HVDC Transmission Market Size, Share & Trends

HVDC Transmission Market by LCC, VSC, CCC, Converter Stations, Transmission Cables, Point-to-Point Transmission, Back-to-Back Stations, Multi Terminal Systems, Bulk Power Transmission and Interconnecting Grids - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The HVDC transmission market is projected to grow from USD 15.62 billion in 2025 to USD 22.07 billion in 2030, at a CAGR of 7.2% during the forecast period. The major factors driving market growth are integrating VSC technology into HVDC systems, rapid transition toward renewable energy, and a strong focus of governments and utilities on grid modernization to improve power reliability. In addition, constant advances in power electronics and the adoption of digital and automation technologies, the electrification of the transportation sector, and growing demand for integrated networks across long distances provide ample opportunities for the market players.

KEY TAKEAWAYS

- By Region, Asia Pacific HVDC transmission market accounted for 38.6% revenue share in 2024.

- By technology, the LCC-based HVDC systems segment is expected to dominate the market.

- By component, the converter stations segment is expected to register a CAGR of 7.3%.

- By application, the infeed urban areas segment is expected to witness the fastest growth in the HVDC transmission market.

- Hitachi Ltd., Siemens Energy, and GE Vernova were identified as some of the star players in the global HVDC transmission market, given their strong market share and product footprint.

- Hyosung Heavy Industries, EFACEC, and TBEA Co., Ltd. among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

- By Region, Asia Pacific HVDC transmission market accounted for 38.6% revenue share in 2024.

- By technology, the LCC-based HVDC systems segment is expected to dominate the market.

- By component, the converter stations segment is expected to register a CAGR of 7.3%.

- By application, the infeed urban areas segment is expected to witness the fastest growth in the HVDC transmission market.

- Hitachi Ltd., Siemens Energy, and GE Vernova were identified as some of the star players in the global HVDC transmission market, given their strong market share and product footprint.

- Hyosung Heavy Industries, EFACEC, and TBEA Co., Ltd. among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The HVDC transmission industry is expected to witness substantial growth in the coming years, driven by the increasing demand for long-distance and high-capacity power transmission, integration of renewable energy sources, and the modernization of aging power grids. Utilities and grid operators are increasingly deploying advanced HVDC solutions, including voltage-source converters (VSC), hybrid HVDC systems, and modular multilevel converters, to enhance grid reliability, efficiency, and stability. Rising investments in cross-border interconnections, offshore wind projects, and large-scale renewable integration, coupled with supportive government policies and decarbonization initiatives, are further accelerating market growth. With its ability to reduce transmission losses, optimize energy flow, and enable flexible grid management, HVDC technology is emerging as a critical enabler for the global transition toward a sustainable and resilient power infrastructure.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The HVDC transmission market is undergoing a significant revenue transformation, driven by the shift from legacy LCC and CCC systems to advanced VSC-based architectures with integrated smart monitoring and control. Manufacturers increasingly focus on developing compact, offshore-ready, digitally connected components to meet evolving grid demands. EPCs (Engineering, Procurement, and Construction) and TSOs (Transmission System Operator) prioritize standardized, low-maintenance solutions, while critical end users such as data centers, hydrogen production sites, and offshore platforms require highly reliable power infrastructure. Leading companies such as Hitachi Energy (Switzerland), Siemens Energy (Germany), Mitsubishi Electric (Japan), and GE Vernova (US) are at the forefront of innovation, developing next-generation HVDC technologies that support grid flexibility, high-voltage reliability, and digital integration. These dynamics are redefining global value chains and unlocking growth in high-value HVDC components.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Integration of VSC technology into HVDC systems

-

Global shift toward renewable energy sources

Level

-

High initial investment

-

Availability of substitute technologies

Level

-

Growing adoption of digital and automation technologies

-

Electrification of transportation sector

Level

-

Interoperability issues due to lack of standardization

-

Complexities associated with obtaining necessary permits

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Integration of VSC Technology into HVDC Systems

The adoption of VSC technology in HVDC systems is driving market growth by enhancing flexibility, efficiency, and grid compatibility. VSC-based systems allow independent control of active and reactive power, support weak or passive grids, enable black start, and facilitate connections with offshore wind farms, urban substations, and asynchronous networks. Their compact design suits densely populated regions, while multi-terminal VSC networks support future smart grids. Rising renewable energy integration and urban grid upgrades are accelerating global deployment, with Europe, China, and the Middle East leading the transition toward VSC-based HVDC solutions.

Restraint: High Upfront Capital Investment

High upfront capital costs remain a major barrier to HVDC adoption. Establishing HVDC links requires substantial investment in converter stations, transmission lines, control systems, and integration with existing grids, often exceeding AC system costs, especially for shorter distances. Specialized equipment, engineering expertise, and long permitting cycles further increase initial expenses. While HVDC offers long-term efficiency gains, smaller utilities and developing regions may struggle to secure financing. Limited budgets, competing infrastructure priorities, and multi-year ROI timelines continue to constrain widespread deployment, making capital intensity a key restraint in the HVDC transmission market.

Opportunity: Electrification of the Transportation Sector

The global shift toward transportation electrification is creating significant opportunities for the HVDC transmission market. Increasing adoption of electric vehicles, high-speed electric trains, and urban e-mobility systems is driving demand for high-capacity, long-distance power transmission. HVDC systems minimize transmission losses and efficiently deliver bulk electricity, supporting EV charging corridors, rail electrification, and integration of renewable energy. Investments across Asia, Europe, and North America in green transportation infrastructure require robust, reliable grids. HVDC networks ensure grid stability, balance urban and remote generation, and open growth avenues for utilities and vendors in the electrified transport ecosystem.

Challenge: Interoperability Due to Lack of Standardization

A key challenge in the HVDC market is the lack of standardization, causing interoperability issues between systems from different manufacturers or countries. Custom-built HVDC projects with proprietary hardware and software complicate integration with existing grids, increase operational and maintenance costs, and limit scalability. Incompatibility in control systems and communication protocols can delay multi-vendor or cross-border projects. Without widely adopted technical standards, modular or multi-terminal HVDC grids face development hurdles, increasing risks of vendor lock-in, reduced interoperability, and long-term operational challenges, constraining the market’s growth potential and adoption speed globally.

HVDC Transmission Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Operates ultra-high-voltage DC lines to deliver renewable power over thousands of kilometers from western bases to eastern load centers. | Minimizes losses| Enables large-scale renewable integration| Strengthens national grid stability |

|

Deploys offshore HVDC links to connect North Sea wind farms with mainland grids for stable renewable power supply. | Integrates offshore wind|Reduces curtailment| Ensures reliable grid connection| Supports EU climate goals |

|

Uses HVDC transmission systems to power high-speed and intercity electric rail networks across the country. | Provides stable electricity| Reduces operational costs| Supports sustaina+C6ble rail transport |

|

Implements subsea HVDC “power-from-shore” systems to supply electricity to offshore oil and gas platforms. | Cuts emissions| Lowers fuel costs| Ensures reliable offshore power supply |

|

Exports clean hydropower to the US through HVDC interconnections. | Facilitates renewable energy trade| Reduces carbon footprint| Boosts regional grid stability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players operating in the HVDC transmission companies with a significant global presence include Hitachi, Ltd. (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), GE Vernova (US), Prysmian Group (Italy), TOSHIBA CORPORATION (Japan), NKT A/S (Denmark), Nexans (France), LS ELECTRIC Co., Ltd. (South Korea), NR Electric Co., Ltd. (China). The HVDC transmission ecosystem comprises raw material providers, component manufacturers, HVDC system integrators & EPC contractors, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

HVDC Transmission Market, By Technology

The Line Commutated Converter (LCC) segment accounted for a significant share in 2024. Its growth is driven by high efficiency, proven reliability, and suitability for long-distance, high-capacity bulk power transmission. LCC technology remains widely adopted in cross-border interconnections, offshore wind integration, and regional grid modernization projects. Emerging technology, such as Voltage Source Converter (VSC), is gaining traction for flexible grid control, lower environmental impact, and integration with renewable energy sources, enabling real-time voltage regulation, reduced losses, and enhanced stability of modern power networks.

HVDC Transmission Market, By Component

The converter stations segment accounted for a significant share in 2024. Its growth is driven by converter stations' critical role in voltage conversion, grid integration, and enabling long-distance bulk power transfer. Converter stations are widely adopted across cross-border power projects, offshore wind farms, and inter-regional transmission networks. Emerging innovations such as modular multilevel converters and hybrid converter stations are gaining traction for enhanced efficiency, compact design, and improved fault tolerance, enabling reliable and scalable HVDC deployment.

HVDC Transmission Market, By Project Type

The point-to-point transmission segment dominated the market in 2024. Its growth is driven by widespread use in connecting distant power generation sources to load centers, enabling efficient long-distance electricity transfer with minimal losses. Point-to-point HVDC projects are extensively adopted in inter-regional and cross-border grids, offshore wind farms, and large-scale renewable energy integration. Emerging multi-terminal and hybrid HVDC systems are gaining attention for their flexibility, scalability, and ability to support complex modern grids with distributed renewable generation.

HVDC Transmission Market, By Application

Bulk power transmission accounted for the largest share in 2024. HVDC systems are increasingly deployed to transport large volumes of electricity over long distances with minimal losses and improved stability. They are widely adopted for interconnecting regional grids, integrating offshore wind and solar farms, and enhancing urban and industrial power supply reliability. Emerging applications in smart grids and renewable-heavy networks are gaining traction, enabling dynamic load management, real-time monitoring, and improved overall grid efficiency.

REGION

Asia Pacific to be fastest-growing region in global HVDC transmission market during forecast period

Asia Pacific is expected to lead growth in the HVDC transmission market during the forecast period. Rapid urbanization, increasing electricity demand, and large-scale renewable energy integration are driving adoption. Countries like China, India, Japan, and South Korea are investing heavily in grid modernization and cross-border power interconnections. China and India are leading with multiple HVDC mega-projects for long-distance bulk power transmission and offshore wind integration, while Japan and South Korea focus on smart grid deployment and renewable energy interconnection. Local and global players such as Hitachi, Mitsubishi Electric, Siemens Energy, GE Vernova, and Prysmian Group support the regional expansion through advanced converter stations, innovative cable technologies, and strategic infrastructure projects.

The Asia Pacific HVDC transmission market is projected to grow from USD 6.08 billion in 2025 to USD 8.93 billion by 2030, at a CAGR of 8.0%. Rising investments in large-scale renewable energy projects, expanding long-distance transmission needs, and ongoing grid modernization initiatives are driving market growth. Additionally, increasing demand for efficient cross-border interconnections and reliable integration of offshore wind and remote solar resources is accelerating the adoption of HVDC technology across the region.

HVDC Transmission Market: COMPANY EVALUATION MATRIX

In the HVDC transmission market matrix, Hitachi Energy (Star) leads with a strong market presence and a comprehensive portfolio of HVDC solutions, including high-capacity converter stations, advanced cables, and grid integration technologies. The company drives large-scale adoption through reliable long-distance bulk power transmission projects, renewable energy interconnections, and cross-border grid links. NKT A/S (Emerging Leader) is gaining traction with innovative HVDC cable technologies and turnkey transmission solutions that enhance efficiency, reduce losses, and support renewable integration. While Hitachi Energy dominates with scale, established global projects, and proven technology, NKT shows strong growth potential to advance toward the leaders’ quadrant by expanding its HVDC infrastructure portfolio and increasing adoption across Asia Pacific, Europe, and emerging markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.01 Billion |

| Market Forecast in 2030 (Value) | USD 22.07 Billion |

| Growth Rate | CAGR of 7.2% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (MW) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: HVDC Transmission Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| HVDC Transmission Equipment & Solutions Providers | Competitor benchmarking of major HVDC players (Hitachi, Siemens Energy, Mitsubishi Electric, GE Vernova, Prysmian Group) Segmentation analysis by component, technology, project type, and application Regional market insights with country-level focus (Asia Pacific, Europe, North America, RoW) Trend analysis of emerging HVDC technologies (VSC, hybrid HVDC systems, modular multilevel converters) Pipeline and megaproject tracking for point-to-point and multi-terminal HVDC projects | Identify gaps in product and project portfolio Highlight emerging market opportunities and technological trends Support strategic planning, grid expansion, and renewable integration initiatives Benchmark market position against global and regional competitors Enable investment decisions and partnership strategies |

| Transmission Project Developers | Project pipeline mapping for new and upcoming HVDC installations Assessment of project financing and regulatory approvals Regional demand analysis for point-to-point and multi-terminal projects | Enable project prioritization and investment planning Identify high-potential regions and segments Support strategic partnerships and joint ventures |

| Utilities & Grid Operators | Analysis of HVDC integration with existing AC grids Load flow modeling and renewable energy integration studies Identification of optimal converter technologies for specific regions | Enhance grid reliability and efficiency Support renewable energy penetration and decarbonization goals Reduce operational and integration risks |

| HVDC Technology Providers | Technology benchmarking (LCC vs VSC vs hybrid HVDC) Adoption trend analysis across regions and applications Product portfolio gap analysis and roadmap suggestions | Identify R&D focus areas Strengthen market positioning against competitors Support technology development and commercialization |

| Investors & Financial Analysts | Market sizing and forecast by region, project type, and technology ROI and risk assessment of ongoing and planned HVDC projects Competitive landscape and market share analysis | Support informed investment decisions Highlight high-growth opportunities Mitigate investment and market risks |

RECENT DEVELOPMENTS

- March 2025 : Prysmian Group (Italy) launched a 245?kV HVAC (High Voltage Alternating Current) dynamic cable system. This innovative solution is designed to enable efficient and reliable power transmission for floating offshore wind farms, addressing the mechanical and electrical challenges of dynamic subsea environments.

- August 2024 : Siemens Energy (Germany) partnered with Mitsubishi Electric Corporation (Japan) to jointly develop advanced DC switching station technologies and circuit breakers, enabling next-generation multi-terminal HVDC systems.

- May 2024 : Hitachi Energy Ltd. (Switzerland) entered a strategic collaboration with Grid United (US) under a capacity reservation agreement to deploy HVDC technology for interconnecting regional power grids in the US.

Table of Contents

Methodology

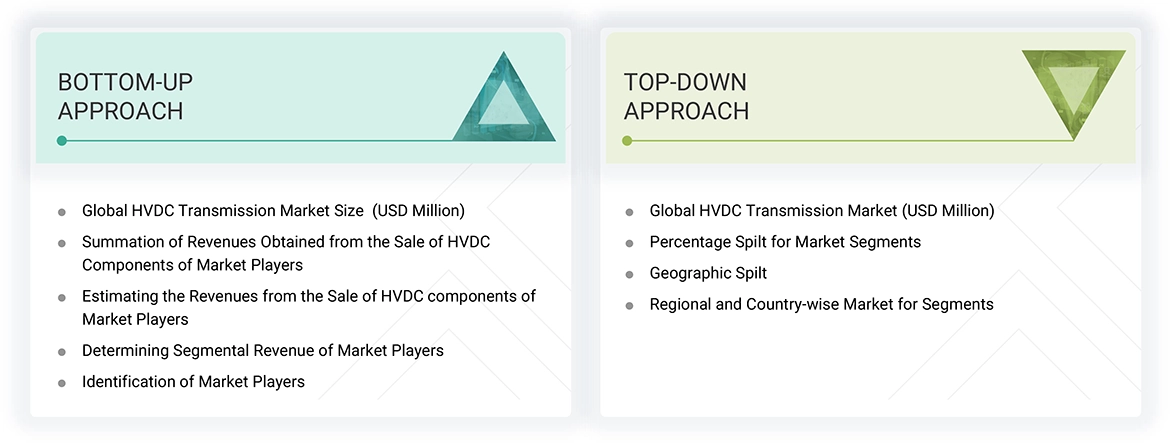

The research study involved four major activities in estimating the size of the HVDC transmission market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation were adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market's value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives..

The HVDC transmission market report estimates the global market size using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

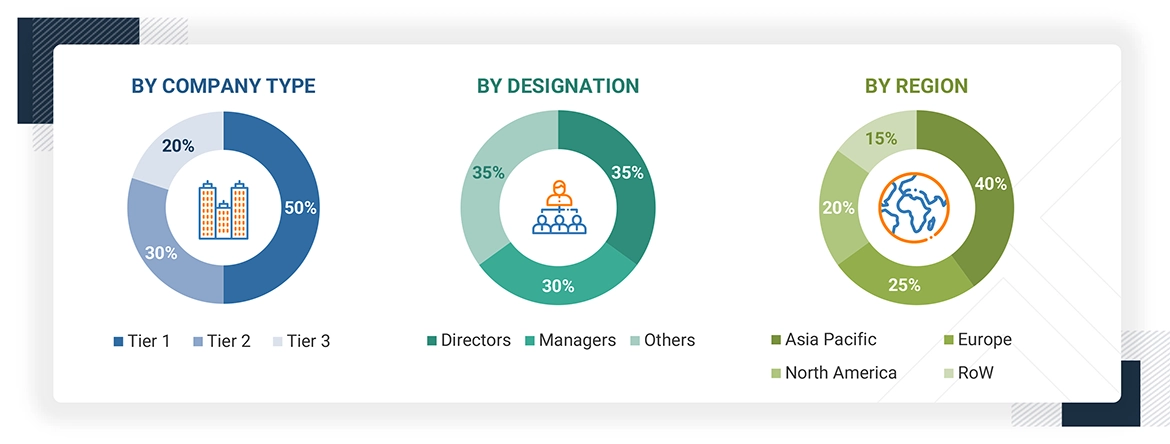

Extensive primary research has been conducted after understanding the HVDC transmission market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data was collected mainly through telephonic interviews, which comprised 80% of the total primary interviews; questionnaires and emails were also used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce our primary research findings. This, along with the in-house subject matter experts' opinions, has led us to the findings as described in the report.

Note: "Others" includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the HVDC transmission market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, focusing on top-line investments and spending in the ecosystem (segment-level splits and significant developments in the market have been considered)

- Identifying stakeholders in the HVDC transmission market that influence the entire market and participants across the supply chain

- Analyzing major manufacturers and solution providers of HVDC transmission, as well as studying their product portfolios

- Analyzing trends related to the adoption of HVDC transmission components

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, collaborations, mergers & acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of HVDC in the power transmission market

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and finally with the domain experts at MarketsandMarkets

HVDC Transmission Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall HVDC transmission market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

The HVDC transmission market refers to the industry for technologies and systems that enable the efficient transfer of electricity over long distances using high-voltage direct current. The market, segmented by components such as converter stations, transmission cables, and other components, represents a critical part of the global power transmission sector, enabling efficient, long-distance, and high-capacity electricity transfer. HVDC transmission systems efficiently deliver power over extended distances, employing overhead transmission lines, submarine cables, or underground cables. Using HVDC transmission technology for power is more economical than traditional AC lines, improving stability, reliability, and capacity. HVDC transmission systems are suited to such demands to address the ability to transmit electricity securely and stably between power networks operating at different frequencies. This asynchronous interconnection capability is precious for integrating renewable energy sources into the grid, as renewables often generate power at varying frequencies. Additionally, HVDC transmission systems provide operators with instantaneous and precise control over power flow, enhancing flexibility and suitability for modern power grid management.

Key Stakeholders

- HVDC Transmission Component Suppliers

- Electricity/Power Generating Companies.

- Electricity/Power Transmission Companies

- Electricity/Power Distribution Companies

- Power Grids Suppliers

- Power Project Consultants

- Government Procurement Organizations

- Turnkey Solution Providers

- Banks, Financial Institutions, Investors, and Venture Capitalists

- Research Organizations

- End Users

Report Objectives

- To describe and forecast the high-voltage direct current (HVDC) transmission market by component, project type, technology, application, and region, in terms of value

- To describe and forecast the high-voltage direct current (HVDC) transmission market by technology, in terms of volume

- To forecast the market size for various segments across the main regions: North America, Europe, Asia Pacific, and the RoW

- To provide industry-specific information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the HVDC transmission market

- To study the complete value chain and related industry segments for the HVDC transmission market

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To analyze trends/disruptions impacting customer business; pricing analysis; patents analysis; trade analysis (export and import scenario); tariff and regulatory landscape; Porter's five forces analysis; case studies; key stakeholders & buying criteria; technology analysis; ecosystem mapping; impact of artificial intelligence; impact of 2025 US tariff; and key conferences and events related to the HVDC transmission market.

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position regarding ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as product launches/developments, expansions, acquisitions, partnerships, collaborations, agreements, and research and development (R&D) activities carried out by players in the HVDC transmission market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information

- Country-wise breakdown for North America, Europe, Asia Pacific, and the Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Who are the key players in the global HVDC transmission market?

Hitachi, Ltd. (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), GE Vernova (US), and Prysmian Group (Italy) are the key players in the global HVDC transmission market.

Which region is expected to hold the largest market share and why?

Asia Pacific is projected to hold the largest HVDC transmission market share due to the rising electricity demand, renewable integration, and major investments in long-distance transmission.

What are the primary forces fueling growth and the significant opportunities within the HVDC transmission market?

The integration of VSC technology and the global shift toward renewable energy are likely to act as significant drivers, and opportunities include advancements in power electronics, transportation electrification, and long-distance interconnections.

What are the prominent strategies adopted by market players?

The key players have adopted product launches, acquisitions, collaborations, partnerships, investments, agreements, and expansions to strengthen their position in the HVDC transmission market.

What is the impact of Gen AI/AI on the HVDC transmission market on a scale of 1–10 (1 - least impactful and 10 - most impactful)?

The impact is as follows:

|

Integration of Renewable Energy Sources |

9 |

|

Predictive Maintenance Systems |

8 |

|

Autonomous Grid Control & Self-Healing Systems |

7 |

|

Cybersecurity Threat Detection |

6 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the HVDC Transmission Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in HVDC Transmission Market

Giovanni

Apr, 2017

Can you provide information on projected and expected HVDC installations and their investors. .

Giovanni

Apr, 2017

I am looking for information on planed tenders in area of HVDC installations and modernisations..

Giovanni

Apr, 2017

I want market numbers and projections in the HVDC transmission in China and Asia. Thanks!.

Jorge

Aug, 2016

We want to understand the potential and current HVDC projects in South America region, especially in Colombia and Peru..

MD

Apr, 2021

Can you provide information on projected and expected HVDC installations and their investors..

ngoga

Apr, 2017

I am conducting a research on HVDC and looking forward more technical information in terms of different technologies and components used in HVDC transmission. .

Peter

Dec, 2018

Can I get information of major market drivers and challenges in the hvdc transmission? Thanks.

Boguslaw

Dec, 2015

I am looking for an information about existing HVDC installations all over the world and plans of their modernisations. .

Young-Hwan

Aug, 2019

As a senior power system researcher, I am investigating prospective R&D research topics to enhance power system reliability in germany including HVDC system and FACTS devices. .

ÁLVARO

Feb, 2019

we are trying to evaluate new market opportunities and the state-of-the-art technologies in the HVDC transmission in Europe. Can you provide this information?.

Yong

Jan, 2014

Hello. I want to purchase "Single User License". "Single User" means just allowed on one laptop? And, is this product printable? .