Maleic Anhydride Market by Raw Material (n-butane and Benzene), Application (Unsaturated Polyester Resin (UPR), 1,4-butanediol (1,4-BDO), Lubricating Oil Additives, and Copolymers)), and Region - Global Forecast to 2026

Updated on : September 02, 2025

Maleic Anhydride Market

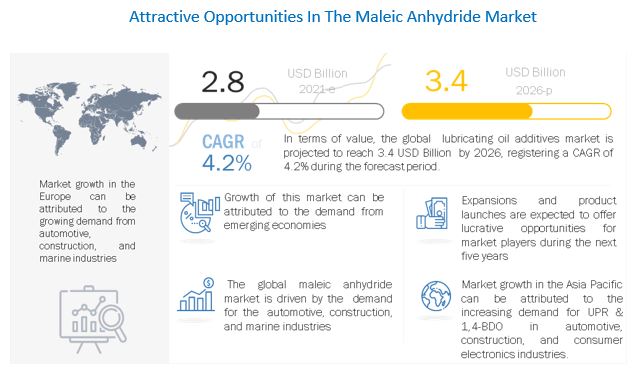

The global maleic anhydride market was valued at USD 2.8 billion in 2021 and is projected to reach USD 3.4 billion by 2026, growing at 4.2% cagr from 2021 to 2026. Factors such as increasing demand for UPR in the automotive industry, high growth in the construction and wind energy industries, and growing demand of 1,4-BDO in various end-use industries are major driving factors. Commercialization of bio-based maleic anhydride is the major growth opportunity for the market. Asia Pacific is the key market for maleic anhydride, globally, in terms of value. It is also the fastest-growing region in the market. Whereas Europe is the second-largest market for maleic anhydride, globally, in terms of value, followed by North America.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Maleic Anhydride Market

The global pandemic has affected almost every sector in the world. The maleic anhydride market has shown negative growth as it was affected due to disruptions in the global supply chain and fall in the oil prices. This situation arise due to fall in demand from the automobile sector. The market is highly dependent on the automotive and industrial sectors. Asia Pacific is the largest region in terms of value for the maleic anhydride market.

In Asia Pacific, a reduction in vehicle traffic was seen from South Asia constituting countries, such as India, Bangladesh, Sri Lanka, and Central Asian countries. This lowered the demand for maleic anhydride in the region. China holds a major market share in the maleic anhydride market in the Asia Pacific region but was severely affected by the pandemic initially. Millions of people were quarantined, thus putting a pause on all supply chains dependent on China. The travel bans and lockdown imposed in most of the major cities in China had reduced the production of oil in the country. It has also affected the workforce community without which, many ports, such as Shenzhen and Shanghai, are closed for operations. However, the country has shown signs of recovery after the lockdown of three months. Most of the businesses have reopened, which is expected to generate the demand for maleic anhydride. Other developing countries too have accelerated their vehicle production in 2021 after the rollout of the mass vaccination drive.

Maleic Anhydride Market Dynamics

Driver: Increasing demand for UPR & 1,4-BDO from the automotive industry

The increasing sales of passenger cars and commercial vehicles drive the maleic anhydride market in the automotive industry. Maleic anhydride is used as an ingredient in UPR, which is further used to manufacture automotive composites, such as closure panels, body panels, fenders, Grille Opening Reinforcement (GOR), heat shields, headlamp reflectors, and pick-up boxes. Maleic anhydride copolymers are also used to manufacture lubricant additives, such as viscosity index improver, pour point depressant, and dispersant. The increasing sales of passenger and commercial vehicles, globally, are driving the overall maleic anhydride market.

The motorization rate has increased over the past five years in developed and the developing countries, owing to the increasing disposable income of people and industrial growth. The consistent rise in the number of vehicles is increasing the demand for engine oil, functional fluids, and automotive components in the emerging economies; thus, positively influencing the maleic anhydride market.

Restraints: Growth in demand for hybrid vehicles and increasing battery price parity

Hybrid vehicles contain both a small Internal Combustion Engine (ICE) and an electric motor for optimum power utilization and reducing emissions from vehicles. The growing number of hybrid vehicles is expected to reduce the demand for engine oil, functional fluid, and transmission fluid per vehicle, almost by half, according to industry experts. This factor, coupled with the increasing battery parity, is expected to impact the volume of the maleic anhydride market.

Batteries for electric vehicles are very expensive; however, with improved technology, their cost is reducing, and the driving range per charge is increasing. These factors have a huge impact on engine oil consumption, especially with decreasing battery costs. The demand for electric vehicles is expected to increase, thereby decreasing the overall engine oil consumption; which is expected to decrease the demand for maleic anhydride in lubricating oil additives.

Opportunities: Commercialization of bio-based maleic anhydride

Maleic anhydride is traditionally produced through the oxidation of aromatic compounds. The key players in the market are continually innovating to develop alternative feedstock for maleic anhydride due to the growing awareness regarding the toxicity of benzene and other aromatic compounds. Although there is an alternative for petroleum-based maleic anhydride available in the market, there are few applications, such as UPR, copolymers, and 1,4-BDO, wherein maleic anhydride cannot be replaced by other substitutes. Hence, to solve this problem, an alternative to the petroleum-based maleic anhydride is available—bio-based maleic anhydride—that can be produced using a renewable source as feedstock. The bio-based raw material is fermented to produce a mixture comprising butanol, which is further purified and then oxidized to get the desired maleic anhydride.

The use of bio-based feedstock has its own advantages over conventional ones. The oil resources are limited, and the extraction of benzene and its further oxidation are expensive procedures. In addition, the manufacturers have to rely on tougher technologies and sophisticated equipment, which directly affects the manufacturing cost of maleic anhydride. In order to overcome these constraints, the commercialization of bio-based maleic anhydride on a large scale is essential

Challenges: Fluctuations in prices of crude oil

Crude oil prices play a crucial role in the maleic anhydride market. Any structural changes in the oil market impact the raw material prices for maleic anhydride. The fluctuations of prices of crude oil places maleic anhydride producers in adverse situations, which affect profitability. The fluctuating crude oil prices in the last few years have affected the maleic anhydride value chain as crude oil is the raw material for benzene, which is used for manufacturing maleic anhydride. Countries that consume large amounts of energy have been coping with oil prices above USD 100 per barrel since 2011, which had fallen to approximately USD 50 per barrel in March 2020. Therefore, fluctuating crude oil prices have created uncertainties for maleic anhydride producers. Owing to fluctuating base oil prices, the decision to buy crude oil becomes difficult as manufacturers are unsure of the prices at which they should buy crude oil.

n-butane is estimated to be the fastest-growing raw material in the maleic anhydride market between 2021 and 2026.

The n-butane-based maleic anhydride accounted for the larger share, in terms of both volume and value, in 2020. This dominance is expected to continue during the forecast period, owing to its high demand from the growing building & construction and automotive industries. The n-butane segment is projected to witness higher growth, in terms of both volume and value, during the forecast period, owing to stringent policies and regulations on the use of benzene for maleic anhydride production.

Lubricating oil additives was the largest application for maleic anhydride market in 2020

Lubricating oil additives is the third-largest application of maleic anhydride. Maleic anhydride is used in the production of lubricating oil and hydraulic fluids to boost the performance of lubricants by providing alkalinity, static and dust control, emulsification, corrosion inhibition, dispersion, shear stability, and low-temperature fluidity. Lubricating oils are used in gasoline and diesel engine crankcase to prevent dispersion and corrosion. The growing automotive industry in the Asia Pacific and the Middle East & African regions is expected to drive the demand for lubricating oil additives, which, in turn, would drive the demand for maleic anhydride in the region.

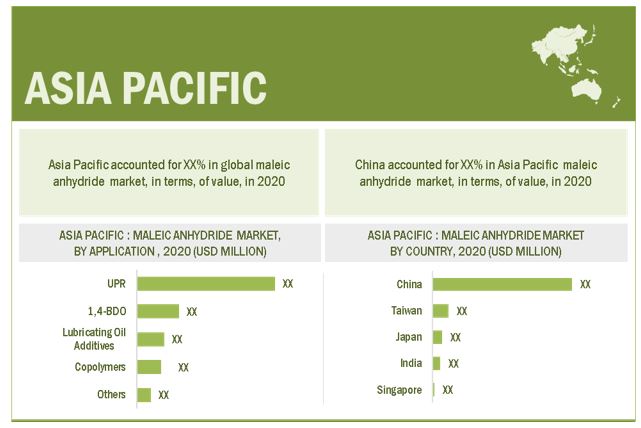

Asia Pacific is estimated to be the largest maleic anhydride market in 2020, in terms of value

Asia Pacific is projected to be the largest maleic anhydride market, in terms of value, in 2020 due to the rise in the automotive production. The maleic anhydride market in the Asia Pacific is also projected to grow at the highest CAGR, in terms of value, during the forecast period. This dominance is attributed to the growing domestic industries, increasing demand from end-use industries, and growing use of maleic anhydride in different applications, such as agricultural chemicals and pharmaceuticals. The demand for maleic anhydride is growing and is expected to register higher growth in Asia Pacific and the Middle East & Africa than in the other regions.

To know about the assumptions considered for the study, download the pdf brochure

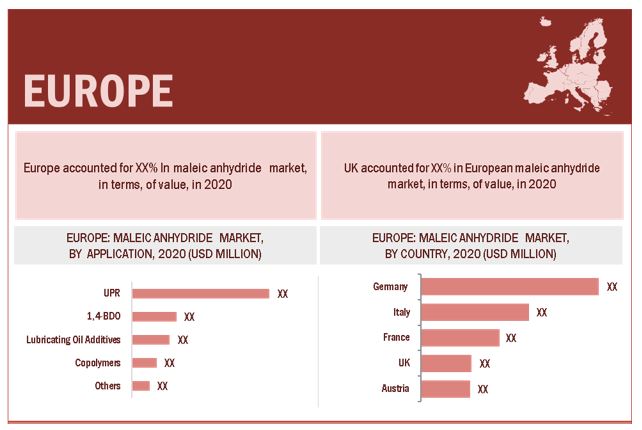

Europe is estimated to be the second-largest maleic anhydride market during the forecast period.

Europe was the second-largest market for maleic anhydride, in terms of value, in 2020. The maleic anhydride market in Europe is projected to grow slower during the forecast period as it is a mature market.

The chemical industry is a significant part of the country's economy; it is regarded as the world leader in chemical production and has four categories: base chemicals, specialty chemicals, pharmaceuticals, and consumer chemicals. However, the growth of maleic anhydride in the region has been hampered due to the financial crisis, which still has a profound impact on many of the economies in the region. The European chemical industry, however, is still in a strong position. The majority of the chemical sales in Europe are of petrochemicals and polymers, which experience a continuous rise of share in sales among all the chemicals.

The demand for maleic anhydride in industries, such as automotive and building & construction, is driving the market in the region. There are huge growth opportunities in Germany, the UK, Spain, Italy, and other European countries.

The UPR segment is the most significant application of maleic anhydride in the region. Europe has a few global market players of maleic anhydrides, such as Polynt-Riechhold Group (Italy) and ESIM Chemicals (Austria).

Maleic Anhydride Market Players

The key market players profiled in the report include Huntsman Corporation (US), Changzhou Yabang Chemical Co., Ltd. (China), Shanxi Qiaoyou Chemical Co., Ltd. (China), Polynt-Reichhold Group (Italy), Zibo Qixiang Tengda Chemical Co., Ltd. (China), Mitsubishi Chemical Corporation (Japan), Nippon Shokubai Co., Ltd.(Japan), LANXESS AG( Germany), Gulf Advanced Chemical Industries Co., Ltd. (Saudi Arabia), Ningbo Jiangning Chemical Co., Ltd. (China), China Bluestar Harbin Petrochemical Co, Ltd.(China), Nan Ya Plastics (Taiwan), Shijiazhuang Bailong chemical Co., Ltd.( China), Yongsan Chemical Co., Ltd.( South Korea), IG Petrochemicals Ltd.( India), MOL Plc. ( Hungary), PT Justus Sakti Raya (Indonesia ), Global Ispat Koksna Industrija d.o.o. Lukavac (Bosnia & Herzegovina), Tianjin Bohai Chemical industry group Co., Ltd.( China), Cepsa (Spain), Ruse Chemicals (Bulgaria), Yunnan Yunwei Company Limited (China), Shanxi Taiming Chemical Industry Co., Ltd.( China), Huanghua Hongcheng Business Corp., Ltd. (China), and Aekyung Petrochemical Co., Ltd. (South Korea).

Maleic Anhydride Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 2.8 billion |

|

Revenue Forecast in 2026 |

USD 3.4 billion |

|

CAGR |

4.2% |

| Years considered for the study | 2016-2026 |

| Base Year | 2021 |

| Forecast period | 2021–2026 |

| Units considered | Volume (Kiloton); Value (USD Million) |

| Segments | Raw Material, Application, and Region |

| Regions | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

| Companies | Huntsman Corporation (US), Changzhou Yabang Chemical Co., Ltd. (China), Shanxi Qiaoyou Chemical Co., Ltd. (China), Polynt-Reichhold Group (Italy), Zibo Qixiang Tengda Chemical Co., Ltd. (China), Mitsubishi Chemical Corporation (Japan), Nippon Shokubai Co., Ltd.(Japan), LANXESS AG( Germany), Gulf Advanced Chemical Industries Co., Ltd. (Saudi Arabia), Ningbo Jiangning Chemical Co., Ltd. (China), China Bluestar Harbin Petrochemical Co, Ltd.(China), Nan Ya Plastics (Taiwan), Shijiazhuang Bailong chemical Co., Ltd.( China), Yongsan Chemical Co., Ltd.( South Korea), IG Petrochemicals Ltd.( India), MOL Plc.( Hungary), PT Justus Sakti Raya (Indonesia ), Global Ispat Koksna Industrija d.o.o. Lukavac (Bosnia & Herzegovina), Tianjin Bohai Chemical industry group Co., Ltd.( China), Cepsa (Spain), Ruse Chemicals (Bulgaria), Yunnan Yunwei Company Limited (China), Shanxi Taiming Chemical Industry Co., Ltd.( China), Huanghua Hongcheng Business Corp., Ltd. (China), and Aekyung Petrochemical Co., Ltd. (South Korea) |

This report categorizes the global maleic anhydride market based on raw material, application, and region.

On the basis of raw material, the maleic anhydride market has been segmented as follows:

- n-butane

- Benzene

On the basis of application, the maleic anhydride market has been segmented as follows:

- UPR

- 1,4-BDO

- Lubricating Oil Additives

- Copolymers

- Others

On the basis of region, the maleic anhydride market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In July 2020, Polynt-Reichhold Group announced to build a 50,000 tons capacity greenfield maleic anhydride plant, to be located at its Morris, Illinois site.

- In September 2019, Huntsman Corporation acquired its remaining 50% interest in the Sasol-Huntsman maleic anhydride joint venture. The acquisition helped Huntsman fully integrate its European business and cater to the specific needs of its key customers, including construction and coatings.

- In December 2019, Nippon Shokubai and Sanyo Chemical (Japan) have agreed to merge their respective businesses via a share transfer to form an integrated holding company named Synfomix Co. Ltd. (Kyoto, Japan). The materials division of Synfomix will manufacture products, including ethylene oxide, ethylene glycols, ethanolamines, acrylates, acrylic hydroxy monomers, superabsorbent polymers, maleic anhydride, and maleic anhydride derivatives.

FAQ:

What are the factors influencing the growth of maleic anhydride?

Increasing demand from the automotive and industrial sector is driving the maleic anhydride market

What are different raw materials of maleic anhydride?

It is obtained either from the oxidation process of n-butane or oxidation of benzene

What is the biggest Restraint for lubricant oil additives?

Increase in the stringent environmental regulations and growth in demand for hybrid vehicles and increasing battery price parity are the major restraint of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 MALEIC ANHYDRIDE MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 MALEIC ANHYDRIDE: MARKET DEFINITION AND INCLUSIONS, BY RAW MATERIAL

1.2.3 MALEIC ANHYDRIDE: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.3 MARKET SCOPE

1.3.1 MALEIC ANHYDRIDE: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 MALEIC ANHYDRIDE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE) PRODUCTION CAPACITY

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): APPLICATIONS SERVED AND THEIR AVERAGE SELLING PRICES

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 6 MALEIC ANHYDRIDE MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY-SIDE

FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY-SIDE

2.4.2 DEMAND-SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 MALEIC ANHYDRIDE MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 9 N-BUTANE RAW MATERIAL TO HAVE THE LARGER SHARE IN MARKET DURING FORECAST PERIOD

FIGURE 10 UPR TO BE THE LARGEST AND FASTEST-GROWING APPLICATION OF MALEIC ANHYDRIDE

FIGURE 11 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 SIGNIFICANT OPPORTUNITIES IN THE MALEIC ANHYDRIDE MARKET

FIGURE 12 HIGH GROWTH EXPECTED IN EMERGING ECONOMIES DURING FORECAST PERIOD

4.2 MARKET SIZE, BY REGION

FIGURE 13 ASIA PACIFIC TO BE THE LARGEST MALEIC ANHYDRIDE MARKET DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: MALEIC ANHYDRIDE MARKET, BY RAW MATERIAL AND COUNTRY

FIGURE 14 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN ASIA PACIFIC

4.4 MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION AND REGION

FIGURE 15 UPR TO DOMINATE THE MALEIC ANHYDRIDE MARKET ACROSS REGIONS

4.5 MALEIC ANHYDRIDE MARKET: MAJOR COUNTRIES

FIGURE 16 INDIA TO BE THE FASTEST-GROWING MALEIC ANHYDRIDE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IMPACTING MALEIC ANHYDRIDE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for UPR and lubricant additives in the automotive industry

TABLE 2 TOTAL SALES OF ALL VEHICLES (IN UNITS), BY COUNTRY

5.2.1.2 High growth in construction and wind energy industries

TABLE 3 WIND TURBINE INSTALLED CAPACITY, BY KEY COUNTRY, 2015–2018 (MW)

5.2.1.3 Growing demand for UPR and 1,4-BDO in various end-use industries

FIGURE 18 SYNTHESIS OF UPR FROM MALEIC ANHYDRIDE

FIGURE 19 SYNTHESIS OF 1,4-BUTANEDIOL FROM MALEIC ANHYDRIDE

5.2.2 RESTRAINTS

5.2.2.1 Growth in demand for hybrid vehicles and increasing battery price parity

5.2.2.2 Increasing governmental regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Commercialization of bio-based maleic anhydride

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in prices of crude oil

FIGURE 20 CRUDE OIL PRICES, 2016–2021

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 MALEIC ANHYDRIDE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN OF MALEIC ANHYDRIDE MARKET

5.4.1 RAW MATERIALS

5.4.2 MANUFACTURING

5.4.3 DISTRIBUTION

5.4.4 END-USE INDUSTRIES

5.5 TRADE DATA

5.5.1 IMPORT SCENARIO OF MALEIC ANHYDRIDE

FIGURE 23 MALEIC ANHYDRIDE IMPORTS, BY KEY COUNTRY, 2017–2020

TABLE 5 MALEIC ANHYDRIDE IMPORTS, BY REGION, 2017–2020 (USD THOUSAND)

5.5.2 EXPORT SCENARIO OF MALEIC ANHYDRIDE

FIGURE 24 MALEIC ANHYDRIDE EXPORTS, BY KEY COUNTRY, 2017–2020

TABLE 6 MALEIC ANHYDRIDE EXPORTS, BY REGION, 2017-2020 (USD THOUSAND)

5.6 TECHNOLOGY ANALYSIS

FIGURE 25 MANUFACTURING OF MALEIC ANHYDRIDE FROM DIFFERENT SOURCES

5.7 PATENT ANALYSIS

5.7.1 INTRODUCTION

5.7.2 APPROACH

5.7.3 DOCUMENT TYPE

TABLE 7 GRANTED PATENTS ACCOUNT FOR 10% OF ALL PATENTS BETWEEN 2010 AND 2020

FIGURE 26 PATENTS REGISTERED FOR MALEIC ANHYDRIDE, 2010–2020

FIGURE 27 PATENT PUBLICATION TRENDS FOR MALEIC ANHYDRIDE, 2010–2020

5.7.4 INSIGHTS

5.7.5 LEGAL STATUS OF PATENTS

FIGURE 28 LEGAL STATUS OF MALEIC ANHYDRIDE PATENTS

5.7.6 JURISDICTION ANALYSIS

FIGURE 29 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

5.7.7 TOP APPLICANTS

FIGURE 30 CHINA PETROLEUM & CHEMICAL CORPORATION REGISTERED THE HIGHEST NUMBER OF PATENTS BETWEEN 2010 AND 2020

TABLE 8 TOP 10 PATENT OWNERS IN US, 2010-2020

5.8 AVERAGE SELLING PRICES OF MALEIC ANHYDRIDE

TABLE 9 AVERAGE SELLING PRICES OF MALEIC ANHYDRIDE, BY REGION, (USD/KG)

FIGURE 31 AVERAGE SELLING PRICES, MALEIC ANHYDRIDE, 2018-2026 (USD/KG)

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 32 REVENUE SHIFT FOR MALEIC ANHYDRIDE MARKET

5.10 ECOSYSTEM/MARKET MAP

FIGURE 33 MALEIC ANHYDRIDE MARKET: ECOSYSTEM

TABLE 10 MARKET: ECOSYSTEM

5.11 CASE STUDIES

5.11.1 A CASE STUDY ON MALEIC ANHYDRIDE USED IN AUTOMOTIVE INDUSTRY

5.11.2 A CASE STUDY ON MALEIC ANHYDRIDE USED IN SPACECRAFT

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON MALEIC ANHYDRIDE MARKET

5.13 MACROECONOMIC INDICATORS

5.13.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

TABLE 11 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2018 – 2026 (USD BILLION)

5.14 MALEIC ANHYDRIDE: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 34 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

TABLE 12 MALEIC ANHYDRIDE MARKET: MARKET FORECAST SCENARIOS, 2018–2026 (USD MILLION)

5.14.1 NON-COVID-19 SCENARIO

5.14.2 OPTIMISTIC SCENARIO

5.14.3 PESSIMISTIC SCENARIO

5.14.4 REALISTIC SCENARIO

5.15 COVID-19 IMPACT

5.15.1 INTRODUCTION

5.16 COVID-19 HEALTH ASSESSMENT

FIGURE 35 COVID-19: THE GLOBAL PROPAGATION

FIGURE 36 COVID-19 PROPAGATION: SELECT COUNTRIES

5.17 COVID-19 ECONOMIC ASSESSMENT

FIGURE 37 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.17.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 38 CRITERIA IMPACTING GLOBAL ECONOMY

6 MALEIC ANHYDRIDE MARKET, BY RAW MATERIAL (Page No. - 93)

6.1 INTRODUCTION

FIGURE 39 N-BUTANE TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

TABLE 13 MALEIC ANHYDRIDE MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 14 MARKET SIZE, BY RAW MATERIAL, 2020–2026 (USD MILLION)

TABLE 15 MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 16 MARKET SIZE, BY RAW MATERIAL, 2020–2026 (KILOTON)

6.2 N-BUTANE

6.2.1 LOW PRODUCTION COST OF MALEIC ANHYDRIDE USING N-BUTANE DRIVES THE GROWTH OF THIS SEGMENT

FIGURE 40 ASIA PACIFIC TO BE LARGEST MARKET FOR N-BUTANE-BASED MALEIC ANHYDRIDE

TABLE 17 N-BUTANE-BASED MALEIC ANHYDRIDE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 N-BUTANE-BASED MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 19 N-BUTANE-BASED MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 20 N-BUTANE-BASED MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

6.3 BENZENE

6.3.1 MALEIC ANHYDRIDE PRODUCTION USING BENZENE IS DECLINING DUE TO ITS TOXICITY AND STRINGENT REGULATIONS

FIGURE 41 ASIA PACIFIC TO BE THE LARGEST MARKET FOR BENZENE-BASED MALEIC ANHYDRIDE

TABLE 21 BENZENE-BASED MALEIC ANHYDRIDE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 BENZENE-BASED MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 23 BENZENE-BASED MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 24 BENZENE-BASED MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

7 MALEIC ANHYDRIDE MARKET, BY APPLICATION (Page No. - 100)

7.1 INTRODUCTION

FIGURE 42 UPR APPLICATION TO DOMINATE MALEIC ANHYDRIDE MARKET DURING FORECAST PERIOD

TABLE 25 MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 26 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 27 MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 28 MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

7.2 UPR

7.2.1 INCREASING USE OF UPR IN VARIOUS INDUSTRIES TO DRIVE MARKET

FIGURE 43 ASIA PACIFIC TO BE FASTEST-GROWING MALEIC ANHYDRIDE MARKET FOR UPR APPLICATION

TABLE 29 MALEIC ANHYDRIDE MARKET SIZE IN UPR APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 MARKET SIZE IN UPR APPLICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 31 MARKET SIZE IN UPR APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 32 MARKET SIZE IN UPR APPLICATION, BY REGION, 2020–2026 (KILOTON)

7.3 1,4-BDO

7.3.1 RISING DEMAND FOR POLYURETHANE TO DRIVE 1,4-BDO MARKET

FIGURE 44 NORTH AMERICA TO BE THIRD-LARGEST MALEIC ANHYDRIDE MARKET FOR 1,4-BDO APPLICATION

TABLE 33 MALEIC ANHYDRIDE MARKET SIZE IN 1,4-BDO APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 MARKET SIZE IN 1,4-BDO APPLICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 35 MARKET SIZE IN 1,4-BDO APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 36 MARKET SIZE IN 1,4-BDO APPLICATION, BY REGION, 2020–2026 (KILOTON)

7.4 LUBRICATING OIL ADDITIVES

7.4.1 GROWING TRANSPORTATION INDUSTRY TO DRIVE THE LUBRICATING OIL ADDITIVES APPLICATION

FIGURE 45 EUROPE TO BE SECOND-LARGEST MALEIC ANHYDRIDE MARKET FOR LUBRICATING OIL ADDITIVES APPLICATION

TABLE 37 MALEIC ANHYDRIDE MARKET SIZE IN LUBRICATING OIL ADDITIVES APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 MARKET SIZE IN LUBRICATING OIL ADDITIVES APPLICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 39 MARKET SIZE IN LUBRICATING OIL ADDITIVES APPLICATION, BY REGION,2016–2019 (KILOTON)

TABLE 40 MARKET SIZE IN LUBRICATING OIL ADDITIVES APPLICATION, BY REGION, 2020–2026 (KILOTON)

7.5 COPOLYMERS

7.5.1 INCREASING USE OF COPOLYMERS IN VARIOUS END-USE INDUSTRIES TO DRIVE THE MARKET

FIGURE 46 EUROPE TO BE SECOND-LARGEST MALEIC ANHYDRIDE MARKET FOR COPOLYMERS APPLICATION

TABLE 41 MARKET SIZE IN COPOLYMERS APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 MARKET SIZE IN COPOLYMERS APPLICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 43 MARKET SIZE IN COPOLYMERS APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 44 MARKET SIZE IN COPOLYMERS APPLICATION, BY REGION, 2020–2026 (KILOTON)

7.6 OTHERS

FIGURE 47 EUROPE TO BE SECOND-LARGEST MALEIC ANHYDRIDE MARKET FOR OTHER APPLICATIONS

TABLE 45 MALEIC ANHYDRIDE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

TABLE 47 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 48 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (KILOTON)

8 MALEIC ANHYDRIDE MARKET, REGIONAL ANALYSIS (Page No. - 115)

8.1 INTRODUCTION

FIGURE 48 ASIA PACIFIC TO BE FASTEST-GROWING MALEIC ANHYDRIDE MARKET DURING FORECAST PERIOD

TABLE 49 MALEIC ANHYDRIDE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 51 MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 52 MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

8.2 NORTH AMERICA

FIGURE 49 NORTH AMERICA: MALEIC ANHYDRIDE MARKET SNAPSHOT

8.2.1 NORTH AMERICA: MARKET, BY RAW MATERIAL

TABLE 53 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (KILOTON)

8.2.2 NORTH AMERICA: MARKET, BY APPLICATION

TABLE 57 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.2.3 NORTH AMERICA: MARKET, BY COUNTRY

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.2.3.1 US

8.2.3.1.1 Presence of major oil & gas giants in country is driving maleic anhydride market

TABLE 65 US: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 66 US: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 67 US: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 68 US: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.2.3.2 Canada

8.2.3.2.1 Construction and manufacturing sectors drive maleic anhydride market in country

TABLE 69 CANADA: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 72 CANADA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.2.3.3 Mexico

8.2.3.3.1 Booming industrialization and rising population to increase demand for maleic anhydride

TABLE 73 MEXICO: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 74 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 75 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 76 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3 ASIA PACIFIC

FIGURE 50 ASIA PACIFIC: MALEIC ANHYDRIDE MARKET SNAPSHOT

8.3.1 ASIA PACIFIC: MARKET, BY RAW MATERIAL

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (KILOTON)

8.3.2 ASIA PACIFIC: MARKET, BY APPLICATION

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3 ASIA PACIFIC: MALEIC ANHYDRIDE MARKET, BY COUNTRY

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.3.3.1 China

8.3.3.1.1 High demand for UPR in construction and manufacturing sector will drive market in this country

TABLE 89 CHINA: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 90 CHINA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 91 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 92 CHINA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3.2 Taiwan

8.3.3.2.1 Taiwan is among leading manufacturers of 1,4-BDO

TABLE 93 TAIWAN: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 94 TAIWAN: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 95 TAIWAN: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 96 TAIWAN: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3.3 Japan

8.3.3.3.1 Construction and manufacturing will drive the maleic anhydride market in the country

TABLE 97 JAPAN: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 98 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 99 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 100 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3.4 India

8.3.3.4.1 Growing manufacturing sector drives demand for maleic anhydride

TABLE 101 INDIA: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 102 INDIA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 103 INDIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 104 INDIA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.3.3.5 Singapore

8.3.3.5.1 Growth in construction industry in country to drive maleic anhydride market

TABLE 105 SINGAPORE: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 106 SINGAPORE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 107 SINGAPORE: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 108 SINGAPORE: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4 EUROPE

FIGURE 51 EUROPE: MALEIC ANHYDRIDE MARKET SNAPSHOT

8.4.1 EUROPE: MALEIC ANHYDRIDE MARKET, BY RAW MATERIAL

TABLE 109 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 112 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (KILOTON)

8.4.2 EUROPE: MALEIC ANHYDRIDE MARKET, BY APPLICATION

TABLE 113 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 116 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3 EUROPE MALEIC ANHYDRIDE MARKET, BY COUNTRY

TABLE 117 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 120 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.4.3.1 Germany

8.4.3.1.1 Growing automotive industry is expected to drive demand for maleic anhydride

TABLE 121 GERMANY: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 124 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3.2 Italy

8.4.3.2.1 Complete economic recovery is expected to fuel market

TABLE 125 ITALY: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 126 ITALY: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 127 ITALY: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 128 ITALY: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3.3 France

8.4.3.3.1 Manufacturing sector is driving maleic anhydride market in country

TABLE 129 FRANCE: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 131 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 132 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3.4 UK

8.4.3.4.1 Government's plans for infrastructure spending are expected to drive maleic anhydride market in UK

TABLE 133 UK: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 134 UK: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 135 UK: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 136 UK: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.4.3.5 Austria

8.4.3.5.1 Growing economy and investment in infrastructure to drive demand for maleic anhydride

TABLE 137 AUSTRIA: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 138 AUSTRIA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 139 AUSTRIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 140 AUSTRIA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA: MALEIC ANHYDRIDE MARKET, BY RAW MATERIAL

TABLE 141 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 144 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (KILOTON)

8.5.2 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION

TABLE 145 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 148 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5.3 MIDDLE EAST & AFRICA MALEIC ANHYDRIDE MARKET, BY COUNTRY

TABLE 149 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 152 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020-2026 (KILOTON)

8.5.3.1 Saudi Arabia

8.5.3.1.1 Increasing demand from building & construction industry to drive maleic anhydride market

TABLE 153 SAUDI ARABIA: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 154 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 155 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 156 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5.3.2 Turkey

8.5.3.2.1 Turkey, as newly industrialized country, to provide opportunities for market growth

TABLE 157 TURKEY: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 158 TURKEY: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 159 TURKEY: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 160 TURKEY: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.5.3.3 UAE

8.5.3.3.1 Growing demand for UPR from different industries is driving maleic anhydride market

TABLE 161 UAE: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 162 UAE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 163 UAE: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 164 UAE: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.6 SOUTH AMERICA

8.6.1 SOUTH AMERICA: MALEIC ANHYDRIDE MARKET, BY RAW MATERIAL

TABLE 165 SOUTH AMERICA: MALEIC ANHYDRIDE MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 168 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2026 (KILOTON)

8.6.2 SOUTH AMERICA: MALEIC ANHYDRIDE MARKET, BY APPLICATION

TABLE 169 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 170 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 171 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 172 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

8.6.3 SOUTH AMERICA: MARKET, BY COUNTRY

TABLE 173 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 174 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 175 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 176 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

8.6.3.1 Brazil

8.6.3.1.1 Rapidly expanding economy, stimulated by increasing investments, is expected to drive demand for maleic anhydride

TABLE 177 BRAZIL: MALEIC ANHYDRIDE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 178 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 179 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 180 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 173)

9.1 INTRODUCTION

9.2 STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 52 OVERVIEW OF STRATEGIES ADOPTED BY MALEIC ANHYDRIDE MANUFACTURERS

9.3 MARKET SHARE ANALYSIS

9.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 53 RANKING OF TOP FIVE PLAYERS IN THE MALEIC ANHYDRIDE MARKET, 2020

9.3.2 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 181 MALEIC ANHYDRIDE MARKET: DEGREE OF COMPETITION

FIGURE 54 MARKET SHARE, BY COMPANY (2020)

9.3.2.1 Huntsman Corporation

9.3.2.2 Changzhou Yabang Chemical Co., Ltd.

9.3.2.3 Shanxi Qiaoyou Chemical Co., Ltd.

9.3.2.4 Polynt-Reichhold Group

9.3.2.5 Zibo Qixiang Tengda Chemical

9.3.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2016–2020

FIGURE 55 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FIVE YEARS

9.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 56 MALEIC ANHYDRIDE MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 182 MARKET: RAW MATERIAL FOOTPRINT

TABLE 183 MARKET: APPLICATION FOOTPRINT

TABLE 184 MARKET: COMPANY REGION FOOTPRINT

9.5 COMPANY EVALUATION QUADRANT (TIER 1)

9.5.1 STARS

9.5.2 EMERGING LEADERS

FIGURE 57 MALEIC ANHYDRIDE MARKET: COMPANY EVALUATION QUADRANT, 2020

9.6 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

9.6.1 RESPONSIVE COMPANIES

9.6.2 STARTING BLOCKS

FIGURE 58 START-UP/SMES EVALUATION QUADRANT FOR MALEIC ANHYDRIDE MARKET

9.7 COMPETITIVE SITUATION AND TRENDS

9.7.1 DEALS

TABLE 185 MARKET: DEALS (2018 TO 2021)

9.7.2 OTHER DEVELOPMENTS

TABLE 186 MALEIC ANHYDRIDE MARKET: EXPANSIONS (2018 TO 2021)

10 COMPANY PROFILES (Page No. - 186)

10.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

10.1.1 HUNTSMAN CORPORATION

TABLE 187 HUNTSMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 59 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

10.1.2 LANXESS AG

TABLE 188 LANXESS AG: BUSINESS OVERVIEW

FIGURE 60 LANXESS AG: COMPANY SNAPSHOT

10.1.3 NIPPON SHOKUBAI CO., LTD.

TABLE 189 NIPPON SHOKUBAI CO., LTD.: BUSINESS OVERVIEW

FIGURE 61 NIPPON SHOKUBAI CO., LTD.: COMPANY SNAPSHOT

10.1.4 MITSUBISHI CHEMICAL CORPORATION

TABLE 190 MITSUBISHI CHEMICAL CORPORATION: BUSINESS OVERVIEW

FIGURE 62 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

10.1.5 POLYNT-REICHHOLD GROUP

TABLE 191 POLYNT-REICHHOLD GROUP: BUSINESS OVERVIEW

FIGURE 63 POLYNT-REICHHOLD GROUP: COMPANY SNAPSHOT

10.1.6 CHANGZHOU YABANG CHEMICAL CO., LTD.

TABLE 192 CHANGZHOU YABANG CHEMICAL CO., LTD.: BUSINESS OVERVIEW

10.1.7 ZIBO QIXIANG TENGDA CHEMICAL

TABLE 193 ZIBO QIXIANG TENGDA CHEMICAL: BUSINESS OVERVIEW

10.1.8 SHANXI QIAOYOU CHEMICAL CO., LTD.

TABLE 194 SHANXI QIAOYOU CHEMICAL CO., LTD.: BUSINESS OVERVIEW

10.1.9 GULF ADVANCED CHEMICAL INDUSTRIES CO., LTD. (GACIC)

TABLE 195 GULF ADVANCED CHEMICAL INDUSTRIES CO., LTD. (GACIC): BUSINESS OVERVIEW

10.1.10 NINGBO JIANGNING CHEMICAL CO., LTD.

TABLE 196 NINGBO JIANGNING CHEMICAL CO., LTD.: BUSINESS OVERVIEW

10.2 STARTUPS AND SMES

10.2.1 CHINA BLUESTAR HARBIN PETROCHEMICAL CO, LTD.

TABLE 197 CHINA BLUESTAR HARBIN PETROCHEMICAL CO, LTD.: COMPANY OVERVIEW

10.2.2 NAN YA PLASTICS

TABLE 198 NAN YA PLASTICS: COMPANY OVERVIEW

10.2.3 SHIJIAZHUANG BAILONG CHEMICAL CO., LTD.

TABLE 199 SHIJIAZHUANG BAILONG CHEMICAL CO., LTD.: COMPANY OVERVIEW

10.2.4 YONGSAN CHEMICAL CO., LTD.

TABLE 200 YONGSAN CHEMICAL CO., LTD.: COMPANY OVERVIEW

10.2.5 IG PETROCHEMICALS LTD.

TABLE 201 IG PETROCHEMICALS LTD.: COMPANY OVERVIEW

10.2.6 MOL PLC

TABLE 202 MOL PLC: COMPANY OVERVIEW

10.2.7 PT JUSTUS SAKTI RAYA

TABLE 203 PT JUSTUS SAKTI RAYA: COMPANY OVERVIEW

10.2.8 GLOBAL ISPAT KOKSNA INDUSTRIJA D.O.O. LUKAVAC (GIKIL)

TABLE 204 GLOBAL ISPAT KOKSNA INDUSTRIJA D.O.O. LUKAVAC (GIKIL): COMPANY OVERVIEW

10.2.9 TIANJIN BOHAI CHEMICAL INDUSTRY GROUP CO., LTD.

TABLE 205 TIANJIN BOHAI CHEMICAL INDUSTRY GROUP CO., LTD.: COMPANY OVERVIEW

10.2.10 CEPSA

TABLE 206 CEPSA: COMPANY OVERVIEW

10.2.11 RUSE CHEMICALS

TABLE 207 RUSE CHEMICALS: COMPANY OVERVIEW

10.2.12 YUNNAN YUNWEI COMPANY LIMITED

TABLE 208 YUNNAN YUNWEI COMPANY LIMITED: COMPANY OVERVIEW

10.2.13 SHANXI TAIMING CHEMICAL INDUSTRY CO. LTD.

TABLE 209 SHANXI TAIMING CHEMICAL INDUSTRY CO. LTD.: COMPANY OVERVIEW

10.2.14 HUANGHUA HONGCHENG BUSINESS CORP., LTD.

TABLE 210 HUANGHUA HONGCHENG BUSINESS CORP., LTD.: COMPANY OVERVIEW

10.2.15 AEKYUNG PETROCHEMICAL CO., LTD.

TABLE 211 AEKYUNG PETROCHEMICAL CO., LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS (Page No. - 215)

11.1 INTRODUCTION

11.2 LIMITATION

11.3 UNSATURATED POLYESTER RESINS MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.4 UNSATURATED POLYESTER RESINS MARKET

TABLE 212 UNSATURATED POLYESTER RESINS, BY REGION, 2017–2020 (USD MILLION)

TABLE 213 UNSATURATED POLYESTER RESINS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 214 UNSATURATED POLYESTER RESINS, BY REGION, 2017–2020 (KILOTON)

TABLE 215 UNSATURATED POLYESTER RESINS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

11.4.1 ASIA PACIFIC

11.4.1.1 By country

TABLE 216 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 217 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 218 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 219 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

11.4.1.2 By end-use

TABLE 220 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 221 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 222 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 223 ASIA PACIFIC: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

11.4.2 NORTH & CENTRAL AMERICA

11.4.2.1 By end-use

TABLE 224 NORTH & CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 225 NORTH & CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 226 NORTH & CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 227 NORTH & CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

11.4.3 NORTH AMERICA

11.4.3.1 By country

TABLE 228 NORTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 229 NORTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 230 NORTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 231 NORTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

11.4.4 CENTRAL AMERICA

11.4.4.1 By country

TABLE 232 CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 233 CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 234 CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 235 CENTRAL AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

11.4.5 EUROPE

11.4.5.1 By country

TABLE 236 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 237 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 238 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 239 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

11.4.5.2 By end-use

TABLE 240 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 241 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 242 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 243 EUROPE: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

11.4.6 SOUTH AMERICA

11.4.6.1 By country

TABLE 244 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 245 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 246 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 247 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

11.4.6.2 By end-use

TABLE 248 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 249 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 250 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 251 SOUTH AMERICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

11.4.7 MIDDLE EAST & AFRICA

11.4.7.1 By country

TABLE 252 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 253 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 254 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 255 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

11.4.7.2 By end-use

TABLE 256 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 257 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 258 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 259 MIDDLE EAST & AFRICA: UNSATURATED POLYESTER RESINS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

12 APPENDIX (Page No. - 239)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

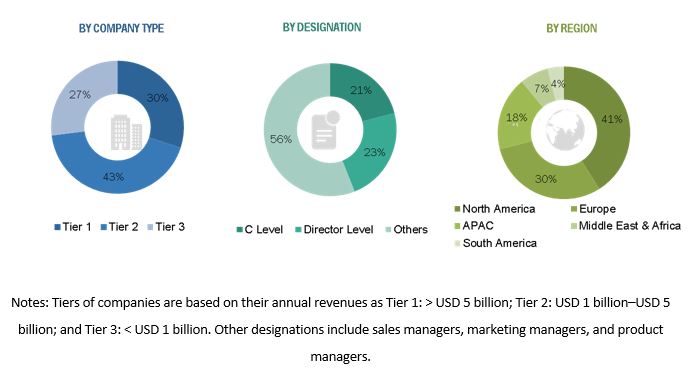

The study involved four major activities to estimate the market size for maleic anhydride. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The maleic anhydride market comprises several stakeholders such as raw material suppliers, manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as automotive, construction, marine and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the maleic anhydride market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the maleic anhydride market, in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the maleic anhydride market on the basis of raw material and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, merger & acquisition, and agreement in the maleic anhydride market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Maleic Anhydride Market