Metal Replacement Market by End-Use Industry (Automotive, Aerospace & Defense, Construction, Healthcare, Others), Type (Engineering Plastics, Composites), and Region - Global Forecast to 2021

The metal replacement market is projected to reach USD 159.82 billion by 2021, at a CAGR of 9.2%. Metal replacing materials exhibit superior properties, such as mechanical strength and heat & chemical resistance, and are generally used in applications requiring a higher level of performance. These materials are also lighter than the commonly used metals. As such, they have replaced traditional engineering materials, such as wood and metal, in many applications. Besides equaling or surpassing traditional materials in weight/strength and other properties, metal replacing materials, such as engineering plastics, are much easier to manufacture, especially into complex shapes. In this study, 2015 has been considered the base year and 2016-2021 as the forecast period to estimate the metal replacement market size.

Metal Replacement Market Dynamics

Drivers

- Engineering plastics replacing traditional materials in end-use applications

- Increasing metal replacement in the aerospace & defense industry

Restraints

- High cost materials

Opportunities

- Potential opportunities in new applications

- Increasing demand from emerging markets

Challenges

- Volatile crude oil prices

Increasing metal replacement in the aerospace & defense industry is another contributing factor for growth of the metal replacing materials market

Metal replacing materials are materials that exhibit superior properties, such as mechanical strength and heat & chemical resistance. These materials include engineering plastics, such as polycarbonates (PC), acrylonitrile butadiene styrene (ABS), polyamides (PA), thermoplastic polyesters (PET & PBT), polyacetals (POM), fluoropolymers, and others; and composites, such as GFRP and CFRP. Metal replacing materials are favored for their superior properties, enabling their use across a wide range of industrial and consumer industries, such as automotive, aerospace & defense, healthcare, construction, electronics, packaging, and so on. Increasing demand from these industries is expected to drive consumption of engineering plastics, which is a major segment of the metal replacing materials market, in the near future.

The following are the major objectives of the study:

- To analyze and forecast the size of the metal replacement market in terms of value

- To define, describe, and forecast the metal replacement market by end-use industry, type, and region

- To forecast the market size of different segments based on regions, such as North America, Europe, Asia-Pacific, Middle East & Africa, and South America

- To provide detailed information regarding major factors influencing growth of the metal replacement market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the metal replacement market segments based on individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their core competencies

- To analyze competitive developments, such as alliances, joint ventures, mergers & acquisitions, and new product launches in the metal replacement market

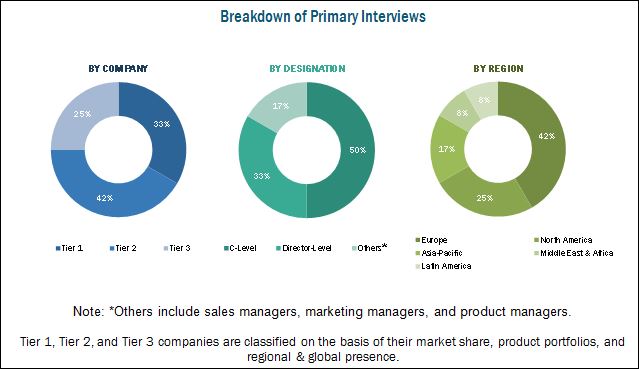

Different secondary sources, such as company websites, encyclopedias, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource have been used to identify and collect information useful for this extensive, commercial study of the global metal replacement market. Primary sources, including experts from related industries, have been interviewed to verify and collect critical information and assess prospects of the market. The top-down approach has been implemented to validate the market size in terms of value. With data triangulation procedures and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Metal Replacement Market

This study answers several questions for stakeholders, primarily, which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. These stakeholders include metal replacement manufacturers such as ExxonMobil Chemical (USA) and LyondellBasell Industries (Netherlands); and metal replacing material manufacturers, such as Solvay SA (Belgium), SGL-Group (Germany), Owens Corning Corporation (U.S.), Celanese Corporation (U.S.), BASF SE (Germany), Toray Industries, Inc. (U.S.), and Jushi Group (China).

Major Metal Replacement Market Developments

- In September 2016, SGL Group inaugurated a new production line for precursor at its FISIPE site in Lavradio, near Lisbon in Portugal. This new production line will help the company to meet the increasing demand of carbon fiber across the globe.

- In September 2016, Solvay expanded the production capacity of its composite materials facility in Germany. The capacity expansion will help the company meet the growing demand from the aerospace industry.

- In January 2016, Owens Corning acquired announced the acquisition of Ahlstrom's glass non-woven and fabrics businesses. Ahlstrom is a fiber based materials company headquartered in Finland. The acquisition helped the company increase its market share in the metal replacing materials industry

Key Target Audience in Metal Replacement Market

- Manufacturers of Metal Replacing Materials

- Traders, Distributors, and Suppliers of Metal Replacing Materials

- End-Use Industries Operating in the Metal Replacing Materials Supply Chain

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Metal Replacement Market Report Scope

This research report categorizes the metal replacement market on the basis of end-use industry, type, and region. The report forecasts revenues as well as analyzes the trends in each of these submarkets.

On the basis of end-use industry:

- Automotive

- Aerospace & Defense

- Construction

- Healthcare

- Others

On the basis of type:

- Engineering Plastics

- Composites

On the basis of region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Metal Replacement Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

New Product Analysis

- Product matrix, which gives a detailed comparison of new products and market trends in each industry

Metal Replacement Market Geographic Analysis

- Further breakdown of a region with respect to a particular country and application

Metal Replacement Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

The metal replacement market is projected to reach USD 159.82 billion by 2021, at a CAGR of 9.2% from 2016 to 2021. The key factor propelling the growth of the metal replacement market is the increasing demand for metal replacing materials from the automotive and aerospace & defense industries.

Major end-use industries in the metal replacement market include automotive, aerospace & defense, construction, healthcare, and others. In the automotive industry, metal replacing materials are used in the manufacturing of vehicle body parts, as well as various under-the-hood components. Therefore, increase in automobile production, along with repair & maintenance activities, is likely to propel the demand for metal replacing materials in the automotive industry.

Based on type, the metal replacement market has been segmented into engineering plastics and composites. The engineering plastics segment is further subdivided into polycarbonates, acrylonitrile butadiene styrene (ABS), polyamides, thermoplastic polyesters, polyacetals, fluoropolymers, and others; whereas the composites segment is subdivided into CFRP (carbon fiber reinforced plastics) and GFRP (glass fiber reinforced plastics). In the engineering plastics segment, acrylonitrile butadiene styrene is estimated to account for the largest market share in 2016, in terms of volume; followed by polyamides and polycarbonates. In the composites segment, GFRP is estimated to account for the largest market share in 2016, by volume. The composites segment is projected to register the highest CAGR during the forecast period due to high growth in the CFRP market.

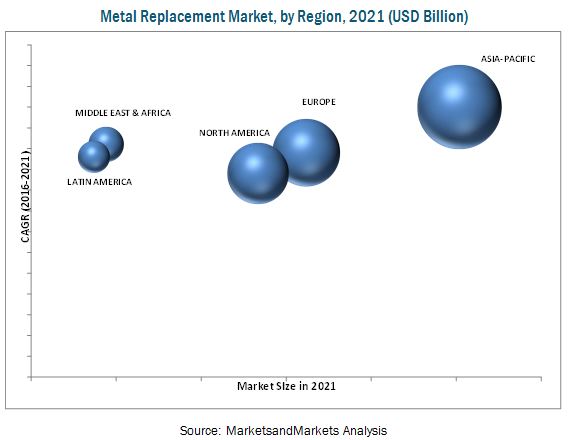

The metal replacement market in the Asia-Pacific region is anticipated to grow at the highest CAGR between 2016 and 2021. This region has witnessed significant infrastructural development in recent years, which has led to the initiation of several housing construction projects. The region’s construction industry is expected to grow at a healthy rate of 5.8% from 2017 to 2022. This has consequently led to increase in demand for metal replacing materials in the construction sector to replace steel bars for concrete reinforcement as well as to manufacture sewage systems. In addition, the high growth of the market in Asia-Pacific is also attributed to the increasing demand of metal replacing materials to manufacture lightweight and fuel efficient vehicles.

Metal replacement’ application in the aerospace & defense, construction, automotive, and healthcare industry drive the growth of metal replacement market

Automotive

Automotive was the largest end-use industry segment of the global metal replacing materials market in 2015. Automotive industry is growing globally, According to OICA correspondent’s survey, 90.78 billion vehicles were produced in 2015. Metal replacing materials are extensively used in the automotive industry in the manufacturing of connectors, under-the-hood components, body parts, and reflectors & lighting sockets, among others. These materials are used in light automobiles as well as heavy transportation vehicles. For example, engineering plastics are increasingly being used in the automotive industry, as they are lightweight and high performance materials. Automotive manufacturers are adopting engineering plastics as an alternative to metals and glass, since these plastics provide an ideal combination of price and performance. The demand for metal replacing materials is expected to increase substantially in coming years, as various companies operational in the automotive industry are focusing on vehicle weight reduction and improved fuel efficiency, due to the increasing governmental norms and regulations.

Aerospace & Defense

Aerospace & defense is the second largest end-use industry segment of the metal replacement materials market. According to the general aviation manufacturers association 2,331 aircrafts were shipped in 2015. With increasing demand from the general aviation aircraft manufacturers have been searching for an alternative to traditional engineering materials such as metals with equally or more durable lighter materials, as reduction in the weight of an aircraft leads to increased fuel efficiency. The increasing need for the use of lightweight materials instead of metals, without compromising on the strength and durability of the material has led to the adoption of metal replacing materials such as engineering plastics and composite materials in the aerospace & defense industry

Construction

Metals are being replaced by engineered plastics and composites in drainage systems, and electric wiring systems, among others in the construction industry. Metal replacing materials such as glass fiber reinforced plastics are used instead of steel bars used for concrete reinforcement. The global construction industry is expected to reach 12 trillion by 2020. The growth is derived by rising standard of living and increased disposable income in several countries in Asia-Pacific have led to significant infrastructural growth in these countries, which is further contributing to the overall growth of the construction industry. This has consequently lead to the growth of the construction industry in several countries. The growing construction sector in these countries is anticipated to result in the increased demand for materials, such as GFRP for the construction of high strength and durable structures

Healthcare

In the healthcare sector, metal replacing materials are majorly used in the manufacturing of lightweight medical devices. Recently Scientists have developed a composite material that can replace screws and plates used to join bones in an orthopedic surgery. Screws and plates made from these materials are used exactly like traditional materials; the biggest advantage of these materials is that they get dissolved inside the body over a period of time post healing. These new inventions and the consequently increasing demand for use in medical devices is expected to lead to the growth of the metal replacing materials market in healthcare end-use industry.

Critical Questions the Metal Replacement Market Report Answers

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for metal replacement?

Estimating the future demand of metal replacing materials is a prime challenge due to economic slowdown in varied regions worldwide. North America and Europe have still not recovered completely from the economic crisis, which, in turn, has affected the demand for metal replacing materials in major end-use industries in these regions.

Key Metal Replacement Market Industry Players

Key companies operating in the metal replacement market include Solvay SA (Belgium), SGL-Group (Germany), Owens Corning Corporation (U.S.), Celanese Corporation (U.S.), BASF SE (Germany), Toray Industries, Inc. (U.S.), and Jushi Group (China). These players, with a wide market reach and established distribution network, are investing more on research & development activities. They also have strong technical and market development capabilities, which enable them to upgrade their existing products for new applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.4.1 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Industry Insights

2.5 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Global Metal Replacement Market

4.2 Metal Replacement Market, By Region

4.3 Global Metal Replacement Market By End-Use Industries & Region

4.4 Global Metal Replacement Market Growth

4.5 Global Metal Replacement Market, By End-Use Industry

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By End-Use Industry

5.2.2 By Type

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Engineering Plastics Replacing Traditional Materials in End-Use Industries

5.3.1.2 Increasing Metal Replacement in Aerospace & Defense Sector

5.3.2 Restraints

5.3.2.1 High Cost of Materials

5.3.3 Opportunities

5.3.3.1 Potential Opportunities in New Applications

5.3.3.2 Increasing Demand From Emerging Markets

5.3.4 Challenges

5.3.4.1 Volatile Crude Oil Prices

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

7 Metal Replacement Market, By End-Use Industry (Page No. - 46)

7.1 Introduction

7.2 Automotive

7.3 Aerospace & Defense

7.4 Construction

7.5 Healthcare

7.6 Others

8 Metal Replacement Market, By Type (Page No. - 55)

8.1 Introduction

8.2 Engineering Plastics

8.2.1 Engineering Plastics Segment, By Type

8.2.1.1 Polycarbonates (PCS)

8.2.1.2 Acrylonitrile Butadiene Styrene (ABS)

8.2.1.3 Polyamides (PAS)

8.2.1.4 Thermoplastic Polyesters

8.2.1.5 Polyacetals

8.2.1.6 Fluoropolymers

8.2.1.7 Others

8.3 Composites

8.3.1 Glass Fibre Reinforced Plastics

8.3.2 Carbon Fibre Reinforced Plastics

9 Metal Replacement Market, By Region (Page No. - 73)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 South Korea

9.2.4 Indonesia

9.2.5 India

9.2.6 Malaysia

9.2.7 Philippines

9.2.8 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Russia

9.3.5 Spain

9.3.6 Italy

9.3.7 Turkey

9.3.8 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Middle East & Africa

9.5.1 Uae

9.5.2 South Africa

9.5.3 Rest of the Middle East and Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Chile

10 Competitive Landscape (Page No. - 109)

10.1 Overview

10.2 New Product Launches: the Most Popular Growth Strategy

10.3 Maximum Number of Developments in 2014

10.4 Competitive Situations & Trends

10.4.1 Expansions

10.4.2 Mergers & Acquisitions

10.4.3 New Product Launches & Developments

10.4.4 Partnerships, Agreements & Collaborations

10.4.5 Others

11 Company Profiles (Page No. - 120)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 BASF SE

11.2 Covestro AG

11.3 Celanese Corporation

11.4 E. I. Dupont De Nemours and Company

11.5 Solvay SA

11.6 LG Chem Ltd.

11.7 Toray Industries Inc.

11.8 SGL Group

11.9 Jushi Group

11.10 Owens Corning

11.11 Saint-Gobain SA

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 153)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT : Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (108 Tables)

Table 1 Global Metal Replacement Market, By End-Use Industry, 2014–2021 (USD Billion)

Table 2 Global Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 3 Global Metal Replacement Market in Automotive, By Region, 2014–2021 (USD Million)

Table 4 Global Metal Replacement Market in Automotive, By Region, 2014–2021 (Kilotons)

Table 5 Global Metal Replacement Market in Aerospace & Defense, By Region, 2014–2021 (USD Million)

Table 6 Global Metal Replacement Market in Aerospace & Defense, By Region, 2014–2021 (Kilotons)

Table 7 Global Metal Replacement Market in Construction, By Region, 2014–2021 (USD Million)

Table 8 Global Metal Replacement Market in Construction, By Region, 2014–2021 (Kilotons)

Table 9 Global Metal Replacement Market in Healthcare, By Region, 2014–2021 (USD Million)

Table 10 Global Metal Replacement Market in Healthcare, By Region, 2014–2021 (Kilotons)

Table 11 Global Metal Replacement Market in Other End-Use Industrys, By Region, 2014–2021 (USD Million)

Table 12 Global Metal Replacement Market in Other End-Use Industrys, By Region, 2014–2021 (Kilotons)

Table 13 Metal Replacement Market, By Type, 2014-2021 (USD Billion)

Table 14 Metal Replacement Market, By Type, 2014-2021 (Kilotons)

Table 15 Engineering Plastics Segment, By Region, 2014-2021 (USD Billion)

Table 16 Engineering Plastics Segment, By Type, 2014-2021 (KT)

Table 17 Polycarbonates (PCS) Subsegment, By Region, 2014-2021 (USD Million)

Table 18 Polycarbonates (PCS) Subsegment, By Region, 2014-2021 (KT)

Table 19 Acrylonitrile Butadiene Styrene (ABS) Subsegment, By Region, 2014-2021 (USD Million)

Table 20 Acrylonitrile Butadiene Styrene (ABS) Subsegment, By Region, 2014-2021 (KT)

Table 21 Polyamides (PAS) Subsegment, By Region, 2014-2021 (USD Million)

Table 22 Polyamides (PAS) Subsegment, By Region, 2014-2021 (KT)

Table 23 Thermoplastic Polyesters Subsegment, By Region, 2014-2021 (USD Million)

Table 24 Thermoplastic Polyesters Subsegment, By Region, 2014-2021 (KT)

Table 25 Polyacetals Subsegment, By Region, 2014-2021 (USD Million)

Table 26 Fluoropolymers Subsegment, By Region, 2014-2021 (USD Million)

Table 27 Fluoropolymers Subsegment, By Region, 2014-2021 (KT)

Table 28 Other Metal Replacing Materials Segment, By Region, 2014-2021 (USD Million)

Table 29 Other Metal Replacing Materials Segment, By Region, 2014-2021 (KT)

Table 30 Composites Segment, By Region, 2014-2021 (KT)

Table 31 Composites Segment, By Type, 2014-2021 (USD Billion)

Table 32 Composites Segment, By Type, 2014-2021 (Kilotons)

Table 33 GFRP Segment, By Region, 2014-2021 (USD Million)

Table 34 GFRP Segment, By Region, 2014-2021 (KT)

Table 35 CFRP Segment, By Region, 2014-2021 (USD Million)

Table 36 CFRP Segment, By Region, 2014-2021 (KT)

Table 37 Global Metal Replacement Market, By Region, 2014–2021 (USD Billion)

Table 38 Global Metal Replacement Market, By Region, 2014–2021 (Kilotons)

Table 39 Asia-Pacific Metal Replacement Market, By Country, 2014–2021 (Kilotons)

Table 40 Asia-Pacific Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 41 Asia-Pacific Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 42 China Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 43 China Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 44 Japan Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 45 Japan Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 46 South Korea Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 47 South Korea Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 48 Indonesia Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 49 Indonesia Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 50 India Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 51 India Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 52 Malaysia Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 53 Malaysia Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 54 Philippines Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 55 Philippines Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 56 Rest of Asia-Pacific Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 57 Rest of Asia-Pacific Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 58 Europe Metal Replacement Market, By Country, 2014–2021 (USD Million)

Table 59 Europe Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 60 Europe Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 61 Germany Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 62 Germany Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 63 U.K. Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 64 U.K. Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 65 France Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 66 France Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 67 Russia Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 68 Russia Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 69 Spain Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 70 Spain Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 71 Italy Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 72 Italy Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 73 Turkey Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 74 Turkey Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 75 Rest of Europe Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 76 Rest of Europe Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 77 North America Metal Replacement Market, By Country, 2014–2021 (Kilotons)

Table 78 North America Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 79 North America Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 80 U.S. Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 81 U.S. Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 82 Canada Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 83 Canada Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 84 Mexico Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 85 Mexico Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 86 Middle East & Africa Metal Replacement Market, By Country, 2014–2021 (Kilotons)

Table 87 Middle East & Africa Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 88 Middle East & Africa Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 89 Uae Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 90 Uae Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 91 South Africa Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 92 South Africa Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 93 Rest of Middle East & Africa Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 94 Rest of Middle East & Africa Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 95 South America Metal Replacement Market, By Country, 2014–2021 (USD Million)

Table 96 South America Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 97 South America Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 98 Brazil Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 99 Brazil Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 100 Argentina Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 101 Argentina Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 102 Chile Metal Replacement Market, By Type, 2014–2021 (Kilotons)

Table 103 Chile Metal Replacement Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 104 Expansions, 2011–2016

Table 105 Mergers & Acquisitions, 2011–2016

Table 106 New Product Launches, 2013-2016

Table 107 Agreements, Contracts, Partnerships, Collaborations & Joint Ventures, 2012–2016

Table 108 Others Developments, 2010–2015

List of Figures (50 Figures)

Figure 1 Market Size Estimation: Bottom-Up Approach

Figure 2 Breakdown of Primary Interviews: By Company, Designation & Region

Figure 3 Engineering Plastics Type Segment to Lead Metal Replacement Market During Forecast Period

Figure 4 Automotive End-Use Industry Segment to Lead Metal Replacement Market During Forecast Period

Figure 5 Global Metal Replacement Market Size Ranking, By Region

Figure 6 U.S. and China Major Countries in Global Metal Replacement Market

Figure 7 Long Term Sustainability in the Metal Replacement Market

Figure 8 Metal Replacement Market in Asia-Pacific is Expeced to Register Highest CAGR Between 2016 and 2021

Figure 9 Asia-Pacific & Automotive Contributed Largest Shares to the Global Metal Replacement Market

Figure 10 India Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 Asia-Pacific & Europe are the Largest Markets for Metal Replacing Materials

Figure 12 Significant Growth Opportunities for the Market in Asia-Pacific

Figure 13 Metal Replacement Market: Market Dynamics

Figure 14 Metal Replacing Materials: Value Chain

Figure 15 Porter’s Five Forces Analysis

Figure 16 Automotive Segment Estimated to Lead Metal Replacement Market in 2016

Figure 17 Engineering Plastics Segment Projected to Lead the Global Metal Replacement Market in 2016

Figure 18 Asia-Pacific: Fastest-Growing Market for Engineering Plastics

Figure 19 ABS Subsegment Expected to Lead the Engineering Plastics Segment of the Metal Replacement Market

Figure 20 Asia-Pacific Region Expected to Lead the Composites Segment

Figure 21 GFRP Expected to Lead the Composites Segment, in Terms of Volume, in 2016

Figure 22 India Metal Replacement Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia-Pacific Metal Replacement Market Snapshot

Figure 24 Europe Metal Replacement Market Snapshot

Figure 25 North America Metal Replacement Market Snapshot

Figure 26 Companies Adopted New Product Launches as the Key Growth Strategies in the Last Four Years From 2012-2015

Figure 27 Key Growth Strategies in the Metal Replacement Market, 2011–2015

Figure 28 Year 2014 Witnessed the Maximum Number of Developments

Figure 29 BASF SE: Company Snapshot

Figure 30 BASF SE: SWOT Analysis

Figure 31 Covestro AG: Company Snapshot

Figure 32 Covestro AG: SWOT Analysis

Figure 33 Celanese Corporation: Company Snapshot

Figure 34 Celanese Corporation: SWOT Analysis

Figure 35 Du Pont: Company Snapshot

Figure 36 Dupont: SWOT Analysis

Figure 37 Solvay SA: Company Snapshot

Figure 38 Solvay SA: SWOT Analysis

Figure 39 LG Chem Ltd.: Company Snapshot

Figure 40 LG Chem Ltd.: SWOT Analysis

Figure 41 Toray Industries Inc.: Company Snapshot

Figure 42 Toray Industries Inc.: SWOT Analysis

Figure 43 SGL Group: Company Snapshot

Figure 44 SGL Group: SWOT Analysis

Figure 45 Jushi Group: Company Snapshot

Figure 46 Jushi Group Co. Ltd.: SWOT Analysis

Figure 47 Owens Corning : Company Snapshot

Figure 48 Owens Corning: SWOT Analysis

Figure 49 Saint-Gobain SA: Company Snapshot

Figure 50 Saint-Gobain: SWOT Analysis

Growth opportunities and latent adjacency in Metal Replacement Market