Government Cloud Market by Solution (Cloud Storage, Disaster Recovery, Identity and Access Management, Risk and Compliance Management), Service, Service Model (IaaS, PaaS, SaaS), Deployment Model, and Region - Global Forecast to 2022

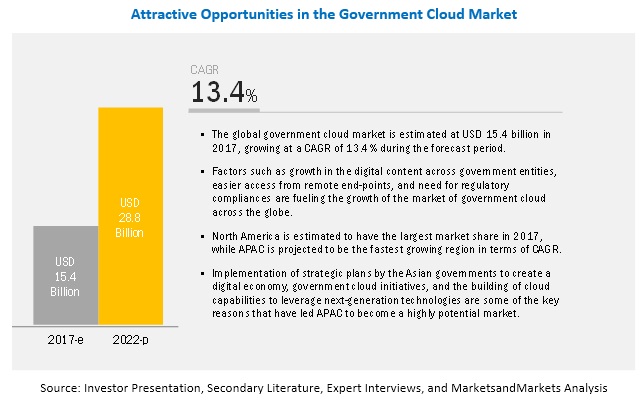

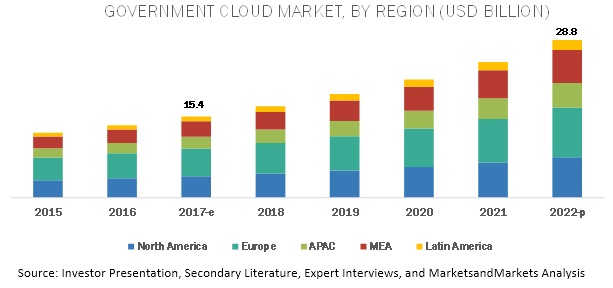

[119 Pages Report] The government cloud market is expected to grow from USD 15.4 billion in 2017 to USD 28.8 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.4%. The report considers 2017 as the estimated year for the study and the market size forecast is done from 2017 to 2022. Factors such as growth in the digital content across government entities, easier access from remote end-points, and need for regulatory compliances are fueling the growth of the market of government cloud across the globe.

The objective of the report is to define, describe, and forecast the government cloud market size based on solutions, services, service model, deployment model, and region.

By Type, the services segment is expected to grow at the highest rate during the forecast period

Based on type, the government cloud market is segmented into solutions and services. The services segment includes integration and migration; training, consulting, and education; and support and maintenance. Lowering the cost, business agility, and business continuity, through a policy-driven and software-defined cloud, are the major driving factors, triggering government service organizations to shift to a cloud world. These services help in educating government employees about the strategic transformation, business assessment, solution assessment, RoI, and knowledge workshop. The benefits offered by education services are rapid adoption of updated technologies, improved individual and team productivity, and increased returns on software investments.

By Service model, the IaaS service model to hold the largest market size during the forecast period

The government cloud market is segmented based on service models into SaaS, PaaS, and IaaS. These service models are utilized for the deployment of software, platform, and infrastructure over the internet. Among the mention service models, IaaS holds largest market size as it provides is the capability to transfer work to the cloud at the time of peak demand for on-premises systems. This helps users save their capital resource that may get used for the cost of additional servers. IaaS supports the government agencies and help them realize their cost savings and efficiencies while modernizing and expanding their IT capabilities with limited capital resources.

North America to account for the largest market size during the forecast period.

North America is expected to hold the highest market share and dominate the government cloud market during the forecast period. North America is the foremost potential market due to the presence of a large number of players offering government cloud solutions and services in this region. North America is the most mature region in the government cloud market, as most of the large enterprises are located in this region. APAC is expected to witness the highest growth rate during the forecast period, owing to the rapid development of the required infrastructure and the urge to adopt new technologies. MEA and Latin America are estimated to hold the least market size in 2017, as they are still developing their infrastructure. Government agencies in these regions have also realized the importance of government cloud adoption as a viable solution to achieve effective and efficient operations to ensure smooth business continuity.

Market Dynamics

Driver: Greater storage and computing capabilities

Federal agencies and other government departments across the globe are realizing the importance of maintaining and controlling cloud data for continuity and compliance purposes. The government cloud helps these agencies manage and store their data securely and efficiently. This results in enhanced and unified teams that can handle bigger projects at an effective cost. Cloud hosting services can be advantageous for government agencies and other small departments. These services can be rented for the computing power and data storage requirements, as often as needed, rather than incurring a one-time investment for procuring the servers and handling the ongoing expenses for maintaining the expensive data centers. Furthermore, the government cloud provides greater computing capabilities when implementing disaster recovery solutions, as it enables government agencies to configure customized settings for backup, with regards to the data and application types, sequence, and backup location. It involves the replication of application and data on a virtual machine, and the data can be recovered automatically when a disruption occurs.

Restraint: Varying structure of the regulatory policies

Regulatory policies vary from country to country and organization to organization. Many countries do not have a consigned body to govern these policies. Therefore, the policies have to be regulated and implemented taking into account the regional factors, such as macroeconomic risk factors, along with the business requirements. Organizations have started implementing risk and compliance solutions along with audit management solutions to help overcome this restraint. The structure of the varying regulatory policies along with the changing macroeconomic factors make it difficult for vendors to meet the government agencies requirements. Some organizations, especially in the regions where there are no proper governing and regulatory bodies, tend to implement in-house regulatory guidelines and policies.

Opportunity: Increasing adoption of IAM

With the growth in the use of cloud, managing and securing multiple accounts via cloud is increasing at a fast pace. This has resulted in the increased adoption of IAM solutions. Earlier, organizations used to consider IAM as a capital expenditure, which was purchased and implemented on-premises. There was a huge cost structure associated with the successful implementation of IAM projects, which required months of rigorous work. However, the trend is now changing continuously, due to the growing cloud market. Implementing and accessing IAM solutions and services via cloud have become easier, due to the limited capital required for the initiation and the less time spent on implementation. With the growth of SMEs, the adoption of IAM solutions across organizations has also increased.

Challenge: Reluctance of government agencies to adopt the cloud technology

Cloud computing is a game-changing solution for all types of industries, especially the government sector. However, there still exist a large number of government agencies that express reluctance to adopt the cloud technology. This is primarily attributed to the lack of technological awareness, and privacy and security concerns. Though the government cloud market has grown significantly over the period, security and compliance have always been the key challenges faced by enterprises in this market. Government agencies are very sensitive when it comes to data storage on cloud-based platforms. Any disruption to the data will have a significant effect on the governmental operations. Due to this, many government agencies are reluctant to use the government cloud model. Therefore, cloud processes need to be monitored continuously to minimize risks and improve the security features.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Value(USD Billion) |

|

Segments covered |

Type, Service Model, Deployment Model, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

It includes 24 major vendors, namely, AWS (US), Microsoft (US), IBM (US), Google (US), HPE (US), Oracle (US), Salesforce (US), Cisco Systems (US), Dell Technologies (US), VMware (US), Verizon (US), CGI Group (Canada), AT&T (US), SAP (Germany), NetApp (US), Informatica (US), Huddle (UK), Capgemini (France), CenturyLink (US), Citrix (US), Equinix (US), Fujitsu (Japan), NTT DATA (Japan), Red Hat (US), and NEC (Japan). |

The research report segments the government cloud market into the following submarkets:

By Solutions

- Cloud Storage

- Disaster Recovery

- Identity and Access Management (IAM)

- Risk and compliance management

- Others (reporting and analytics, and security and vulnerability)

By Services

- Training, consulting, and education

- Support and Maintenance

- Integration and Migration

By Service Model

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Key Market Players

AWS (US), Microsoft (US), IBM (US), Google (US), HPE (US), Oracle (US), and Salesforce (US)

AWS is strategically focusing on expanding its market using various organic and inorganic strategies. The company has a strong foothold in the Americas, EMEA, and APAC, and it has been categorically focusing on expanding its foothold in the emerging markets, by making its products available to regional distributors, channel partners, resellers, service partners, and technology partners. Amazon Web Services offers a strong support service through its dense network of technology partners, located globally. The company leverages its internal R&D budget to cater to the needs of a wide class of enterprises, by deploying highly innovative and customized solutions and services. The company caters to various government departments, such as federal government, state and local government, defense and intelligence, and criminal justice and public safety, to expand its customer base. It is strongly focused on expanding its global footprint, and therefore, opened data centers in the UK and Canada. The company is expected to launch Amazon Web Services data centers in Sweden, Middle East, France, and China soon.

Recent Developments

- In September 2017, Microsoft announced the availability of managed disks in Microsoft Azure Government cloud, to simplify disk management for Azure IaaS Virtual Machines (VMs) by managing the storage accounts associated with VM disks.

- In September 2017, IBM partnered with VMware to announce that more than 1,400 enterprises, in nearly every industry vertical, around the world, are extending their VMware environments to the IBM Cloud. This partnership enabled customers to create new business opportunities, using IBM Clouds global reach, cloud-native services, and infrastructural and operational consistency.

- In July 2017, AWS announced G3 instances, the next-generation of GPU-powered Amazon Elastic Compute Cloud (Amazon EC2) instances, designed with the powerful combination of Central Processing Unit (CPU) and Random Access Memory (RAM), for workloads such as 3D rendering, 3D visualizations, graphics-intensive remote workstations, video encoding, and virtual reality applications, for Amazon Web Services GovCloud (US).

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the government cloud market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Regional Scope

1.4 Years Considered

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Government Cloud Market

4.2 Government Cloud Market, By Solution

4.3 Government Cloud Market, By Service

4.4 Government Cloud Market, By Service Model

4.5 Government Cloud Market, By Deployment Model

4.6 Market Investment Scenario, 20172022

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Greater Storage and Computing Capabilities

5.1.1.2 Faster Deployment, Scalability, Agility, and Flexibility

5.1.1.3 Increasing Number of Digital Services in Government Organizations

5.1.2 Restraints

5.1.2.1 Varying Structure of the Regulatory Policies

5.1.3 Opportunities

5.1.3.1 Increasing Adoption of Iam

5.1.3.2 Emergence of Open Data Platform

5.1.4 Challenges

5.1.4.1 Reluctance of Government Agencies to Adopt the Cloud Technology

5.1.4.2 Risk of Information Loss

5.2 Ecosystem

5.3 Regulations and Standards in Government Cloud

5.3.1 Introduction

5.3.1.1 Federal Risk and Authorization Management Program (Fedramp)

5.3.1.2 National Strategy for Trusted Identity in Cyberspace (Nstic)

5.3.1.3 Homeland Security Presidential Directive 12 (Hspd-12)

5.3.1.4 Identity Credential and Access Management (Icam)

5.3.1.5 Federal Information Security Management Act (Fisma)

6 Government Cloud Market Analysis, By Type (Page No. - 37)

6.1 Introduction

6.2 Solutions

6.2.1 Cloud Storage

6.2.1.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.2.1.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

6.2.2 Disaster Recovery

6.2.2.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.2.2.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

6.2.3 Identity and Access Management

6.2.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.2.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

6.2.4 Risk and Compliance Management

6.2.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.2.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

6.2.5 Others

6.2.5.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.2.5.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

6.3 Services

6.3.1 Training, Consulting, and Education

6.3.1.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.3.1.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

6.3.2 Support and Maintenance

6.3.2.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.3.2.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

6.3.3 Integration and Migration

6.3.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

6.3.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

7 Government Cloud Market Analysis, By Service Model (Page No. - 47)

7.1 Introduction

7.2 Software as a Service

7.2.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

7.2.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

7.3 Platform as a Service

7.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

7.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

7.4 Infrastructure as a Service

7.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

7.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

8 Government Cloud Market Analysis, By Deployment Model (Page No. - 51)

8.1 Introduction

8.2 Public Cloud

8.2.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

8.2.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

8.3 Private Cloud

8.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

8.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

8.4 Hybrid Cloud

8.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

8.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9 Geographic Analysis (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.2.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.2.3 US

9.2.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.2.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.2.4 Canada

9.2.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.2.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.3 Europe

9.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.3.3 United Kingdom

9.3.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.3.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.3.4 Germany

9.3.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.3.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.3.5 France

9.3.5.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.3.5.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.3.6 Rest of Europe

9.3.6.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.3.6.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.4 Asia Pacific

9.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.4.3 India

9.4.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.4.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.4.4 Japan

9.4.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.4.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.4.5 Anz

9.4.5.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.4.5.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.4.6 Rest of Apac

9.4.6.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.4.6.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.5 Middle East and Africa

9.5.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.5.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.5.3 Middle East

9.5.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.5.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.5.4 Africa

9.5.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.5.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.6 Latin America

9.6.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.6.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.6.3 Brazil

9.6.3.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.6.3.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.6.4 Mexico

9.6.4.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.6.4.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

9.6.5 Rest of Latin America

9.6.5.1 Market Estimates and Forecasts, 2015 - 2022 (USD Million)

9.6.5.2 Market Estimates and Forecasts, By Region, 2015 - 2022 (USD Million)

10 Competitive Landscape (Page No. - 79)

10.1 Overview

10.2 Microquadrant: Cloud Migration Services Market

10.2.1 Visionary Leaders

10.2.1.1 Definition

10.2.1.2 Vendors

10.2.2 Dynamic Differentiators

10.2.2.1 Definition

10.2.2.2 Vendors

10.2.3 Innovators

10.2.3.1 Definition

10.2.3.2 Vendors

10.2.4 Emerging Companies

10.2.4.1 Definition

10.2.4.2 Vendors

11 Company Profiles (Page No. - 80)

11.1 AWS

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 MnM View

11.2 Microsoft

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 MnM View

11.3 IBM

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 MnM View

11.4 Google

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 MnM View

11.5 HPE

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 MnM View

11.6 Oracle

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MnM View

11.7 Salesforce

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 MnM View

11.8 Cisco Systems

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MnM View

11.9 Dell Technologies

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 MnM View

11.10 Vmware

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MnM View

11.11 Verizon

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.11.4 MnM View

11.12 CGI Group

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Recent Developments

11.12.4 MnM View

12 Appendix (Page No. - 111)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (62 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Government Cloud Market Size, By Type, 20152022 (USD Billion)

Table 3 Market Size, By Solution, 20152022 (USD Billion)

Table 4 Cloud Storage: Market Size, By Region, 20152022 (USD Million)

Table 5 Disaster Recovery: Government Cloud Market Size, By Region, 20152022 (USD Million)

Table 6 Identity and Access Management: Market Size, By Region, 20152022 (USD Million)

Table 7 Risk and Compliance Management: Government Cloud Market Size, By Region, 20152022 (USD Million)

Table 8 Other Solutions: Market Size, By Region, 20152022 (USD Million)

Table 9 Market Size, By Service, 20152022 (USD Million)

Table 10 Training, Consulting, and Education: Market Size, By Region, 20152022 (USD Million)

Table 11 Support and Maintenance Market: Government Cloud Market Size, By Region, 20152022 (USD Million)

Table 12 Integration and Migration: Market Size, By Region, 20152022 (USD Million)

Table 13 Government Cloud Market Size, By Service Model, 20152022 (USD Billion)

Table 14 Software as A Service: Market Size, By Region, 20152022 (USD Million)

Table 15 Platform as A Service: Government Cloud Market Size, By Region, 20152022 (USD Million)

Table 16 Infrastructure as A Service: Government Cloud Market Size, By Region, 20152022 (USD Million)

Table 17 Market Size, By Deployment Model, 20152022 (USD Billion)

Table 18 Public Cloud: Government Cloud Market Size, By Region, 20152022 (USD Million)

Table 19 Private Cloud: Government Cloud Market Size, By Region, 20152022 (USD Million)

Table 20 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 21 Government Cloud Market Size, By Region, 20152022 (USD Billion)

Table 22 North America: Market Size, By Type, 20152022 (USD Billion)

Table 23 North America: Government Cloud Market Size, By Solution, 20152022 (USD Million)

Table 24 North America: Market Size, By Service, 20152022 (USD Million)

Table 25 North America: Government Cloud Market Size, By Service Model, 20152022 (USD Million)

Table 26 North America: Market Size, By Deployment Model, 20152022 (USD Billion)

Table 27 North America: Market Size, By Country, 20152022 (USD Billion)

Table 28 United States: Government Cloud Market Size, By Type, 20152022 (USD Billion)

Table 29 United States: Market Size, By Solution, 20152022 (USD Million)

Table 30 United States: Market Size, By Service, 20152022 (USD Million)

Table 31 United States: Market Size, By Service Model, 20152022 (USD Million)

Table 32 United States: Market Size, By Deployment Model, 20152022 (USD Million)

Table 33 Europe: Government Cloud Market Size, By Type, 20152022 (USD Billion)

Table 34 Europe: Market Size, By Solution, 20152022 (USD Million)

Table 35 Europe: Market Size, By Service, 20152022 (USD Million)

Table 36 Europe: Market Size, By Service Model, 20152022 (USD Million)

Table 37 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 38 Europe: Market Size, By Country, 20152022 (USD Million)

Table 39 United Kingdom: Market Size, By Type, 20152022 (USD Million)

Table 40 United Kingdom: Government Cloud Market Size, By Solution, 20152022 (USD Million)

Table 41 United Kingdom: Market Size, By Service, 20152022 (USD Million)

Table 42 United Kingdom: Government Cloud Market Size, By Service Model, 20152022 (USD Million)

Table 43 United Kingdom: Market Size, By Deployment Model, 20152022 (USD Million)

Table 44 Asia Pacific: Government Cloud Market Size, By Type, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Solution, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 47 Asia Pacific: Government Cloud Market Size, By Service Model, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 49 Asia Pacific: Government Cloud Market Size, By Country, 20152022 (USD Million)

Table 50 Middle East and Africa: Market Size, By Type, 20152022 (USD Million)

Table 51 Middle East and Africa: Market Size, By Solution, 20152022 (USD Million)

Table 52 Middle East and Africa: Government Cloud Market Size, By Service, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Service Model, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Sub region, 20152022 (USD Million)

Table 56 Latin America: Government Cloud Market Size, By Type, 20152022 (USD Million)

Table 57 Latin America: Market Size, By Solution, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 59 Latin America: Government Cloud Market Size, By Service Model, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Country, 20152022 (USD Million)

Table 62 Market: Vendor Ranking, 2017

List of Figures (37 Figures)

Figure 1 Government Cloud Market: Market Segmentation

Figure 2 Global Government Cloud Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Market: Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 North America is Estimated to Have the Largest Market Share in 2017

Figure 8 Global Market Size, 2015-2022 (USD Billion)

Figure 9 Top 3 Segments in the Market, 2017

Figure 10 Growth Trend of the Government Cloud Market During the Forecast Period

Figure 11 Cloud Storage Solution is Estimated to Have the Largest Share in the Market in 2017

Figure 12 Training, Consulting, and Education Segment is Estimated to Have the Largest Share in the Market in 2017

Figure 13 Software as A Service Segment is Estimated to Have the Largest Share in the Market in 2017

Figure 14 Public Cloud is Estimated to Have the Largest Share in the Market in 2017

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 16 Government Cloud Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Government Cloud Ecosystem

Figure 18 Solutions Segment is Expected to Have A Larger Market Size During the Forecast Period

Figure 19 Cloud Storage Solution is Expected to Have the Largest Market Size During the Forecast Period

Figure 20 Training, Consulting, and Education Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 21 Infrastructure as A Service Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Public Cloud is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 24 North America: Government Cloud Market Snapshot

Figure 25 Asia Pacific: Government Cloud Market Snapshot

Figure 26 Amazon Web Services: Company Snapshot

Figure 27 Microsoft: Company Snapshot

Figure 28 IBM: Company Snapshot

Figure 29 Google: Company Snapshot

Figure 30 HPE: Company Snapshot

Figure 31 Oracle: Company Snapshot

Figure 32 Salesforce: Company Snapshot

Figure 33 Cisco Systems: Company Snapshot

Figure 34 Dell Technologies: Company Snapshot

Figure 35 Vmware: Company Snapshot

Figure 36 Verizon: Company Snapshot

Figure 37 CGI Group: Company Snapshot

Growth opportunities and latent adjacency in Government Cloud Market

Hello, I want to download PDF Brochure for this study