This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the medical robots market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the medical robots market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), the Organisation for Economic Co-operation and Development (OECD), Ambulatory surgery centers (ASCs), Minimally Invasive Robotic Association (MIRA), Clinical Robotic Surgery Association (CRSA), American Association of Healthcare Administrative Management (AAHAM), Centers for Disease Control and Prevention (CDC), American Medical Group Association (AMGA), Centers for Medicare & Medicaid Services (CMS), American Hospital Association (AHA), Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the medical robots market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

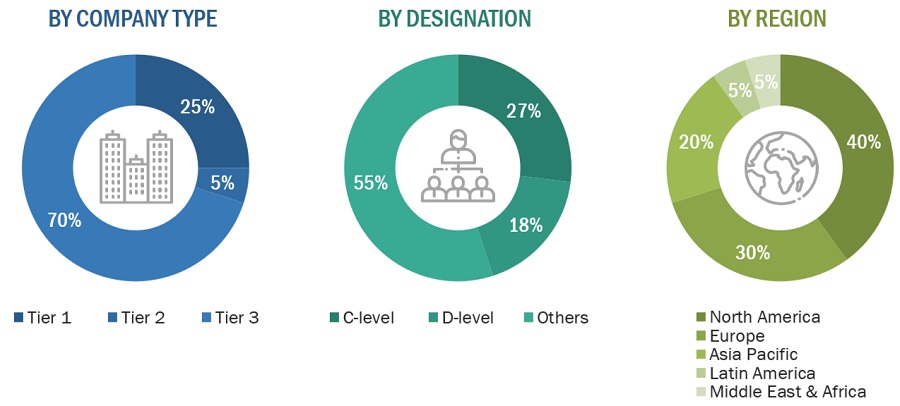

Extensive primary research was conducted after acquiring basic knowledge about the global medical robots market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital personnel, department heads, hospital directors, corporate personnel) and supply side (such as C-level and D-level executives, technology experts, software developers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Breakdown of Primary Interviews

Note 1: Tiers are defined based on the total revenues of companies. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global medical robots market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

Key players in the global medical robots market were identified through secondary research, and their global market shares were determined through primary and secondary research

-

The research methodology included the study of the annual and quarterly financial reports and regulatory filings, data books of major market players, and interviews with industry experts for detailed market insights.

-

All percentage shares, splits, and breakdowns for the global medical robots market were determined by using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated and added with detailed inputs and analysis and presented in this report.

Global Medical Robots Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Medical Robots Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the medical robots market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical robots market.

Market Definition:

Medical robots are advanced technological systems designed to assist healthcare professionals in various medical procedures, tasks, and interventions. These robots are equipped with sensors, actuators, and sophisticated control systems that enable them to perform specific functions autonomously or under the guidance of human operators.

Medical robots are utilized across different domains within healthcare, including surgery, rehabilitation, diagnostics, pharmacy automation, and patient care. They play a crucial role in enhancing precision, efficiency, and safety in medical interventions, contributing to improved patient outcomes, reduced complications, and enhanced healthcare delivery.

Key Stakeholders:

-

Manufacturers of medical robots

-

Suppliers and distributors of medical robots

-

Third-party refurbishers/suppliers

-

Clinical settings

-

Educational institutions

-

Group purchasing organizations (GPOs)

-

Academic medical centers and universities

-

Corporate entities

-

Community centers

-

Government institutes

-

Market research & consulting firms

-

Contract manufacturing organizations (CMOs)

-

Venture capitalists & investors

Report Objectives

-

To define, describe, and forecast the medical robots market by product & service, type, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall medical robots market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To profile the key players in the market and comprehensively analyze their market shares and core competencies2

-

To forecast the size of the market segments with respect to five main regions: North America, the Asia Pacific, Europe, Latin America, and the Middle East & Africa

-

To track and analyze competitive developments, such as acquisitions, product launches, expansions, agreements & collaborations, and approvals

-

To benchmark players within the medical robots market using the Competitive Evaluation Matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Additional Company Profiling

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

-

Further breakdown of the Rest of Europe medical robots market into Switzerland, Russia, and others

-

Further breakdown of the Rest of Asia Pacific medical robots market into South Korea, Singapore, and others

Growth opportunities and latent adjacency in Medical Robots Market