Incident Response Market by Component (Solution and Services), Service (Retainer, Assessment and Response, and Planning and Development), Security Type, Organization Size, Deployment Mode, Vertical and Region - Global Forecast to 2023

[173 Pages Report] The global incident response market size was USD 11.05 billion in 2017 and is projected to reach USD 33.76 billion by 2023, growing at a Compound Annual Growth Rate (CAGR) of 20.3% during the forecast period. The base year for the study is 2017 and the forecast period is 2018–2023.

Incident response refers to a predefined and an organized set of procedures and approaches that need to be followed in the event of cyber-attacks, which are sometimes known as cyber incidents, security incidents, and Information Technology (IT) incidents. The various incident response solutions include capabilities such as case management, orchestration, automation, and intelligence into a single platform and assist security teams assess, measure, and improve these capabilities. Organizations use incident response solutions to monitor networks and endpoints for the advanced intrusions and fraudulent activities.

To know about the assumptions considered for the study, download the pdf brochure

Incident Response Market Dynamics

Drivers

- Stringent government regulations and compliance requirements

- Rise in the sophistication level of cyber-attacks

- Heavy financial losses post incident occurrence

Restraints

- Financial constraints and high innovation costs

Opportunities

- Growing BYOD trend among organizations

Challenges

- Lack of competent security professionals to handle challenging security incidents

- Availability of open source and pirated security solutions

Stringent government regulations and compliance requirements

Governments and the security agencies, which include regulatory bodies across various geographies are conscious about the protection of the sensitive data of their citizens and organizations against any cyber threats. The continuously evolving cyber threats have given rise to a large number of government regulations globally that are needed to be strictly adhered to, by all organizations. Organizations are compelled to meet the mandatory security standards, failing which a heavy amount of fine is to be paid to the government and regulatory bodies. For instance, PCI DSS clearly states requirements, which are expected to be followed by any company during, before, and after an incident. Similarly, the HIPAA compliance mandates organizations to maintain the integrity of the patient’s health information, failing to which they are charged with heavy fines. Moreover, other compliances, such as EU GDPR, SOX, GLBA, FISMA, and NERC-CIP, also regulate various verticals to maintain the data integrity and encourages organizations to adopt the best cybersecurity practices. This regulation of data is done by maintaining incident response teams that are capable of handling and identifying breaches and any security incidents. Organizations are bound to develop the incident response plans and policies, which should be reviewed and approved by the management, annually.

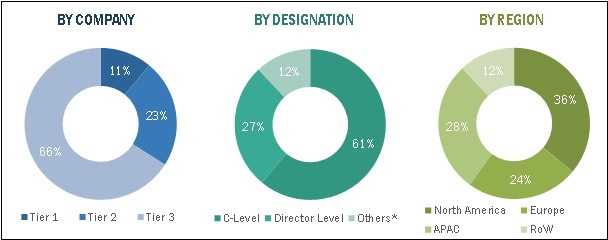

*Others include product managers, marketing managers, and analysts Note: Tier 1 companies’ overall annual revenue > USD 1 billion; Tier 2 companies’ annual revenue > USD 100 million; and Tier 3 companies’ annual revenue < USD 100 million

Objectives of the Study:

- To define, describe, and forecast the incident response market by component, security type, deployment mode, organization size, vertical, and region.

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the incident response market.

- To forecast the market size of the market segments with respect to the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players of the global market and comprehensively analyze their market size and core competencies in the market.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global incident response market.

The research methodology used to estimate and forecast the market began with the collection and analysis of data on key vendors revenues through secondary sources, such as company websites, press releases, annual reports, TechTarget reports, Cloud Security Alliance reports, SC magazine, and SANS Institute studies. Vendor offerings are taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global incident response market from the revenues of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process, and to arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the figure below:

BREAKDOWN OF PRIMARY PARTICIPANTS

Note: Tier 1 company = overall annual revenues >USD 1 billion; Tier 2 company = USD 500 million – 1 billion; and Tier 3 company = USD 100–500 million

The global incident response market comprises key vendors, such as Symantec (US), McAfee (US), Palo Alto Networks (US), FireEye (US), IBM (US), Cisco (US), Check Point Software Technologies (Israel), BAE Systems (UK), Rapid7 (US), Dell (US), Verizon (US), CrowdStrike (US), Optiv (US), Trustwave (US), NTT Security (Germany), Resolve Systems (US), Kudelski Security (US), Swimlane (US), LogRhythm (US), Carbon Black (US), RiskIQ (US), Accenture (Ireland), AlienVault (US), Kaspersky Lab (Russia), Paladion Networks (US), and Coalfire (US). These vendors provide IR solutions and services to end-users for catering to their unique business requirements, productivity, compliances, and security needs.

Major Incident Response Market Developments:

- In April 2018, Symantec announced upgradation of its powerful threat detection technology used by its own world-class research teams available to Advanced Threat Protection (ATP) customers. Symantec’s Targeted Attack Analytics (TAA) enables ATP customers to leverage advanced machine learning to automate and discover the targeted attacks.

- In April 2018, McAfee partnered with Syncurity, a leader in the Security Orchestration Automation and Response (SOAR) space, to integrate its incident response Flow platform with McAfee’s enterprise security manager that enable customers to quickly identify and validate threats to their information from increasingly sophisticated cyber threats.

- In April 2018, Dell RSA acquired Fortscale, a pioneer in embedded behavioural analytics, to provide customers with new UEBA capabilities through the RSA NetWitness Platform.

Key Target Audience

- Cybersecurity vendors

- Information security consultants

- Incident response service vendors

- Security system integrators

- Government agencies

- Managed Security Service Providers (MSSPs)

- Value-Added Resellers (VARs)

- Independent software vendors

“The study answers several questions for stakeholders, primarily which market segments to focus over the next 2–5 years for prioritizing their efforts and investments.”

Scope of the Report

The research report segments the market into the following submarkets:|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Component, Service Type, Security Type, Deployment Mode, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

Symantec (US), McAfee (US), Palo Alto Networks (US), FireEye (US), IBM (US), Cisco (US), Check Point Software Technologies (Israel), BAE Systems (UK), Rapid7 (US), Dell (US), Verizon (US), CrowdStrike (US), Optiv (US), Trustwave (US), NTT Security (Germany), Resolve Systems (US), Kudelski Security (US), Swimlane (US), LogRhythm (US), Carbon Black (US), RiskIQ (US), Accenture (Ireland), AlienVault (US), Kaspersky Lab (Russia), Paladion Networks (US), and Coalfire (US). |

Incident Response Market By Component:

- Solution

- Services

Incident Response Market By Service Type:

- Retainer

- Assessment and Response

- Tabletop Exercises

- Incident Response Planning and Development

- Advanced Threat Hunting

- Others

Incident Response Market Study By Security Type:

- Web Security

- Application Security

- Endpoint Security

- Network Security

- Cloud Security

By Deployment Mode:

- Cloud

- On-Premises

By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail and E-Commerce

- Travel and Hospitality

- Manufacturing

- IT and Telecommunication

- Others

Incident Response Market By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives the detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North American incident response market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

Stringent government regulations and compliances requirements, rise in the sophistication level of the cyber-attacks, and heavy financial losses post incident occurrence has led enterprises to adopt IR solutions and services to detect and respond to advanced cyber threats and data breaches. Moreover, the Small and Medium-size enterprises (SMEs) are gaining a high traction in the market, as they are more targeted by cyber-attacks and data breaches. With the adoption of incident response solutions, organizations can effectively maintain and secure their critical information from data breaches enable organizations to respond to an incident more efficiently. IR solutions help organizations optimize employees’ productivity, protect sensitive data, applications, and comply with stringent regulations.

Incident response refers to a predefined and an organized set of procedures and approaches that need to be followed in the event of cyber-attacks, which are sometimes known as cyber incidents, security incidents, and Information Technology (IT) incidents. Incident response solutions and services help organizations handle and manage not only the aftermath of the attacks but also define a clear set of protocols that need to be followed before and during security incidents. These security incidents are handled by the Computer Security Incident Response Team (CSIRT) of organizations, thereby helping reduce the total cost and time involved in recovering from security incidents.

IR services include various service types, such as IR retainer, assessment and response, tabletop exercises, IR planning and development, and advanced threat hunting. The assessment and response services is expected to dominate the incident response market and is estimated to have the largest market share in 2018. The IR retainer is expected to play a key role in changing the marketspace and to grow at the highest CAGR during the forecast period, as these services help organizations to maintain access to the critical capabilities needed to effectively respond to various security incidents.

The Banking, Financial Services, and Insurance (BFSI) is the fastest growing vertical in the global incident response market, as the vertical has to meet stringent legal and regulatory compliances associated with information security. SMEs continue to deploy IR solutions, as they are facing security concerns and cyber-attacks such as Denial of Services (DoS) attacks; virus, worm, and Trojan horse infections; illegal inside activities: cyberespionage: and compromise of sensitive information of an agency.

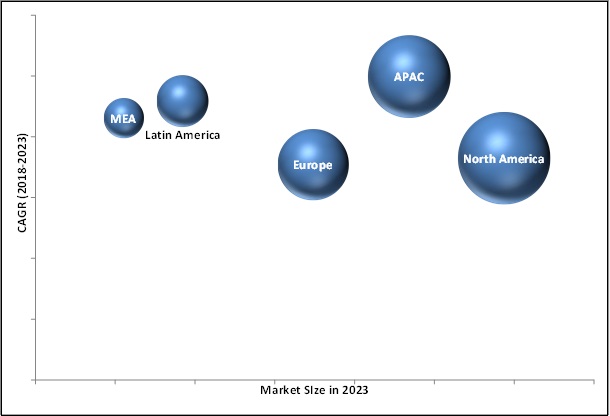

North America is estimated to hold the largest market size in 2018. The increasing need for organizations to reduce the misuse of the internet and enhance their employees productivity, and addressing the incidents of attacks on enterprises IT infrastructures are expected to drive the incident response market. Furthermore, rapid economic growth in the major countries, along with regulatory reforms and economic stability, is expected to drive the market in Asia Pacific (APAC). In the Middle East and Africa (MEA) region, enterprises in a range of verticals, such as BFSI, government, and manufacturing, are expected to increase their investments in IR solutions and services.

Security vendors are offering various services types in incidence response market to detect, prevent, and respond to cyber-threats via IR retainer, assessment and response, tabletop exercises, incident response planning and development, and advanced threat hunting. As the frequency of security breaches has increased over the past 5 years, organizations have increased their IT security investments to protect against advanced threats. However, for many enterprises, including SMEs, these investment costs are a matter of concern. For a strong and advanced security, the cost of innovation is still high. Hence, many organizations view budgetary constraints as a barrier to the adoption of advanced incident response solutions and services.

INCIDENT RESPONSE MARKET, BY REGION, BY 2023 (USD BILLION)

Source: MarketsandMarkets Analysis

Usage of incident response solutions in BFSI, government, and healthcare and life sciences industry verticals drive the growth of incident response market

Banking, Financial Services, and Insurance

The BFSI sector mainly deals with the national and international regulations, such as Basel-III, GLBA, PCI DSS, BFSI is an industry term for companies such as commercial banks, insurance institutes, and nonbanking financial organizations, which provide financial products and services. The BFSI industry is always on the lookout for incident response solutions and services that could protect the industry’s employees, customers, assets, offices, branches, and operations. Hence, this vertical holds a significant share of the total incident response market.

Government

The government vertical consists of 4 institutional units, namely, central government, state government, local government, and the social security funds. The government agencies across the globe handle the critical and sensitive information by serving citizens and collecting intelligence. Cyber-attacks and vulnerabilities have increased the security breaches in various government agencies. Attackers are targeting networks across this vertical to breach the sensitive information related to the administration, departmental activities, and prime security intelligence. Incident response solutions are capable of protecting networks from cyber threats. Incident response vendors offer various solutions and services to this vertical for protecting the valuable networking assets.

Healthcare and Life Sciences

The healthcare sector provides products and services to treat patients with preventive and comforting care. This sector is witnessing considerable changes with the deployment of the latest trends in technologies that have completely transformed its operations. The use of various mobile and web applications has improved the productivity of professionals and patients’ experience. Technological changes centralized the storage of data, such as patients medical history, payment information, and Social Security Number (SSN), which are the prime targets for cybercriminals. Incident response solutions help organizations monitor, report, and remote login, and assist in the overall management, which include secure remote access, backup and recovery, and secure wireless connection.

Critical questions which the report answers- What are the new opportunities which the incident response vendors are exploring?

- Who are the key players in the incidence response market and how intense is the competition?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Market

4.2 Global Incident Response Market By Component

4.3 Global Market Share of Top 3 Services and Regions

4.4 Market Share, By Security Type, 2018

4.5 Market Investment Scenario

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Government Regulations and Compliance Requirements

5.2.1.2 Rise in the Sophistication Level of Cyber-Attacks

5.2.1.3 Heavy Financial Losses Post Incident Occurrence

5.2.2 Restraints

5.2.2.1 Financial Constraints and High Innovation Costs

5.2.3 Opportunities

5.2.3.1 Growing Byod Trend Among Organizations

5.2.4 Challenges

5.2.4.1 Lack of Competent Security Professionals to Handle Challenging Security Incidents

5.2.4.2 Availability of Open Source and Pirated Security Solutions

5.3 Regulatory Implications

5.3.1 Payment Card Industry Data Security Standard (PCI DSS)

5.3.2 Health Insurance Portability and Accountability Act (HIPAA)

5.3.3 Gramm–Leach–Bliley Act (GLBA)

5.3.4 Sarbanes–Oxley Act (SOX)

5.3.5 General Data Protection Regulation (GDPR)

6 Incident Response Market By Component (Page No. - 39)

6.1 Introduction

6.2 Solution

6.3 Services

7 Incident Response Market By Service (Page No. - 43)

7.1 Introduction

7.2 Retainer

7.3 Assessment and Response

7.4 Tabletop Exercises

7.5 Planning and Development

7.6 Advanced Threat Hunting

7.7 Others

8 Incident Response Market By Security Type (Page No. - 51)

8.1 Introduction

8.2 Web Security

8.3 Application Security

8.4 Endpoint Security

8.5 Network Security

8.6 Cloud Security

9 Incident Response Market By Deployment Mode (Page No. - 58)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Incident Response Market By Organization Size (Page No. - 62)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.3 Large Enterprises

11 Incident Response Market, By Vertical (Page No. - 66)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Government

11.4 Healthcare and Life Sciences

11.5 Retail and Ecommerce

11.6 Travel and Hospitality

11.7 Manufacturing

11.8 Telecom and IT

11.9 Others

12 Incident Response Market By Region (Page No. - 76)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Russia

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 Singapore

12.4.2 Australia

12.4.3 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Middle East

12.5.2 Africa

12.6 Latin America

12.6.1 Brazil

12.6.2 Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 102)

13.1 Overview

13.2 Competitive Scenario

13.2.1 New Product Launches and Product Enhancements

13.2.2 Agreements and Partnerships

13.2.3 Mergers and Acquisitions

13.2.4 Business Expansions

14 Company Profiles (Page No. - 109)

Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, MnM View

14.1 Introduction

14.2 IBM

14.3 Cisco

14.4 Symantec

14.5 Check Point

14.6 Fireeye

14.7 Bae Systems

14.8 Rapid7

14.9 Dell

14.10 Accenture

14.11 Verizon

14.12 Crowdstrike

14.13 Mcafee

14.14 Optiv

14.15 Trustwave

14.16 Logrhythm

14.17 Carbon Black

14.18 Coalfire

14.19 Paladion Networks

14.20 Alienvault

14.21 Riskiq

14.22 Swimlane

14.23 Resolve Systems

14.24 Kudelski Security

14.25 Ntt Security

14.26 Kaspersky Lab

*Details Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 166)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (72 Tables)

Table 1 Global Incident Response Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Global Market Size, By Component, 2016–2023 (USD Million)

Table 3 Solution: Incident Response Market Size By Region, 2016–2023 (USD Million)

Table 4 Services: Market Size By Region, 2016–2023 (USD Million)

Table 5 Incident Response Market Size, By Service, 2016–2023 (USD Million)

Table 6 Retainer: Market Size By Region, 2016–2023 (USD Million)

Table 7 Assessment and Response: Incident Response Market Size, By Region, 2016–2023 (USD Million)

Table 8 Tabletop Exercises: Market Size By Region, 2016–2023 (USD Million)

Table 9 Planning and Development: Market Size By Region, 2016–2023 (USD Million)

Table 10 Advanced Threat Hunting: Incident Response Market Size By Region, 2016–2023 (USD Million)

Table 11 Others: Market Size By Region, 2016–2023 (USD Million)

Table 12 Market Size, By Security Type, 2016–2023 (USD Million)

Table 13 Web Security: Market Size By Region, 2016–2023 (USD Million)

Table 14 Application Security: Market Size By Region, 2016–2023 (USD Million)

Table 15 Endpoint Security: Incident Response Market Size By Region, 2016–2023 (USD Million)

Table 16 Network Security: Market Size By Region, 2016–2023 (USD Million)

Table 17 Cloud Security: Market Size By Region, 2016–2023 (USD Million)

Table 18 Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 19 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 20 On-Premises: Market Size By Region, 2016–2023 (USD Million)

Table 21 Incident Response Market Size, By Organization Size, 2016–2023 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 23 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 24 Incident Response Market Size, By Vertical, 2016–2023 (USD Million)

Table 25 Banking, Financial Services, and Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 26 Government: Market Size, By Region, 2016–2023 (USD Million)

Table 27 Healthcare and Life Sciences: Market Size By Region, 2016–2023 (USD Million)

Table 28 Retail and Ecommerce: Market Size By Region, 2016–2023 (USD Million)

Table 29 Travel and Hospitality: Market Size By Region, 2016–2023 (USD Million)

Table 30 Manufacturing: Incident Response Market Size By Region, 2016–2023 (USD Million)

Table 31 Telecom and IT: Market Size By Region, 2016–2023 (USD Million)

Table 32 Others: Market Size By Region, 2016–2023 (USD Million)

Table 33 Incident Response Market Size, By Region, 2016–2023 (USD Million)

Table 34 North America: Market Size By Country, 2016–2023 (USD Million)

Table 35 North America: Market Size By Component, 2016–2023 (USD Million)

Table 36 North America: Incident Response Market Size By Service, 2016–2023 (USD Million)

Table 37 North America: Market Size By Security Type, 2016–2023 (USD Million)

Table 38 North America: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 39 North America: Incident Response Market Size By Organization Size, 2016–2023 (USD Million)

Table 40 North America: Market Size By Vertical, 2016–2023 (USD Million)

Table 41 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 42 Europe: Market Size By Component, 2016–2023 (USD Million)

Table 43 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 44 Europe: Incident Response Market Size By Security Type, 2016–2023 (USD Million)

Table 45 Europe: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 46 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 47 Europe: Market Size By Vertical, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market Size, By Country, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market Size By Component, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 51 Asia Pacific: Incident Response Market Size By Security Type, 2016–2023 (USD Million)

Table 52 Asia Pacific: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 53 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 54 Asia Pacific: Market Size By Vertical, 2016–2023 (USD Million)

Table 55 Middle East and Africa: Incident Response Market Size, By Subregion, 2016–2023 (USD Million)

Table 56 Middle East and Africa: Market Size By Component, 2016–2023 (USD Million)

Table 57 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 58 Middle East and Africa: Market Size By Security Type, 2016–2023 (USD Million)

Table 59 Middle East and Africa: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 60 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 61 Middle East and Africa: Market Size By Vertical, 2016–2023 (USD Million)

Table 62 Latin America: Incident Response Market Size, By Country, 2016–2023 (USD Million)

Table 63 Latin America: Market Size By Component, 2016–2023 (USD Million)

Table 64 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 65 Latin America: Market Size By Security Type, 2016–2023 (USD Million)

Table 66 Latin America: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 67 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 68 Latin America: Incident Response Market Size By Vertical, 2016–2023 (USD Million)

Table 69 New Product Launches and Product Enhancements, 2018

Table 70 Agreements and Partnerships, 2018

Table 71 Mergers and Acquisitions, 2017–2018

Table 72 Business Expansions, 2016–2018

List of Figures (48 Figures)

Figure 1 Global Incident Response Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Incident Response Market: Assumptions

Figure 8 Market Size By Service

Figure 9 Market Size By Security Type

Figure 10 Market Size By Organization Size

Figure 11 Incident Response Market Size By Deployment Mode

Figure 12 North America is Estimated to Hold the Largest Market Share in 2018

Figure 13 Top 3 Revenue Segments of the Incident Response Market

Figure 14 Stringent Regulations are Spurring the Demand for Incident Response Solutions and Services

Figure 15 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 16 Assessment and Response Services Segment and North America are Estimated to Have the Largest Market Shares in 2018

Figure 17 Network Security Type is Estimated to Have the Largest Market Share in 2018

Figure 18 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 19 Incident Response Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Assessment and Response Segment is Estimated to Have the Largest Market Size in 2018

Figure 22 Cloud Security Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Cloud Deployment Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Banking, Financial Services, and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 North America is Estimated to Account for the Largest Incident Response Market Size in 2018

Figure 27 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 28 North America: Market Snapshot

Figure 29 Asia Pacific: Market Snapshot

Figure 30 Key Developments By the Leading Players in the Incident Response Market During 2016–2018

Figure 31 Market Evaluation Framework

Figure 32 Geographic Revenue Mix of the Top 5 Market Players

Figure 33 IBM: Company Snapshot

Figure 34 IBM: SWOT Analysis

Figure 35 Cisco: Company Snapshot

Figure 36 Cisco: SWOT Analysis

Figure 37 Symantec: Company Snapshot

Figure 38 Symantec: SWOT Analysis

Figure 39 Check Point: Company Snapshot

Figure 40 Check Point: SWOT Analysis

Figure 41 Fireeye: Company Snapshot

Figure 42 Fireeye: SWOT Analysis

Figure 43 Bae Systems: Company Snapshot

Figure 44 Rapid7: Company Snapshot

Figure 45 Dell: Company Snapshot

Figure 46 Accenture: Company Snapshot

Figure 47 Verizon: Company Snapshot

Figure 48 Kudelski Security: Company Snapshot

Growth opportunities and latent adjacency in Incident Response Market

Understanding of the Cyber Risk Management, Digital Risk Management, Cyber Security Incident Management, Business Continuity Management, Business Resilience.

Gather insights into market analysis for products addressing the Security Operation and Incident Response segments.

Hello can I get the updated market size and value for Incident Response Market with the base year 2022