Hemodynamic Monitoring Systems Market by Product (Disposables and Monitors), Type (Invasive, Minimally Invasive, and Non-invasive), End User (Hospitals, Clinics & Ambulatory Care Center, and Home Care Setting), and Region - Global Forecasts to 2023

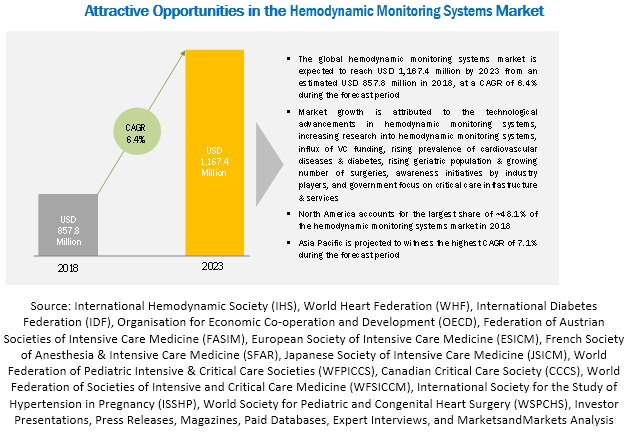

The hemodynamic monitoring systems market is projected to reach USD 1,167.4 million by 2023, at a CAGR of 6.4% during the forecast period. Factors such as technological advancements in hemodynamic monitoring systems, increasing research into hemodynamic monitoring systems, influx of VC funding, rising prevalence of cardiovascular diseases & diabetes, rising geriatric population & growing number of surgeries, awareness initiatives by industry players, and government focus on critical care infrastructure & services are driving the growth of the hemodynamic monitoring systems market. In addition, growing demand for patient monitoring devices in non-hospital settings and the emerging economies (such as China, India, Brazil, and Mexico) are expected to offer lucrative growth opportunities for market players in the hemodynamic monitoring systems market. However, a risk associated with invasive hemodynamic monitoring, such as sepsis, bleeding, hemorrhage, thrombosis, air embolism, and pulmonary capillary necrosis is expected to restrain the growth of this market. Moreover, increasing pricing pressure on market players, limited patient awareness related to disease diagnosis, and dearth of skilled professionals are adversely impacting the growth of the market.

By type, noninvasive hemodynamic monitoring systems segment is expected to grow at the highest CAGR during the forecast period

The noninvasive hemodynamic monitoring systems segment is expected to grow at the highest CAGR during the forecast owing to the reduction of staffing costs, treatment expenses, and hospital stay; rising incidence of respiratory disorders; fewer complications of noninvasive hemodynamic monitoring as compared to invasive methods; and better portability, ease of use, and better precision.

Monitors segment to witness the highest growth in the forecast period

The monitors segment is expected to grow at the highest CAGR during the forecast owing to the increasing prevalence of CVD; technological advancements in monitoring systems; increasing funding by government authorities for improving patient-centered care, safety, and efficiency; and the ability of hemodynamic monitors to improve cath lab efficiency.

By geography, Asia Pacific (APAC) to register the highest CAGR in the forecast period

The APAC region comprising Japan, China, India, and Rest of Asia Pacific offers high-growth opportunities for players in the hemodynamic monitoring systems market. Some of the factors driving market growth in the APAC region are Japan’s growing healthcare industry; extensive government reimbursement coverage for critical cardiac procedures; improving healthcare infrastructure in India and China; high diabetes prevalence in Vietnam, Singapore, Malaysia, China, and India; and government initiatives in Australia and Singapore.

Increasing penetration in the high-growth Asia Pacific market will prove to be an effective growth strategy for companies focusing on increasing their shares in the global hemodynamic monitoring systems market.

Market Dynamics

Driver: Technological advancements in hemodynamic monitoring systems

Recent years have witnessed a growing preference for noninvasive technologies from traditionally accepted invasive techniques.

Noninvasive hemodynamic monitoring systems facilitate painless diagnosis and reduce the risk of blood-borne infections in patients. In addition, these systems are easier to use (as compared to invasive systems) and can be operated by a nurse in the absence of a specialist/doctor. Owing to this advantage, the hemodynamic state can be simultaneously monitored in numerous patients, which results in a reduction in staff costs as well as treatment expenses. These advantages are expected to increase the market for noninvasive systems in the coming years. Noninvasive hemodynamic monitoring involves the continuous measurement of blood pressure using finger cuffs and the measurement of cardiac output using the pulse contour method for the critically ill patients. Caretaker Medical’s Caretaker 4, for example, uses a finger cuff to measure continuous beat-by-beat blood pressure (“cNIBP”), heart rate, and other physiological parameters.

Restraint Risks associated with invasive hemodynamic monitoring

Apart from the discomfort associated with invasive monitoring (mainly the insertion of the pulmonary artery catheter), there are several risks associated with this technique—sepsis, bleeding, cardiac arrhythmias, reduced circulation to the distal limb, hemorrhage, nerve damage (during insertion), thrombosis, air embolism, and pulmonary capillary necrosis. These factors increase the mortality rate during invasive hemodynamic procedures.

Due to this, invasive hemodynamic monitoring is recommended only for a set of specific indications, provided that the risks associated are overshadowed by the benefits of obtaining the relevant data during the procedure. In addition, the use of invasive hemodynamic monitoring systems is not recommended for elderly and weak patients. Moreover, invasive hemodynamic monitoring is extremely expensive and requires skilled professionals to perform catheter insertions in patients. Although invasive hemodynamic monitoring provides accurate, comprehensive, and continuous data about the hemodynamic state of patients, the abovementioned risks limit their usage.

Opportunity: Emerging markets

Emerging markets will offer potential growth opportunities for global players operating in the hemodynamic monitoring systems market in the coming years, mainly due to the increasing patient population across these countries, rising adoption of patient monitoring devices, growing awareness regarding cardiovascular diseases, and improving healthcare infrastructure. Moreover, emerging countries have registered a sustained increase in surgical procedures during the past decade, driven by the growing target patient population, a growing number of CVD-related deaths, and rising medical tourism.

Challenge: Increasing pricing pressure on market players

Various initiatives are being taken to curtail healthcare costs through price regulations, competitive pricing, bidding and tender mechanics, coverage and payment policies, comparative effectiveness of therapies, technology assessments, and managed-care arrangements, globally. In response to the increasing pressure to reduce healthcare costs, healthcare providers have aligned themselves with group purchasing organizations and integrated health networks, which negotiate for the bulk purchase of medical devices. Bulk purchasing increases pricing pressure and decreases profit margins for players, particularly for small and medium-sized manufacturers that offer a limited range of hemodynamic monitoring systems.

Reforms on payments such as prospective payment systems for hospital care, preferential site of service payments, and value-based purchasing have added to the pressure on medical device companies. Furthermore, hospitals are consolidating, and large group purchasing organizations, hospital networks, and other groups continue to seek ways to aggregate purchasing power. In the UK, for instance, due to BREXIT, economic conditions have been hit, with volatility in currency exchange rates and a rising number of regulatory complexities. These outcomes may adversely affect businesses, financial conditions, or the results of operations in this market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

USD million and billion |

|

Segments covered |

Product, Type, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Edwards Lifesciences (US), PULSION Medical Systems SE (Germany), LiDCO Group (UK), Deltex Medical (UK), ICU Medical (US), CNSYSTEMS MEDIZINTECHNIK GMBH(Austria), CareTaker Medical (US), OSYPKA MEDICAL GMBH (Germany), Cheetah Medical (US), Uscom (Australia), NI Medical (Israel) |

The research report categorizes the hemodynamic monitoring systems market into the following segments and subsegments:

Hemodynamic Monitoring Systems Market by Product

- Monitors

- Disposables

Hemodynamic Monitoring Systems Market by Type

- Invasive

- Minimally invasive

- Noninvasive

Hemodynamic Monitoring Systems Market by End User

- Hospitals

- Clinics and ambulatory care centers

- Home care settings

Hemodynamic Monitoring Systems Market by Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Key Market Players

Edwards Lifesciences (US), PULSION Medical Systems SE (Germany), LiDCO Group (UK)

Recent Developments

- In March 2018, Edwards Lifesciences launched Acumen Hypotension Prediction Index (HPI) software in the US.

- In February 2018, LiDCO Group had an agreement with Spacelabs Healthcare SAS to distribute LiDCO products in France.

- In January 2018, Koninklijke Philips launched IntelliVue X3.

- In January 2018, The University Teaching Hospital (US) incorporated Deltex’s Oesophageal Doppler Monitoring (ODM) system.

Critical questions the report answers:

- Where will all these developments take the hemodynamic monitoring systems market in the long term?

- What are the upcoming trends for the hemodynamic monitoring systems market?

- Which segment in hemodynamic monitoring systems provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants in the hemodynamic monitoring systems market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Markets Covered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation Methodology

2.3 Market Data Validation and Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Market Overview

4.2 Asia Pacific: Market, By Country and End User

4.3 Geographic Snapshot: Global Market

4.4 Global Market, By Type (2018 vs 2023)

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.3 Drivers

5.3.1 Technological Advancements in Hemodynamic Monitoring Systems

5.3.1.1 Microelectromechanical Systems (MEMS)

5.3.1.2 Hypotension Prediction Index (HPI) Software

5.3.2 Increasing Research Into Hemodynamic Monitoring Systems

5.3.3 Influx of VC Funding

5.3.4 Rising Prevalence of Cardiovascular Diseases and Diabetes

5.3.5 Rising Geriatric Population and Growing Number of Surgeries

5.3.6 Awareness Initiatives By Industry Players

5.3.7 Government Focus on Critical Care Infrastructure and Services

5.4 Restraints

5.4.1 Risks Associated With Invasive Hemodynamic Monitoring

5.5 Opportunities

5.5.1 Emerging Markets

5.5.2 Growing Demand for Patient Monitoring Devices in Non-Hospital Settings

5.6 Challenges

5.6.1 Increasing Pricing Pressure on Market Players

5.6.2 Limited Patient Awareness Related to Disease Diagnosis

5.6.3 Dearth of Skilled Professionals

6 By Product (Page No. - 50)

6.1 Introduction

6.2 Disposables

6.3 Monitors

7 By Type (Page No. - 58)

7.1 Introduction

7.2 Invasive Hemodynamic Monitoring Systems

7.3 Minimally Invasive Hemodynamic Monitoring Systems

7.4 Noninvasive Hemodynamic Monitoring Systems

8 By End User (Page No. - 68)

8.1 Introduction

8.2 Hospitals

8.3 Clinics and Ambulatory Care Centers

8.4 Home Care Settings

9 By Region (Page No. - 78)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 RoE

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 RoAPAC

9.5 RoW

10 Competitive Landscape (Page No. - 114)

10.1 Introduction

10.2 Market Share Analysis

10.2.1 Edwards Lifesciences Corporation

10.2.2 Pulsion Medical Systems Se

10.2.3 Lidco Group PLC

10.3 Market Share Analysis, By Region

10.4 Competitive Scenario

11 Company Profiles (Page No. - 122)

(Business Overview, Strength of Service Portfolio, Business Strategy Excellence, and Key Relationships)*

11.1 Edwards Lifesciences Corporation

11.2 Pulsion Medical Systems Se (Part of the Maquet Getinge Group)

11.3 Lidco Group

11.4 Deltex Medical Group PLC

11.5 ICU Medical

11.6 Cnsystems Medizintechnik GmbH

11.7 Caretaker Medical

11.8 Osypka Medical GmbH

11.9 Cheetah Medical

11.10 NI Medical

11.11 Uscom

*Details on Business Overview, Strength of Service Portfolio, Business Strategy Excellence, and Key Relationships Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 142)

12.1 Discussion Guide: Hemodynamic Monitoring Systems Market

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (91 Tables)

Table 1 Indicative List of Companies That Received Venture Capitalist Funding for the Hemodynamic Monitoring Systems Segment

Table 2 Top Five Countries With the Highest Number of Diabetics (Aged 20–79 Years), 2015 vs 2040

Table 3 Population Aged 60 Years and Over, By Region (In Million)

Table 4 Awareness Initiatives in 2017–2018

Table 5 By Product, 2016–2023 (USD Million)

Table 6 Types of Disposables Used in Hemodynamic Monitoring

Table 7 Hemodynamic Monitoring Disposables Market, By Region, 2016–2023 (USD Million)

Table 8 North America: Hemodynamic Monitoring Market for Disposables, By Country, 2016–2023 (USD Million)

Table 9 Europe: Hemodynamic Monitoring Market for Disposables, By Country, 2016–2023 (USD Million)

Table 10 Asia Pacific: Hemodynamic Monitoring Market for Disposables, By Country, 2016–2023 (USD Million)

Table 11 Types of Hemodynamic Monitors

Table 12 Hemodynamic Monitors Market, By Region, 2016–2023 (USD Million)

Table 13 North America: Hemodynamic Monitors Market, By Country, 2016–2023 (USD Million)

Table 14 Europe: Hemodynamic Monitors Market, By Country, 2016–2023 (USD Million)

Table 15 Asia Pacific: Hemodynamic Monitors Market, By Country, 2016–2023 (USD Million)

Table 16 Market, By Type, 2016–2023 (USD Million)

Table 17 Invasive Hemodynamic Monitoring Systems Market, By Region, 2016–2023 (USD Million)

Table 18 North America: Invasive Hemodynamic Monitoring Systems Market, By Country, 2016–2023 (USD Million)

Table 19 Europe: Invasive Market, By Country, 2016–2023 (USD Million)

Table 20 Asia Pacific: Invasive Market, By Country, 2016–2023 (USD Million)

Table 21 Minimally Invasive Market, By Region, 2016–2023 (USD Million)

Table 22 North America: Minimally Invasive Hemodynamic Monitoring Systems Market, By Country, 2016–2023 (USD Million)

Table 23 Europe: Minimally Invasive Market, By Country, 2016–2023 (USD Million)

Table 24 Asia Pacific: Minimally Invasive Market, By Country, 2016–2023 (USD Million)

Table 25 Noninvasive Market, By Region, 2016–2023 (USD Million)

Table 26 North America: Noninvasive Market, By Country, 2016–2023 (USD Million)

Table 27 Europe: Noninvasive Market, By Country, 2016–2023 (USD Million)

Table 28 Asia Pacific: NoninvasiveMarket, By Country, 2016–2023 (USD Million)

Table 29 By End User, 2016–2023 (USD Million)

Table 30 Hemodynamic Monitoring Systems Market for Hospitals, By Region, 2016–2023 (USD Million)

Table 31 North America: Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 32 Europe: Hemodynamic Monitoring Systems Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 33 Asia Pacific: Hemodynamic Monitoring Systems Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 34 Hemodynamic Monitoring Systems Market for Clinics and Ambulatory Care Centers, By Region, 2016–2023 (USD Million)

Table 35 North America: Market for Clinics and Ambulatory Care Centers, By Country, 2016–2023 (USD Million)

Table 36 Europe: Hemodynamic Monitoring Systems Market for Clinics and Ambulatory Care Centers, By Country, 2016–2023 (USD Million)

Table 37 Asia Pacific: Market for Clinics and Ambulatory Care Centers, By Country, 2016–2023 (USD Million)

Table 38 Market for Hemodynamic Monitoring Systems by Home Care Settings, By Region, 2016–2023 (USD Million)

Table 39 North America: Market for Home Care Settings, By Country, 2016–2023 (USD Million)

Table 40 Europe: Market for Home Care Settings, By Country, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market for Hemodynamic Monitoring Systems by Home Care Settings, By Country, 2016–2023 (USD Million)

Table 42 Hemodynamic Monitoring Systems Market By Region, 2016–2023 (USD Million)

Table 43 North America: Hemodynamic Monitoring Systems Market, By Country, 2016–2023 (USD Million)

Table 44 North America: Hemodynamic Monitoring Systems Market, By Product, 2016–2023 (USD Million)

Table 45 North America: Hemodynamic Monitoring Systems Market, By Type, 2016–2023 (USD Million)

Table 46 North America: Hemodynamic Monitoring Systems Market, By End User, 2016–2023 (USD Million)

Table 47 US: Hemodynamic Monitoring Systems Market, By Product, 2016–2023 (USD Million)

Table 48 US: Hemodynamic Monitoring Systems Market, By Type, 2016–2023 (USD Million)

Table 49 US: Hemodynamic Monitoring Systems Market, By End User, 2016–2023 (USD Million)

Table 50 Canada: Hemodynamic Monitoring Systems Market, By Product, 2016–2023 (USD Million)

Table 51 Canada: Hemodynamic Monitoring Systems Market, By Type, 2016–2023 (USD Million)

Table 52 Canada: Hemodynamic Monitoring Systems Market, By End User, 2016–2023 (USD Million)

Table 53 Europe: Hemodynamic Monitoring Systems Market, By Country, 2016–2023 (USD Million)

Table 54 Europe: Market, By Product, 2016–2023 (USD Million)

Table 55 Europe: Market, By Type, 2016–2023 (USD Million)

Table 56 Europe: Market, By End User, 2016–2023 (USD Million)

Table 57 Germany: Market, By Product, 2016–2023 (USD Million)

Table 58 Germany: Market, By Type, 2016–2023 (USD Million)

Table 59 Germany: Market, By End User, 2016–2023 (USD Million)

Table 60 UK: Market, By Product, 2016–2023 (USD Million)

Table 61 UK: Market, By Type, 2016–2023 (USD Million)

Table 62 UK: Market, By End User, 2016–2023 (USD Million)

Table 63 France: Hemodynamic Monitoring Systems Market, By Product, 2016–2023 (USD Million)

Table 64 France: Market, By Type, 2016–2023 (USD Million)

Table 65 France: Market, By End User, 2016–2023 (USD Million)

Table 66 RoE: Hemodynamic Monitoring Systems Market, By Product, 2016–2023 (USD Million)

Table 67 RoE: Market, By Type, 2016–2023 (USD Million)

Table 68 RoE: Market, By End User, 2016–2023 (USD Million)

Table 69 Prominent Research Projects Focusing on Hemodynamic Monitoring

Table 70 Asia Pacific: Hemodynamic Monitoring Systems Market, By Country, 2016–2023 (USD Million)

Table 71 Asia Pacific: Market, By Product, 2016–2023 (USD Million)

Table 72 Asia Pacific: Market, By Type, 2016–2023 (USD Million)

Table 73 Asia Pacific: Market, By End User, 2016–2023 (USD Million)

Table 74 Japan: Hemodynamic Monitoring Systems Market, By Product, 2016–2023 (USD Million)

Table 75 Japan: Market, By Type, 2016–2023 (USD Million)

Table 76 Japan: Market, By End User, 2016–2023 (USD Million)

Table 77 China: Market, By Product, 2016–2023 (USD Million)

Table 78 China: Market, By Type, 2016–2023 (USD Million)

Table 79 China: Market, By End User, 2016–2023 (USD Million)

Table 80 India: Market, By Product, 2016–2023 (USD Million)

Table 81 India: Market, By Type, 2016–2023 (USD Million)

Table 82 India: Hemodynamic Monitoring Systems Market, By End User, 2016–2023 (USD Million)

Table 83 RoAPAC: Market, By Product, 2016–2023 (USD Million)

Table 84 RoAPAC: Market, By Type, 2016–2023 (USD Million)

Table 85 RoAPAC: Market, By End User, 2016–2023 (USD Million)

Table 86 RoW: Market, By Product, 2016–2023 (USD Million)

Table 87 RoW: Market, By Type, 2016–2023 (USD Million)

Table 88 RoW: Market, By End User, 2016–2023 (USD Million)

Table 89 Product Launches and Product Enhancements, 2015-2018

Table 90 Agreements, Collaborations, and Partnerships

Table 91 Other Developments

List of Figures (36 Figures)

Figure 1 Market Segmentation

Figure 2 Research Methodology

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Research Design

Figure 7 Data Triangulation Methodology

Figure 8 Monitors Segment to Witness the Highest Growth in the Forecast Period

Figure 9 By Type, 2018 vs 2023

Figure 10 Hospitals Segment to Account for the Largest Share of the global Market in 2018

Figure 11 Asia Pacific to Register the Highest CAGR in the Forecast Period

Figure 12 Technological Advancements in Hemodynamic Monitoring Sytems is the Key Factor Driving the Growth of the Market

Figure 13 Hospitals Segment to Dominate the Market in 2018

Figure 14 Asia Pacific to Witness the Highest Growth Rate During the Forecast Period

Figure 15 Invasive Systems Segment to Command the Largest Market Share By 2023

Figure 16 Percentage Change in Population Aged 60 Years and Over, By Region (2000–2030)

Figure 17 By Product, 2018 vs 2023 (USD Million)

Figure 18 By Type, 2018 vs 2023

Figure 19 By End User, 2018 vs 2023 (USD Million)

Figure 20 By Region, 2018 vs 2023

Figure 21 North America: Market Snapshot

Figure 22 Europe: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 RoW: Market Snapshot

Figure 25 Key Developments in the Market Between 2015 and 2018

Figure 26 Market Share Analysis, By Key Player, 2017

Figure 27 North America: Market Share Analysis, By Key Player, 2017

Figure 28 Europe: Market Share Analysis, By Key Player, 2017

Figure 29 Asia Pacific: Market Share Analysis, By Key Player, 2017

Figure 30 RoW: Market Share Analysis, By Key Player, 2017

Figure 31 Geographic Presence of Key Players

Figure 32 Edwards Lifesciences Corporation: Company Snapshot (2017)

Figure 33 Pulsion Medical Systems Se: Company Snapshot (2017)

Figure 34 Lidco Group: Company Snapshot (2017)

Figure 35 Deltex Medical Group PLC: Company Snapshot (2017)

Figure 36 ICU Medical: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hemodynamic Monitoring Systems Market

The market with Hemodynamic monitoring is going to grow specially in India. The Indian market requires cost effective and easy to maintain device that can suit the need for Indian healthcare .