Gas Analyzer, Sensor & Detector Market by Technology (Electrochemical, Infrared, Metal Oxide Semiconductor, Catalytic, Laser), System (Fixed and Portable), Application (Water Treatment, Healthcare, Food & Beverages) - Global Forecast to 2021

The Gas Analyzer market is projected to reach USD 4.06 Billion by 2021, at a CAGR of 5.7% from 2017 to 2022. In this study, 2015 has been considered as the base year, while the forecast period has been considered from 2016 to 2021.

The main objective of the study is to define, describe, and forecast the GASDF market based on technology, application, and region. The report includes detailed information about the major factors, such as drivers, restraints, opportunities, and industry specific challenges influencing the growth of the market. The report strategically analyzes the market segments with respect to individual growth trends, growth prospects, and contribution to the total market. In the report, the GASD market has been studied for regions, namely, North America, Europe, Asia Pacific, and South America, Middle East & Africa.

In this report, the market sizes have been derived through various research methodologies. In the secondary research process, different sources have been referred to, to identify and collect information for this study on the GASD market. These secondary sources include annual reports, press releases, and investor presentations of companies; associations such as American Gas Association, Online analyzer and fire & gas detection system, Analyzer Professional Group; and white papers, certified publications, and articles from recognized authors. In the primary research process, sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The bottom-up approach has been used to estimate the market size, in terms of value. The top-down approach has been implemented to validate the market size, in terms of value. With the data triangulation procedure and validation of data through primaries, exact values of the sizes of the overall parent market and individual markets have been determined and confirmed in this study.

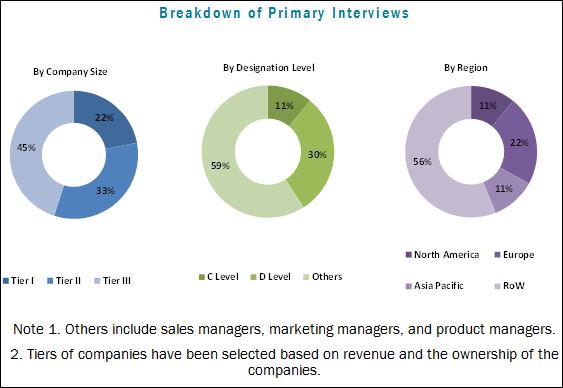

The figure below illustrates the breakdown of profiles of primary interview participants.

To know about the assumptions considered for the study, download the pdf brochure

GASD value chain consists of raw material suppliers such as Dragerwerk Ag & Co.KgaA (Germany), and AMETEK Inc (U.S.), manufacturers such as Honeywell International Inc (U.S.) and Emerson Electric Co (U.S.), and others. The third node in the value chain consists of distribution and marketing of GASD devices to particular end-use industries such as Oil & Gas and Chemicals and Building & Construction.

The stakeholders in the GASD market are:

- GASD manufacturers

- GASD traders, distributors, and suppliers

- Raw material suppliers

- Government and research organizations

- Industrial & commercial cleaning agencies

- Agricultural associations

Scope of the Gas Analyzer market Report

The report forecasts revenue growth and provides an analysis of trends in each of the subsegments of the GASD market. This research report categorizes the market based on the following:

GASD Market, By Technology:

- Electrochemical

- Infrared

- Metal Oxide Semiconductor (MOS)

- Catalytic

- Zirconia

- Photo Ionization Detection (PID)

- Paramagnetic

- Laser

- Others

GASD Market, By Application:

- Oil & Gas and Chemicals

- Buildings & Construction

- Food & Beverages

- Healthcare

- Water Treatment

- Others

GASD Market, By System:

- Fixed

- Portable

GASD Market, By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Central & South America

Each region has been further segmented into the key countries in the region.

Available Customizations:

The following customization options are available for the report:

-

Country Information

- GASD market analysis for additional countries

-

Company Information

- Detailed analysis and profiles of additional market players (up to five)

The gas analyzer market is projected to reach USD 4.06 Billion at CAGR of 5.70% between 2016 and 2021. This high growth is fueled by the increasing demand for Gas Analyzer, Sensor & Detector due to the implementation of stringent environmental conservation policies, and rising standards on workplace and residential safety.

GASD devices are mainly used for measuring safety in any industry to protect their plant and personnel from unwanted damage. Gas Analyzer, Sensor & Detector devices have high sensitivity, stability, and detection range. These devices can be converted from single gas detection to multi gas detection just by the addition of different sensors within the same device. These multi gas analyzers make Gas Analyzer, Sensor & Detector highly familiar and economically safe to operate. GASD devices are highly efficient and can be used in several applications. There are two types of Gas Analyzer, Sensor & Detector systems available in two versions on major scale, namely, fixed and portable.

The GASD market is driven by petrochemical, refineries, food & beverage, gas pipeline and chemical industries and a range of applications. Increasing R&D efforts and huge demand from the construction sector due to growing infrastructural needs, makes Gas Analyzer, Sensor & Detector useful in a large number of applications. Other applications such as water treatment, healthcare, and food packages, also help in the growth of the Gas Analyzer, Sensor & Detector market. Growing advancements and technological inventions in the GASD equipment market would be very effective during the forecast period. The oil & gas and chemical industries have been the largest end-user markets and also the fastest-growing market for Gas Analyzer, Sensor & Detector devices in 2015. Safety control for industrial gas processes is one of the key driving factors for Gas Analyzer, Sensor & Detector devices market in both industries. The companies operating various chemical plants or oil and gas extraction sites have to make sure that the emissions of various potent gases are according to the standards set by the local governments; this has led to a surge in demand for Gas Analyzer, Sensor & Detector devices.

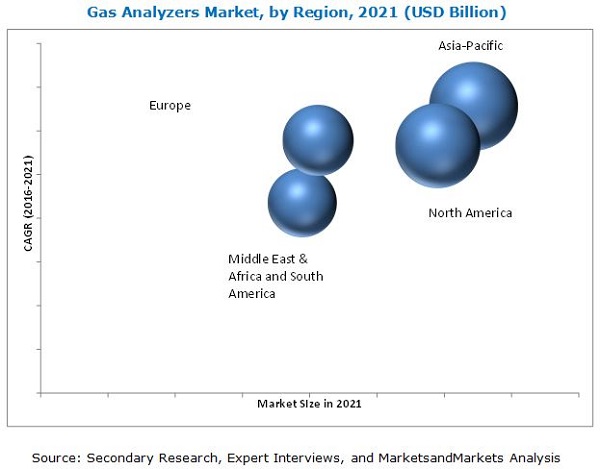

The Asia-Pacific region continues to be a significant market of GASD devices. Globally, this region has been a leader in the Gas Analyzer, Sensor & Detector market with respect to demand as well as production capacity. Key countries in the Asia-Pacific market include Japan (the most dominant market), China, India, and Australia. South Korea, Malaysia, and Singapore witnessed promising demand for Gas Analyzer, Sensor & Detector devices in 2015, which is expected to grow steadily in the near future.

The GASD market is undergoing high-value research activities to create new equipment and processes to minimize toxic gas hazards. One of the major problems is the wide price range that makes device choosing and deriving optimal cost effectiveness very difficult.

Market players such as Honeywell International, Inc. (U.S.), ABB Ltd. (Switzerland), General Electric Co. (U.S.), Emerson Electric Co. (U.S.), Figaro Engineering Inc. (Japan), and Drägerwerk AG & Co. KGaA (Germany) focus on expanding their regional reach. Other development strategies adopted by market players are new product launches, agreements & collaborations, and mergers & acquisitions.

Frequently Asked Questions (FAQ):

How big is the Gas Analyzer market ?

The Gas Analyzer market is projected to reach USD 4.06 Billion by 2021, at a CAGR of 5.7%

Who leading market players in Gas Analyzer market ?

Market players such as Honeywell International, Inc. (U.S.), ABB Ltd. (Switzerland), General Electric Co. (U.S.), Emerson Electric Co. (U.S.), Figaro Engineering Inc. (Japan), and Drägerwerk AG & Co. KGaA (Germany) focus on expanding their regional reach.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Scope

1.2.1 Market Definition

1.3 Markets Covered

1.3.1 Years Considered for the Study

1.3.2 Currency

1.4 Stakeholders

1.4.1 Limitations

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

3 Executive Summary (Page No. - 24)

3.1 Introduction

3.2 Market Outlook

3.3 Conclusion

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in GASD Market

4.2 Gas Sensor Market – Major Applications

4.3 Gas Detector Market Share, By Technology and By Region

4.4 Gas Analyzer Market, By Region

4.5 North America Gas Sensor Market (2014 – 2021)

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Government’s Stringent Safety and Environment Regulations

5.3.1.2 Increased Demand for Oil and Gas in Developing Economies

5.3.2 Restraints

5.3.2.1 Technical Issues and Cost Factors

5.3.3 Opportunities

5.3.3.1 Green Building Concept

5.3.3.2 Growing Awareness in Industrial, Commercial, and Residential Sectors

5.3.3.3 New Technological Developments

5.3.4 Challenges

5.3.4.1 Developing Affordable and Effective Technologies

5.4 Air Quality Standards in Europe

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research & Product Development

6.2.2 Manufacturers (Manufacturing & Assembly)

6.2.3 Distribution

6.2.4 Marketing and Sales

6.2.5 Post-Sale Services

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Global Analyzer Market, By End-Use Industry, Systems, Technology, and Region (Page No. - 49)

7.1 Introduction

7.1.1 Gas Analyzer Market, By Region

7.1.2 Gas Analyzer Market, By Technology

7.2 Asia-Pacific

7.3 North America

7.4 Europe

7.5 South America and Middle-East & Africa

7.5.1 Gas Analyzer Market, By End-Use Industry

7.6 Asia-Pacific

7.7 North America

7.8 Europe

7.9 South America and Middle East & Africa

7.9.1 Gas Analyzer Market, By Systems

8 Gas Sensor Market, By Application, By System, By Technology, and By Region (Page No. - 70)

8.1 Introduction

8.2 Sensor Market, By Region

8.3 Gas Sensor Market, By Technology

8.4 Asia-Pacific

8.5 North America

8.6 Europe

8.7 South America and Middle-East& Africa

8.8 Gas Sensor Market, By Application

8.8.1 Asia-Pacific

8.8.2 North America

8.8.3 Europe

8.8.4 South America and Middle-East & Africa

8.9 Gas Sensor Market, By System

9 Gas Detector Market, By Application, By System, By Technology, and By Region (Page No. - 89)

9.1 Introduction

9.1.1 Gas Detector Market, By Region

9.1.2 Gas Detector Market, By Technology

9.1.3 Asia-Pacific

9.1.4 North America

9.1.5 Europe

9.1.6 South America and Middle-East& Africa

9.2 Gas Detector Market, By Application

9.2.1 Asia-Pacific

9.2.2 North America

9.2.3 Europe

9.2.4 South America and Middle-East & Africa

9.3 Gas Detector Market, By System

10 Competitive Landscape (Page No. - 110)

10.1 Overview

10.2 Competitive Situations and Trends

10.2.1 New Product Launches

10.2.2 Expansions & Agreements

10.2.3 Mergers & Acquisitions

10.2.4 Joint Ventures & Contracts

11 Company Profiles (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Honeywell International Inc.

11.2 ABB Ltd.

11.3 General Electric Co.

11.4 Emerson Electric Co.

11.5 Dragerwerk AG & Co. KGAA

11.6 Ametek Inc.

11.7 Siemens

11.8 Figaro Engineering Inc.

11.9 Trolex Ltd.

11.10 Enerac Inc.

11.11 Xtralis Pty Ltd.

11.12 Testo AG

11.13 California Analytical Instruments Inc.

11.14 Other Market Players

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 Appendix (Page No. - 152)

12.1 Discussion Guide

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

List of Tables (76 Tables)

Table 1 GASD Market, By Technology

Table 2 GASD Market, By System

Table 3 GASD Market, By End-Use Industries

Table 4 Gas Analyzer Market Size, By Region, 2014-2021 (USD Million)

Table 5 Gas Analyzer Market Size, By Region, 2014-2021 (Thousand Unit)

Table 6 Gas Analyzer Market Size, By Technology, 2014–2021 (USD Million)

Table 7 Gas Analyzer Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 8 Asia Pacific Gas Analyzer Market Size, By Technology, 2014–2021 (USD Million)

Table 9 Asia Pacific Gas Analyzer Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 10 Asia Pacific Gas Analyzer Market Size, By Country, 2014–2021 (USD Million)

Table 11 North America Gas Analyzer Market Size, By Technology, 2014–2021 (USD Million)

Table 12 North America Gas Analyzer Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 13 North America Gas Analyzer Market Size, By Country,2014-2021 (USD Million)

Table 14 Europe Gas Analyzer Market Size, By Technology, 2014–2021 (USD Million)

Table 15 Europe Gas Analyzer Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 16 Europe Gas Analyzer Market Size, By Country, 2014–2021 (USD Million)

Table 17 South America and Middle East & Africa Gas Analyzer Market Size, By Technology, 2014–2021 (USD Million)

Table 18 South America Middle East & Africa Gas Analyzer Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 19 South America ,Middle East & Africa Gas Analyzer Market Size, By Country, 2014–2021 (Thousand Unit)

Table 20 Gas Analyzer Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 21 Asia-Pacific Gas Analyzer Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 22 North America Gas Analyzer Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 23 Europe Gas Analyzer Market Size, By End-Use Industry, 2014-2021 (USD Million)

Table 24 South America ,Middle East & Africa Gas Analyzer Market Size, By End-Use Industry, 2014-2021 (USD Million)

Table 25 Gas Analyzer Market Size, By Systems, 2014–2021 (USD Million)

Table 26 Gas Analyzer Market Size, By Systems, 2014–2021 (Thousand Unit)

Table 27 Gas Sensor Market Size, By Region, 2014–2021 (USD Million)

Table 28 Gas Sensor Market Size, By Region, 2014–2021 (Thousand Unit)

Table 29 Gas Sensor Market Size, By Technology, 2014–2021 (USD Million)

Table 30 Gas Sensor Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 31 Asia-Pacific: Gas Sensor Market Size, By Technology, 2014–2021 (USD Million)

Table 32 Asia-Pacific: Gas Sensor Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 33 Asia-Pacific: Gas Sensor Market Size, By Country, 2014–2021 (USD Million)

Table 34 North America: Gas Sensor Market Size, By Technology, 2014–2021 (USD Million)

Table 35 North America: Gas Sensor Market Size, By Technology, 2013-2021 (Thousand Unit)

Table 36 North America: Gas Sensor Market Size, By Country, 2014–2021 (USD Million)

Table 37 Europe: Gas Sensor Market Size, By Technology, 2014–2021 (USD Million)

Table 38 Europe: Gas Sensor Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 39 Europe: Gas Sensor Market Size, By Country, 2014–2021 (USD Million)

Table 40 South America and Middle East & Africa: Gas Sensor Market Size, By Technology, 2014–2021 (USD Million)

Table 41 South America and Middle East & Africa: Gas Sensor Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 42 South America and Middle East & Africa: Gas Sensor Market Size, By Country, 2014–2021 (USD Million)

Table 43 Gas Sensor Market Size, By Application, 2014–2021 (USD Million)

Table 44 Asia-Pacific: Gas Sensor Market Size, By Application, 2014–2021 (USD Million)

Table 45 North America: Gas Sensor Market Size, By Application, 2014–2021 (USD Million)

Table 46 Europe: Gas Sensor Market Size, By Application, 2014–2021 (USD Million)

Table 47 South America and Middle-East & Africa: Gas Sensor Market Size, By Application, 2014–2021 (USD Million)

Table 48 Gas Sensor Market Size, By System, 2014–2021 (USD Million)

Table 49 Gas Sensor Market Size, By System, 2014–2021 (Thousand Unit)

Table 50 Gas Detector Market Size, By Region, 2014–2021 (USD Million)

Table 51 Gas Detector Market Size, By Region, 2014–2021 (Thousand Unit)

Table 52 Gas Detector Market Size, By Technology, 2014–2021 (USD Million)

Table 53 Gas Detector Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 54 Asia-Pacific: Gas Detector Market Size, By Technology, 2014–2021 (USD Million)

Table 55 Asia-Pacific: Gas Detector Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 56 Asia-Pacific: Gas Detector Market Size, By Country, 2014–2021 (USD Million)

Table 57 North America: Gas Detector Market Size, By Technology, 2014–2021 (USD Million)

Table 58 North America: Gas Detector Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 59 North America: Gas Detector Market Size, By Country, 2014–2021 (USD Million)

Table 60 Europe: Gas Detector Market Size, By Technology, 2014–2021 (USD Million)

Table 61 Europe: Gas Detector Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 62 Europe: Gas Detector Market Size, By Country, 2014–2021 (USD Million)

Table 63 South America and Middle East & Africa: Gas Detector Market Size, By Technology, 2014–2021 (USD Million)

Table 64 South America and Middle East & Africa: Gas Detector Market Size, By Technology, 2014–2021 (Thousand Unit)

Table 65 South America and Middle East & Africa: Gas Detector Market Size, By Country, 2014–2021 (Thousand Unit)

Table 66 Gas Detector Market Size, By Application, 2014–2021 (USD Million)

Table 67 Asia-Pacific: Gas Detector Market Size, By Application, 2014–2021 (USD Million)

Table 68 North America: Gas Detector Market Size, By Application, 2014–2021 (USD Million)

Table 69 Europe: Gas Detector Market Size, By Application, 2014–2021 (USD Million)

Table 70 South America and Middle-East and Africa: Gas Detector Market Size, By Application, 2014–2021 (USD Million)

Table 71 Gas Detector Market Size, By System, 2014–2021 (USD Million)

Table 72 Gas Detector Market Size, By System, 2014–2021 (Thousand Unit)

Table 73 New Product Launches, 2011–2015

Table 74 Expansions & Agreements, 2011–2015

Table 75 Mergers & Acquisitions, 2011–2015

Table 76 Joint Ventures & Contracts. 2011-2015

List of Figures (50 Figures)

Figure 1 GASD Market Segmentation

Figure 2 Global GASD Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Size Estimation Methodology: Data Triangulation

Figure 7 Gas Analyzer Market Snapshot (2016 vs 2021): Market in Oil & Gas and Chemicals Applications to Witness Highest Growth

Figure 8 Gas Detector Market Size, By Technology, 2016–2021 (USD Million)

Figure 9 Gas Sensor Market Share, By Region, 2015 (USD Million)

Figure 10 Global Gas Analyzer Market, By Value

Figure 11 Oil & Gas and Chemicals Projected to Be the Fastest Growing Applications of the Gas Sensor Market Between 2016 to 2021

Figure 12 Electrochemical Technology Accounted for the Largest Share of Gas Detector Market

Figure 13 Asia-Pacific Accounted for Largest Share of the Gas Analyzer Market in 2015

Figure 14 North America Accounts for Largest Share of Gas Sensor Market Throughout the Review Period

Figure 15 Asia-Pacific Market to Observe Rapid Growth Between 2016–2021

Figure 16 Global Gas Analyzer, Sensor and Detector Market: Drivers, Restraints, Opportunities and Challenges

Figure 17 Overview of GASD Value Chain

Figure 18 Porter’s Five Forces Analysis

Figure 19 Oil & Gas and Chemicals Industry Accounts for Largest Market Share, 2016 - 2021

Figure 20 Asia-Pacific is the Largest Market for Global Gas Analyzer in 2015

Figure 21 MOS Technology: the Fastest-Growing Segment, 2016–2021

Figure 22 Electrochemical Technology is Projected to Have the Highest Market Share in the Gas Analyzer Market, Between 2016 and 2021

Figure 23 Electrochemical Segment Accounted for Largest Share of North America Gas Analyzer Market, 2016 - 2021

Figure 24 Oil & Gas and Chemicals Industry to Account for the Largest Market Share (Value), 2016 - 2021

Figure 25 North America Was the Largest Market for Gas Sensor in 2015

Figure 26 Electrochemical Technology Captured the Highest Market Share (Value) in 2015

Figure 27 MOS Technology to Witness the Highest CAGR in the Gas Sensor Market, 2016 - 2021

Figure 28 MOS to Be the Second Fastest-Growing Technology in the Gas Sensor Market, 2016 - 2021

Figure 29 Other Applications to Be the Fastest-Growing Segment in the Gas Sensor Market, 2016 - 2021

Figure 30 Oil & Gas and Chemicals Industry to Account for the Largest Market Share (Value)

Figure 31 North America: the Largest Market for Gas Detectors, 2016 - 2021

Figure 32 MOS Technology to Have the Highest CAGR , 2016 - 2021

Figure 33 Electrochemical Technology to Have the Highest Market Share (Value) in the Gas Detector Market, 2016 - 2021

Figure 34 North America to Be the Second Fastest-Growing Market for Gas Detectors

Figure 35 Oil & Gas and Chemicals to Be the Fastest-Growing Application for the Gas Detector Market, 2016 - 2021

Figure 36 Companies Adopted New Product Launches as the Key Growth Strategy Over the Last Three Years

Figure 37 New Product Launch is the Major Strategy Adopted By Companies, 2011–2015

Figure 38 Battle for Development Market Share: New Product Launches Was the Key Strategy, 2011–2015

Figure 39 Honeywell International Inc.: Company Snapshot

Figure 40 Honeywell International Inc.: SWOT Analysis

Figure 41 ABB Ltd.: Company Snapshot

Figure 42 ABB Ltd.: SWOT Analysis

Figure 43 General Electric Co: Company Snapshot

Figure 44 General Electric Co.: SWOT Analysis

Figure 45 Emerson Electric Co.: Company Snapshot

Figure 46 Emerson Electric Co.: SWOT Analysis

Figure 47 Dragerwerk AG & Co. KGAA: Company Snapshot

Figure 48 Dragerwerk AG & Co. KGAA: SWOT Analysis

Figure 49 Ametek Inc.: Company Snapshot

Figure 50 Siemens: Company Snapshot

Growth opportunities and latent adjacency in Gas Analyzer, Sensor & Detector Market

Marke data for the global Gas Analyzer, sensor & detectors market

Specific information on cost-benefit analysis of gas sensors and market share analysis

Specific interest on gas detectors market trends, customer base, major suppliers in Australia

Need information on sensor

Information on sensors type, market estimation and key players of lead acetate tape present in the market

Interested in acetaldehyde, methane, benzene, sulfur dioxide, and total sulfur analyzer for Carbon dioxide monitoring in beverage industry

Gas sensors Market for consumer (mobile/fitness), automotive (air quality) and buildings (air quality) applications

Gas sensor and analyser market report for various gas types such as CO, CO2, Nox, SO2, and H2S)

Interested in Smart Cities report with coverage of changing trends in Healthcare

Interested in technology trends and Applications for graphene sensors

Moisture Analyzer Market

General information on portable gas sensor/detector/analyzer market

Greenhouse gases and lased based gas sensing market and insights

Market size and CAGR information in GASD market

We are interested to be a part of this market study, ap2e is a manufacturer of gas analyzers based in France with global presence.

General information on Gas analyzers

"Area of intereset: electronic nose markets Qualitative and quantitative (market volume, CAGR, revenue) information Competitive landscape Customer details"

General information on Gas analyzers for Gas detection, Temperature sensing, IR sensing, electronic control systems and others

Need infromation on Gas sensors and its applications.