Infrared Imaging Market Size, Share & Trends

Infrared Imaging Market by Type (Reflective, Thermal), Wavelength (NIR, SWIR, MWIR, LWIR), Component (Cameras, Scopes, Modules), Technology (Cooled, Uncooled), Application (Condition Monitoring, Detection, Security & Surveillance)- Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The infrared imaging market is projected to grow from USD 8.61 billion in 2025 to USD 11.65 billion by 2030, at a CAGR of 6.2% from 2025 to 2030. The infrared imaging market is propelled by rising demand in defence, industrial automation, healthcare diagnostics, and surveillance applications. Growing security threats and the need for enhanced visibility in low-light conditions are accelerating the adoption of thermal imaging across military and law enforcement agencies. In parallel, industries use infrared cameras for predictive maintenance, reducing downtime and improving safety.

KEY TAKEAWAYS

- The North American Infrared Imaging market accounted for a 47.1% revenue share in 2025.

- By Type, the reflective segment is expected to account the highest CAGR of 7.2%

- By Component, the cameras segment is projected to grow at fastest rate from 2025-2030

- By Technology, the uncooled segment is expected to dominate the market

- By Application, the monitoring & inspection segment will grow the fastest during the forecast period

- Teledyne FLIR LLC, Fluke Corporation, and L3 Harris Technologies were identified as star players in the infrared imaging market, as they have focused on innovation and have brought industry coverage and strong operational and financial strength

- Seek Thermal, INFRARED CAMERAS INC., and Tonbo Imaging have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy

The infrared imaging industry is projected to grow rapidly over the next decade, driven by the demand for infrared imaging systems is driven by the need for accurate, non-contact thermal monitoring across defence, manufacturing, healthcare, and energy sectors. Rising concerns about equipment failures, process inefficiencies, and public safety are prompting industries to deploy infrared imaging solutions for real-time diagnostics and surveillance. Market growth is further supported by increasing investments in smart infrastructure, automation, and advanced safety systems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Infrared imaging technology captures and visualizes thermal energy emitted by objects and environments, finding extensive use across defence, industrial, and surveillance sectors. Market growth is fuelled by rising adoption in security and surveillance applications, along with the increasing demand for uncooled infrared cameras. Additionally, expanding applications of SWIR cameras and the growing integration of infrared imaging in aerospace systems are creating significant opportunities for industry players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing use of infrared imaging products in security & surveillance applications

-

Rising adoption of infrared cameras in quality control and inspection applications

Level

-

Stringent import and export regulations for selling infrared cameras in US

-

Limitations associated with image resolution and sensitivity of infrared cameras

Level

-

Emerging applications of IR imaging technology in automotive sector

-

Integration of infrared imaging technology into consumer electronics

Level

-

Integration and compatibility challenges pertaining to infrared imaging technology

-

Crafting precision-engineered IR imaging products requires advanced design expertise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing use of infrared imaging products in security & surveillance applications

The increasing use of infrared imaging products in security and surveillance applications is a significant growth driver for the market. Rising global concerns over safety, border security, and crime prevention fuel demand for advanced imaging solutions. Infrared cameras enable enhanced visibility in low-light or no-light conditions, providing critical support for law enforcement, military, and civilian security operations. This trend is expected to accelerate adoption across both developed and emerging economies.

Restraint: Stringent import and export regulations for selling infrared cameras in US

Stringent import and export regulations in the U.S. for selling infrared cameras pose a significant barrier for market players. Restrictions on advanced infrared technology due to national security concerns limit global trade, making it difficult for manufacturers to expand their international footprint and capitalize on cross-border opportunities.

Opportunity: Emerging applications of IR imaging technology in automotive sector

The automotive sector presents a significant opportunity for infrared imaging technology, particularly with the rise of advanced driver assistance systems (ADAS) and autonomous vehicles. Infrared cameras enhance driver safety by detecting pedestrians, animals, and obstacles in low visibility conditions such as night or fog. Growing investments by automotive OEMs in thermal imaging for collision avoidance, smart navigation, and driver monitoring systems are expected to accelerate demand, creating lucrative avenues for infrared imaging providers worldwide.

Challenge: Integration and compatibility challenges pertaining to infrared imaging technology

Integration and compatibility challenges remain a key hurdle in the infrared imaging market. Aligning infrared systems with existing digital platforms, sensors, and industrial setups requires specialized expertise. High costs of integration and interoperability issues hinder seamless adoption, particularly across emerging industries, slowing down large-scale deployment of infrared imaging solutions.

Infrared Imaging Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Thermal imaging cameras for military surveillance and border security applications | Enhanced threat detection| Real-time monitoring| Improved operational safety in low-visibility conditions |

|

Handheld IR thermography for electrical and mechanical predictive maintenance | Reduced downtime| Early fault identification| Cost savings through preventive repairs |

|

Cooled MWIR/LWIR sensors in aerospace platforms for target acquisition and tracking | High-resolution imaging| Extended detection range| Superior performance in adverse weather |

|

Integrated IR cameras in IP video surveillance systems for perimeter security | 24/7 monitoring| Low-light visibility| Seamless integration with network analytics |

|

Uncooled IR modules for missile guidance and defense electronics | Compact design| Reliable performance|Enhanced accuracy in guidance systems |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The infrared imaging market ecosystem features a robust network of stakeholders driving innovation in thermal and reflective technologies. OEMs like Xenics, Teledyne FLIR, Leonardo DRS, Fluke, Axis, and Opgal develop integrated imaging solutions for security and industrial applications. Component suppliers, including Intevac, C-Thermal, InfraTec, Lynred, IR Cameras, and Princeton Infrared Technologies, provide essential sensors and lenses. Software providers such as HGH Infrared Systems and New Imaging Technologies enable advanced analytics and AI integration. End consumers, notably the U.S. Air Force and Kongsberg, leverage these for defense, surveillance, and aerospace needs, fostering market growth across sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Infrared Imaging Market, By Type

The reflective segment is expected to grow at the highest CAGR, driven by its increasing use in scientific research, industrial testing, and material inspection. Its ability to provide high-precision imaging in laboratory and field applications is fuelling adoption, supported by advancements in sensor technology and cost-efficient optical solutions.

Infrared Imaging Market, By Component

The camera segment is projected to hold the largest share, owing to their wide applications in security, defence, industrial inspection, and healthcare. Continuous innovations, miniaturization, and cost reduction of infrared cameras have expanded adoption across industries, while rising demand for surveillance and monitoring in both military and civil applications boosts growth.

Infrared Imaging Market, By Wavelength

In 2024, the LWIR (Long-Wave Infrared) segment accounted for the largest share, owing to its strong suitability for night vision, surveillance, and thermal monitoring. LWIR cameras operate effectively in total darkness and through atmospheric obscurants, making them essential in defence, security, and industrial inspection applications.

Infrared Imaging Market, By Application

The security & surveillance segment captured the highest market share due to rising global security concerns, border monitoring needs, and critical infrastructure protection. Infrared imaging provides round-the-clock monitoring in low-light or obscured environments. Growing adoption by defence forces, airports, and smart cities initiatives has further accelerated the dominance of this segment.

Infrared Imaging Market, By Technology

The uncooled technology segment captured the highest market share, fuelled by lower costs, compact design, and maintenance-free operation. Uncooled infrared cameras are increasingly deployed in industrial monitoring, firefighting, and commercial surveillance applications, as they provide reliable imaging performance while being energy-efficient and more affordable than cooled counterparts.

Infrared Imaging Market, By Vertical

Between 2025 and 2030, the non-industrial segment is expected to register the highest CAGR, driven by rapid adoption in defence, civil infrastructure, medical, and research applications. In scientific studies, demand for enhanced security, early disease detection, and thermal monitoring will accelerate market growth globally across non-industrial sectors.

REGION

Asia Pacific to be the fastest-growing region in the global prinfrared imaging market during the forecast period

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period, driven by increasing defense budgets, rising industrial automation, and the adoption of surveillance solutions in countries like China, India, and Japan. Expanding aerospace, electronics, and semiconductor sectors also contribute significantly to infrared imaging demand in the region.

Infrared Imaging Market: COMPANY EVALUATION MATRIX

Teledyne FLIR LLC (Star) leads with a strong market presence and a wide portfolio in the infrared imaging market matrix, driving large-scale adoption across industries like defence and industrial inspection. Lynred (Emerging Leader) is gaining traction with advanced cooled IR detectors in aerospace and security applications. While Teledyne FLIR dominates with scale, Lynred shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - Top Infrared Imaging Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.06 Billion |

| Market Forecast in 2030 (Value) | USD 11.65 Billion |

| Growth Rate | CAGR of 6.2% from 2025–2030 |

| Years Considered | 2021–2024 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Reflective, Thermal By Component: Camera, Scopes, Modules By Wavelength: NIR, SWIR, MWIR, LWIR By Application: Security & Surveillance, Monitoring & Inspection, Detection By Technology: Cooled, Uncooled By Vertical: Industrial (Aerospace, Electro |

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Infrared Imaging Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Infrared Imaging Manufacturer |

|

|

| Thermal Imaging-Based Manufacturer |

|

|

| Security & Surveillance Infrared Imaging Manufacturer |

|

|

| US-based Infrared Imaging Raw Material Supplier |

|

|

| Aerospace Infrared Imaging Customer |

|

|

RECENT DEVELOPMENTS

- June 2024 : Teledyne FLIR LLC (US) completed its acquisition of Adimec (Netherlands), a developer of high-performance industrial and scientific cameras. Known for delivering precise imaging for critical applications in life sciences and semiconductor inspection, Adimec joins Teledyne’s portfolio to strengthen its digital imaging capabilities across niche, accuracy-driven markets.

- September 2024 : Fluke Corporation (US) introduced the iSee Mobile Thermal Camera, a compact, smartphone-compatible tool designed for electricians, HVAC technicians, and contractors. Real-time thermal imaging capabilities enhance on-the-go inspections, enabling accurate temperature measurements in hard-to-reach areas while improving safety, portability, and convenience in professional thermal diagnostics.

- May 2024 : Axis Communications AB (Sweden) introduced the AXIS Q1961-XTE, the world’s first explosion-protected thermometric camera for Zone and Division 2 hazardous areas. Building on their 2023 innovation, this launch demonstrates Axis’ continued expansion in explosion-protected solutions, offering safer and cost-efficient temperature monitoring for high-risk industrial environments.

- September 2023 : Leonardo S.p.A. (US) unveiled its STAG-5 LLD, a next-gen 5-inch EO/IR stabilized gimbal designed for Group 1 UAS platforms. Equipped with high-definition LWIR, SWIR, EO sensors, and the TENUM 1280 core, it enhances military airborne ISR operations with superior imaging, reduced weight, and MOSA compatibility.

- December 2024 : RTX (US) launched its advanced PC5 series thermal cameras, designed for forest fire prevention and perimeter surveillance. With multi-spectral capabilities, real-time analytics, and long-range detection, the compact PC5 enhances environmental safety and security with high-resolution thermal and visible imaging, making it ideal for 24/7 outdoor monitoring.

Table of Contents

Methodology

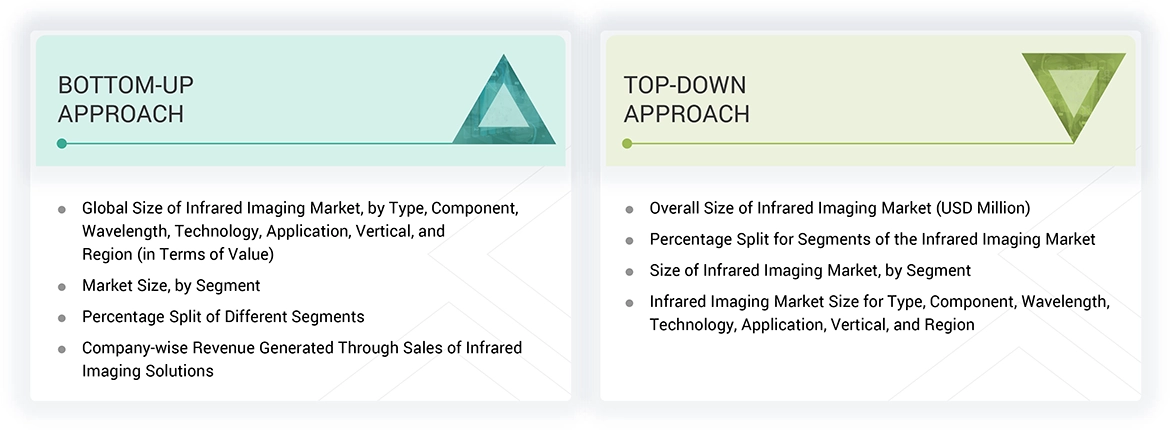

The study involved four major activities in estimating the current size of the infrared imaging market—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved referring to various secondary sources to identify and collect necessary information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Source |

Web Link |

|

Company Blogs |

https://www.lynred.com/blog/what-makes-infrared-market-unique |

|

News |

|

|

Infrared Commission on Non-ionizing Radiation Protection |

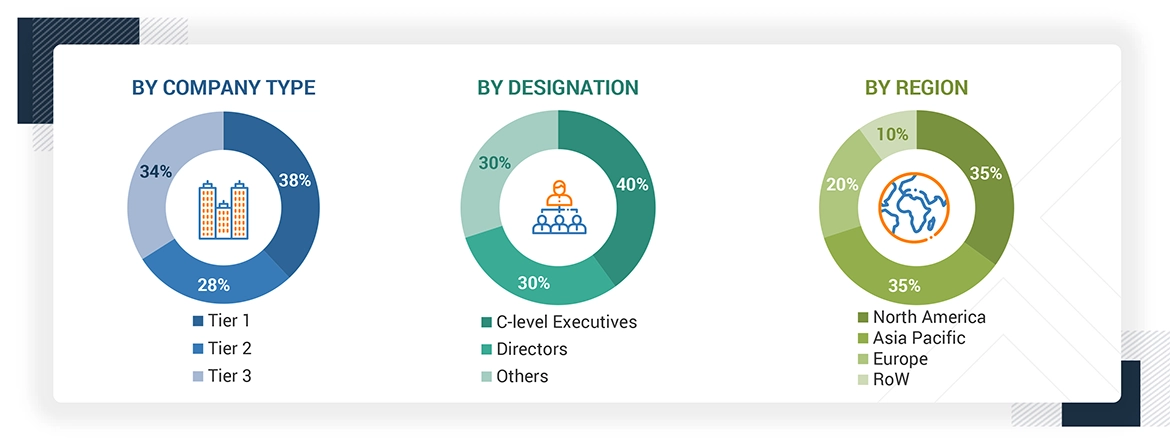

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the infrared imaging market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of infrared imaging solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies were defined based on their total revenue as of 2024: tier 1: revenue greater than USD 1 billion, tier 2: revenue between USD 500 million and USD 1 billion, and tier 3: revenue less than USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Infrared Imaging Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the market was split into several segments and subsegments. The data triangulation procedure was employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

Infrared imaging is an advanced technology that captures images of the infrared (IR) spectrum beyond the visible light range. Infrared Cameras convert IR radiation into visible images using detectors from materials such as indium gallium arsenide (InGaAs) and mercury cadmium telluride (MCT or HgCdTe). This technology enables the detection of heat signatures and temperature variations, allowing users to identify heat leaks in buildings, electrical faults, and locate people or animals in low-light conditions. Infrared imaging is also widely applied in astronomy, medical diagnostics, industrial inspection, and environmental monitoring, making it a versatile tool across diverse sectors.

Key Stakeholders

- Infrared imaging product manufacturers

- Infrared imaging product traders/suppliers

- Raw material suppliers and distributors

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to infrared technology

- Technology investors

- Governments, regulatory bodies, and financial institutions

- Venture capitalists, private equity firms, and startups

- End users

Report Objectives

- To define, describe, and forecast the infrared imaging market, in terms of value, by type, component, technology, wavelength, application, vertical, and region

- To provide the market size estimation for North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To describe and forecast the infrared imaging market for reflective and thermal cameras, in terms of volume

- To provide information about two types of infrared imaging products: Portable and fixed

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth

- To provide a detailed overview of the infrared imaging value chain, ecosystem analysis, Porter’s five forces analysis, case studies, tariff analysis, regulations, pricing analysis, patent analysis, AI impact, and US tariff impact

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends related to components, connectivity technologies, and applications that shape and influence the global infrared imaging market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments in the infrared imaging market, such as expansions, agreements, partnerships, contracts, product developments, and research and development (R&D) activities

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the infrared imaging market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the infrared imaging market.

Key Questions Addressed by the Report

At what CAGR is the infrared imaging market anticipated to grow from 2025 to 2030?

The global infrared imaging market is expected to grow at a CAGR of 6.2% between 2025 and 2030.

Which regions are expected to pose significant demand for infrared imaging solutions during the forecast period, and why?

Asia Pacific and North America are likely to witness substantial demand for infrared imaging solutions owing to growing industrial automation, defense modernization, and increasing focus on safety and preventive maintenance. Rapid infrastructure development and smart city initiatives are boosting the adoption of thermal imaging in surveillance, utilities, and transportation sectors. Additionally, strong government support and investments in advanced sensing technologies across the automotive, manufacturing, and healthcare industries are accelerating the deployment of infrared imaging systems for real-time diagnostics, monitoring, and security applications.

What are the significant growth opportunities in the infrared imaging market?

Significant growth opportunities in the infrared imaging market include AI-integrated thermal analytics, rising smart infrastructure projects, defense modernization, autonomous vehicle integration, and non-contact healthcare diagnostics. Expanding consumer electronics and industrial predictive maintenance applications drive demand, making infrared imaging vital across security, automation, environmental monitoring, and smart city ecosystems.

Who are the key players in the infrared imaging market?

Teledyne FLIR LLC (US), Fluke Corporation (US), Leonardo S.p.A. (US), Axis Communications AB. (Sweden), L3Harris Technologies, Inc. (US), RTX (US), Exosens (France), Opgal, Optronic Industries Ltd. (Israel), Lynredv (France), Allied Vision Technologies GmbH (Germany), BAE Systems (UK), and Testo SE & Co. KGaA (Germany) are the major market players.

What are the major applications of infrared imaging technology?

Security & surveillance, monitoring & inspection, and detection are the major applications in the infrared imaging market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Infrared Imaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Infrared Imaging Market

User

Sep, 2019

Thermal hyperspectral imagers provide information that conventional spectral imagers cannot. A broader range of materials can be detected, mapped, and sorted by thermal hyperspectral imagers. We are planning to expand our offerings in this area so wanted to know if insights on thermal hyperspectral imaging present in the report..

User

Sep, 2019

I can see that the SWIR technology is witnessing significant growth in the infrared imaging market. We are planning include SWIR technology based products in our product portfolio, so would like to have an estimate of the SWIR market in China, and South Korea..

User

Sep, 2019

We are into the business of providing infrared cameras, and want to explore the market for infrared sensors. We are particularly interested in volume data of IR sensors, is it covered in the study?.

User

Nov, 2019

LWIR and MWIR are the prominent technologies in the infrared market, while NIR and SWIR are the emerging ones. Can you tell me if the report analyzes the market between NIR, LWIR, MWIR, and SWIR technologies? .

User

Mar, 2019

My company is engaged in providing hardware and software solutions for infrared camera. Our solutions are aimed at automated process monitoring application. Is the information on this application available in the report?.