This study involved the extensive use of both primary and secondary sources. Exhaustive secondary research was done to collect information on the radiotherapy industry. The next step was to validate these findings, assumptions and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up where employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the radiotherapy market. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the radiotherapy market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

The market for the companies offering radiotherapy products is arrived at by secondary data available through paid and unpaid sources analysing the product portfolios of the major companies in the ecosystem and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study full. The secondary research was used to obtain critical information on the industries value chain, the total pool of key players, market classification and segmentation from the market and technology oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the radiotherapy market. The primary sources from the demand side include OEMs, private and contract testing organizations and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

After the complete market engineering (calculations for market statistics, market breakdown, market estimation, market forecasting and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at fill primary research was also conducted to identify the segmentation types industry trends competitive landscape of radiotherapy offered by various market players and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends and key players strategies.

In the complete market engineering process, the top down and bottom up approaches were extensively used along with several data regulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/ insights through the report.

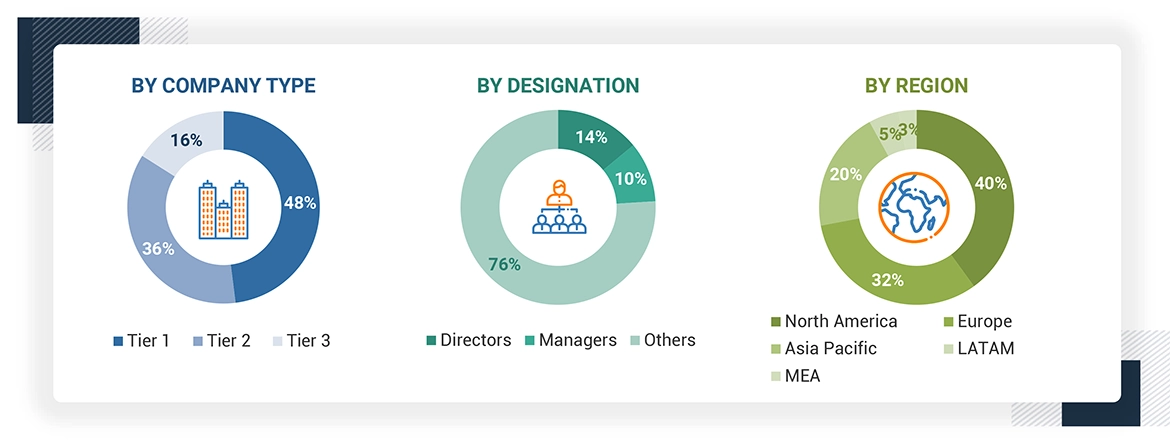

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = < USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the lab consumable market. These methods were also used extensively to estimate the size of various segments in the market.

To determine the size of the global radiotherapy market, revenue share analysis was employed wirth leading players. In this case, key players in the market have been identified, with their radiotherapy products business revenues determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of top market players' annual and financial reports. On the other hand, primary research incorporated in-depth interviews with key opinion leaders, in particular, chief executive officers, directors, and key marketing executives.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global radiotherapy market was split into segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the radiotherapy market was validated using both top-down and bottom-up approaches.

Market Definition

Radiotherapy is the use of X-rays, gamma rays, neutrons, protons, and other high-energy types of radiation to destroy cancer cells and shrink tumors. The two main types of radiotherapy are- External radiation therapy and Internal radiation therapy. In External-beam radiation therapy, the radiation comes from a machine outside the body, and in internal radiation therapy, or brachytherapy, radioactive material is put inside the body close to the cancer cells.

Stakeholders

-

Radiotherapy product manufacturing companies

-

Distributors, suppliers, and commercial service providers

-

Healthcare service providers

-

Clinical research organizations (CROs)

-

Radiotherapy service providers

-

Radiotherapy product distributors

-

Medical research laboratories

-

Cancer care centers

-

Cancer research organizations

-

Academic medical centers and universities

-

Market research and consulting firms

Report Objectives

-

To define, describe, and forecast the radiotherapy market based on system and software & service, technology, application, procedure, end user, and region.

-

To provide detailed information regarding the major factors influencing the growth potential of the global radiotherapy market (drivers, restraints, opportunities, challenges, and trends).

-

To analyze the micro markets for individual growth trends, prospects, and contributions to the global radiotherapy market.

-

To analyze key growth opportunities in the global radiotherapy market for key stakeholders and provide details of the competitive landscape for market leaders.

-

To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East and Africa (GCC Countries and Rest of MEA).

-

To profile the key players in the global radiotherapy market and comprehensively analyze their market shares and core competencies.

-

To track and analyze the competitive developments undertaken in the global radiotherapy market, such as agreements, expansions, and product launches.

Growth opportunities and latent adjacency in Radiotherapy Market