The study involved significant activities in estimating the current market size for the Industrial Valve market. Exhaustive secondary research was done to collect information on the Industrial Valve industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Industrial Valve market.

Secondary Research

The market for the companies offering smart manufacturing solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to to identify and collect information related to the study. Secondary sources included annual reports, press releases, investor presentations of blockchain vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after understanding and analyzing the current scenario of the industrial valve market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

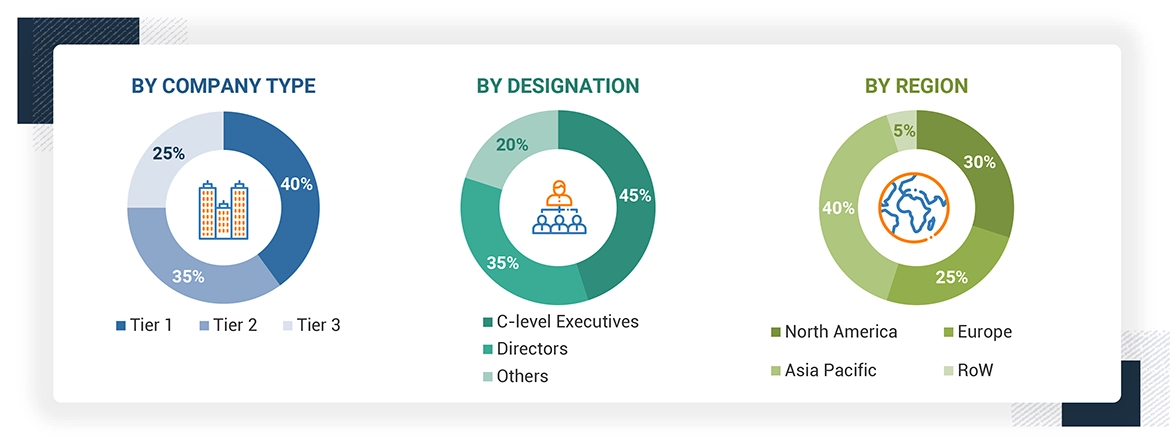

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts' opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches wete used to estimate and validate the total size of the Industrial Valve market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Industrial Valve Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Industrial Valve combines systems that provide real-time data to ascertain the changing demands and requirements of the manufacturing sector. It can solve the current and future problems of manufacturing through an open infrastructure, encompassing various information from enabling technology solutions. It also fosters flexibility in manufacturing processes and provides cost-effectiveness and agility.

Key Stakeholders

-

End users

-

Government bodies, venture capitalists, and private equity firms

-

Industrial Valve manufacturers

-

Industrial Valve distributors

-

Industrial Valve industry associations

-

Professional service/solution providers

-

Research institutions and organizations

-

Standards organizations and regulatory authorities

-

System integrators

-

Technology consultants

Report Objectives

-

To describe and forecast the Industrial Valve market in terms of value based on Valve type, Component, Function, Material, Fluid Type, Size, Pressure Range, and industry

-

To forecast the size of the Industrial Valve market in terms of volume

-

To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the RoW (Rest of the World)

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

-

To provide a detailed overview of the value chain of the Industrial Valve ecosystem

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the opportunities for stakeholders and details of the competitive landscape of the market

-

To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2

-

To analyze the major growth strategies implemented by key market players, such as agreements, acquisitions, product launches, expansions, and partnerships

-

To study the impact of AI on the market under study, along with a macroeconomic outlook for each region

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players based on various blocks of the supply chain

User

Sep, 2019

I have a requirement regarding the shipment data specific to North America with various types of valves.

User

Sep, 2019

Need to understand the butterfly triple off set valve market; it is included in this report.

User

Sep, 2019

Global trends & forecasts for the upcoming 5 years in Oil & Gas, Chemical, Power (generation), Energy, Ship, Maritime industries. Upcoming projects and plans with a focus on specific geographies.

User

Nov, 2019

I am looking for in-depth analysis of the industrial valves market. Can you help me with the scope of the industrial valves market? I would like to know more about the segments covered in the report. I would also like to understand the research methodology used to arrive at the market size..

User

Mar, 2019

I am Interested in undertanding the total global industrial valves market in terms of volume and size. I am also interested in understanding the competitive landscape of market players the key strategies adopted by them in this market..