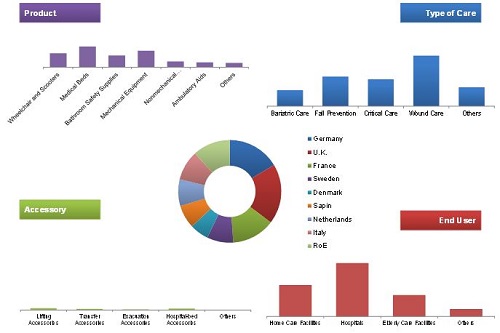

European Patient Handling Equipment Market by Product (Wheelchair, Scooters, Bathroom Safety Supply, Mechanical, Ambulatory), by Type of Care (Bariatric, Critical, Wound, Fall), by Accessories (Lifting, Transfer), by End User (Hospital, Elderly) - Forecast to 2019

The European patient handling equipment market is estimated to grow at a CAGR of 11.4% to reach $5,150.2 million by 2019. The nonmechanical equipment product segment is expected to witness the fastest growth during the forecast period.

In this report, the market is broadly segmented on the basis of product, type of care, end user, accessories and geography. On the basis of products, the European patient handling equipment market is broadly segmented into wheelchair and scooters, medical beds, bathroom safety supplies, mechanical equipment, nonmechanical equipment, ambulatory aids, and others (stretchers, transfers, hospital furniture, and evacuation equipment). The wheelchair and scooters segment is bifurcated into wheelchairs and scooters. The wheelchair segment is further bifurcated into manual wheelchairs and powered wheelchairs. The medical beds segment is divided into curative care beds, psychiatric care beds, long-term care beds, and others.

On the basis of type of care, the European patient handling equipment market is broadly classified into bariatric care, fall prevention, critical care, wound care, and others (acute care and long-term care). Wound care is the largest segment of this market. On the basis of end users, the market is classified into home care, hospital, elderly care, and others (emergency medical services, long-term acute care facilities, trauma centers, and nursing homes). Hospitals are the major end users of this market.

On the basis of accessories, the market is segmented into lifting accessories, transfer accessories, evacuation accessories, stretcher accessories, hospital-bed accessories, and others (bathroom safety supplies such as safety frames, grab bars, bariatric aids, and shower chairs; and ambulatory aids such as wheeled walkers, lift chairs, folding walkers, and canes). Lifting accessories accounted for the largest share of this segment.

The European patient handling equipment market by region is segmented into Germany, the U.K., France, Sweden, Denmark, Spain, the Netherlands, Italy, and Rest of Europe (RoE).

Growth of this market is propelled by the increasing incidences of lifestyle diseases and high recovery cost from injuries promoting use of equipment. However, lack of skilled training and knowledge to handle patients and persistent difficulty in handling obese patients are the key factors limiting the growth of this market.

Key players operating in the European patient handling equipment market are ArjoHuntleigh, Inc. (Sweden), Guldmann, Inc. (Denmark), Linet, Inc. (Czech Republic), Stiegelmeyer, Inc. (Germany), and Handicare, Inc. (Norway), Benmor Medical Ltd (U.K.), Sidhil Ltd (U.K.), Spectra Care Group (U.K.), Mangar International Ltd. (U.K.), and Etac Ltd. (U.K.).

Scope of the Report : European Patient Handling Equipment Market

- The market study does not cover market for accessories at the country level

- The market study covers the market by volume only for wheelchairs and scooters at the regional level

- This study does not cover the services market for European patient handling

|

Particular |

Scope |

|

Country |

|

|

Historical Year |

2012 |

|

Base Year |

2013 |

|

Projected Year |

2014 |

|

Forecast Period |

20142019 |

|

Revenue Currency |

USD ($) |

European Patient Handling Equipment Market Segmentation

This research report categorizes the European patient handling equipment market on the basis of product, type of care, accessory, end user, and region.

By Product

- Wheelchairs and Scooters

- Wheelchairs

- Manual Wheelchairs

- Powered Wheelchairs

- Scooters

- Wheelchairs

- Medical Beds

- Curative Care Beds

- Psychiatric Care Beds

- Long-term Care Beds

- Others (Maternity Beds and Bariatric Beds)

- Bathroom Safety Supplies

- Mechanical Equipment

- Nonmechanical Equipment

- Ambulatory Aids

- Others (Stretchers, Transfers, Hospital Furniture, and Evacuation Equipment)

By Type of Care

- Bariatric Care,

- Fall Prevention

- Critical Care

- Wound Care

- Others (Acute Care and Long-term Care)

By Accessory

- Lifting Accessories

- Transfer Accessories

- Evacuation Accessories

- Stretcher Accessories

- Hospital-bed Accessories

- Others (Bathroom Safety Supplies Such As Safety Frames, Grab Bars, Bariatric Aids, and Shower Chairs; and Ambulatory Aids Such As Wheeled Walkers, Lift Chairs, Folding Walkers, and Canes)

By End User

- Home Care Facilities

- Hospitals

- Elderly Care Facilities

- Others (Emergency Medical Services, Long-term Acute Care Facilities, Trauma Centers, and Nursing Homes)

By Region

- Germany

- U.K.

- France

- Sweden

- Denmark

- Spain

- Netherlands

- Italy

- Rest of Europe (RoE)

The European patient handling equipment market is expected to grow at a double-digit CAGR of 11.4% to reach $5,150.2 million by 2019. Factors such as rising geriatric population, increasing incidences of lifestyle diseases, and high recovery cost from injuries resulting from manual handling of equipment are driving the growth of this market. However, lack of skilled training and knowledge to handle patients and persistent difficulty in handling obese patients are hindering the growth of this market.

On the basis of products, the market is segmented into wheelchairs and scooters, medical beds, bathroom safety supplies, mechanical equipment, nonmechanical equipment, ambulatory aids, and others (stretchers, transfers, hospital furniture, and evacuation equipment). The wheelchairs and scooters segment is bifurcated into wheelchairs and scooters. The wheelchair segment is further bifurcated into manual wheelchairs and powered wheelchairs. The medical beds segment is divided into curative care beds, psychiatric care beds, long-term care beds, and others.

On the basis of type of care, the European patient handling equipment market is segmented into bariatric care, fall prevention, critical care, wound care, and others (acute care and long-term care). Critical care is the fastest-growing segment of this market due to the rising aging population and disabilities from non-communicable diseases.

On the basis of accessories, the market is segmented into lifting accessories, transfer accessories, evacuation accessories, stretcher accessories, hospital-bed accessories, and others (bathroom safety supplies such as safety frames, grab bars, bariatric aids, and shower chairs; and ambulatory aids such as wheeled walkers, lift chairs, folding walkers, and canes).

On the basis of end users, the European patient handling equipment market is categorized into home care facilities, hospital, elderly care facilities, and others (emergency medical services, long-term acute care facilities, trauma centers, and nursing homes). Hospitals are the major end users of the market.

Geographically, the market is dominated by THE U.K., followed by Germany. France is expected to grow at a double-digit CAGR during the forecast period.

Key players operating in the European Patient Handling Equipment Market are ArjoHuntleigh, Inc. (Sweden), Guldmann, Inc. (Denmark), Linet, Inc. (Czech Republic), and Stiegelmeyer, Inc. (Germany).

European Patient Handling Equipment Market Scenario, 2014

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Scope

1.2.2 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Methodology

2.2 Description of the European Patient Handling Equipment Demand Model

2.2.1 Increase in Lifestyle Diseases

2.2.2 Increase in Geriatric Population

2.2.3 Market Size Estimation & Data Triangulation

2.3 Market Share Estimation

2.3.1 Key Data Points Taken From Secondary Sources

2.3.2 Key Data Points From Primary Sources

2.3.2.1 Key Industry Insights

2.4 Assumptions

3 Executive Summary

4 Premium Insights

4.1 By Product

4.2 By Type of Care

4.3 By End-User

4.4 By Accessories

4.5 By Country

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Product

5.2.2 By Type of Care

5.2.3 By End User

5.2.4 By Accessories

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Aging Population and Disabilities From Non-Communicable Diseases to Propel the Need of Market

5.3.1.2 Increasing Incidences of Lifestyle Diseases is Projected to Fuel the Need for Market

5.3.1.3 High Recovery Cost From Injuries Promoting Use of European Patient Handling Equipment

5.3.2 Restraints

5.3.2.1 Lack of Skilled Training and Adequate Knowledge Necessary to Handle Patients

5.3.2.2 Persistent Difficulty in Handling Obese Patients

5.3.3 Opportunities

5.3.3.1 Private Institutional Nursing

5.3.3.2 M&A and Joint Ventures

5.3.4 Threats

5.3.4.1 Competition Among Players

5.4 Burning Issues

5.4.1 Regulations Regarding Manual Lifting Creating Awareness in Caregivers Regarding the Benefits of Equipment

5.5 Winning Imperative

5.5.1 Technological Advancements Providing Competitive Edge to the Major Players in European Patient Handling Equipment Market

6 Industry Insights

6.1 Supply Chain Analysis

6.2 Key Influencers

6.3 Porters Five Forces Analysis

6.3.1 Threat From New Entrant

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Strategic Benchmarking

6.4.1 New Product Launch

7 European Patient Handling Equipment Market, By Product

7.1 Introduction

7.1.1 Wheelchairs and Scooters

7.1.2 Medical Beds

7.1.3 Bathroom Safety Supplies

7.1.4 Mechanical Equipment

7.1.5 Non Mechanical Equipment

7.1.6 Ambulatory Aids

7.1.7 Other Patient Handling Equipment

8 European Patient Handling Equipment Market, By Type of Care

8.1 Introduction

8.1.1 Critical Care

8.1.2 Bariatric Care

8.1.3 Fall Prevention

8.1.4 Wound Care

8.1.5 Other (Acute Care & Long Term Care)

9 European Patient Handling Equipment Market, By End User

9.1 Introduction

9.1.1 Home Care

9.1.2 Hospital

9.1.3 Elderly Homes

9.1.4 Other (Emergency Medical Services, Long-Term Acute Care, Trauma Centers and Nursing Homes)

10 European Patient Handling Equipment Market, By Accessories

10.1 Introduction

11 European Patient Handling Equipment Market, By Countries

11.1 Introduction

11.2 the U.K.

11.3 France

11.4 Germany

11.5 Italy

11.6 Spain

11.7 the Netherlands

11.8 Sweden

11.8 Denmark

11.9 RoE

12 Competitive Landscape

12.1 Overview

12.2 Competitive Situation and Trends

12.3.1 New Product Launches

12.3.2 Agreements, Partnerships, Collaborations, & Joint Ventures

12.3.3 Mergers and Acquisitions

12.3.4 Expansions

12.3.5 Other Developments

13 Company Profiles

13.1 Introduction

13.2 Linet Spol. S.R.O.

13.3 Getinge Group (Arjohuntleigh)

13.4 Guldmann Inc.

13.5 Handicare

13.6 Benmor Medical Ltd

13.7 Sidhil Ltd

13.8 Spectra Care Group

13.9 Mangar International

13.1 ETAC Ltd

13.11 Stiegelmeyer, Inc

14 Appendix

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

Table of Contents (AVAILABLE CUSTOMIZATION)

1. European Patient Handling Market, By Product

1.1. Others

1.1.1. Stretchers

1.1.2. Hospital Furniture

1.1.3. Evacuation Equipment

2. European Patient Handling Market, By Product(Volume)

2.1. Bathroom Safety Supplies

2.2. Mechanical Equipment

2.3. Non Mechanical Equipment

2.4. Ambulatory Aids

3. European Patient Handling Accessories Market, By Country

3.1. U.K.

3.2. Germany

3.3. Italy

3.4. Spain

3.5. France

3.6. Rest of Europe(ROE)

4. Company Profiles(Additional 8 CPS)

4.1. Astor Bannerman Co.Uk.

4.2. Batec Mobility

4.3. Chiltern Invadex (UK) Ltd.

4.4. Nightingale Bariatric Solutions

4.5. Reanimed Healthcare System Ltd.

4.6. Roma Medicals

4.7. Silvalea Ltd.

4.8. Simplymed Ltd.

List of Tables (78 Tables)

Table 1 Government Policies Promoting the Use of European Patient Handling Equipment in the Market

Table 2 Challenges to Bariatric Care Are Limiting the Growth of the Market

Table 3 M & A and Joint Ventures Are Paving New Growth Avenues for Players in European Patient Handling Equipment Market

Table 4 Competition Among Players is Constraining Growth of Market

Table 5 Market Size, By Product, 20122019 ($Million)

Table 6 Wheelchairs and Scooters Market Size (Value), By Country, 20122019 ($Million)

Table 7 European Wheelchair and Scooters Market, By Volume, 20122019 (Thousand Units)

Table 8 Wheelchair Market Size (Value), By Country, 20122019 ($Million)

Table 9 Scooters Market Size (Value), By Country, 20122019 ($Million)

Table 10 Medical Beds Market Size (Value), By Country, 20122019 ($Million)

Table 11 European Medical Beds Market Size, By Volume, 20122019 (Thousand Units)

Table 12 Bathroom Safety Supplies Market, By Country, 20122019 ($Million)

Table 13 Mechanical Equipment Market, By Country, 20122019 ($Million)

Table 14 Non Mechanical Equipment Market, By Country, 20122019 ($Million)

Table 15 Ambulatory Aids Market, By Country, 20122019 ($Million)

Table 16 Other Market, By Country, 20122019 ($Million)

Table 17 European Patient Handling Equipment Market, By Type of Care, 20122019 ($Million)

Table 18 Critical Care Market, By Country, 20122019 ($Million)

Table 19 Bariatric Care Market, By Country, 20122019 ($Million)

Table 20 Fall Prevention Market, By Country, 20122019 ($Million)

Table 21 Wound Care Equipment Market, By Country, 20122019 ($Million)

Table 22 Other Market, By Country, 20122019 ($Million)

Table 23 European Patient Handling Equipment Market, By End User, 20122019 ($Million)

Table 24 Home Care Market, By End User, 20122019 ($Million)

Table 25 Hospital Market, By Country, 20122019 ($Million)

Table 26 Elderly Home Market, By Country, 20122019 ($Million)

Table 27 Other Market, By Country, 20122019 ($Million)

Table 28 Market Table , By Accessories, 20122019 ($Million)

Table 29 Germany: Patient Handling Equipment Market Size, By Product, 20122019 ($Million)

Table 30 Germany: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 31 Germany: Market Size, By Type of Care, 20122019 ($Million)

Table 32 Germany: Market Size, By End-User, 20122019 ($Million)

Table 33 U.K.: Patient Handling Equipment Market Size, By Product, 20122019 ($Million)

Table 34 U.K.: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 35 U.K.: Market Size, By Type of Care, 20122019 ($Million)

Table 36 U.K.: Market Size, By End-User, 20122019 ($Million)

Table 37 France: Market Size, By Product, 20122019 ($Million)

Table 38 France: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 39 France: Market Size, By Type of Care, 20122019 ($Million)

Table 40 France: Market Size, By End-User, 20122019 ($Million)

Table 41 Sweden: Market Size, By Product, 20122019 ($Million)

Table 42 Sweden: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 43 Sweden: Market Size, By Type of Care, 20122019 ($Million)

Table 44 Sweden: Market Size, By End-User, 20122019 ($Million)

Table 45 Denmark: Market Size, By Product, 20122019 ($Million)

Table 46 Denmark: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 47 Denmark: Market Size, By Type of Care, 20122019 ($Million)

Table 48 Denmark: Market Size, By End-User, 20122019 ($Million)

Table 49 Spain: Market Size, By Product, 20122019 ($Million)

Table 50 Spain: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 51 Spain: Market Size, By Type of Care, 20122019 ($Million)

Table 52 Spain: Market Size, By End-User, 20122019 ($Million)

Table 53 The Netherlands: Market Size, By Product, 20122019 ($Million)

Table 54 The Netherlands: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 55 The Netherlands: Market Size, By Type of Care, 20122019 ($Million)

Table 56 The Netherlands: Market Size, By End-User, 20122019 ($Million)

Table 57 Italy: Market Size, By Product, 20122019 ($Million)

Table 58 Italy: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 59 Italy: Market Size, By Type of Care, 20122019 ($Million)

Table 60 Italy: Market Size, By End-User, 20122019 ($Million)

Table 61 RoE: Market Size, By Product, 20122019 ($Million)

Table 62 RoE: Market Size for Wheelchairs and Scooters, 20122019 ($Million)

Table 63 RoE: Market Size, By Type of Care, 20122019 ($Million)

Table 64 RoE: Market Size, By End-User, 20122019 ($Million)

Table 65 New Product Launches, 20112014

Table 66 Agreements, Partnerships, and Collaborations, 20112014

Table 67 Mergers and Acquisitions, 20112014

Table 68 Expansions, 20112014

Table 69 Other Developments, 20112014

Table 70 The Company Offers the Following Products:

Table 71 The Company Offers the Following Products:

Table 72 Recent Developments

Table 73 The Company Offers the Following Products:

Table 74 The Company Offers the Following Products:

Table 75 The Company Offers the Following Products:

Table 76 Recent Developments

Table 77 The Company Offers the Following Products:

Table 78 The Company Offers the Following Products:

List of Figures (51 Figures)

Figure 1 European Patient Handling Equipment Market: Research Methodology

Figure 2 Prevalence Rate (%) of Diabetes and Cvs Across Various Regions, 2011

Figure 3 Geriatric Population (%) of the Total Population of Respective Regions

Figure 4 Safe Patient Handling is Effective in Reducing Worker Injuries and Lost Time

Figure 5 European Patient Handling Equipment Market Size Estimation and Data Triangulation

Figure 6 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 7 European Patient Handling Equipment Market Snapshot (2014 vs. 2019): Non Mechanical Equipment Will Be the Fastest Growing Product Segment in The Next Five Years

Figure 8 European Patient Handling Equipment Market, By Product, 2014

Figure 9 European Patient Handling Equipment Market Share, 2014

Figure 10 Attractive Market Opportunities in Patient Handling Equipment Market

Figure 11 Medical Beds to Capture the Lions Share in the European Market

Figure 12 U.K. Will Grow at the Highest Rate in the Forecast Period

Figure 13 Mechanical Equipment Market Will Account for the Second Leading Market Share in 2014

Figure 14 Hospitals Will Continue to Account for the Leading Market Share in the Next Five Years

Figure 15 U.K. Market Holds Enormous Opportunity

Figure 16 Critical Care Market Will Attract Major Market Attention in the Forecast Period

Figure 17 Increasing Prevalence of Lifestyle Diseases Will Spur the Demand for European Patient Handling Equipment

Figure 18 Supply Chain: Reverse Logistics is the is the Most Preferred Strategy Followed By Prominent Players

Figure 19 Porters Five Forces Analysis (2014): High Intensity of Rivalry Among Competitors is Increasing Competition in the Industry

Figure 20 Strategic Benchmarking: Stryker & Getinge Largely Adopted Inorganic Growth Strategies for Technology Integration & Product Enhancement

Figure 21 European Patient Handling Equipment Market is Dominated By Medical Beds Segment

Figure 22 More Than Half of the Wheelchair and Scooter Market is Dominated By Powered Wheelchair

Figure 23 Untapped Market Will Lead to Higher Growth of the U.K. Region for Medical Beds

Figure 24 Europe Dominates the Bathroom Safety Supplies Market

Figure 25 Rising Incidences of Lifestyle Diseases Will Lead to Growth of North American Market

Figure 26 Underdeveloped North American Region is Expected to Grow at A Fast Pace for Non Mechanicalequipment

Figure 27 Market is Dominated By Wound Care Segment

Figure 28 Europe Will Be the Major Contributor to the Critical Care Equipment Market in 2014

Figure 29 Germany: Bariatric Care Segment to Almost Double in 5 Years

Figure 30 Europe Dominates the Fall Prevention Segment in Market

Figure 31 Rising Incidences of Lifestyle Diseases Will Lead to the Growth of Wound Care Equipment Market in North America

Figure 32 Other Market, By Country, 2014 vs. 2019 ($Million)

Figure 33 Market Snapshot (2014 vs. 2019): Hospitals End User Segment Will Continue to Account for Largest Market Share in 2019

Figure 34 Snapshot (2014 vs. 2019):

Figure 35 Market Snapshot (2014 vs. 2019): U.K. Will Continue to Lead the Market in 2019

Figure 36 Market Snapshot (2014 vs. 2019): U.K. Will Continue to Lead the Market in 2019

Figure 37 Other Market, By Country, 2014 vs. 2019 ($Million)

Figure 38 Lifting Accessories Occupied the Largest Share in the Accessories Segment of the Market in 2014

Figure 39 Transfer Accessories Segment Will Be the Fastest Growing Segment in the Market

Figure 40 Lifting Accessories Market Will Maintain the Leading Position in 2019

Figure 41 Geographic Revenue Mix of Top 5 Market Players - Reference

Figure 42 Handicare, Inc.: Business Overview

Figure 43 SWOT Analysis

Figure 44 Stiegelmeyer, Inc.: Business Overview

Figure 45 SWOT Analysis

Figure 46 Linet, Inc.: Business Overview

Figure 47 SWOT Analysis

Figure 48 Guldmann, Inc: Business Overview

Figure 49 SWOT Analysis

Figure 50 Getinge Group: Business Overview

Figure 51 SWOT Analysis

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in European Patient Handling Equipment Market