Various secondary sources, directories, and databases have been used to identify and collect information for an extensive study of the Automotive Lighting Market. The study involved four main activities in estimating the current size of the Automotive Lighting Market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the existing vehicle models & their light technologies, upcoming technologies, and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the Automotive Lighting Market. Secondary sources include company annual reports/presentations, press releases, and industry association publications such as publications of the American Lighting Association (ALA), Canadian Automobile Association (CAA), China Association of Automobile Manufacturers (CAAM), Automotive Component Manufacturers Association of India (ACMA), and European Automobile Manufacturers Association (EAMA) among others. Additionally, secondary research has been carried out to understand the average count of various lights by vehicle type, historical production, and sales of new vehicles.

Primary Research

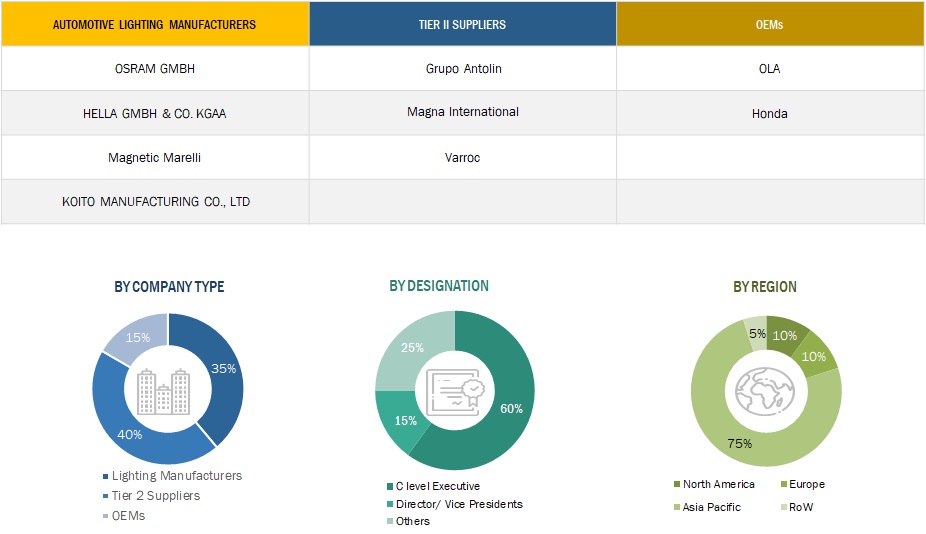

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as ICE vehicle production and electric vehicle sales forecast, Automotive Lighting Market forecast and penetration rate, future technology trends, and upcoming technologies in the Automotive Lighting industry. Data triangulation was then done with the information gathered from secondary research. Stakeholders from the demand and supply side have been interviewed to understand their views on the points mentioned above.

Primary interviews have been conducted with market experts from Automotive Lighting manufacturers and technology providers across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. A similar percentage of primary interviews have been conducted with automotive lighting manufacturers, respectively. The data from primary interviews has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, manufacturing, and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the conclusions described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

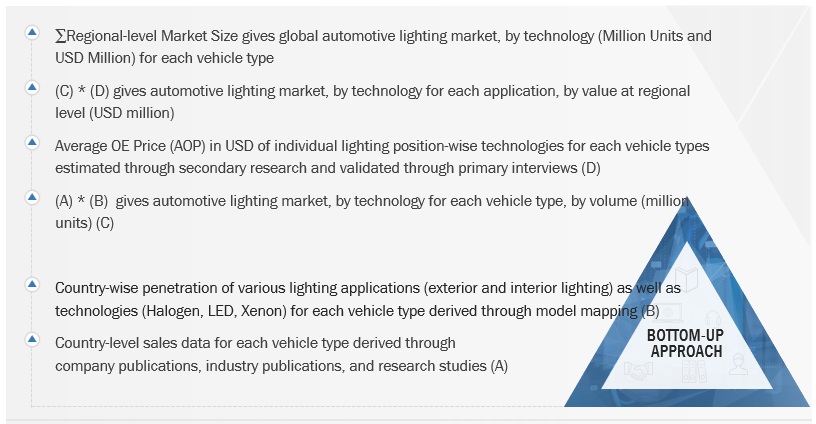

A detailed market estimation approach was followed to estimate and validate the value of the Automotive Lighting Market and other dependent submarkets, as mentioned below:

-

Key players in the Automotive Lighting Market were identified through secondary research, and their global market shares were determined through primary and secondary research.

-

The research methodology included studying annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

-

All industry-level penetration rates, percentage shares, splits, and breakdowns for Automotive Lighting were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Lighting Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and sub-segments—using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends.

Market Definition

Automotive Lighting: An automotive lighting system consists of various lights and signaling devices that are fitted on the front, rear, side, and interior of the vehicle. These lights perform the primary function of providing illumination to the driver to drive safely in the dark. They may be used to enhance the visibility of an automobile, illuminate the interior, and act as a warning system for other vehicles. Automotive lighting ensures the vehicle's on-road safety and the pedestrian's by alerting the pedestrian about the vehicle's presence through exterior lighting.

Stakeholders

-

Automotive OEMs

-

Automotive lighting manufacturers and suppliers

-

Automotive components and raw material suppliers for Automotive Lighting

-

Traders and distributors of Automotive Lighting

-

Automobile organizations/associations and government bodies

-

Automotive software manufacturers and providers

-

Authorized service centers and independent aftermarket service providers

-

National and Regional Environmental Regulatory Agencies or Organizations

Report Objectives

-

To define, describe, and forecast the size of the Automotive Lighting market in terms of value (USD million) and volume (million units) as follows:

-

Vehicle type (passenger car, light commercial vehicles, trucks, and buses)

-

Technology (halogen, xenon/HID, LED, OLED, Matrix LED, LASER))

-

Application {exterior (headlights, fog lights, daytime running lights (DRL), taillights, Center high mount stop lamp (CHMSL), and sidelights) and interior (dashboard, glove box, reading lights, and dome lights)}

-

Electric & Hybrid vehicle lighting market, vehicle type (BEV, PHEV and FCEV)

-

Electric & Hybrid vehicle lighting market, technology (halogen, xenon/HID, and light emitting diode (LED))

-

Electric & Hybrid vehicle lighting market, application (Interior Lighting and Exterior Lighting)

-

Two-wheeler automotive lighting market, by position (front, rear, and side)

-

Automotive Adaptive lighting market, by type (front adaptive lighting (auto on/off, high beam assist, bending/cornering lights, and headlight leveling), rear adaptive lighting, and ambient lighting)

-

Region [Asia Pacific, Europe, North America, and Rest of the World]

-

To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze the market and provide the average selling price (ASP) analysis, and patent analysis.

-

To evaluate the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

-

To evaluate the dynamics of competitors in the Automotive Lighting market and distinguish them into stars, emerging leaders, pervasive players, and participants.

-

To understand the dynamics of start-ups/SMEs prevalent in the market ecosystem of the Automotive Lighting market and distinguish them into progressive companies, responsive companies, dynamic companies, and starting blocks.

-

To analyze the recent new developments, expansion strategies, collaborations, partnerships, joint ventures, mergers & acquisitions, and other activities carried out by key players in the Automotive Lighting market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Adaptive Module Market, By Function And Country

-

Auto On/Off Function

-

Bending/Cornering

-

High Beam Assist

-

Headlight Levelling

Two-Wheeler Automotive Lighting Market, By Vehicle Type

(Note: Countries included in the study: China, India, Japan, South Korea, Thailand, Germany, UK, France, Spain, Italy, US, Canada, Mexico, Brazil, Russia.

User

Nov, 2019

We were wondering if the report has historical yearly market sizes from 2010 to the current year (e.g. market sizes for total automotive lighting and LED lighting for 2010, 2011, 2012...2016)?.

User

Nov, 2019

I am looking for a automotive lighting market analysis for my MMBA thesis. Thanks for any support..

User

Nov, 2019

I am looking for a reliable source of clear and conclusive quantitative data. Your report above seems to contain what I need, but also many other items of information that I certainly do not need. Main topics of interest:- Car Interior Lighting Market size and growth - Car Interior technologies and their relative importance over time - Main players (designers and makers of car interior lighting solutions in terms of market share). Supply chain of car interior lighting (for the most common applications/functions). I was wondering if you could offer a customised report with this information and if so, under what conditions. Please contact my by email, phone is not preferred due to frequent traveling and meetings. Thank you in advance!.

User

Nov, 2019

We are a supplier to the Automotive Lighting Industry and I am interested to see if this report is specific with trends by manufacture and or information on Tier 2 suppliers. .

User

Nov, 2019

Current status and future outlook of the car lighting market, including a split between different technologies: LED, halogen, Xenon. Ideally also a split by brand (which brand will use which technology).

User

Nov, 2019

Understand the automotive light market specifically for India with Global Trends in Automotive Lighting.

User

Nov, 2019

Hi would require this today for preparation for an interview with Osram Market size in UK and growth area for automotive lighting and online platform how to target.

User

Nov, 2019

1/In which form is the report delivered? 2/Can we also get the raw data in form a database excel? 3/For passenger car would it be possible to have an analyzis by vehicle segments (A, B, C, D, .....)?.

User

Nov, 2019

Automotive front lighting technologies, specifically penetration rates of LEDs going forward (e.g. by 2018, 2023, etc.).

User

Nov, 2019

Before ordering the report, I would like to get the sample for evaluation. Thanks in advance, Best regards,.