High Strength Steel Market by Type (High Strength Low Alloy, Dual Phase, Bake Hardenable, Carbon Manganese), End-Use Industry (Automotive, Yellow Goods & Mining Equipment, Construction, Aviation & Marine), and Region - Global Forecast to 2023

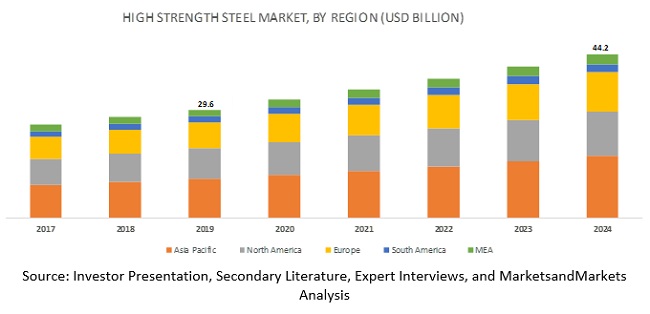

The high strength steel market is projected to reach USD 44.2 billion by 2024, at a CAGR of 8.4%. Increasing consumption of high strength steels in the automotive and construction industries to improve the fuel efficiency of automobiles and ensure high strength and improved safety features of buildings is driving the growth of the high strength steel market across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

By type, the high strength low alloy segment is projected to lead the high strength steel market during the forecast period

The high strength low alloy type segment is expected to lead the high strength steel market in 2018. The growth of this segment of the market can be attributed to the increased demand for high strength low alloy steels from the automotive industry. High strength low alloy steels are the most widely used steels in various end-use industries as they offer superior mechanical properties such as high corrosion resistance, increased formability, and excellent weldability, among others.

The automotive end-use industry segment is expected to lead the high strength steel market during the forecast period

Among end-use industries, the automotive segment is expected to lead the high strength steel market in 2018. The growth of the automotive end-use industry segment of the high strength steel market can be attributed to the increased demand for high strength steels from the automotive industry. It is expected that the amount of high strength steels used in the production of automobiles will be more than double in the next 15 years. The increase in the global automobile production is a major factor leading to the growth of the automotive end-use industry segment of the high strength steel market across the globe. The use of high strength steels for manufacturing body panels of automobiles results in an increase in their fuel efficiency by reducing their weight by approximately 60%. This, in turn, contributes to the growing demand for high strength steels from the automotive industry. The increasing demand for electric and hybrid vehicles across the globe is also expected to contribute towards the growth of the high strength steel market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region is projected to be the largest market for high strength steels during the forecast period.

The Asia Pacific region is the largest consumer of high strength steels across the globe, and this trend is projected to continue during the forecast period as well. The growth of the Asia Pacific high strength steel market can be attributed to the economic growth of emerging economies such as China, India, and Taiwan, among others. Increasing production of the manufacturing sector of the Asia Pacific region to cater to the domestic requirements for superior quality products and rising exports from the region are factors leading to an increased demand for high strength steels from the region.

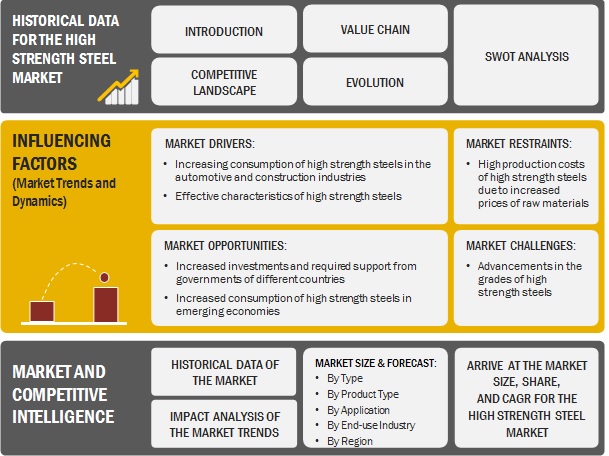

Market Dynamics

Driver: Increasing consumption of high strength steels in the automotive and construction industries

The increase in the global automobile production is a major factor leading to the growth of the high strength steel market across the globe. The use of high strength steels for manufacturing body panels of automobiles increases their fuel efficiency by reducing their weight by approximately 60%. This, in turn, contributes to the growing demand for high strength steels from the automotive industry. The increasing demand for electric and hybrid vehicles across the globe is also expected to contribute towards the growth of the high strength steel market during the forecast period.

The construction industry across the globe is also witnessing growth in the commercial and residential sectors. Factors such as improved employment opportunities, increased per capita income of masses, and adoption of luxurious lifestyle by the middle-class population are expected to drive the growth of the construction industry across the globe. This leads to the increased demand for high strength steels from the construction industry as high strength steels ensure reduced product thickness, enable improved toughness of products at low temperatures, and ensure their high-yield strengths. Moreover, these steels also have outstanding weldability.

The extensive use of high strength steels in the automotive and construction industries is driving the growth of the high strength steel market across the globe. The increased demand for high strength steels has resulted in the increased production of high strength steels across the globe.

Restraint: High production costs of high strength steels due to increased prices of raw materials

Increasing iron ore prices across the globe are strongly affecting the prices of steels. Prices of iron ore increased by 20% to 22% in the 4th quarter of 2017, thereby leading to increased production costs of steels. The cost of manufacturing high strength steels is higher as compared to other steels made from conventional materials. This is a major restraint for the manufacturers of high strength steels. Presently, high strength steels are used in the automotive industry for manufacturing luxury, premium, and performance vehicles, while the usage percentage of high strength steels is only about 10% to 13% in the overall automotive production across the globe.

Opportunity: Increased investments and required support from governments of different countries

Increasing investments by governments of various countries offer flexibility and support to the manufacturers of high strength steels across the globe. For instance, in 2015, the Government of China undertook an initiative to upgrade key steel producers of the country by enabling them to improve their steel production techniques to ensure improved quality products. Moreover, in February 2018, the Welsh Government offered an R&D funding of USD 81.4 million for sites of Tata Steel (India) in Port Talbot and Llanwern to improve the quality of high strength steels produced at these sites.

The rules and regulations related to the steel industry in emerging economies such as India, China, and Brazil are not as stringent as those in the US and Western European countries. Various new steel plants are expected to be established in these countries in future, which, in turn, are expected to fuel the growth of the high strength steel market in these countries. For instance, the Bharat New Vehicle Safety Assessment Program (BNVSAP), which mandates all new cars manufactured in India from October 2018 onwards, to undergo various safety tests to ensure that they adhere to the required safety norms. Government agencies of different countries are also making efforts to reduce carbon emissions from vehicles. As such, they are funding a number of R&D activities to develop new materials that reduce the weight of vehicles.

Challenge: Advancements in the grades of advanced high strength steels and ultra-high strength steels

Over the last 50 years, continuous advancements in steels or steel grades have taken place across the globe. The need for steels, which are strong and safe, and have a powerful impact is ever increasing. This has led to the introduction of various steel grades such as conventional steels, high strength steels, advanced high strength steels, ultra-high strength steels, and giga steels, among others, which offer advanced characteristics. Hence, continuous advancements in different types of steel grades are expected to restrain the growth of the high strength steel market across the globe.

Moreover, growing safety concerns related to the automotive crash and accidents among consumers act as a challenge for the manufacturers of the automobiles and as such, these concerns need to be addressed by them before using high strength steels for manufacturing automobiles. Safety regulations have accelerated the use or incorporation of Advanced High Strength Steels (AHSS) in vehicles, thereby posing a challenge to the growth of the high strength steel market across the globe. The National Highway Traffic Safety Administration (NHTSA) of the US has set the standards for safety of vehicles to ensure high impact resistance and fuel economy. Various kinds of testing by the Insurance Institute for Highway Safety (IIHS) of the US have encouraged improved frontal and rear impact ratings of automobiles as well as improvement in their roof strength. Meeting all these standards often result in the increased weight of vehicles, which, in turn, can increase the production costs of vehicles.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

High Strength Steel Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2019 |

USD 29.6 billion |

|

Revenue Forecast in 2024 |

USD 44.2 billion |

|

CAGR |

8.4% |

|

Market size available for years |

20192024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Volume (Kilotons) and Value (USD Billion) |

|

Segments covered |

Type (High Strength Low Alloy, Dual Phase, Bake Hardenable, Carbon Manganese, And Others), By Product Type (Cold rolled, Hot rolled, Metallic coated, Direct rolled), Application (Body and Closures, Suspensions, Bumper and Intrusion Beams and other), End-Use Industry (Automotive, Construction, Yellow Goods & Mining Equipment, Aviation & Marine, And Others), And Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and South America |

|

Companies covered |

Voestalpine AG (Austria), POSCO Group (South Korea), ArcelorMittal S.A. (Luxembourg), SSAB AB (Sweden), Nippon Steel & Sumitomo Metal Corporation (Japan), Tata Steel (India), Steel Authority of India Limited (India), United States Steel Corporation (US), Baosteel Group Corporation (China), Severstal JSC (Russia), ThyssenKrupp AG (Germany), JFE Steel Corporation (Japan), Nucor Corporation (US), and JSW Steel (India), among others |

The research report categorizes the high strength steel market to forecast the revenues and analyze the trends in each of the following sub-segments:

High strength steel Market, by Type:

- High Strength Low Alloy

- Dual Phase

- Bake Hardenable

- Carbon Manganese

- Others

High strength steel Market, by Product Type:

- Cold rolled

- Hot rolled

- Metallic coated

- Direct rolled

High strength steel Market, by Application:

- Body and Closures

- Suspensions

- Bumper and Intrusion Beams

- Others

High strength steel Market, by End-use Industry:

- Automotive

- Construction

- Yellow Goods & Mining Equipment

- Aviation & Marine

- Others

High strength steel Market, by Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Key Market Players in High Strength Steel Market

Voestalpine AG (Austria), POSCO Group (South Korea), ArcelorMittal S.A. (Luxembourg), SSAB AB (Sweden), Nippon Steel & Sumitomo Metal Corporation (Japan), Tata Steel (India), United States Steel Corporation (US), Steel Authority of India Limited (India), Baosteel Group Corporation (China), Severstal JSC (Russia), ThyssenKrupp AG (Germany), JFE Steel Corporation (Japan), Nucor Corporation (US), and JSW Steel (India), among others.

Recent Developments

- In February, 2018, Tata Steel (India) has expanded its Hot Strip Mill at Port Talbot by investing more than USD 17.0 million to increase its annual production capacity of steels by 5%. This expansion aims at enabling the company to produce high-value steels for its customers.

- In December 2017, Nippon Steel & Sumitomo Metal Corporation (NSSMC) (Japan) merged its subsidiary, Nippon Steel & Sumikin Koutetsu Wakayama Corporation (NSSKW) (Japan) with itself. This merger helped NSSMC in enhancing its upstream ironmaking and steelmaking operations.

- In December 2017, Steel Authority of India Limited (SAIL) (India) supplied approximately 55,000 metric tons of steel to Delhi Metro for its Magenta Line. The company is also supplying Thermo Mechanical Treatment (TMT) plates and structural plates to Delhi Metro

- In November 2017, SSAB AB (Sweden), in joint collaboration with Gestamp (Spain) (which is an automotive component manufacturer), developed Docol PHS 2000. Docol PHS 2000 offers high tensile strength. It is used in the automotive industry to develop bumpers.

- In September 2017, Voestalpine AG (Austria) invested USD 425.0 million in expanding its existing steel plant in Kapfenberg (Austria). This investment enabled the company to offer high-quality products manufactured by using new technologies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Premium Insights (Page No. - 29)

3.1 The High Strength Steel Market is Expected to Witness Significant Growth Between 2018 and 2023

3.2 Market, By Region

3.3 Market, By Type and End-Use Industry

3.4 Market, By Type

3.5 Market, By Region

3.6 Market: Emerging vs Developed Economies

4 Executive Summary (Page No. - 33)

4.1 Market, By Type

4.2 Market, By Region

4.3 Market, By End-Use Industry

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Consumption of High Strength Steels in the AutomotiveAnd Construction Industries

5.2.1.2 Effective Characteristics of High Strength Steels

5.2.2 Restraints

5.2.2.1 High Production Costs of High Strength Steels Due to Increased Prices of Raw Materials

5.2.3 Opportunities

5.2.3.1 Increased Investments and Required Support From GovernmentsOf Different Countries

5.2.3.2 Increased Consumption of High Strength Steels in Emerging Economies

5.2.4 Challenges

5.2.4.1 Advancements in the Grades of Advanced High Strength SteelsAnd Ultra-High Strength Steels

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 High Strength Steel Market, By Type (Page No. - 46)

6.1 Introduction

6.2 High Strength Low Alloy (HSLA)

6.3 Dual Phase (DP)

6.4 Bake Hardenable (BH)

6.5 Carbon Manganese (CMN)

6.6 Others

7 High Strength Steel Market, By End-Use Industry (Page No. - 56)

7.1 Introduction

7.2 Automotive

7.3 Construction

7.4 Yellow Goods & Mining Equipment

7.5 Aviation & Marine

7.6 Others

8 Regional Analysis (Page No. - 69)

8.1 Introduction

8.2 Asia Pacific

8.2.1 China

8.2.2 India

8.2.3 Japan

8.2.4 South Korea

8.2.5 Taiwan

8.2.6 Australia

8.2.7 Rest of Asia Pacific

8.3 North America

8.3.1 US

8.3.2 Mexico

8.3.3 Canada

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 UK

8.4.4 Belgium

8.4.5 Russia

8.4.6 Italy

8.4.7 Spain

8.4.8 Rest of Europe

8.5 Middle East & Africa

8.5.1 Iran

8.5.2 South Africa

8.5.3 Saudi Arabia

8.5.4 UAE

8.5.5 Rest of the Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

9 Competitive Landscape (Page No. - 119)

9.1 Introduction

9.1.1 Expansions: the Most Popular Growth Strategy

9.2 Posco Group (South Korea): the Most Active Player in the High Strength Steel Market Between January 2012 and February 2018

9.3 Competitive Situations & Trends

9.3.1 Expansions

9.3.2 New Product Developments

9.3.3 Agreements, Contracts, and Collaborations

9.3.4 Mergers & Acquisitions

9.3.5 Divestments

9.3.6 Joint Ventures

10 Company Profiles (Page No. - 135)

(Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Introduction

10.2 Arcelormittal S.A.

10.3 United States Steel Corporation

10.4 Baosteel Group Corporation

10.5 SSAB AB

10.6 Voestalpine AG

10.7 Posco Group

10.8 Nippon Steel & Sumitomo Metal Corporation

10.9 Steel Authority of India Limited

10.10 Tata Steel

10.11 Angang Steel Company Limited

*Details on Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

10.12 Other Companies

10.12.1 Hebei Puyong Iron and Steel Group Co., Ltd.

10.12.2 Jiangsu Shagang International Trade Co., Ltd.

10.12.3 JFE Steel Corporation

10.12.4 Nucor Corporation

10.12.5 China Steel Corporation

10.12.6 Thyssenkrupp Ag

10.12.7 Metinvest Holding, LLC

10.12.8 PAO Severstal

10.12.9 JSW Steel

10.12.10 Novolipetsk Steel (NIMK)

10.12.11 Gerdau S.A.

10.12.12 Citic

10.12.13 Hyundai Steel Company

10.12.14 Wuhan Iron and Steel Corporation

10.12.15 Shandong Iron and Steel Group

11 Appendix (Page No. - 170)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (113 Tables)

Table 1 Top 20 Countries of the World With High Automotive ProductionIn 2016

Table 2 High Strength Steel Market, By Type, 2016-2023 (Kilo Tons)

Table 3 High Strength Steel Market, By Type, 2016-2023 (USD Billion)

Table 4 High Strength Low Alloy Steel Market, By Region, 2016-2023 (Kilo Tons)

Table 5 High Strength Low Alloy Steel Market, By Region,2018-2023 (USD Million)

Table 6 Market of Dual Phase High Strength Steel, By Region,2016-2023 (Kilo Tons)

Table 7 Market of Dual Phase High Strength Steel, By Region,2016-2023 (USD Million)

Table 8 Market of Bake Hardenable High Strength Steel, By Region,2016-2023 (Kilo Tons)

Table 9 Market of Bake Hardenable High Strength Steel, By Region,2016-2023 (USD Million)

Table 10 Market of Carbon Manganese High Strength Steel, By Region,2016-2023 (Kilo Tons)

Table 11 Market of Carbon Manganese High Strength Steel, By Region,2016-2023 (USD Million)

Table 12 Market of Others High Strength Steel, By Region, 2016-2023 (Kilo Tons)

Table 13 Market of Others High Strength Steel, By Region, 20162023 (USD Million)

Table 14 High Strength Steel Market, By End-Use Industry, 2016-2023 (Kilo Tons)

Table 15 High Strength Steel Market, By End-Use Industry,2016-2023 (USD Billion)

Table 16 High Strength Steel Market for Automotive, By Region,2016-2023 (Kilo Tons)

Table 17 High Strength Steel Market for Automotive, By Region,2016-2023 (USD Million)

Table 18 High Strength Steel Market for Construction, By Region,2016-2023 (Kilo Tons)

Table 19 High Strength Steel Market for Construction, By Region,2016-2023 (USD Million)

Table 20 High Strength Steel Market for Yellow Goods & Mining Equipment,By Region, 2016-2023 (Kilo Tons)

Table 21 High Strength Steel Market for Yellow Goods & Mining Equipment,By Region, 2016-2023 (USD Million)

Table 22 High Strength Steel Market for Aviation & Marine, By Region,2016-2023 (Kilo Tons)

Table 23 High Strength Steel Market for Aviation & Marine, By Region,2016-2023 (USD Million)

Table 24 High Strength Steel Market for Other End-Use Industries, By Region, 2016-2023 (Kilo Tons)

Table 25 High Strength Steel Market for Other End-Use Industries, By Region, 20162023 (USD Million)

Table 26 High Strength Steel Market, By Region, 20162023 (Kilo Tons)

Table 27 High Strength Steel Market, By Region, 20162023 (USD Million)

Table 28 Asia Pacific Market, By Country,2016-2023 (Kilo Tons)

Table 29 Asia Pacific Market, By Country,2016-2023 (USD Million)

Table 30 Asia Pacific Market, By Type, 2016-2023 (Kilo Tons)

Table 31 Asia Pacific Market, By Type,2016-2023 (USD Million)

Table 32 Asia Pacific Market, By End-Use Industry,2016-2023 (Kilo Tons)

Table 33 Asia Pacific Market, By End-Use Industry,2016-2023 (USD Million)

Table 34 China Market, By End-Use Industry,20162023 (Kilo Tons)

Table 35 China Market, By End-Use Industry,20162023 (USD Million)

Table 36 India Market, By End-Use Industry,20162023 (Kilo Tons)

Table 37 India Market, By End-Use Industry,20162023 (USD Million)

Table 38 Japan Market, By End-Use Industry,20162023 (Kilo Tons)

Table 39 Japan Market, By End-Use Industry,20162023 (USD Million)

Table 40 South Korea Market, By End-Use Industry,20162023 (Kilo Tons)

Table 41 South Korea Market, By End-Use Industry,20162023 (USD Million)

Table 42 Taiwan Market, By End-Use Industry,20162023 (Kilo Tons)

Table 43 Taiwan Market, By End-Use Industry,20162023 (USD Million)

Table 44 Australia Market, By End-Use Industry,20162023 (Kilo Tons)

Table 45 Australia Market, By End-Use Industry,20162023 (USD Million)

Table 46 Rest of Asia Pacific Market, By End-Use Industry, 20162023 (Kilo Tons)

Table 47 Rest of Asia Pacific Market, By End-Use Industry, 20162023 (USD Million)

Table 48 North America Market, By Country,2016-2023 (Kilo Tons)

Table 49 North America Market, By Country,2016-2023 (USD Million)

Table 50 North America Market, By Type,2016-2023 (Kilo Tons)

Table 51 North America Market, By Type,2016-2023 (USD Million)

Table 52 North America Market, By End-Use Industry,2016-2023 (Kilo Tons)

Table 53 North America Market, By End-Use Industry,2016-2023 (USD Million)

Table 54 US Market, By End-Use Industry,20162023 (Kilo Tons)

Table 55 US Market, By End-Use Industry,20162023 (USD Million)

Table 56 Mexico Market, By End-Use Industry,20162023 (Kilo Tons)

Table 57 Mexico Market, By End-Use Industry,20162023 (USD Million)

Table 58 Canada Market, By End-Use Industry,20162023 (Kilo Tons)

Table 59 Canada Market, By End-Use Industry,20162023 (USD Million)

Table 60 Europe Market, By Country, 2016-2023 (Kilo Tons)

Table 61 Europe Market, By Country,2016-2023 (USD Million)

Table 62 Europe Market, By Type, 2016-2023 (Kilo Tons)

Table 63 Europe Market, By Type, 2016-2023 (USD Million)

Table 64 Europe Market, By End-Use Industry,2016-2023 (Kilo Tons)

Table 65 Europe Market, By End-Use Industry,2016-2023 (USD Million)

Table 66 Germany Market, By End-Use Industry,20162023 (Kilo Tons)

Table 67 Germany Market, By End-Use Industry,20162023 (USD Million)

Table 68 France Market, By End-Use Industry,20162023 (Kilo Tons)

Table 69 France Market, By End-Use Industry,20162023 (USD Million)

Table 70 UK Market, By End-Use Industry,20162023 (Kilo Tons)

Table 71 UK Market, By End-Use Industry,20162023 (USD Million)

Table 72 Belgium Market, By End-Use Industry,20162023 (Kilo Tons)

Table 73 Belgium Market, By End-Use Industry,20162023 (USD Million)

Table 74 Russia Market, By End-Use Industry,20162023 (Kilo Tons)

Table 75 Russia Market, By End-Use Industry,20162023 (USD Million)

Table 76 Italy Market, By End-Use Industry,20162023 (Kilo Tons)

Table 77 Italy Market, By End-Use Industry,20162023 (USD Million)

Table 78 Spain Market, By End-Use Industry,20162023 (Kilo Tons)

Table 79 Spain Market, By End-Use Industry,20162023 (USD Million)

Table 80 Rest of Europe Market, By End-Use Industry, 20162023 (Kilo Tons)

Table 81 Rest of Europe Market, By End-Use Industry, 20162023 (USD Million)

Table 82 Middle East & Africa Market, By Country,2016-2023 (Kilo Tons)

Table 83 Middle East & Africa Market, By Country,2016-2023 (USD Million)

Table 84 Middle East & Africa Market, By Type,2016-2023 (Kilo Tons)

Table 85 Middle East & Africa Market, By Type,2016-2023 (USD Million)

Table 86 Middle East & Africa Market, By End-Use Industry, 2016-2023 (Kilo Tons)

Table 87 Middle East & Africa Market, By End-Use Industry, 2016-2023 (USD Million)

Table 88 Iran Market, By End-Use Industry,20162023 (Kilo Tons)

Table 89 Iran Market, By End-Use Industry,20162023 (USD Million)

Table 90 South Africa Market, By End-Use Industry,20162023 (Kilo Tons)

Table 91 South Africa Market, By End-Use Industry,20162023 (USD Million)

Table 92 Saudi Arabia Market, By End-Use Industry,20162023 (Kilo Tons)

Table 93 Saudi Arabia Market, By End-Use Industry,20162023 (USD Million)

Table 94 UAE Market, By End-Use Industry,20162023 (Kilo Tons)

Table 95 UAE Market, By End-Use Industry,20162023 (USD Million)

Table 96 Rest of the Middle East & Africa Market,By End-Use Industry, 20162023 (Kilo Tons)

Table 97 Rest of the Middle East & Africa Market,By End-Use Industry, 20162023 (USD Million)

Table 98 South America Market, By Country,2016-2023 (Kilo Tons)

Table 99 South America Market, By Country,2016-2023 (USD Million)

Table 100 South America Market, By Type,2016-2023 (Kilo Tons)

Table 101 South America Market, By Type,2016-2023 (USD Million)

Table 102 South America Market, By End-Use Industry,2016-2023 (Kilo Tons)

Table 103 South America Market, By End-Use Industry,2016-2023 (USD Million)

Table 104 Brazil Market, By End-Use Industry,20162023 (Kilo Tons)

Table 105 Brazil Market, By End-Use Industry,20162023 (USD Million)

Table 106 Argentina Market, By End-Use Industry,20162023 (Kilo Tons)

Table 107 Argentina Market, By End-Use Industry,20162023 (USD Million)

Table 108 Expansions, January 2012 and February 2018

Table 109 New Product Developments, January 2012 and February 2018

Table 110 Agreements, Contracts, and Collaborations, January2012 and February 2018

Table 111 Mergers & Acquisitions, January 2012 and February 2018

Table 112 Divestments, January 2012 and February 2018

Table 113 Joint Ventures, January 2012 and February 2018

List of Figures (53 Figures)

Figure 1 High Strength Steel Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation,And Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 The Automotive End-Use Industry is Expected to Drive the Demand for High Strength Steels Between 2018 and 2023

Figure 8 The Asia Pacific Region is Expected to Be the Key Market for High Strength Steels Between 2018 and 2023

Figure 9 The Automotive End-Use Industry Segment and the High Strength Low Alloy Steel Type Segment Accounted for the Large 2017

Figure 10 The High Strength Low Alloy Type Segment is Projected to Lead the Market of High Strength Steel Between 2018 and 2023

Figure 11 The Asia Pacific Market of High Strength Steel is Expected to Grow at Highest CAGR in Terms of Volume Between 2018 and 2023

Figure 12 China is Projected to Emerge as A Lucrative Market for High Strength Steels Between 2018 and 2023

Figure 13 The High Strength Low Alloy Type Segment is Expected to Lead the Market of High Strength Steel From 2018 to 2023

Figure 14 The Asia Pacific Market of High Strength Steel is Projected to Grow at the Highest CAGR, in Terms of Value Between 2018 and 2023

Figure 15 Market, By End-Use Industry,2018-2023 (USD Billion)

Figure 16 Dynamics of the High Strength Steel Market

Figure 17 Porters Five Forces Analysis

Figure 18 The High Strength Low Alloy Type Segment is Projected to Lead the Market of High Strength Steel From 2018 to 2023

Figure 19 The High Strength Low Alloy Type Segment of the Asia Pacific Market of High Strength Steel is Projected to Grow at the Highest CAGR From 2023

Figure 20 The Asia Pacific Region is Expected to Lead the Dual Phase Type Segment of the High Strength Steel Market in 2018

Figure 21 The Asia Pacific Region is Expected to Lead the Bake Hardenable Type Segment of the High Strength Steel Market in 2018

Figure 22 The North American Region is Expected to Lead the Carbon Manganese Type Segment of the High Strength Steel Market in 2018

Figure 23 The Other Types Segment of the Asia Pacific Market of High Strength Steel is Projected to Grow at the Highest CAGR Between2018 and 2022

Figure 24 The Automotive End-Use Industry Segment is Projected to Lead the Market of High Strength Steel From 2018 to 2023

Figure 25 The Automotive End-Use Industry Segment of the Asia Pacific Market of High Strength Steel is Projected to Grow at the Highest CAGR 57

Figure 26 The Asia Pacific Region is Projected to Lead the Construction End-Use Industry Segment of the High Strength Steel Market From2018 to 2023

Figure 27 The Asia Pacific Region is Expected to Lead the Yellow Goods & Mining Equipment End-Use Industry Segment of the High Strength Steel in 2018

Figure 28 The North American Region is Projected to Lead the Aviation & Marine End-Use Industry Segment of the High Strength Steel Market from to 2023

Figure 29 The Others End-Use Industry Segment of the Asia Pacific Market of High Strength Steel is Projected to Grow at the Highest Between 2018 and 2023

Figure 30 High Strength Steel Market, By Region, 2017

Figure 31 Asia Pacific Market Snapshot

Figure 32 North America Market Snapshot

Figure 33 Europe Market Snapshot

Figure 34 Middle East & Africa Market Snapshot

Figure 35 South America Market Snapshot

Figure 36 Expansions Were the Most Preferred Strategy By the Key Companies Between January 2012 and February 2018

Figure 37 Battle for Market Shares: Expansions Were the Key Strategy Adopted By Market Players Between January 2012 and February 2018

Figure 38 Shares of Growth Strategies in the Market of High Strength Steel, By Company, January 2012 - February 2018

Figure 39 Regional Revenue Mix of the Top Five Market Players of the High Strength Steel Market Between 2012 and 2017

Figure 40 Arcelormittal S.A.: Company Snapshot

Figure 41 SWOT Analysis

Figure 42 United States Steel Corporation: Company Snapshot

Figure 43 SWOT Analysis

Figure 44 SSAB AB: Company Snapshot

Figure 45 Voestalpine Ag: Company Snapshot

Figure 46 SWOT Analysis

Figure 47 Posco Group: Company Snapshot

Figure 48 SWOT Analysis

Figure 49 Nippon Steel & Sumitomo Metal Corporation: Company Snapshot

Figure 50 Steel Authority of India Limited: Company Snapshot

Figure 51 SWOT Analysis

Figure 52 Tata Steel: Company Snapshot

Figure 53 SWOT Analysis

Growth opportunities and latent adjacency in High Strength Steel Market

The client is an NGO focused on advancement of advanced high-strength. Just wants the report brochure.

General information on High Strength Steel Market

General information on patents

Specific information on flat steel plates, its grades in Middle East and specifically in GCC

market size for Punches & Dies, Tool Industry and imports to India for HSS & Powder metallurgy with Company Names

Market information on high Strength Steel for the automotive industry focusing on India, Korea, China, Japan