Shortwave Infrared (SWIR) Market Size, Share & Industry Trends Growth Analysis Report by Camera, Lenses, Spectral Imaging, Area & Line Scan, Active & Passive Thermal Imaging, Pushbroom, Snapshot, Security & Surveillance, Monitoring & Inspection, Technology, Vertical and Region – Global Forecast to 2029

Updated on : Oct 22, 2024

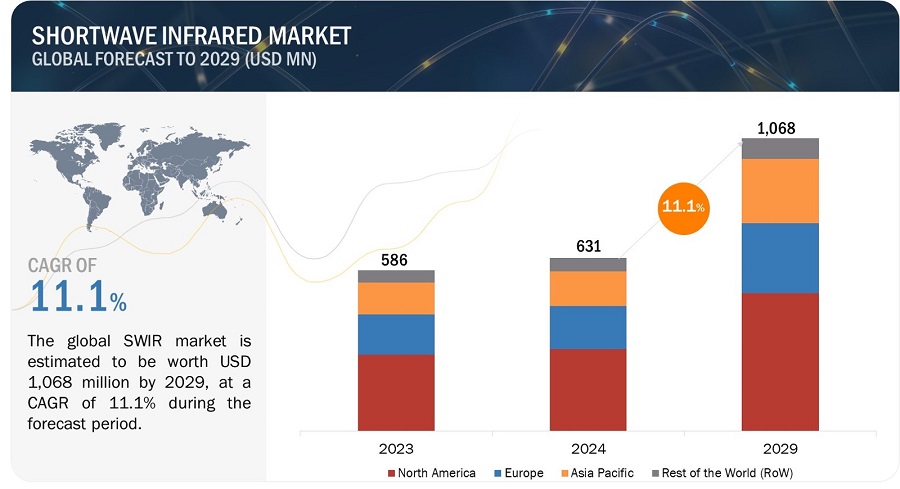

The global shortwave infrared (SWIR) market size is estimated to be valued at USD 631 million in 2024 and is projected to reach USD 1,068 million by 2029, growing at a CAGR of 11.1% from 2024 to 2029.

Based on imaging type, the SWIR industry is segmented into spectral, thermal, and hyperspectral imaging. Spectral imaging is widely used in many applications due to its InGaAs sensors, which are widely available in the market.

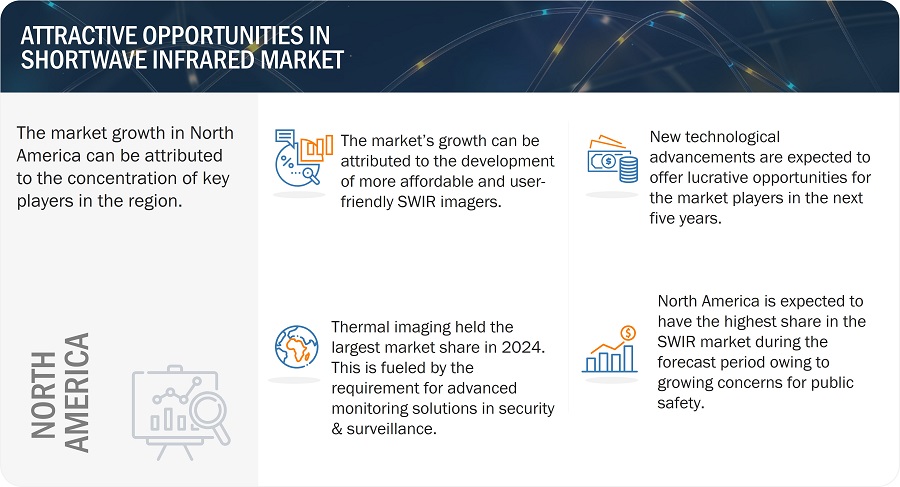

SWIR offers superior imaging details for applications such as semiconductor inspection, fruit ripeness monitoring, and surveillance, among others. Hence, it is increasingly used in various emerging applications. The development of more affordable, user-friendly SWIR systems also supports the growth of the market. The potential application of SWIR in consumer electronics is also expected to drive market growth in the near future.

Shortwave Infrared (SWIR) Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

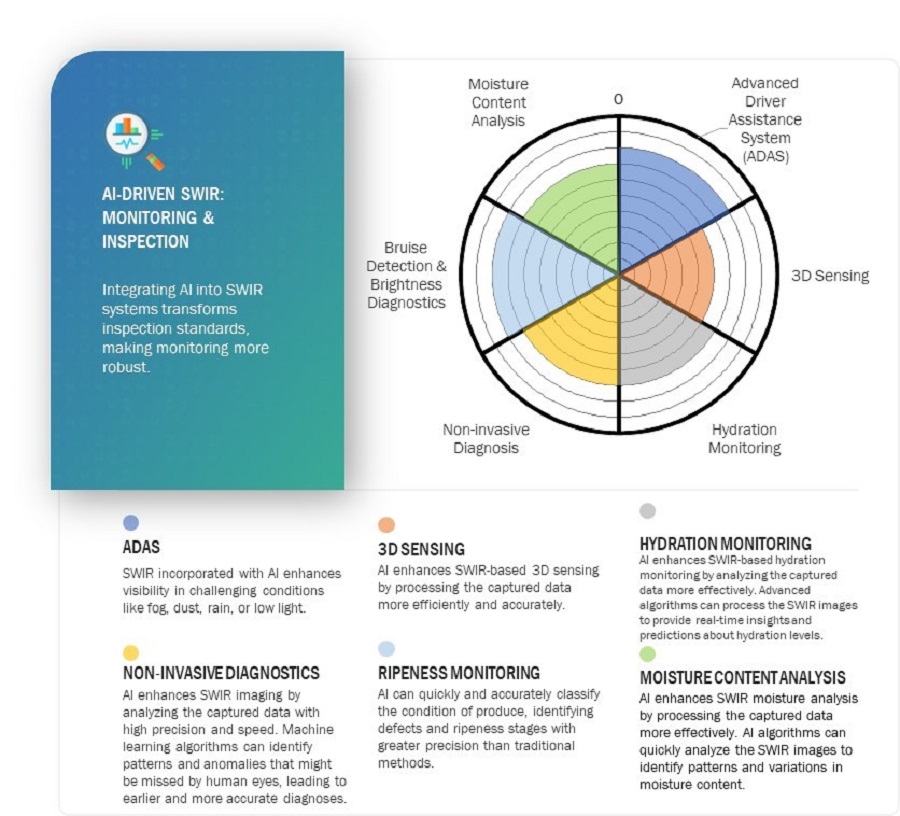

AI Impact in SWIR Market

Integrating AI algorithms with SWIR technology has enhanced accuracy, speed, efficiency, and adoption in various applications. According to a recent International Association for Pattern Recognition (IAPR) report, AI-powered imaging systems have revolutionized multiple sectors, including healthcare, agriculture, and security.

The incorporation of AI in SWIR systems has brought forward newer applications and use cases such as Advanced Driver Assistance Systems (ADAS), 3D sensing, hydration monitoring, bruise detection and ripeness monitoring, and non-invasive diagnostics, among others.

Shortwave Infrared (SWIR) Market Trends

Driver: Enhanced vision and 3D sensing by SWIR in automotive vertical

SWIR has enhanced vision and 3D sensing capabilities, thereby increasing visibility in low-light conditions and enhancing driver safety. Its high-resolution imaging supports ADAS (Advanced Driver Assistance Systems) in identifying objects with great precision. SWIR also has the ability to see through materials and detect thermal differences, which aids in understanding vehicle surroundings. This integration of 3D sensing and enhanced vision in the automotive sector is expected to drive market growth for SWIR systems.

Restraint: Less signal-to-noise ratio in SWIR imagers

A lower signal-to-noise ratio in images makes it hard to understand the fine details and reduces image quality and clarity. The signal-to-noise ratio in a SWIR imager makes a huge difference in seeing and not seeing an object in question. In SWIR, achieving a higher signal-to-noise ratio is important as it impacts the accuracy and output of information captured by the imagers. Improvements in signal-to-noise ratio are crucial for clearer images and more reliable outputs.

Opportunity: Use in disaster management and response

SWIR is useful in disaster management and response because of its ability to see through smoke, fog, dust, and certain materials, which are highly likely to block the view of emergency response personnel during disaster management operations. SWIR can provide clear images in low light conditions, helping emergency personnel to rescue individuals and assess damage in challenging environments. These cameras can also detect temperature variations, identifying hotspots in fires, among other disasters.

Challenge: Fundamental limits of FOV (Field of Vision)

The camera's FOV determines how much of the scene can be captured simultaneously. For SWIR cameras, expanding the FOV can be challenging due to limitations in optics, sensor design, and system architectures. A wide FOV is desirable when capturing big areas; however, the resolution is compromised, or system complexity is highly increased.

SWIR Market Ecosystem

The leading players operating in the SWIR market are Teledyne FLIR LLC (US), Leonardo DRS (US), Corning Incorporated (US), Allied Vision Technologies GmbH (Germany), and Collins Aerospace (US), among others.

Shortwave Infrared (SWIR) Market Segment

Monitoring & inspection segment to exhibit highest CAGR during forecast period.

The monitoring & inspection segment is anticipated to register the highest CAGR during the forecast period. The SWIR technology provides images even in challenging conditions of low light and dust, and hence has universal applicability.

In most applications, industries are applying SWIR cameras to quality control and maintenance, as it is capable of finding the defects and problems that are impossible to detect with other imaging technologies. Factors such as enhanced visibility, technological advancements, and versatility in penetration through materials like plastic and fabrics are the growth of the market for this segment. SWIR systems are crucial in food & beverages, semiconductor wafer inspection, and automotive applications, among others. SWIR also has significant potential applications in consumer electronics.

Cooled SWIR to register high growth during forecast period.

Cooled SWIR imagers provide superior sensitivity, higher resolution, and better performance in low light and challenging circumstances, making them ideal for monitoring & inspection and surveillance where temperature differences might occur.

Critical applications for these cameras are in security & surveillance, and industrial inspection, where accuracy and reliability are the main players. The integration of the next-generation cooling technologies that will make these cameras more efficient and affordable will drive further adoption. Technological advancements are also making cooled SWIR imagers affordable, which is expected to fuel the market growth.

Spectral imaging to be fastest-growing type in SWIR market.

Spectral Imaging offers a close insight into materials and their compilation. It acquires data through various wavelengths, subsequently enabling the discovery and examination of materials with discrepancies, making it valuable in applications such as food & beverages, environmental monitoring, and medical research, among others.

With increasing superior accuracy and insights acquired through spectral imaging than conventional methods of imaging, it is becoming a tool for various industries from agriculture to environmental monitoring and security. Improvements to technology make SWIR affordable to be used in various industries. Increased demand for data-rich imaging fuels the fastest growth of spectral imaging in the SWIR market.

Shortwave Infrared (SWIR) Market Regional Analysis

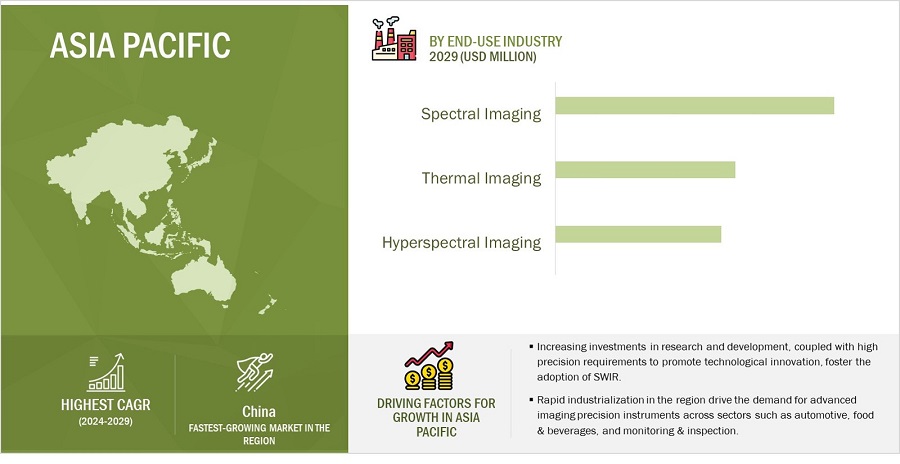

Asia Pacific to register CAGR in SWIR market during the forecast period.

The Asia Pacific region is projected to register the highest CAGR in the SWIR market. The high growth of the market is attributed to rapid industrialization, primarily in China, Japan, and South Korea. The region is a major base for electronics, automotive, and semiconductor manufacturers.

Hence, there is a high demand for monitoring & inspection solutions for production and testing purposes in the electronics, automotive, and semiconductor sectors. Moreover, high spending on research and development and supportive government policies and programs regarding the application of advanced manufacturing technologies are also supporting the growth of the SWIR market in this region.

Shortwave Infrared (SWIR) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Shortwave Infrared (SWIR) Companies - Key Market Players

The SWIR companies is dominated by players such as

- Teledyne FLIR (US),

- Collins Aerospace (US),

- Leonardo DRS (US),

- Allied Vision Technologies (Germany), and

- Corning Incorporated (US), among others.

Shortwave Infrared (SWIR) Report Scope

|

Report Metric |

Details |

| Estimated Shortwave Infrared (SWIR) Market Size | USD 631 million in 2024 |

| Projected Market Size | USD 1,068 million by 2029 |

| Growth Rate | CAGR of 11.1% |

|

Shortwave Infrared (SWIR) Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Imaging Type, By Offering, By Technology, By Use-case, By Vertical, and by Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World (RoW) |

|

Companies covered |

Major players operating in the SWIR market are Teledyne FLIR LLC (US), Corning Incorporated (US), Collins Aerospace (US), Allied Vision Technologies GmbH (Germany), and Leonardo DRS (US), among others. (A total of 25 players have been profiled) |

Shortwave Infrared (SWIR) Highlights

The study categorizes the SWIR market based on the following segments:

|

Segment |

Subsegment |

|

By Imaging Type |

|

|

By Offering |

|

|

By Technology |

|

|

By Use-case |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Shortwave Infrared (SWIR) Industry

- In May 2024, Teledyne FLIR LLC announced a partnership with UE Systems Inc. (US) through which the company aims to provide industrial customers with advanced predictive maintenance solutions. This collaboration will combine Teledyne's thermal imaging systems with UE system's ultrasonic technology.

- In December 2021, Allied Vision Technologies GmbH (Germany) launched Alvium 1800 (SWIR Camera), which was made available with Sony's innovate InGaAs SWIR sensors.

- In September 2023, Leonardo DRS (US) launched Small Unmanned Aircraft System Tactical Agile Gimbal (STAG)-5 LLD gimbal which offers high-definition day and night imaging for small, unmanned aircraft. It is lightweight, highly stable, and integrates advanced sensors for superior performance in military operations.

Frequently Asked Questions:

What are the SWIR market's major driving factors and opportunities?

The SWIR market has emerging applications due to the superior penetration and details offered by different SWIR systems. The development of more affordable and user-friendly SWIR is one of the drivers of the SWIR market.

Which region is expected to hold the highest market share?

North America commands a large share of the SWIR market. The expanding SWIR sector and industry demands are driving the adoption of SWIR in the North American market. However, increasing funding for R&D focused on enhancing the analytical capabilities of SWIR facilitates the high growth of SWIR solutions in the Asia Pacific region.

Who are the leading players in the global SWIR market?

Companies such as Teledyne FLIR LLC (US), Leonardo DRS (US), Corning Incorporated (US), Allied Vision Technologies GmbH (Germany), and Collins Aerospace (US) are some of the leading players in the global SWIR market.

What are some of the technological advancements in the market?

What is the size of the global SWIR market?

The global SWIR market is valued at USD 631 million in 2024 and is anticipated to reach USD 1,068 million by 2029, at a CAGR of 11.1% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Mounting demand for smart vehicles and automation solutions- Rising adoption of security measures to prevent theft and terrorism- Increasing deployment of advanced technologies to meet food safety standardsRESTRAINTS- Low signal-to-noise ratio of images taken by SWIR cameras- High sensitivity to temperature changesOPPORTUNITIES- Rising need for advanced tools to improve situational awareness- Integration of SWIR technology into smartphonesCHALLENGES- Lower resolution and pixel count of SWIR images- Limitations associated with optics and sensor design

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERINGINDICATIVE PRICING TREND, BY IMAGING TYPEINDICATIVE PRICING TREND, BY REGION

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Indium gallium arsenide (InGaAs)COMPLEMENTARY TECHNOLOGIES- Thermal management systems- CloudADJACENT TECHNOLOGIES- Mid-wave infrared (MWIR) imaging cameras- Long-wave infrared (LWIR) imaging cameras

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISRESEARCHERS ADOPT ALLIED VISION TECHNOLOGIES’ GOLDEYE SWIR CAMERAS TO ANALYZE WATER ABSORPTIONPHARMACEUTICALS INDUSTRY USES PROPHOTONIX’S COBRA HYPERSPEC IMAGING SOLUTIONS TO IDENTIFY EMPTY BLISTERS AND FOREIGN PILLSRADIANT OPTRONICS LEVERAGES ALLIED VISION TECHNOLOGIES’ GOLDEYE G-008 SWIR CAMERAS TO REDUCE SILICON CRACKSLYTID’S SIRIS SWIR CAMERA PROVIDES HIGH-SPEED FULL-FRAME IMAGES FOR ASTROPHYSICAL OBSERVATIONSCINOGY TECHNOLOGIES INSTALLS ALLIED VISION TECHNOLOGIES’ GOLDEYE G-008 SWIR CAMERAS TO ENSURE STABILITY OF LASER SIGNALS

- 5.11 INVESTMENT AND FUNDING SCENARIO

-

5.12 TRADE ANALYSISIMPORT SCENARIO (HS CODE 902750)EXPORT SCENARIO (HS CODE 902750)

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS AND STANDARDS

-

5.16 IMPACT OF GEN AI/AI ON SWIR MARKETTOP USE CASESCASE STUDY: AGRICOLA MODERNA INTEGRATES SPECIM FX10E HYPERSPECTRAL CAMERA TO GATHER DETAILED SPECTRAL DATA USING AIINTEGRATION OF AI WITH SWIR TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 HANDHELD DEVICES

- 6.3 FIXED/STATIONARY SYSTEMS

- 6.4 UAV/DRONE-BASED SYSTEMS

- 7.1 INTRODUCTION

-

7.2 SENSORSINDIUM GALLIUM ARSENIDEINDIUM ANTIMONIDELEAD SULFIDEMERCURY CADMIUM TELLURIDEOTHER SENSORS

- 7.3 OPTICS

- 7.4 ELECTRONICS

- 7.5 OTHER SYSTEM ARCHITECTURES

- 8.1 INTRODUCTION

-

8.2 SPECTRALLINE SCAN- Adoption in industries to deliver high-resolution images and detect detects to boost segmental growthAREA SCAN- Ability to enhance diagnostic accuracy, treatment precision, and medicine research to fuel segmental growth

-

8.3 THERMALREQUIREMENT FOR HIGH-QUALITY IMAGES IN SECURITY AND SURVEILLANCE OPERATIONS TO ACCELERATE SEGMENTAL GROWTHPASSIVEACTIVE

-

8.4 HYPERSPECTRALPUSHBROOM/LINE SCAN- Rising need for scanners allowing rapid and continuous data collection to foster segmental growthSNAPSHOT- Increasing focus on speeding up diagnostic and monitoring processes to contribute to segmental growthOTHER HYPERSPECTRAL IMAGING TYPES

- 9.1 INTRODUCTION

-

9.2 MODULESCOMPACT, LIGHTWEIGHT, AND LOW ENERGY CONSUMPTION TO CONTRIBUTE TO SEGMENTAL GROWTH

-

9.3 CAMERASADOPTION FOR SECURITY MONITORING PURPOSES IN RESIDENTIAL AND COMMERCIAL BUILDINGS TO EXPEDITE SEGMENTAL GROWTH

- 9.4 OTHER OFFERINGS

- 10.1 INTRODUCTION

-

10.2 COOLEDABILITY TO REDUCE THERMALLY INDUCED NOISE AND OPTIMIZE SPECTRAL FILTERING TO AUGMENT SEGMENTAL GROWTH

-

10.3 UNCOOLEDLOW COSTS AND LONG SERVICE LIVES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.1 INTRODUCTION

-

11.2 SECURITY & SURVEILLANCEGROWING CONCERN ABOUT TERRORISM AND BORDER SECURITY TO FOSTER SEGMENTAL GROWTH

-

11.3 MONITORING & INSPECTIONINCREASING NEED FOR EARLY IDENTIFICATION OF MACHINERY ISSUES TO BOLSTER SEGMENTAL GROWTH

-

11.4 DETECTIONRISING EMPHASIS ON REAL-TIME MONITORING OF GAS LEAKS TO BOOST SEGMENTAL GROWTH

- 12.1 INTRODUCTION

-

12.2 PROCESSRISING ADOPTION OF INFRARED CAMERAS TO MONITOR INDUSTRIAL FURNACES AND DETECT IMPURITIES TO EXPEDITE SEGMENTAL GROWTHCONSUMER ELECTRONICSAUTOMOTIVEAEROSPACEELECTRONICS & SEMICONDUCTORSOIL & GASFOOD & BEVERAGESGLASS

-

12.3 DISCRETEINCREASING DEPLOYMENT OF ADVANCED INFRARED IMAGING TECHNOLOGIES TO IMPROVE SITUATIONAL AWARENESS TO AUGMENT SEGMENTAL GROWTHMILITARY & DEFENSEMEDICALSCIENTIFIC RESEARCHOTHER DISCRETE INDUSTRIES

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Mounting adoption of infrared cameras to enhance military and security operations to fuel market growthCANADA- Rising government initiatives to support aircraft manufacturing to augment market growthMEXICO- Increasing deployment of advanced manufacturing technologies and electric vehicles to drive market

-

13.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEUK- Rising emphasis on compliance with smart home regulations to contribute to market growthGERMANY- Increasing production of passenger cars to accelerate market growthFRANCE- Growing adoption of infrared cameras in food industry for moisture detection and food inspection to drive marketREST OF EUROPE

-

13.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Burgeoning demand for advanced security and surveillance solutions to ensure public safety to fuel market growthJAPAN- Shifting preference from traditional fuel-powered to battery electric vehicles to contribute to market growthINDIA- Rising implementation of incentive programs for medical devices sector to foster market growthREST OF ASIA PACIFIC

-

13.5 ROWMACROECONOMIC OUTLOOK FOR ROWSOUTH AMERICA- Rising investment in medical sector to contribute to market growthMIDDLE EAST- Burgeoning adoption of advanced imaging solutions in industrial sectors to accelerate market growth- GCC countries- Rest of Middle EastAFRICA- Increasing investment in infrastructure development projects to boost segmental growth

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

- 14.3 REVENUE ANALYSIS, 2019–2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

-

14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Offering footprint- Technology footprint- Industry footprint- Region footprint

-

14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

14.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

15.1 KEY PLAYERSTELEDYNE FLIR LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALLIED VISION TECHNOLOGIES GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCORNING INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOLLINS AEROSPACE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEONARDO DRS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHAMAMATSU PHOTONICS K.K.- Business overview- Products/Solutions/Services offered- Recent developmentsFLUKE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsSPECIM, SPECTRAL IMAGING LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsXENICS- Business overview- Products/Solutions/Services offeredNEW IMAGING TECHNOLOGIES (NIT)- Business overview- Products/Solutions/Services offered- Recent developmentsRAPTOR PHOTONICS- Business overview- Products/Solutions/Services offeredLYNRED- Business overview- Products/Solutions/Services offered- Recent developmentsPHOTON ETC.- Business overview- Products/Solutions/Services offeredBASLER AG- Business overview- Products/Solutions/Services offered- Recent developmentsTESTO SE & CO.- Business overview- Products/Solutions/Services offered

-

15.2 OTHER PLAYERSSIERRA-OLYMPIA TECH.IRCAMERAS LLCEPISENSORSPRINSTON INFRARED TECHNOLOGIES, INC.INFRATECH GMBHCOX CO., LTDC-THERMALZHEJIANG DALI TECHNOLOGY CO.,LTD.AXIS COMMUNICATIONS ABTONBO IMAGINGHGHINVIEW TECHNOLOGIESINTEVAC, INC.SEEK THERMALTERABEE

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

- TABLE 1 SWIR MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 SWIR MARKET: RISK ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN SWIR ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF SWIR CAMERAS OFFERED BY KEY PLAYERS, BY OFFERING (USD THOUSAND)

- TABLE 5 INDICATIVE PRICING TREND OF SWIR CAMERAS, BY IMAGING TYPE, 2020–2023 (USD THOUSAND)

- TABLE 6 INDICATIVE PRICING TREND OF SWIR CAMERAS, BY REGION, 2020–2023 (USD THOUSAND)

- TABLE 7 PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE USE CASES

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE USE CASES

- TABLE 10 IMPORT DATA FOR HS CODE 902750-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 902750-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 12 LIST OF MAJOR PATENTS, 2020–2024

- TABLE 13 LIST OF KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 19 SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 20 SPECTRAL: SWIR MARKET, BY SCANNING TYPE, 2020–2023 (USD MILLION)

- TABLE 21 SPECTRAL: SWIR MARKET, BY SCANNING TYPE, 2024–2029 (USD MILLION)

- TABLE 22 SPECTRAL: SWIR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 23 SPECTRAL: SWIR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 24 SPECTRAL: SWIR MARKET, BY USE CASE, 2020–2023 (USD MILLION)

- TABLE 25 SPECTRAL: SWIR MARKET, BY USE CASE, 2024–2029 (USD MILLION)

- TABLE 26 SPECTRAL: SWIR MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 27 SPECTRAL: SWIR MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 28 SPECTRAL: SWIR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 29 SPECTRAL: SWIR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 30 THERMAL: SWIR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 31 THERMAL: SWIR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 32 THERMAL: SWIR MARKET, BY USE CASE, 2020–2023 (USD MILLION)

- TABLE 33 THERMAL: SWIR MARKET, BY USE CASE, 2024–2029 (USD MILLION)

- TABLE 34 THERMAL: SWIR MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 35 THERMAL: SWIR MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 36 THERMAL: SWIR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 37 THERMAL: SWIR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 38 HYPERSPECTRAL: SWIR MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 39 HYPERSPECTRAL: SWIR MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 40 HYPERSPECTRAL: SWIR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 41 HYPERSPECTRAL: SWIR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 42 HYPERSPECTRAL: SWIR MARKET, BY USE CASE, 2020–2023 (USD MILLION)

- TABLE 43 HYPERSPECTRAL: SWIR MARKET, BY USE CASE, 2024–2029 (USD MILLION)

- TABLE 44 HYPERSPECTRAL: SWIR MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 45 HYPERSPECTRAL: SWIR MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 46 HYPERSPECTRAL: SWIR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 47 HYPERSPECTRAL: SWIR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 48 SWIR MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 49 SWIR MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 50 MODULES: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 51 MODULES: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 52 CAMERAS: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 53 CAMERAS: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 54 CAMERAS: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (THOUSAND UNITS)

- TABLE 55 CAMERAS: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (THOUSAND UNITS)

- TABLE 56 OTHER OFFERINGS: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 57 OTHER OFFERINGS: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 58 SWIR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 59 SWIR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 60 COOLED: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 61 COOLED: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 62 UNCOOLED: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 63 UNCOOLED: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 64 SWIR MARKET, BY USE CASE, 2020–2023 (USD MILLION)

- TABLE 65 SWIR MARKET, BY USE CASE, 2024–2029 (USD MILLION)

- TABLE 66 SECURITY & SURVEILLANCE: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 67 SECURITY & SURVEILLANCE: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 68 MONITORING & INSPECTION: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 69 MONITORING & INSPECTION: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 70 DETECTION: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 71 DETECTION: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 72 SWIR MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 73 SWIR MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 74 PROCESS: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 75 PROCESS: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 76 DISCRETE: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 77 DISCRETE: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 78 SWIR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 79 SWIR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: SWIR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: SWIR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 84 EUROPE: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 85 EUROPE: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 86 EUROPE: SWIR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 87 EUROPE: SWIR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: SWIR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SWIR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 92 ROW: SWIR MARKET, BY IMAGING TYPE, 2020–2023 (USD MILLION)

- TABLE 93 ROW: SWIR MARKET, BY IMAGING TYPE, 2024–2029 (USD MILLION)

- TABLE 94 ROW: SWIR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 95 ROW: SWIR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 96 MIDDLE EAST: SWIR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 97 MIDDLE EAST: SWIR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 98 SWIR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2024

- TABLE 99 SWIR MARKET: DEGREE OF COMPETITION, 2023

- TABLE 100 SWIR MARKET: OFFERING FOOTPRINT

- TABLE 101 SWIR MARKET: TECHNOLOGY FOOTPRINT

- TABLE 102 SWIR MARKET: INDUSTRY FOOTPRINT

- TABLE 103 SWIR MARKET: REGION FOOTPRINT

- TABLE 104 SWIR MARKET: DETAILED LIST OF KEYS STARTUPS/SMES

- TABLE 105 SWIR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 106 SWIR MARKET: PRODUCT LAUNCHES, JANUARY 2020−JULY 2024

- TABLE 107 SWIR MARKET: DEALS, JANUARY 2020−JULY 2024

- TABLE 108 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 109 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 TELEDYNE FLIR LLC: DEALS

- TABLE 111 ALLIED VISION TECHNOLOGIES GMBH: COMPANY OVERVIEW

- TABLE 112 ALLIED VISION TECHNOLOGIES GMBH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 113 ALLIED VISION TECHNOLOGIES GMBH: PRODUCT LAUNCHES

- TABLE 114 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 115 CORNING INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 CORNING INCORPORATED: DEALS

- TABLE 117 COLLINS AEROSPACE: COMPANY OVERVIEW

- TABLE 118 COLLINS AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 119 COLLINS AEROSPACE: OTHERS

- TABLE 120 LEONARDO DRS: COMPANY OVERVIEW

- TABLE 121 LEONARDO DRS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 LEONARDO DRS: PRODUCT LAUNCHES

- TABLE 123 LEONARDO DRS: DEALS

- TABLE 124 LEONARDO DRS: OTHERS

- TABLE 125 HAMAMATSU PHOTONICS K.K.: COMPANY OVERVIEW

- TABLE 126 HAMAMATSU PHOTONICS K.K.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 HAMAMATSU PHOTONICS K.K.: DEALS

- TABLE 128 FLUKE CORPORATION: COMPANY OVERVIEW

- TABLE 129 FLUKE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 FLUKE CORPORATION: PRODUCT LAUNCHES

- TABLE 131 SPECIM, SPECTRAL IMAGING LTD.: COMPANY OVERVIEW

- TABLE 132 SPECIM, SPECTRAL IMAGING LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 SPECIM, SPECTRAL IMAGING LTD.: DEALS

- TABLE 134 XENICS: COMPANY OVERVIEW

- TABLE 135 XENICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 NEW IMAGING TECHNOLOGIES (NIT): COMPANY OVERVIEW

- TABLE 137 NEW IMAGING TECHNOLOGIES (NIT): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 NEW IMAGING TECHNOLOGIES (NIT): PRODUCT LAUNCHES

- TABLE 139 NEW IMAGING TECHNOLOGIES (NIT): DEALS

- TABLE 140 RAPTOR PHOTONICS: COMPANY OVERVIEW

- TABLE 141 RAPTOR PHOTONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 LYNRED: COMPANY OVERVIEW

- TABLE 143 LYNRED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 LYNRED: DEALS

- TABLE 145 PHOTON ETC: COMPANY OVERVIEW

- TABLE 146 PHOTON ETC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 BASLER AG: COMPANY OVERVIEW

- TABLE 148 BASLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 BASLER AG: PRODUCT LAUNCHES

- TABLE 150 TESTO SE & CO.: COMPANY OVERVIEW

- TABLE 151 TESTO SE & CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 SIERRA-OLYMPIA TECH.: COMPANY OVERVIEW

- TABLE 153 IRCAMERAS LLC: COMPANY OVERVIEW

- TABLE 154 EPISENSORS: COMPANY OVERVIEW

- TABLE 155 PRINSTON INFRARED TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 156 INFRATECH GMBH: COMPANY OVERVIEW

- TABLE 157 COX CO., LTD: COMPANY OVERVIEW

- TABLE 158 C-THERMAL: COMPANY OVERVIEW

- TABLE 159 ZHEJIANG DALI TECHNOLOGY CO.,LTD.: COMPANY OVERVIEW

- TABLE 160 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- TABLE 161 TONBO IMAGING: COMPANY OVERVIEW

- TABLE 162 HGH: COMPANY OVERVIEW

- TABLE 163 INVIEW TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 164 INTEVAC, INC.: COMPANY OVERVIEW

- TABLE 165 SEEK THERMAL: COMPANY OVERVIEW

- TABLE 166 TERABEE: COMPANY OVERVIEW

- FIGURE 1 SWIR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SWIR MARKET: RESEARCH DESIGN

- FIGURE 3 SWIR MARKET: RESEARCH APPROACH

- FIGURE 4 SWIR MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 SWIR MARKET: BOTTOM-UP APPROACH

- FIGURE 6 SWIR MARKET: TOP-DOWN APPROACH

- FIGURE 7 SWIR MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 SWIR MARKET: DATA TRIANGULATION

- FIGURE 9 SWIR MARKET: RESEARCH LIMITATIONS

- FIGURE 10 SPECTRAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 11 CAMERAS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2029

- FIGURE 12 MONITORING & INSPECTION SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 UNCOOLED SEGMENT TO DOMINATE SWIR MARKET BETWEEN 2024 AND 2029

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF SWIR MARKET IN 2024

- FIGURE 15 GROWING DEMAND FOR PRECISE INSPECTION AND SURVEILLANCE SYSTEMS TO BOOST MARKET GROWTH

- FIGURE 16 PROCESS SEGMENT TO REGISTER HIGHER CAGR IN SWIR MARKET DURING FORECAST PERIOD

- FIGURE 17 SECURITY & SURVEILLANCE SEGMENT TO HOLD LARGEST SHARE OF SWIR MARKET IN 2029

- FIGURE 18 SPECTRAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 19 THERMAL SEGMENT AND US TO HOLD LARGEST SHARES OF NORTH AMERICAN SWIR MARKET IN 2024

- FIGURE 20 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL SWIR MARKET FROM 2024 TO 2029

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 IMPACT ANALYSIS: DRIVERS

- FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 24 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 25 IMPACT ANALYSIS: CHALLENGES

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 SWIR ECOSYSTEM

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 AVERAGE SELLING PRICE TREND OF SWIR CAMERAS OFFERED BY KEY PLAYERS, BY OFFERING

- FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE USE CASES

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE USE CASES

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO

- FIGURE 34 IMPORT DATA FOR HS CODE 902750-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 35 EXPORT DATA FOR HS CODE 902750-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 36 PATENT APPLIED AND GRANTED, 2012–2023

- FIGURE 37 THERMAL SEGMENT TO CAPTURE LARGEST SHARE OF SWIR MARKET IN 2024

- FIGURE 38 CAMERAS SEGMENT TO HOLD LARGEST SHARE OF SWIR MARKET IN 2029

- FIGURE 39 SWIR MARKET, BY TECHNOLOGY

- FIGURE 40 UNCOOLED SEGMENT TO DOMINATE SWIR MARKET FROM 2024 TO 2029

- FIGURE 41 SECURITY & SURVEILLANCE SEGMENT TO DOMINATE SWIR MARKET DURING FORECAST PERIOD

- FIGURE 42 SWIR MARKET, BY VERTICAL

- FIGURE 43 DISCRETE SEGMENT TO HOLD LARGER SHARE OF SWIR MARKET IN 2029

- FIGURE 44 SWIR MARKET, BY REGION

- FIGURE 45 NORTH AMERICA TO CAPTURE LARGEST SHARE OF SWIR MARKET IN 2024

- FIGURE 46 NORTH AMERICA: SWIR MARKET SNAPSHOT

- FIGURE 47 EUROPE: SWIR MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: SWIR MARKET SNAPSHOT

- FIGURE 49 SWIR MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2019–2023

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING SWIR TECHNOLOGIES, 2023

- FIGURE 51 COMPANY VALUATION, 2023

- FIGURE 52 FINANCIAL METRICS, 2023 (EV/EBITDA)

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 SWIR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 55 SWIR MARKET: COMPANY FOOTPRINT

- FIGURE 56 SWIR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 58 LEONARDO DRS: COMPANY SNAPSHOT

- FIGURE 59 HAMAMATSU PHOTONICS K.K.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the SWIR market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Sources |

Web Link |

|

Company Blogs |

|

|

Industry Journals |

|

|

Environmental Protection Agency |

Primary Research

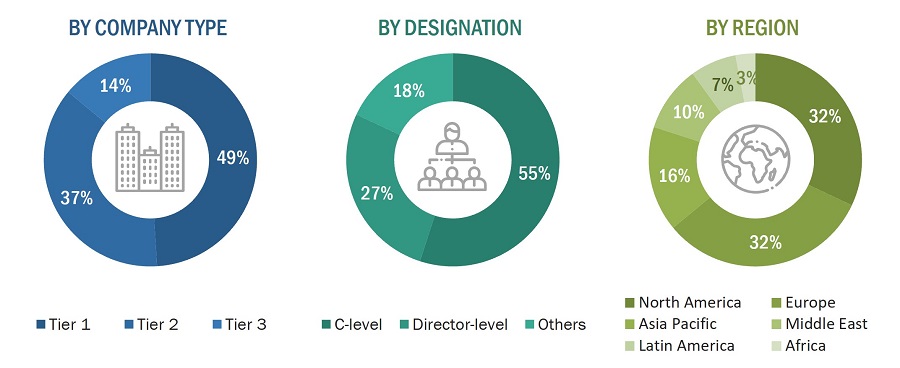

Extensive primary research was conducted after gaining knowledge about the current scenario of the SWIR market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

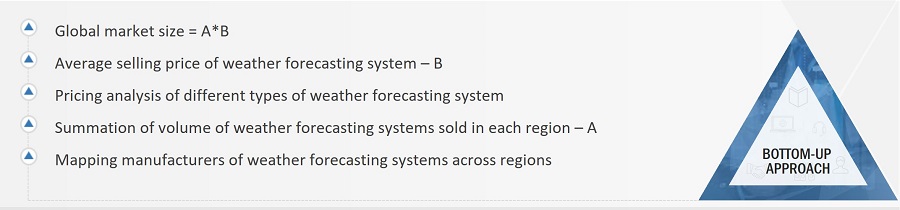

Bottom-Up Approach

- Identifying various applications of SWIR

- Analyzing the penetration of each type of SWIR technology through secondary and primary research

- Analyzing the penetration of SWIR for different applications and verticals through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the detailed working of SWIR and their implementation in numerous applications; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with MarketsandMarkets domain experts

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

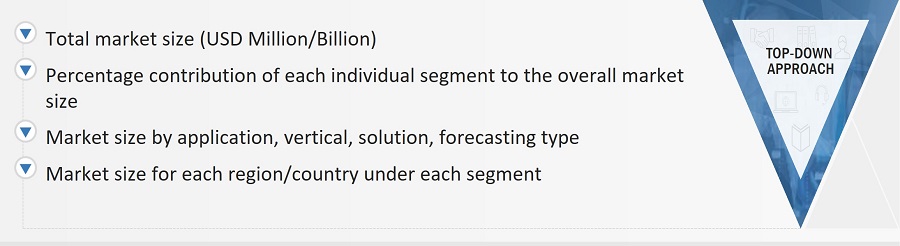

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the SWIR market; further, splitting the key market areas based on imaging type, offering, technology, use case, vertical, and region, and listing the key developments

- Identifying all leading players and applications in the SWIR market based on region through secondary research and thoroughly verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with the industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size from the estimation process explained in the previous section, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides, and the market size was validated using top-down and bottom-up approaches.

Market Definition

Short Wave IR (SWIR) is a subset of the infrared band in the electromagnetic spectrum, covering wavelengths ranging from 1 to 3 microns. This wavelength is not visible to human eyes and can often offer a better image than what is achievable with visible light imaging. A number of manufacturers make SWIR imagers that detect various ranges of the electromagnetic spectrum with multiple qualities.

For imaging in this range, SWIR cameras convert the radiation of objects in the SWIR range to a measurable form. The capability of a SWIR camera depends on the type of component used. Lenses and detectors are the two most essential components of a SWIR camera and account for a significant percentage of the total parts of a SWIR camera. Indium gallium arsenide (InGaAs), mercury cadmium telluride (HgCdTe), and indium antimonide (InSb) are a few of the types of SWIR detectors available in the SWIR market.

Key Stakeholders

- SWIR material and component providers

- SWIR providers, integrators, and installers

- Electronic hardware equipment manufacturers

- Optical system manufacturers

- SWIR software and solution providers

- Consulting companies

- SWIR related associations, organizations, forums, and alliances

- Government and corporate bodies

- Research institutes and organizations

- Venture capitalists, private equity firms, and startup companies

- Distributors and traders

- Original equipment manufacturers (OEMs)

- End users

Report Objectives

- To define, describe, and forecast the SWIR market in terms of value, segmented by imaging type, by offering, by technology, use case, and vertical

- To describe and forecast the market, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To study different types of materials used in SWIR products with the scope limited to qualitative research only

- To forecast the SWIR market in terms of volume

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the SWIR market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the SWIR market

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders

- To analyze competitive developments, such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches and developments; in the SWIR market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of regions into respective countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Shortwave Infrared (SWIR) Market