Gas Sensor Market Size, Share and Trends, 2025 To 2033

Gas Sensor Market by Gas Type (Oxygen, Carbon Monoxide, Carbon Dioxide, Volatile Organic Compounds, Hydrocarbons), Technology (Electrochemical, Infrared, Solid-State/Metal-Oxide-Semiconductors), Output Type, Connectivity - Global Forecast to 2033

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The gas sensor market is expected to grow from USD 1.78 billion in 2025 to USD 3.20 billion by 2033, at a CAGR of 7.6% from 2025 to 2033. The market is experiencing substantial growth due to increasing demand for autonomous vehicles, the integration of Internet of Things, cloud computing, and big data technologies. Additionally, rising adoption in consumer electronics and the growing need for miniaturized wireless gas sensors present opportunities for market expansion.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific gas sensor market accounted for a 35.6% revenue share in 2024.

-

By ProductBy product, the air quality monitors segment is expected to register the highest CAGR of 10.4%.

-

By OutputBy output, the digital segment is projected to grow at the fastest rate from 2025 to 2033.

-

By ConnectivityBy connectivity, the wired segment is expected to dominate the market in 2025.

-

By Gas TypeBy gas type, the volatile organic compounds segment will grow the fastest during the forecast period.

-

By TechnologyBy technology, the holographic segment is expected to register the highest CAGR of 13.0%.

-

By End UseBy end use, the smart cities & building automation segment is expected to dominate the market in 2025.

-

Competitive Landscape - Key PlayersHoneywell International Inc., MSA Safety Incorporated, and Amphenol Corporation were identified as some of the star players in the gas sensor market (global), given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsWinsen, Cubic Sensor and Instrument Co., Ltd., and eLichens, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The gas sensor market is projected to grow steadily over the next decade, driven by factors such as the integration of gas sensors into HVAC systems and air quality monitors, as well as the implementation of health and safety regulations. With the increasing integration of gas sensors in smartphones and wearable devices for continuously monitoring environmental or atmospheric air quality, the demand for gas sensors is likely to increase in this industry. Companies such as Bosch Sensortec (Germany), Sensirion (Switzerland), Omron (Japan), and ams-OSRAM AG (Austria) currently provide gas sensors for consumer electronics.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growing demand for highly accurate and micro-sized gas sensors for gas detection, air quality monitoring, and measuring target gas concentration is driving the growth of the gas sensor market. The introduction of gas sensors compatible with IoT devices is expected to create new revenue sources for manufacturers of gas sensors and modules. While several companies are still remain slow to capitalize on opportunities in the market for IoT-compatible gas sensors, ELT Sensor Addressed Corp. (Korea) is already engaged in R&D for the same. The company offers the IoT-S300EA Series, comprising a single-channel CO2 sensor module used in IoT devices such as air cleaners for residential houses and buildings. Such technological developments are expected to create new revenue streams for companies in the gas sensor market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand in oil & gas, chemicals, mining, and power sectors

-

Implementation of health and safety regulations

Level

-

Intense pricing pressure resulting in declining average selling prices

-

High qualification barriers in safety-critical applications

Level

-

Incorporation of Internet of Things, cloud computing, and big data technologies

-

Increasing demand for miniaturized wireless gas sensors

Level

-

Complex manufacturing process

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand in oil & gas, chemicals, mining, and power sectors

The growth of the gas sensor market is expected to be driven by their increasing demand in critical industries such as oil & gas, chemicals, mining, and power. These industries use gas sensors to detect and monitor the presence of combustible and toxic gases.

Restraint: Intense pricing pressure resulting in declining average selling prices

Several companies are focusing their research and development on offering cost-effective gas sensor solutions that utilize MEMS technology and developing IoT-compatible sensors. This is leading to pricing pressure, especially for applications where gas sensors are used in high volumes.

Opportunity: Incorporation of Internet of Things, cloud computing, and big data technologies

The Internet of Things (IoT) plays a vital role in the information technology sector. It refers to a network of sensors created by connecting various information-gathering devices to the internet. Additionally, IoT drives a significant demand for advanced connected devices that enable M2M communication and interoperability with other devices according to the needs of the connected environment.

Challenge: Complex manufacturing process

Gas sensors need complex designs and precise engineering to achieve high sensitivity, selectivity, and reliability. Maintaining accuracy often requires advanced materials and sophisticated designs, which can cause technical problems like signal drift, slow response times, and reduced reliability over time. Sensors made for multi-gas detection or with wireless communication capabilities often require intricate component integration, making their manufacturing more complicated and expensive.

GAS SENSOR MARKET SIZE, SHARE AND TRENDS, 2025 TO 2033: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides advanced electrochemical, infrared, catalytic bead, and semiconductor gas sensors for industrial safety systems, HVAC controls, commercial buildings, and environmental monitoring platforms | High-accuracy gas detection, strong compliance with safety standards, and seamless integration with industrial IoT and automated safety systems |

|

Delivers rugged, high-precision gas sensor modules for fixed and portable gas detection systems used in oil & gas, mining, chemical processing, utilities, and commercial infrastructure | Industrial-grade reliability, enhanced worker safety, and proven performance in harsh and hazardous operating environments |

|

Offers a wide portfolio of CO2, VOC, CO, and refrigerant gas sensors designed for HVAC systems, automotive cabin air-quality control, home appliances, medical devices, and smart building management | Accurate and stable air-quality monitoring, energy-efficiency optimization, and scalable sensor platforms for high-volume OEM applications |

|

Specializes in compact, low-power CO2, VOC, and multi-parameter indoor-air quality sensors used in consumer electronics, air purifiers, smart homes, and commercial building automation | High-precision digital sensing, miniaturized design, and easy system integration enabling superior indoor-environment monitoring |

|

Provides advanced MEMS and spectral gas-sensing solutions for HVAC systems, workplace safety devices, industrial automation, and smart consumer products such as wearable air-quality monitors and appliances | High-sensitivity optical detection, low-power operation, and strong capability for multi-gas, IoT-enabled sensing across diverse commercial applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The gas sensor market functions within a dynamic and interconnected system driven by technological advancements, changing regulations, and rising demand across various sectors. This system includes research & development, manufacturers, integrators, distributors, and end users & customers, each playing a crucial role in shaping the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Gas Sensor Market, By Product

Air quality monitors exhibit the highest CAGR, driven by increasing demand in the smart cities & building automation sector. Growth of smart homes, smart buildings, and connected infrastructure encourages the integration of air-quality sensors into HVAC systems, building-management systems (BMS), ventilation controls, and home-automation platforms.

Gas Sensor Market, By Technology

The holographic segment exhibits the highest CAGR during the forecast period because of its ability to offer highly precise, real-time gas detection without physical contact with the gas. As industries like chemical manufacturing, aerospace, and healthcare increasingly seek more accurate and non-invasive gas detection methods, holographic sensors are becoming a promising solution.

Gas Sensor Market, By End Use

The smart cities & building automation sector holds largest market share in 2024. The high growth of the market in the smart cities & building automation segment is attributed to the increasing demand for energy-efficient, sustainable infrastructure and the growing need for real-time monitoring of air quality, emissions, and environmental conditions.

REGION

Asia Pacific to grow at the fastest rate in the global gas sensor market during the forecast period

Asia Pacific is expected to experience the highest CAGR from 2025 to 2033, driven by increased use of these sensors across automotive, building automation & smart cities, power & energy, oil & gas, and chemical industries. The rising adoption of oxygen, carbon dioxide, carbon monoxide, and nitrogen oxide gas sensors in the automotive sector is fueling market growth. The regional growth can be linked to the increased deployment of these sensors in various industries. Asia Pacific is a key region for the automotive industry due to higher passenger car manufacturing and sales in countries such as China, Japan, and South Korea. The expansion of oxygen, carbon dioxide, carbon monoxide, and nitrogen oxide gas sensors in automotive applications continues to support market development.

GAS SENSOR MARKET SIZE, SHARE AND TRENDS, 2025 TO 2033: COMPANY EVALUATION MATRIX

In the gas sensor market matrix, Honeywell International (Star) leads with a strong global presence and a comprehensive portfolio of gas sensors. The company’s robust manufacturing capacity across Japan, China, Malaysia, and Europe enhances supply reliability, making it the preferred supplier for Tier-1 automotive and industrial OEMs. SIA MiPex (Emerging Leader) is rapidly gaining momentum through its gas sensor product portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Honeywell International Inc. (US)

- MSA Safety Incorporated (US)

- Amphenol Corporation (US)

- Sensirion AG (Switzerland)

- ams-OSRAM AG (Austria)

- Figaro Engineering Inc. (Japan)

- Alphasense (UK)

- Process Sensing Technologies (UK)

- MEMBRAPOR (Switzerland)

- Senseair AB (US)

- Nissha Co., Ltd. (Japan)

- Fuji Electric Co., Ltd. (Japan)

- Renesas Electronics Corporation (Japan)

- Danfoss (Denmark)

- Gasera Ltd. (Finland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.59 Billion |

| Market Forecast in 2033 (Value) | USD 3.20 Billion |

| Growth Rate | CAGR of 7.6% from 2025-2033 |

| Years Considered | 2021-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Units Considered | Value (USD Billion/Million) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: GAS SENSOR MARKET SIZE, SHARE AND TRENDS, 2025 TO 2033 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based HVAC & Air Quality OEM | Sensor benchmarking across CO2, VOC, methane, and oxygen sensing platforms; calibration accuracy comparison; and drift performance under variable humidity | Optimized sourcing recommendations and sensor selection for improved indoor air quality monitoring and compliance |

| European Industrial Safety Equipment Manufacturer | Application mapping for toxic gas detection in chemical plants and refineries; evaluation of alarm thresholds, response time, and cross-sensitivity | Competitive product mapping across 25+ sensor suppliers, highlighting safety certifications and ruggedization levels |

RECENT DEVELOPMENTS

- October 2025 : Sensirion introduced the next-generation SGM5304 gas meter module. The new SGM5304 marks the latest advancement in Sensirion’s gas metering product lineup.

- June 2025 : Sensirion AG announced the acquisition of Kuva Systems, a Cambridge-based innovator in image-based methane emissions monitoring. The company will be integrated into Sensirion Connected Solutions, strengthening its position as a full-spectrum provider for continuous methane emissions monitoring in oil and gas applications.

- May 2025 : Honeywell International Inc. launched a new gas detector assembly line at the Masdar Innovation Centre in Abu Dhabi, supporting the UAE’s industrial and localization objectives.

- May 2025 : Honeywell International Inc. introduced a new Hydrogen Leak Detector (HLD) solution specifically designed to detect microscopic hydrogen leaks in real time, helping to ensure the safety of hydrogen-powered systems.

- January 2025 : MSA Safety Incorporated introduced the SENTRY io® Controller, a gas and flame monitoring system. This new device supports MSA gas and flame detectors by lowering costs and offering data analytics that help protect workers and facilities.

Table of Contents

Methodology

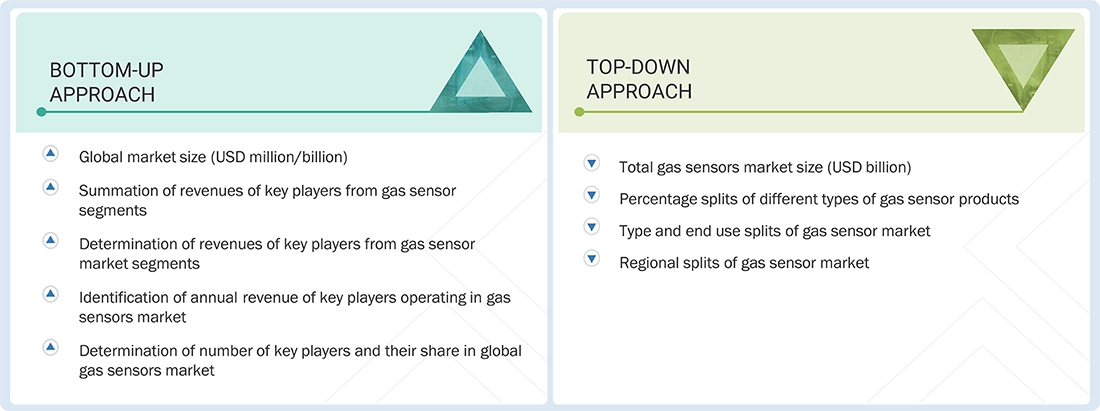

The study involved key activities in estimating the current size of the gas sensor market. Extensive secondary research was conducted to gather information on the gas sensor market. The next step was to validate these findings, assumptions, and estimates with industry experts across the value chain through primary research. Different approaches, including top-down and bottom-up methods, were used to estimate the total market size. Then, the market segmentation and data triangulation procedures were applied to determine the size of the segments and subsegments within the gas sensor market.

Secondary Research

The secondary research process involved consulting various secondary sources to gather information relevant to this study. These sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. This secondary research was mainly conducted to collect essential information about the industry's supply chain, value chain, the overall number of key players, and market classification and segmentation based on industry trends, geographic regions, and key developments from both market and technology perspectives. The secondary data was collected and analyzed to estimate the overall market size, which was also verified through primary research.

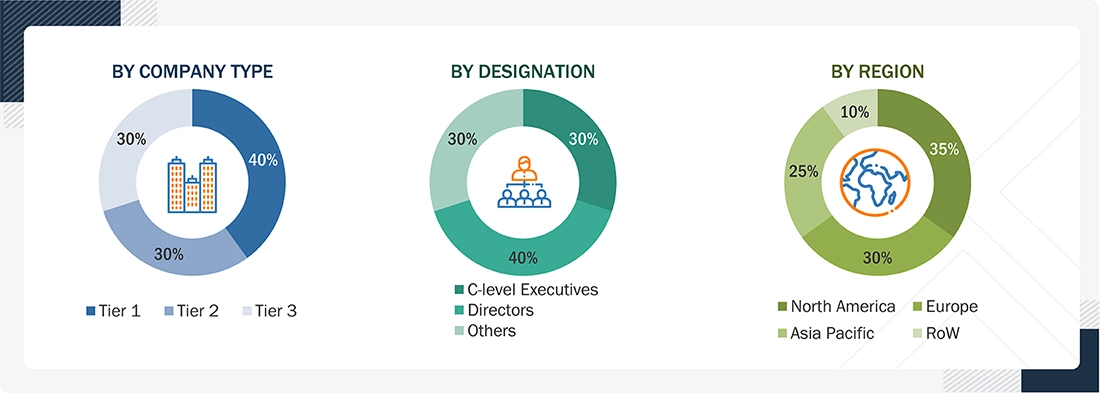

Primary Research

Extensive primary research was conducted after analyzing the current market scenario for gas sensors through secondary research. Several primary interviews were carried out with key opinion leaders from both the demand and supply sides across four key regions: North America, Europe, Asia Pacific, and the rest of the world. About 25% of the primary interviews involved the demand side, with 75% involving the supply side. Most of the primary data were collected via telephonic interviews, which made up 80% of all primary interviews. Surveys and emails were also used to collect data.

Note: The three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various gas sensor organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report employed both top-down and bottom-up methodologies to estimate and validate the market size of the gas sensors and their associated submarkets. Secondary research was conducted to identify key market participants, and their market shares across various regions were ascertained through a combination of primary and secondary research techniques.

This research methodology involved analyzing annual and financial reports of leading companies, along with conducting interviews with experts such as CEOs, VPs, directors, and marketing executives to gather key insights, both quantitative and qualitative. All percentage shares, splits, and breakdowns were determined using secondary sources and validated through primary sources. All relevant parameters influencing the market were thoroughly examined, verified through primary research, and analyzed to produce the final quantitative and qualitative data. This data was consolidated and enriched with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figures below illustrate the overall market size estimation process used for this study.

Bottom-Up Approach

- More than 30 companies offering gas sensors were identified, and their offerings were mapped based on their product, output type, connectivity, technology, type, end use, and region.

- The global gas sensors market size was derived through the data sanity method. The revenue of gas sensor providers was analyzed through annual reports and press releases and summed up to derive the overall market size.

- For each company, a percentage was assigned to the overall revenue to derive the revenues from the gas sensors segment.

- Each company's percentage was assigned after analyzing various factors, including its product offerings, range of gas sensor-related offerings, geographical presence, R&D expenditures and initiatives, and recent developments/strategies adopted for growth in the gas sensors market.

- For the CAGR, the market trend analysis of gas sensors was carried out by understanding the industry penetration rate and the demand and supply of gas sensors in different sectors.

- Estimates at every level were verified and cross-checked by discussing them with key opinion leaders, including the head of sales, directors, operations managers across the market, and domain experts from MarketsandMarkets.

- Various paid and unpaid information sources were studied, such as annual reports, press releases, white papers, and databases.

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of gas sensors, splitting the market based on product, output type, connectivity, technology, type, and end use, and listing key developments in key market areas

- Identifying all major players in the gas sensors market by product, output type, connectivity, technology, type, and end use, and their penetration in various applications through secondary research, and verifying with a brief discussion with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which gas sensors are served by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with the industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Gas Sensor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall size of the gas sensor market from the estimation process described above, the market was divided into several segments and subsegments. Data triangulation and market breakdown techniques were used (where applicable) to complete the entire market engineering process and obtain precise statistics for all segments and subsegments. The data was triangulated by analyzing various factors and trends from both the demand and supply sides. The market size was validated using both top-down and bottom-up approaches.

Market Definition

A gas sensor is a device used to detect the presence and concentration of gases in an environment. These sensors are crucial for various applications like industrial safety, environmental monitoring, and indoor air quality management. Gas sensors operate by detecting specific physical or chemical properties of gases, such as their molecular composition or reactions with certain materials.

Key Stakeholders

- Raw material suppliers

- Component manufacturers and providers

- Sensor manufacturers and providers

- Original equipment manufacturers

- ODM and OEM technology and solution providers

- Software service providers

- Gas sensing device suppliers and distributors

- Market research and consulting firms

- Associations, organizations, forums, and alliances related to gas sensor industry

- Technology investors

- Governments and financial institutions

- Venture capitalists, private equity firms, and startups

- End users

Report Objectives

- To define and forecast the size of the gas sensor in terms of value, based on product, output type, connectivity, technology, type, end use, and region.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To define, describe, segment, and forecast the size of the gas sensor market, in terms of volume, based on type

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the gas sensor market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the gas sensor market

Available Customizations:

With the market data given, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for the report.

- Additional country-level analysis of the green hydrogen market

- Profiling of additional market players (up to 5)

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Gas Sensor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Gas Sensor Market

Gagan

Mar, 2017

We need information regarding Gas sensors specifically in the medical industry. In Europe, Ireland and UK are the target markets, this is required for university research project..

User

Nov, 2020

AerNos will change the world.

User

Sep, 2019

HVAC comprises a number of gas sensors uses to monitor the indoor air and control the ventilation. Do you have gas sensor data for HVAC applications in APAC?.

Alexander

Jul, 2017

Does the report include price and necessary measurement rages for low cost MOX sensors? Can you provide any comparison of these sensors with Electrochemical sensors?.

Aaron

Sep, 2018

Could I get a sample report? I want to get a sense of what type of data I would get if we buy this report.

User

Sep, 2019

The government mandates is one of the major factor influencing the growth of gas sensor market. What would be impact of government mandates in long term like after 3 years and 5 years? .

James

Nov, 2016

I need to know some additional coverage details on this report, specifically if the gas type is expanded beyond the description. BTEX, bio-aerosols, microorganism's, and other carbon/biologic compounds are of specific interest..

User

Sep, 2019

The VOC sensor is widely used these days in smart cities and building applications. How do you look towards the use of VOCs in consumer electronics applications? Do you have VOC market estimations for various applications?.

User

Nov, 2019

There has been a huge research in the use of miniaturized and wireless gas sensors. How do you look towards the use of miniaturized gas sensors used in portable sensors? Do you have MEMS gas sensor forecasts for next 5 years? .

Giriraj

Jul, 2019

We are building an application that uses sensors and provides critical alarms for threshold violations. This report will help us to gauge the market and align our product accordingly. Can you share the report brochure or sample? .

Valentina

Jul, 2017

Good evening, I'm an Italian student and for study purposes, I'm interested in the market forecasts for MOS-type gas sensors only. Aware I'm asking a lot, do you think I could have some information in that field only?.

David

Jul, 2019

I am a graduate student researching gas sensor use cases and market sizing in smart cities. Specifically I am interested in optical and metal oxide detectors..

Kannan

Jun, 2018

We are looking for market sizes of Gas sensors for gases like ammonia, CO, hydrocarbons. Further, we are more interested in Electrochemical type gas sensors..

Hiroki

Jun, 2017

We’d mainly like to know the below points. As you may guess, we are working on an investigation into specifically CO2 sensor companies market analysis and opportunity. 1. Market size transition (actual to forecast) of CO2 Sensors market by below segments and factors. A) For building use B) For smart house use C) For automotive use D) For IoT use 2. Competitor intelligence (incl. strategy, SWOT analysis) A) Sense Air - Sweden B) Amphenol – U.S. C) Cubic - China D) Figaro Engineering - Japan E) Others .

User

Mar, 2019

Automotive and transportation sector is the most important application of gas sensors. Do you have market estimations for oxygen and NOx gas sensors used for the monitoring of in-cabin air quality monitoring?.

Jingyao

Jan, 2019

I am a doctoral student with specialization in gas sensor field. I want to learn more from the report brochure so that I could better understand industry dynamics in this field. Can you please share the brochure with me?.

Oliver

Jan, 2017

Does the report provide insights on MEMS-based gas sensors and their market potential in general and especially in consumer electronics, environmental and building automation applications?.