High Temperature Composite Resin Market by Resin Type (Phenolic, Epoxy, Thermoplastic, Polyimide, Cyanate Ester), Manufacturing Process, End-use Industry (Aerospace & Defense, Transportation, Electrical & Electronics), and Region - Global Forecast to 2023

Updated Date: Oct 17, 2019

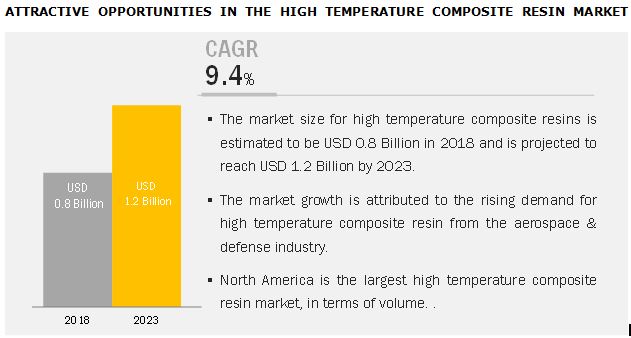

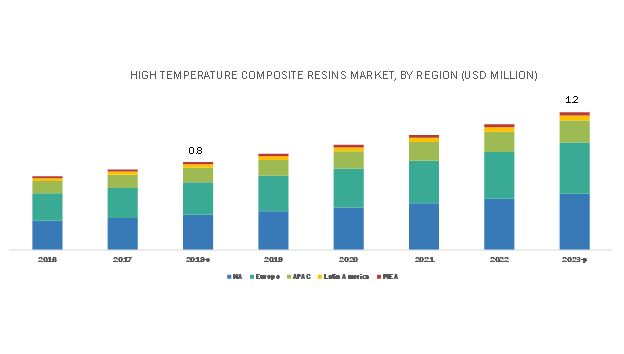

[123 Pages Report] The high temperature composite resin market is projected to grow from USD 0.8 billion in 2019 to USD 1.2 billion by 2024, at a CAGR of 9.4% between 2019 and 2024. The market is growing due to the high demand from the aerospace & defense, and transportation industries.

Lay-up projected to be fastest-growing manufacturing process of high temperature composite resin market during forecast period.

The lay-up molding process is the major composite manufacturing process consuming high temperature composite resins owing to the developed aerospace & defense industry and recovery of the marine industry at the global level. This process is applicable for designing simple enclosures and lightly loaded structural panels because it provides orientation of the fibers that can be controlled as needed so that they can absorb maximum stresses to which they are subjected.

Aerospace & defense has the largest share in the high temperature composite resin market

Aerospace & defense is estimated to be the largest segment of the high temperature composite resin market in 2018. This larger market share is attributed to the growing demand for high temperature composite resin for manufacturing various components, such as engine parts, interiors, and outer structures of aircraft, missiles, and satellites.

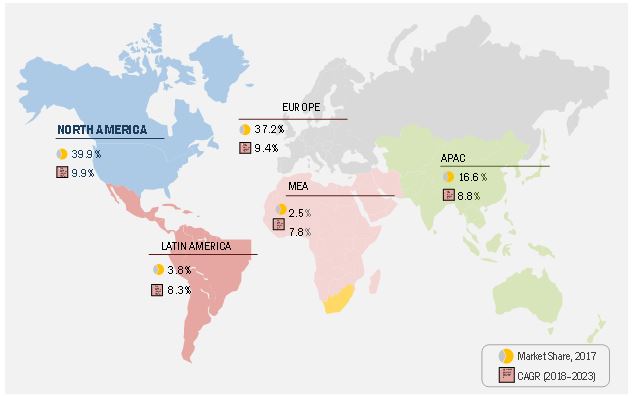

North America is expected to dominate the high temperature composite resin market owing to high demand from aerospace & defense and transportation industries.

The North American region is expected to be the fastest-growing high temperature composite resin market globally between 2018 and 2023 due to the increased demand from aerospace & defense and transportation industries. Stringent safety regulations in this region, especially in the US., have helped the high temperature composite resin market to grow in the transportation and aerospace & defense application segment. The demand for high temperature composite resin in aerospace & defense is also high owing to the presence of the largest aircraft manufacturers Boeing and Lockheed Martin in the country. The use of high temperature composite resins in fighter jets is rising significantly in the region owing to the high defense budget of the US.

Market Dynamics

Driver: Excellent thermal performance of high temperature composite resins

These resins when reinforced with ceramic and metal matrix composites have the ability to withstand extreme heat -- 1649°C/3000°F or more. Many manufacturers mainly prefer polymer resins to ceramics or metals because polymers perform better under fatigue than more brittle ceramics and are much lighter than most metals. These resins have been developed to handle moderate-to-high temperatures and tough environmental conditions with ease while providing weight savings and lower life-cycle costs into the bargain. For instance, polyimide resin provides excellent thermoxidative stability due to which it resists oxidation (combustion) that breaks down molecular bonds and causes weight loss and structural decline, even at very high temperature. The resistance of these resins to fire, smoke, and toxicity makes them an ideal choice for aircraft and automobile interiors.

Restraint: High cost of high temperature composite resins

The manufacturing of formulated high temperature composite resins for use in composite matrix consists of several steps, resulting in high priced end-product. The machinery and tools required for its production are also capital-intensive, leading to an escalation in the cost. This high cost of the end product is a restraint for composite manufacturers in the supply chain, limiting the growth of high temperature composite resin. Additionally, high temperature thermoplastics composite resins being costly are used only in high-end applications such as aerospace & defense and transportation (high-end luxury and sports cars). This has led to the limited use of these resins.

Opportunity: Increasing demand from Europe and North America to meet stringent regulations

Currently, composites industries are concentrated mainly in the technologically advanced regions such as North America and Europe. However, there has been a shift toward emerging economies such as China, Japan, South Korea, India, Brazil, and many other countries in APAC, MEA, and Latin America. There has been an increasing demand for high temperature composite resin in interior and exterior applications in the transportation, aerospace & defense, electrical & electronics, and building & construction industries to meet the stringent regulations. The FST regulations for public transportations vary across the EU and to meet them many companies have set up research institutes and production facilities for cost-effective manufacturing of high temperature composite resins in these regions. Increasing use of composites in aircraft also helped in driving the high temperature composite market in these regions.

Challenge: need for continuous improvement in product offering

The high temperature composite resin market constantly needs innovative products to meet the current and future stringent regulations. Continuous portfolio optimization in the high temperature composite resin market is important to sustain the high competition and to serve the composite end users. New technology is needed to reduce the curing and gel time of resin, thus increasing the production rate of composites components. Also, low temperature curing will help in lowering the gel time of the composites as well as the viscosity and the cycle time. Thus, there is a need for continuous R&D to sustain the competitiveness of the market.

Scope Of The Report

|

|

|

2016–2023 |

|

2017 |

|

2018–2023 |

|

Value (USD Thousand), Volume (Ton) |

|

Resin Type, Manufacturing Process, End-Use Industry, and Region |

|

North America, Europe, APAC, MEA, and Latin America |

|

The high temperature composite resin market comprises major manufacturers such as Huntsman International LLC (US), Sumitomo Bakelite Co., Ltd. (Japan), Royal Tencate N.V. (Netherlands), Arkema S.A. (France), Lonza AG (Switzerland), Hexcel Corporation (US), Hexion Inc. (US), Nexam Chemical Holding AB (Sweden), DIC Corporation (Japan), and UBE Industries, Ltd. (Japan)

|

The research report categorizes the high temperature composite resin market to forecast the revenues and analyze the trends in each of the following sub-segments:

On the basis of resin type, the high temperature composite resin market has been segmented as follows:

- Phenolic

- Epoxy

- Thermoplastic

- Polyimide

- Benzoxazine

- Cyanate Ester

- Others (BMI and phthalonitriles)

On the basis of end-use industry, the high temperature composite resin market has been segmented as follows:

- Aerospace & defense

- Transportation

- Electrical & Electronics

- Others (oil & gas, building & construction, medical, marine, and industrial)

On the basis of manufacturing process, the high temperature composite resin market has been segmented as follows:

- Layup

- Filament Winding

- Injection Molding

- Pultrusion

- Compression Molding

- Others (RTM, resin film infusion, tube rolling, etc.)

On the basis of region, the high temperature composite resin market has been segmented as follows:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- Latin America

Key Market Players

The high temperature composite resin market comprises major manufacturers such as Huntsman International LLC (US), Sumitomo Bakelite Co., Ltd. (Japan), Royal Tencate N.V. (Netherlands), Arkema S.A. (France), Lonza AG (Switzerland), Hexcel Corporation (US), Hexion Inc. (US), Nexam Chemical Holding AB (Sweden), DIC Corporation (Japan), and UBE Industries, Ltd. (Japan). The study includes an in-depth competitive analysis of these key players in the high temperature composite resin market, with their company profiles, recent developments, and key market strategies.

Recent Developments

•In March 2018, Hexcel made a strategic alliance with Arkema (France) to develop thermoplastic solutions for the aerospace industry. The company focuses on developing thermoplastic carbon fiber-reinforced tapes to serve the aerospace & defense industry.

• In December 2017, Sumitomo Bakelite Ltd partnered with GRIP Metal (Canada) to build high quality composites for aerospace and automotive applications. Use of thermoset composite can add value and offer cost effective solutions

• In March 2016, TenCate expanded its facility at Nottingham, UK. This facility will help the company to increase its production capacity and offer innovative solutions based on thermoset composite materials.

Key Questions Addressed by the Report

• What are the major end-use industries of high temperature composite resin?

• Which industry is the major consumer of high temperature composite resin?

• Which region is the largest and fastest-growing market for high temperature composite resin?

• What are the major types of high temperature composite resin?

• What are the major strategies adopted by leading market players?.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for The Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in The High Temperature Composite Resin Market

4.2 High Temperature Composite Resin Market, By Resin Type

4.3 High Temperature Composite Resin Market, By Manufacturing Process

4.4 High Temperature Composite Resin Market, By End-Use Industry and Region

4.5 High Temperature Composite Resin Market, By Country

4.6 High Temperature Composite Resin Market Size, By End-Use Industry

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Excellent Thermal Performance of High Temperature Composite Resins

5.2.1.2 Increasing Demand for Lightweight Materials from Transportation and Aerospace & Defense Industries

5.2.1.3 Increase in Demand for High Temperature Thermoplastic Resin

5.2.2 Restraints

5.2.2.1 High Cost of High Temperature Composite Resins

5.2.2.2 Recycling-Related Issues

5.2.2.3 Handling and Processing Issues

5.2.3 Opportunities

5.2.3.1 Increasing Demand from Europe and North America to Meet Stringent Regulations

5.2.3.2 Number of Research Programs in Line to Reduce The Cost of High Temperature Composite Resins

5.2.4 Challenges

5.2.4.1 Need for Continuous Improvement in Product Offering

5.2.4.2 Ongoing Global Economic Volatility and Fluctuating Commodity Prices

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Bargaining Power of Suppliers

5.3.3 Bargaining Power of Buyers

5.3.4 Threat of New Entrants

5.3.5 Intensity of Competitive Rivalry

6 High Temperature Composite Resin Market, By Resin Type (Page No. - 40)

6.1 Introduction

6.2 Phenolic

6.2.1 Phenolic: High Temperature Composite Resin Market, By End-Use Industry

6.3 Epoxy

6.3.1 Epoxy: High Temperature Composite Resin Market, By End-Use Industry

6.4 Thermoplastic

6.4.1 Thermoplastic: High Temperature Composite Resin Market, By End-Use Industry

6.5 Polyimide

6.5.1 Polyimide: High Temperature Composite Resin Market, By End-Use Industry

6.6 Benzoxazine

6.6.1 Benzokazine: High Temperature Composite Resin Market, By End-Use Industry

6.7 Cyanate Ester

6.7.1 Cyanate Ester: High Temperature Composite Resin Market, By End-Use Industry

6.8 Others (BMI and Phthalonitriles)

6.8.1 Other Resins: High Temperature Composite Resin Market, By End-Use Industry

7 High Temperature Composite Resin Market, By Manufacturing Process (Page No. - 51)

7.1 Introduction

7.1.1 Layup

7.1.1.1 Layup: High Temperature Composite Resin Market, By Region

7.1.2 Filament Winding

7.1.2.1 Filament Winding: High Temperature Composite Resin Market, By Region

7.1.3 Injection Molding

7.1.3.1 Injection Molding: High Temperature Composite Resin Market, By Region

7.1.4 Pultrusion

7.1.4.1 Pultrusion: High Temperature Composite Resin Market, By Region

7.1.5 Compression Molding

7.1.5 Compression Molding: High Temperature Composite Resin Market, By Region

7.1.6 Other Processes

7.1.6 Others: High Temperature Composite Resin Market, By Region

8 High Temperature Composite Resin Market, By End-Use Industry (Page No. - 55)

8.1 Introduction

8.2 Aerospace & Defense

8.2.1 Others: High Temperature Composite Resin Market, By Region

8.2.2 Aircraft Components

8.2.3 Space & Defense Components

8.3 Transportation

8.3.1 Transportation: High Temperature Composite Resin Market, By Region

8.4 Electrical & Electronics

8.4.1 Electrical & Electronics: High Temperature Composite Resin Market, By Region

8.5 Others

8.5.1 Others: High Temperature Composite Resin Market, By Region

9 High Temperature Composite Resin Market, By Region (Page No. - 64)

9.1 Introduction

9.2 North America

9.2.1 North America: 3d Printing Materials Market, By Country

9.2.1.1 Us

9.2.2.2 Canada

9.3 Europe

9.3.1 Europe: 3d Printing Materials Market, By Country

9.3.1.1 Germany

9.3.1.2 France

9.3.1.3 Spain

9.3.1.4 UK

9.3.1.5 Italy

9.3.1.6 Rest of Europe

9.4 APAC

9.4.1 APAC: 3d Printing Materials Market, By Country

9.4.1.1 China

9.4.1.2 Japan

9.4.1.3 South Korea

9.4.1.4 India

9.4.1.5 Malaysia

9.4.1.6 Rest of APAC

9.5 Latin America

9.5.1 Latin America: 3d Printing Materials Market, By Country

9.5.1.1 Brazil

9.5.1.2 Mexico

9.5.1.3 Rest of Latin America

9.6 Mea

9.6.1 Mea: 3d Printing Materials Market, By Country

9.6.1.1 Israel

9.6.1.2 South Africa

9.6.1.3 Rest of Mea

10 Competitive Landscape (Page No. - 89)

10.1 Introduction

10.2 Market Ranking

10.2.1 Huntsman Corporation

10.2.2 Hexcel Corporation

10.2.3 Royal Tencate N.V.

10.3 Recent Development

10.3.1 New Product Launch

10.3.2 Expansion

10.3.3 Acquisition

10.3.4 Agreements, Partnerships, & Collaboration

11 Company Profiles (Page No. - 94)

(Business Overview, Products Offered, Recent Developments, Swot Analysis, MNM View)*

11.1 Huntsman International Llc

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 Swot Analysis

11.1.5 Winning Imperatives

11.1.6 Current Focus and Strategies

11.1.7 Threat from Competition

11.1.8 Huntsman’s Right to Win

11.2 Hexcel Corporation

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 Swot Analysis

11.2.5 Winning Imperatives

11.2.6 Current Focus and Strategies

11.2.7 Threat from Competition

11.2.8 Hexcel’s Right to Win

11.3 Sumitomo Bakelite Co., Ltd.

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 Swot Analysis

11.3.5 Winning Imperatives

11.3.6 Current Focus and Strategies

11.3.7 Threat from Competition

11.3.8 Sumitomo’s Right to Win

11.4 Royal Tencate N.V.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 Swot Analysis

11.4.5 Winning Imperatives

11.4.6 Current Focus and Strategies

11.4.7 Threat from Competition

11.4.8 Royal Tencate’s Right to Win

11.5 Hexion Inc.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 Swot Analysis

11.5.5 Winning Imperatives

11.5.6 Current Focus and Strategies

11.5.7 Threat from Competition

11.5.8 Hexion’s Right to Win

11.6 DIC Corporation

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MNM View

11.7 Arkema S.A.

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 MNM View

11.8 Lonza AG

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MNM View

11.9 Nexam Chemical Holding Ab

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 MNM View

11.1 UBE Industries, Ltd.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MNM View

*Details On Business Overview, Products Offered, Recent Developments, Swot Analysis, MNM View Might Not be Captured in Case of Unlisted Companies.

11.11 Other Companies

11.11.1 Renegade Materials Corporation

11.11.2 Maverick Corporation

11.11.3 Raptor Resins Inc.

11.11.4 Performance Polymer Solutions Inc.

11.11.5 Barrday Corporation

11.11.6 Hybrid Plastics Inc.

11.11.7 De-Comp Composites, Inc.

11.11.8 Shikoku Chemicals Corporation

11.11.9 Celanese Corporation

11.11.10 SABIC

12 Appendix (Page No. - 116)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: MarketsandMarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (65 Tables)

Table 1 High Temperature Composite Resin Market Size, 2016–2023

Table 2 High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (USD Thousand)

Table 3 High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (Ton)

Table 4 Phenolic High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 5 Phenolic High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 6 Epoxy High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 7 Epoxy High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 8 Thermoplastic High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 9 Thermoplastic High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 10 Polyimide High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 11 Polyimide High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 12 Benzoxazine High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 13 Benzoxazine High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 14 Cyanate Ester High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 15 Cyanate Ester High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 16 Other High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 17 Other High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 18 High Temperature Composite Resin Market Size, By Manufacturing Process, 2016–2023 (USD Thousand)

Table 19 High Temperature Composite Resin Market Size, By Manufacturing Process, 2016–2023 (Tons)

Table 20 High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 21 High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 22 High Temperature Composite Resin Market Size in Aerospace & Defense, By Region, 2016–2023 (USD Thousand)

Table 23 High Temperature Composite Resin Market Size in Aerospace & Defense, By Region, 2016–2023 (Ton)

Table 24 High Temperature Composite Resin Market Size in Transportation,

Table 25 High Temperature Composite Resin Market Size in Transportation, By Region, 2016–2023 (Ton)

Table 26 High Temperature Composite Resin Market Size in Electrical & Electronics, By Region, 2016–2023 (USD Thousand)

Table 27 High Temperature Composite Resin Market Size in Electrical & Electronics End-Use Industry, By Region, 2016–2023 (Ton)

Table 28 High Temperature Composite Resin Market Size in Other End-Use Industries, By Region, 2016–2023 (USD Thousand)

Table 29 High Temperature Composite Resin Market Size in Other End-Use Industries, By Region, 2016–2023 (Ton)

Table 30 High Temperature Composite Resin Market Size, By Region, 2016–2023 (USD Thousand)

Table 31 High Temperature Composite Resin Market Size, By Region, 2016–2023 (Ton)

Table 32 North America: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 33 North America: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 34 North America: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (USD Thousand)

Table 35 North America: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (Ton)

Table 36 North America: High Temperature Composite Resin Market Size, By Country, 2016–2023 (USD Thousand)

Table 37 North America: High Temperature Composite Resin Market Size, By Country, 2016–2023 (Ton)

Table 38 Europe High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 39 Europe: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 40 Europe: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (USD Thousand)

Table 41 Europe: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (Ton)

Table 42 Europe: High Temperature Composite Resin Market Size, By Country, 2016–2023 (USD Thousand)

Table 43 Europe: High Temperature Composite Resin Market Size, By Country, 2016–2023 (Ton)

Table 44 APAC: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 45 APAC: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 46 APAC: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (USD Thousand)

Table 47 APAC: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (Ton)

Table 48 APAC: High Temperature Composite Resin Market Size, By Country, 2016–2023 (USD Thousand)

Table 49 APAC: High Temperature Composite Resin Market Size, By Country, 2016–2023 (Ton)

Table 50 Latin America: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 51 Latin America: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 52 Latin America: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (USD Thousand)

Table 53 Latin America: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (Ton)

Table 54 Latin America: High Temperature Composite Resin Market Size, By Country, 2016–2023 (USD Thousand)

Table 55 Latin America: High Temperature Composite Resin Market Size, By Country, 2016–2023 (Ton)

Table 56 Mea: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (USD Thousand)

Table 57 Mea: High Temperature Composite Resin Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 58 Mea: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (USD Thousand)

Table 59 Mea: High Temperature Composite Resin Market Size, By Resin Type, 2016–2023 (Ton)

Table 60 Mea: High Temperature Composite Resin Market Size, By Country, 2016–2023 (USD Thousand)

Table 61 Mea: High Temperature Composite Resin Market Size, By Country, 2016–2023 (Ton)

Table 62 New Product Launch, 2014–2018

Table 63 Expansion, 2014–2018

Table 64 Acquisition, 2014–2018

Table 65 Agreement, Partnership, & Collaboration, 2014–2018

List of Figures (43 Figures)

Figure 1 High Temperature Composite Resin Market Segmentation

Figure 2 High Temperature Composite Resin Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 High Temperature Composite Resin Market: Data Triangulation

Figure 6 Aerospace & Defense to be The Largest End-Use Industry in The High Temperature Composite Resin Market

Figure 7 Phenolic to be The Largest Resin Type in The High Temperature Composite Resin Market

Figure 8 US to Dominate The High Temperature Composite Resin Market

Figure 9 North America Dominated The High Temperature Composite Resin Market

Figure 10 Significant Growth Opportunities in The High Temperature Composite Resin Market, 2018–2023

Figure 11 Phenolic to be The Largest Resin Type

Figure 12 Lay-Up to be The Fastest-Growing Manufacturing Process

Figure 13 North America Led The High Temperature Composite Resin Market

Figure 14 Germany to Register The Highest Cagr in The High Temperature Composite Resin Market

Figure 15 Aerospace & Defense to be The Largest End-Use Industry

Figure 16 Factors Governing The High Temperature Composite Resin Market

Figure 17 High Temperature Composite Resin Market: Porter’s Five Forces Analysis

Figure 18 Phenolic to be The Largest Resin Type in The High Temperature Composite Resin Market

Figure 19 Aerospace & Defense End-Use Industry to Dominate Phenolic High Temperature Composite Resin Market

Figure 20 Aerospace & Defense to be The Lagest End-Use Industry in Epoxy High Temperature Composite Resin Market

Figure 21 Aerospace & Defense to be The Lagest End-Use Industry in Thermoplastic High Temperature Composite Resin Market

Figure 22 Lay-Up Manufacturing Process to Register The Highest Cagr

Figure 23 Aerospace & Defense to Outpace Other End-Use Industries

Figure 24 North America to Register The Highest Cagr in The High Temperature Composite Resin Market in Aerospace & Defense End-Use Industry

Figure 25 Europe to be The Largest High Temperature Composite Resin Market in Transportation End-Use Industry

Figure 26 APAC to be The Largest High Temperature Composite Resin Market in Electrical & Electronics End-Use Industry

Figure 27 US to Drive The North American High Temperature Composite Resin Market (2016–2023)

Figure 28 North America: High Temperature Composite Resin Market Snapshot

Figure 29 Europe: High Temperature Composite Resin Market Snapshot

Figure 30 APAC: High Temperature Composite Resin Market Snapshot

Figure 31 Brazil to Dominate The High Temperature Composite Resin Market in Latin America

Figure 32 Israel to be The Largest High Temperature Composite Resin Market in Mea

Figure 33 New Product Launch Was The Key Growth Strategy Between 2014 and 2018

Figure 34 Huntsman Corporation: The Largest Company in The High Temperature Composite Resin Market

Figure 35 Huntsman International Llc: Company Snapshot

Figure 36 Hexcel Corporation: Company Snapshot

Figure 37 Sumitomo Bakelite Co., Ltd.: Company Snapshot

Figure 38 Royal Tencate N.V.: Company Snapshot

Figure 39 Hexion Inc.: Company Snapshot

Figure 40 DIC Corporation: Company Snapshot

Figure 41 Arkema S.A.: Company Snapshot

Figure 42 Lonza Ag: Company Snapshot

Figure 43 UBE Industries, Ltd.: Company Snapshot

Growth opportunities and latent adjacency in High Temperature Composite Resin Market

Understaning on mining applications pertaining to corrosion.