Furfural Market by Raw Material (Sugarcane Bagasse, Corncob, Rice Husk), Application (Derivatives, Solvents), End-Use Industry (Agriculture, Paint & Coatings, Pharmaceuticals, Food & Beverages, Refineries), and Region - Global Forecast to 2028

Updated on : September 17, 2025

Furfural Market

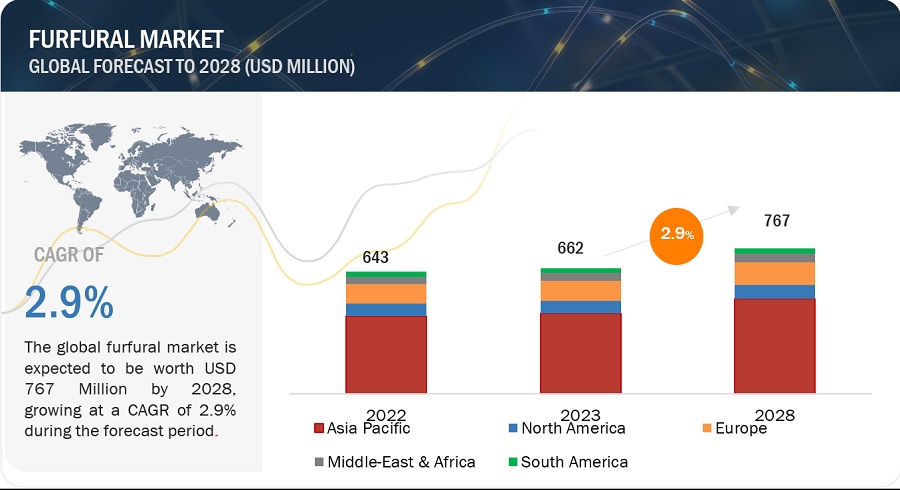

The global furfural market size was valued at USD 662 million in 2023 and is projected to reach USD 767 million by 2028, growing at 2.9% cagr from 2023 to 2028. Furfural is an organic intermediate obtained using renewable sources or raw materials like corncobs, sugarcane bagasse, oats, and rice husk etc. It finds use in various applications such as derivatives and solvents as it is a green chemical and is used in many end-use industries like refineries, paint & coatings, agriculture etc.

Furfural Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Furfural Market

Furfural Market Dynamics

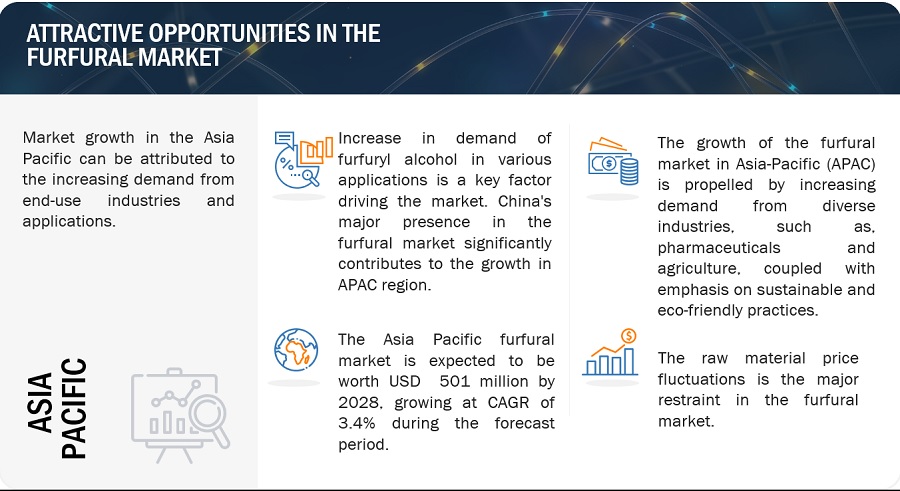

Driver: Growing demand for furfuryl alcohol

The surging demand for furfuryl alcohol stands out as a primary driver propelling the furfural market forward. Furfuryl alcohol, a key derivative of furfural, is witnessing an increasing preference across various industries, contributing significantly to the market's growth trajectory. Its versatile applications, particularly in the production of furan resins used in foundry applications, have fueled its demand. As industries prioritize sustainable and eco-friendly solutions, the unique properties of furfuryl alcohol make it a sought-after component. The growing awareness and adoption of furfuryl alcohol as a bio-based and renewable resource in the manufacturing sector underscores its pivotal role in driving the overall expansion of the furfural market.

Restraint: Availability of crude oil-based alternatives in the market

The furfural market faces a notable restraint in the form of the availability of crude oil-based alternatives. The traditional dependence on crude oil-derived substances in various industries poses a challenge to the widespread adoption of furfural and its derivatives. As industries continue to rely on conventional sources, the shift towards embracing furfural-based products encounters resistance due to existing infrastructures and well-established supply chains associated with crude oil derivatives. The inertia in transitioning from crude oil-based alternatives to bio-based solutions limits the potential market share that furfural could otherwise capture. Overcoming this challenge requires not only technological innovations but also a shift in mindset within industries to prioritize the adoption of sustainable and eco-friendly alternatives, such as furfural, in their manufacturing processes.

Opportunity: Increased applications in textile industries

The emerging demand from the textile industry presents a significant market opportunity within the furfural sector. As the textile industry increasingly seeks sustainable and environmentally friendly alternatives, furfural has gained attention for its versatile applications. Furfural's potential use in the textile industry arises from its ability to serve as a bio-based component in the production of various textile-related chemicals and materials. As a result, the rising demand from the textile sector positions Furfural as a promising player in addressing the sustainability goals of the industry, thereby creating a valuable market opportunity.

Challenge: Raw material price fluctuations

Raw material price fluctuations pose a significant market challenge for the furfural industry. The production of furfural relies heavily on agricultural by-products such as corncobs, rice husks, and sugarcane bagasse. The prices of these raw materials are subject to various external factors, including weather conditions, agricultural policies, and global market trends. Fluctuations in raw material prices can impact production costs, subsequently affecting the overall economics of furfural manufacturing. Such uncertainties can pose challenges for industry participants in terms of maintaining stable pricing structures and profit margins. To navigate this challenge, players in the furfural market must implement strategic measures, including supply chain optimization, risk management, and exploring alternative and more stable sources of raw materials, to ensure resilience in the face of price volatility.

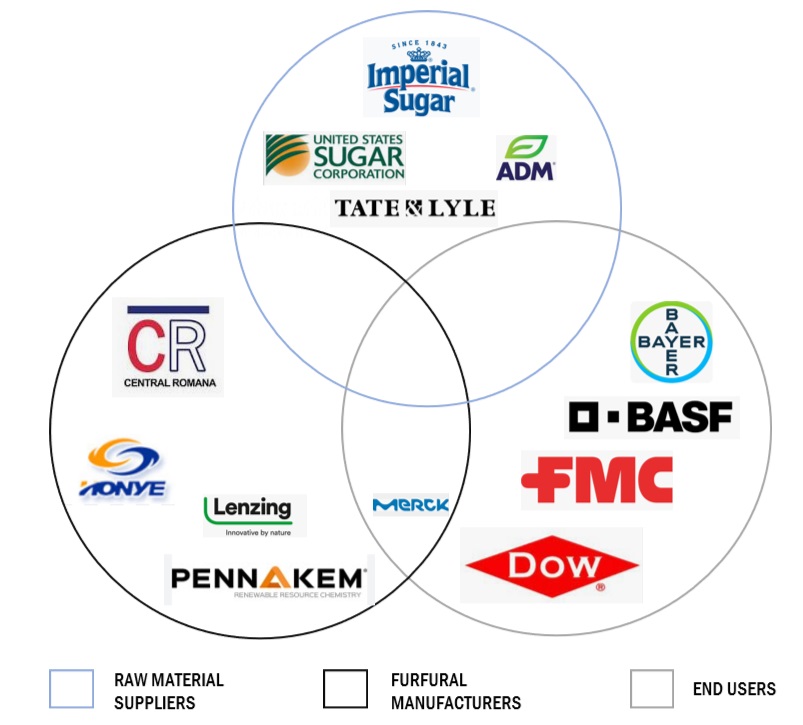

Furfural Market Ecosystem

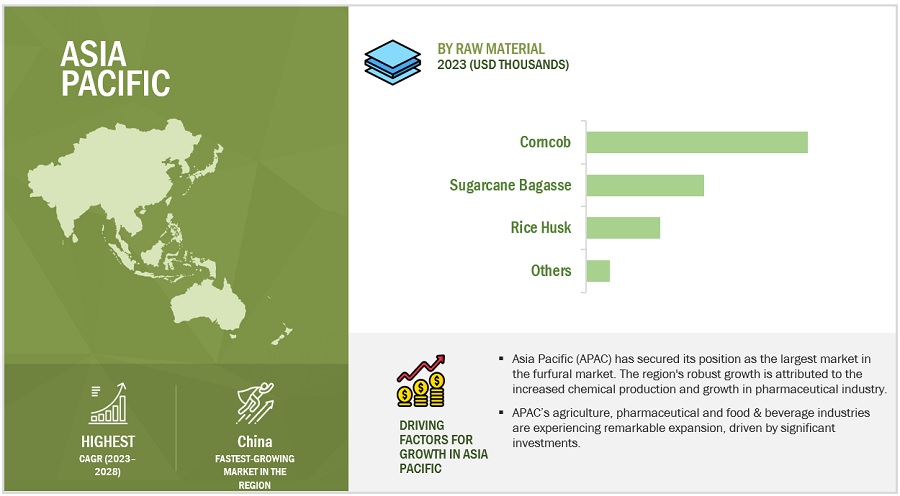

By Raw Material sugarcane bagasse to have highest growth in the forecast period

Sugarcane bagasse is rapidly emerging as the swiftest-growing segment among materials like corn cob, rice husk, and others in the furfural market. Fueled by inherent advantages and versatile applications, sugarcane bagasse, an abundant by-product from the sugar industry, is gaining notable traction. Its high cellulose and hemicellulose content make it an exceptional raw material for furfural production, and the efficient conversion of these components enhances overall yield and productivity during synthesis. Furthermore, the utilization of sugarcane bagasse aligns seamlessly with sustainability initiatives, offering an eco-friendly alternative to conventional sources.

By application, the derivatives segment led the market in 2022.

In 2022, the derivatives segment stood out as the largest application of furfural, commanding the largest share of the market. Furfural serves as a crucial starting material to produce various furan derivatives. Notably, furfuryl alcohol, tetrahydrofuran (THF), maleic anhydride (MA), 2-methyltetrahydrofuran (MTHF), and 1,5-pentanediol are among the derivatives manufactured on a commercial scale. This dominance underscores the pivotal role of furfural in the synthesis of key industrial derivatives, contributing significantly to the overall market landscape.

By end-use industry, the paint & coatings segment was the second largest segment in 2022.

In the furfural market, the paint and coatings industry has emerged as the second-largest end-use sector. This notable trend can be attributed to the versatile applications and unique chemical properties of furfural. Derived from agricultural by-products, furfural has secured a significant niche in the paint and coatings sector due to its efficacy as both a resin and solvent. Its compatibility with diverse paint formulations and coatings, coupled with its ability to enhance adhesion and durability, has spurred its adoption in the industry. As the paint and coatings industry pursues innovative and environmentally conscious solutions, furfural's distinct attributes position it as a crucial player, driving its noteworthy presence within this end-use sector in the furfural market.

Asia Pacific to register highest CAGR during the forecast period.

Asia-Pacific (APAC) stands out as the fastest-growing region in the furfural market due to a combination of factors driving heightened demand and production. The region's rapid industrialization, particularly in emerging economies like China and India, fuels the need for furfural across various industries, including chemicals, pharmaceuticals, and agriculture. Additionally, APAC's commitment to sustainable practices aligns with furfural's eco-friendly attributes, further boosting its adoption. The robust agricultural activities in the region, providing ample biomass for furfural production, contribute to the market's expansion.

To know about the assumptions considered for the study, download the pdf brochure

Furfural Market Players

The Furfural market comprises key manufacturers such as Central Romana Corporation (Dominican Republic), Pennakem (US), Silvateam (Italy), Illovo Sugar (South Africa), Hongye Holding Group Corporation Limited (China), KRBL Limited (India), Lenzing AG(Austria), and Merck KGaA (Germany), and others. Expansions, mergers & acquisitions, and deals were some of the major strategies adopted by these key players to enhance their positions in the furfural market. A major focus was given to the expansions and deals.

Read More: Furfural Companies

Furfural Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 662 Million |

|

Revenue Forecast in 2028 |

USD 767 Million |

|

CAGR |

2.9% |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD thousands) and Volume (Tons) |

|

Segments Covered |

Raw material, Application, End-Use industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

|

Companies covered |

Central Romana Corporation (Dominican Republic), Pennakem (US), Silvateam (Italy), Illovo Sugar (South Africa), Hongye Holding Group Corporation Limited (China), KRBL Limited (India), Lenzing AG(Austria), and Merck KGaA (Germany) are the top manufacturers covered in the furfural market. |

This research report categorizes the furfural market based on raw material, application, end-use industry, and region.

Furfural Market by Raw Material

- Sugarcane Bagasse

- Corncob

- Rice Husk

- Others

Furfural Market by Application

- Derivatives

- Solvents

- Others

Furfural Market by End-Use Industry

- Agriculture

- Paint & Coatings

- Pharmaceuticals

- Food & Beverages

- Refineries

- Others

Furfural Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- Fortum announced a new biorefinery project in Assam, India. It is expected to start production in 2024. The biorefinery is a joint venture of the Indian oil refinery company Numaligarh Refinery Limited (NRL), Chempolis and Fortum.

- In June 2023, Origin Materials announced startup of origin 1, world’s first commercial CMF (chloromethyl furfural) plant.

- In May 2021, The Kilombero Sugar Company, in which Illovo Sugar Africa holds 75% of the share share announced a major expansion project. This new development will increase the company’s sugar production from 127 000 tons of sugar per annum, to 271 000 tons.

- In May 2019 Pennakem, LLC, obtained the approval of use of its renewable solvent Viridisol M as a raw material authorized for natural detergents and natural detergents made with organic raw materials.

- In May 2017, The U.S. Department of Agriculture granted its "biobased" certificate to Lenzing Group's acetic acid, furfural. This highlighted a significant strength in the company's commitment to sustainability.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the furfural market?

The major drivers influencing the growth of the furfural market are growing demand for furfuryl alcohol and shift towards renewable chemicals.

What are the major challenges in the furfural market?

The major challenge in the furfural market is fluctuations in raw material price.

What are the restraining factors in the furfural market?

The major restraining factor is the availability of crude oil-based alternatives.

What is the key opportunity in the furfural market?

Emerging demand from the textile and fashion industry is a major opportunity in the furfural market.

Who are the key players in the global furfural market?

The key players operating in the furfural market are Central Romana Corporation (Dominican Republic), Pennakem (US), Silvateam (Italy), Illovo Sugar (South Africa), Hongye Holding Group Corporation Limited (China), KRBL Limited (India), Lenzing AG(Austria), and Merck KGaA (Germany), amongst others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for furfuryl alcohol- Increase in utilization of furfural in agrochemicals and horticulture- Shift toward renewable chemicalsRESTRAINTS- Availability of crude oil-based alternatives- Lack of technological advancement and production process frameworkOPPORTUNITIES- Emerging demand from textile and fashion industriesCHALLENGES- Fluctuations in raw material prices- Low yield of furfural from traditional technology

- 5.3 TRENDS & DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- 5.4 PRICING ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM/MARKET MAP

-

5.7 TECHNOLOGY ANALYSISSUPRA YIELD TECHNOLOGYFURFURAL-BASED BIOPLASTICSFURFURAL’S CATALYTIC TRANSFORMATION INTO VALUE-ADDED CHEMICALSFURFURAL IN COATINGS

-

5.8 PATENT ANALYSISINTRODUCTIONMETHODOLOGYFURFURAL MARKET, PATENT ANALYSIS (2013–2022)

- 5.9 TRADE ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSAVERAGE TARIFF RATESENVIRONMENTAL STANDARD (CHINA)REGULATION (EC) NO 1272/2008REGULATION (EC) NO 1907/2006

-

5.12 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 CASE STUDY ANALYSISUSE OF PD-PDO/ZNSO4 CATALYST IN FURFURAL MANUFACTURINGCONVERSION OF FURFURAL INTO BIO-CHEMICALS THROUGH BIO-CATALYSIS

-

5.15 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTSTRENDS AND FORECAST OF OIL INDUSTRY AND ITS IMPACT ON FURFURAL MARKET

- 6.1 INTRODUCTION

- 6.2 SOLID ACID TYPE CATALYSTS

- 6.3 LIQUID ACID TYPE CATALYSTS

- 7.1 INTRODUCTION

- 7.2 QUAKER BATCH PROCESS

- 7.3 CHINESE BATCH PROCESS

- 8.1 INTRODUCTION

-

8.2 CORNCOBHIGHEST HEMICELLULOSE CONTENT OF ALL RAW MATERIALS FOR FURFURAL

-

8.3 SUGARCANE BAGASSE (SCB)SUSTAINABLE SUGAR INDUSTRY BY-PRODUCT

-

8.4 RICE HUSKLOWEST CONTENT OF HEMICELLULOSE

- 8.5 OTHER RAW MATERIALS

- 9.1 INTRODUCTION

-

9.2 DERIVATIVESHIGH DEMAND IN FURFURYL ALCOHOL MANUFACTURING TO DRIVE MARKET

-

9.3 SOLVENTNON-TOXICITY MAKES FURFURAL SUITABLE ALTERNATIVE TO PHENOLS

- 9.4 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 AGRICULTUREGROWING DEMAND FOR BIO-BASED PESTICIDES AND HERBICIDES TO DRIVE MARKET

-

10.3 PAINT & COATINGSINCREASING DEMAND FOR HIGH-PERFORMANCE COATINGS TO DRIVE MARKET

-

10.4 PHARMACEUTICALSADVANCEMENT IN APPLICATIONS IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

-

10.5 FOOD & BEVERAGESGROWING DEMAND FOR NATURAL FLAVORS TO DRIVE MARKET

-

10.6 REFINERIESEXPANDING APPLICATIONS IN SOLVENT EXTRACTION TO DRIVE MARKET

- 10.7 OTHER END-USE INDUSTRIES

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACTCHINA- Largest producer of furfural in worldINDIA- Pharmaceutical industry to be major driver of marketJAPAN- Growing investment in chemical and pharmaceutical industriesTHAILAND- Market to be driven by rising sportswear industryREST OF ASIA PACIFIC

-

11.3 EUROPERECESSION IMPACTGERMANY- Investments in chemical & petrochemical industry to drive marketFRANCE- Strong base of plastic industries to create growth opportunitiesITALY- Intensive horticulture activities to drive marketUK- Increasing focus on bioenergy to drive marketBELGIUM- Presence of one of largest furfuryl alcohol plants makes country major marketNETHERLANDS- Presence of major food & beverage companies to support market growthREST OF EUROPE

-

11.4 NORTH AMERICARECESSION IMPACTUS- Growing sportswear market to fuel demandCANADA- Growth in agrochemical market to boost demandMEXICO- Increasing investments in pharmaceutical industry and growing food & beverage industry

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACTGCC COUNTRIES- Growth in end-use industries to propel market- Saudi Arabia- UAE- Rest of GCCSOUTH AFRICA- Significant export of furfural to Asia Pacific and European countriesDOMINICAN REPUBLIC- Usage of furfural in agriculture and pharmaceutical industries to drive marketREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing investments across end-use industriesARGENTINA- Increasing investments in construction sector and growing chemical sectorREST OF SOUTH AMERICA

- 12.1 OVERVIEW

- 12.2 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 12.3 MARKET SHARE ANALYSIS

-

12.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.5 COMPANY FOOTPRINT

-

12.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 COMPETITIVE BENCHMARKING

-

12.8 COMPETITIVE SITUATIONS AND TRENDSDEALSOTHERS

-

13.1 KEY PLAYERSCENTRAL ROMANA CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewLENZING AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPENNAKEM, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products/Solutions/Services offered- MnM viewKRBL LIMITED- Business overview- Products/Solutions/Services offered- MnM viewILLOVO SUGAR (SOUTH AFRICA) (PTY) LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSILVATEAM- Business overview- Products/Solutions/Services offered- MnM viewHONGYE HOLDING GROUP CORPORATION LIMITED- Business overview- Products/Solutions/Services offered- MnM viewKANTO CHEMICAL CO., INC.- Business overview- Products/Solutions/Services offered- MnM viewTANIN- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSLAXMI FURALS PVT LTDHEFEI TNJ CHEMICAL INDUSTRY CO., LTD.FURNOVA POLYMERS LTDTOKYO CHEMICAL INDUSTRY CO., LTD. (TCI)SHANDONG XINHUA PHARMAJUNSEI CHEMICAL CO., LTD.A. B. ENTERPRISESSHANDONG YINO BIOLOGIC MATERIALS CO., LTD.RX CHEMICALSKUNSHAN ODOWELL CO., LTD.CENTRAL DRUG HOUSE (P) LTD.AECOCHEMBEIJING LYS CHEMICALS CO., LTD.ZHUCHENG TAISHENG CHEMICAL CO., LTD.XINGTAI CHUNLEI FURFURYL ALCOHOL CO., LTD.

- 14.1 INTRODUCTION

-

14.2 TETRAHYDROFURAN (THF) MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.3 TETRAHYDROFURAN MAREKT, BY PROCESS TECHNOLOGY

- 14.4 TETRAHYDROFURAN MAREKT, BY APPLICATION

- 14.5 TETRAHYDROFURAN MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 TOP 30 CHEMICALS THAT CAN BE OBTAINED FROM BIOMASS

- TABLE 3 AVERAGE PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES (USD/KG), 2022

- TABLE 4 AVERAGE PRICE TREND, BY REGION (USD/KG)

- TABLE 5 ECOSYSTEM OF FURFURAL MARKET

- TABLE 6 LIST OF PATENTS FOR FURFURAL

- TABLE 7 FURFURAL MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 TARIFF RELATED TO FURFURAL

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 12 KEY BUYING CRITERIA FOR FURFURAL MARKET

- TABLE 13 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 14 FURFURAL YIELD FROM DIFFERENT TYPES OF RAW MATERIALS

- TABLE 15 FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (TON)

- TABLE 16 FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (USD THOUSAND)

- TABLE 17 FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (TON)

- TABLE 18 FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (USD THOUSAND)

- TABLE 19 FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 20 FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 21 FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 22 FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 23 FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 24 FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 25 FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (TON)

- TABLE 26 FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

- TABLE 27 FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (TON)

- TABLE 28 FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD THOUSAND)

- TABLE 29 FURFURAL MARKET, BY REGION, 2021–2028 (TON)

- TABLE 30 FURFURAL MARKET, BY REGION, 2021–2028 (USD THOUSAND)

- TABLE 31 ASIA PACIFIC: FURFURAL MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 32 ASIA PACIFIC: FURFURAL MARKET, BY COUNTRY, 2021–2028 (USD THOUSAND)

- TABLE 33 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 34 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 35 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 36 ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 37 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 38 ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 39 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (TON)

- TABLE 40 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (USD THOUSAND)

- TABLE 41 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (TON)

- TABLE 42 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (USD THOUSAND)

- TABLE 43 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (TON)

- TABLE 44 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

- TABLE 45 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (TON)

- TABLE 46 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD THOUSAND)

- TABLE 47 CHINA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 48 CHINA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 49 CHINA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 50 CHINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 51 CHINA: FURFURAL MARKET SIZE, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 52 CHINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 53 INDIA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 54 INDIA: FURFURAL MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 55 INDIA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 56 INDIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 57 INDIA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 58 INDIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 59 JAPAN: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 60 JAPAN: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 61 JAPAN: FURFURAL MARKET SIZE, BY APPLICATION, 2021–2028 (TON)

- TABLE 62 JAPAN: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 63 JAPAN: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 64 JAPAN: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 65 THAILAND: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 66 THAILAND: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 67 THAILAND: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 68 THAILAND: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 69 THAILAND: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 70 THAILAND: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 71 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 72 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 73 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 74 REST OF ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 75 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 76 REST OF ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 77 EUROPE: FURFURAL MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 78 EUROPE: FURFURAL MARKET, BY COUNTRY, 2021–2028 (USD THOUSAND)

- TABLE 79 EUROPE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 80 EUROPE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 81 EUROPE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 82 EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 83 EUROPE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 84 EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 85 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (TON)

- TABLE 86 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (USD THOUSAND)

- TABLE 87 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (TON)

- TABLE 88 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (USD THOUSAND)

- TABLE 89 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (TON)

- TABLE 90 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

- TABLE 91 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (TON)

- TABLE 92 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD THOUSAND)

- TABLE 93 GERMANY: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 94 GERMANY: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 95 GERMANY: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 96 GERMANY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 97 GERMANY: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 98 GERMANY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 99 FRANCE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 100 FRANCE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 101 FRANCE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 102 FRANCE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 103 FRANCE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 104 FRANCE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 105 ITALY: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 106 ITALY: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 107 ITALY: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 108 ITALY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 109 ITALY: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 110 ITALY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 111 UK: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 112 UK: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 113 UK: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 114 UK: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 115 UK: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 116 UK: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 117 BELGIUM: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 118 BELGIUM: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 119 BELGIUM: FURFURAL MARKET SIZE, BY APPLICATION, 2021–2028 (TON)

- TABLE 120 BELGIUM: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 121 BELGIUM: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 122 BELGIUM: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 123 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 124 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 125 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 126 NETHERLANDS: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 127 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 128 NETHERLANDS: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 129 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 130 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 131 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 132 REST OF EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 133 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 134 REST OF EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 135 NORTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 136 NORTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021–2028 (USD THOUSAND)

- TABLE 137 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 138 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 139 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 140 NORTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 141 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 142 NORTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 143 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (TON)

- TABLE 144 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (USD THOUSAND)

- TABLE 145 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (TON)

- TABLE 146 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (USD THOUSAND)

- TABLE 147 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (TON)

- TABLE 148 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

- TABLE 149 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (TON)

- TABLE 150 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD THOUSAND)

- TABLE 151 US: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 152 US: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 153 US: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 154 US: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 155 US: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 156 US: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 157 CANADA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 158 CANADA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 159 CANADA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 160 CANADA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 161 CANADA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 162 CANADA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 163 MEXICO: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 164 MEXICO: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 165 MEXICO: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 166 MEXICO: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 167 MEXICO: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 168 MEXICO: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 169 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 170 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY COUNTRY, 2021–2028 (USD THOUSAND)

- TABLE 171 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 172 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 173 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 174 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 175 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 176 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 177 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (TON)

- TABLE 178 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (USD THOUSAND)

- TABLE 179 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (TON)

- TABLE 180 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (USD THOUSAND)

- TABLE 181 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (TON)

- TABLE 182 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

- TABLE 183 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (TON)

- TABLE 184 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD THOUSAND)

- TABLE 185 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 186 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 187 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 188 GCC COUNTRIES: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 189 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 190 GCC COUNTRIES: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 191 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 192 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 193 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 194 SAUDI ARABIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 195 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 196 SAUDI ARABIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 197 UAE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 198 UAE: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 199 UAE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 200 UAE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 201 UAE: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 202 UAE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 203 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 204 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 205 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 206 REST OF GCC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 207 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 208 REST OF GCC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 209 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 210 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 211 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 212 SOUTH AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 213 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 214 SOUTH AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 215 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 216 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 217 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 218 DOMINICAN REPUBLIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 219 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 220 DOMINICAN REPUBLIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 222 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 227 SOUTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021–2028 (TON)

- TABLE 228 SOUTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021–2028 (USD THOUSAND)

- TABLE 229 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 230 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 231 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 232 SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 233 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 234 SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 235 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (TON)

- TABLE 236 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017–2020 (USD THOUSAND)

- TABLE 237 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (TON)

- TABLE 238 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021–2028 (USD THOUSAND)

- TABLE 239 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (TON)

- TABLE 240 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

- TABLE 241 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (TON)

- TABLE 242 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021–2028 (USD THOUSAND)

- TABLE 243 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 244 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 245 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 246 BRAZIL: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 247 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 248 BRAZIL: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 249 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 250 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 251 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 252 ARGENTINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 253 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 254 ARGENTINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 255 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (TON)

- TABLE 256 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 257 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (TON)

- TABLE 258 REST OF SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (TON)

- TABLE 259 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 260 REST OF SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021–2028 (USD THOUSAND)

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY KEY FURFURAL PLAYERS

- TABLE 262 FURFURAL MARKET: DEGREE OF COMPETITION

- TABLE 263 FURFURAL MARKET: APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 264 FURFURAL MARKET: REGIONAL FOOTPRINT (25 COMPANIES)

- TABLE 265 FURFURAL MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 266 FURFURAL MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 267 FURFURAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 268 DEALS, 2019–2023

- TABLE 269 OTHERS, 2019–2023

- TABLE 270 CENTRAL ROMANA CORPORATION: COMPANY OVERVIEW

- TABLE 271 LENZING AG: COMPANY OVERVIEW

- TABLE 272 LENZING AG: OTHERS

- TABLE 273 PENNAKEM, LLC: COMPANY OVERVIEW

- TABLE 274 PENNAKEM, LLC: DEALS

- TABLE 275 PENNAKEM, LLC: OTHERS

- TABLE 276 MERCK KGAA: COMPANY OVERVIEW

- TABLE 277 KRBL LIMITED: COMPANY OVERVIEW

- TABLE 278 ILLOVO SUGAR (SOUTH AFRICA) (PTY) LTD: COMPANY OVERVIEW

- TABLE 279 ILLOVO SUGAR (SOUTH AFRICA) (PTY) LTD: OTHERS

- TABLE 280 SILVATEAM: COMPANY OVERVIEW

- TABLE 281 HONGYE HOLDING GROUP CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 282 KANTO CHEMICAL CO., INC.: COMPANY OVERVIEW

- TABLE 283 TANIN: COMPANY OVERVIEW

- TABLE 284 LAXMI FURALS PVT LTD: COMPANY OVERVIEW

- TABLE 285 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 286 FURNOVA POLYMERS LTD: COMPANY OVERVIEW

- TABLE 287 TOKYO CHEMICAL INDUSTRY CO., LTD. (TCI): COMPANY OVERVIEW

- TABLE 288 SHANDONG XINHUA PHARMA: COMPANY OVERVIEW

- TABLE 289 JUNSEI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 290 A. B. ENTERPRISES: COMPANY OVERVIEW

- TABLE 291 SHANDONG YINO BIOLOGIC MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 292 RX CHEMICALS: COMPANY OVERVIEW

- TABLE 293 KUNSHAN ODOWELL CO., LTD.: COMPANY OVERVIEW

- TABLE 294 CENTRAL DRUG HOUSE (P) LTD.: COMPANY OVERVIEW

- TABLE 295 AECOCHEM: COMPANY OVERVIEW

- TABLE 296 BEIJING LYS CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 297 ZHUCHENG TAISHENG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 298 XINGTAI CHUNLEI FURFURYL ALCOHOL CO., LTD. NC.: COMPANY OVERVIEW

- TABLE 299 THF MARKET, BY PROCESS TECHNOLOGY, 2015–2022 (KILOTON)

- TABLE 300 THF MARKET, BY PROCESS TECHNOLOGY, 2015–2022 (USD MILLION)

- TABLE 301 THF MARKET, BY APPLICATION, 2015–2022 (KILOTON)

- TABLE 302 THF MARKET, BY APPLICATION, 2015–2022 (USD MILLION)

- TABLE 303 THF MARKET, BY REGION, 2015–2022 (KILOTON)

- TABLE 304 THF MARKET, BY REGION, 2015–2022 (USD MILLION)

- FIGURE 1 FURFURAL MARKET SEGMENTATION

- FIGURE 2 FURFURAL MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 FURFURAL MARKET: DATA TRIANGULATION

- FIGURE 6 CORNCOB SEGMENT TO LEAD FURFURAL MARKET DURING FORECAST PERIOD

- FIGURE 7 DERIVATIVES SEGMENT TO DOMINATE FURFURAL MARKET

- FIGURE 8 AGRICULTURE TO BE LARGEST END-USE INDUSTRY IN FURFURAL MARKET

- FIGURE 9 ASIA PACIFIC DOMINATED FURFURAL MARKET IN 2022

- FIGURE 10 ASIAN ECONOMIES TO WITNESS RELATIVELY HIGHER GROWTH RATE FOR FURFURAL MARKET

- FIGURE 11 CHINA ACCOUNTED FOR LARGEST SHARE IN TERMS OF VOLUME

- FIGURE 12 FURFURAL MARKET IN CHINA TO GROW AT HIGHEST CAGR

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FURFURAL MARKET

- FIGURE 14 REVENUE SHIFT FOR FURFURAL MANUFACTURERS

- FIGURE 15 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES

- FIGURE 16 AVERAGE SELLING PRICE TREND, BY REGION (USD/KG)

- FIGURE 17 VALUE CHAIN ANALYSIS OF FURFURAL MARKET

- FIGURE 18 FURFURAL MARKET: ECOSYSTEM MAPPING

- FIGURE 19 LIST OF MAJOR PATENTS FOR FURFURAL MARKET (2013–2022)

- FIGURE 20 EXPORT SCENARIO, HS CODE 293212 ENCOMPASSING FURFURAL OR 2-FURALDEHYDE "FURFURALDEHYDE" (USD MILLION)

- FIGURE 21 IMPORT SCENARIO, HS CODE 293212 ENCOMPASSING FURFURAL OR 2-FURALDEHYDE "FURFURALDEHYDE" (USD MILLION)

- FIGURE 22 FURFURAL MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA

- FIGURE 25 GLOBAL OIL PRODUCTION, 2017–2021

- FIGURE 26 CORNCOB SEGMENT TO DOMINATE FURFURAL MARKET DURING FORECAST PERIOD

- FIGURE 27 DERIVATIVES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 28 AGRICULTURE TO BE LARGEST APPLICATION OF FURFURAL DURING FORECAST PERIOD

- FIGURE 29 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC MARKET TO RECORD FASTEST-GROWTH DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC: FURFURAL MARKET SNAPSHOT

- FIGURE 32 EUROPE: FURFURAL MARKET SNAPSHOT

- FIGURE 33 REVENUE ANALYSIS OF KEY COMPANIES IN FURFURAL MARKET OVER LAST FIVE YEARS

- FIGURE 34 SHARE OF LEADING COMPANIES IN FURFURAL MARKET

- FIGURE 35 COMPANY EVALUATION MATRIX, 2022

- FIGURE 36 FURFURAL MARKET: PRODUCT FOOTPRINT (25 COMPANIES)

- FIGURE 37 START-UP/SME EVALUATION MATRIX

- FIGURE 38 LENZING AG: COMPANY SNAPSHOT

- FIGURE 39 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 40 KRBL LIMITED: COMPANY SNAPSHOT

The study involved four major activities for estimating the current size of the global furfural market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of furfural through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the furfural market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the furfural market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The furfural market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the furfural market. Primary sources from the supply side include associations and institutions involved in the furfural industry, key opinion leaders, and processing players.

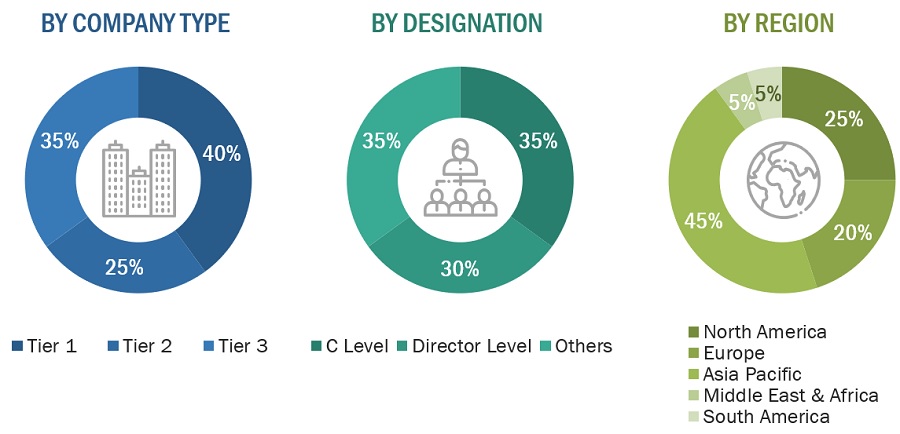

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2022, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global furfural market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the furfural market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

The furfural market encompasses the production, distribution, and consumption of furfural, a chemical compound derived from agricultural by-products such as corncobs, sugarcane bagasse etc. Furfural serves as a versatile platform chemical, finding applications in various industries, including pharmaceuticals, agriculture, paints & coatings etc. Key market components include furfural manufacturers, suppliers of raw materials, distributors, and end-users. Market dynamics are influenced by factors such as raw material availability, technological advancements, environmental regulations, and the demand for sustainable and renewable chemicals.

Key Stakeholders

- Raw material suppliers

- Furfural manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End users

- Traders and distributors

Report Objectives

- To define, analyze, and project the size of the furfural market in terms of value and volume based on raw material, application, end-use industry and region.

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders.

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the furfural market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Furfural Market