

14.8 Acuity Brands

14.9 Beghelli S. P. A.

14.10 Daisalux

14.11 Zumtobel Group

14.12 Osram Licht AG

14.13 Key Innovators

14.13.1 Digital Lumens

14.13.2 Fulham Co., Inc.

14.13.3 Arrow Emergency Lighting Limited

14.13.4 Arts Energy

14.13.5 Taurac

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 153)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (61 Tables)

Table 1 Market, By Power System, 2014–2022 (USD Million)

Table 2 Market for Self-Contained Power Systems, By Application, 2014–2022 (USD Million)

Table 3 Market for Central Power Systems, By Application, 2014–2022 (USD Million)

Table 4 Market for Hybrid Power Systems, By Application, 2014–2022 (USD Million)

Table 5 Emergency Lighting Market, By Battery Type, 2014–2022 (USD Million)

Table 6 Market for NI–CD Battery Type, By Region, 2014–2022 (USD Million)

Table 7 Market for NI–MH Battery Type, By Region, 2014–2022 (USD Million)

Table 8 Market for Lifepo4 Battery Type, By Region, 2014–2022 (USD Million)

Table 9 Market for Lead–Acid Battery Type, By Region, 2014–2022 (USD Million)

Table 10 Market, By Light Source, 2014–2022 (USD Million)

Table 11 Market for Fluorescent Lighting, By Region, 2014–2022 (USD Million)

Table 12 Market for LED, By Region, 2014–2022 (USD Million)

Table 13 Market for Incandescent Lighting, By Region, 2014–2022 (USD Million)

Table 14 Market for Induction Lighting, By Region, 2014–2022 (USD Million)

Table 15 Market for Other Light Sources, By Region, 2014–2022 (USD Million)

Table 16 Market, By Offering, 2014–2022 (USD Million)

Table 17 Market for Hardware Component, By Type, 2014–2022 (USD Million)

Table 18 Market, By Application, 2014–2022 (USD Million)

Table 19 Market for Residential Application, By Region, 2014–2022 (USD Million)

Table 20 Market for Residential Application, By Power System, 2014–2022 (USD Million)

Table 21 Market for Commercial Application, By Region, 2014–2022 (USD Million)

Table 22 Market for Commercial Application, By Power System, 2014–2022 (USD Million)

Table 23 Market for Industrial Application, By Region, 2014–2022 (USD Million)

Table 24 Market for Industrial Application, By Power System, 2014–2022 (USD Million)

Table 25 Market for Other Applications, By Region, 2014–2022 (USD Million)

Table 26 Market for Other Applications, By Power System, 2014–2022 (USD Million)

Table 27 Market, By Region, 2014–2022 (USD Million)

Table 28 Emergency Lighting Market in North America, By Country, 2014–2022 (USD Million)

Table 29 Market in North America, By Battery Type, 2014–2022 (USD Million)

Table 30 Market in North America, By Light Source, 2014–2022 (USD Million)

Table 31 Market in North America, By Offering, 2014–2022 (USD Million)

Table 32 Market in North America, By Application, 2014–2022 (USD Million)

Table 33 Emergency Lighting Market in US, By Application, 2014–2022 (USD Million)

Table 34 Emergency Lighting Market in Canada, By Application, 2014–2022 (USD Million)

Table 35 Market in Mexico, By Application, 2014–2022 (USD Million)

Table 36 Market in Europe, By Country, 2014–2022 (USD Million)

Table 37 Market in Europe, By Battery Type, 2014–2022 (USD Million)

Table 38 Market in Europe, By Light Source, 2014–2022 (USD Million)

Table 39 Market in Europe, By Offering, 2014–2022 (USD Million)

Table 40 Emergency Lighting Market in Europe, By Application, 2014–2022 (USD Million)

Table 41 Market in Germany, By Application, 2014–2022 (USD Million)

Table 42 Market in UK, By Application, 2014–2022 (USD Million)

Table 43 Market in France, By Application, 2014–2022 (USD Million)

Table 44 Emergency Lighting Market in Rest of Europe, By Application, 2014–2022 (USD Million)

Table 45 Market in APAC, By Country, 2014–2022 (USD Million)

Table 46 Market in APAC, By Battery Type, 2014–2022 (USD Million)

Table 47 Market in APAC, By Light Source, 2014–2022 (USD Million)

Table 48 Emergency Lighting Market in APAC, By Offering, 2014–2022 (USD Million)

Table 49 Market in APAC, By Application, 2014–2022 (USD Million)

Table 50 Market in China, By Application, 2014–2022 (USD Million)

Table 51 Market in Japan, By Application, 2014–2022 (USD Million)

Table 52 Market in India, By Application, 2014–2022 (USD Million)

Table 53 Market in Rest of APAC, By Application, 2014–2022 (USD Million)

Table 54 Market Size in RoW, By Region, 2014–2022 (USD Million)

Table 55 Market in RoW, By Battery Type, 2014–2022 (USD Million)

Table 56 Market in RoW, By Light Source, 2014–2022 (USD Million)

Table 57 Emergency Lighting Market in RoW, By Offering, 2014–2022 (USD Million)

Table 58 Market in RoW, By Application, 2014–2022 (USD Million)

Table 59 Market in South America, By Application, 2014–2022 (USD Million)

Table 60 Market in Middle East & Africa, By Application, 2014–2022 (USD Million)

Table 61 Market Ranking for the Market, 2015

List of Figures (79 Figures)

Figure 1 Emergency Lighting Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown & Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Growth of Market, 2014–2022

Figure 7 Self-Contained Power Systems Expected to Hold the Largest Size of the Emergency Lighting Market During the Forecast Period

Figure 8 Lifepo4 Battery Type Expected to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 9 LED Light Source Estimated to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 10 Services Market Estimated to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 11 Industrial Application Expected to Hold the Largest Size of the Emergency Lighting Market During the Forecast Period

Figure 12 North America Held the Largest Share of the Market in 2016

Figure 13 Significant Adoption of Emergency Lighting Expected in APAC Between 2017 and 2022

Figure 14 Market for Self-Contained Power Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 15 LED Light Source Held the Largest Share of the Market in APAC in 2016

Figure 16 US Dominated the Emergency Lighting Market in 2016

Figure 17 Residential Application to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 18 Technological Advancements Expected to Drive the Market

Figure 19 Reduction in LED Prices

Figure 20 Value Chain Analysis: Major Value is Added During Manufacturing and Distribution

Figure 21 Market, By Power System

Figure 22 Self-Contained Power Systems Expected to Dominate the Market During the Forecast Period

Figure 23 Residential Application Expected to Witness the Highest Growth Rate in the Market for Central Power System During the Forecast Period

Figure 24 Emergency Lighting Market, By Battery Type

Figure 25 Lifepo4 Battery Type Expected to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 26 APAC Estimated to Register the Highest Growth Rate for the Lifepo4 Battery Type Used in Emergency Lighting During the Forecast Period

Figure 27 Market, By Light Source

Figure 28 LED Light Source Expected to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 29 APAC is Estimated to Witness the Highest Growth Rate in the LED Light Segment of the Emergency Lighting During the Forecast Period

Figure 30 Market, By Offering

Figure 31 Hardware Segment Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 32 Market, By Application

Figure 33 Industrial Application Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 34 Self-Contained Power Systems Expected to Witness the Highest Growth Rate for the Residential Application of Emergency Lighting During the Forecast Period

Figure 35 APAC Estimated to Witness the Highest Growth Rate for the Industrial Application of Emergency Lighting During the Forecast Period

Figure 36 Market, By Region

Figure 37 Geographic Snapshot of the Market

Figure 38 Market in North America

Figure 39 North America: Emergency Lighting Market Snapshot

Figure 40 Market in Europe

Figure 41 Europe: Market Snapshot

Figure 42 Market in APAC

Figure 43 APAC: Market Snapshot

Figure 44 Market in RoW

Figure 45 RoW: Market Snapshot

Figure 46 Key Growth Strategy Adopted By the Companies Between 2014 and 2016

Figure 47 Dive Chart

Figure 48 Geographic Revenue Mix of Major Companies

Figure 49 Philips Lighting Holding B. V.: Company Snapshot

Figure 50 Philips Lighting Holding B. V.: Product Offering

Figure 51 Philips Lighting Holding B. V.: Business Strategy

Figure 52 Hubbell Lighting, Inc.: Company Snapshot

Figure 53 Hubbell Lighting, Inc.: Product Offering

Figure 54 Hubbell Lighting, Inc.: Business Strategy

Figure 55 Cooper Industries: Company Snapshot

Figure 56 Cooper Industries: Product Offering

Figure 57 Cooper Industries: Business Strategy

Figure 58 Schneider Electric SE: Company Snapshot

Figure 59 Schneider Electric SE: Product Offering

Figure 60 Schneider Electric SE: Business Strategy

Figure 61 Emerson: Company Snapshot

Figure 62 Emerson: Product Offering

Figure 63 Emerson: Business Strategy

Figure 64 Legrand S.A.: Company Snapshot

Figure 65 Legrand S.A.: Product Offering

Figure 66 Legrand S.A.: Business Strategy

Figure 67 Acuity Brands: Company Snapshot

Figure 68 Acuity Brands: Product Offering

Figure 69 Acuity Brands: Business Strategy

Figure 70 Beghelli S. P. A.: Product Offering

Figure 71 Beghelli S. P. A.: Business Strategy

Figure 72 Daisalux: Product Offering

Figure 73 Daisalux: Business Strategy

Figure 74 Zumtobel Group: Company Snapshot

Figure 75 Zumtobel Group: Product Offering

Figure 76 Zumtobel Group: Business Strategy

Figure 77 Osram Licht AG: Company Snapshot

Figure 78 Osram Licht AG: Product Offering

Figure 79 Osram Licht AG: Business Strategy

Growth opportunities and latent adjacency in Emergency Lighting Market

Please share detailed research methodology and market definitions, so I can be sure about the quality of the research.

Can you share what the current size is of the market for any indoor application in just North America? So that numbers are in line with my expectations?

Have you considered Wireless Emergency in this report? If so what are the expectations?