FRP Rebar Market

FRP Rebar Market by Fiber Type (Carbon Fiber, Glass Fiber, Basalt Fiber), Resin Type (Vinyl Ester, Epoxy, Other Resin Types), Diameter (< 10 mm, 10–20 mm, > 20 mm), Surface Treatment (Sand Coated, Ribbed, Others), Tensile Strength (Low strength (500 MPa), Medium Strength (500-1000 MPa), High Strength (> 1000 MPa)), Application (Highway, Bridges, & Buildings, Marine Structure & Waterfront, Water Treatment Plants, Other Applications), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The FRP rebar market is projected to reach USD 1.19 billion by 2030 from USD 0.69 billion in 2025, at a CAGR of 11.5% from 2025 to 2030. The major driver of the FRP rebar industry is its high corrosion resistance, which provides a substantial improvement in the strength and longevity of concrete structures in hostile environments, such as marine, coastal, and chemically aggressive conditions.

KEY TAKEAWAYS

-

BY FIBER TYPEThe fiber type segment consists of glass fiber, carbon fiber, and basalt fiber. The glass fiber segment is projected to register the highest CAGR of the FRP rebar market during the forecast period because of its cost-saving nature, high strength-to-weight ratio, and corrosion resistance, rendering it a perfect substitute for conventional steel in most applications.

-

BY RESIN TYPEThe resin type segment consists of epoxy resin, vinyl ester, and other resin types. Epoxy resin is expected to be the fastest growing resin type in the FRP rebar market in the forecasted period due to its high mechanical strength, adhesive properties, and chemical and water resistance, which render it capable of a vast majority of structural uses.

-

BY TENSILE STRENGTHThe tensile strength is divided into Low strength, Medium strength, and high strength. Low tensile strength FRP rebar will register the highest CAGR during the forecast period based on its cost-effective yet balanced performance and suitability for numerous general construction purposes. It provides adequate strength for most residential, commercial, and light infrastructure developments without the higher material expense of high tensile strength types.

-

BY DIAMETERThe diameter segment includes < 10 mm, 10-20 mm, and > 20 mm. The segment with a diameter between 10–20 mm is expected to have the highest CAGR over the forecast period because, among segments by diameter, it offers the most ideal balance of strength, flexibility, and weight, and therefore, is suitable for a broader range of applications across industries, such as construction, automotive, oil & gas, and aerospace.

-

BY SURFACE TREATMENTThe surface treatment segment consists of sand coated, ribbed and other surface treatments. The segment for sand-coated surface treatment is anticipated to demonstrate the highest CAGR in the FRP rebar industry, due to its higher bonding strength with concrete compared to smooth or helically wrapped rebars.

-

BY APPLICATIONThe major applications of FRP rebar are Highways, Bridges, & Buildings, Marine Construction & Waterfront, Water treatment plants, and other applications. Due to rapidly growing usage of corrosion-free and high-strength materials in the construction and infrastructure sector, the buildings and bridges segment is expected to record the maximum CAGR in the FRP rebar market. As traditional steel reinforcement continues to face corrosion and high maintenance costs, the application of FRP rebars continues to rise in concrete structures exposed to harsh environments, including coastal, industrial and humid areas.

-

BY REGIONThe FRP rebar market covers Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa. The FRP rebar market in Asia Pacific is predicted to grow at the highest CAGR due to speeding infrastructure development, urbanization, and rising government investments in construction materials that are durable and corrosion-resistant.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Dextra Group (Thailand), Pultron Composites (New Zealand), and Pultrall Inc. (Canada)have entered into a number of agreements and partnerships to cater to the growing demand for FRP rebar across innovative applications.

The market for FRP rebar is experiencing strong growth owing to a combination of factors, including the presence of many small and large players and mounting government regulations in key markets. New and existing players are responding to the demand for durable, corrosion-resistant reinforcement products, leading to increased competition and market fragmentation. Government policies in the US, Canada, India, and China are significantly contributing to the growth of the market. These countries are implementing building codes and specifications that encourage the utilization of such sophisticated materials as FRP rebar, especially in infrastructure.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers' businesses. These shifts influence the revenues of end users. As a result, the revenue changes for end users are likely to impact the revenues of FRP rebar suppliers, which, in turn, affect the revenues of FRP rebar manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand in construction industry

-

Government led-regulations on use of FRP Rebar

Level

-

High cost of FRP rebar

-

Availability of substitute

Level

-

Rising investments in large-scale civil engineering projects

-

Growing use in the construction of highways and bridges

Level

-

Supply chain and manufacturing constraints

-

Inability to completely replace steel rebar

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand in construction industry

The global construction sector is entering a phase of strong growth, with construction activity projected to increase by more than USD 4.2 trillion from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037. This boom, driven by major economies like China, the US, and India, is likely to significantly boost the demand for high-end building materials, such as FRP rebars. As infrastructure investments rise, particularly in India, which is forecasted to be the fastest-growing construction superpower, and the UK, which is expected to lead Western Europe’s growth, the demand for high-performance, corrosion-resistant reinforcement solutions becomes increasingly critical. Furthermore, FRP rebars are lighter and less cumbersome, lowering shipping and installation expenses and making them essential considerations in high-volume infrastructure projects.

Restraint: Availability of substitute

Market dominance by steel rebar presents a significant barrier to the adoption of FRP rebar for several reasons. Steel rebar has been a longstanding choice in construction, benefiting from a well-established infrastructure for manufacturing, distribution, and installation. This widespread availability makes steel rebar quite affordable. Additionally, contractors, engineers, and construction professionals are familiar with steel rebar, which further strengthens its position in the market. Although FRP rebar offers advantages such as improved corrosion resistance and enhanced durability, its higher initial cost and limited availability compared to steel make it less practical for many construction projects, especially those where budget constraints are a concern.

Opportunity: Rising investments in large-scale civil engineering projects

The growing investment in mega civil engineering projects presents significant opportunities for the FRP rebar market. These large-scale projects require high-strength materials that ensure long-term performance, require less maintenance, and offer durability against harsh environmental conditions. FRP rebar is particularly suited for major infrastructure developments such as bridges, tunnels, highways, ports, and skyscrapers, as steel rebar can suffer from corrosion and deterioration over time. A prime example of this is NEOM, Saudi Arabia’s multi-billion-dollar mega-city project, which emphasizes advanced construction technologies, sustainability, and long-lasting infrastructure. Such initiatives prioritize innovative materials for future-proof urban planning, making FRP rebar an effective solution for reinforcing concrete structures that must endure extreme climates and last for decades.

Challenge:Supply chain and manufacturing constraints

Producing FRP rebar is still in its infancy, making it difficult to scale production to meet a growing market demand. FRP rebars are produced by only a handful of companies that specialize in FRP rebars. The narrow base of production makes it difficult to get products on site, especially in the case of large-scale infra projects. There is no vertically integrated supply chain that includes: raw material procurement, fabrics, and distribution; slow lead times, bottlenecks in the supply chain or variations in product quality disrupt the interest of consumers and the ability of the industry to scale up and compete in the marketplace.

FRP Rebar Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Construction of the 23km-long Jizan Flood Mitigation Channel in Jizan Economic City, using GFRP rebar as concrete reinforcement throughout the entire project - the world's largest project constructed using FRP rebar. | Complete corrosion resistance in harsh coastal environment, elimination of maintenance costs over project lifespan, and alignment with non-metallic initiative for sustainable infrastructure development. |

|

Construction of modular FRP quarantine and isolation units for a 500-bed Greenfield hospital project in Kasargod, Kerala, using FRP sandwich sheets for walls, roof panels, and doors in collaboration with Tata Consulting Engineers | Lightweight construction with high strength-to-weight ratio, complete corrosion resistance and weatherproof performance, easier and cheaper transportation, and maintenance-free service life for healthcare infrastructure. |

|

Integration of GFRP rebar in tunnel linings for the Mumbai Coastal Road Project and Versova-Ghatkopar Metro line, allowing TBM cutting through reinforcement without requiring steel cutter modifications | Faster tunnel boring machine advance rates, minimized mechanical wear on equipment, and long-term structural integrity in high-humidity subsurface conditions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The FRP rebar market ecosystem consists of raw material suppliers (Syensqo, BASF), FRP rebar manufacturer (Dextra Group, Pultron Composite), distributor (L&T Sufin, Harris Supply Solution) and end users (L & T construction, Saudi Aramco). The raw material suppliers provide fibers and resins to FRP rebar manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

FRP Rebar Market, By Fiber Type

Glass fiber is expected to hold the largest market share among the fiber types in the FRP rebar market by 2030. This is due to its ideal combination of cost, availability, and performance, making it the most practical fiber choice for large-scale construction applications. While carbon and basalt fibers have superior strength, they come at significantly higher prices. In contrast, glass fiber provides sufficient mechanical properties, including high tensile strength, good chemical resistance, and exceptional durability, all at a fraction of the cost.

FRP Rebar Market, By Resin Type

Vinyl ester is expected to hold the largest share of the FRP rebar market due to its high chemical resistance, strong mechanical properties, and excellent fiber adhesion, making it suitable for demanding structural applications. When compared to other resins like polyester or epoxy, vinyl ester offers superior resistance to moisture, corrosion, and extreme environmental conditions. This allows FRP rebar to last longer in aggressive environments, such as seawater, wastewater treatment plants, and industrial buildings. Additionally, it has a favorable cost-performance balance, making it the preferred choice for large-scale construction projects.

FRP Rebar Market, By Diameter

The 10–20 mm diameter FRP rebar segment exhibits the highest CAGR as it represents the most widely used size range in structural applications such as bridges, tunnels, marine structures, and buildings. This diameter range offers an optimal balance between strength, weight, and cost, making it suitable for primary load-bearing components while ensuring easier handling and installation compared to larger bars. Most design standards and construction codes specify reinforcement within this range, leading to higher adoption and large-scale production efficiencies. Moreover, ongoing infrastructure projects and the shift toward corrosion-resistant, durable materials further accelerate the demand for 10–20 mm FRP rebars, solidifying their position as the fastest-growing segment in the market.

FRP Rebar Market, By Surface Treatment

The sand-coated segment within the FRP rebar industry is the largest and fastest-growing, mainly owing to its excellent bonding ability with concrete, which improves structural strength and carrying capacity. Sand-coated FRP rebars offer greater surface roughness than other coatings such as epoxy or resin, thereby achieving greater mechanical interlock with concrete, which is indispensable in high-strength construction. Moreover, these rebars are known for their excellent corrosion resistance, durability, and long-term cost savings in maintenance, which ensures that they are greatly favored in infrastructure, marine, and industrial applications. Their cost-efficiency along with performance reliability has led to broad acceptance, making sand-coated FRP the leader of choice in both emerging and established markets.

FRP Rebar Market, By Tensile Strength

Low-strength FRP rebar shows the highest CAGR because it offers a much more affordable entry point for many construction projects especially in developing regions while still delivering the key benefits of FRP (corrosion resistance, lightweight, durability). In applications where ultra-high strength isn’t essential (residential, low-rise buildings, non-critical infrastructure, or less severe environmental exposure), low-strength FRP rebars meet performance needs at lower cost. This makes them attractive to budget-sensitive clients, leads to wider adoption in smaller and mid-scale works, and boosts demand growth substantially.

FRP Rebar Market, By Applications

The highways, bridges, and buildings segment will register the highest CAGR in the FRP rebar market during the forecast period as a result of increased global interest in infrastructure modernization, sustainability, and durability. Such structures are subjected to environmental stress conditions like moisture, de-icing chemicals, and salts, which enhance the corrosion of conventional steel reinforcement. FRP rebar, characterized by its corrosion resistance, high tensile strength, and lightweight characteristics, is a long-life option that incurs low maintenance and extends infrastructure life. Governments and agencies across the globe in regions such as North America, Europe, and the Asia Pacific are making the use of corrosion-resistant materials in public infrastructure compulsory or preferred to lower lifecycle costs and enhance safety.

REGION

Asia Pacific to be fastest-growing region in global FRP rebar market during forecast period

Asia Pacific will register the highest CAGR in the FRP rebar market during the forecast period due to the increased urbanization, massive infrastructure projects, and high usage of eco-friendly building materials. China, India, Japan, and Southeast Asian countries are all making heavy investments in transport infrastructure, smart cities, industrial parks, and coastal defense infrastructure, which need strong, corrosion-resistant reinforcement options such as FRP rebar. In addition, favorable government policies and tightened building standards are driving the transition toward next-generation materials. The region is further aided by a robust manufacturing sector with increasing numbers of regional and local FRP rebar manufacturers providing cost-competitive solutions and boosting production capacity in order to satisfy rising demand.

FRP Rebar Market: COMPANY EVALUATION MATRIX

In the FRP Rebar market matrix, Dextra Group (Star) leads with a strong market share and extensive product footprint, driven by its strong global presence, and proven track record in delivering high-performance, corrosion-resistant reinforcement solutions using various fiber types. Sireg S.P.A. (Emerging Leader) is gradually gaining market traction through targeted regional projects and innovative offerings but with a relatively smaller scale and limited global footprint. While Dextra Group dominates through scale and a diverse portfolio, Sireg S.P.A. shows significant potential to move toward the leaders’ quadrant as demand for high-strength alloys continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.64 Billion |

| Market Forecast in 2030 (Value) | USD 1.19 Billion |

| Growth Rate | CAGR of 11.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Tonnes) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: FRP Rebar Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Supplier |

|

|

| FRP Rebar Manufacturers |

|

|

| Construction Companies |

|

|

| APAC-based GFRP Rebar Manufacturers |

|

|

RECENT DEVELOPMENTS

- March 2025 : Dextra Group, in association with its Saudi Arabian GFRP manufacturing partner, Industrial Control Solutions Company (ICSC), joined as a Bronze Supporting Member of NEx, an ACI Center of Excellence for Nonmetallic Building Materials. The association is dedicated to the promotion of nonmetallic material use, especially GFRP rebars, within the construction sector. Pierre Hofmann, Geotechnical Product Line General Manager at Dextra, stressed that the partnership is an important platform for the exchange of ideas regarding the future of construction and engineering aimed at creating sustainable, innovative solutions for the industry.

- March 2025 : Pultron Composites of New Zealand reported the successful application of its Mateenbar glass GFRP rebar in building a strengthened concrete breakwater for Tauranga Bridge Marina. Bellingham Marine designed and constructed the project to safeguard the marina against severe weather. The application of Mateenbar GFRP rebar provides considerable benefits compared to conventional steel reinforcement in seawater environments, such as improved corrosion resistance, lower weight, and high tensile strength, improving the structure’s durability, performance, and life.

- January 2025 : Dextra Group (Thailand) and Normet International Ltd. (Finland) entered into a Memorandum of Understanding (MoU) for cooperation on the worldwide development and supply of next-generation FRP reinforcing products. The strategic alliance targets the application of FRP in the underground mine and tunneling industries through the provision of high-strength, lightweight, and green reinforcement solutions that improve operational efficiency and safety. The partnership signals increased industry demand for using high-performance composites to replace traditional materials for aggressive underground applications.

Table of Contents

Methodology

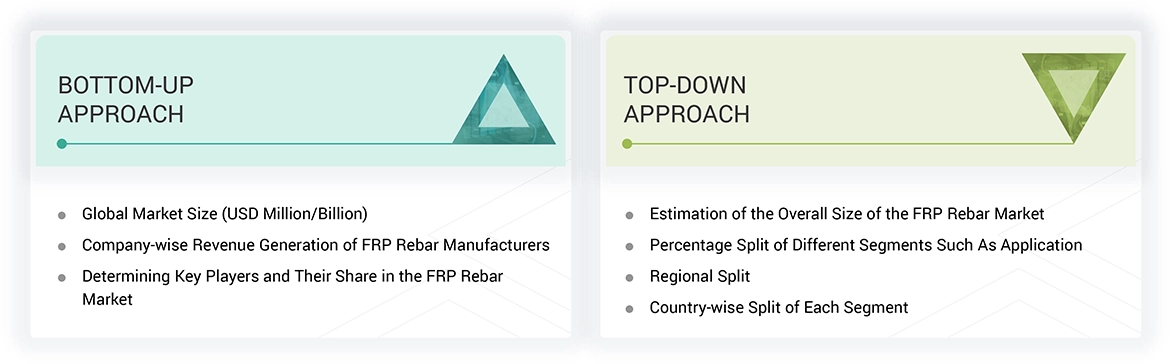

The study involves two major activities in estimating the current market size for the FRP rebar market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering FRP rebar and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the FRP rebar market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the FRP rebar market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the FRP rebar industry, system integrators, component providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to fiber type, resin type, diameter, surface treatment, tensile strength, application, and region. Stakeholders from the demand side, including CIOs, CTOs, CSOs, and installation teams of customers/end users for FRP rebar services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of FRP rebar and future outlook of their business which will affect the overall market.

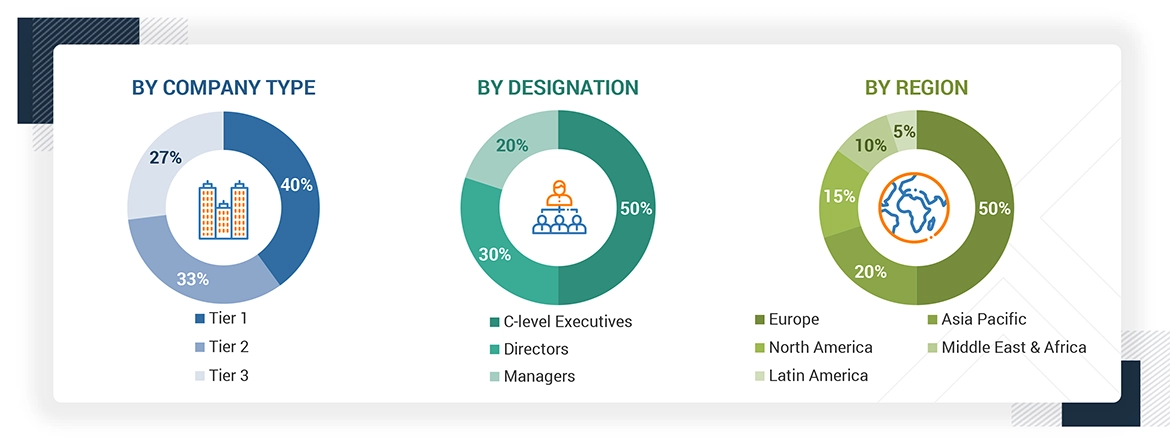

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the FRP rebar market includes the following details. The market size was determined from the demand side. The market was upsized based on the demand for FRP rebar in different applications at the regional level. Such procurements provide information on the demand aspects of the FRP rebar industry for each application. For each application, all possible segments of the FRP rebar market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

FRP rebar is an advanced type of rebar that boasts a unique composite structure. It is crafted from a polymer matrix—often consisting of materials such as epoxy, vinyl ester, or polyester—and is reinforced with high-strength fibers, including glass (GFRP), carbon (CFRP), aramid, or basalt. This innovative combination results in a lightweight yet robust reinforcement solution that is highly resistant to corrosion, making it particularly suitable for challenging environments like coastal areas, chemical plants, or industrial settings where traditional steel rebar is prone to degradation over time. The exceptional tensile strength of FRP rebar not only enhances structural integrity but also contributes to longer-lasting and more durable construction applications, paving the way for advanced engineering solutions in a variety of sectors.

Stakeholders

- FRP Rebar Manufacturers

- FRP Rebar Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the FRP rebar market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global FRP rebar market by fiber type, resin type, tensile strength, diameter, surface treatment, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the FRP rebar market? What key strategies have market players adopted to strengthen their market presence?

Key players include Dextra Group (Thailand), Pultron Composites (New Zealand), Pultrall Inc. (Canada), Schöck Bauteile GmbH (Germany), Sireg S.P.A. (Italy), Kodiak Fiberglass Rebar (US), Neuvokas Corporation (US), Röchling Group (Germany), Armastek (Russia), TUF Bar (Canada), ARC Insulations & Insulator Ltd. (India), Jindal Advanced Materials (India), SKD Composites (India), Galen Composites (Russia), and Röchling SE & Co. KG (Germany). Strategies include product launches, acquisitions, and expansions.

What are the drivers and opportunities for the FRP rebar market?

The market is driven by increasing demand from the construction industry and growing investments in large-scale civil engineering projects, creating strong opportunities for growth.

Which region is expected to hold the largest market share?

Asia Pacific is expected to hold the largest market share due to rapid industrialization, urbanization, and a high concentration of small-scale FRP rebar manufacturers.

What is the projected growth rate of the FRP rebar market over the next five years?

The FRP rebar market is projected to grow at a CAGR of 11.5% during the forecast period.

How is the FRP rebar market aligned for future growth?

The market is well-aligned for future growth due to rising demand for corrosion-resistant, durable materials in infrastructure projects, making FRP rebars a strong alternative to steel in construction and bridge building.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the FRP Rebar Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in FRP Rebar Market

Amrit

May, 2015

FRP rebar market report.

Safaa

Nov, 2018

Information on GFRP rebar by application.

Roque

May, 2015

Interested in industrial, automotive and aerospace markets of GFRP/BFRP.

kuwar

Feb, 2017

FRP market in UAE.

Mayank

Sep, 2018

Intrested in market size by region, production process, target customers at global level for FRP rebar market .

Alvaro

Jul, 2016

Interested in GFRP bars market.

João

Jan, 2019

Analysis of Concrete structure property at higher temperature .