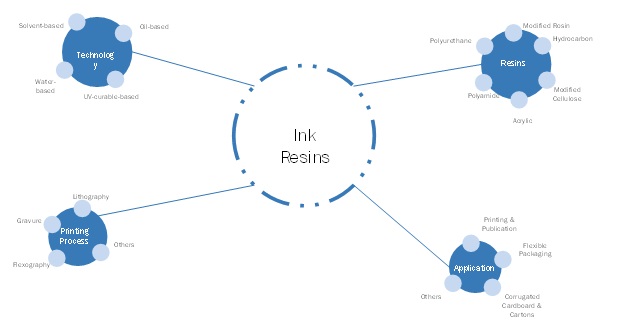

Ink Resin Market by Resin Type (Modified Rosins, Hydrocarbon, Modified Cellulose), by Technology (Oil, Solvent, Water, UV-curable), by Application (Printing & Publication, Flexible Packaging, Corrugated Cardboards & Cartons) - Global Forecast to 2026

Updated on : June 17, 2024

Ink Resins Market

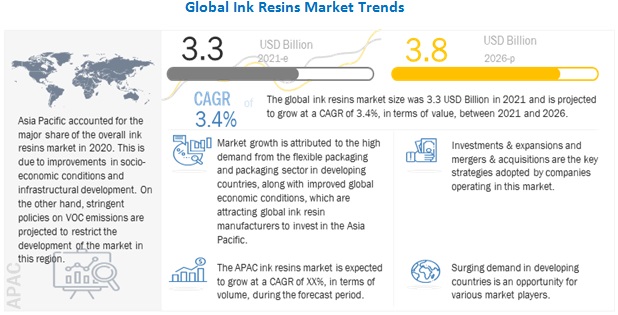

Ink Resins Market was valued at USD 3.3 billion in 2021 and is projected to reach USD 3.8 billion by 2026, growing at 3.4% cagr from 2021 to 2026. Increasing environmental protection standards for the printing ink industry, growth of packaging and energy curable inks industries, increasing demand for UV-cured inks, and new resin technologies are the key factors contributing to the growth of the ink resins market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Ink Resins Market

The outbreak of COVID-19 has disrupted the production of raw materials used in ink resins manufacturing. The value chain of ink resins had witnessed various disruptions owing to the outbreak of COVID-19. The major disruption in the value chain has been the lack of suppliers owing to the shutdown of various industries, including raw material manufacturers. This was aggravated by international and regional road restrictions imposed across the globe to curb the spread of the pandemic.

Ink Resins Market Dynamics

Driver: Improved supply of raw materials for ink resins

Resins are crucial to ink formulation, providing essential characteristics to inks. They impart many of the important characteristics of a finished ink, including gloss and adhesion. Key raw materials the ink industry relies on are benzene, toluene, ethylene and propylene. IPDI (isophorone diisocyanate) and IPDA (isophorone diamine) are available, which are crucial for the high-end polyurethane resin market. The availability of acrylates is expected to remain steady, albeit subject to some seasonal and competing demand in paints and coatings, adhesives, and construction applications. Resin raw materials are available, although costs continue to be susceptible to the volatility of feedstock costs or interim supplydemand imbalances. Propylene oxide-based polyols are available, but pricing has increased. The supply of raw materials has improved; however, pricing has not decreased.

Restraint: Volatile raw material prices and fluctuations in demand due to competition from other industries using resins

There was a shortage of raw materials, mainly base chemicals for resins, used for producing resins during 2010-2020. It was due to a surge in oil prices, followed by a demand and supply gap, which led to increased competition from other industries using resins, such as adhesives & sealants and composites. It exerted upward pressure on prices, eventually leading to the substitution of major resins, such as epoxy, polyurethane, acrylic, alkyd, and vinyl, with other resins that include cellulose, phenolic, and vinyl esters.

The prices of resins in Europe were relatively high compared with other regions. Therefore, the manufacturers of ink resins in Europe planned to realign their purchasing operations, which eventually led to the substitution of ink resins by other raw materials.

These factors are hindering the growth of the ink resins market.

Opportunity: Renewed interest in water-based inks

Environmental advantages are driving interest in water-based inks. For specific product lines, there is an increasing interest in water-based inks, especially with regard to high-quality process printing for pre-print corrugated boxes or packages. The use of water-based systems continues to be of interest to reduce waste and emissions. There is some renewed interest in water-based inks for high-performance laminations and one-part systems for outdoor applications.

The renewed interest in water-based inks is expected to increase in demand for acrylic and maleic resins as they are a major part of at least half of all water-based inks.

Challenge: Lower cost and improved performance of resins

Ink manufacturers want to lower the cost of their resins but need the same performance. The main expectation of ink manufacturers from resin suppliers are stable price support, better quality supply, sufficient quantity offer, and technical discussion/exchange.

Managing the ups and downs of raw material prices by ink resin manufacturers takes significant resources, which could be better spent on developing new opportunities with ink manufacturers. The main challenges in the resin industry are to satisfy different quality requirements from each customer and to assist each customer and find the best ways to handle high raw material costs in such a competitive resin market environment.

Ink Resins Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The modified rosin resin type to be the largest of ink resins market.

Rosin is expected to be the largest ink resin type segment. The modified rosin is a natural resin obtained from pine trees and is regarded as an inexpensive resin. Its price has risen slightly over the last decade; however, there has been little decline in its use. It is ecologically sound to produce rosin from living sources, as opposed to fossil sources and tree stumps, making gum rosin a regenerative starting material for printing ink resins. Rosin has been used in alcohol-based lacquers, in combination with mineral oils for applications such as comic publication and newspaper inks.

The UV-curable-based technology to witness the fastest growth of ink resins market.

The use of UV-curable inks in the US in the packaging market continues to increase, especially with the introduction of low migration inks that support current global and regional regulations. Key advantages of UV-cured inks are solvent-free inks resulting in lower insurance, high level of product resistance, ease of usage, and flexibility to accommodate various sizes and variety of print jobs. Solvent-based inks continue to be the largest technology segment. The main resin used is low viscosity nitrocellulose (NC), which is featured in more than 70% of all solvent-based liquid inks. Liquid media, based on NC, disperse pigment reasonably well, have a good balance between viscosity and solids content, have low odor, print well, and are compatible with a large number of media based on other polymers.

The gravure printing process to be largest of ink resins market.

Gravure and flexographic printing processes continue to replace lithographic inks in several applications with the growing packaging segment. The digital printing process is rapidly gaining market share owing to the shift from ink media to electronic media in the publication sector. Other printing processes such as letterpress have become obsolete and are losing market share to the flexographic and gravure processes.

The printing & publication to be largest application of ink resins market.

There is a high potential for demand growth of ink resins from the flexible packaging and corrugated cardboard & cartons segments during 2021-2026 due to improved living standard in developing countries and increased demand for food security.

The demand for resins from the printing & publication segment is declining due to the shift toward the digital media and the Internet in addition to the decline in demand from the newspaper and magazine industry.

APAC is the largest ink resins market in the forecast period

Asia Pacific is the largest ink resins market, in terms of both, value and volume, and is projected to be the fastest-growing during the forecast period. The region has witnessed economic growth over the last decade.

Fueled by booming economies in China, India, and a few smaller countries, the ink industry is growing. In particular, the packaging sector offers opportunities as manufacturers and global packaging converters expand to the region. Growth of the printing inks industry varied throughout the Asia Pacific region, with China witnessing the highest increase at 10%. Inkjet printing is on the rise in the Asia Pacific and is growing at a high rate throughout the region, both, in industrial segments such as wide format signage as well as in personal use. Apart from personal use, inkjet inks have an increasing demand from the wide format markets in India and Australia. The packaging segment is growing at the highest rate and is sustainable. It also has the shortest life cycle and therefore requires constantly changing formulations. The labels, packaging, and corrugated sectors in Australia and India are growing at significant rates as companies use the technologies and capabilities available to export to the nearby regions. In Indonesia and Thailand, UV printing has been steadily developing. In Japan, hybrid (UV and oil-based) type ink is one of the trends. To meet environmental regulations, it is necessary to adhere to the regulations regarding VOCs and solvents as well as aromatic solvents. Demand for gravure inks not containing toluene is increasing in Southeast Asia. Due to the growth in exporting packaged food, environmental requirements are needed to be met for boil and retort packages. Environmental-friendly inks are gaining an increasing market share. With the exception of Japan and Republic of Korea, markets in the Asia Pacific region are expected to grow during the forecast period.

The spread of COVID-19 started in China in early January 2020, and within a short time, spread in other Asian countries such as Japan, South Korea, and Thailand, resulting in rapid positive cases and death. This led national governments across APAC to announce lockdowns, leading to a decrease in decreased traffic, construction & mining activities, manufacturing activities, and most commercial segments. Considering the above factors, the ink resins market has declined in APAC in 2020.

In India, for instance, the COVID-19 scenario could impact in both negative (short-term) and positive ways. The ink resins for packaging market for packaging in India is projected to grow at a significant rate between 2021 and 2026. The demand for packaged food is growing amidst panic buying, and the demand for medicines is also expected to grow. The packaging industry in the country would thus experience rapid growth as more packaging is being demanded to serve a population of 1.3 billion.

Ink Resins Market Players

The key players operating in the market are BASF SE (Germany), Covestro AG (Germany), The Dow Chemical Company (US), Evonik Industries AG (Germany), and Lawter (US).

Ink Resins Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin Type |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players Lawter (US), BASF SE (Germany), Covestro AG (Germany), The Dow Chemical Company (US), Evonik Industries AG (Germany), Kraton Corporation (US), Arakawa Chemical Industries, Ltd. (Japan), Hydrite Chemical Co. (US), Indulor Chemie GmbH (Germany), and IGM Resins (Netherlands). (Total of 25 companies) |

This research report categorizes the ink resins market based on resin type, end-use industry, application, and region.

Ink Resins Market by Resin Type:

- Modified Rosin

- Hydrocarbon

- Modified Cellulose

- Acrylic

- Polyamide

- Polyurethane

- Others

Ink Resins Market by Technology:

- Oil-based

- Solvent-based

- Water-based

- UV-curable-based

Ink Resins Market by Printing Process:

- Lithography

- Gravure

- Flexography

- Others

Ink Resins Market by Application:

- Printing & Publication

- Flexible Packaging

- Corrugated Cardboard & Cartons

- Others

Ink Resins Market by Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In April 2021, Azelis made public its new distribution agreement with BASF, effective immediately, for the dispersions, additives, and resins range in Australia and New Zealand (ANZ). The products subject to the agreement are commonly used in coatings, adhesives, sealants, and elastomers (CASE), and construction applications.

- In March 2021, Bodo Möller Chemie South Africa expanded the exclusive sales and distribution agreement with BASF South Africa (Pty) Ltd. for resins and additives. With the expansion of the partnership in the field of dispersions for the CASE industry, Bodo Möller Chemie is now further completing the offerings for local customers. The agreement applies to South Africa and all other countries in Southern Africa.

Frequently Asked Questions (FAQ):

What is the current size of the global ink resins market?

The global ink resins market is estimated to be USD 3.3 billion n 2021 and projected to reach USD 3.8 billion by 2026, at a CAGR of 3.4%.

Who are the major players of the ink resins market?

The major players operating in the ink resins market are BASF SE (Germany), Covestro AG (Germany), The Dow Chemical Company (US), Evonik Industries AG (Germany), and Lawter (US).

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including acquisitions, expansions, and agreements are expected to help the market grow. Expansion and agreement are the key strategies adopted by companies operating in this market.

Which application segment has high potential demand for ink resins?

There is high potential demand for ink resins from the flexible packaging and corrugated cardboard & folding cartons segments in the near future. This can be attributed to the rising demand for inks in food packaging (seafood), beverages, cigarette packaging, pouches, bags, and lamination designs. In addition, demand from the narrow web, tags, and label printing segments is also leading to the increasing demand for inks, which, in turn, is increasing the demand for ink resins. The inks utilized in packaging, especially plastics are experiencing the highest demand in the current marketplace.

Which is the fastest-growing region in the market?

APAC is the fastest market for ink resins globally. Growth is majorly attributed to the booming economies of China, India, and a few smaller countries. Particularly, the packaging sector offers opportunities as manufacturers and global packaging converters expand to the region due to the low cost of production and ability to better serve the local emerging markets. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 INK RESINS MARKET SEGMENTATION

1.4 MARKET INCLUSIONS AND EXCLUSIONS

1.4.1 MARKET INCLUSIONS

1.4.2 MARKET EXCLUSIONS

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 INK RESINS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 4 INK RESINS MARKET: BY VALUE

FIGURE 5 INK RESINS MARKET, BY REGION

FIGURE 6 INK RESINS MARKET, BY TECHNOLOGY

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, BY APPLICATION

FIGURE 8 MARKET SIZE ESTIMATION: BY APPLICATION

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST

2.3.2 DEMAND-SIDE FORECAST

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 INK RESINS MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 1 INK RESINS MARKET SNAPSHOT

FIGURE 10 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

FIGURE 11 UV-CURABLE-BASED TO BE FASTEST-GROWING TECHNOLOGY BETWEEN 2021 AND 2026

FIGURE 12 PRINTING & PUBLICATION TO BE LARGEST APPLICATION

FIGURE 13 MODIFIED ROSIN SEGMENT TO DOMINATE INK RESINS MARKET

FIGURE 14 GRAVURE SEGMENT TO LEAD INK RESINS MARKET

FIGURE 15 ASIA PACIFIC WAS LARGEST INK RESINS MARKET

TABLE 2 MAJOR PLAYERS PROFILED IN THIS REPORT

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN INK RESINS MARKET

FIGURE 16 INK RESINS MARKET TO GROW DUE TO INCREASING DEMAND FROM EMERGING NATIONS

4.2 INK RESINS MARKET, BY RESIN

FIGURE 17 ACRYLIC INK RESINS TO REGISTER FASTEST GROWTH RATE

4.3 ASIA PACIFIC INK RESINS MARKET, BY APPLICATION AND COUNTRY

FIGURE 18 PRINTING & PUBLICATION AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2020

4.4 INK RESINS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 19 DEVELOPING MARKETS TO GROW FASTER THAN DEVELOPED MARKETS

4.5 ASIA PACIFIC INK RESINS MARKET

FIGURE 20 INDIA TO BE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INK RESINS MARKET

5.2.1 DRIVERS

5.2.1.1 Improved supply of raw materials for ink resins

5.2.1.2 Rising packaging and energy-curable inks industries

5.2.1.3 Environmental concerns, growing awareness, and stringent regulations

5.2.1.4 New ink resin technologies

5.2.2 RESTRAINTS

5.2.2.1 Volatile raw material prices and fluctuations in demand due to competition from other industries using resins

5.2.2.2 Unstable geopolitical situations

5.2.2.3 Increasing consolidation among ink resin suppliers

5.2.3 OPPORTUNITIES

5.2.3.1 Renewed interest in water-based inks

5.2.3.2 EB curing picking up interest among food packagers

5.2.4 CHALLENGES

5.2.4.1 Lower cost and improved performance of resins

5.2.4.2 Stringent and time-consuming regulatory policies

5.2.4.3 Competition with larger industries with higher purchasing power for important raw materials

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS FOR INK RESINS MARKET

TABLE 3 INK RESINS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 23 INK RESIN: VALUE CHAIN ANALYSIS

TABLE 4 INK RESINS MARKET: SUPPLY CHAIN ECOSYSTEM

5.4.1 IMPACT OF COVID-19 ON VALUE CHAIN

5.4.1.1 Action plan against current vulnerability

5.5 MACROECONOMIC INDICATORS

5.5.1 INTRODUCTION

5.5.2 TRENDS AND FORECAST OF GDP

TABLE 5 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE

5.6 COVID-19 IMPACT ANALYSIS

5.6.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.6.2 ECONOMIC IMPACT OF COVID-19 – SCENARIO ASSESSMENT

FIGURE 25 FACTORS IMPACTING ECONOMIES OF SELECT G20 COUNTRIES IN 2020

5.7 PRICING ANALYSIS

FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN INK RESINS MARKET, BY REGION IN 2020

5.7.1 SUPPLY CHAIN CRISES SINCE PANDEMIC

5.8 INK RESINS ECOSYSTEM

FIGURE 27 INK RESINS ECOSYSTEM

5.9 EXPORT-IMPORT TRADE STATISTICS

TABLE 6 EXPORT DATA FOR POLYURETHANE RESINS (2019–2020)

TABLE 7 IMPORT DATA FOR POLYURETHANE RESINS (2019–2020)

TABLE 8 EXPORT DATA FOR ACRYLIC RESINS (2019–2020)

TABLE 9 IMPORT DATA FOR ACRYLIC RESINS (2019–2020)

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2017–2021

5.10.3 PATENT ANALYSIS BY JURISDICTION

FIGURE 29 PATENTS PUBLISHED BY EACH JURISDICTION, 2017–2021

5.10.4 TOP APPLICANTS

FIGURE 30 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2017–2021

5.11 EMERGING TECHNOLOGY ANALYSIS

5.11.1 DIGITAL LABEL PRINTERS

5.11.2 SPECIAL EFFECTS AND FINISHING

5.12 CASE STUDY

5.12.1 SOLENT DESIGN STUDIO

5.12.2 DIGIFORCE

5.12.3 USE OF PRINTERS IN THE AEROSPACE INDUSTRY

5.13 REGULATION OF PRINTERS

5.13.1 ISO STANDARDS

5.13.1.1 Papers per minute

5.13.1.2 Toner standards

5.13.1.3 Printing paper standards

5.13.1.4 Monochrome testing

5.13.1.5 Multicolor testing

5.13.1.6 Color richness testing

6 INK RESINS MARKET, BY RESIN TYPE (Page No. - 86)

6.1 INTRODUCTION

FIGURE 31 MODIFIED ROSIN RESIN DOMINATES INK RESINS MARKET

TABLE 10 INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 11 INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

6.2 MODIFIED ROSIN INK RESIN

6.2.1 A LINE OF WATER-BASED FLEXOGRAPHIC INKS HAS BEEN DEVELOPED THROUGH ROSIN ESTER TECHNOLOGY

6.2.2 GUM

6.2.3 TALL OIL ROSIN (TOR)

6.2.4 STUMPWOOD

6.2.5 METAL RESINATES

6.2.6 ESTER GUMS

6.2.7 MALEIC RESINS

6.2.7.1 Rosin maleic adducts

6.2.7.2 Partially esterified rosin maleics

6.2.7.3 Esterified rosin maleics

6.2.8 PHENOLIC RESINS

TABLE 12 MODIFIED ROSIN: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 MODIFIED ROSIN: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.3 HYDROCARBON INK RESINS

6.3.1 HYDROCARBON RESINS ARE USED EXTENSIVELY IN PRINTING INKS AND HAVE REPLACED MANY NATURAL RESINS THAT ARE USED AS BINDERS FOR INKS

6.3.2 C5 ALIPHATIC HYDROCARBON RESINS

6.3.3 C9 AROMATIC HYDROCARBON RESINS

6.3.4 MODIFIED C9 HYDROCARBONS

TABLE 14 HYDROCARBON: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 15 HYDROCARBON: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.4 MODIFIED CELLULOSE INK RESINS

6.4.1 CELLULOSE PROVIDES AN ENTIRE RANGE OF HIGHLY USEFUL FILM FORMER RESINS FOR LIQUID INKS

6.4.2 NITROCELLULOSE RESINS

6.4.2.1 RS Nitrocellulose

6.4.2.2 SS Nitrocellulose

6.4.3 ETHYL CELLULOSE RESINS

6.4.3.1 N-Type

6.4.3.2 T-Type

6.4.4 EHEC RESINS

6.4.5 CARBOY METHYL CELLULOSE (CMC)

6.4.6 CELLULOSE ACETATES

TABLE 16 MODIFIED CELLULOSE: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 MODIFIED CELLULOSE: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.5 ACRYLIC INK RESINS

6.5.1 ACRYLICS ARE RARELY USED DIRECTLY AS THEY HAVE LIMITED SOLUBILITY IN INKS

6.5.2 ACRYLIC SOLUTION RESINS

6.5.3 ACRYLIC AQUEOUS EMULSIONS

6.5.4 ACRYLIC NAD

TABLE 18 ACRYLIC: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 ACRYLIC: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.5.5 PASTE INKS

6.5.6 SOLVENT INKS

6.5.7 WATER-BASED INKS

6.6 POLYAMIDE INK RESINS

6.6.1 POLYAMIDE RESINS FIND WIDE USE AS BINDERS IN PRINTING INKS

6.6.2 REACTIVE POLYAMIDES

6.6.3 NON-REACTIVE POLYAMIDES

6.6.3.1 Co-solvent polyamides

6.6.3.2 Alcohol soluble polyamides

TABLE 20 POLYAMIDE: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 POLYAMIDE: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.7 POLYURETHANE INK RESINS

6.7.1 POLYURETHANE RESIN HAS EXCELLENT PROPERTIES AND CAN BE MADE MORE ATTRACTIVE BY APPLYING ADVANCED TECHNOLOGIES

TABLE 22 POLYURETHANE: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 POLYURETHANE: INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.8 OTHER INK RESINS

TABLE 24 OTHER INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 OTHER INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7 INK RESINS MARKET, BY TECHNOLOGY (Page No. - 101)

7.1 INTRODUCTION

FIGURE 32 SOLVENT-BASED TECHNOLOGY TO DOMINATE OVERALL INK RESINS MARKET

TABLE 26 INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 27 INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (KILOTON)

7.2 OIL-BASED

7.2.1 OIL-BASED INKS ARE USED PRIMARILY IN DROP ON DEMAND (D.O.D.) WIDE-FORMAT PRINTERS FOR COMMERCIAL APPLICATIONS

TABLE 28 OIL-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 OIL-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.3 SOLVENT-BASED INKS

7.3.1 SOLVENT-BASED INK SYSTEMS ARE EQUIPPED WITH OXIDIZERS AND OTHER POLLUTION-CONTROL DEVICES TO ELIMINATE VOCS

7.3.2 RESIN TYPES FOR SOLVENT-BASED INKS

7.3.3 ADVANTAGES & DISADVANTAGES

TABLE 30 SOLVENT-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 SOLVENT-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.4 WATER-BASED INKS

7.4.1 WATER-BASED INKS EXCEL IN PRINTING APPLICATIONS INVOLVING PAPER, CARDBOARD, AND TEXTILES, ARE EVEN USED TO PRINT ON FOILS, PLASTICS, AND FOOD PACKAGING

7.4.2 RESIN TYPES FOR WATER-BASED INKS

7.4.3 ADVANTAGES AND DISADVANTAGES

TABLE 32 WATER-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 WATER-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.5 UV-CURABLE INKS

7.5.1 UV-CURING TECHNOLOGIES REGISTERING HIGH GROWTH

7.5.2 RESIN SYSTEMS

7.5.3 ADVANTAGES AND LIMITATIONS

TABLE 34 UV-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 35 UV-BASED INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8 INK RESINS MARKET, BY PRINTING PROCESS (Page No. - 111)

8.1 INTRODUCTION

FIGURE 33 GRAVURE PRINTING PROCESS DOMINATES INK RESINS MARKET

TABLE 36 INK RESINS MARKET SIZE IN PRINTING INKS, BY PRINTING PROCESS, 2019–2026 (USD MILLION)

TABLE 37 INK RESINS MARKET SIZE IN PRINTING INKS, BY PRINTING PROCESS, 2019–2026 (KILOTON)

8.2 LITHOGRAPHY PROCESS

8.2.1 RISING DEMAND FOR LITHOGRAPHIC INK PRINTING PROCESS INCREASES RESIN CONSUMPTION

TABLE 38 INK RESINS MARKET SIZE IN LITHOGRAPHY PROCESS, BY REGION, 2019–2026 (USD MILLION)

TABLE 39 INK RESINS MARKET SIZE IN LITHOGRAPHY PROCESS, BY REGION, 2019–2026 (KILOTON)

8.3 GRAVURE PROCESS

8.3.1 GRAVURE PRINTERS ARE FINDING APPLICATIONS IN THE GROWING PACKAGING INDUSTRY

TABLE 40 INK RESINS MARKET SIZE IN GRAVURE PROCESS, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 INK RESINS MARKET SIZE IN GRAVURE PROCESS, BY REGION, 2019–2026 (KILOTON)

8.4 FLEXOGRAPHY PROCESS

8.4.1 FLEXOGRAPHY PROCESS IS USED FOR PACKAGING AND PUBLISHING APPLICATIONS

TABLE 42 INK RESINS MARKET SIZE IN FLEXOGRAPHY PROCESS, BY REGION, 2019–2026 (USD MILLION)

TABLE 43 INK RESINS MARKET SIZE IN FLEXOGRAPHY PROCESS, BY REGION, 2019–2026 (KILOTON)

8.5 OTHER PRINTING PROCESSES

TABLE 44 INK RESINS MARKET SIZE IN OTHER PRINTING PROCESSES, BY REGION, 2019–2026 (USD MILLION)

TABLE 45 INK RESINS MARKET SIZE IN OTHER PRINTING PROCESSES, BY REGION, 2019–2026 (KILOTON)

9 INK RESINS MARKET, BY APPLICATION (Page No. - 119)

9.1 INTRODUCTION

FIGURE 34 PRINTING & PUBLICATION SEGMENT PROJECTED TO LEAD INK RESINS MARKET

TABLE 46 INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 47 INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2 PRINTING & PUBLICATION

9.2.1 PRINTING & PUBLICATION INK MARKET IS FACING DECLINE DUE TO RISE OF INTERNET

TABLE 48 INK RESINS MARKET SIZE IN PRINTING & PUBLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 49 INK RESINS MARKET SIZE IN PRINTING & PUBLICATION, BY REGION, 2019–2026 (KILOTON)

9.3 FLEXIBLE PACKAGING

9.3.1 FLEXIBLE PACKAGING ADDS VALUE AND MARKETABILITY TO EDIBLE AND NON-EDIBLE PRODUCTS

TABLE 50 INK RESINS MARKET SIZE IN FLEXIBLE PACKAGING, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 INK RESINS MARKET SIZE IN FLEXIBLE PACKAGING, BY REGION, 2019–2026 (KILOTON)

9.4 CORRUGATED CARDBOARD & CARTONS

9.4.1 CORRUGATED CARDBOARD & CARTONS INDUSTRY IS GROWING AT A HIGH RATE IN KRAFT OR TEST LINER PREPRINT

TABLE 52 INK RESINS MARKET SIZE IN CORRUGATED CARDBOARD & CARTONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 53 INK RESINS MARKET SIZE IN CORRUGATED CARDBOARD & CARTONS, BY REGION, 2019–2026 (KILOTON)

9.5 OTHERS

TABLE 54 INK RESINS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 55 INK RESINS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (KILOTON)

10 INK RESINS MARKET, BY REGION (Page No. - 128)

10.1 INTRODUCTION

FIGURE 35 INK RESINS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2021 AND 2026

TABLE 56 INK RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 57 INK RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

10.2 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: INK RESINS MARKET SNAPSHOT

TABLE 58 ASIA PACIFIC: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 60 ASIA PACIFIC: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 61 ASIA PACIFIC: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 62 ASIA PACIFIC: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (KILOTON)

TABLE 64 ASIA PACIFIC: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (KILOTON)

TABLE 66 ASIA PACIFIC: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.2.1 CHINA

10.2.1.1 Largest ink resins market in Asia Pacific

10.2.2 JAPAN

10.2.2.1 Demand for new innovative packaging methods is helping in the growth of the ink industry

10.2.3 INDIA

10.2.3.1 Government initiatives and significant market opportunities making India a key market for ink resins

10.2.4 PAKISTAN

10.2.4.1 Increase in growth of packaging industry expected to help the ink industry grow

10.2.5 INDONESIA

10.2.5.1 New opportunities have helped ink industry to survive COVID-19 period

10.2.6 PHILIPPINES

10.2.6.1 Government initiatives helping the growth of packaging industry

10.2.7 MALAYSIA

10.2.7.1 The country is moving toward environment-friendly packaging leading to new demand in the ink market

10.2.8 BANGLADESH

10.2.8.1 Large printing sector promoting growth in the inks market

10.2.9 SRI LANKA

10.2.9.1 Large export market helping in the growth of the packaging industry

10.2.10 REST OF ASIA PACIFIC

10.3 EUROPE

FIGURE 37 EUROPE: INK RESINS MARKET SNAPSHOT

TABLE 68 EUROPE: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 69 EUROPE: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 70 EUROPE: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 72 EUROPE: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (KILOTON)

TABLE 74 EUROPE: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 75 EUROPE: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (KILOTON)

TABLE 76 EUROPE: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.1 GERMANY

10.3.1.1 Developments and investments in consumer sectors leading to the growth of chemical industry

10.3.2 FRANCE

10.3.2.1 Government investments to drive the inks market

10.3.3 ITALY

10.3.3.1 Food & beverage industry to promote the packaging industry

10.3.4 RUSSIA

10.3.4.1 Significant demand from packaging industry leading to high market growth

10.3.5 TURKEY

10.3.5.1 A leading market for paints and inks & coatings in Europe

10.3.6 REST OF EUROPE

10.4 NORTH AMERICA

FIGURE 38 NORTH AMERICA: INK RESINS MARKET SNAPSHOT

TABLE 78 NORTH AMERICA: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 80 NORTH AMERICA: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 82 NORTH AMERICA: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (KILOTON)

TABLE 84 NORTH AMERICA: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (KILOTON)

TABLE 86 NORTH AMERICA: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.4.1 US

10.4.1.1 Largest market for ink resins in the region

10.4.2 CANADA

10.4.2.1 Demand for ink resins to increase due to the growing packaging industry

10.4.3 MEXICO

10.4.3.1 Printing inks market in witnessing high growth

10.5 MIDDLE EAST & AFRICA

FIGURE 39 INCREASING DEMAND FOR INK RESINS FROM PRINTING & PUBLICATION APPLICATION TO DRIVE MARKET IN MIDDLE EAST & AFRICA

TABLE 88 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 90 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 92 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (KILOTON)

TABLE 94 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (KILOTON)

TABLE 96 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.5.1 SAUDI ARABIA

10.5.1.1 Various leading manufacturers have set up their manufacturing units in the country

10.5.2 UAE

10.5.2.1 Government initiatives are promoting local players, boosting demand in the ink resins market

10.5.3 SOUTH AFRICA

10.5.3.1 Government investments boosting the economy

10.5.4 NIGERIA

10.5.4.1 Food industry accounts for major share of flexible packaging

10.5.5 EGYPT

10.5.5.1 Publishing business is leading to growth of the ink resins market

10.5.6 ETHIOPIA

10.5.6.1 COVID-19 has impacted industries

10.5.7 KENYA

10.5.7.1 Government initiatives to propel the ink resins market

10.5.8 ISRAEL

10.5.8.1 Growth of plastic industry offers major opportunities for packaging industry

10.5.9 JORDAN

10.5.9.1 Major economic breakdown but undertaking efforts to recover

10.5.10 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

FIGURE 40 FLEXIBLE PACKAGING TO BE FASTEST-GROWING APPLICATION OF SOUTH AMERICAN INK RESINS MARKET

TABLE 98 SOUTH AMERICA: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 99 SOUTH AMERICA: INK RESINS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 100 SOUTH AMERICA: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 101 SOUTH AMERICA: INK RESINS MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 102 SOUTH AMERICA: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (USD MILLION)

TABLE 103 SOUTH AMERICA: INK RESINS MARKET SIZE, BY PRINTING PROCESS, 2019–2026 (KILOTON)

TABLE 104 SOUTH AMERICA: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 105 SOUTH AMERICA: INK RESINS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (KILOTON)

TABLE 106 SOUTH AMERICA: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 107 SOUTH AMERICA: INK RESINS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.6.1 BRAZIL

10.6.1.1 Manufacturers are expanding production capacities, helping ink resins market grow

10.6.2 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 166)

11.1 OVERVIEW

FIGURE 41 COMPANIES ADOPTED AGREEMENTS AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2021

11.2 MARKET SHARE ANALYSIS

TABLE 108 INK RESINS MARKET: DEGREE OF COMPETITION

FIGURE 42 INK RESINS MARKET: MARKET SHARE ANALYSIS FOR 2020

11.2.1 MARKET RANKING ANALYSIS

FIGURE 43 RANKING OF KEY PLAYERS

11.3 COMPANY REVENUE ANALYSIS

FIGURE 44 REVENUE ANALYSIS FOR KEY COMPANIES DURING THE PAST THREE YEARS

11.4 COMPANY EVALUATION QUADRANT, 2020

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 PARTICIPANTS

FIGURE 45 INK RESINS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.5 SME MATRIX, 2020

11.5.1 PROGRESSIVE COMPANIES

11.5.2 DYNAMIC COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 RESPONSIVE COMPANIES

FIGURE 46 INK RESINS MARKET: EMERGING COMPANIES’ COMPETITIVE LEADERSHIP MAPPING, 2020

11.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 47 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INK RESINS MARKET

11.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 48 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INK RESINS MARKET

11.8 COMPETITIVE SCENARIO

11.8.1 MARKET EVALUATION FRAMEWORK

TABLE 109 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 110 MOST FOLLOWED STRATEGY

TABLE 111 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

11.8.2 MARKET EVALUATION MATRIX

TABLE 112 COMPANY PRODUCT FOOTPRINT

TABLE 113 COMPANY REGION FOOTPRINT

TABLE 114 COMPANY INDUSTRY FOOTPRINT

11.9 STRATEGIC DEVELOPMENTS

TABLE 115 DEALS, 2017–2021

TABLE 116 OTHERS, 2017–2021

12 COMPANY PROFILES (Page No. - 179)

12.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats)*

12.1.1 LAWTER

TABLE 117 LAWTER : BUSINESS OVERVIEW

FIGURE 49 LAWTER : COMPANY SNAPSHOT

12.1.2 BASF SE

TABLE 118 BASF SE: BUSINESS OVERVIEW

FIGURE 50 BASF SE: COMPANY SNAPSHOT

TABLE 119 BASF SE: DEALS

12.1.3 COVESTRO AG

TABLE 120 COVESTRO AG: BUSINESS OVERVIEW

FIGURE 51 COVESTRO AG: COMPANY SNAPSHOT

TABLE 121 COVESTRO AG: DEALS

12.1.4 THE DOW CHEMICAL COMPANY

TABLE 122 THE DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 52 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

12.1.5 EVONIK INDUSTRIES AG

TABLE 123 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

FIGURE 53 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

TABLE 124 EVONIK INDUSTRIES AG: OTHERS

12.1.6 KRATON CORPORATION

TABLE 125 KRATON CORPORATION: COMPANY SNAPSHOT

FIGURE 54 KRATON CORPORATION: COMPANY SNAPSHOT

12.1.7 ARAKAWA CHEMICAL INDUSTRIES LTD.

TABLE 126 ARAKAWA CHEMICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 55 ARAKAWA CHEMICAL INDUSTRIES LTD.: COMPANY SNAPSHOT

12.1.8 HYDRITE CHEMICAL CO.

TABLE 127 HYDRITE CHEMICAL CO.: BUSINESS OVERVIEW

12.1.9 INDULOR CHEMIE GMBH

TABLE 128 INDULOR CHEMIE GMBH: BUSINESS OVERVIEW

12.1.10 IGM RESINS

TABLE 129 IGM RESINS : BUSINESS OVERVIEW

12.2 OTHER COMPANIES

12.2.1 FLINT GROUP

TABLE 130 FLINT GROUP: COMPANY OVERVIEW

12.2.2 DIC CORPORATION

TABLE 131 DIC CORPORATION: COMPANY OVERVIEW

12.2.3 THE LUBRIZOL CORPORATION

TABLE 132 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

12.2.4 EASTMAN CHEMICAL COMPANY

TABLE 133 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

12.2.5 MITSUBISHI CHEMICAL CORPORATION

TABLE 134 MITSUBISHI CHEMICAL CORPORATION: BUSINESS OVERVIEW

12.2.6 ARKEMA

TABLE 135 ARKEMA: BUSINESS OVERVIEW

12.2.7 INGEVITY

TABLE 136 INGEVITY: BUSINESS OVERVIEW

12.2.8 RESINALL CORP

TABLE 137 RESINALL CORP: BUSINESS OVERVIEW

12.2.9 GELLNER INDUSTRIAL LLC

TABLE 138 GELLNER INDUSTRIAL LLC: BUSINESS OVERVIEW

12.2.10 KANE INTERNATIONAL CORPORATION

TABLE 139 KANE INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

12.2.11 VIL RESINS

TABLE 140 VIL RESINS: BUSINESS OVERVIEW

12.2.12 D.R. COATS, INK & RESINS PVT. LTD.

TABLE 141 D.R. COATS, INK & RESINS PVT. LTD.: BUSINESS OVERVIEW

12.2.13 ALLNEX GROUP

TABLE 142 ALLNEX GROUP: BUSINESS OVERVIEW

12.2.14 SETCO CHEMICALS (I) PVT. LTD.

TABLE 143 SETCO CHEMICALS (I) PVT. LTD.: BUSINESS OVERVIEW

12.2.15 SAUDI INDUSTRIAL RESINS LIMITED

TABLE 144 SAUDI INDUSTRIAL RESINS LIMITED.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 216)

13.1 INTRODUCTION

13.2 LIMITATION

13.3 DIGITAL PRINTING MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 GLOBAL DIGITAL PRINTING MARKET

TABLE 145 GLOBAL DIGITAL PRINTING MARKET, 2015–2020 (USD MILLION)

TABLE 146 GLOBAL DIGITAL PRINTING MARKET, 2021–2026 (USD MILLION)

13.3.3.1 Digital Printer

13.3.3.2 Ink Market for Digital Printing

13.3.3.3 Print Head Market for Digital Printers

13.3.4 DIGITAL PRINTING MARKET, BY REGION

TABLE 147 DIGITAL PRINTING MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 148 DIGITAL PRINTING MARKET, BY REGION, 2021–2026 (USD MILLION)

13.3.4.1 Asia Pacific

13.3.4.2 North America

13.3.4.3 Europe

13.3.4.4 Rest of the World

14 APPENDIX (Page No. - 220)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

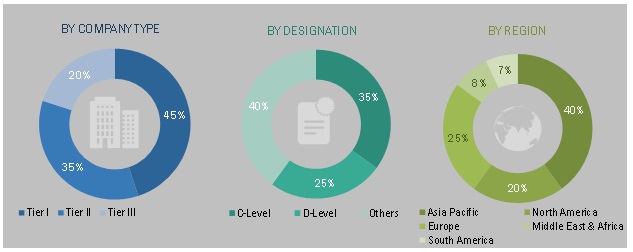

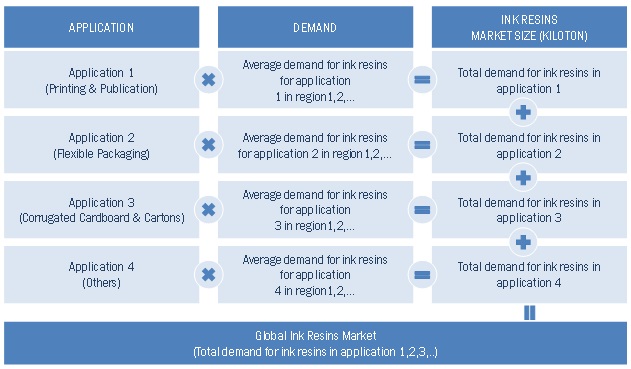

The study involves four major activities in estimating the current market size of ink resins. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The ink resins market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as printing & publication, flexible packaging, corrugated cardboards & cartons and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the ink resins market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Ink Resins Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global ink resins market in terms of value and volume

- To analyze and forecast the ink resins market by resin type, technology, printing process and application

- To forecast the ink resins market size with respect to five main regions: North America, Europe, APAC, the Middle East & Africa, and South America

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments in the market, such as mergers & acquisitions, new product launches, investments, and expansions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the subsegments of the global ink resins market included in the report.

2. Core competencies of companies are determined in terms of their key developments and key strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the ink resins market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ink Resin Market