Healthcare Adhesive Tapes Market by Resin (Acrylic, Rubber, Silicone), Backing Material (Paper, Fabric, Plastic), Application (Surgery, Hygiene, Wound Dressing, Secure Iv Lines, Ostomy Seal, Splint, Bandages, Diagnostic), and Region - Forecast to 2023

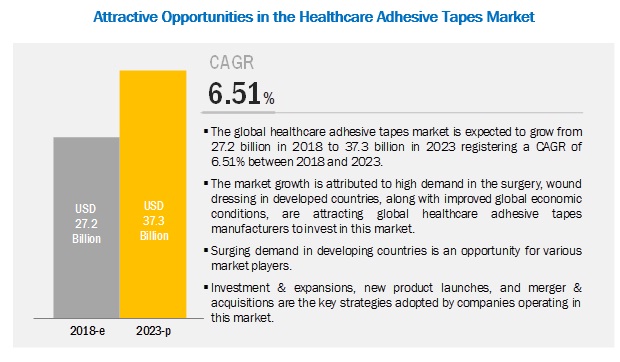

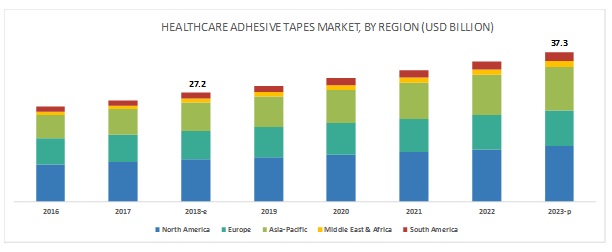

[155 Pages Report] The market for healthcare adhesive tapes is estimated to grow from USD 27.2 billion in 2018 to USD 37.3 billion by 2023, at a CAGR of 6.51% during the forecast period due the high demand for these tapes for primary treatment of wounds by covering and securing to prevent bacterial infections, and to hold bandages in place. They are also used for securing dressings, catheters, and infusion or drainage devices. It comes in a variety of lengths and widths that are designed to meet a wide range of bandaging needs. The growth of the market is due to the increasing use of these tapes in wound care and for surgery in emerging economies such as India, China, Thailand, Indonesia, Brazil, and Argentina.

The fabric segment is expected to account for the largest share of the healthcare adhesive tapes market.

The fabric segment is expected to account for the largest market share during the forecast period. Fabric tapes have high strength, flexibility, and elasticity, which make them durable. Owing to their strength, these tapes are used for securing dressings, catheters, tubing, and other medical purposes. Their strength and elasticity make them useable on body areas such as the biceps, which expand and contract with movement. The fabric tapes are water resistant and come in a variety of widths, lengths, and styles which are designed to meet an assortment of bandaging needs. These tapes are comfortable and can be removed cleanly and painlessly and are also used for newborn babies. Owing to their fabric backing, doctors or surgeons can mark them with pens to tag surgical scrubs and other equipment. However, these tapes are not used in cases requiring frequent redressing due to their strong adhesion which may cause the skin to peel off.

The bandages, transdermal patches, and blister protection application is projected to register the highest growth in the healthcare application.

Designed specifically for use in healthcare applications, adhesive tape bandages may be used on fragile or at-risk skin, as well as in moist skin environments. Air permeable, they allow outside air to penetrate and reach the underlying dressing or skin, creating a "breathable" healing and support solution. Transdermal drug delivery patches are used in therapeutic systems to deliver the drug at a controlled rate in a systematic circulation of discrete dosage by utilizing the passive diffusion of drugs when applied to the skin. These tapes deliver the infusion of the drug over a period of time and can be terminated any time by removing the patch. These tapes are similar to the wound tapes, flat and they consist active pharmaceutical ingredients and adhesives which deliver the drugs to the body via human skin.

APAC is expected to account for the largest market share during the forecast period.

APAC has emerged as the leading consumer and producer of healthcare adhesive tapes. The easy availability of low-cost labor and economical & accessible raw materials are driving foreign investments, thereby increasing the production of healthcare adhesive tapes in the region. The market in APAC is mainly driven by China, which is the leading consumer of healthcare adhesive tapes, globally.

India is expected to be the fastest-growing healthcare adhesive tapes market in APAC during the forecast period. The Indian healthcare & hygiene sector is witnessing a phase of rapid transformation and growth, mainly driven by infrastructure development, changing lifestyle and buyers preferences. This is expected to drive the healthcare adhesive tapes market in the APAC region.

Many international companies are investing in China and India to cater to the market demand. Key companies such as 3M Company (US) and Cardinal Health (US), and medium-sized companies such as Vancive Technologies (Subsidiary of Avery Dennison) and Lohmann GmbH & Co.KG (Germany) have manufacturing facilities in China to cater to the increasing demand.

Key Market Players

The major vendors in the healthcare adhesive tapes market are 3M (US), Cardinal Health, Inc. (US), Nitto Denko Corporation (Japan), Johnson & Johnson Services, Inc. (US), PAUL HARTMANN AG (Germany), Avery Dennison Corporation (US), NICHIBAN Co., Ltd. (Japan), Smith & Nephew (UK), Lohmann GmbH & Co.KG (Germany), Scapa Group Plc (US), Medline Industries Inc. (US), and Essity Aktiebolag (PUBL) (Sweden). Nitto Denko Corporation (Japan), is one of the largest healthcare adhesive tapes companies. This company has a strong global presence. It has a diversified product portfolio to cater to end-use industries according to their requirements. To sustain its dominating position, the company may enter into new industries and target new markets.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

20162023 |

|

Base year |

2017 |

|

Forecast period |

20182023 |

|

Units considered |

Value (USD) and Volume (MSM) |

|

Segments |

Resin, Backing Material, Application, and Region |

|

Geographies |

APAC, North America, Europe, South America, and Middle East & Africa |

|

Companies |

3M (US), Cardinal Health, Inc. (US), Nitto Denko Corporation (Japan), Johnson & Johnson Services, Inc (US), PAUL HARTMANN AG (Germany), Avery Dennison Corporation (US), NICHIBAN Co., Ltd. (Japan), Smith & Nephew (UK), Lohmann GmbH & Co.KG (Germany), Scapa Group Plc (US), Medline Industries Inc. (US), and Essity Aktiebolag (PUBL) (Sweden). |

This research report categorizes the healthcare adhesive tapes market based on resin, backing material, application, and region.

On the basis of resin, the healthcare adhesive tapes market is segmented as follows:

- Acrylic

- Rubber

- Silicone

- Others (urethane, EVA, PE, hydrophilic, and hybrids)

On the basis of backing material, the healthcare adhesive tapes market is segmented as follows:

- Paper

- Fabric

- Plastic

- Others (metal, foam, and silicone)

On the basis of application, the healthcare adhesive tapes market is segmented as follows:

- Surgery

- Wound Dressing

- Splints

- Secure IV Line

- Ostomy Seal

- Hygiene

- Bandages, Transdermal Patches, and Blister Protection

- Diagnostic, Monitoring & Medical Devices, and Optical Care

- Others (burn injury treatment, sports-related fatalities, and others)

On the basis of region, the healthcare adhesive tapes market is segmented as follows:

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In July 2017, Cardinal Health (US) acquired Medtronic's Patient Care, Deep Vein Thrombosis and Nutritional Insufficiency business for USD 6.1 billion. This acquisition provides product offerings which are used across a wide range of applications in the healthcare industry.

- In May 2017, Avery Dennison acquired Finesse Medical, an innovator of healthcare products used in the management of wound and skin conditions. With a revenue of approximately USD 17.11 million over the last year, the company is a key supplier to global healthcare-product OEMs and also provides contract manufacturing and product development services. This acquisition will accelerate the achievement of Avery Dennison's long-term strategic and financial goals for industrial and healthcare materials segment

- In April 2017, Essitys (Sweden) acquired BSN medical, a leading medical solutions company. The company develops, manufactures, markets, and sells products within wound care, compression therapy, and orthopedics. Through this acquisition, the companys aim is to become leading provider of hygiene and health solutions, globally.

Key questions addressed by the report

- What are the mid-to-long-term impacts of the developments undertaken by the key players of the market?

- Are the manufacturers of healthcare adhesive tapes shutting down their plants because of the poor growth globally in a few applications?

- Which backing material has the potential to register the highest market share and because of which application?

- What is the upcoming application for healthcare adhesive tapes?

- What will be the future of the healthcare adhesive tapes market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.2 Key Industry Insights

2.3.3 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions and Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Healthcare Adhesive Tapes Market

4.2 Healthcare Adhesive Tapes Market, By Resin Type

4.3 Healthcare Adhesive Tapes Market, By Backing Material

4.4 APAC Healthcare Adhesive Tapes Market, By Application and Country

4.5 Healthcare Adhesive Tapes Market, Developed vs Developing Countries

4.6 Healthcare Adhesive Tapes Market, By Country

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Surgical Procedures/Operations

5.2.1.2 Increasingly Aging Population

5.2.1.3 High Demand for Healthcare Adhesive Tapes in APAC

5.2.1.4 Rising Penetration of Disposable Hygiene Products

5.2.2 Restraint

5.2.2.1 Stagnant Growth in the Baby Diaper Segment in Matured Markets

5.2.3 Opportunities

5.2.3.1 Growing Healthcare Sector in Emerging Markets

5.2.3.2 Rising Standard of Living

5.2.4 Challenges

5.2.4.1 Increasing Awareness About Advanced Wound Care Products

5.2.4.2 Increasing Pricing Pressure on Market Players

5.3 Porters Five Forces Analysis

5.3.1 Intensity of Competitive Rivalry

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Threat of New Entrants

5.4 Macroeconomic Overview and Key Trends

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.2.1 Economic Outlook of the US

5.4.2.2 Economic Outlook of Germany

5.4.2.3 Economic Outlook of China

5.4.2.4 Economic Outlook of India

6 Healthcare Adhesive Tapes Market, By Resin Type (Page No. - 46)

6.1 Introduction

6.2 Acrylic

6.2.1 Breathable Nature of Acrylic Leads to Its Use in Healthcare Adhesive Tapes

6.3 Silicone

6.3.1 Excellent Adhesion on Low Surface Energy Substrates is Driving This Segment of the Market

6.4 Rubber

6.4.1 Properties Such as Strong Bonding and Long Durability in High Temperatures are Boosting the Rubber-Based Healthcare Adhesive Tapes Market

6.5 Others

7 Healthcare Adhesive Tapes Market, By Backing Material (Page No. - 53)

7.1 Introduction

7.2 Paper

7.2.1 Eco-Friendliness of Paper Increases Its Use as A Backing Material for Healthcare Adhesive Tapes

7.3 Fabric

7.3.1 Durability of Fabric Healthcare Adhesive Tapes is A Governing Factor for the Market

7.4 Plastic

7.4.1 Plastic Healthcare Adhesive Tapes are Water-Resistant, Which is One of Its Excellent Properties

7.5 Others

8 Healthcare Adhesive Tapes Market, By Application (Page No. - 60)

8.1 Introduction

8.2 Surgery

8.2.1 Ease of Use and Removal and Reduced Risk of Infection Offered By Healthcare Adhesive Tapes are Increasing Its Use in Surgeries

8.3 Wound Dressing

8.3.1 Use of Healthcare Adhesive Tapes in Wound Dressings Enable Better Wound Healing

8.4 Splints

8.4.1 Increasing Incidences of Fracture and Improved Medical Treatment Processes are Expected to Drive the Market in This Segment

8.5 Secure Iv Lines

8.5.1 APAC Market is Expected to Register the Highest CAGR in the Secure Iv Lines Segment

8.6 Ostomy Seals

8.6.1 Growing Awareness About the Use of Ostomy Care Products is Helping the Market Growth

8.7 Hygiene

8.7.1 Ease of Use and Removal, Reduced Risk of Infection, and Other Properties of Healthcare Adhesive Tapes are Driving the Market in the Hygiene Segment

8.8 Bandages, Transdermal Patches, and Blister Protection

8.8.1 Increasing Use of Healthcare Adhesive Tapes in Bandages for Varied Applications is Driving the Market

8.9 Diagnostic, Monitoring & Medical Devices, and Optical Care

8.9.1 Increasing Demand for Self-Testing Kits for Blood Glucose Monitoring and Laboratory Test Kits is Likely to Drive the Market

8.10 Other Applications

8.10.1 Burn Injury Treatment

8.10.2 Sport Related Fatalities

9 Healthcare Adhesive Tapes Market, By Region (Page No. - 73)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 High Demand for Medical Products in the Country is Expected to Drive the Market

9.2.2 Canada

9.2.2.1 Advanced Healthcare Procedures Majorly Consume Healthcare Adhesive Tapes in Canada

9.2.3 Mexico

9.2.3.1 Mexico is Expected to Register the Highest CAGR During the Forecast Period

9.3 Europe

9.3.1 Germany

9.3.1.1 Strong Economy and Healthcare Infrastructure are Spurring the Demand in the Country

9.3.2 Italy

9.3.2.1 Governments Efforts to Promote Medical Industries is Expected to Drive the Demand for Healthcare Adhesive Tapes

9.3.3 UK

9.3.3.1 Government Support for Medical Research is Boosting the Market

9.3.4 Benelux

9.3.4.1 Stringent Regulations on Voc Content and Growing Awareness About Hygiene are Increasing the Demand for Healthcare Adhesive Tapes

9.3.5 France

9.3.5.1 Increasing Awareness of Hygiene Products is Augmenting the Demand for Healthcare Adhesive Tapes

9.3.6 Spain

9.3.6.1 Growing Aging Population is Expected to Drive the Market

9.3.7 Poland

9.3.7.1 Health Awareness, Changing Lifestyle, and Insurance Schemes are Expected to Drive the Market

9.3.8 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Demographic and Economic Factors are Collectively Impacting the Market in China

9.4.2 India

9.4.2.1 as an Investor-Friendly Market, India Provides Huge Opportunities for Healthcare Adhesive Tapes Manufacturers

9.4.3 Japan

9.4.3.1 Growing Aging Population is A Major Factor Increasing the Demand for Healthcare Adhesive Tapes

9.4.4 South Korea

9.4.4.1 Stringent Regulations Regarding Voc Emissions May Affect the Market Growth in the Country

9.4.5 Taiwan

9.4.5.1 Competitive Environment in the Healthcare Sector Offers Opportunities to the Healthcare Adhesive Tapes Manufacturers

9.4.6 Malaysia

9.4.6.1 Business-Friendly Policies, Government Support, and Increasing Wound Care Products Manufacturing are the Market Drivers in the Country

9.4.7 Indonesia

9.4.7.1 Availability of Cheap Labor and Raw Materials is A Growth Factor for the Market

9.4.8 Rest of APAC

9.5 South America

9.5.1 Brazil

9.5.1.1 as an Attractive Market for New Investments, Brazil is Generating A Positive Impact on the Market Growth in the Region

9.5.2 Argentina

9.5.2.1 Growing Population and Economy are Expected to Propel the Market

9.5.3 Colombia

9.5.3.1 Countrys Economic Growth and Openness to Global Trade are Favoring the Market Growth

9.5.4 Rest of South America

9.6 Middle East & Africa

9.6.1 UAE

9.6.1.1 Government Spending in the Healthcare Sector is A Governing Factor for the Market in the Country

9.6.2 Saudi Arabia

9.6.2.1 Growing Economy and Government Plans to Improve the Healthcare Sector are Boosting the Market

9.6.3 South Africa

9.6.3.1 Healthcare Sector is Influencing the Market Positively

9.6.4 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 107)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Dynamic Differentiators

10.2.3 Emerging Companies

10.2.4 Innovators

10.3 Strength of Product Portfolio

10.4 Business Strategy Excellence

10.5 Market Leader

10.5.1 Top Two Market Leaders

10.5.2 3M

10.5.3 Cardinal Health

10.6 Competitive Scenario

10.6.1 Merger & Acquisition

10.6.2 New Product Launch

10.6.3 Investment & Expansion

11 Company Profiles (Page No. - 115)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 3M Company

11.2 Cardinal Health, Inc.

11.3 Johnson & Johnson

11.4 Nitto Denko Corporation

11.5 Nichiban Co., Ltd.

11.6 Smith & Nephew PLC

11.7 Scapa Group PLC

11.8 Paul Hartmann AG

11.9 Avery Dennison Corporation

11.10 Essity Aktiebolag (Publ)

11.11 Medline Industries Inc.

11.12 Lohmann GmbH & Co. Kg

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.13 Other Players

11.13.1 Mactac, LLC

11.13.2 Adchem Corporation

11.13.3 Mercator Medical S.A.

11.13.4 Jiangsu Nanfang Medical Co., Ltd.

11.13.5 Dermamed Coatings Company, LLC

11.13.6 Libatape Pharmaceutical Co., Ltd.

11.13.7 Cct Tapes

11.13.8 Seyitler Kimya San. Inc.

11.13.9 Gergonne - the Adhesive Solution

11.13.10 Dermarite Industries, LLC.

11.13.11 A.M.G. Medical Inc.

11.13.12 Sterimed Medical Devices Pvt. Ltd.

11.13.13 Pinnacle Technologies

11.13.14 Wuxi Beyon Medical Products Co., Ltd.

12 Appendix (Page No. - 149)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Related Reports

12.4 Author Details

List of Tables (93 Tables)

Table 1 Healthcare Adhesive Tapes Market Snapshot

Table 2 Major Players Profiled in This Report

Table 3 APAC Urbanization Prospects

Table 4 Trends and Forecast of GDP, Annual Percentage Change

Table 5 US: Economic Outlook

Table 6 Germany: Economic Outlook

Table 7 China: Economic Outlook

Table 8 India: Economic Outlook

Table 9 Healthcare Adhesive Tapes Market Size, By Resin Type, 20162023 (USD Million)

Table 10 Healthcare Adhesive Tapes Market Size, By Resin Type, 20162023 (Msm)

Table 11 Acrylic-Based Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 12 Acrylic-Based Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 13 Silicone-Based Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 14 Silicone-Based Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 15 Rubber-Based Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 16 Rubber-Based Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 17 Other Resins-Based Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 18 Other Resins-Based Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 19 Healthcare Adhesive Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 20 Healthcare Adhesive Tape Market Size, By Backing Material, 20162023 (Msm)

Table 21 Paper Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 22 Paper Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 23 Fabric Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 24 Fabric Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 25 Plastic Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 26 Plastic Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 27 Other Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 28 Other Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 29 Healthcare Adhesive Tapes Market Size, By Application, 20162023 (USD Million)

Table 30 Healthcare Adhesive Tape Market Size, By Application, 20162023 (Msm)

Table 31 Healthcare Adhesive Tapes Market Size in Surgery Application, By Region, 20162023 (USD Million)

Table 32 Healthcare Adhesive Tape Market Size in Surgery Application, By Region, 20162023 (Msm)

Table 33 Healthcare Adhesive Tapes Market Size in Wound Dressing Application, By Region, 20162023 (USD Million)

Table 34 Healthcare Adhesive Tape Market Size in Wound Dressing Application, By Region, 20162023 (Msm)

Table 35 Healthcare Adhesive Tapes Market Size in Splints Application, By Region, 20162023 (USD Million)

Table 36 Healthcare Adhesive Tape Market Size in Splints Application, By Region, 20162023 (Msm)

Table 37 Healthcare Adhesive Tapes Market Size in Secure Iv Lines Application, By Region, 20162023 (USD Million)

Table 38 Healthcare Adhesive Tape Market Size in Secure Iv Lines Application, By Region, 20162023 (Msm)

Table 39 Healthcare Adhesive Tapes Market Size in Ostomy Seals Application, By Region, 20162023 (USD Million)

Table 40 Healthcare Adhesive Tape Market Size in Ostomy Seals Application, By Region, 20162023 (Msm)

Table 41 Healthcare Adhesive Tapes Market Size in Hygiene Application, By Region, 20162023 (USD Million)

Table 42 Healthcare Adhesive Tape Market Size in Hygiene Application, By Region, 20162023 (Msm)

Table 43 Healthcare Adhesive Tapes Market Size in Bandages, Transdermal Patches, and Blister Protection Application, By Region, 20162023 (USD Million)

Table 44 Healthcare Adhesive Tapes Market Size in Bandages, Transdermal Patches, and Blister Protection Application, By Region, 20162023 (Msm)

Table 45 Healthcare Adhesive Tapes Market Size in Diagnostic, Monitoring & Medical Devices, and Optical Care Application, By Region, 20162023 (USD Million)

Table 46 Healthcare Adhesive Tapes Market Size in Diagnostic, Monitoring & Medical Devices, and Optical Care Application, By Region, 20162023 (Msm)

Table 47 Healthcare Adhesive Tapes Market Size in Other Applications, By Region, 20162023 (USD Million)

Table 48 Healthcare Adhesive Tape Market Size in Other Applications, By Region, 20162023 (Msm)

Table 49 Healthcare Adhesive Tapes Market Size, By Region, 20162023 (USD Million)

Table 50 Healthcare Adhesive Tape Market Size, By Region, 20162023 (Msm)

Table 51 North America: Healthcare Adhesive Tapes Market Size, By Resin Type, 20162023 (USD Million)

Table 52 North America: Market Size, By Resin Type, 20162023 (Msm)

Table 53 North America: Surgical Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 54 North America: Market Size, By Backing Material, 20162023 (Msm)

Table 55 North America: Market Size, By Application, 20162023 (USD Million)

Table 56 North America: Surgical Tapes Market Size, By Application, 20162023 (Msm)

Table 57 North America: Market Size, By Country, 20162023 (USD Million)

Table 58 North America: Market Size, By Country, 20162023 (Msm)

Table 59 Europe: Healthcare Adhesive Tapes Market Size, By Resin Type, 20162023 (USD Million)

Table 60 Europe: Market Size, By Resin Type, 20162023 (Msm)

Table 61 Europe: Market Size, By Backing Material, 20162023 (USD Million)

Table 62 Europe: Surgical Tapes Market Size, By Backing Material, 20162023 (Msm)

Table 63 Europe: Market Size, By Application, 20162023 (USD Million)

Table 64 Europe: Market Size, By Application, 20162023 (Msm)

Table 65 Europe: Surgical Tapes Market Size, By Country, 20162023 (USD Million)

Table 66 Europe: Market Size, By Country, 20162023 (Msm)

Table 67 APAC: Healthcare Adhesive Tapes Market Size, By Resin Type, 20162023 (USD Million)

Table 68 APAC: Market Size, By Resin Type, 20162023 (Msm)

Table 69 APAC: Market Size, By Backing Material, 20162023 (USD Million)

Table 70 APAC: Surgical Tapes Market Size, By Backing Material, 20162023 (Msm)

Table 71 APAC: Market Size, By Application, 20162023 (USD Million)

Table 72 APAC: Market Size, By Application, 20162023 (Msm)

Table 73 APAC: Market Size, By Country, 20162023 (USD Million)

Table 74 APAC: Surgical Tapes Market Size, By Country, 20162023 (Msm)

Table 75 South America: Healthcare Adhesive Tapes Market Size, By Resin Type, 20162023 (USD Million)

Table 76 South America: Market Size, By Resin Type, 20162023 (Msm)

Table 77 South America: Market Size, By Backing Material, 20162023 (USD Million)

Table 78 South America: Surgical Tapes Market Size, By Backing Material, 20162023 (Msm)

Table 79 South America: Market Size, By Application, 20162023 (USD Million)

Table 80 South America: Market Size, By Application, 20162023 (Msm)

Table 81 South America: Market Size, By Country, 20162023 (USD Million)

Table 82 South America: Market Size, By Country, 20162023 (Msm)

Table 83 Middle East & Africa: Healthcare Adhesive Tapes Market Size, By Resin Type, 20162023 (USD Million)

Table 84 Middle East & Africa: Market Size, By Resin Type, 20162023 (Msm)

Table 85 Middle East & Africa: Market Size, By Backing Material, 20162023 (USD Million)

Table 86 Middle East & Africa: Surgical Tapes Market Size, By Backing Material, 20162023 (Msm)

Table 87 Middle East & Africa: Market Size, By Application, 20162023 (USD Million)

Table 88 Middle East & Africa: Market Size, By Application, 20162023 (Msm)

Table 89 Middle East & Africa: Market Size, By Country, 20162023 (USD Million)

Table 90 Middle East & Africa: Surgical Tapes Market Size, By Country, 20162023 (Msm)

Table 91 Merger & Acqusition, 20162018

Table 92 New Product Launch, 20162018

Table 93 Investment & Expansion, 20162018

List of Figures (43 Figures)

Figure 1 Healthcare Adhesive Tapes Market Segmentation

Figure 2 Healthcare Adhesive Tapes Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Healthcare Adhesive Tapes Market: Data Triangulation

Figure 6 APAC to Register the Highest CAGR in Healthcare Adhesive Tapes Market

Figure 7 Silicone-Based Healthcare Adhesive Tapes to Register the Highest CAGR

Figure 8 Plastic Segment to Register the Highest CAGR in the Healthcare Adhesive Tapes Market

Figure 9 Secure Iv Lines to Be the Fastest-Growing Application of Healthcare Adhesive Tapes

Figure 10 Emerging Economies Offer Attractive Opportunities to Healthcare Adhesive Tapes Manufacturers

Figure 11 Acrylic Segment Dominated the Healthcare Adhesive Tapes Market in 2017

Figure 12 Fabric Segment to Lead the Healthcare Adhesive Tapes Market

Figure 13 Surgery Application and China Accounted for the Largest Share in APAC

Figure 14 Market in Developing Countries to Grow Faster Than in Developed Countries

Figure 15 India to Be the Fastest-Growing Market for Healthcare Adhesive Tapes

Figure 16 Drivers, Restraints, Opportunities, and Challenges: Healthcare Adhesive Tapes Market

Figure 17 Aging Population: US vs China vs Japan

Figure 18 Acrylic Was the Largest Resin Type for Healthcare Adhesive Tapes in 2017

Figure 19 Plastic to Be the Fastest-Growing Backing Material for Healthcare Adhesive Tapes

Figure 20 Growth of Major Applications to Drive the Healthcare Adhesive Tapes Market

Figure 21 India to Be the Fastest-Growing Market

Figure 22 North America: Healthcare Adhesive Tapes Market Snapshot

Figure 23 Europe: Healthcare Adhesive Tapes Market Snapshot

Figure 24 APAC: Healthcare Adhesive Tapes Market Snapshot

Figure 25 Rise in Demand for Bandages and Wound Dressing Products to Drive the Healthcare Adhesive Tapes Market in South America

Figure 26 Rise in Demand for Diagnostic, Monitoring & Medical Devices, and Optical Care Products to Drive the Healthcare Adhesive Tapes Market in South America

Figure 27 Healthcare Adhesive Tapes Market Competitive Leadership Mapping in 2017

Figure 28 Merger & Acquisition Was the Key Strategy Adopted By Companies Between 2016 and 2018

Figure 29 3M Company: Company Snapshot

Figure 30 3M Company: SWOT Analysis

Figure 31 Cardinal Health: Company Snapshot

Figure 32 Cardinal Health: SWOT Analysis

Figure 33 Johnson & Johnson: Company Snapshot

Figure 34 Johnson & Johnson: SWOT Analysis

Figure 35 Nitto Denko Corporation: Company Snapshot

Figure 36 Nitto Denko Corporation: SWOT Analysis

Figure 37 Nichiban: Company Snapshot

Figure 38 Nichiban Co: SWOT Analysis

Figure 39 Smith & Nephew: Company Snapshot

Figure 40 Scapa Group: Company Snapshot

Figure 41 Paul Hartmann AG: Company Snapshot

Figure 42 Avery Dennison Corporation: Company Snapshot

Figure 43 Essity Aktiebolag (Publ): Company Snapshot

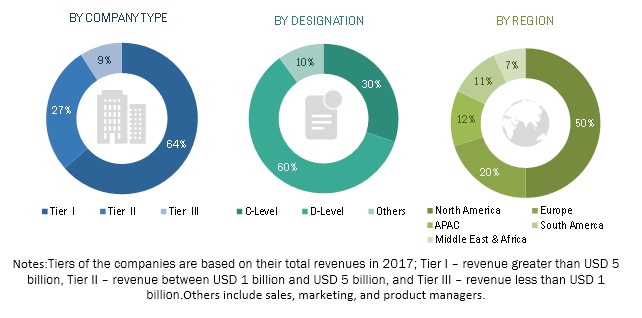

The study involved four major activities in estimating the current market size of healthcare adhesive tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation methods were used to estimate the market size of the segments and the subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg, and BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The healthcare adhesive tapes market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side for this market is characterized by the development of hospitals, clinics, application industries such as surgery, ostomy seals, wound dressing, secure IV lines, splints, and others industries and the growth in population. The supply side is characterized by advancements in functions, resin chemistries, technologies, and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the overall size of the healthcare adhesive tapes market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global healthcare adhesive tapes market, in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze and forecast the healthcare adhesive tapes market based on resin type, backing material, and application

- To analyze and forecast the market size, with respect to five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments such as investment & expansion, new product launch, and merger & acquisition in the market

- To analyze opportunities in the market for stakeholders and provide details of a competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of a specific country based on application

Company Information:

- Detailed analysis and profiling of additional market players (up to twenty three)

Growth opportunities and latent adjacency in Healthcare Adhesive Tapes Market