3D Scanners Market by Offering (Hardware, Software, Services), Type (3D Laser Scanners, Structured Light Scanners), Technology (Laser Triangulation, Pattern Fringe, Laser Pulse, Laser Phase-shift), Range, Industry and Region - Global Forecast to 2028

Updated on : Sep 12, 2024

3D Scanner Market Size, Share & Growth

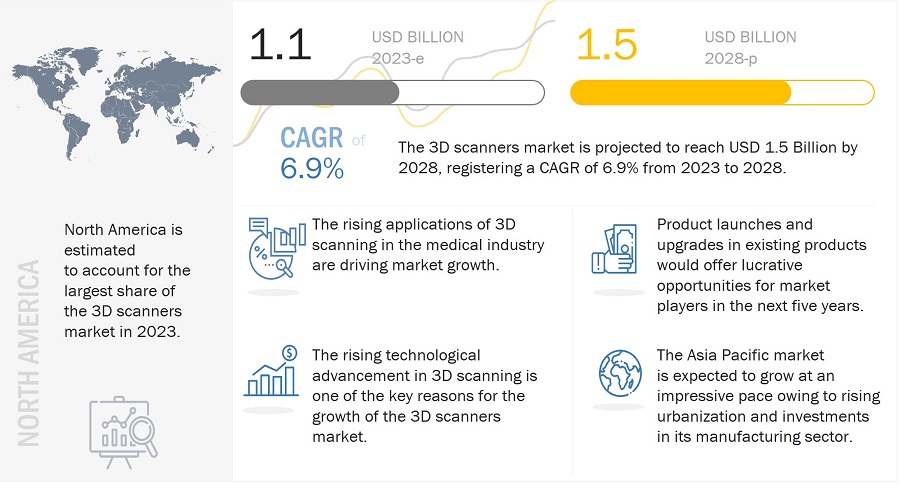

[250 Pages Report] The global 3D scanners market size is projected to grow from USD 1.1 Billion in 2023 to USD 1.5 Billion by 2028, at a CAGR of 6.9% during the forecast period.

The market for 3D laser scanners is projected to grow significantly during the forecast period owing to their easy availability and convenience of usage. These scanners are widely used in automotive, architecture & construction, healthcare, and energy & power industries. 3D scanners are widely used in the automotive industry in the early stages of designing, producing, and installing single components and finished products in automobiles. Quality control & inspection are also important processes in automobile production. Other popular 3D scanning applications in this industry include prototyping, simulating, aftermarket designing, and reverse engineering. Such applications are expected to drive the demand of 3D scanners industry worldwide.

3D Scanners Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

3D Scanner Market Trends & Dynamics

DRIVERS: Growing implementation of 3D scanning in medical industry

Traditionally, medical practitioners measured body size and shape by hand to assess health status. Nowadays, computed tomography (CT) scanners can produce 3D internal images of an individual’s body. 3D body surface scanners are transforming the ability to accurately measure a person’s body size, shape, and skin-surface area. Though these scanners have been mainly developed for the clothing industry, their low cost, non-invasiveness, and ease of use make them appealing for widespread clinical applications and large-scale epidemiological surveys. 3D scanners are used in designing and manufacturing orthosis/prosthesis, designing and manufacturing aesthetic prostheses, and monitoring wound healing. Mobile 3D scanners can detect the shape of the limb, enabling an accurate 3D-printed model. Hence, 3D scanning provides a much better fit and is crucial for prosthetic design.

RESTRAINTS: Availability of 3D scanning substitutes

3D scanners have applications in various industries, including manufacturing, architecture & construction, and healthcare. Cost-effective alternatives to 3D scanning are available for these industries. For architecture, construction, and geospatial industries, cost-effective alternatives such as manual measurement, electronic distance measurement (EDM), total stations, theodolites, mobile mapping, photogrammetry, and 360-degree systems are available. EDM is capable of highly accurate measurements, and the data collected is used to construct an object in 3D. It is one of the most commonly used methods in the construction industry. However, though EDM is highly accurate, it is slow, and creating a 3D model with its help is complex. In the manufacturing industry, the conventional method of 3D scanning through tactile probing is still widely used, especially in the Asia Pacific. In the healthcare industry, especially for dental applications, the traditional and manual method of PVS impression is used to measure tooth structure as a cost-effective solution. Though 3D scanners offer quick and highly accurate 3D scanning, the availability of cost-effective alternatives may restrain the growth of the 3D scanners market.

OPPORTUNITIES: Increasing adoption of 3D scanners in public safety

The demand for accurate and fast data collection methods is growing rapidly in public safety organizations to clear accident/crime scenes faster, minimize time on the scene, and reduce the manpower requirements for evidence gathering. The adoption of tools such as 3D laser scanners, 360-degree cameras, and drones in crime scene/accident reconstruction and fire investigations is growing, as they can capture data efficiently and accurately. These tools complement each other, especially in large crime scenes or accident sites such as traffic accidents, forest fires, building fires, etc., and help investigators create a complete view and achieve safer, faster, and more accurate results. With more and more law enforcement agencies and fire departments investing in advanced tools such as 3D laser scanners, total robotic stations, drones, etc., a combined solution that can integrate and use data from multiple tools will offer attractive growth opportunities in the years to come. Additionally, 3D data analysis and visualization software solutions that can create virtual reality (VR) compatible deliverables wherein a jury can walk through the actual crime scene and experience various viewpoints will help them make informed decisions.

CHALLENGES: Complexity of 3D scanning software solutions

Companies employ new, updated 3D scanning software that enables non-contact, fast, accurate, and automated inspections and measurements. However, proper training is crucial for users to take full advantage of advanced 3D laser scanners and scanning software. The complex post-processing workflows might seem challenging for users who do not use these devices or use them infrequently. Hence, 3D scanning software solutions are complex to operate and require proper training. Increased focus on providing more comprehensive training, fresher training, and technical support are some major steps that can help mitigate this challenge. Additionally, the unwillingness to switch from conventional measurement methods to modern techniques hinders the market growth.

The quality control & inspection segment to hold highest market share during the forecast period.

Quality control & inspection are integral to the production process to ensure smooth conduct without incurring any extra cost. In quality control & inspection applications, 3D scanners are used for CAD-based inspections, dimensional analysis, machine calibrations, etc. 3D scanners are also used to check misalignments, which can cause machine downtime and adversely affect the performance of machines. 3D scanning enables part inspections and dimensional analysis of machine components to verify their accuracy and quality and eliminate costly scraps and reworks. 3D scanning also allows the identification of defective parts, which arrive from suppliers, to establish and maintain strict quality standards, especially in critical industries like healthcare, automotive, aerospace, and defense. 3D scanners are used for quality control & inspection in many other industries, such as architecture & construction, electronics, energy & power, and heavy machinery.

The market for automotive industry is expected to grow at the highest CAGR during the forecast period

3D scanners are widely used in the automotive industry in the early stages of designing, producing, and installing single components and finished products in automobiles. Quality control & inspection are also important processes in automobile production. Most car manufacturers do not make their digital data available to outside producers; hence, the production of replacement parts, such as spoilers and bumpers, depends on 3D scanning. For instance, while designing and manufacturing a bumper for a particular car, 3D scanning can capture mount points and clearance areas to ensure that the new bumper will fit perfectly. Other popular 3D scanning applications in this industry include prototyping, simulating, aftermarket designing, and reverse engineering. 3D scanning technology is also used in aftermarket component production. Hexagon AB, Carl Zeiss AG, and Nikon Corporation are among the leading players that offer state-of-the-art 3D scanners for use in the automotive industry.

Medium range scanners expected to grow at a highest CAGR during the forecast period

Medium range scanners generally have a scanning range of 1–30 meters. Time of flight (TOF) scanning technology is widely used for medium-range 3D scanning. Medium-range 3D scanners have many applications in the architecture and construction industry, from design to maintenance activities of buildings or process plants. Handheld medium-range 3D scanners, which enable complete onsite 3D scene documentation, are also available in the market. Besides the architecture and construction industry, medium-range 3D scanners are used in artifact & cultural heritage preservation, forensics, and entertainment applications.

3D Scanners Market by Region

To know about the assumptions considered for the study, download the pdf brochure

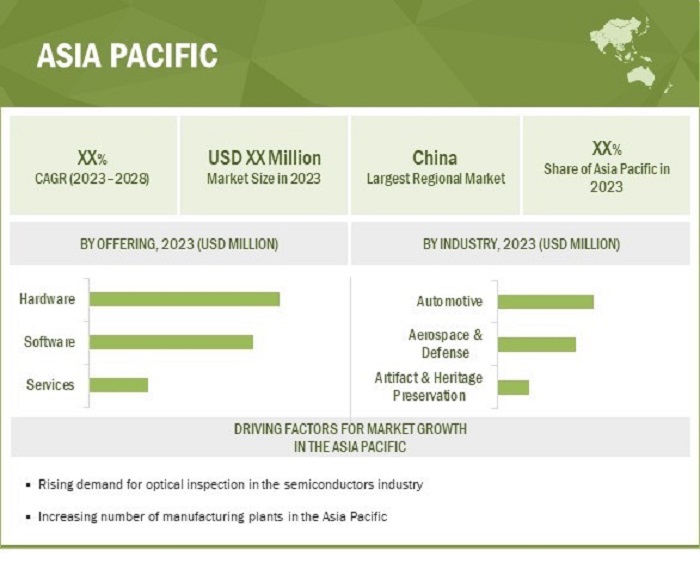

The market in Asia Pacific projected to grow at the highest CAGR from 2023 to 2028.

Growing population, flourishing economies, and ongoing government initiatives to promote industrial growth have made the Asia Pacific an ideal destination for production in several industries, including semiconductors, electronics, and automotive. The demand for automobiles in the Asia Pacific is also expected to grow in the coming years, which will boost production. Some key players in the 3D scanners market in this region are Topcon Corporation, Nikon Corporation, and Maptek Pty Ltd. China is one of the key manufacturing hubs in the world, and it held the largest share of the Asia Pacific 3D scanners market in 2022. It is also expected to continue its dominant position during the forecast period. The country is considered the global manufacturing hub for electronics, semiconductors, automobiles, and other consumer industries. OEMs in China are continuously striving to improve the production capabilities of their automobile manufacturing plants through quality checks, which are expected to fuel the demand for 3D scanners in the country.

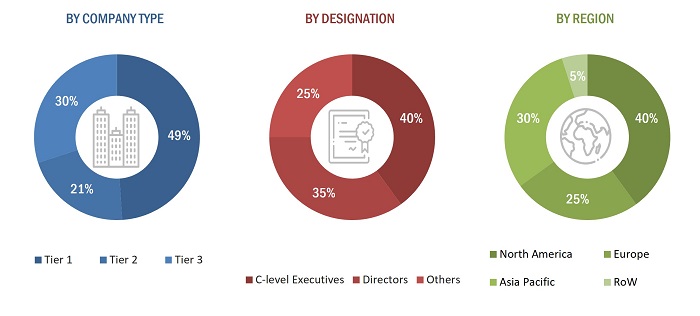

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 49%, Tier 2 - 21%, and Tier 3 - 30%

- By Designation: C-level Executives - 40%, Directors - 35%, and Others - 25%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 30%, and RoW - 5%

Key Market Players - 3D Scanner Market

The 3D scanners companies such as Hexagon AB (Sweden), FARO Technologies, Inc. (US), Trimble Inc. (US), Nikon Corporation (Japan), and Carl Zeiss AG (Germany) are among a few top players in the 3D scanners market.

3D Laser Scanners Market Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.1 Billion in 2023 |

|

Projected Market Size |

USD 1.5 Billion by 2028 |

|

Growth Rate |

CAGR of 6.9% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Offering, Type, Technology, Range, Product Type, Application and Industry |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Hexagon AB (Sweden), FARO Technologies, Inc. (US), Trimble Inc.(US), Nikon Corporation (Japan), and Carl Zeiss AG (Germany) and Others- (Total 26 players have been covered) |

3D Scanners Market Highlights

This research report categorizes the 3D scanners market by offering, type, technology, range, product type, application, industry and region.

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Type: |

|

|

By Range: |

|

|

By Technology: |

|

|

By Product Type: |

|

|

By Application: |

|

|

By Industry: |

|

|

By Region |

|

Recent Developments

- In October 2022, FARO Technologies, Inc. announced the release of the Focus Core Laser Scanner. The scanner provides high capturing efficiency, accuracy, and data quality for professional applications. It takes less than one minute per scan.

- In September 2022, Creaform announced the release of Peel 3 and Peel 3.CAD, offering high versatility, performance, and affordability.

- In July 2020, Trimble Inc. announced the Trimble X12 scanning system to the geospatial scanning portfolio. This scanner integrates with Trimble software to capture data precisely and in-field registration with state-of-the-art 3D laser scanning and imaging hardware technology.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the 3D scanners market during 2023-2028?

The global 3D scanners market is expected to record a CAGR of 6.9% from 2023–2028.

What are the driving factors for the 3D scanners market?

Growing implementation of 3D scanning in medical and manufacturing industries is the key driving factor for this 3D scanners market.

Which are the significant players operating in the 3D scanners market?

Hexagon AB (Sweden), FARO Technologies, Inc. (US), Trimble Inc. (US), Nikon Corporation (Japan), and Carl Zeiss AG (Germany) are among a few top players in the 3D scanners market.

Which region will grow at a fast rate in the future?

The 3D scanners market in Asia Pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for 3D scanning in manufacturing- Growing importance of 3D data in product modeling and visualization- Increasing preference for 3D scanning over traditional inspection methods for quality control- Growing implementation of 3D scanning in medical industry- Rapid technological advancements in 3D scanningRESTRAINTS- Availability of substitutesOPPORTUNITIES- Growing investments in Industry 4.0 adoption- Increasing adoption of 3D scanners in public safetyCHALLENGES- Complexity of 3D scanning software solutions- High costs of using 3D scanners

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

-

5.7 TECHNOLOGY ANALYSISCLOUD-BASED SOLUTIONSARTIFICIAL INTELLIGENCE5G

- 5.8 PORTER’S FIVE FORCES ANALYSIS

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS, 2022–2023

-

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

-

6.2 HARDWARECONTINUOUS ADVANCEMENTS IN 3D SCANNING HARDWARE TO BOOST MARKET

-

6.3 SOFTWARERISING ADOPTION OF AI TO FAVOR GROWTH

-

6.4 SERVICESNEED FOR REGULAR HARDWARE AND SOFTWARE MAINTENANCE DRIVING SERVICES MARKETAFTERSALES SERVICESSTORAGE-AS-A-SERVICEMEASUREMENT SERVICES

- 7.1 INTRODUCTION

-

7.2 3D LASER SCANNERSRISING DEMAND FOR RAPID, NON-CONTACT MEASUREMENT TO DRIVE ADOPTION

-

7.3 STRUCTURED LIGHT SCANNERSGROWING NEED FOR COST-EFFECTIVE SCANNING SOLUTIONS TO BOOST MARKET

- 8.1 INTRODUCTION

-

8.2 SHORT RANGEHIGH DEMAND IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

-

8.3 MEDIUM RANGERISING USAGE IN ARCHITECTURE AND CONSTRUCTION TO SUPPORT GROWTH

-

8.4 LONG RANGEGROWING DEMAND FOR HIGH ACCURACY IN LARGE-AREA SCANNING TO BOOST ADOPTION

- 9.1 INTRODUCTION

-

9.2 LASER TRIANGULATIONHIGH RESOLUTION AND ACCURACY TO BOOST GROWTH

-

9.3 PATTERN FRINGE TRIANGULATIONTECHNOLOGY ADOPTION TO RELY ON DEMAND FOR STRUCTURED LIGHT SCANNERS

-

9.4 LASER PULSE BASEDPRECISION IN MEASURING LARGE OBJECTS TO SUPPORT DEMAND

-

9.5 LASER PHASE-SHIFT BASEDGROWING DEMAND FOR AS-BUILT PLANS IN INDUSTRIES TO ENSURE GROWTH

- 10.1 INTRODUCTION

-

10.2 FIXEDHIGH DEMAND TO INSPECT CRITICAL COMPONENTS ACROSS INDUSTRIES TO DRIVE MARKET- Bridge CMM- Gantry CMM- Horizontal arm CMM

-

10.3 TRIPOD-MOUNTEDGROWING DEMAND FOR 3D SCANNING IN ARCHITECTURE AND CONSTRUCTION TO BOOST MARKET

-

10.4 PORTABLEHIGH PORTABILITY AND CAPABILITY TO SCAN SMALL SPACES TO DRIVE ADOPTION

-

10.5 DESKTOPGROWING NEED FOR 3D SCANNING OF COMPLEX OBJECTS TO SUPPORT GROWTH

- 11.1 INTRODUCTION

-

11.2 QUALITY CONTROL & INSPECTIONSTRINGENT QUALITY STANDARDS IN CRITICAL INDUSTRIES TO DRIVE MARKET

-

11.3 REVERSE ENGINEERINGGROWING DEMAND FOR 3D MODELING AND PART RECONSTRUCTION TO PUSH ADOPTION

-

11.4 VIRTUAL SIMULATIONINCREASING USAGE OF REAL-TIME SIMULATION AND ANALYSIS PUSHING DEMAND SURGE

- 11.5 OTHER APPLICATIONS

- 12.1 INTRODUCTION

-

12.2 AEROSPACE & DEFENSEREQUIREMENT TO MAINTAIN HIGH QUALITY AND SAFETY STANDARDS TO DRIVE ADOPTION OF 3D SCANNERSCOMMERCIAL AIRCRAFTDEFENSESPACE

-

12.3 AUTOMOTIVENEED FOR QUALITY INSPECTION AND REVERSE ENGINEERING TO DRIVE DEMAND FOR 3D SCANNERSAUTOMOTIVE DESIGNING AND STYLINGPILOT PLANT METROLOGYAUTOMOTIVE COMPONENT INSPECTION

-

12.4 ARCHITECTURE & CONSTRUCTIONRISING DEMAND IN BUILDING MODELING AND SURVEYING TO AUGMENT MARKETPLANT SCANNINGOUTDOOR AND INDOOR SCANNING

-

12.5 MEDICALGROWING DEMAND IN DENTAL AND ORTHOPEDICS APPLICATIONS TO BOOST SCANNER USAGEDENTALORTHOPEDICSNEUROSURGERY

-

12.6 ELECTRONICSGROWING INVESTMENTS IN SEMICONDUCTOR INDUSTRY TO SUPPORT GROWTH

-

12.7 ENERGY & POWERNEED FOR REGULAR INSPECTIONS TO DRIVE ADOPTIONHYDROPOWERWIND POWERPETROCHEMICALS

-

12.8 ARTIFACT & HERITAGE PRESERVATIONGROWING DEMAND FOR ACCURATE AND DETAILED SCANS FOR RENOVATION TO BOOST MARKET

-

12.9 MININGRAPID DETECTION CAPABILITIES TO ATTRACT END-USER INTEREST IN 3D SCANNING

- 12.10 OTHER INDUSTRIES

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICAUS- US to hold largest share of North American marketCANADA- High demand in several industries to favor 3D scanners marketMEXICO- Growing automotive industry to boost market growth

-

13.3 EUROPEGERMANY- Germany to dominate European marketUK- Huge aerospace and automotive manufacturing sectors to ensure strong demandFRANCE- Growing investment in medical industry to augment growthITALY- Strong focus on strengthening manufacturing to drive marketSPAIN- High investments in automotive manufacturing to support growthREST OF EUROPE

-

13.4 ASIA PACIFICCHINA- China held the largest share of Asia Pacific market in 2022JAPAN- Rising aerospace and semiconductor industry to boost demandSOUTH KOREA- Growing expansion by automotive manufacturers to augment growthINDIA- Huge investments in developing manufacturing industry to favor marketREST OF ASIA PACIFIC

-

13.5 ROWMIDDLE EAST- Favorable government initiatives to drive marketAFRICA- Rising focus on infrastructure development to drive marketSOUTH AMERICA- High growth in automotive industry to boost demand

- 14.1 INTRODUCTION

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE ANALYSIS OF TOP FIVE COMPANIES

- 14.4 MARKET SHARE ANALYSIS, 2022

-

14.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.6 COMPANY EVALUATION QUADRANT FOR SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 14.7 3D SCANNERS MARKET: COMPANY FOOTPRINT

- 14.8 COMPETITIVE BENCHMARKING

-

14.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALS

-

15.1 KEY PLAYERSHEXAGON AB- Business overview- Products offered- Recent developments- MnM viewTRIMBLE INC.- Business overview- Products offered- Recent developments- MnM viewFARO TECHNOLOGIES, INC.- Business overview- Products offered- Recent developments- MnM viewCARL ZEISS AG- Business overview- Products offered- Recent developments- MnM viewNIKON CORPORATION- Business overview- Products offered- Recent developments- MnM viewARTEC EUROPE, S.A.R.L.- Business overview- Products offered- Recent developmentsCREAFORM- Business overview- Products offered- Recent developmentsCYBEROPTICS CORPORATION- Business overview- Products offeredJENOPTIK AG- Business overview- Products offered- Recent developmentsMAPTEK PTY LTD.- Business overview- Products offeredTOPCON CORPORATION- Business overview- Products offered- Recent developments

-

15.2 OTHER PLAYERSAUTOMATED PRECISION, INC.EVATRONIX SAKREON TECHNOLOGIESPOLYGA INC.RANGEVISION LLCREVOPOINT 3D TECHNOLOGIES INC.RIEGL LASER MEASUREMENT SYSTEMS GMBHSCANTECH (HANGZHOU) CO., LTD.SHINING 3D TECH CO., LTD.SURPHASERSMARTTECHSTONEX SRLTHUNK3DZOLLER & FRÖHLICH GMBHZG TECHNOLOGY CO., LTD.

- 16.1 INTRODUCTION

- 16.2 ROBOTIC VISION MARKET, BY REGION

-

16.3 NORTH AMERICAUS- US to hold largest share of robotic vision market in North America in 2021CANADA- Rising government funding to drive growth of robotic vision marketMEXICO- Mexico to emerge as major manufacturing hub in North America

- 17.1 INSIGHTS OF INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT

- TABLE 2 3D SCANNERS MARKET ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICES OF 3D SCANNERS, BY COMPANY (USD)

- TABLE 4 3D SCANNERS MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 7 CASE STUDY: ARTEC LEO HELPED VORTEQ CREATE FASTEST CYCLING SKINSUITS

- TABLE 8 CASE STUDY: 3D SCANNERS HELP DRIVE INNOVATION IN INSPECTION

- TABLE 9 CASE STUDY: USE OF POINT CLOUD DATA FOR AUTOMATIC INSPECTION MEASUREMENT

- TABLE 10 CASE STUDY: 3D SCANNER HELPED TO ACHIEVE ACCURATE AND FASTER MEASUREMENTS

- TABLE 11 CASE STUDY: 3D SCANNING FOR DESIGNING REPLACEMENT PIPING IN POWER PLANT

- TABLE 12 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 13 3D SCANNERS MARKET: LIST OF PATENTS, 2020–2022

- TABLE 14 3D SCANNERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 STANDARDS FOR 3D SCANNERS MARKET

- TABLE 20 3D SCANNERS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 21 3D SCANNERS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 22 3D SCANNING HARDWARE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 23 3D SCANNING HARDWARE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 24 3D SCANNING HARDWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 3D SCANNING HARDWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 3D SCANNING SOFTWARE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 27 3D SCANNING SOFTWARE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 28 3D SCANNING SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 3D SCANNING SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 3D SCANNING SERVICES MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 31 3D SCANNING SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 3D SCANNING SERVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 3D SCANNING SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 ADVANTAGES OF 3D LASER SCANNERS AND STRUCTURED LIGHT SCANNERS

- TABLE 35 DISADVANTAGES OF 3D LASER SCANNERS AND STRUCTURED LIGHT SCANNERS

- TABLE 36 3D SCANNERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 37 3D SCANNERS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 3D LASER SCANNERS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 39 3D LASER SCANNERS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 40 3D LASER SCANNERS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 3D LASER SCANNERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 STRUCTURED LIGHT SCANNERS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 43 STRUCTURED LIGHT SCANNERS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 44 STRUCTURED LIGHT SCANNERS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 STRUCTURED LIGHT SCANNERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 3D SCANNERS MARKET: RANGE COMPARISON

- TABLE 47 3D SCANNERS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 48 3D SCANNERS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 49 3D SCANNERS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 50 3D SCANNERS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 51 3D SCANNERS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 52 3D SCANNERS MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 53 3D SCANNERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 3D SCANNERS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 3D SCANNERS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 56 3D SCANNERS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 57 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 58 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 59 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 3D SCANNERS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 62 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 63 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 3D SCANNERS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 66 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 67 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 3D SCANNERS MARKET FOR ARCHITECTURE & CONSTRUCTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 70 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 71 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 3D SCANNERS MARKET FOR MEDICAL INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 3D SCANNERS MARKET FOR ELECTRONICS, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 74 3D SCANNERS MARKET FOR ELECTRONICS, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 75 3D SCANNERS MARKET FOR ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 3D SCANNERS MARKET FOR ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 3D SCANNERS MARKET FOR ENERGY & POWER, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 78 3D SCANNERS MARKET FOR ENERGY & POWER, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 79 3D SCANNERS MARKET FOR ENERGY & POWER, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 3D SCANNERS MARKET FOR ENERGY & POWER, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 82 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 83 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 3D SCANNING MARKET FOR ARTIFACT & HERITAGE PRESERVATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 3D SCANNERS MARKET FOR MINING, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 86 3D SCANNERS MARKET FOR MINING, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 87 3D SCANNERS MARKET FOR MINING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 3D SCANNERS MARKET FOR MINING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 90 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 91 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 3D SCANNERS MARKET FOR OTHER INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 3D SCANNERS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 3D SCANNERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: 3D SCANNERS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: 3D SCANNERS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: 3D SCANNERS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: 3D SCANNERS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: 3D SCANNERS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: 3D SCANNERS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: 3D SCANNERS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: 3D SCANNERS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: 3D SCANNERS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 104 EUROPE: 3D SCANNERS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: 3D SCANNERS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: 3D SCANNERS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: 3D SCANNERS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: 3D SCANNERS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: 3D SCANNERS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: 3D SCANNERS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: 3D SCANNERS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: 3D SCANNERS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 ROW: 3D SCANNERS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 114 ROW: 3D SCANNERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 ROW: 3D SCANNERS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 116 ROW: 3D SCANNERS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 ROW: 3D SCANNERS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 118 ROW: 3D SCANNERS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 120 3D SCANNERS MARKET SHARE ANALYSIS (2022)

- TABLE 121 COMPANY FOOTPRINT

- TABLE 122 INDUSTRY: COMPANY FOOTPRINT

- TABLE 123 REGIONAL: COMPANY FOOTPRINT

- TABLE 124 3D SCANNERS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 125 3D SCANNERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 126 3D SCANNERS MARKET: PRODUCT LAUNCHES, 2020–2022

- TABLE 127 3D SCANNERS MARKET: DEALS, 2020–2022

- TABLE 128 HEXAGON AB: BUSINESS OVERVIEW

- TABLE 129 HEXAGON AB: PRODUCT OFFERINGS

- TABLE 130 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 131 HEXAGON AB: DEALS

- TABLE 132 TRIMBLE INC.: BUSINESS OVERVIEW

- TABLE 133 TRIMBLE INC.: PRODUCT OFFERINGS

- TABLE 134 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 135 FARO TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 136 FARO TECHNOLOGIES, INC.: PRODUCT OFFERINGS

- TABLE 137 FARO TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 138 FARO TECHNOLOGIES, INC.: DEALS

- TABLE 139 CARL ZEISS AG: BUSINESS OVERVIEW

- TABLE 140 CARL ZEISS AG: PRODUCT OFFERINGS

- TABLE 141 CARL ZEISS AG: PRODUCT LAUNCHES

- TABLE 142 CARL ZEISS AG: DEALS

- TABLE 143 NIKON CORPORATION: BUSINESS OVERVIEW

- TABLE 144 NIKON CORPORATION: PRODUCT OFFERINGS

- TABLE 145 NIKON CORPORATION: PRODUCT LAUNCHES

- TABLE 146 NIKON CORPORATION: DEALS

- TABLE 147 ARTEC EUROPE, S.A.R.L.: BUSINESS OVERVIEW

- TABLE 148 ARTEC EUROPE, S.A.R.L.: PRODUCT OFFERINGS

- TABLE 149 ARTEC EUROPE, S.A.R.L.: PRODUCT LAUNCHES

- TABLE 150 CREAFORM: BUSINESS OVERVIEW

- TABLE 151 CREAFORM: PRODUCT OFFERINGS

- TABLE 152 CREAFORM: PRODUCT LAUNCHES

- TABLE 153 CYBEROPTICS CORPORATION: BUSINESS OVERVIEW

- TABLE 154 CYBEROPTICS CORPORATION: PRODUCT OFFERINGS

- TABLE 155 JENOPTIK AG: BUSINESS OVERVIEW

- TABLE 156 JENOPTIK AG: PRODUCT OFFERINGS

- TABLE 157 JENOPTIK AG: DEALS

- TABLE 158 MAPTEK PTY LTD.: BUSINESS OVERVIEW

- TABLE 159 MAPTEK PTY LTD.: PRODUCT OFFERINGS

- TABLE 160 TOPCON CORPORATION: BUSINESS OVERVIEW

- TABLE 161 TOPCON CORPORATION: PRODUCT OFFERINGS

- TABLE 162 TOPCON CORPORATION: PRODUCT LAUNCHES

- TABLE 163 ROBOTIC VISION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 164 ROBOTIC VISION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 165 NORTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 166 NORTH AMERICA: ROBOTIC VISION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 167 NORTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 168 NORTH AMERICA: ROBOTIC VISION MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

- FIGURE 1 3D SCANNERS MARKET: SEGMENTATION

- FIGURE 2 3D SCANNERS MARKET: RESEARCH DESIGN

- FIGURE 3 3D SCANNERS MARKET: RESEARCH APPROACH

- FIGURE 4 3D SCANNERS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 3D SCANNERS MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR 3D SCANNERS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS

- FIGURE 9 HARDWARE TO DOMINATE 3D SCANNERS MARKET FROM 2023 TO 2028

- FIGURE 10 3D LASER SCANNERS SEGMENT TO REGISTER HIGHEST GROWTH

- FIGURE 11 QUALITY CONTROL & INSPECTION TO HOLD LARGEST MARKET SHARE, BY APPLICATION

- FIGURE 12 AUTOMOTIVE SEGMENT TO DOMINATE 3D SCANNERS MARKET, BY INDUSTRY

- FIGURE 13 NORTH AMERICA TO HOLD LARGEST MARKET SHARE, BY REGION

- FIGURE 14 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 15 IMPACT OF RECESSION ON 3D SCANNERS MARKET

- FIGURE 16 GROWING MEDICAL INDUSTRY AND TECHNOLOGICAL ADVANCEMENT IN 3D SCANNERS TO DRIVE MARKET GROWTH

- FIGURE 17 SHORT-RANGE SCANNERS TO ACCOUNT FOR LARGEST SHARE

- FIGURE 18 LASER TRIANGULATION TECHNOLOGY TO REGISTER HIGHEST CAGR

- FIGURE 19 QUALITY CONTROL & INSPECTION TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 20 AUTOMOTIVE SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE

- FIGURE 21 CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 22 3D SCANNERS MARKET DYNAMICS

- FIGURE 23 IMPACT OF DRIVERS ON 3D SCANNERS MARKET

- FIGURE 24 IMPACT OF RESTRAINTS ON 3D SCANNERS MARKET

- FIGURE 25 IMPACT OF OPPORTUNITIES ON 3D SCANNERS MARKET

- FIGURE 26 IMPACT OF CHALLENGES ON 3D SCANNERS MARKET

- FIGURE 27 3D SCANNERS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 3D SCANNERS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICES OF 3D SCANNERS, BY COMPANY (USD)

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES, 2022

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES, 2022

- FIGURE 33 IMPORT VALUE OF LASERS, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 34 EXPORT VALUE OF LASERS, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 36 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 37 3D SCANNERS MARKET: BY OFFERING

- FIGURE 38 3D SCANNERS MARKET, BY OFFERING, 2023 VS. 2028

- FIGURE 39 3D SCANNING SERVICES MARKET, BY TYPE, 2022

- FIGURE 40 3D SCANNERS MARKET: BY TYPE

- FIGURE 41 3D LASER SCANNERS TO HOLD LARGEST MARKET SHARE

- FIGURE 42 3D SCANNERS MARKET: BY RANGE

- FIGURE 43 SHORT-RANGE SCANNERS TO DOMINATE MARKET, BY RANGE

- FIGURE 44 3D SCANNERS MARKET: BY TECHNOLOGY

- FIGURE 45 LASER TRIANGULATION TO DOMINATE MARKET

- FIGURE 46 3D SCANNERS MARKET: BY PRODUCT TYPE

- FIGURE 47 PORTABLE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 48 3D SCANNERS MARKET: BY APPLICATION

- FIGURE 49 QUALITY CONTROL & INSPECTION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 50 3D SCANNERS MARKET: BY INDUSTRY

- FIGURE 51 AUTOMOTIVE TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 52 3D SCANNERS MARKET, BY REGION

- FIGURE 53 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 54 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN 3D SCANNERS MARKET DURING FORECAST PERIOD

- FIGURE 55 NORTH AMERICA: 3D SCANNERS MARKET SNAPSHOT

- FIGURE 56 GERMANY TO REGISTER HIGHEST CAGR IN EUROPEAN 3D SCANNERS MARKET DURING FORECAST PERIOD

- FIGURE 57 EUROPE: 3D SCANNERS MARKET SNAPSHOT

- FIGURE 58 CHINA TO DOMINATE ASIA PACIFIC 3D SCANNERS MARKET

- FIGURE 59 ASIA PACIFIC: 3D SCANNERS MARKET SNAPSHOT

- FIGURE 60 SOUTH AMERICA TO HOLD LARGEST SHARE OF ROW 3D SCANNERS MARKET DURING FORECAST PERIOD

- FIGURE 61 3D SCANNERS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2017–2021

- FIGURE 62 3D SCANNERS MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 63 3D SCANNERS MARKET: COMPANY EVALUATION QUADRANT FOR SMES, 2022

- FIGURE 64 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 65 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 66 FARO TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 67 CARL ZEISS AG: COMPANY SNAPSHOT

- FIGURE 68 NIKON CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 CYBEROPTICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 JENOPTIK AG: COMPANY SNAPSHOT

- FIGURE 71 TOPCON CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the 3D scanners market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the 3D scanners market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred 3D scanners providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from 3D scanners providers, such as Hexagon AB (Sweden), FARO Technologies, Inc. (US), Trimble Inc.(US), Nikon Corporation (Japan), and Carl Zeiss AG (Germany); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the 3D scanners market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the 3D scanners market based on offering, type, range, technology, product type, application, and industry, in terms of value

- To describe and forecast the size of the 3D scanners market based on four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the process flow of the 3D scanners market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the 3D scanners market

- To analyze opportunities for stakeholders by identifying high-growth segments of the 3D scanners market

- To provide a detailed analysis of the recession and its impact on the growth of the 3D scanners market and its segments

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies

- To analyze competitive developments, such as product launches, acquisitions, agreements, and partnerships, in the 3D scanners market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Future of 3D Scanner and the Optical Scanners Market

The future of the 3D scanner and optical scanners market is expected to be driven by a range of factors, including technological advancements, changing customer needs, and new applications in various industries. Here are some possible future trends for both markets:

Increased accuracy and speed: As technology continues to evolve, 3D scanners and optical scanners are expected to become even more accurate and faster. This will enable users to capture more detailed and precise scans, which can be useful for a range of applications, from product design and engineering to quality control and medical imaging.

Expansion of applications: 3D scanners and optical scanners are already being used in a variety of industries, from healthcare to manufacturing. In the future, there are likely to be new applications that emerge, such as in the fields of robotics, virtual and augmented reality, and gaming.

Integration with other technologies: As 3D scanners and optical scanners become more integrated with other technologies, such as artificial intelligence and the Internet of Things, they are likely to become even more powerful and versatile. For example, AI algorithms could be used to improve the accuracy of scans, while IoT sensors could enable 3D scanners and optical scanners to be used in remote or hazardous environments.

Growing demand for portable and handheld scanners: As mobile devices become more powerful and versatile, the demand for portable and handheld 3D scanners and optical scanners is likely to grow. This will enable users to capture scans on the go, making it easier to collect data in the field or in real-time.

Growth Opportunities and Niche Threats for optical scanners in the Future

Optical scanners have been widely used in various industries and applications such as document scanning, barcode scanning, and biometric identification. In the future, there are several growth opportunities and niche threats for optical scanners, including:

Growth Opportunities:

Increasing adoption of digital transformation: With the rise of digital transformation, businesses are seeking to go paperless and automate their processes. This trend is likely to fuel the demand for optical scanners, especially in the document scanning industry.

Emerging applications in healthcare: Optical scanners are finding new applications in the healthcare industry, including medical imaging and biometric identification. The increasing demand for personalized medicine and non-invasive diagnosis is expected to create new growth opportunities for optical scanners in healthcare.

Advancements in technology: With the advancements in technology, optical scanners are becoming more accurate and faster. The integration of artificial intelligence and machine learning is expected to enhance the performance of optical scanners, making them more efficient and reliable.

Growing e-commerce industry: The growing e-commerce industry is likely to boost the demand for barcode scanning, as it is an essential component of logistics and inventory management.

Niche Threats:

Increased competition from mobile devices: With the increasing capabilities of mobile devices, such as smartphones and tablets, many applications that once required optical scanners can now be done with a mobile camera. This may reduce the demand for some types of optical scanners.

Cybersecurity risks: Optical scanners are used in biometric identification, which raises concerns about data privacy and cybersecurity. As technology advances, there is a risk that hackers may be able to bypass the security measures of optical scanners and gain access to sensitive information.

Environmental concerns: The widespread use of optical scanners may raise concerns about the environmental impact of these devices. The disposal of electronic waste, including optical scanners, can have a negative impact on the environment if not done properly.

High cost: Some types of optical scanners can be costly, which may limit their adoption in some industries and applications.

Top companies in optical scanners market:

The optical scanner market includes various companies that operate in different segments, serving a wide range of industries such as healthcare, retail, manufacturing, logistics, and transportation. The top companies in the optical scanner market include Honeywell, Fujitsu, Zebra Technologies, Datalogic, Cognex, Epson, Canon, HP, Kodak Alaris, and Microscan Systems.

These companies provide a range of optical scanning solutions, including handheld scanners, stationary scanners, and mobile computers with built-in scanning capabilities. While there is intense competition, there are also many opportunities for growth in the market, driven by factors such as increasing demand for digital transformation, emerging applications in healthcare, and advancements in technology.

The market scope of optical scanners also includes various applications such as:

Document Scanning: Optical scanners are used to scan and digitize paper documents, making them more easily searchable and shareable in digital format. This is particularly useful in industries such as finance, legal, and healthcare.

Barcode Scanning: Optical scanners are used to scan barcodes, which contain information about a product, package, or shipment. This is a critical function in industries such as retail, logistics, and manufacturing.

Biometric Identification: Optical scanners are used for biometric identification, such as scanning fingerprints or retinas, to verify the identity of individuals. This is important in industries such as law enforcement, border control, and financial services.

Medical Imaging: Optical scanners are used in medical imaging to capture images of internal body structures. This is particularly useful in industries such as healthcare and life sciences.

Quality Control: Optical scanners are used for quality control in manufacturing to ensure that products meet certain standards and specifications. This is important in industries such as aerospace, automotive, and electronics.

3D Scanning: Optical scanners are used for 3D scanning to create digital models of physical objects. This is useful in industries such as architecture, engineering, and product design.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 3D Scanners Market

Doing some market research on 3d body scanners to judge market size and breakdown by region; specifically interested in the UK and Europe.