Hexamethylenediamine Market by Application (Nylon Synthesis, Curing Agents, Lubricants, Biocides, Coatings Intermediate, Adhesives), End-Use Industry (Automotive, Textile, Paints & Coatings, Petrochemical) and Region - Global Forecast to 2027

Updated on : September 02, 2025

Hexamethylenediamine Market

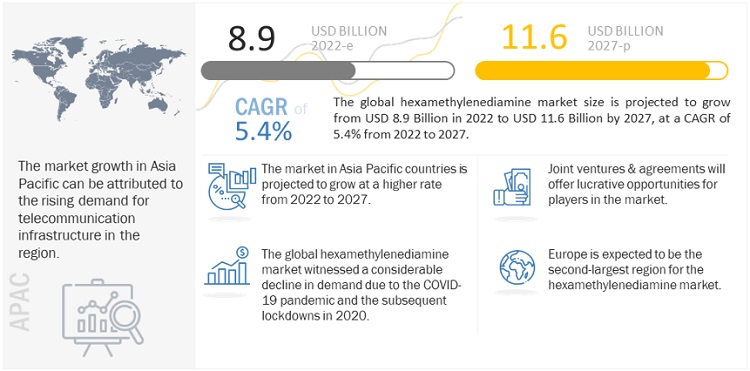

The global hexamethylenediamine market was valued at USD 8.9 billion in 2022 and is projected to reach USD 11.6 billion by 2027, growing at 5.4% cagr from 2022 to 2027. The increase in demamd from various end-use industries such textile, water treatment, and automotive is driving the growth of the Hexamethylene diamine market. Moreover the market is expected to grow due to increased demand for the market product in the textile and automotive industries. This is due to the rising demand for hexamethylenediamine as a precursor in the production of nylon 6-6 which is also expected to drive the growth of the market in the near future.

Global Hexamethylenediamine Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Hexamethylenediamine Market Dynamics

DRIVERS: Use of hexamethylenediamine in the manufacturing of nylon 6-6

The production process of nylon 6-6 fibre and resins is a largest consumer of hexamethylenediamine. As a consequence, the growth for nylon 6-6 fibres has had a huge impact on the overall market. With the increase of nylon as a significant alternative for a wide range of applications, especially in automotive industry, within which nylon has supplanted metals in a spectrum of uses, the hexamethylenediamine market is expected to grow rapidly.

RESTRAINT: Increasing research & development to find a better

The steadily increasing R&D concentrated on the improvement of a better substitute to substitute the use of hexamethylenediamine during the production of nylon 6-6 is a significant market restraint. Moreover, since hexamthylenediamine is a highly corrosive substance, there are regulations governing its production, packaging, and transportation.

OPPORTUNITIES: Rise in demand for bio-based hexamethylenediamine products

Due to the sheer increased demand for bio-based nylon resins, manufacturers are focusing on building a bio-based production technology for the production of hexamethylenediamine and adipic acid (the other component used in the manufacture of nylon 6-6 along with hexamethylenediamine). The main difference among conventional and bio-based hexamethylenediamine are cost efficiency, prices of raw materials, and the production process. A further noticeable development observed in the global hexamethylene diamine market is that major manufacturers are focusing on increasing their production capacity in order to gain a competitive advantage over other market participants. Many manufacturers have increased their presence in emerging markets such as China, India, and other Asian countries. Manufacturers are also investing heavily in acquisitions in the.

CHALLENGES: Environmental issues

Hexamethylenediamine is used in various applications such as the synthesis of nylon 6-6, as a curing agent, and as coating intermediates. Nylon-based textiles and engineering plastic products and components are considered harmful to the environment, with environmental NGOs frequently criticizing their use. Industries such as automotive, electrical & electronics, and packaging, which extensively use plastic products & components, are especially criticized for their role in the solid waste disposal and economical recycling issues. Due to the excessive criticism, the automotive and packaging industries are moving cautiously on the further integration of plastic products in automotive parts and components. Many organizations have made efforts for mass mobilization against the use of plastics, especially in the packaging industry. These factors act as challenges for the hexamethylenediamine market.

Nylon Synthesis to dominate the market in 2021

- The nylon synthesis segment is the largest and fastest-growing application segment of the global hexamethylene diamine market. The demand for hexamethylenediamine from the nylon synthesis application segment has been increasing recently, owing to the growing demand for nylon 6-6 from various end-use industries such as automotive and textile. Nylon 6-6 is used in the manufacture of automotive products and components such as radiator end tanks, rocker covers, air intake manifolds, oil pans, electro-insulating elements, and airbags, among others. The expansion of these end-use industries is expected to drive hexamethylenediamine demand from the nylon synthesis application segment.

- Increase in the demand for tri & quadruple disc hexamethylenediamine

- The hexamethylenediamine market is divided into five end-use industries: automotive, textile, paints & coatings, petrochemical, and others. In 2021, the automotive industry is expected to be the largest end-use industry segment in the hexamethylene diamine market. This segment is also expected to grow at the fastest CAGR during the forecast period. Textile is expected to be the second-largest end-use industry segment of the hexamethylenediamine market, while paints and coatings are expected to grow at the second-fastest CAGR during the forecast period.

North America region to lead the global hexamethylenediamine market by 2027

North America is expected to hold the largest share of the hexamethylenediamine market in 2021. The major countries in this regional hexamethylenediamine market are the United States and Mexico. The North American hexamethylene diamine market is expanding due to the region's expanding automotive industry. The Asia-Pacific hexamethylenediamine market, on the other hand, is expected to grow at the fastest CAGR during the forecast period.

Hexamethylenediamine Market Players

The hexamethylenediaminemarket is dominated by a few globally established players such as BASF SE (Germany), Merck KGaA (Germany), TORAY INDUSTRIES, INC. (Japan), Evonik (Germany), and DuPont de Nemours, Inc.(US) among others.

Hexamethylenediamine Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Kiloton) |

|

Segments covered |

Application, End-Use Industry and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

The major players include BASF SE (Germany), DuPont de Nemours, Inc. (US), TORAY INDUSTRIES, INC. (Japan), Merck KGaA (Germany), and Asahi Kasei Corporation (Japan). (Total 20 companies) |

This research report categorizes the Hexamethylenediamine Market based on, application, end-use industry and region.

Hexamethylenediamine Market on the basis of Application:

- Nylon Synthesis

- Curing Agents

- Lubricants

- Biocides

- Intermediate for Coatings

- Adhesives

- Water Treatment Chemicals

- Others

Hexamethylenediamine Market on the basis of End-Use Industry:

- Automotive

- Textile

- Paint & Coatings

- Petrochemicals

- Others

Hexamethylenediamine Market on the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In March 2022, Asahi Kasei entered into a strategic partnership with Genomatica, Inc. to develop hexamethylenediamine from biomass (bio-hexamethylenediamine). Asahi Kasei currently uses hexamethylenediamine derived from fossil fuels as an intermediate in the production of Leona polyamide 661,2 (also known as nylon 6-6), an engineering plastic with exceptional heat resistance and rigidity. The strategic alliance with Genomatica grants Asahi Kasei preferential access to the early volume of bio-hexamethylenediamine to evaluate its potential as a polyamide 66 feedstock, allowing Asahi Kasei to accelerate trials of polyamide 66 made from biomass-derived intermediate.

- In February 2022, BASF SE began marketing several polyamides (PA) and polyphthalamide (PPA) grades in Europe after acquiring Solvay's PA66 business. These engineering plastics, formerly known as Technyl, will be sold by BASF under the well-known brand name Ultramid. Customers worldwide will benefit from a diverse plastics portfolio that includes both PA66 grades as well as Ultramid One J, a PPA based on PA66/6T. Thus, BASF will assist its customers in developing innovative plastics solutions across all industries, such as connectors and circuit breakers for E&E applications, consumer and household electronics, and autonomous driving and mobility.

- In January 2022, Ascend Performance Materials signed an investment agreement to build a new hexamethylene diamine and specialty chemicals plant in the Xuwei New Area Park in Lianyungang, China. The new plant will be Ascend's first chemical production facility and the company's largest investment outside of the US. The plant will manufacture hexamethylenediamine and specialty chemicals to support Ascend's global polyamide production and regional customers.

- In July 2021, Toray's Resins Technical Center established a new Automotive Center Europe (AMCEU) in the vicinity of Munich, Germany. Toray Resins Europe GmbH, which markets and sells high-performance resin compounds, will benefit from the new facility.

- In November 2020, INVISTA completed a 40,000-ton/year nylon 6-6 polymer capacity expansion at its Shanghai Chemical Industry Park polymer plant (SCIP). This expansion increased the plant's capacity to 190,000 tonnes per year. The additional polymer capacity is an important component of INVISTA's integrated nylon 6-6 value chain at SCIP, where it is also building a 215,000-ton/year hexamethylenediamine (hexamethylenediamine) plant and a 400,000-ton/year adiponitrile (ADN) plant.

Frequently Asked Questions (FAQ):

What is the current size of global hexamethylenediamine market?

The global hexamethylenediamine market size is projected to grow from USD 8.9 billion in 2022 to USD 11.6 billion by 2027, at a CAGR of 5.4% from 2022 to 2027.

How is the hexamethylenediamine market aligned?

The hexamethylene diamine market is consolidated, and have number of manufacturer operating at the regional, and domestic level. The market will continue to be consolidated and this consolidated action will increase over the forecast period.

Who are the key players in the global hexamethylenediamine market?

The key players operating in the hexamethylenediamine market, were BASF SE, Merck KGaA, TORAY INDUSTRIES, INC., Evonik, and DuPont de Nemours, Inc in 2021.

What are the latest ongoing trends in the hexamethylenediamine market?

The latest ongoing trends in the hexamethylene diamine market are increasing consumer preference in the automotive, textile, water treatment chemicals and other end-use industries.

What are some of the mandates in the hexamethylenediamine market?

The OSHA (Occupational Safety and Health Administration) is part of the US Department of Labor. The hexamethylenediamine market aims at adapting and complying with all the standards, rules, and regulations provided by OSHA. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 HEXAMETHYLENEDIAMINE MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

FIGURE 2 HEXAMETHYLENEDIAMINE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 HEXAMETHYLENEDIAMINE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 26)

FIGURE 7 NYLON SYNTHESIS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 AUTOMOTIVE SEGMENT TO BE LEADING END-USE INDUSTRY OF HEXAMETHYLENEDIAMINE DURING FORECAST PERIOD

FIGURE 9 NORTH AMERICA LED HEXAMETHYLENEDIAMINE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 29)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN HEXAMETHYLENEDIAMINE MARKET

FIGURE 10 MARKET IN ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

4.2 HEXAMETHYLENEDIAMINE MARKET, BY REGION

FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.3 NORTH AMERICAN HEXAMETHYLENEDIAMINE MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 12 US AND NYLON SYNTHESIS SEGMENT ACCOUNTED FOR LARGEST SHARES

4.4 HEXAMETHYLENEDIAMINE MARKET: BY KEY COUNTRIES

FIGURE 13 MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 32)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEXAMETHYLENEDIAMINE MARKET

5.2.1 DRIVERS

5.2.1.1 Extensive use in manufacturing nylon 66

5.2.1.2 Increasing demand for polyamides in 3D printing

5.2.2 RESTRAINTS

5.2.2.1 R&D to find replacement of hexamethylenediamine

5.2.2.2 Untapped growth potential in emerging economies

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of bio-based hexamethylenediamine

5.2.3.2 Growth opportunities in Asia Pacific

5.2.4 CHALLENGES

5.2.4.1 Slowdown in Chinese manufacturing sector

5.2.4.2 Environmental issues

6 INDUSTRY TRENDS (Page No. - 35)

6.1 PORTER'S FIVE FORCES ANALYSIS

FIGURE 15 PORTER'S FIVE FORCES ANALYSIS OF HEXAMETHYLENEDIAMINE MARKET

TABLE 1 HEXAMETHYLENEDIAMINE MARKET: PORTER'S FIVE FORCE ANALYSIS

6.1.1 THREAT OF NEW ENTRANTS

6.1.2 THREAT OF SUBSTITUTES

6.1.3 BARGAINING POWER OF SUPPLIERS

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 INTENSITY OF RIVALRY

6.2 MACROECONOMIC INDICATORS

6.2.1 INDUSTRY OUTLOOK

6.2.1.1 Automotive Industry Trends

TABLE 2 NUMBER OF CARS SOLD WORLDWIDE BETWEEN 2010 AND 2022

7 HEXAMETHYLENEDIAMINE MARKET, BY APPLICATION (Page No. - 39)

7.1 INTRODUCTION

FIGURE 16 HEXAMETHYLENEDIAMINE MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

TABLE 3 HEXAMETHYLENEDIAMINE MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 4 HEXAMETHYLENEDIAMINE MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

7.2 NYLON SYNTHESIS

7.2.1 USE OF HEXAMETHYLENEDIAMINE IN MANUFACTURING NYLON 66 TO DRIVE MARKET

TABLE 5 NYLON SYNTHESIS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 6 NYLON SYNTHESIS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.3 CURING AGENTS

7.3.1 USE OF HEXAMETHYLENEDIAMINE AS CURING AGENT FOR ELASTOMERS TO PROPEL MARKET

TABLE 7 CURING AGENTS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 8 CURING AGENTS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.4 LUBRICANTS

7.4.1 PROPERTY OF REDUCING FRICTION BETWEEN SURFACES TO TRIGGER MARKET GROWTH

TABLE 9 LUBRICANTS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 10 LUBRICANTS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.5 BIOCIDES

7.5.1 INCREASE IN DEMAND FOR CUSTOMIZED LABELS TO AUGMENT MARKET GROWTH

TABLE 11 BIOCIDES: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 BIOCIDES: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.6 INTERMEDIATE FOR COATINGS

7.6.1 USE OF HEXAMETHYLENE IN MARINE, INDUSTRIAL, AND CHEMICAL ENVIRONMENTS FOR COATINGS TO BOOST MARKET

TABLE 13 INTERMEDIATE FOR COATINGS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 14 INTERMEDIATE FOR COATINGS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.7 ADHESIVES

7.7.1 DEMAND FROM BUILDING & CONSTRUCTION, PAPER & PACKAGING, WOODWORKING, AND TRANSPORTATION INDUSTRIES TO PROPEL MARKET

TABLE 15 ADHESIVES: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 16 ADHESIVES: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.8 WATER TREATMENT CHEMICALS

7.8.1 USE OF HEXAMETHYLENEDIAMINE AS SCALE AND CORROSION INHIBITOR IN WATER TREATMENT CHEMICALS TO DRIVE MARKET

TABLE 17 WATER TREATMENT CHEMICALS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 WATER TREATMENT CHEMICALS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.9 OTHERS

TABLE 19 OTHER APPLICATIONS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 OTHER APPLICATIONS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8 HEXAMETHYLENEDIAMINE MARKET, BY END-USE INDUSTRY (Page No. - 49)

8.1 INTRODUCTION

FIGURE 17 HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2022 VS. 2027

TABLE 21 HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 22 HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

8.2 AUTOMOTIVE

8.2.1 GROWING DEMAND FOR NYLON-BASED PRODUCTS TO DRIVE MARKET IN THIS SEGMENT

8.2.2 INTERIOR

8.2.3 EXTERIOR

8.2.4 POWERTRAIN

TABLE 23 AUTOMOTIVE: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 AUTOMOTIVE: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.3 TEXTILE

8.3.1 WIDE USE OF HEXAMETHYLENEDIAMINE IN NYLON-BASED TEXTILES TO DRIVE MARKET

8.3.2 APPAREL

8.3.3 INDUSTRIAL CLOTHING

8.3.4 SEWING THREADS

TABLE 25 TEXTILE: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 TEXTILE: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.4 PAINTS & COATINGS

8.4.1 USE OF PAINTS & COATINGS TO IMPART SUBSTRATES WITH CORROSION AND ABRASION RESISTANCE TO SUPPORT MARKET GROWTH IN THIS SEGMENT

8.4.2 INDUSTRIAL

8.4.3 ARCHITECTURAL

8.4.4 SPECIALTY COATINGS

TABLE 27 PAINTS & COATINGS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 PAINTS & COATINGS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.5 PETROCHEMICALS

8.5.1 USE OF HEXAMETHYLENEDIAMINE FOR ENHANCING PERFORMANCE OF AUTOMOTIVE AND INDUSTRIAL PETROLEUM FUELS TO BE MARKET DRIVER

TABLE 29 PETROCHEMICALS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 PETROCHEMICALS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.6 OTHERS

8.6.1 ELECTRICAL & ELECTRONICS

8.6.2 AEROSPACE

TABLE 31 OTHERS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 OTHERS: HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

9 HEXAMETHYLENEDIAMINE MARKET, BY REGION (Page No. - 58)

9.1 INTRODUCTION

FIGURE 18 ASIA PACIFIC TO BE FASTEST-GROWING REGIONAL-LEVEL MARKET

TABLE 33 HEXAMETHYLENEDIAMINE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

9.2 NORTH AMERICA

FIGURE 19 NORTH AMERICA: HEXAMETHYLENEDIAMINE MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILO TON)

9.2.1 US

9.2.1.1 Dominating hexamethylenediamine market in North America

TABLE 41 US: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 42 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2.2 CANADA

9.2.2.1 Increasing demand from automotive and textile industries contributing to market growth

TABLE 43 CANADA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 44 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2.3 MEXICO

9.2.3.1 Increasing demand from automobile sector to drive market

TABLE 45 MEXICO: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 46 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3 EUROPE

FIGURE 20 EUROPE: HEXAMETHYLENEDIAMINE MARKET SNAPSHOT

TABLE 47 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 49 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 51 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Growth in electric vehicles sector to improve demand for hexamethylenediamine

TABLE 53 GERMANY: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 54 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.2 UK

9.3.2.1 FDI investment to enhance recovery of automotive sector

TABLE 55 UK: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 56 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.3 FRANCE

9.3.3.1 Government’s investment to revive automotive sector from impact of COVID-19 to help market growth

TABLE 57 FRANCE: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 58 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.4 ITALY

9.3.4.1 Growing end-use industries to drive market

TABLE 59 ITALY: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 60 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.5 RUSSIA

9.3.5.1 Investment in automotive sector to improve demand for hexamethylenediamine

TABLE 61 RUSSIA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 62 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.6 SPAIN

9.3.6.1 Increased focus on EVs and hybrid vehicles to drive market

TABLE 63 SPAIN: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 64 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.7 REST OF EUROPE

TABLE 65 REST IN EUROPE: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 66 REST IN EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4 ASIA PACIFIC

FIGURE 21 ASIA PACIFIC: HEXAMETHYLENEDIAMINE MARKET SNAPSHOT

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.1 CHINA

9.4.1.1 Increasing demand from automotive and textile sectors to boost market

TABLE 73 CHINA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 74 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.2 JAPAN

9.4.2.1 Automotive, electrical & electronics, petrochemicals, textile, and aerospace industries to drive market

TABLE 75 JAPAN: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 76 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.3 INDIA

9.4.3.1 Increasing use of hexamethylenediamine in nylon synthesis, adhesive manufacturing, and water treatment chemicals to drive market

TABLE 77 INDIA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 78 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.4 SOUTH KOREA

9.4.4.1 Growing electrical & electronics and textile industries to boost market

TABLE 79 SOUTH KOREA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 80 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.5 TAIWAN

9.4.5.1 Demand from paints & coatings, automotive, electrical & electronics, and textile industries to boost market

TABLE 81 TAIWAN: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 82 TAIWAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.6 REST OF ASIA PACIFIC

TABLE 83 REST OF ASIA PACIFIC: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5 MIDDLE EAST & AFRICA

TABLE 85 MIDDLE EAST & AFRICA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 87 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 89 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5.1 SOUTH AFRICA

9.5.1.1 Increased investment in manufacturing sector to drive demand

TABLE 91 SOUTH AFRICA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 92 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5.2 SAUDI ARABIA

9.5.2.1 Growing demand from automotive and petrochemicals end-use industries to drive market

TABLE 93 SAUDI ARABIA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 94 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 95 REST OF MIDDLE EAST & AFRICA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 96 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6 SOUTH AMERICA

TABLE 97 SOUTH AMERICA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 98 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 99 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 101 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 102 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Growing demand from automotive sector fueling market

TABLE 103 BRAZIL: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 104 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Government’s investments in manufacturing sector driving market

TABLE 105 ARGENTINA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 106 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6.3 REST OF SOUTH AMERICA

TABLE 107 REST OF SOUTH AMERICA: HEXAMETHYLENEDIAMINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 108 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 101)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 109 OVERVIEW OF STRATEGIES ADOPTED BY HEXAMETHYLENEDIAMINE MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 22 RANKING OF TOP FIVE PLAYERS IN HEXAMETHYLENEDIAMINE MARKET, 2021

10.3.2 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 110 HEXAMETHYLENEDIAMINE MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 23 HEXAMETHYLENEDIAMINE MARKET: MARKET SHARE ANALYSIS

10.3.2.1 BASF SE

10.3.2.2 Merck KGaA

10.3.2.3 Toray Industries, INC.

10.3.2.4 Evonik

10.3.2.5 DuPont de Nemours, Inc.

10.4 COMPANY EVALUATION QUADRANT (TIER 1)

10.4.1 STARS

10.4.2 PERVASIVE PLAYERS

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

FIGURE 24 HEXAMETHYLENEDIAMINE MARKET: COMPANY EVALUATION QUADRANT, 2021

10.5 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 STARTING BLOCKS

10.5.4 DYNAMIC COMPANIES

FIGURE 25 START-UP/SMES EVALUATION QUADRANT FOR HEXAMETHYLENEDIAMINE MARKET

10.6 COMPETITIVE BENCHMARKING

TABLE 111 HEXAMETHYLENEDIAMINE MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 112 HEXAMETHYLENEDIAMINE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]: BY APPLICATION

TABLE 113 HEXAMETHYLENEDIAMINE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]: BY END-USE INDUSTRY

TABLE 114 HEXAMETHYLENEDIAMINE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]: BY REGION

10.7 COMPETITIVE SITUATION AND TRENDS

TABLE 115 HEXAMETHYLENEDIAMINE MARKET: NEW PRODUCT DEVELOPMENT (2019–2022)

TABLE 116 HEXAMETHYLENEDIAMINE MARKET: DEALS (2019–2022)

11 COMPANY PROFILES (Page No. - 114)

11.1 MAJOR PLAYERS

(Business Overview, Products, Solutions & Services, Recent Developments, MnM View)*

11.1.1 BASF SE

TABLE 117 BASF SE: COMPANY OVERVIEW

FIGURE 26 BASF SE.: COMPANY SNAPSHOT

11.1.2 DUPONT DE NEMOURS, INC.

TABLE 118 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

FIGURE 27 DUPONT DE NEMOURS, INC..: COMPANY SNAPSHOT

11.1.3 TORAY INDUSTRIES, INC.

TABLE 119 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 28 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

11.1.4 MERCK KGAA

TABLE 120 MERCK KGAA: COMPANY OVERVIEW

FIGURE 29 MERCK KGAA: COMPANY SNAPSHOT

11.1.5 ASAHI KASEI CORPORATION

TABLE 121 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

FIGURE 30 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

11.1.6 EVONIK

TABLE 122 EVONIK: COMPANY OVERVIEW

FIGURE 31 EVONIK: COMPANY SNAPSHOT

11.1.7 ASHLAND

TABLE 123 ASHLAND: COMPANY OVERVIEW

FIGURE 32 ASHLAND: COMPANY SNAPSHOT

11.1.8 INVISTA

TABLE 124 INVISTA: COMPANY OVERVIEW

11.1.9 ASCEND PERFORMANCE MATERIALS

TABLE 125 ASCEND PERFORMANCE MATERIALS: COMPANY OVERVIEW

11.1.10 LANXESS

TABLE 126 LANXESS: COMPANY OVERVIEW

FIGURE 33 LANXESS: COMPANY SNAPSHOT

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 ADDITIONAL PLAYERS

11.2.1 DAEJUNG CHEMICALS & METALS CO.,LTD.

11.2.2 ITALMATCH CHEMICALS

11.2.3 GENOMATICA

11.2.4 JUNSEI CHEMICAL CO.,LTD.

11.2.5 ALFA AESAR

11.2.6 SINOPHARM CHEMICAL REAGENT CO. LTD.

11.2.7 ALADDIN INDUSTRIAL CORPORATION

11.2.8 SHENMA INDUSTRIAL CO., LTD. (SHENMA CORPORATION)

11.2.9 SUZHOU SIBIAN CHEMICALS CO., LTD.

11.2.10 MERYER (SHANGHAI) CHEMICAL TECHNOLOGY CO., LTD.

12 APPENDIX (Page No. - 144)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities for estimating the current global size of the hexamethylenediamine Market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of Hexamethylenediamine through primary research. The supply-side approach was employed to estimate the overall size of the Hexamethylenediamine Market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the Hexamethylenediamine Market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

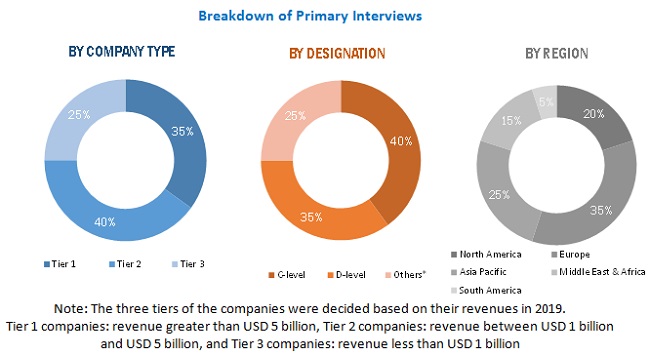

Various primary sources from both the supply and demand sides of the Hexamethylenediamine Market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the Hexamethylenediamine Market industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

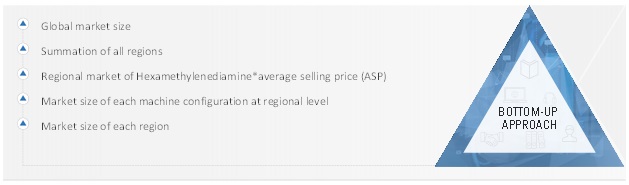

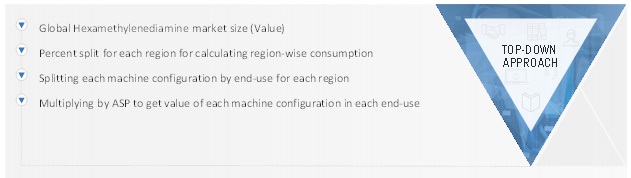

The bottom-up and top-down approaches have been used to estimate the Hexamethylenediamine Market market by applications, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players of each type in the Hexamethylenediamine Market market have been identified through secondary research, and their revenues have been determined through primary and secondary research.

- The market size of the Hexamethylenediamine Market market has been derived from the aggregation of the market shares of the leading players in each machine configuration. The forecast is based on an analysis of market trends, such as the pricing and consumption of Hexamethylenediamine Market

- The market size of Hxamethylenediamine Market by region has been calculated by using the market sizes of each machine configuration in each end-use.

- In terms of value, the market size for Hexamethylenediamine Market for each end-user has been calculated by multiplying the average price of the machine configurations with their volumes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Hexamethylenediamine Market Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Hexamethylenediamine Market Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the Hexamethylenediamine Market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the Hexamethylenediamine Market in terms of value and volume based on application, end-use industry, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments & expansions, and merger & acquisitions, in the Hexamethylenediamine Market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the Hexamethylenediamine Market report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the Hexamethylenediamine Market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hexamethylenediamine Market