Fiberglass Mold Market by Resin Type (Epoxy, Vinyl Ester, Polyester), End-Use Industry (Wind Energy, Marine, Aerospace & Defense, Automotive & Transportation, Construction & Infrastructure), and Region - Global Forecast to 2024

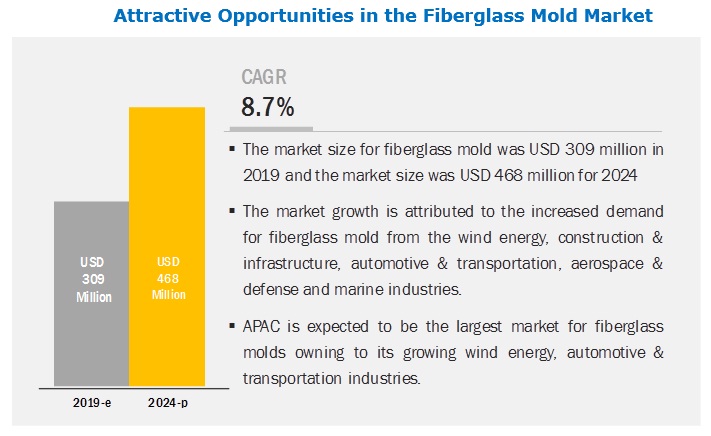

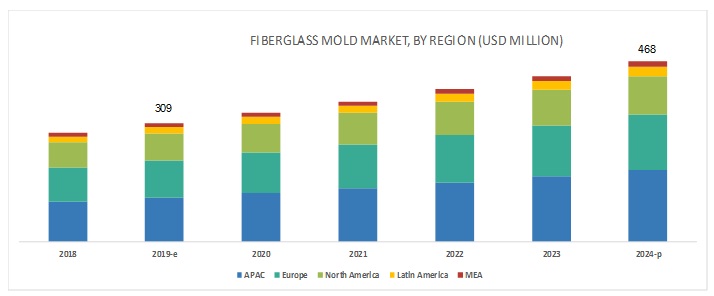

[111 Pages Report] The fiberglass mold market is projected to grow from USD 309 million in 2019 to USD 468 million by 2024, at a CAGR of 8.7% between 2019 and 2024. The market is growing due to the high demand from wind energy, construction & infrastructure, automotive & transportation, aerospace & defense, and marine industries.

Wind energy is expected to the largest end-use industry of fiberglass mold market between 2019 and 2024.

Wind blade molds are manufactured with sandwich construction with composite materials, such as glass fiber composites, carbon fiber composites, and aramid fiber composites, which provide high tensile strength and high bending stiffness-to-weight ratios. The fiberglass molds are the most widely used molds for manufacturing wind composite wind blades. Fiberglass molds are helpful in providing dimensionally accurate, lightweight, and strong composite materials. Component fabricators around the world are constantly looking for molds that exhibit tighter tolerances and longer life. This factor drives the demand for fiberglass mold in the wind energy end-use industry. Also, the increasing demand for renewable energy sources for generating electricity and falling wind energy costs are expected to increase the installation of wind turbines during the forecast period. The increased demand for wind turbine installation is expected to boost the demand for fiberglass molds for blade manufacturing further.

Epoxy resin accounted for a major share in the fiberglass mold market, in terms of both value and volume during the forecast period.

Epoxy-resin-based fiberglass mold is expected to be a promising market during the forecast period. The epoxy-resin-based fiberglass molds offer high heat resistance and excellent mechanical properties. They have better physical, mechanical, and adhesion properties and low shrinkage compared to other resins. These properties enable the epoxy-resin-based molds to be widely used in the various end-use industries.

APAC is expected to lead the fiberglass mold market during the forecast period.

APAC is a key fiberglass mold market. The booming industries including wind energy, automotive & transportation, and construction & infrastructure are responsible for the growth of the fiberglass mold market in the region. China is one of the prominent consumers of fiberglass mold in the region. The country has become the single-largest consumer of fiberglass mold in the wind energy industry and is expected to strengthen its position further. APAC has a presence of major fiberglass mold manufacturers such as Gurit Holding AG and Shandong Shaungyi Technology Co., Ltd.

Key Market Players

The fiberglass mold market comprises major solution providers, such as Gurit Holding AG (Switzerland), Dencam Composites (Denmark), Norco Composites & GRP (UK), Janicki Industries (US), TPI Composites (US), SCHάTZ GmbH & Co. KGaA (Germany), Indutch Composites Technology (India), Shandong Shaungyi Technology (China), EUROS GmbH (Germany), and Molded Fiber Glass Companies (US). The study includes an in-depth competitive analysis of these key players in the fiberglass mold market, with their company profiles, recent developments, and key market strategies.

Gurit Holding AG is one of the prime manufacturers of fiberglass molds. The company has shipped more than 340 molds for a wind turbine. It gives immense emphasis on the development of high-grade fiberglass molds for usage in various end-use industries. As a part of its growth strategy, the company is highly focused on acquisition and expansion. For instance, in September 2017, the company acquired PH Windsolutions Inc. (Canada) to strengthen its expertise in fiberglass mold manufacturing. PH Windsolutions is an expert in the wind blade mold automation systems, which will help Gurit Holding to enhance its service capability, market presence, and addressable customer base.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD Thousand), Volume (Ton) |

|

Segments |

Resin, End-use Industry, and Region |

|

Regions |

APAC, Europe, North America, Latin America, and Middle East & Africa |

|

Companies |

Gurit Holding AG (Switzerland), Dencam Composites (Denmark), Norco Composites & GRP (UK), Janicki Industries (US), TPI Composites (US), SCHάTZ GmbH & Co. KGaA (Germany), Indutch Composites Technology (India), Shandong Shaungyi Technology (China), EUROS GmbH (Germany), and Molded Fiber Glass Companies (US) |

This research report categorizes the fiberglass mold market based on resin, end-use industry, and region.

On the basis of resin type, the fiberglass mold market has been segmented as follows:

- Epoxy

- Vinyl Ester

- Polyester

- Others (BMI, phenolic, and benzoxazine)

On the basis of end-use industry, the fiberglass mold market has been segmented as follows:

- Wind energy

- Marine

- Aerospace & Defense

- Automotive & Transportation

- Construction & Infrastructure

- Others (industrial, consumer goods, electrical component, and sporting goods)

On the basis of region, the fiberglass mold market has been segmented as follows:

- APAC

- Europe

- North America

- Latin America

- Middle East & Africa

Recent Developments

- In September 2017, Gurit Holding AG acquired PH Windsolutions Inc. (Canada) to strengthen its expertise in fiberglass mold manufacturing.

- In June 2016, Gurit Holding AG established a wind blade mold manufacturing facility in Szczecin (Poland). This production plant will help the organization to cater to the growing fiberglass mold demand in Europe.

- In November 2018, Norco Composites & GRP entered into a contract with Sunseeker (UK) for manufacturing 50 predator hard top molds for the marine industry. The contract has helped the Norco Composites & GRP to strengthen its position in the UK.

- In November 2017, TPI Composites opened a new R&D facility in Kolding (Denmark) in order to enhance its technical expertise. This investment has helped the company to offer cost-effective solutions and strengthen technical and engineering resources.

Key Questions Addressed by the Report

- Which are the major end-use industries of fiberglass mold?

- Which industry is the major consumer of fiberglass mold?

- Which region is the largest and fastest-growing market for fiberglass mold?

- What are the major resins used in manufacturing fiberglass mold?

- What are the major strategies adopted by leading market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

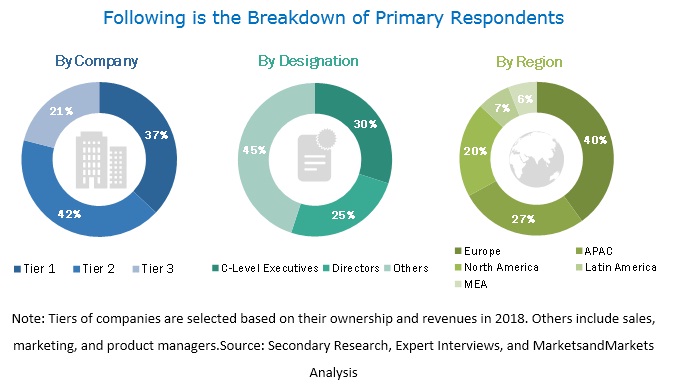

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Significant Growth Opportunities in the Fiberglass Mold Market

4.2 Fiberglass Mold Market, By Resin Type

4.3 Fiberglass Mold Market Share, By Region and End-Use Industry

4.4 Fiberglass Mold Market: Major Countries

4.5 Fiberglass Mold Market, By End-Use Industry

5 Market Overview (Page No. - 32)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Lightweight and Precision Molds for Composite Components

5.1.2 Restraints

5.1.2.1 High R&D and High Cost Involved in the Manufacturing of Fiberglass Molds

5.1.3 Opportunities

5.1.3.1 Adoption of 3d Printing in Fiberglass Mold Manufacturing

5.1.4 Challenges

5.1.4.1 Need to Reduce Production Cycle Time and Increase the Lifecycle of Fiberglass Molds

5.2 Porters Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Suppliers

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Trends (Page No. - 37)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Trends in Automotive & Transportation Industry

6.4 Trends in Aerospace & Defense Industry

6.5 Trends in Wind Energy Industry

7 Fiberglass Mold Market, By Resin Type (Page No. - 41)

7.1 Introduction

7.2 Epoxy

7.2.1 APAC Was the Largest Market for Epoxy Resin-Based Fiberglass Mold in 2018

7.3 Polyester Resin

7.3.1 Polyester Resin-Based Fiberglass Molds are Used Mainly in Railway and Heavy Truck Component Molding

7.4 Vinyl Ester Resin

7.4.1 Marine is the Largest End-Use Industry for Vinyl Ester-Based Fiberglass Mold Market

7.5 Others

8 Fiberglass Mold Market, By End-Use Industry (Page No. - 49)

8.1 Introduction

8.2 Wind Energy

8.2.1 Wind Energy is One of the Prominent Consumers of Fiberglass Molds, Globally

8.3 Marine

8.3.1 North America is the Largest Consumer of Fiberglass Molds in the Marine End-Use Industry

8.4 Automotive & Transportation

8.4.1 Europe is the Largest Consumer of Fiberglass Molds in the Automotive & Transportation End-Use Industry

8.5 Aerospace & Defense

8.5.1 APAC is the Fastest-Growing Region for Fiberglass Mold Market in the Aerospace & Defense End-Use Industry

8.6 Construction & Infrastructure

8.6.1 North America is the Second-Largest Consumer of Fiberglass Molds in Construction & Infrastructure

8.7 Others

9 Fiberglass Mold Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 Canada

9.2.1.1 Wind Energy and Automotive & Transportation End-Use Industries are Expected to Drive the Fiberglass Mold Market in the Country

9.2.2 US

9.2.2.1 US is the Largest Market of Fiberglass Mold in North America

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany is the Biggest Market for Fiberglass Mold in the European Region

9.3.2 UK

9.3.2.1 the UK is the Second-Largest Fiberglass Mold Market in the European Region

9.3.3 France

9.3.3.1 France is One of the Major Fiberglass Mold Markets in the European Region

9.3.4 Italy

9.3.4.1 Wind Energy and Automotive & Transportation are Major End-Use Industries in Italy for the Fiberglass Mold Market

9.3.5 Russia

9.3.5.1 Wind Energy End-Use Industry is Expected to Drive the Market of Fiberglass Mold in Russia

9.4 APAC

9.4.1 China

9.4.1.1 China is the Fastest-Growing Market of Fiberglass Mold, Globally

9.4.2 India

9.4.2.1 India is A Key Fiberglass Mold Market

9.4.3 Japan

9.4.3.1 Japan is an Established Market for Fiberglass Molds in APAC

9.4.4 South Korea

9.4.4.1 South Korea is the Fourth-Largest Market in APAC

9.5 MEA

9.5.1 Uae

9.5.1.1 Uae is the Second-Largest Market of Fiberglass Mold in MEA

9.5.2 South Africa

9.5.2.1 South Africa is the Largest Wind Energy Market in the Region

9.5.3 Saudi Arabia

9.5.3.1 Saudi Arabia is One of the Prominent Countries in the MEA Fiberglass Mold Market

9.6 Latin America

9.6.1 Brazil

9.6.1.1 Brazil is the Largest Market of Fiberglass Mold in Latin America

9.6.2 Mexico

9.6.2.1 Automotive & Transportation is One of the Major End-Use Industries in the Country

10 Competitive Landscape (Page No. - 83)

10.1 Introduction

10.2 Competitive Leadership Mapping, 2018

10.2.1 Visionary Leaders

10.2.2 Dynamic Differentiators

10.2.3 Emerging Companies

10.2.4 Innovators

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio

10.3.2 Business Strategy Excellence

10.4 Ranking of Key Players, 2018

10.5 Competitive Scenario

10.5.1 Expansion & Investment

10.5.2 Merger & Acquisition

10.5.3 Agreement & Partnership

11 Company Profiles (Page No. - 90)

11.1 Gurit Holding AG

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Dencam Composites

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 MnM View

11.3 Norco Composites & GRP

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 MnM View

11.4 Janicki Industries, Inc.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 MnM View

11.5 TPI Composites, Inc.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 MnM View

11.6 Schόtz GmbH & Co. Kgaa

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 MnM View

11.7 Indutch Composites Technology Pvt. Ltd.

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 MnM View

11.8 Shandong Shuangyi Technology Co., Ltd

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 MnM View

11.9 Euros GmbH

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 MnM View

11.10 Molded Fiber Glass Companies

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 MnM View

11.11 Other Key Companies

11.11.1 GBT Composites Technology Limited

11.11.2 SSP Technology

11.11.3 Bayview Composites

11.11.4 Performance Composites

11.11.5 LM Wind

11.11.6 Fiberglass UK Ltd.

11.11.7 AP Hollings & Sons Limited

11.11.8 Cmdt LLC

11.11.9 Mouldcam

11.11.10 Sintex-Wausaukee Composites

12 Appendix (Page No. - 105)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (67 Tables)

Table 1 Trends and Forecast of GDP, 20172023 (USD Billion)

Table 2 Automotive & Transportation Production, By Country, 20132017 (Million Units)

Table 3 Number of New Airplane Deliveries, By Region

Table 4 Wind Energy Installation, By Country, 20162017 (Mw)

Table 5 Fiberglass Mold Market Size, By Resin Type, 20172024 (Ton)

Table 6 Fiberglass Mold Market Size, By Resin Type, 20172024 (USD Thousand)

Table 7 Epoxy: Fiberglass Mold Market Size, By Region, 20172024 (Ton)

Table 8 Epoxy: Fiberglass Mold Market Size, By Region, 20172024 (USD Thousand)

Table 9 Polyester: Fiberglass Mold Market Size, By Region, 20172024 (Ton)

Table 10 Polyester: Fiberglass Mold Market Size, By Region, 20172024 (USD Thousand)

Table 11 Vinyl Ester: Fiberglass Mold Market Size, By Region, 20172024 (Ton)

Table 12 Vinyl Ester: Fiberglass Mold Market Size, By Region, 20172024 (USD Thousand)

Table 13 Other Resin Types: Fiberglass Mold Market Size, By Region, 20172024 (Ton)

Table 14 Other Resin Types: Fiberglass Mold Market Size, By Region, 20172024 (USD Thousand)

Table 15 Fiberglass Mold Market Size, By End-Use Industry, 20172024 (Ton)

Table 16 Fiberglass Mold Market Size, By End-Use Industry, 20172024 (USD Thousand)

Table 17 Fiberglass Mold Market Size in Wind Energy, By Region, 20172024 (Ton)

Table 18 Fiberglass Mold Market Size in Wind Energy, By Region, 20172024 (USD Thousand)

Table 19 Fiberglass Mold Market Size in Marine, By Region, 20172024 (Ton)

Table 20 Fiberglass Mold Market Size in Marine, By Region, 20172024 (USD Thousand)

Table 21 Fiberglass Mold Market Size in Automotive & Transportation, By Region, 20172024 (Ton)

Table 22 Fiberglass Mold Market Size in Automotive & Transportation, By Region, 20172024 (USD Thousand)

Table 23 Fiberglass Mold Market Size in Aerospace & Defense, By Region, 20172024 (Ton)

Table 24 Fiberglass Mold Market Size in Aerospace & Defense, By Region, 20172024 (USD Thousand)

Table 25 Fiberglass Mold Market Size in Construction & Infrastructure, By Region, 20172024 (Ton)

Table 26 Fiberglass Mold Market Size in Construction & Infrastructure, By Region, 20172024 (USD Thousand)

Table 27 Fiberglass Mold Market Size in Other End-Use Industries, By Region, 20172024 (Ton)

Table 28 Fiberglass Mold Market Size in Other End-Use Industries, By Region, 20172024 (USD Thousand)

Table 29 Fiberglass Mold Market Size, By Region, 20172024 (Ton)

Table 30 Fiberglass Mold Market Size, By Region, 20172024 (USD Thousand)

Table 31 North America: Fiberglass Mold Market Size, By Country,20172024 (Ton)

Table 32 North America: Fiberglass Mold Market Size, By Country, 20172024 (USD Thousand)

Table 33 North America: Fiberglass Mold Market Size, By Resin Type,20172024 (Ton)

Table 34 North America: Fiberglass Mold Market Size, By Resin Type, 20172024 (USD Thousand)

Table 35 North America: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (Ton)

Table 36 North America: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (USD Thousand)

Table 37 US: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (Ton)

Table 38 US: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (USD Thousand)

Table 39 Europe: Fiberglass Mold Market Size, By Country, 20172024 (Ton)

Table 40 Europe: Fiberglass Mold Market Size, By Country, 20172024 (USD Thousand)

Table 41 North America: Fiberglass Mold Market Size, By Resin Type,20172024 (Ton)

Table 42 North America: Fiberglass Mold Market Size, By Resin Type, 20172024 (USD Thousand)

Table 43 Europe: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (Ton)

Table 44 Europe: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (USD Thousand)

Table 45 APAC: Fiberglass Mold Market Size, By Country, 20172024 (Ton)

Table 46 APAC: Fiberglass Mold Market Size, By Country, 20172024 (USD Million)

Table 47 APAC: Fiberglass Mold Market Size, By Resin Type, 20172024 (Ton)

Table 48 APAC: Fiberglass Mold Market Size, By Resin Type, 20172024 (USD Thousand)

Table 49 APAC: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (Ton)

Table 50 APAC: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (USD Thousand)

Table 51 China: Fiberglass Mold Market Size, By End-Use Industry,20172024 (Ton)

Table 52 China: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (USD Thousand)

Table 53 MEA: Fiberglass Mold Market Size, By Country, 20172024 (Ton)

Table 54 MEA: Fiberglass Mold Market Size, By Country, 20172024 (USD Thousand)

Table 55 MEA: Fiberglass Mold Market Size, By Resin Type, 20172024 (Ton)

Table 56 MEA: Fiberglass Mold Market Size, By Resin Type, 20172024 (USD Thousand)

Table 57 MEA: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (Ton)

Table 58 MEA: Fiberglass Mold Market Size, By End-Use Industry, 20192024 (USD Thousand)

Table 59 Latin America: Fiberglass Mold Market Size, By Country, 20172024 (Ton)

Table 60 Latin America: Fiberglass Mold Market Size, By Country, 20172024 (USD Thousand)

Table 61 Latin America: Fiberglass Mold Market Size, By Resin Type, 20172024 (Ton)

Table 62 Latin America: Fiberglass Mold Market Size, By Resin Type, 20172027 (USD Thousand)

Table 63 Latin America: Fiberglass Mold Market Size, By End-Use Industry, 20172024 (Ton)

Table 64 Latin America: Fiberglass Mold Market Size, By End-Use Industry, 20142021 (USD Thousand)

Table 65 Expansion & Investment, 20142018

Table 66 Merger & Acquisition, 20142018

Table 67 Argeement & Partnership, 20142018

List of Figures (34 Figures)

Figure 1 Market Segmentation

Figure 2 Fiberglass Mold Market: Research Design

Figure 3 Fiberglass Mold Market: Bottom-Up Approach

Figure 4 Fiberglass Mold Market: Top-Down Approach

Figure 5 Fiberglass Mold Market: Data Triangualtion

Figure 6 Epoxy Resin-Based Fiberglass Mold to Drive the Fiberglass Mold Market, 20172024

Figure 7 Wind Energy Industry to Drive the Fiberglass Mold Market, 20172024

Figure 8 APAC to Dominate the Fiberglass Mold Market, 2018

Figure 9 China to Be the Fastest-Growing Fiberglass Mold Market

Figure 10 Fiberglass Mold Market to Grow at A Significant Rate

Figure 11 Epoxy to Be the Leading Resin Type in the Fiberglass Mold Market

Figure 12 APAC Accounted for the Largest Market Share in 2017

Figure 13 China Was the Fastest-Growing Market in 2018

Figure 14 Wind Energy to Account for the Highest Share in Fiberglass Mold Market

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the Fiberglass Mold Market

Figure 16 Fiberglass Mold Market: Porters Five Forces Analysis

Figure 17 Epoxy Resin Expected to Dominate the Market

Figure 18 APAC is Expected to Lead the Demand for Epoxy-Based Fiberglass Mold Market

Figure 19 APAC is Expected to Grow at Highest Cagr in the Global Polyester Resin-Based Fiberglass Mold Market, 20172024

Figure 20 Europe to Be the Second-Largest Epoxy Resin-Based Fiberglass Mold Market

Figure 21 Wind Energy End-Use Industry is Expected to Dominate the Market

Figure 22 APAC is Expected to Lead the Demand in Epoxy-Based Resin Fiberglass Mold Market

Figure 23 APAC is Expected to Grow at the Highest Cagr in the Polyester-Based Resin Fiberglass Mold Market

Figure 24 Europe to Be the Largest Epoxy Resin-Based Fiberglass Mold Market

Figure 25 APAC to Drive the Fiberglass Mold Market

Figure 26 North America: Fiberglass Mold Market Snapshot

Figure 27 Europe: Fiberglass Mold Market Snapshot

Figure 28 APAC: Fiberglass Mold Market Snapshot

Figure 29 Companies Adopted Expansion as the Key Growth Strategy Between 2014 and 2018

Figure 30 Global Fiberglass Mold Market Competitive Leadership Mapping, 2018

Figure 31 Gurit Holdings AG Led the Fiberglass Mold Market in 2018

Figure 32 Gurit Holding AG: Company Snapshot

Figure 33 Gurit Holding AG: SWOT Analysis

Figure 34 TPI Composites, Inc.: Compa

The study involved various activities to estimate the current market size for fiberglass molds. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The fiberglass mold market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the various industries such as wind energy, construction & infrastructure, automotive & transportation, aerospace & defense, marine, and other industries. The supply side is characterized by advancements in technology and diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total fiberglass mold market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in the wind energy, construction & infrastructure, automotive & transportation, aerospace & defense, marine, and other industries.

Report Objectives

- To analyze and forecast the market size of the fiberglass mold market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market on the basis of resin and end-use industry

- To define, describe, and forecast the market on the basis of five regions, namely, APAC, Europe, North America, Latin America, and Middle East & Africa

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC fiberglass mold market

- Further breakdown of Rest of Europe fiberglass mold market

- Further breakdown of Rest of Latin fiberglass mold market

- Further breakdown of Rest of Middle East & Africa fiberglass mold market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Fiberglass Mold Market