Membrane Separation Technology Market by Application (Water & Wastewater Treatment, Food & Beverage, Medical & Pharmaceutical, Industrial Processing), Technology (RO, UF, MF, NF), and Region - Global Forecast to 2022

The global membrane separation technology market is projected to reach USD 28.10 billion by 2022 at a CAGR of 7.2%. The base year considered for the study is 2016 while the forecast period is from 2017 to 2022. Membrane separation technology is used to separate and to purify a specific component from the rest of the mixture. This technology is widely used for commercial and industrial purposes. Certain properties of membrane separation technology, such as durability, porosity, permeability, stability, and selectivity, make them an indispensable element in various industrial applications. Membrane separation technology are widely used in water & wastewater treatment, industrial, laboratory, medical, food & beverage, and research applications to purify, concentrate, sterilize, or separate samples.

Market Dynamics

Drivers

- Increasing awareness regarding water & wastewater treatment

- Requirement for selective separation technology for meeting water quality standards

- Stringent regulatory and sustainability policies concerning the environment

- Growth in the biopharmaceutical industry

- Benefit of low operating power and capable of working in harsh environments

Restraints

- Cost restraints related to adoption of membrane filters

Opportunities

- Growing demand for membrane separation technology in emerging economies

Challenges

- Growing demand for membrane separation technology in emerging economies

Increasing awareness regarding water & wastewater treatment

Water is a basic necessity for human existence and industrial development. Increasing population and expansion of industries increases the demand for water, which in turn, increases the need for membranes in water & wastewater treatment applications. Moreover, increasing concerns regarding wastewater discharge and drinking water quality is also driving the membrane separation technology market, globally.

The scarcity of pure water has provided opportunities for use of membranes in brackish water purification. High purity standards and stringent regulations regarding drinking water and industrial wastewater discharge are leading to increased water and wastewater treatment activities that use RO, UF, and MF membranes on a large scale. In the U.S., it is mandated by the law that citizens should be given clean and abundant water. The EUs bathing water standards policy have rules for safeguarding public health with clean bathing water and so on. All these policies are set to increase water & wastewater treatment processes across the world. This is driving the growth of the global membrane separation technology market.

Objectives of the Study:

- To define, describe, and forecast the membrane separation technology market on the basis of technology, application, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the membrane separation technology market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

The top-down and bottom-up both approaches have been used to estimate and validate the size of the global membrane separation technology market and to estimate the size of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), Organization for Economic Co-operation and Development (OECD), and other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the membrane separation technology market.

To know about the assumptions considered for the study, download the pdf brochure

The major players covered in the report are The Dow Chemical Company (U.S.), The 3M Company (U.S.), GE Water & Process Technologies (U.S.), Toray Industries (Japan), Merck Millipore (Germany), Asahi Kasei Corporation (Japan), Hydranautics (U.S.), Danaher Corporation (U.S.), Pentair plc (U.K.), and Koch Membrane Systems Inc. (U.S.).

Key Target Audience:

- Providers of membrane separation technology

- Traders, Distributors, and Suppliers of membrane separation technology

- Regional Manufacturers Associations and General membrane separation technology Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

- This research report categorizes the membrane separation technology market on the basis of technology, application, and region.

Based on technology:

- RO

- UF

- MF

- NF

- Others

Based on Application:

- Water & Waste water treatment

- Food & Beverage

- Medical & Pharmaceutical

- Industry processing

- Others

Based on Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- The market is further analyzed for the key countries in each of these regions.

Critical questions which the report answers<

- What are the upcoming trends for membrane separation technologies in developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the membrane separation technology market is provided by technology and application.

Company Information:

- Detailed analysis and profiles of additional market players.

The global membrane separation technology market is projected to reach USD 28.10 billion by 2022 at a CAGR of 7.2%. The membrane separation technology market has witnessed significant growth in the recent years, and this growth is projected to persist in the coming years as well. Membrane separation technology is used to separate and to purify a specific component from the rest of the mixture. This technology is widely used for commercial and industrial purposes. With recent developments in membrane separation technology market and increasing demand for reduction of energy consumption in the chemical processing industry, newer membrane technologies and processes are being developed for new applications.

There are various types of membrane separation technologies are considered in the report including reverse osmosis (RO), ultrafiltration (UF), microfiltration (MF), nanofiltration (NF), and others. Among these technologies RO accounted for the largest market share due to its cost effective nature. NF is the fastest growing technology owing to its increasing usage to separate trace amounts of salts and other dissolved solutes from already treated water to produce ultrapure water for the electronics industry.

North America, Europe, Asia-Pacific, Middle East & Africa, and South America are the main regions considered for the membrane separation technology market in the report. Asia-Pacific is the largest membrane separation technology market. This region dominates the membrane separation technology market due to the extensive usage of membrane separation technology in medical & pharmaceutical, water & wastewater treatment, and chemical processing sectors. The market for the MEA region is projected to witness the second-highest growth rate between 2017 and 2022 owing to the increasing demand for water treatment plants in the region.

Though the membrane separation technology market is growing at a significant rate, a few factors such as the high price of equipment, shift of the end-use market from developed countries to emerging countries, and the rising cost of production hinder the growth of the market, globally.

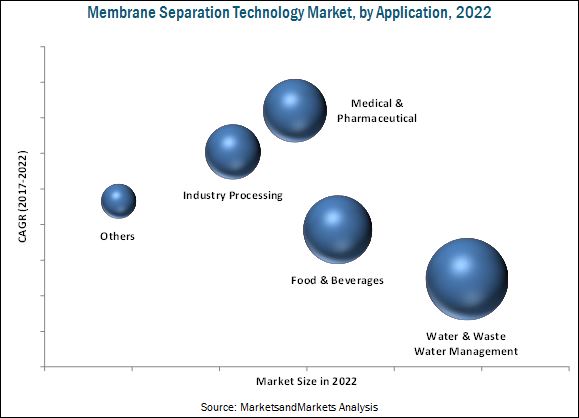

Membrane separation technology is used in various applications such as water & wastewater treatment, industrial processing, medical & pharmaceutical, and food & beverage.

Water & Wastewater Treatment

Membranes separation technology in water & wastewater treatment plants are used for microbial removal, desalination of sea water, sewage treatment, wastewater treatment of water from industries, processing of natural mineral water, production of potable water, and treatment of brackish water. The two major membrane processes used for water & wastewater treatment include RO and NF. Knowing which membrane system solution suits the best for water treatment challenge helps to increase the plant efficiency, along with reduced operating & chemical costs, and compliance with increasingly stringent waste disposal regulations.

Food & Beverage

Despite being a relatively mature sector, there are still emerging and potential applications in protein isolation and other separations. An important trend for membranes in the food & beverage sector also relates to wastewater treatment. As disposal regulations have become stringent and sewage surcharges escalate, the industry is being forced to look for new cost-effective water treatment technologies using membranes. Major technologies used in food & beverage industry are RO, NF, UF, MF, along with some of the less used technologies such as pervaporation, gas transfer, and membrane distillation.

Medical & Pharmaceutical

Membranes find widespread applications in the biopharmaceutical industry as its products and their intermediates are susceptible to degradation due to heat and chemical treatment, making it difficult to separate those using alternative technologies. Other medical applications of membranes involve artificial kidneys transplant, blood oxygenators, and controlled release drug delivery system. Microfiltration membranes are widely used for producing injectable drug solution. The market for pharmaceuticals is expected to continue to grow at a relatively high rate in the next five years, providing a large market for manufacturers of microfiltration membranes.

Critical questions the report answers:

- What are the upcoming hot bets for membrane separation technology market?

- How market dynamics is changing for different types of technology in different applications?

The Dow Chemical Company (U.S.), GE Water & Process Technologies (U.S.), The 3M Company (U.S.), Toray Industries (Japan), and Merck Millipore (Germany) are the leading companies in this market. These companies are projected to account for a significant share of the market in the near future. Entering into related industries and targeting new markets will enable the membrane separation technology manufacturers to overcome the effects of volatile economies, leading to diversified business portfolios and increase in revenues. Other major membrane separation technology providers are Asahi Kasei Corporation (Japan), Hydranautics (U.S.), Danaher Corporation (U.S.), and Koch Membrane Systems Inc. (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Research Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Data From Primary Sources

2.1.2.2 Key Industry Insights

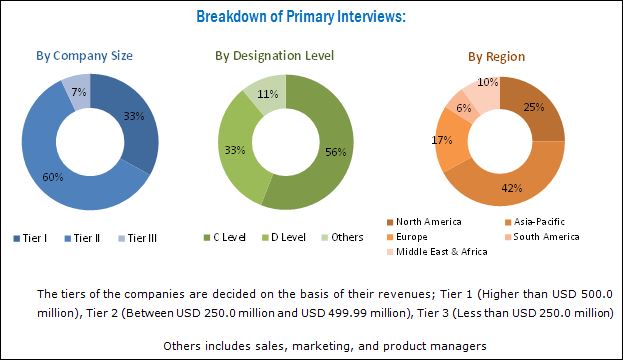

2.1.2.3 Breakdown of Primary Interviews:

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Significant Market Opportunities in the Membrane Separation Technology Market

4.2 Membrane Separation Technology Market in Asia-Pacific Region By Country and Application

4.3 Membrane Separation Technology Market, By Technology (2016)

4.4 Membrane Separation Technology Market, By Application

5 Market Overview (Page No. - 30)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Awareness Regarding Water & Wastewater Treatment

5.1.1.2 Requirement for Selective Separation Technology for Meeting Water Quality Standards

5.1.1.3 Stringent Regulatory and Sustainability Policies Concerning the Environment

5.1.1.4 Replacement of Other Technologies

5.1.1.5 Growth in the Biopharmaceutical Industry

5.1.2 Restraints

5.1.2.1 Cost Restraints Related to Adoption of Membrane Filters

5.1.3 Opportunities

5.1.3.1 Growing Demand for Membrane Separation Technology in Emerging Economies

5.1.4 Challenge

5.1.4.1 Increasing Membrane Lifespan

5.2 Porters Five Forces

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Buyers

5.2.4 Bargaining Power of Suppliers

5.2.5 Intensity of Rivalry

6 Membrane Separation Technology Market, By Technology (Page No. - 38)

6.1 Introduction

6.2 RO

6.3 UF

6.4 MF

6.5 NF

6.6 Others

7 Membrane Separation Technology Market, By Application (Page No. - 42)

7.1 Introduction

7.2 Water & Wastewater Treatment

7.2.1 Desalination

7.2.2 Public Utility Water Treatment

7.2.3 Wastewater Reuse

7.3 Food & Beverage

7.3.1 Diary Processing

7.3.2 Beverage Processing

7.3.3 Food & Starch Processing

7.4 Medical & Pharmaceutical

7.4.1 Pharmaceutical Processing

7.4.2 Medical Device

7.4.3 Others

7.5 Industry Processing

7.6 Others

8 Region (Page No. - 47)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Spain

8.3.2 Italy

8.3.3 Germany

8.3.4 U.K.

8.3.5 France

8.3.6 Netherlands

8.3.7 Others

8.4 Asia-Pacific

8.4.1 China

8.4.2 Southeast Asia

8.4.3 India

8.4.4 Japan

8.4.5 Australia

8.4.6 Rest of Asia-Pacific

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 Qatar

8.5.3 Oman

8.5.4 UAE

8.5.5 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Chile

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 85)

9.1 Introduction

9.1.1 Dynamics

9.1.2 Innovators

9.1.3 Vanguards

9.1.4 Emerging

9.2 Competitive Benchmarking

9.3 Product Offerings

9.4 Business Strategy

10 Company Profiles (Page No. - 89)

(Business Overview, Product Offerings & Business Strategies, Key Insights, Recent Developments, MnM View)*

10.1 Merck Millipore

10.2 The DOW Chemical Company

10.3 Toray Industries, Inc.

10.4 Nitto Denko Corporation (Hydranautics)

10.5 Pentair PLC

10.6 Asahi Kasei Corporation

10.7 GE Water & Process Technologies

10.8 Koch Membranes Systems, Inc.

10.9 Pall Corporation

10.10 The 3M Company

10.11 Other Companies

10.11.1 Axeon Water Technologies

10.11.2 Corning Inc.

10.11.3 GEA Filtration

10.11.4 Hyflux Ltd.

10.11.5 Inge GmbH

10.11.6 Lanxess AG

10.11.7 LG Water Solution

10.11.8 Markel Corporation

10.11.9 Membranium

10.11.10 Microdyn-Nadir GmbH

10.11.11 Parker-Hannifin Corporation

10.11.12 PCI Membranes

10.11.13 Toyobo Co., Ltd.

10.11.14 Veolia Environnement Sa

10.11.15 W. L. Gore & Associates

*Details on Business Overview, Product Offerings & Business Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 119)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (60 Tables)

Table 1 Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 2 Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 3 Membrane Separation Technology Market Size, By Region, 20152022 (USD Million)

Table 4 North America: Membrane Separation Technology Market Size, By Country, 20152022 (USD Million)

Table 5 North America: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 6 North America: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 7 U.S.: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 8 U.S.: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 9 Canada: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 10 Canada: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 11 Mexico: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 12 Mexico: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 13 Europe: Membrane Separation Technology Market Size, By Country, 20152022 (USD Million)

Table 14 Europe: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 15 Europe: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 16 Spain: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 17 Spain: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 18 Italy: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 19 Italy: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 20 Germany: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 21 Germany: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 22 U.K.: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 23 U.K.: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 24 France: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 25 France: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 26 Netherlands: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 27 Netherlands: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 28 Asia-Pacific: Membrane Separation Technology Market Size, By Country, 20152022 (USD Million)

Table 29 Asia-Pacific: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 30 Asia-Pacific: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 31 China: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 32 China: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 33 Southeast Asia: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 34 Southeast Asia: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 35 India: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 36 India: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 37 Japan: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 38 Japan: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 39 Australia: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 40 Australia: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 41 Middle East & Africa: Membrane Separation Technology Market Size, By Country, 20152022 (USD Million)

Table 42 Middle East & Africa: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 43 Middle East & Africa: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 44 Saudi Arabia: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 45 Saudi Arabia: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 46 Qatar: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 47 Qatar: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 48 Oman: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 49 Oman: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 50 UAE: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 51 UAE: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 52 Rest of Middle East & Africa: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 53 Rest of Middle East & Africa: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 54 South America: Membrane Separation Technology Market Size, By Country, 20152022 (USD Million)

Table 55 South America: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 56 South America: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 57 Brazil: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 58 Brazil: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

Table 59 Chile: Membrane Separation Technology Market Size, By Technology, 20152022 (USD Million)

Table 60 Chile: Membrane Separation Technology Market Size, By Application, 20152022 (USD Million)

List of Figures (29 Figures)

Figure 1 Market Segmentation

Figure 2 Membrane Separation Technology Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Water & Wastewater Treatment to Be the Largest Application for Membrane Separation Technology Market

Figure 7 RO Technology Dominates Overall Membrane Separation Technology Market

Figure 8 U.S. Dominates the Membrane Separation Technology Market

Figure 9 Asia-Pacific Dominated Global Membrane Separation Technology Market

Figure 10 Attractive Opportunities in Membrane Separation Technology Market

Figure 11 China Dominates the Membrane Separation Technology Market in Asia-Pacific

Figure 12 RO Technology Accounted for Largest Share of Membrane Separation Technology Market, 2016

Figure 13 Medical & Pharmaceutical to Be the Fastest-Growing Application Between 2017 and 2022

Figure 14 Drivers, Restraints, Opportunities, and Challenges in Membrane Separation Technology Market

Figure 15 Membrane Separation Technology: Porters Five Forces Analysis

Figure 16 RO Technology Projected to Lead Membrane Separation Technology Market During Forecast Period (2017-2022)

Figure 17 Water & Wastewater Treatment Application Dominated Membrane Separation Technology Market, 2017-2022

Figure 18 India to Register the Highest CAGR in Membrane Separation Technology Market Between 2017 and 2022

Figure 19 Membrane Separation Technology Market to Witness Highest Growth in Medical & Pharmaceutical Application

Figure 20 Spain Dominated the Membrane Separation Technology Market in 2016

Figure 21 Water & Wastewater Treatment Application to Drive Membrane Separation Technology Market in Asia-Pacific

Figure 22 Dive Chart

Figure 23 Merck Millipore: Company Snapshot

Figure 24 The DOW Chemical Company: Company Snapshot

Figure 25 Toray Industries, Inc.: Company Snapshot

Figure 26 Pentair PLC: Company Snapshot

Figure 27 Asahi Kasei Corporation: Company Snapshot

Figure 28 Pall Corporation: Company Snapshot

Figure 29 The 3M Company: Company Snapshot

Growth opportunities and latent adjacency in Membrane Separation Technology Market