ETFE Market by Type(Pellet/Granule, Powder), Technology(Extrusion, Injection), Application(Films & Sheets, Wire & Cables, Tubes, Coatings), End-use Industry(Building & Construction, Automotive, Aerospace & Defense) & Region - Global Forecast to 2026

Updated on : August 25, 2025

ETFE Market

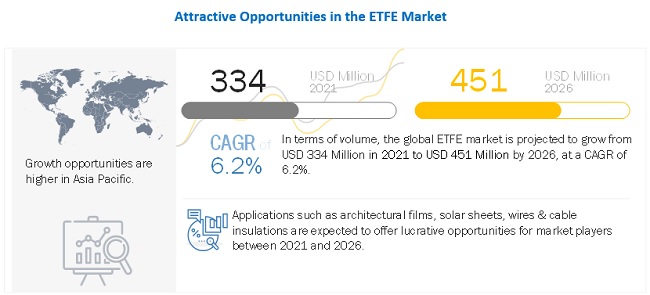

The global ETFE market was valued at USD 334 million in 2021 and is projected to reach USD 451 million by 2026, growing at 6.2% cagr from 2021 to 2026. Increasing usage of ETFE in solar panels, substitute for glass and other conventional materials, and growing demand in end-use industries are driving the demand for ETFE during the forecast period. Growth potential in emerging economies in Asia pacific and Middle east region offers opportunities for the market.

ETFE is mainly utilized in the building & construction industry as architectural films. Aerospace & defence, automotive, nuclear, and electronics are other end-use industries that require ETFE in various applications such as wires & cables, tubes, and jacketing. ETFE is prone to puncture, transmit more sound than glass, and higher cost than other conventional material, which is hampering the market growth.

North America is the largest market for ETFE, followed by Asia Pacific and Europe. The growth of the North America ETFE market can be attributed to the increased demand for ETFE from various end-use industries of the region. The Asia Pacific ETFE market is projected to grow at the highest CAGR during the forecast period, in terms of both, volume and value. Increasing investments in infrastructure development projects, rising urbanization, improving standards of living, thriving automotive sector, as well as high economic growth, are the key factors for the region's overall growth. The formulation and implementation of various policies mandating the use of environment-friendly products have led to innovations in the ETFE industry of the region.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global ETFE market

Due to the COVID-19 pandemic, the economic growth of several countries had declined owing to the suspension of the manufacturing facilities, declining demand for oil & gas and industrial products, and disruption of supply chain. Manufacturing companies producing ETFE went into a temporary shutdown phase. The utilization rate of companies also declined because of labor shortage due to social distancing regulation or as a protective measure to curb the spreading of the virus. The pandemic expects to have a lasting impact on the supply, demand, and prices of products. The price of crude oil increased during the pandemic, which further influenced the price of ETFE. Manufacturers of ETFE witnessed a decline in revenue due to sluggish growth in the construction and automotive market.

ETFE Market Dynamics

Driver: Increasing usage of ETFE in solar panels to drive market

Materials used for photovoltaic (PV) are conventionally protected with glass sheets due to their light-transmitting properties. However, with steady growth in PV applications, companies are looking for alternative options for glass due to its high weight and rigidity.

ETFE has thermal and chemical flexibility of fluoropolymers and good mechanical properties. ETFE films are used for front and backing sheets of PV modules. When used as front sheets for PV modules, these films help improve the efficiency of solar cells since they transmit 90%–95% of light. When used as backing sheets, they help improve durability due to their excellent resistance to adverse weather conditions and do not deteriorate, even if left outdoors for a long time. The low weight of ETFE sheets helps in reducing the weight of PV modules.

ETFE films can withstand UV exposure and are suitable for flexible and lightweight solar modules. They provide cushioning and structural support to solar cells and circuitry while improving the transmission of sunlight for energy conversion. Along with reducing system costs, ETFE films help manufacturers reduce their packaging and shipping costs. ETFE has a low coefficient of friction which allows self-cleaning and is integrated with matt finish to minimize glare reflection.

PV accounted for 3.1% of the global electricity generation in 2019. The US and China are major countries involved in power generation from solar PV. In 2020, PV solar generation increased by 23% from 2019. Globally, countries are planning for Net Zero Emissions by 2050. According to the International Energy Agency (IEA), with the Net Zero Emission scenario, the global solar PV power generation in 2030 will be 6,970 TWh. This growth, in turn, will increase the demand for ETFE films.

Restraints: Prone to puncture and transmit more sound than glass

ETFE allows more sound transmission than other materials such as glass and other plastics. This factor is restraining market growth. ETFE pillows transmit almost all sounds from outside. However, noise and rain suppression systems are now being incorporated into external structures with successful results. For a roof subject to raindrops, the sound of rain can be suppressed by adding a rain attenuation layer on the cushions' surface. This acts as a dampener, stopping the sound reverberating around the space below. However, adding additional layers to the surface will increase the construction cost.

Despite its strength, ETFE can be cut through with a sharp knife. Therefore, it is generally not used in windows or exterior walls unless a foundation of roughly 15 ft. is created off the ground. ETFE foil can be punctured with a knife or other sharp implements. ETFE roofs or canopies are prone to damage by birds, especially near seashores, where seagulls are susceptible to damage the roof by pecking. Therefore, ETFE membranes are not preferred in applications where regular maintenance is not feasible, which acts as a restraint for the ETFE market.

Opportunity: Growth potential in emerging economies

Growing industrial development in emerging economies, especially in Asia Pacific, the Middle East, and South America, pushes the growth of the building & construction industry. The advanced properties of the ETFE tensile structure make it an ideal solution for various projects. The usage of tensile structures has benefitted architects to create exceptional structures. The extensive adoption of tensile structures in the construction industry in emerging economies is due to modern structures. Limitless designs are now possible with ETFE films as they offer the flexibility of being merged with conventional construction techniques. For instance, in 2020, Vector Foiltec (Germany) designed the roof of FALCON MALL, Kunming, China, with the ETFE system.

India, Brazil, China, countries in emerging clusters such as MENA (the Middle East and North Africa) and ASEAN countries are prime markets for tensile structures. Such structures are gaining popularity in these countries and globally owing to their cost efficiency, esthetic benefits, and robust service file. India is emerging as a major market for tensile architecture and awnings & canopies due to the country's acceptance of architecture films as a cost-effective and efficient building material. These factors are expected to provide significant growth opportunities for market players

Asia Pacific is projected to lead the PV power generation in the next five years. The growing adoption of PV modules in countries such as China, Japan, and India fuels the market's growth. Various initiatives and favorable policies launched by governments of different countries in Asia Pacific to promote solar energy are expected to propel the demand for PV systems in the region in the coming years. The shift toward EVs will promote the growth of the automotive industry in the region. The growth in various end-use industries in emerging economies will offer opportunities to ETFE producers.

Challenges: Lack of skilled workforce

Installing tensile structures in demanding construction applications require extensive training and is best handled by skilled and experienced professionals. Several professionals are involved in the entire production cycle, from early designs to the complete construction of tensile structures. This usually includes contractors, engineers, manufacturers, and installers. The use of ETFE in tensile architecture is subjected to various designs and execution complications. Like any other conventional building, the crew involved is required to consider every minute detail of the building structure, its purpose, service life, site environmental factors, and building code requirements to safeguard the building. The limited availability of a skilled workforce is a challenge for stakeholders in the ETFE market, particularly in developing countries.

Pellet/granule is the largest segment by type in the ETFE market.

Based on type, pellet/granule is estimated to be the largest type of ETFE during the forecast period. The pellet/granule form of ETFE can be both, extruded and injected to convert it to films & sheets, wires & cables, and tubes, which are then used by various end-use industries such as architecture, automotive, chemical processing, and others. They have low melting points and high-melt flow rates (MFRs), making pellets suitable for injection, extrusion, rotational, and other molding processes.

Films & sheets is the largest segment by application in the ETFE market.

Films & sheets is estimated to be the largest and fastest-growing application segment in the ETFE market during the forecast period. ETFE films & sheets are temperature, aging, and chemical resistant and have superior mechanical strength. ETFE films and sheets are now largely replacing glass in the building & construction industry due to superior light transmission properties. ETFE sheets are more commonly found as roofing in public areas, such as stations, airports, educational centers, museums, conference centers, and other artistic structures. ETFE films are also used for front and backing sheets of photovoltaic (PV) modules. When used as front sheets for PV modules, these films help improve the efficiency of solar cells since they transmit 90%-95% of light.

Building & Construction is the largest segment by end-use industry in the ETFE market.

Building & Construction is estimated to be the largest end-use industry segment in the ETFE market during the forecast period. ETFE is majorly used in non-residential, civil infrastructures, and commercial buildings for roofing application. Energy efficiency, cost control, low carbon emissions, sustainability, recyclability, and green buildings are major factors that influence the construction industry. ETFE films are lightweight, cost-effective, eco-friendly, 100% recyclable and esthetically preferred compared to glass. These properties propel the demand for ETFE films in the construction industry.

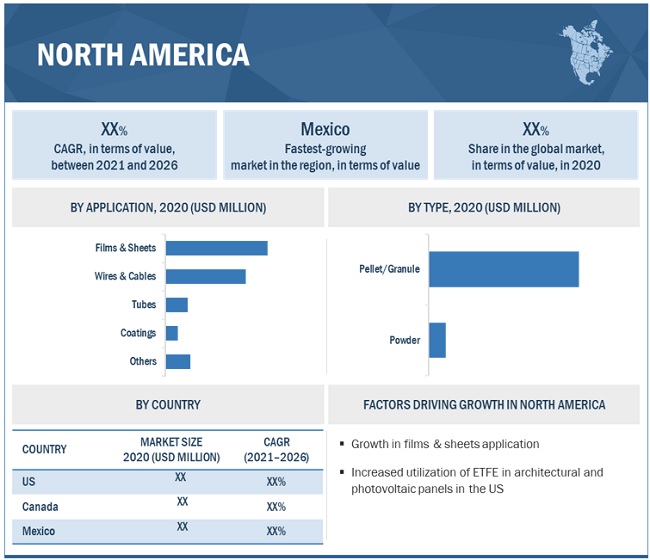

North America is estimated to be the largest market for ETFE.

North America accounted for the largest share of the ETFE market in 2020, followed by Europe and APAC. The major end users of ETFE in North America building & construction, automotive, aerospace, electric & electronics, nuclear, and solar energy. . The US dominates the ETFE market in North America in terms of value and volume. New construction projects, greenhouse applications, steady growth in automotive, and an increase in PV installation in the region are driving the ETFE market in the region. Global ETFE manufacturers such as AGC Inc. (Japan), The Chemours Company (US), 3M (US), and Daikin Industries, Ltd. (Japan) have their business operation in the US.

To know about the assumptions considered for the study, download the pdf brochure

ETFE Market Players

The leading players in the ETFE market are AGC Inc. (Japan), The Chemours Company (US), 3M (US), Daikin Industries, Ltd. (Japan), Vector Foiltec (Germany), HaloPolymer (Russia), Guangzhou Li Chang Fluoroplastics Co., Ltd. (China), Hubei Everflon Polymer Co., Ltd. (China), Ensinger Group (Germany), Dongyue Group (China), Saint-Gobain S.A. (France), Mitsubishi Chemical Advanced Materials (Switzerland), Solvay S.A. (Belgium), BASF SE (Germany), SABIC (Saudi Arabia), and others.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2020 to strengthen their position in the market. New product development, contract & agreements, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for the ETFE in the emerging economies.

ETFE Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Unit considered |

Value (USD Million), Volume (Tons) |

|

Segments |

Type, Technology, Application, End-use industry and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East & Africa and South America |

|

Companies |

The major players are AGC Inc. (Japan), The Chemours Company (US), 3M (US), Daikin Industries, Ltd. (Japan), Vector Foiltec (Germany), HaloPolymer (Russia), Guangzhou Li Chang Fluoroplastics Co., Ltd. (China), Hubei Everflon Polymer Co., Ltd. (China), Ensinger Group (Germany), Dongyue Group (China), Saint-Gobain S.A. (France), Mitsubishi Chemical Advanced Materials (Switzerland), Solvay S.A. (Belgium), BASF SE (Germany), SABIC (Saudi Arabia), and others are covered in the ETFE market. |

This research report categorizes the global ETFE market on the basis of Type, Technology, Application, and Region.

ETFE Market on the basis of Type:

- Pellet/Granule

- Powder

ETFE Market on the basis of Technology:

- Extrusion Molding

- Injection Molding

- Others

ETFE Market on the basis of Application:

- Films & Sheets

- Wires & Cables

- Tubes

- Coatings

- Others

ETFE Market on the basis of End-use industry:

- Building & Construction

- Automotive

- Aerospace & Defense

- Nuclear

- Solar Energy

- Others

ETFE Market on the basis of region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In 2021, Vector Foiltec installed 6,814 m² of Texlon ETFE on Assima Mall in Kuwait City, Kuwait.

- In 2020, Vector Foiltec installed the Texlon ETFE roof in Allegiant Stadium, Las Vegas, Nevada, US. It covers 24,685 m² and consists of 107 ETFE cushions.

- In 2020, Vector Foiltec installed Texlon ETFE canopy and façade to University Of Oregon – Hayward Field, Eugene, Oregon, US. It covers 15,610 m², and the stadium has a capacity of over 25,000 seats.

- In December 2020, AGC Chemicals Americas offers F-CLEAN ETFE film for commercial greenhouse facility operators. It offers light transmittance based on specific plant growing requirements.

- In November 2020, AGC announced the installation of Fluon ETFE films on the roof (75,000m2) of SoFi Stadium, US.

- In March 2020, AGC announced the use of their Fluon ETFE film as the roofing material at Tokyo International Airport, covering 9,000m2.

- In September 2019, Daikin America, Inc. announced the expansion of Decatur, Alabama facilities with an investment of up to USD 195 million. The expansion will add production capabilities for polymers, enhance infrastructure and R&D capability.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the ETFE market?

The major driver influencing the growth of ETFE is increasing usage of ETFE in solar panels to drive market.

How is the ETFE market segmented by type?

The ETFE market is segmented on the basis of type as Pellet/Granule and Powder.

What is the major challenge in the ETFE market?

Lack of skilled workforce is a major challenge in the ETFE market.

How is the ETFE market segmented by the application?

Lack of skilled workforce is a major challenge in the ETFE market.

How is the ETFE market segmented by the technology?

The ETFE market is segmented on the basis of technology as Extrusion Molding, Injection Molding, and Others.

What are the major opportunities in the ETFE market?

Growth potential in emerging economies is an opportunity for the ETFE market.

Which region has the largest market for ETFE?

North America has the largest market for ETFE owing to the increase in demand from US.

How market segments for ETFE by region?

On the basis of region the market is segmented into North America, Europe, APAC, Middle East & Africa and South America

What is ETFE?

ETFE is a fluorine-based plastic that offers high corrosion resistance, strength, and energy radiation resistance properties. It is lightweight, transparent, recyclable, and strong.

Who are the major manufacturers of ETFE?

The major manufacturers of ETFE are AGC Inc. (Japan), The Chemours Company (US), 3M (US), Daikin Industries, Ltd. (Japan), Vector Foiltec (Germany), HaloPolymer (Russia), Guangzhou Li Chang Fluoroplastics Co., Ltd. (China), Hubei Everflon Polymer Co., Ltd. (China), Ensinger Group (Germany), Dongyue Group (China), Saint-Gobain S.A. (France), Mitsubishi Chemical Advanced Materials (Switzerland), Solvay S.A. (Belgium), BASF SE (Germany), and SABIC (Saudi Arabia). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 ETFE PROPERTIES

TABLE 2 MARKET SEGMENT DEFINITION, BY TYPE

TABLE 3 MARKET SEGMENT DEFINITION, BY TECHNOLOGY

TABLE 4 MARKET SEGMENT DEFINITION, BY APPLICATION

TABLE 5 MARKET SEGMENT DEFINITION, BY END-USE INDUSTRY

1.3 MARKET SCOPE

1.3.1 INCLUSIONS & EXCLUSIONS

TABLE 6 INCLUSIONS & EXCLUSIONS IN REPORT

1.3.2 MARKET SEGMENTATION

FIGURE 1 ETFE MARKET SEGMENTATION

1.3.3 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 PACKAGE SIZE

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 2 ETFE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH: ASCERTAINING SHARE OF ETFE FROM US FLUOROPOLYMER MARKET, IN TERMS OF DEMAND

FIGURE 3 APPROACH 1: BASED ON ETFE SHARE US MARKET, 2020

2.2.2 SUPPLY-SIDE APPROACH: ASCERTAINING SHARE OF KEY PLAYERS IN GLOBAL MARKET

FIGURE 4 APPROACH 2: GLOBAL FLUOROPOLYMER MARKET IN 2020

2.3 DATA TRIANGULATION

FIGURE 5 ETFE MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.4.3 GROWTH RATE ASSUMPTIONS

2.4.4 FORECASTING FACTORS IMPACTING GROWTH

FIGURE 6 FORECASTING FACTORS IMPACTING GROWTH

3 EXECUTIVE SUMMARY (Page No. - 58)

FIGURE 7 PELLET/GRANULE ACCOUNTED FOR LARGER SHARE IN 2020

FIGURE 8 EXTRUSION MOLDING ACCOUNTED FOR LARGEST SHARE OF ETFE MARKET IN 2020

FIGURE 9 FILMS & SHEETS ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

FIGURE 10 BUILDING & CONSTRUCTION ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR ETFE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 SIGNIFICANT OPPORTUNITIES IN ETFE MARKET

FIGURE 12 FILMS & SHEETS APPLICATION TO OFFER GROWTH OPPORTUNITIES TO MARKET PLAYERS

4.2 ETFE MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY, 2020

FIGURE 13 US CAPTURED LARGEST MARKET SHARE IN NORTH AMERICA IN 2020

4.3 ETFE MARKET, BY TYPE

FIGURE 14 PELLET/GRANULE SEGMENT TO DOMINATE ETFE MARKET DURING 2021–2026

4.4 ETFE MARKET, BY TECHNOLOGY

FIGURE 15 EXTRUSION MOLDING TO LEAD ETFE MARKET FROM 2021 TO 2026

4.5 ETFE MARKET, BY APPLICATION

FIGURE 16 FILMS & SHEETS TO BE FASTEST-GROWING SEGMENT OF ETFE MARKET

4.6 ETFE MARKET, BY END-USE INDUSTRY

FIGURE 17 BUILDING & CONSTRUCTION TO COMMAND ETFE MARKET

4.7 ETFE MARKET, BY COUNTRY

FIGURE 18 INDIA TO WITNESS HIGHEST CAGR IN GLOBAL ETFE MARKET, IN TERMS OF VOLUME, FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ETFE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing usage of ETFE in solar panels to drive market

FIGURE 20 SOLAR PHOTOVOLTAIC POWER GENERATION

5.2.1.2 Substitute for glass and other conventional plastics materials

TABLE 7 COMPARISON BETWEEN PROPERTIES OF ETFE FILM AND GLASS

TABLE 8 COMPARISON BETWEEN PROPERTIES OF ETFE AND PET

5.2.1.3 Growing demand in end-use industries

5.2.2 RESTRAINTS

5.2.2.1 Prone to puncture and transmit more sound than glass

5.2.2.2 Higher cost of ETFE than that of conventional materials

5.2.3 OPPORTUNITIES

5.2.3.1 Growth potential in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled workforce

5.2.4.2 Price volatility of raw materials

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 21 ETFE MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 9 ETFE MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 COVID-19 IMPACT

5.4.1 IMPACT OF COVID-19 ON BUILDING & CONSTRUCTION INDUSTRY

5.4.1.1 Disruption in commercial construction sectors

5.4.2 DISRUPTION IN AUTOMOTIVE INDUSTRY

5.4.3 MOST AFFECTED REGIONS/COUNTRIES

5.4.3.1 China

5.4.3.2 Europe

5.4.4 STIMULUS PACKAGE BY G-20 COUNTRIES

TABLE 10 RELIEF PACKAGES ANNOUNCED BY G-20 COUNTRIES

FIGURE 22 GDP GROWTH RATE, BY REGION, 2019–2026

5.5 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: ETFE MARKET

5.5.1 INDUSTRY STRUCTURE

5.5.2 RAW MATERIAL SUPPLIERS

5.5.3 MANUFACTURERS

5.5.4 END USERS

5.5.5 COVID-19 IMPACT

5.6 REGULATORY LANDSCAPE

TABLE 11 ETFE FIRE RESISTANCE AS PER INTERNATIONAL STANDARDS

5.7 AVERAGE PRICING ANALYSIS

FIGURE 24 WEIGHTED AVERAGE PRICING ANALYSIS (USD/KG) OF ETFE, BY REGION, 2020

TABLE 12 AVERAGE SELLING PRICE OF ETFE, TYPE VS. REGION, USD/KG

5.8 CASE STUDY

5.8.1 ETFE FILM FOR ROOFING APPLICATION

5.8.2 RETRACTABLE ETFE ROOF

5.9 PATENT ANALYSIS

5.9.1 INTRODUCTION

5.9.2 METHODOLOGY

5.9.3 DOCUMENT TYPE

TABLE 13 GRANTED PATENTS ARE 10% OF TOTAL COUNT IN LAST 10 YEARS

FIGURE 25 NUMBER OF PATENTS FILED IN LAST 10 YEARS

5.9.4 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 26 YEAR-WISE DATA OF NUMBER OF PATENTS PUBLISHED, 2010–2020

5.9.5 INSIGHT

5.9.6 LEGAL STATUS OF PATENTS

FIGURE 27 LEGAL STATUS

5.9.7 JURISDICTION ANALYSIS

FIGURE 28 PATENT ANALYSIS FOR TOP 10 JURISDICTIONS BY DOCUMENT

5.9.8 TOP COMPANIES/APPLICANTS

FIGURE 29 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2010–2020

TABLE 14 PATENTS BY ASAHI GLASS CO., LTD., 2010–2019

TABLE 15 PATENTS BY DAIKIN INDUSTRIES, LTD. AND DAIKIN AMERICA, INC., 2015–2020

TABLE 16 PATENTS BY DUPONT, 2011–2018

TABLE 17 TOP PATENT OWNERS (US) IN LAST 10 YEARS

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES (YC & YCC SHIFT)

FIGURE 30 REVENUE SHIFT IN ETFE MARKET

5.11 RANGE SCENARIOS OF ETFE MARKET

FIGURE 31 PRE- AND POST-COVID-19 ANALYSIS OF ETFE DEMAND

5.12 ECOSYSTEM

FIGURE 32 ETFE ECOSYSTEM

5.13 MACROECONOMIC INDICATORS

5.13.1 INTRODUCTION

5.13.2 TRENDS AND FORECAST OF GDP

TABLE 18 GDP GROWTH PROJECTION WORLDWIDE

5.13.3 GLOBAL AUTOMOBILE PRODUCTION AND GROWTH

TABLE 19 GLOBAL AUTOMOBILE PRODUCTION (UNITS) & GROWTH, BY COUNTRY

5.14 ADJACENT AND RELATED MARKETS

5.14.1 INTRODUCTION

5.14.2 LIMITATIONS

5.14.3 HIGH-PERFORMANCE FLUOROPOLYMERS MARKET

5.14.3.1 Market definition

5.14.3.2 High-performance fluoropolymers market, by type

TABLE 20 HIGH-PERFORMANCE FLUOROPOLYMER MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 21 HIGH-PERFORMANCE FLUOROPOLYMERS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

5.14.3.3 High-performance fluoropolymers market, by form

TABLE 22 HIGH-PERFORMANCE FLUOROPOLYMER MARKET SIZE, BY FORM, 2018–2025 (KILOTON)

TABLE 23 HIGH-PERFORMANCE FLUOROPOLYMER MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

5.14.3.4 High-performance fluoropolymers market, by end-use industry

TABLE 24 HIGH-PERFORMANCE FLUOROPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 25 HIGH-PERFORMANCE FLUOROPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

5.14.3.5 High-performance fluoropolymers market, by region

TABLE 26 HIGH-PERFORMANCE FLUOROPOLYMERS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 27 HIGH-PERFORMANCE FLUOROPOLYMERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

5.14.4 CONSTRUCTION FABRICS MARKET

5.14.4.1 Market definition

5.14.4.2 Construction fabrics market, by type

TABLE 28 CONSTRUCTION FABRICS MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

5.14.4.3 Construction fabrics market, by application

TABLE 29 CONSTRUCTION FABRICS MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

5.14.4.4 Construction fabrics market, by region

TABLE 30 CONSTRUCTION FABRICS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

6 ETFE MARKET, BY TYPE (Page No. - 103)

6.1 INTRODUCTION

FIGURE 33 PELLET/GRANULE ETFE TO DOMINATE MARKET BETWEEN 2021 AND 2026

TABLE 31 ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 32 ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 33 ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 34 ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

6.2 PELLET/GRANULE

6.2.1 EASE IN PROCESSABILITY DRIVE DEMAND IN VARIOUS END-USE INDUSTRIES

TABLE 35 PELLET/GRANULE ETFE MARKET SIZE, BY REGION, 2016–2018 (TON)

TABLE 36 PELLET/GRANULE ETFE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 37 PELLET/GRANULE ETFE MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 38 PELLET/GRANULE ETFE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 POWDER

6.3.1 GROWTH IN COATING APPLICATIONS IN CHEMICAL PROCESSING TO DRIVE DEMAND

TABLE 39 POWDER ETFE MARKET SIZE, BY REGION, 2016–2018 (TON)

TABLE 40 POWDER ETFE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 41 POWDER ETFE MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 42 POWDER ETFE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 ETFE MARKET, BY TECHNOLOGY (Page No. - 109)

7.1 INTRODUCTION

FIGURE 34 EXTRUSION TECHNOLOGY TO LEAD ETFE MARKET

TABLE 43 ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 44 ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 45 ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 46 ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

7.2 EXTRUSION MOLDING

7.2.1 INCREASED DEMAND FOR ETFE IN FILM & SHEET APPLICATIONS

TABLE 47 EXTRUSION MOLDING: ETFE MARKET SIZE, BY REGION, 2016–2018 (TON)

TABLE 48 EXTRUSION MOLDING: ETFE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 49 EXTRUSION MOLDING: ETFE MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 50 EXTRUSION MOLDING: ETFE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 INJECTION MOLDING

7.3.1 MECHANICAL, ELECTRICAL, AND THERMAL PROPERTIES SUITABLE FOR INJECTION MOLDING PROCESS

TABLE 51 INJECTION MOLDING: ETFE MARKET SIZE, BY REGION, 2016–2018 (TON)

TABLE 52 INJECTION MOLDING: ETFE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 53 INJECTION MOLDING: ETFE MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 54 INJECTION MOLDING: ETFE MARKET SIZE IN INJECTION MOLDING, BY REGION, 2019–2026 (USD MILLION)

7.4 OTHERS

TABLE 55 OTHERS: ETFE MARKET SIZE, BY REGION, 2016–2018 (TON)

TABLE 56 OTHERS: ETFE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 57 OTHERS: ETFE MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 58 OTHERS: ETFE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 ETFE MARKET, BY APPLICATION (Page No. - 117)

8.1 INTRODUCTION

FIGURE 35 FILMS & SHEETS TO LEAD ETFE MARKET

TABLE 59 ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 60 ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 61 ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 62 ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 FILMS & SHEETS

8.2.1 CONSTRUCTION AND PHOTOVOLTAIC TO DRIVE ETFE FILMS DEMAND

TABLE 63 ETFE MARKET SIZE IN FILMS & SHEETS, BY REGION, 2016–2018 (TON)

TABLE 64 ETFE MARKET SIZE IN FILMS & SHEETS, BY REGION, 2016–2018 (USD MILLION)

TABLE 65 ETFE MARKET SIZE IN FILMS & SHEETS, BY REGION, 2019–2026 (TON)

TABLE 66 ETFE MARKET SIZE IN FILMS & SHEETS, BY REGION, 2019–2026 (USD MILLION)

8.3 WIRES & CABLES

8.3.1 STEADY RECOVERY OF AUTOMOTIVE SECTOR TO DRIVE MARKET

TABLE 67 ETFE MARKET SIZE IN WIRES & CABLES, BY REGION, 2016–2018 (TON)

TABLE 68 ETFE MARKET SIZE IN WIRES & CABLES, BY REGION, 2016–2018 (USD MILLION)

TABLE 69 ETFE MARKET SIZE IN WIRES & CABLES, BY REGION, 2019–2026 (TON)

TABLE 70 ETFE MARKET SIZE IN WIRES & CABLES, BY REGION, 2019–2026 (USD MILLION)

8.4 TUBES

8.4.1 RESISTANCE AGAINST HIGH TEMPERATURE, CHEMICALS, AND RADIATION PROPERTIES OF ETFE TUBES

TABLE 71 ETFE MARKET SIZE IN TUBES, BY REGION, 2016–2018 (TON)

TABLE 72 ETFE MARKET SIZE IN TUBES, BY REGION, 2016–2018 (USD MILLION)

TABLE 73 ETFE MARKET SIZE IN TUBES, BY REGION, 2019–2026 (TON)

TABLE 74 ETFE MARKET SIZE IN TUBES, BY REGION, 2019–2026 (USD MILLION)

8.5 COATINGS

8.5.1 GROWTH OF SEMICONDUCTOR INDUSTRY TO DRIVE MARKET

TABLE 75 ETFE MARKET SIZE IN COATINGS, BY REGION, 2016–2018 (TON)

TABLE 76 ETFE MARKET SIZE IN COATINGS, BY REGION, 2016–2018 (USD MILLION)

TABLE 77 ETFE MARKET SIZE IN COATINGS, BY REGION, 2019–2026 (TON)

TABLE 78 ETFE MARKET SIZE IN COATINGS, BY REGION, 2019–2026 (USD MILLION)

8.6 OTHERS

TABLE 79 ETFE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2018 (TON)

TABLE 80 ETFE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2018 (USD MILLION)

TABLE 81 ETFE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (TON)

TABLE 82 ETFE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9 ETFE MARKET, BY END-USE INDUSTRY (Page No. - 130)

9.1 INTRODUCTION

FIGURE 36 BUILDING & CONSTRUCTION TO DOMINATE MARKET BETWEEN 2021 AND 2026

TABLE 83 ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

TABLE 84 ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2 BUILDING & CONSTRUCTION

9.2.1 GROWING CONSTRUCTION INDUSTRY TO BOOST DEMAND FOR ETFE

TABLE 85 ETFE MARKET SIZE FOR BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (TON)

TABLE 86 ETFE MARKET SIZE FOR BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 EMERGING TRENDS AND NEW INVESTMENTS TO DRIVE DEMAND FOR ETFE

9.3.1.1 Growth in electric vehicles production to drive demand

TABLE 87 ETFE MARKET SIZE FOR AUTOMOTIVE, BY REGION, 2019–2026 (TON)

TABLE 88 ETFE MARKET SIZE FOR AUTOMOTIVE, BY REGION, 2019–2026 (USD MILLION)

9.4 AEROSPACE & DEFENSE

9.4.1 TECHNOLOGICAL INNOVATIONS AND INCREASING PENETRATION OF ETFE-COATED WIRES IN AIRCRAFT MANUFACTURING

TABLE 89 ETFE MARKET SIZE FOR AEROSPACE & DEFENSE, BY REGION, 2019–2026 (TON)

TABLE 90 ETFE MARKET SIZE FOR AEROSPACE & DEFENSE, BY REGION, 2019–2026 (USD MILLION)

9.5 NUCLEAR

9.5.1 DEVELOPMENT OF NEW POWER PLANTS TO BOOST DEMAND FOR ETFE

TABLE 91 ETFE MARKET SIZE FOR NUCLEAR, BY REGION, 2019–2026 (TON)

TABLE 92 ETFE MARKET SIZE FOR NUCLEAR, BY REGION, 2019–2026 (USD MILLION)

9.6 SOLAR ENERGY

9.6.1 INCREASE IN SOLAR PV INSTALLED CAPACITY TO BOOST DEMAND

TABLE 93 ETFE MARKET SIZE FOR SOLAR ENERGY, BY REGION, 2019–2026 (TON)

TABLE 94 ETFE MARKET SIZE FOR SOLAR ENERGY, BY REGION, 2019–2026 (USD MILLION)

9.7 OTHERS

TABLE 95 ETFE MARKET SIZE FOR OTHER INDUSTRIES, BY REGION, 2019–2026 (TON)

TABLE 96 ETFE MARKET SIZE FOR OTHER INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

10 ETFE MARKET, BY REGION (Page No. - 140)

10.1 INTRODUCTION

FIGURE 37 REGIONAL SNAPSHOT: ASIA PACIFIC EMERGING AS NEW HOTSPOT

TABLE 97 ETFE MARKET SIZE, BY REGION, 2016–2018 (TON)

TABLE 98 ETFE MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 99 ETFE MARKET SIZE, BY REGION, 2019–2026 (TON)

TABLE 100 ETFE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 38 ETFE MARKET SNAPSHOT IN NORTH AMERICA: US TO LEAD ETFE MARKET IN NORTH AMERICA

TABLE 101 NORTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (TON)

TABLE 102 NORTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 103 NORTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 104 NORTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 106 NORTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 107 NORTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 108 NORTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 110 NORTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 111 NORTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 112 NORTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 114 NORTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 115 NORTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 116 NORTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

TABLE 118 NORTH AMERICA: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Rising demand from end-use industries to support market growth

FIGURE 39 US SOLAR PV GENERATING CAPACITY, 2020-2050 (GIGAWATTS)

TABLE 119 US: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 120 US: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 121 US: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 122 US: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 US: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 124 US: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 125 US: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 126 US: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 127 US: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 128 US: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 129 US: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 130 US: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growth in PV application to fuel ETFE demand

TABLE 131 CANADA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 132 CANADA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 133 CANADA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 134 CANADA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 CANADA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 136 CANADA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 137 CANADA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 138 CANADA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 139 CANADA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 140 CANADA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 141 CANADA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 142 CANADA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Shift toward green buildings to drive use in building & construction

TABLE 143 MEXICO: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 144 MEXICO: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 145 MEXICO: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 146 MEXICO: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 MEXICO: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 148 MEXICO: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 149 MEXICO: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 150 MEXICO: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 151 MEXICO: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 152 MEXICO: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 153 MEXICO: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 154 MEXICO: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 155 EUROPE: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (TON)

TABLE 156 EUROPE: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 157 EUROPE: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 158 EUROPE: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 159 EUROPE: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 160 EUROPE: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 161 EUROPE: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 162 EUROPE: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 164 EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 165 EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 166 EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 167 EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 168 EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 169 EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 170 EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 171 EUROPE: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

TABLE 172 EUROPE: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing adaptation of PV to support market growth

FIGURE 40 PV INSTALLED CAPACITY, GERMANY, 2015-2021

TABLE 173 GERMANY: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 174 GERMANY: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 175 GERMANY: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 176 GERMANY: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 GERMANY: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 178 GERMANY: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 179 GERMANY: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 180 GERMANY: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 181 GERMANY: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 182 GERMANY: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 183 GERMANY: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 184 GERMANY: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Growth in architectural applications to fuel demand

TABLE 185 FRANCE: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 186 FRANCE: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 187 FRANCE: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 188 FRANCE: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 FRANCE: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 190 FRANCE: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 191 FRANCE: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 192 FRANCE: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 193 FRANCE: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 194 FRANCE: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 195 FRANCE: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 196 FRANCE: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Construction industry growth to drive demand

TABLE 197 UK: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 198 UK: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 199 UK: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 200 UK: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 201 UK: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 202 UK: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 203 UK: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 204 UK: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 205 UK: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 206 UK: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 207 UK: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 208 UK: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Government investments to propel growth of PV market

TABLE 209 SPAIN: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 210 SPAIN: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 211 SPAIN: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 212 SPAIN: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 213 SPAIN: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 214 SPAIN: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 215 SPAIN: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 216 SPAIN: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 217 SPAIN: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 218 SPAIN: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 219 SPAIN: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 220 SPAIN: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Increase in adoption of electric vehicles to drive demand

TABLE 221 ITALY: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 222 ITALY: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 223 ITALY: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 224 ITALY: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 225 ITALY: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 226 ITALY: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 227 ITALY: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 228 ITALY: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 229 ITALY: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 230 ITALY: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 231 ITALY: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 232 ITALY: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 Investments in construction industry to fuel demand

TABLE 233 RUSSIA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 234 RUSSIA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 235 RUSSIA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 236 RUSSIA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 237 RUSSIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 238 RUSSIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 239 RUSSIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 240 RUSSIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 241 RUSSIA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 242 RUSSIA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 243 RUSSIA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 244 RUSSIA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 245 REST OF EUROPE: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 246 REST OF EUROPE: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 247 REST OF EUROPE: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 248 REST OF EUROPE: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 249 REST OF EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 250 REST OF EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 251 REST OF EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 252 REST OF EUROPE: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 253 REST OF EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 254 REST OF EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 255 REST OF EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 256 REST OF EUROPE: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 41 ETFE MARKET SNAPSHOT FOR ASIA PACIFIC: CHINA TO LEAD ETFE MARKET

TABLE 257 ASIA PACIFIC: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (TON)

TABLE 258 ASIA PACIFIC: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 259 ASIA PACIFIC: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 260 ASIA PACIFIC: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 261 ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 262 ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 263 ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 264 ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 265 ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 266 ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 267 ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 268 ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 269 ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 270 ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 271 ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 272 ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 273 ASIA PACIFIC: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

TABLE 274 ASIA PACIFIC: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Development in construction and PV to support market growth

TABLE 275 CHINA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 276 CHINA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 277 CHINA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 278 CHINA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 279 CHINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 280 CHINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 281 CHINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 282 CHINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 283 CHINA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 284 CHINA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 285 CHINA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 286 CHINA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Government investments in renewable energy leading growth of solar market

TABLE 287 JAPAN: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 288 JAPAN: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 289 JAPAN: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 290 JAPAN: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 291 JAPAN: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 292 JAPAN: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 293 JAPAN: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 294 JAPAN: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 295 JAPAN: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 296 JAPAN: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 297 JAPAN: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 298 JAPAN: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Government investments in PV installations to drive demand

TABLE 299 SOUTH KOREA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 300 SOUTH KOREA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 301 SOUTH KOREA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 302 SOUTH KOREA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 303 SOUTH KOREA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 304 SOUTH KOREA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 305 SOUTH KOREA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 306 SOUTH KOREA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 307 SOUTH KOREA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 308 SOUTH KOREA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 309 SOUTH KOREA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 310 SOUTH KOREA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Recovery from COVID-19 pandemic to boost demand for ETFE

TABLE 311 INDIA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 312 INDIA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 313 INDIA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 314 INDIA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 315 INDIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 316 INDIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 317 INDIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 318 INDIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 319 INDIA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 320 INDIA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 321 INDIA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 322 INDIA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 323 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 324 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 325 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 326 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 327 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 328 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 329 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 330 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 331 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 332 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 333 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 334 REST OF ASIA PACIFIC: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

TABLE 335 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (TON)

TABLE 336 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 337 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 338 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 339 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 340 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 341 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 342 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 343 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 344 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 345 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 346 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 347 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 348 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 349 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 350 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 351 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

TABLE 352 MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Vision 2030 and other government plans to boost non-hydrocarbon sectors

TABLE 353 SAUDI ARABIA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 354 SAUDI ARABIA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 355 SAUDI ARABIA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 356 SAUDI ARABIA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 357 SAUDI ARABIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 358 SAUDI ARABIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 359 SAUDI ARABIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 360 SAUDI ARABIA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 361 SAUDI ARABIA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 362 SAUDI ARABIA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 363 SAUDI ARABIA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 364 SAUDI ARABIA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.5.2 SOUTH AFRICA

10.5.2.1 Steady growth in end-use industry to boost market

TABLE 365 SOUTH AFRICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 366 SOUTH AFRICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 367 SOUTH AFRICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 368 SOUTH AFRICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 369 SOUTH AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 370 SOUTH AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 371 SOUTH AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 372 SOUTH AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 373 SOUTH AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 374 SOUTH AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 375 SOUTH AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 376 SOUTH AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 377 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 378 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 379 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 380 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 381 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 382 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 383 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 384 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 385 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 386 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 387 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 388 REST OF MIDDLE EAST & AFRICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 389 SOUTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (TON)

TABLE 390 SOUTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 391 SOUTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (TON)

TABLE 392 SOUTH AMERICA: ETFE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 393 SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 394 SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 395 SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 396 SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 397 SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 398 SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 399 SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 400 SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 401 SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 402 SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 403 SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 404 SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 405 SOUTH AMERICA: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (TON)

TABLE 406 SOUTH AMERICA: ETFE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Turmoil in construction sector to affect market growth

TABLE 407 GROWTH RATE (%) - SECTORS AND CIVIL CONSTRUCTION

TABLE 408 BRAZIL: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 409 BRAZIL: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 410 BRAZIL: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 411 BRAZIL: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 412 BRAZIL: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 413 BRAZIL: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 414 BRAZIL: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 415 BRAZIL: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 416 BRAZIL: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 417 BRAZIL: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 418 BRAZIL: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 419 BRAZIL: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Domestic production of automobiles to increase demand for ETFE

TABLE 420 ARGENTINA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 421 ARGENTINA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 422 ARGENTINA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 423 ARGENTINA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 424 ARGENTINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 425 ARGENTINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 426 ARGENTINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 427 ARGENTINA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 428 ARGENTINA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 429 ARGENTINA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 430 ARGENTINA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 431 ARGENTINA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

TABLE 432 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (TON)

TABLE 433 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 434 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (TON)

TABLE 435 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 436 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (TON)

TABLE 437 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2016–2018 (USD MILLION)

TABLE 438 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (TON)

TABLE 439 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 440 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (TON)

TABLE 441 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 442 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (TON)

TABLE 443 REST OF SOUTH AMERICA: ETFE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 248)

11.1 INTRODUCTION

FIGURE 42 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS BETWEEN 2018 AND 2021 248

11.2 REVENUE ANALYSIS

FIGURE 43 REVENUE ANALYSIS OF TOP COMPANIES FROM 2016 TO 2020

11.3 MARKET SHARE ANALYSIS

FIGURE 44 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 444 ETFE MARKET: DEGREE OF COMPETITION

11.3.1 STRATEGIC POSITIONING OF KEY PLAYERS

11.4 COMPANY EVALUATION MATRIX DEFINITION AND TECHNOLOGY

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 45 COMPANY EVALUATION QUADRANT, 2020

11.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 46 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

11.6 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 47 RANKING ANALYSIS OF TOP FIVE PLAYERS IN ETFE MARKET, 2020

11.7 COMPETITIVE BENCHMARKING

TABLE 445 COMPANY APPLICATION FOOTPRINT

TABLE 446 COMPANY REGION FOOTPRINT

11.8 KEY MARKET DEVELOPMENT

11.8.1 EXPANSION

TABLE 447 EXPANSION, 2018–2021

11.8.2 CONTRACT & AGREEMENT

TABLE 448 CONTRACT & AGREEMENT, 2018–2021

11.8.3 NEW PRODUCT DEVELOPMENT

TABLE 449 NEW PRODUCT DEVELOPMENT, 2018–2021

11.8.4 ANNOUNCEMENT

TABLE 450 ANNOUNCEMENT, 2018–2021

12 COMPANY PROFILES (Page No. - 259)

(Business Overview, Products Offered, Recent Developments, Winning Imperatives, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 AGC INC.

TABLE 451 AGC INC.: BUSINESS OVERVIEW

FIGURE 48 AGC INC.: COMPANY SNAPSHOT

TABLE 452 AGC INC.: PRODUCT OFFERINGS

TABLE 453 AGC INC.: PRODUCT LAUNCHES

TABLE 454 AGC INC.: OTHERS

FIGURE 49 AGC INC.’S CAPABILITIES IN ETFE MARKET

12.1.2 THE CHEMOURS COMPANY

TABLE 455 THE CHEMOURS COMPANY: BUSINESS OVERVIEW

FIGURE 50 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

TABLE 456 THE CHEMOURS COMPANY: PRODUCT OFFERINGS

TABLE 457 THE CHEMOURS COMPANY: OTHERS

FIGURE 51 THE CHEMOURS COMPANY’S CAPABILITIES IN ETFE MARKET

12.1.3 3M

TABLE 458 3M: BUSINESS OVERVIEW

FIGURE 52 3M: COMPANY SNAPSHOT

TABLE 459 3M: PRODUCT OFFERINGS

FIGURE 53 3M’S CAPABILITIES IN ETFE MARKET

12.1.4 DAIKIN INDUSTRIES, LTD.

TABLE 460 DAIKIN INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 54 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 461 DAIKIN INDUSTRIES, LTD.: PRODUCT OFFERED

TABLE 462 DAIKIN INDUSTRIES, LTD.: OTHERS

FIGURE 55 DAIKIN INDUSTRIES, LTD.’S CAPABILITY IN ETFE MARKET

12.1.5 VECTOR FOILTEC GMBH

TABLE 463 VECTOR FOILTEC GMBH: BUSINESS OVERVIEW

TABLE 464 VECTOR FOILTEC GMBH: PRODUCT OFFERED

TABLE 465 VECTOR FOILTEC: OTHERS

FIGURE 56 VECTOR FOILTEC GMBH’S CAPABILITY IN ETFE MARKET

12.1.6 HALOPOLYMER

TABLE 466 HALOPOLYMER: BUSINESS OVERVIEW

TABLE 467 HALOPOLYMER: PRODUCT OFFERED

12.1.7 GUANGZHOU LICHANG FLUOROPLASTICS CO. LTD

TABLE 468 GUANGZHOU LI CHANG FLUOROPLASTICS CO., LTD.: ANNUAL PRODUCTION

TABLE 469 GUANGZHOU LI CHANG FLUOROPLASTICS CO., LTD.: BUSINESS OVERVIEW

TABLE 470 GUANGZHOU LI CHANG FLUOROPLASTICS CO., LTD.: PRODUCT OFFERED

12.1.8 HUBEI EVERFLON POLYMER CO., LTD

TABLE 471 HUBEI EVERFLON POLYMER CO., LTD: BUSINESS OVERVIEW

TABLE 472 HUBEI EVERFLON POLYMER CO., LTD: PRODUCT OFFERED

12.1.9 ENSINGER GROUP

TABLE 473 ENSINGER GROUP: BUSINESS OVERVIEW

TABLE 474 ENSINGER GROUP: PRODUCT OFFERED

12.1.10 DONGYUE GROUP

TABLE 475 DONGYUE GROUP: BUSINESS OVERVIEW

FIGURE 57 DONGYUE GROUP: COMPANY SNAPSHOT

TABLE 476 DONGYUE GROUP: PRODUCT OFFERED

12.1.11 SAINT-GOBAIN S.A.

TABLE 477 SAINT-GOBAIN S.A.: BUSINESS OVERVIEW

FIGURE 58 SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

TABLE 478 SAINT-GOBAIN S.A.: PRODUCT OFFERED

12.1.12 MITSUBISHI CHEMICAL ADVANCED MATERIALS

TABLE 479 MITSUBISHI CHEMICAL ADVANCED MATERIALS: BUSINESS OVERVIEW

TABLE 480 MITSUBISHI CHEMICAL ADVANCED MATERIALS: PRODUCT OFFERED

12.1.13 SOLVAY S.A.

TABLE 481 SOLVAY S.A.: BUSINESS OVERVIEW

FIGURE 59 SOLVAY S.A.: COMPANY SNAPSHOT

TABLE 482 SOLVAY S.A.: PRODUCT OFFERINGS

12.1.14 BASF SE

TABLE 483 BASF SE: BUSINESS OVERVIEW

FIGURE 60 BASF SE: COMPANY SNAPSHOT

TABLE 484 BASF SE: PRODUCT OFFERED

12.1.15 SABIC

TABLE 485 SABIC.: BUSINESS OVERVIEW

FIGURE 61 SABIC: COMPANY SNAPSHOT

TABLE 486 SABIC: PRODUCT OFFERED

12.1.16 SHANDONG HENGYI NEW MATERIAL TECHNOLOGY CO., LTD

12.1.17 BEIJING STARGET CHEMICALS CO., LTD

12.1.18 ZEUS INDUSTRIAL PRODUCTS

*Details on Business Overview, Products Offered, Recent Developments, Winning Imperatives, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 295)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

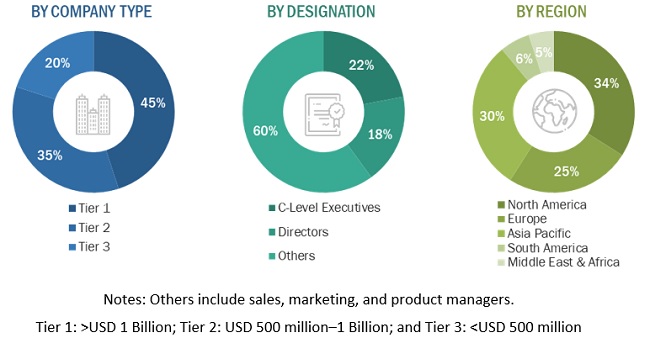

This technical and market-oriented study of the ETFE market involved extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information. Primary sources include industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of this industry's value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

The ETFE market comprises several stakeholders in the supply chain, including distributors, ETFE manufacturers, carriers, and end users. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. Primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the companies in the ETFE market. Primary sources from the supply side include associations and institutions actively involved in the ETFE industry, key opinion leaders, and processing players in the ETFE market.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach, the overall consumption of fluoropolymers in the US is ascertained from secondary sources and MNM’s repository. The US is the largest consumer of fluoropolymers. The information pertaining to the fluoropolymer market is gathered from MNM’s reports and secondary sources. Based on the given information, global fluoropolymer consumption is ascertained. The ETFE share is identified from secondary sources and validated from primary sources. Based on that, the overall consumption of ETFE has been estimated.

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global ETFE market in terms of value and volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To analyze the global ETFE market based on type, technology, application, end-use industry and region

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, in terms of value and volume

- To analyze the impact of COVID-19 on the market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To strategically profile key players and comprehensively analyze their key developments such as new product launches, expansions, and acquisitions in the ETFE market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC ETFE market

- Further breakdown of Rest of Europe ETFE market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ETFE Market

Information on suppliers Ethylene Tetrafluoroethylene (ETFE) product technical specification and commercial terms

FTFE market

Interested in connected markets associated with nanotechnology

Interested in ETFE market and its applciation

Market trends in ETFE market and understand its applications in sports stadiums

Market data on use of Ethylene Tetrafluoroethlyne for CPVC making