Automotive LiDAR Market Size, Share & Analysis

Automotive LiDAR Market By Technology (Mechanical LiDAR and Solid-state LiDAR), Image Type, ICE Vehicle Type (PC, LCV, HCV), Location, Electric Vehicle, Range, Laser Wavelength, Measurement Process, Level of Autonomy, and Region – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The automotive LiDAR market is projected to reach USD 9.85 billion by 2032 from USD 1.25 billion in 2025, at a CAGR of 34.2% from 2025 to 2032. Growth of the automotive LiDAR market is driven by the rising demand for advanced sensor technologies that enhance vehicle safety, autonomy, and navigation in modern automobiles.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific region is estimated to dominate the automotive LiDAR market, with a share of 56.2%, in 2025.

-

By ICE Vehicle TypeBy ICE vehicle type, the heavy commercial vehicle segment is projected to register the highest CAGR of 156.5% during the forecast period.

-

By Electric Vehicle TypeBy electric vehicle type, the battery electric vehicle segment is projected to grow at the highest rate during the forecast period.

-

By Image TypeBy image type, the 3D segment is projected to dominate the market during the forecast period.

-

By Laser WavelengthBy laser wavelength, the short-wave infrared segment is projected to grow at the highest rate during the forecast period.

-

By Level of AutonomyBy level of autonomy, the semi-autonomous segment is projected to register a higher CAGR (27.5%) than the autonomous segment during the forecast period.

-

By LocationBy location, the bumper & grill segment is projected to lead the market during the forecast period.

-

By Measurement ProcessBy measurement process, the time of flight (ToF) segment is projected to dominate the market during the forecast period.

-

By TechnologyBy technology, the solid-state LiDAR segment is projected to grow at a higher rate than the mechanical LiDAR segment during the forecast period.

-

By RangeBy range, the long-range LiDAR segment is projected to grow at a higher rate than the short- & mid-range LiDAR segment during the forecast period.

-

Competitive LandscapeHesai Group, RoboSense, Huawei Technologies were identified as Star players in the automotive LiDAR market, as they have focused on innovation and have broad technology and range coverage and strong operational & financial strength.

-

Competitive LandscapeLIVOX, Leishen Intelligent Systems, and Aeva have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The automotive LiDAR market is witnessing steady growth, driven by the rising demand for advanced sensor technologies, such as solid-state LiDAR and multi-sensor fusion systems, to enhance vehicle safety, enable autonomous driving capabilities, and comply with stringent regulatory standards worldwide. New developments, including strategic partnerships between OEMs and LiDAR suppliers like BMW with Innoviz and Mercedes-Benz with Valeo, investments in cost-effective production for mass-market adoption, and innovations in high-resolution 4D LiDAR for improved environmental perception, are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses emerges from customer trends or disruptions, such as the accelerating adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles that demand precise environmental sensing for enhanced safety and navigation. Automotive OEMs, clients of LiDAR manufacturers, are changing trends or disruptions, which will impact revenues of end users of automotive LiDAR manufacturers. The revenue impact on end users will affect the revenue of OEMs, which will further affect the revenues of automotive LiDAR manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological innovation and diversification in LiDAR

-

OEM investments in higher autonomy levels accelerating automotive LiDAR adoption

Level

-

Cost barrier slowing adoption rate in volume segments

-

Impact of alternative sensor technologies

Level

-

Expansion of autonomous ride-hailing fleets

-

Increasing automation in commercial vehicles

Level

-

Raw material volatility & geopolitical risks

-

Adverse weather limitations on automotive LiDAR performance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological innovation and diversification in LiDAR

Continuous innovation in LiDAR technology, including Optical Phased Array, Flash, and MEMS architectures, is driving strong growth in the automotive LiDAR market. Emerging techniques like FMCW and SLAM, coupled with hardware advances such as Texas Instruments' integrated laser driver and Hesai Group's high-performance portfolio, are improving detection accuracy, range, and system compactness for autonomous vehicles.

Restraint: Cost barrier slowing adoption rate in volume segments

The high cost of LiDAR, estimated between USD 500 and 700 per sensor due to complex components and advanced manufacturing, is the main restraint to widespread use. This makes integration prohibitive for mass-market vehicles that prioritize cheaper camera and radar alternatives, though new technologies like solid-state and MEMS-based LiDAR are expected to reduce costs and enable broader adoption soon.

Opportunity: Expansion of autonomous ride-hailing fleets

The rising adoption of robotaxis and autonomous ride-hailing fleets is driving significant demand for automotive LiDAR, which is crucial for Level 4 and Level 5 autonomy due to its precise 3D mapping and real-time obstacle detection. Recent agreements, such as Hesai's contract with a US robotaxi operator and its supply to Baidu's Apollo platform, highlight LiDAR's increasing importance as a standard sensor technology for large-scale global deployment in autonomous mobility.

Challenge: Raw material volatility & geopolitical risks

Fluctuating prices of raw materials like silicon and rare earth elements, alongside geopolitical tensions and trade restrictions, pose challenges to the automotive LiDAR market by increasing manufacturing costs and complicating supply chains. Additionally, security concerns related to sourcing, such as Chinese-sourced sensors, emphasize the need for diversified supply chains, potentially constraining mass-market adoption.

lidar-sensor-automotive-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplying long-range LiDAR sensors for Volvo and Mercedes-Benz vehicles to enable highway autonomy and proactive safety systems | Detects objects up to 250 m | Improves reaction time, enhances highway safety | Supports Level 3 automation |

|

Providing solid-state LiDAR sensors and perception software for BMW’s autonomous driving platform | Compact design lowers system cost | Supports mass-market integration | Improves reliability under vibration |

|

Developing automotive-grade LiDAR for ADAS functions, such as automatic braking, lane keeping, and traffic-jam assist | Enables 360° environment perception | Improves pedestrian detection accuracy | Reduces accident risk |

|

Integrating LiDAR into sensor-fusion architectures combining radar, cameras, and AI algorithms | Improves detection confidence | Enhances decision-making for autonomous driving | Increases operational safety |

|

Using proprietary LiDAR systems in autonomous robotaxi fleets and delivery vehicles | Provides high-resolution 3D mapping | Ensures redundancy for full autonomy | Optimizes fleet efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The automotive LiDAR market ecosystem is a dynamic network of sectors working together to advance autonomous driving. It includes component manufacturers, such as Hamamatsu Photonics (Japan), which supplies key photodetectors, and Osram Opto Semiconductors (Germany), which provides lasers and optics essential for LiDAR systems. It also includes LiDAR system providers, such as Velodyne Lidar (US) and RoboSense (China), which design and manufacture complete LiDAR solutions, integrating sensors and scanning technology for accurate 3D mapping. The ecosystem further includes NVIDIA (US), a software provider offering AI-powered data processing platforms, and Waymo (US), a software provider that develops perception algorithms for real-time vehicle decision-making to enhance the utility of LiDAR data for autonomous systems. OEMs, such as Mercedes-Benz (Germany) and Baidu Co., Ltd. (China), are also covered in the market ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By ICE Vehicle Type

The passenger car segment is anticipated to account for the largest market share during the forecast period, driven by several key factors, such as the growing trend of autonomous mobility in passenger cars essential for advanced driver assistance systems that enhance vehicle safety and performance. Additionally, features such as automatic emergency braking, adaptive cruise control, and emergency lane-keeping systems are increasingly becoming standard, pushing manufacturers to integrate LiDAR into their vehicles.

By Electric Vehicle Type

The battery electric vehicle (BEV) segment is projected to dominate the automotive LiDAR market over the forecast period due to the accelerating global shift toward electrification and the demand for advanced autonomous features in EVs. China’s EV revolution plays a pivotal role, with leading models like Zeekr 009, Rising Auto F7, and IM Motors’ LS6 and LS7 integrating LiDAR technologies from RoboSense (China) and Hesai Group (China).

By Image Type

The 3D segment is projected to account for a significant share during the forecast period, driven by the rising demand for advanced perception capabilities in autonomous and semi-autonomous vehicles. 2D LiDAR is gradually being eliminated from the market as it provides only a flat, two-dimensional view due to its limited number of channels, which restricts its ability to capture detailed spatial information. In contrast, 3D LiDAR, with its capability to generate rich three-dimensional point clouds, enables advanced algorithms, such as 3D object detection and segmentation, which makes it far superior for applications in autonomous driving.

By Laser Wavelength

The near-infrared segment is projected to account for the largest market share over the forecast period, driven by several key factors. Near-infrared wavelength LiDAR operates at 905 nm wavelength. These LiDAR systems demonstrate superior performance in challenging environmental conditions, including fog and rain, compared to those operating at 1550 nm. This advantage is crucial for automotive applications, as LiDAR systems must maintain accurate detection capabilities in adverse weather. The M3 LiDAR from RoboSense (China) and the Robin W LiDAR from Seyond (US), functioning at 905 nm, provide reliable distance measurements and effective object detection even in less-than-ideal visibility conditions. Near-infrared LiDAR can penetrate fog more effectively, resulting in less signal attenuation than 1550 nm systems, which are more susceptible to scattering by fog droplets.

By Level of Autonomy

The semi-autonomous segment is projected to account for the largest share during the forecast period, driven by the growing adoption of Level 2 (L2) and Level 3 (L3) autonomous features in mainstream vehicles. Several models, such as the IM L6 and Zeekr 7X, are already equipped with LiDAR from RoboSense (China) to enable L2 capabilities, providing advanced driver assistance systems for enhanced safety and convenience.

By Location

The bumper & grill segment is poised to secure a significant position in the automotive LiDAR market due to its practicality for seamless integration and optimal front-facing perception. Installing LiDAR in the bumper or grill lets manufacturers maintain vehicle aesthetics and aerodynamics while embedding advanced sensing capabilities. For instance, luxury models like the Mercedes-Benz S-Class have successfully incorporated LiDAR into the grill, emphasizing its effectiveness for advanced driver-assistance systems.

By Measurement Process

The frequency-modulated continuous wave (FMCW) segment is projected to grow significantly over the forecast period. Its unique capability to directly measure the speed of an object using the Doppler effect eliminates the need for multiple measurements to calculate velocity, as is required in Time of Flight (ToF) systems. This efficiency simplifies the measurement process and enhances accuracy, making FMCW LiDAR particularly appealing for driver assistance systems and autonomous vehicles.

By Technology

The solid-state LiDAR segment is projected to lead during the forecast period, driven by its compact design, cost efficiency, and durability compared to traditional mechanical LiDAR. Unlike mechanical systems, solid-state LiDAR has fewer moving parts, which makes it more resilient to wear and tear, vibrations, and environmental challenges. Mercedes-Benz EQS, XPeng P5, and NIO ET7 are vehicles equipped with solid-state LiDAR.

By Range

The long-range segment is projected to account for a significant share over the forecast period. Its ability to enhance the perception of autonomous driving and advanced safety features drives the segment's growth. Unlike short-range LiDAR, which overlaps with capabilities provided by existing sensors such as cameras and ultrasonic systems, long-range LiDAR is uniquely suited for high-speed scenarios, detecting objects, vehicles, and pedestrians at greater distances to ensure advanced decision-making for Level 3 and above autonomy.

By Region

Asia Pacific is poised to dominate the automotive LiDAR market during the forecast period. The region's growth is driven by its progressive government policies, rapid technological innovations, and the strong presence of leading automakers and LiDAR providers. Various developments and initiatives to promote the use of autonomous vehicles are also driving the popularity of LiDAR in the region. For example, Seoul’s “Autonomous Driving Vision 2030” aims to establish city-wide autonomous driving infrastructure, including real-time traffic signal data for multi-lane roads, a precise road map for autonomous driving, and an open platform to update real-time by 2026 in South Korea. Similarly, Japan plans to deploy Level 4 vehicles across 100 municipalities by 2027, reflecting its commitment to autonomous mobility. In August 2024, the country offered more than 16,000 test licenses for driverless cars to promote autonomous testing. Moreover, prominent Chinese models like the BYD Han EV, BYD Han DM-i, and Chery Exeed STERRA ES are expected to be equipped with LiDAR systems offered by RoboSense (China), signifying growing LiDAR adoption in mass-market vehicles.

REGION

Europe to be fastest-growing region in global automotive LIDAR market during forecast period

The European automotive LiDAR market is expected to register the highest CAGR during the forecast period, driven by strong demand for next-generation autonomous vehicles and advanced driver-assistance systems (ADAS), leading OEMs and suppliers in Germany, France, and the UK to adopt solid-state LiDAR technologies for enhanced perception and navigation while reducing accident rates. Stringent regulatory mandates from Euro NCAP and the EU's General Safety Regulation (GSR-2) are compelling the integration of LiDAR in vehicles, with Germany's automotive hub pioneering Level 3+ autonomy deployments. Rising investments in urban mobility solutions and electric vehicle electrification are further accelerating the adoption of automotive LiDAR in the region.

lidar-sensor-automotive-market: COMPANY EVALUATION MATRIX

In the automotive LiDAR market matrix, Hesai Group (Star) leads with a strong market share and extensive product portfolio, driven by solid-state and digital LiDAR solutions widely adopted in passenger vehicles, ADAS, and robotaxi applications. Hesai Group dominates through scale and diverse positioning, with partnerships with multiple global OEMs like BYD and Geely. Valeo (Emerging Leader) is gaining visibility with its mechanical LiDAR tailored for high-performance autonomous driving and perception software in automotive and industrial solutions. Valeo shows niche product potential to move toward the leader's quadrant as demand for advanced sensor fusion continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Hesai group (China)

- RoboSense (China)

- Huawei Technologies Co., Ltd. (China)

- Seyond (US)

- Luminar Technologies, Inc. (US)

- Valeo (France)

- Innoviz Technologies Ltd (Israel)

- Ouster Inc. (US)

- Denso Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- Aptiv (Ireland)

- Continental AG (Germany

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.88 Billion |

| Market Forecast in 2032 (Value) | USD 9.85 Billion |

| Growth Rate | CAGR of 34.2% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion) and Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, and North America |

WHAT IS IN IT FOR YOU: lidar-sensor-automotive-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| LiDAR Sensor Manufacturer |

|

|

| Tier 1 System Integrator |

|

|

| Semiconductor/Laser Diode Supplier |

|

|

| Mapping & Autonomous Fleet Operator |

|

|

RECENT DEVELOPMENTS

- November 2025 : RoboSense announced that IM Motors’ LS9 SUV will feature custom-developed 520-beam Ultra-Wide FOV Digital LiDAR as standard equipment. It features L3-standard perception capabilities and maximum range of up to 300 meters.

- September 2025 : Hesai Group launched two new LiDAR products at IAA Mobility 2025. This included the ETX, an automotive-grade ultra-long-range LiDAR designed for L3 autonomous driving and behind-the-windshield integration. Hesai also showcased the FTX, a fully solid-state short-range LiDAR with an ultra-wide 180° × 140° field of view, intended for covering vehicle blind spots.

- September 2025 : Seyond announced a partnership with AM Signal to accelerate the deployment of Seyond’s LiDAR-based ITS Management Platform, SIMPL, across key markets in the Western United States. The collaboration aims to modernize traffic infrastructure by providing high-accuracy vehicle and vulnerable road user detection and real-time data insights.

- September 2025 : Valeo and Capgemini announced a collaboration to test and validate Valeo's new complete, integrated Level 2+ ADAS system. Capgemini will provide end-to-end services, including data-driven verification and validation, to ensure seamless integration and help accelerate the system's time-to-market. The new ADAS architecture is slated to enter production in 2028 for a major OEM.

- May 2025 : Seyond announced a supply contract received from a leading Chinese automotive group to exclusively provide its 905 nm Robin series E1X LiDAR products for multiple brands under the group. The vehicles equipped with Robin E1X are expected to enter mass production in 2026, with projected sales reaching hundreds of thousands over the next three years.

Table of Contents

Methodology

The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive LiDAR market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and autonomous vehicles and ADAS-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

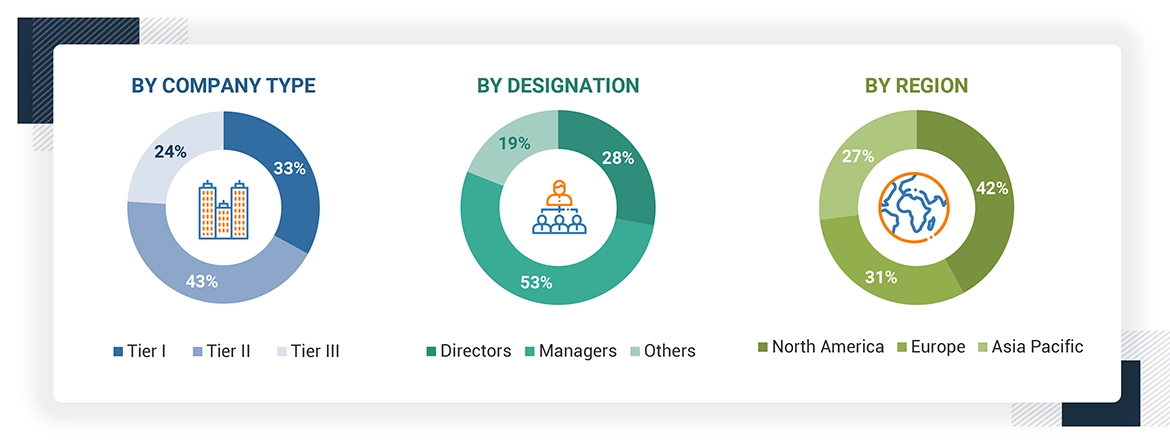

After understanding the automotive LiDAR market scenario through secondary research, extensive primary research has been conducted. Primary interviews have been conducted with market experts from both demand and supply sides across North America, Europe, and Asia Pacific. Approximately 35% of interviews have been conducted from the demand side, while 65% of primary interviews have been conducted from the supply side. The primary data has been collected through questionnaires, emails, and telephone interviews.

In the canvassing of primaries, various departments within organizations, such as sales and operations, have been covered to provide a holistic viewpoint in this report. Primary sources from the supply side include various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders have also been interviewed.

Note: Others include sales, managers, and product managers.

Company tiers are based on the value chain; the company's revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

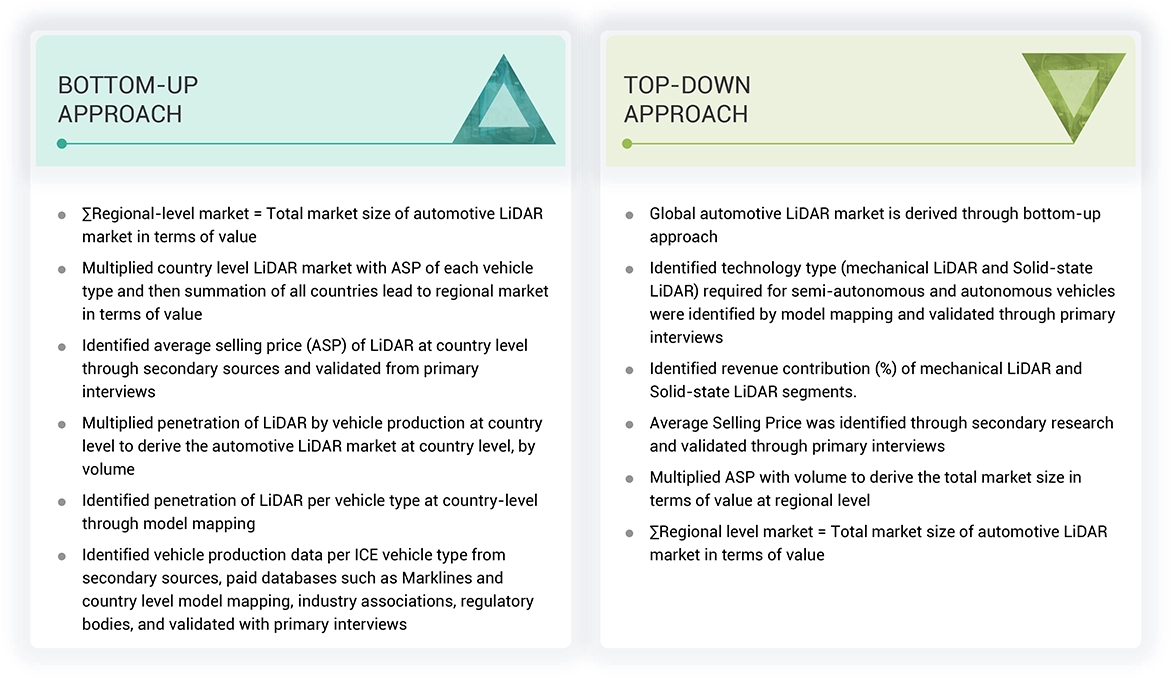

Market Size Estimation Methodology- Top-down approach

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive LiDAR market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Automotive LiDAR Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the methodology mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments, wherever applicable. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

According to Texas Instruments, LiDAR is a sensing technology that detects objects and maps their distances. The technology works by illuminating a target with an optical pulse and measuring the characteristics of the reflected return signal.

Stakeholders

- ADAS System Manufacturers

- Automobile Original Equipment Manufacturers (OEMs)

- Automotive Parts Manufacturers’ Association (APMA)

- Automotive Component Manufacturers

- Governments, Financial Institutions, and Investment Communities

- European Automobile Manufacturers Association (ACEA)

- LiDAR Hardware Suppliers

- LiDAR Software Suppliers

- LiDAR System Integrators

- Manufacturers of Automotive LiDAR Microprocessors

- Original Device Manufacturer (ODM) and OEM Technology Solution Providers

- National Highway Traffic Safety Administration (NHTSA)

- Raw Material and Manufacturing Equipment Suppliers

- Research Institutes and Organizations

- Semiconductor Foundries

- Technology Investors

- Technology Standards Organizations, Forums, Alliances, and Associations

- Vehicle Safety Regulatory Bodies

Report Objectives

- To analyze and forecast the automotive LiDAR market in terms of volume (thousand units) and value (USD million) from 2024 to 2030

-

To segment the market by Technology, Image Type, ICE Vehicle Type, Location, Electric Vehicle, Range, Laser Wavelength, Measurement Process, Level of Autonomy, and region

- To segment and forecast the market by Technology (Mechanical LiDAR and Solid-state LiDAR)

- To segment and forecast the market by Image Type (2D and 3D)

- To segment and forecast the market by ICE Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles)

- To segment and forecast the market by Location (Bumper & Grill, Headlight & Taillight, Roof & Upper Pillars, and Others)

- To segment and forecast the market by Electric Vehicle Type (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, and Hybrid Electric Vehicles)

- To segment and forecast the market by Range (Short and Mid-range and Long-range)

- To segment and forecast the market by Laser Wavelength (Near Infrared, Short-wave Infrared, and Long-wave Infrared)

- To segment and forecast the market by Measurement Process (Frequency Modulated Continuous Process and Time of Flight)

- To segment and forecast the market by Level of Autonomy (Semi-autonomous and Autonomous)

- To forecast the market by region (North America, Europe, and Asia Pacific)

- To identify and analyze key drivers, challenges, restraints, and opportunities influencing the market growth

- To strategically analyze the market for individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Pricing Analysis

- Investment and Funding Scenario

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze the impact of AI on the market

- To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company's specific needs.

- Additional Company Profiles (Up to 5)

- Global Automotive LiDAR market, By Level of Autonomy, at Country Level

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive LiDAR Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive LiDAR Market