Industrial Metrology Market Size, Share & Trends, 2025 To 2030

Industrial Metrology Market by CMM, ODS, Measuring Instrument, X-Ray & CT System, AOI System, Form Measurement Machine, 2D Equipment, Quality & Inspection, Reverse Inspection, and Mapping & Modeling - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

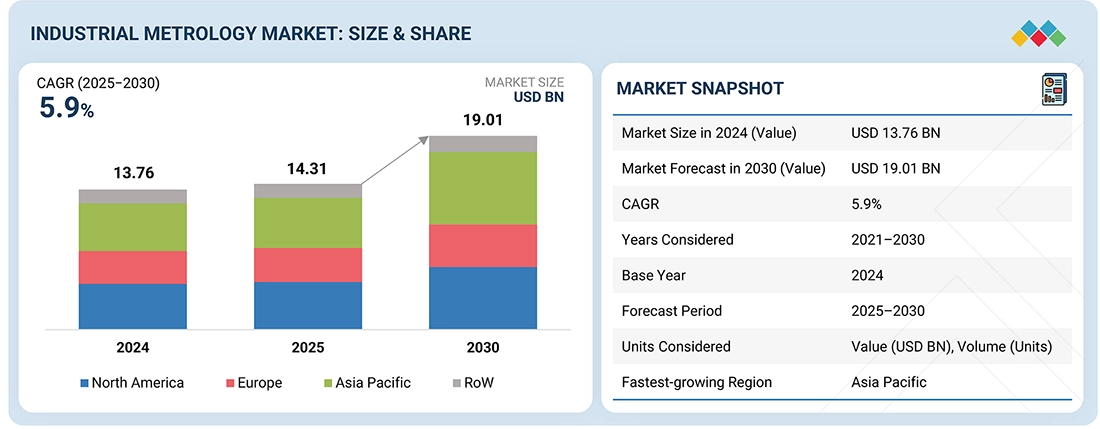

The industrial metrology market is projected to grow from USD 14.31 billion in 2025 to USD 19.03 billion in 2030, at a CAGR of 5.9%. Increasing R&D investments in 3D metrology, rising integration of IoT sensors into industrial metrology solutions, growing focus on quality control and inspection in precision manufacturing, and mounting deployment of autonomous driving technologies are the major factors driving the market growth. In addition, growing emphasis on quality control and regulatory compliance in food industry, increasing adoption of cloud-based, IIoT, and Al technologies to store and analyze metrological data, and rising implementation of Industry 5.0 technologies to provide ample opportunities for the market payers.

KEY TAKEAWAYS

-

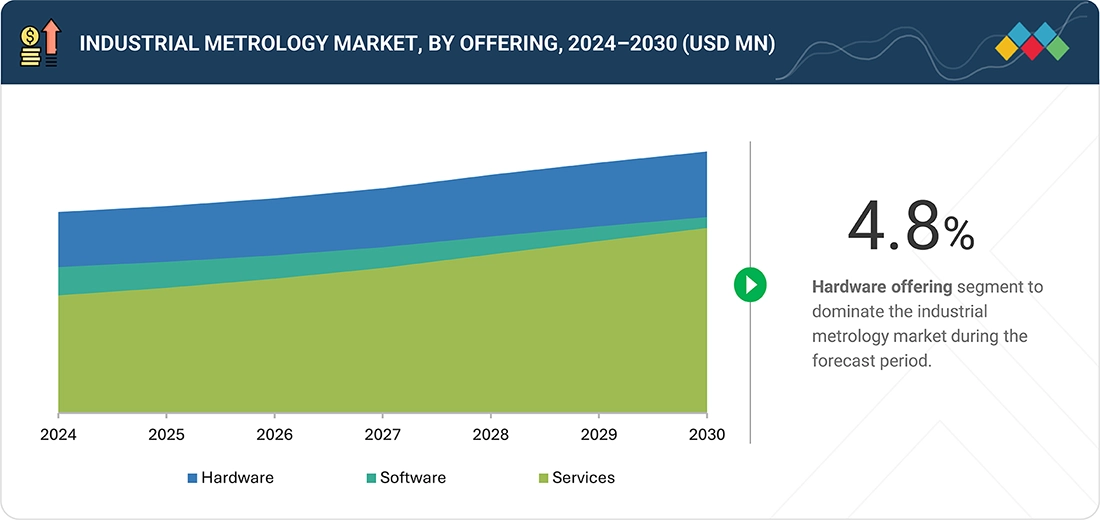

BY OFFERINGThe Industrial Metrology market is segmented into hardware, software, and services, including after-sales, measurement services, SaaS, and Storage-as-a-Service. Hardware dominates due to high demand for precision measurement and automated inspection. Software and services are growing, supporting cloud-based platforms, predictive maintenance, and data analytics, enabling higher efficiency and improved quality control in manufacturing and engineering.

-

BY EQUIPMENTEquipment segments include CMMs, ODS, measuring instruments, X-ray & CT systems, AOI systems, form and contour machines, surface roughness and roundness instruments, and 2D equipment. CMMs lead the market due to versatility and precision. Portable and articulated arm CMMs, along with laser scanners, are gaining traction for flexible, high-speed measurements across industries.

-

BY APPLICATIONApplications include quality control & inspection, reverse engineering, mapping & modeling, and others. Quality control dominates, driven by the need for accurate, repeatable measurements in automotive, aerospace, and precision manufacturing. Reverse engineering and mapping are expanding with 3D scanning and modeling adoption, helping industries optimize processes, minimize errors, and improve product quality.

-

BY END-USE INDUSTRYIndustries include aerospace & defense, automotive, architecture & construction, medical, electronics, energy & power, heavy machinery, and mining. Automotive leads, supported by strict quality standards, component precision, and automation. Aerospace, electronics, and medical sectors are increasingly adopting advanced metrology solutions to enhance safety, reliability, and operational efficiency across complex production and R&D workflows.

-

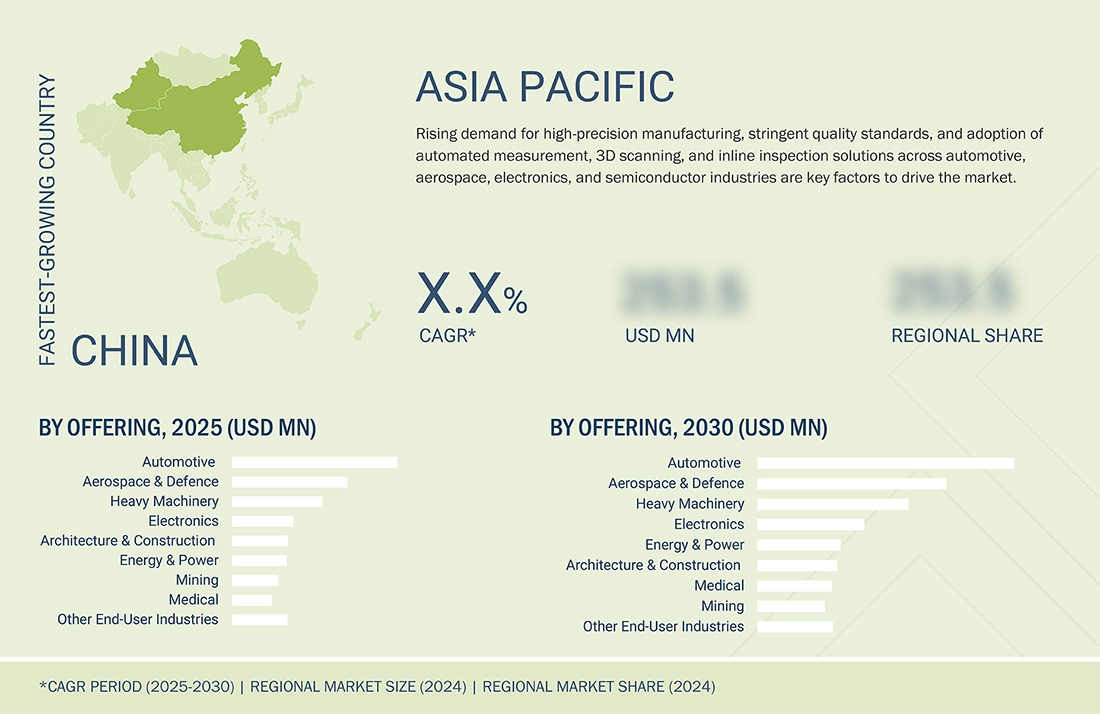

BY REGIONThe industrial metrology market is divided into North America, Europe, Asia Pacific, and RoW. Asia Pacific is the fastest-growing, driven by industrial modernization, automotive and aerospace sector growth, and adoption of advanced manufacturing technologies. North America and Europe remain significant markets due to established manufacturing bases and high adoption of automated, software-driven metrology solutions.

-

COMPETITIVE LANDSCAPEKey players in the Industrial Metrology market include Hexagon AB (Sweden), Nikon Corporation (Japan), FARO (US), Carl Zeiss AG (Germany), and JENOPTIK (Germany). These companies are actively focusing on developing high-precision metrology solutions, including advanced CMMs, laser scanners, optical displacement sensors, and portable measurement systems. Continuous innovation in automation, sensor accuracy, software integration, and cloud-enabled workflows is driving product differentiation. Strategic partnerships with industrial clients, integration with enterprise software, and collaborations with R&D institutes and component suppliers are further strengthening their market presence and enhancing operational efficiency, accuracy, and quality control across aerospace, automotive, electronics, and heavy machinery applications.

The Industrial Metrology Market is expected to experience strong growth in the coming years, driven by increasing adoption of precision measurement solutions across automotive, aerospace, electronics, medical, and heavy machinery sectors. Rising demand for automated CMMs, laser scanners, optical displacement sensors, and portable metrology equipment is fueling market expansion. Integration of AI, IoT, and cloud-based analytics is enhancing measurement accuracy, enabling real-time data monitoring, predictive maintenance, and process optimization. Growing investments in digital manufacturing, smart factories, and quality-driven production initiatives are further accelerating adoption. As a critical enabler of Industry 4.0 and digital transformation, industrial metrology technology is poised to improve operational efficiency, reduce defects, and support high-precision manufacturing across multiple industries.

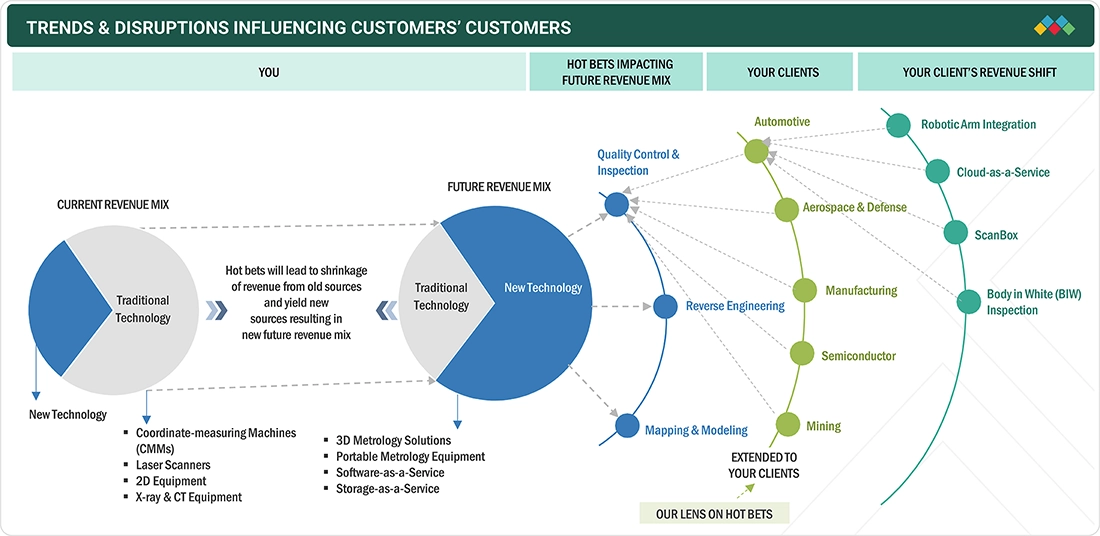

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The industrial metrology market is undergoing a significant transformation, driven by the adoption of new use cases, emerging technologies, an evolving ecosystem, and strategic M&A activities. The traditional focus on hardware, such as coordinate-measuring machines (CMMs) and laser scanners, is shifting toward 3D metrology solutions, portable metrology equipment, and service-oriented models like Software-as-a-Service (SaaS) and Storage-as-a-Service. These offerings are designed to address critical client needs, including quality control and inspection, reverse engineering, and mapping and modeling, across key sectors such as automotive, aerospace & defense, and manufacturing. The market is moving toward more integrated, software-driven, and service-centric solutions, enabling outcomes like robotic arm integration, cloud-based metrology, and advanced scanning platforms, ultimately helping customers enhance operational efficiency, accuracy, and scalability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing R&D investments in 3D metrology

-

Rising integration of IoT sensors into industrial metrology solutions

Level

-

Limited technical knowledge regarding integration of industrial metrology with robots and 3D models

-

Concerns regarding big data handling and manufacturing unit configuration

Level

-

Growing emphasis on quality control and regulatory compliance in food industry

-

Increasing adoption of cloud-based, IIoT, and AI technologies to store and analyze metrological data

Level

-

Growing concern about cyber security

-

Shortage of easy-to-use 3D metrology software solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Focus on Quality Control and Inspection in Precision Manufacturing

Quality control and inspection tools play a critical role in advancing industrial metrology through technologies like CMMs, automated inspection systems, and 3D scanning solutions. Automated systems and robotic inspection improve efficiency, minimize manual intervention, and ensure high accuracy in production. 3D scanning enables precise surface analysis and examination of complex geometries. Industries with tight tolerances, such as automotive, aerospace, and medical devices, increasingly rely on advanced metrology to enhance precision, reduce errors, and maintain consistent product quality.

Restraint: Limited Technical Knowledge Regarding Integration of Industrial Metrology with Robots and 3D Models

Effective industrial metrology depends on technical expertise in geometrical and dimensional measurements, quality control analysis, and operation of advanced equipment. Many manufacturing professionals lack training in robotic integration and 3D scanning technologies. Limited certification programs and industry-specific training exacerbate the skill gap, reducing measurement accuracy and productivity. Staff experienced in traditional CMMs often struggle with newer systems, impacting data reliability and decision-making, and slowing adoption of advanced industrial metrology solutions.

Opportunity: Rising Implementation of Industry 5.0 Technologies

Industry 5.0 promotes enhanced collaboration between humans and machines in manufacturing, integrating IoT, big data, and automation for smarter factories. Real-time in-line inspection systems, smart sensors, and adaptive metrology solutions enable faster, more accurate quality control. This approach enhances flexibility, efficiency, and decision-making across the value chain, from R&D to production. Growing adoption of smart factories and connected metrology tools is driving demand for advanced measurement systems, providing significant growth opportunities in the industrial metrology market.

Challenge: Shortage of Easy-to-Use 3D Metrology Software Solutions

Modern 3D metrology software provides enhanced accuracy and automation, but its complexity and steep learning curve limit widespread adoption. Feature-rich tools require extensive training and continuous technical support, increasing operational costs. Interoperability challenges between hardware and software further complicate deployment. Simplifying user interfaces while maintaining precision, automation, and advanced data analytics is essential to enable broader adoption and ensure efficient, seamless integration of advanced industrial metrology solutions across diverse manufacturing environments.

Industrial Metrology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses CMMs and 3D scanning systems for inline inspection of automotive components and assembly lines. | Improved dimensional accuracy, reduced defects, and faster quality control processes. |

|

Implements laser trackers and probe-based metrology for turbine and aerospace engine component inspection. | High precision in complex parts, reduced rework, and ensured compliance with engineering standards. |

|

Uses optical metrology and profilometry tools to monitor wafer thickness and surface uniformity. | Enhanced semiconductor yield, tighter process control, and minimized production defects. |

|

Employs laser trackers and structured light scanning to verify aerospace structures and assemblies. | Ensured assembly accuracy, reduced errors, and improved overall production efficiency. |

|

Uses automated 3D inspection systems on EV battery packs and vehicle body panels. | Enhanced production quality, reduced assembly errors, and better component fitment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players operating in the industrial metrology market with a significant global presence include Hexagon AB (Sweden), Nikon Corporation (Japan), FARO (US), Carl Zeiss AG (Germany), JENOPTIK (Germany), KLA Corporation (US), Renishaw plc (UK), Mitutoyo Corporation (Japan), KEYENCE CORPORATION (Japan), and CREAFORM (Canada). The industrial metrology ecosystem comprises of R&D, hardware & software providers, end-users, and service providers

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Metrology Market, By Offering

The hardware segment dominates the Industrial Metrology market, driven by strong demand for high-precision coordinate-measuring machines (CMMs), optical displacement sensors, and advanced inspection systems. Software and service offerings, including SaaS, Storage-as-a-Service, after-sales, and measurement services, are gaining traction as enterprises adopt cloud-based metrology, predictive analytics, and automated workflows. These solutions enhance operational efficiency, minimize errors, and ensure higher quality control, supporting digital transformation and sustainable manufacturing practices across multiple industries.

Industrial Metrology Market, By Equipment

CMMs lead the equipment segment, valued for versatility, precision, and adaptability across complex components and high-volume production. Portable and articulated arm CMMs, laser and structured light scanners, and optical displacement sensors are increasingly adopted for flexible, high-speed, and automated measurements. Continuous advances in sensor accuracy, scanning speed, and software integration are enabling real-time data capture, predictive analysis, and seamless connectivity with enterprise resource planning (ERP) and manufacturing execution systems (MES).

Industrial Metrology Market, By Application

Quality control and inspection hold the largest share due to the critical need for accurate, repeatable measurements in automotive, aerospace, and precision manufacturing. Reverse engineering, mapping, and modeling are expanding with the use of 3D scanning, CAD integration, and digital twin technologies. Adoption of automated inspection workflows, AI-based defect detection, and cloud analytics helps companies reduce errors, optimize processes, and accelerate product development across diverse industrial applications. Emerging applications, such as in additive manufacturing and smart factory setups, are expected to drive further growth.

Industrial Metrology Market, By End-User Industry

The automotive industry accounts for the largest market share, driven by the need for precision, adherence to strict quality standards, and increasing automation in production lines. Aerospace, electronics, medical, and heavy machinery sectors are rapidly adopting advanced metrology solutions for improved safety, reliability, and operational efficiency. Integration of software-driven measurement systems, digital workflows, and robotic-assisted inspection is driving enhanced accuracy, faster throughput, and reduced operational costs. Growing adoption in medical device manufacturing and renewable energy equipment is creating new opportunities for metrology solutions.

REGION

Asia Pacific to be fastest-growing region in global near-eye display market during forecast period

Asia Pacific is expected to emerge as the fastest-growing region in the Industrial Metrology market, driven by rapid industrial modernization and increasing adoption of automated, high-precision measurement solutions across China, Japan, South Korea, and India. Strong demand in automotive, aerospace, electronics, and heavy machinery sectors is supported by government initiatives promoting smart manufacturing, Industry 4.0, and digital factory transformations. China’s robust manufacturing infrastructure, Japan’s expertise in precision engineering, South Korea’s electronics and semiconductor industries, and India’s expanding industrial automation initiatives are key growth drivers. Additionally, strategic collaborations between metrology equipment manufacturers, software providers, and industrial clients are accelerating technology adoption, innovation, and establishing the region as a hub for advanced measurement and inspection solutions.

Industrial Metrology Market: COMPANY EVALUATION MATRIX

In the Industrial Metrology market matrix, Hexagon AB (Star) leads with a strong market presence, offering high-precision CMMs, laser scanners, optical displacement sensors, and software-integrated measurement solutions. Hexagon’s comprehensive ecosystem, combined with strategic collaborations with industrial clients, software providers, and R&D institutes, positions it as a dominant force driving large-scale adoption of advanced metrology solutions globally. Renishaw plc (Emerging Leader) is gaining traction with innovative scanning systems, probing technologies, and integrated software platforms. While Hexagon dominates through product performance and enterprise partnerships, Renishaw demonstrates strong potential to move toward the leaders’ quadrant by scaling its hardware innovations, expanding software-enabled solutions, and increasing adoption across automotive, aerospace, electronics, and medical industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.76 Billion |

| Market Forecast in 2030 (Value) | USD 19.01 Billion |

| Growth Rate | CAGR of 5.9% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Rest of the World |

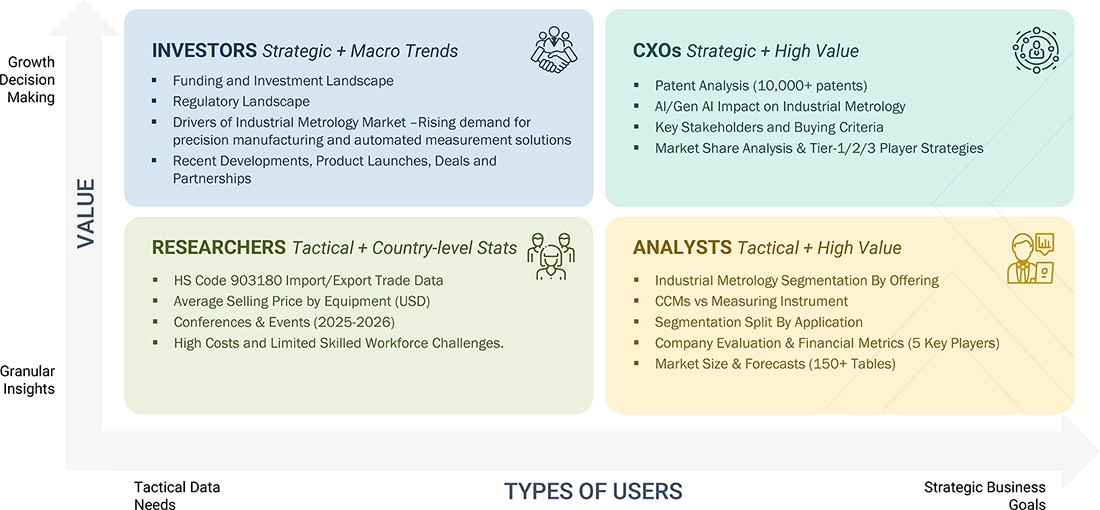

WHAT IS IN IT FOR YOU: Industrial Metrology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Industrial Equipment Manufacturers |

|

|

| Enterprise & Manufacturing Solution Providers |

|

|

| Component & Sensor Suppliers |

|

|

| Metrology Software & Analytics Developers |

|

|

| Investors & Venture Capital Firms |

|

|

RECENT DEVELOPMENTS

- November 2024 : Carl Zeiss AG launched ZEISS CONNECTED QUALITY, a metrology center designed to globalize quality processes. This innovative suite of software promotes effective data sharing, inspection planning, and monitoring of systems across several locations.

- October 2024 : Creaform released updated HandySCAN 3D | MAX Series devices that deliver better accuracy and speed for big and intricate part scanning. The new series delivers 30% more precision for 5-meter parts with its enhanced measurement capacity that ranges between 0.075 mm and 0.010 mm/m. The updated system now offers improved measurement results plus new scanning tools alongside stronger computer software.

- September 2024 : Hexagon AB launched Leica Absolute Tracker ATS800, to minimize the delays in quality inspection in bulk manufacturing. Coupling laser tracking with laser radar capability enables the manufacturer to probe complex features and achieve close assembly tolerances at tens of meters in distance.

Table of Contents

Methodology

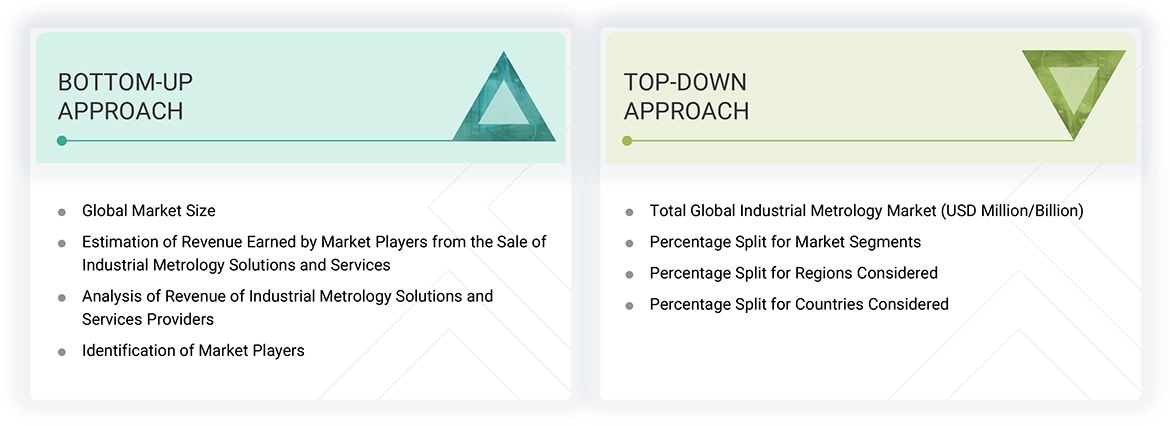

The research study involved 4 major activities in estimating the size of the industrial metrology market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the industrial metrology market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the industrial metrology market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the industrial metrology market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the industrial metrology market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and service providers in the industrial metrology market and studying their solutions

- Analyzing trends related to the adoption of industrial metrology solutions and services

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of industrial metrology solutions and services

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Industrial Metrology Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall industrial metrology market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Industrial metrology provides accuracy and precision in production and quality inspection. It includes measurement and inspection processes, calibration routines, measurement system control, and managing the instruments of measurement in manufacturing industries. By harmonizing measurement with industry needs, industrial metrology increases product quality, promotes technological innovation, and fuels a competitive manufacturing environment. Industrial metrology also contributes to scientific and industrial progress by facilitating innovation and efficiency. The industrial metrology market has been segmented based on offering, equipment, application, end-use industry, and geography. Based on offering, the market is segmented into hardware, software, and services. Equipment comprise CMMs (Coordinate-measuring machines), ODS (Optical scanners and digitizers), measuring instruments, X-ray & CT systems, AOI (Automated optical inspection) Systems, form measurement machines, and 2D equipment. These technologies find widespread usage in multiple end-use industries such as aerospace & defense, automotive, architecture & construction, medical, electronics, energy & power, heavy machinery, mining, and others. Some of the notable applications of industrial metrology are quality control & inspection, reverse engineering, and mapping & modeling in these industries.

An SSE solution requires four fundamental security capabilities: zero trust access network (ZTNA), cloud access security broker (CASB), secure web gateway (SWG), and firewall-as-a-service (FWaaS).

Key Stakeholders

- Raw material suppliers

- Industrial metrology product manufacturers

- Original equipment manufacturers (OEMs)

- OEM technology providers

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Forums, alliances, and associations

- Technology investors

- Research institutes and organizations

- Analysts and strategic business planners

- Market research and consulting firms

- Metrology-related associations, organizations, forums, and alliances

- Government bodies such as regulatory authorities and policymakers

- Venture capitalists, private equity firms, and startup companies

Report Objectives

- To define, describe, and forecast the industrial metrology market, by offering, application, end-use industry, and region, in terms of value

- To forecast the industrial metrology market, by equipment, in terms of value and volume

- To estimate the historical and forecast market sizes, by equipment, for ODS and CMMs, in terms of volume

- To provide the market size estimation for North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth

- To provide a detailed overview of the industrial metrology supply chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To provide information pertaining to key technology trends and patent analysis related to the industrial metrology market

- To provide information regarding trade data related to the industrial metrology market

- To strategically profile key players in the industrial metrology market and comprehensively analyze their market shares and core competencies

- To benchmark the market players using the company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market rankings/shares and product portfolios

- To analyze competitive developments, such as agreements, expansions, acquisitions, product launches, collaborations, partnerships, and research & development (R&D), in the industrial metrology market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

|

Automated Inspection and Quality Control |

9 |

|

Data Analysis and Interpretation |

8 |

|

Customization and Product Development |

7 |

|

Simulation and Virtual Testing |

8 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Metrology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Metrology Market