Micro and Nano PLC Market by Type (Micro PLC, Nano PLC), Offering (Hardware, Software, Services), Architecture (Fixed PLC, Modular PLC), Industry (Automotive, Home & Building Automation, Food & Beverages), and Geography - Global Forecast to 2022

The micro and nano PLC market was valued at USD 5.58 billion in 2015 and is expected to at a CAGR of 6.9% between 2016 and 2022. Programmable logic controller (PLC) is a digital computer used for the automation of industrial electromechanical processes. The PLC continuously monitors the state of input devices and makes decisions based on a customized program to control the state of output devices. On the basis of input/output (I/O) points, two types of PLCs have been defined in the report, namely, micro PLC and nano PLC. Micro PLC has 36 to 256 I/O points, whereas nano PLC has less than 36 I/O points. The increasing automation of industrial processes, demand for compact automation solutions, and widespread adoption of IoT connectivity are the key influencing factors of the market. The base year considered for study is 2015 and the forecast period is between 2016 and 2022.

Market Dynamics:

Drivers:

- Requirement for compact automation solutions

- Adoption of regulatory compliance and its increasing importance

- Growing home & building automation market

Restraints:

- Additional cost incurred by expandability of micro and nano PLC

- Fluctuating oil & gas prices

Opportunities:

- Widespread adoption of IoT connectivity

- Integration of micro PLCs with human machine interface (HMI)

Challenges:

- Increasing security risks

Requirement for compact automation solutions expected to increase demand for micro and nano PLCs

An increasing number of smart factories across the globe are demanding compact, scalable, and flexible automation solutions. These compact automation solutions help companies to control their inventory and reduce transportation cost. In addition, most customers prefer smaller devices that have the same functionality as larger devices for many industrial automation processes. Micro and nano PLCs are smaller in size, faster in speed, and have almost the same capacity as larger PLCs. They provide additional functions in smaller packages and can be used effectively for control applications where the space is limited. The micro and nano PLCs can handle complex sequencing functions and switching of small control devices. Thus, micro and nano PLCs are used for compact automation solutions in various industries such as food & beverages, pharmaceuticals, chemicals, oil & gas, and water & wastewater.

The objectives of the report are as follows:

- To provide a detailed analysis of the micro and nano PLC market based on type, offering, architecture, industry, and geography

- To provide detailed information regarding the major factors influencing the growth of the market

- To give a detailed overview of the value chain in the market and analyzes the market trends on the basis of the Porter's five forces analysis

- To strategically profile key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market leaders.

The micro and nano PLC market is expected to reach USD 8.89 billion by 2022, at a CAGR of 6.9% between 2016 and 2022. The growth of this market is propelled by the growing industrial automation, requirement for compact automation solutions, and growing home and building automation market.

Micro PLC is expected to hold a large share of the overall micro and nano PLC market in 2016. Micro PLC offers various key benefits such as ease of programming, scalability, and smaller size. Furthermore, micro PLCs have a high demand owing to the growing need for compact automation solutions. The nano PLC market is expected to grow at the highest CAGR between 2016 and 2022 owing to its lower cost, greater flexibility, and compact size.

The market for the hardware segment accounted for the largest share of the micro and nano PLC market in 2015. The technological advancement in hardware components and the increasing number of new product launches and developments would increase the adoption of hardware across industries such as automotive, food & beverages, oil & gas, chemicals, and pharmaceuticals, among others. The market for software and services is expected to grow at the highest CAGR between 2016 and 2022. The increasing level of automation at industrial plants has created the need for software to save time in the design of automated control applications and increase the level of safety while handling the equipment.

The modular PLC architecture is expected to hold the largest market size and grow at the highest rate during the forecast period. Modular PLCs are widely used in complex processes. They are easier to troubleshoot and allow some processes to be operational while the issues are being fixed. Furthermore, modular PLCs are designed to customize industrial processes for seamless operations. The fixed PLC market is the second-largest in the global market. Fixed PLC is inexpensive compared to modular PLC and is an ideal solution for compact machineries with limited space and functionality.

The automotive industry dominated the micro and nano PLC market in 2016. The highly competitive automotive sector is one of the early adopters of micro and nano PLCs. The use of micro and nano PLCs helps the industry to save time during assembling, resulting in increased productivity. The market for the food & beverages industry is expected to grow at the highest CAGR between 2016 and 2022. The players in the food & beverages industry are majorly focusing on offering technologically advanced and high-quality products while keeping the production costs low. Thus, there is a growing demand for micro and nano PLCs in the food & beverages industry.

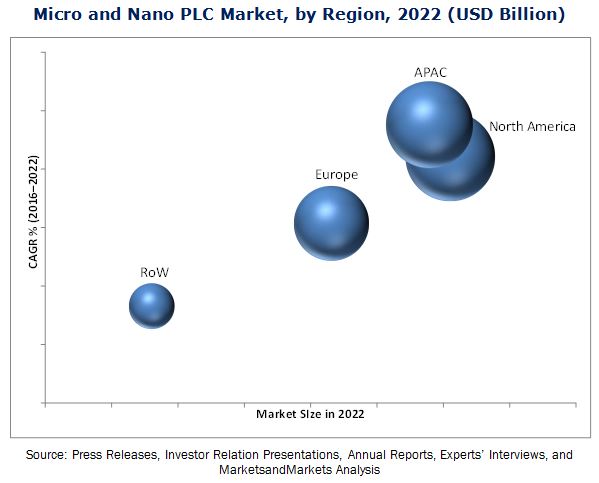

North America accounted for the largest share of the micro and nano PLC market during forecast period. The automation and servicing requirements are shaping the demand for micro and nano PLCs among process industries in this region. Further, supportive government programs, events, and conferences are also driving the growth of the North American market. APAC is expected to be the fastest-growing market in the overall market during the forecast period. The major driving factors for the growth of the APAC market are increased number of manufacturing facilities, aging infrastructure, and trend of smart manufacturing.

Automotive and home & building automation industries are driving the growth of micro and nano PLC market

Automotive:

The micro and nano PLCs are used in automotive industry to mainly create uniform products which results in lower production cost. Micro PLCs and nano PLCs provide an ideal solution to replace relays and automate small processes of automotive manufacturing. In the automotive industry, the micro and nano PLCs control field devices such as sensors, transmitters, and actuators by directly communicating with them. The production line of automobile industry consists of various processes such as assembly, painting, welding, and stamping. Each process requires micro and nano PLCs for controlling their operations.

Home & Building Automation:

Home & building automation is an emerging concept in the market. The micro and nano PLC has huge scope to grow in the home & building automation market. PLCs are majorly used in the lightning control system, parking lot monitoring, HVAC system, and alarm & safety systems. PLC is connected to lighting system via relays. PLC is used for controlling lighting which would minimize the switch wall clutter by replacing it with a low voltage switching solution such as keypad. Further, PLC controls the building’s water system, which determine the water level in the tank and turns off the water feed of the building in case of emergency. One of the most common home automation applications is security system. PLC not only monitors the house but also keeps a check of gas leak, fire, glass break-in, and door break-in when the owner is away from the house.

Critical questions the report answers:

- Where will all the market developments take the industry in the mid to long term?

- What are the upcoming industry applications for micro and nano PLCs?

One of the key restraining factors for the micro and nano PLC market is the additional cost incurred while expanding the I/O capability of micro and nano PLC. The I/O points of micro and nano PLCs are lesser than that of large and medium-sized PLCs. In certain applications, there is a need to expand the number of I/O modules of PLC to accomplish the complex processes which leads to additional cost.

The key market players such as Siemens AG (Germany) and Schneider Electric SE (France) are focusing on strategies such as new product launches and developments, acquisitions, and collaborations to enhance their product offerings and expand their busi

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights - Micro and Nano PLC Market (Page No. - 35)

4.1 Market, 2016–2022

4.2 Market, By Type (2016–2022)

4.3 Market, By Offering (2016–2022)

4.4 Market, By Architecture (2016–2022)

4.5 Market, By Industry and Region

4.6 Market, By Geography

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Offering

5.2.3 By Architecture

5.2.4 By Industry

5.2.5 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Requirement for Compact Automation Solutions

5.3.1.2 Adoption of Regulatory Compliance and Its Increasing Importance

5.3.1.3 Growing Home & Building Automation Market

5.3.2 Restraints

5.3.2.1 Additional Cost Incurred By Expandability of Micro and Nano PLC

5.3.2.2 Fluctuating Oil & Gas Prices

5.3.3 Opportunities

5.3.3.1 Widespread Adoption of IoT Connectivity

5.3.3.2 Integration of Micro PLCs With Human Machine Interface (HMI)

5.3.4 Challenges

5.3.4.1 Increasing Security Risks

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Model

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 Market, By Type (Page No. - 53)

7.1 Introduction

7.2 Micro PLC

7.3 Nano PLC

8 Market, By Offering (Page No. - 69)

8.1 Introduction

8.2 Hardware

8.2.1 Cpu

8.2.2 Memory

8.2.2.1 Executive Memory

8.2.2.2 System Memory

8.2.2.3 I/O Status Memory

8.2.2.4 Data Memory

8.2.2.5 User Memory

8.2.3 Input/Output Modules

8.2.4 Power Supply Unit

8.2.5 Programing Devices

8.3 Software

8.3.1 Programming Software

8.3.2 Simulation Software

8.3.3 Motion Control Software

8.3.4 Redundancy Software

8.4 Services

8.4.1 Installation

8.4.2 Software Upgradation

8.4.3 Training

8.4.4 Maintenance

9 Market Analysis, By Architecture (Page No. - 77)

9.1 Introduction

9.2 Fixed PLC

9.2.1 Advantages of Fixed PLC

9.2.2 Disadvantages of Fixed PLC

9.3 Modular PLC

9.3.1 Advantages of Modular PLC

9.3.2 Disadvantages of Modular PLC

10 Market Analysis, By Industry (Page No. - 82)

10.1 Introduction

10.2 Automotive Industry

10.2.1 General Assembly Line

10.2.2 Painting

10.3 Chemicals & Fertilizers Industry

10.3.1 Batch Process Controlling

10.4 Food & Beverages Industry

10.4.1 Conveyor Control

10.4.2 Separator Control and Monitoring

10.4.3 Bottling Unit Control

10.4.4 Packaging

10.5 Home & Building Automation Industry

10.5.1 Lighting System Control Systems

10.5.2 Water System Control Systems

10.5.3 Security System Control Systems

10.5.4 Parking-Lot Monitoring Systems

10.6 Metals & Mining Industry

10.6.1 Metal Processing

10.6.2 Weighing Control System

10.6.3 Conveyor Belt Control of Open Pit Mining

10.6.4 Mine Drainage System

10.7 Oil & Gas

10.7.1 Upstream

10.7.2 Midstream

10.7.3 Downstream

10.8 Pharmaceutical Industry

10.8.1 Batch Process Control

10.8.2 Packaging

10.9 Pulp & Paper Industry

10.9.1 Control of Batch Digester

10.10 Power

10.10.1 Power Generation

10.10.2 Power Distribution

10.11 Water & Wastewater Industry

10.11.1 Pre-Treatment of Water

10.11.2 Water Distribution System

11 Market, By Geography (Page No. - 101)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.1.1 New Product Launches and Developments Expected to Drive the Market in the U.S.

11.2.2 Canada

11.2.2.1 Optimization of Processes in the Food & Beverages Industry Driving the PLC Market in Canada

11.2.3 Mexico

11.2.3.1 Expansion Plans By Leading Players in the Market

11.3 Europe

11.3.1 U.K.

11.3.1.1 Trend of Automation in the Food & Beverages Industry Driving the Growth of the PLC Market

11.3.2 Germany

11.3.2.1 Emphasis on Various Events to Promote PLC Technology for Smart Manufacturing

11.3.3 France

11.3.3.1 Proactive Steps Taken By the French Government Helping the PLC Market

11.3.4 Rest of Europe

11.3.4.1 New Product Launches Supporting the Growth of the Micro and Nano PLC Market

11.4 Asia-Pacific

11.4.1 China

11.4.1.1 Emphasis on Various Events and Shows to Create Awareness and Promote New Technologies and Equipment of Factory Automation

11.4.2 Japan

11.4.2.1 Transformation of Water & Wastewater Industry With the Help of PLC

11.4.3 India

11.4.3.1 Attractive Mining Sector Driving the Growth of the Market

11.4.4 Rest of APAC

11.4.4.1 Smart Manufacturing Initiative Boosting the Demand for Micro and Nano PLCs

11.5 Rest of the World (RoW)

11.5.1 South America

11.5.1.1 Increasing Presence of Players in the Brazilian Economy Propelling the Market

11.5.2 Middle East

11.5.2.1 Growth of Oil & Gas Industry Creating Huge Growth Avenues for the Micro PLC Market

11.5.3 Africa

11.5.3.1 Advantages of Automation in Africa Driving the Market

12 Competitive Landscape (Page No. - 120)

12.1 Overview

12.2 Market Ranking Analysis of Micro and Nano PLC Manufacturers

12.3 Competitive Situations and Trends

12.3.1 New Product Launches and Developments

12.3.2 Acquisitions, Partnerships, and Collaborations

12.3.3 Expansions

13 Company Profiles (Page No. - 125)

13.1 Introduction

13.2 ABB Ltd.

13.3 Mitsubishi Electric Corporation

13.4 Rockwell Automation Inc.

13.5 Schneider Electric SE

13.6 Siemens AG

13.7 Robert Bosch GmbH (Bosch Rexroth AG)

13.8 General Electric

13.9 IDEC Corporation

13.10 Omron Corporation

13.11 B&R Industrial Automation

14 Appendix (Page No. - 151)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (71 Tables)

Table 1 Micro and Nano PLC Market Segmentation, By Type

Table 2 Market Segmentation, By Offering

Table 3 Market Segmentation, By Architecture

Table 4 Market Segmentation, By Industry

Table 5 Market, By Type, 2013–2022 (USD Million)

Table 6 Micro PLC Market, By Offering, 2013–2022 (USD Million)

Table 7 Micro PLC Market, By Industry, 2013–2022 (USD Million)

Table 8 Micro PLC Market for Automotive Industry, By Region, 2013–2022 (USD Million)

Table 9 Micro PLC Market for Chemical & Fertilizers Industry, By Region, 2013–2022 (USD Million)

Table 10 Micro PLC Market for Food & Beverages Industry, By Region, 2013–2022 (USD Million)

Table 11 Micro PLC Market for Home and Building Automation Idustry, By Region, 2013–2022 (USD Million)

Table 12 Micro PLC Market for Metals & Mining Industry, By Region, 2013–2022 (USD Million)

Table 13 Micro PLC Market for Oil & Gas Industry, By Region, 2013–2022 (USD Million)

Table 14 Micro PLC Market for Pharmaceutical Industry, By Region, 2013–2022 (USD Million)

Table 15 Micro PLC Market for Pulp & Paper Industry, By Region, 2013–2022 (USD Million)

Table 16 Micro PLC Market for Power Industry, By Region, 2013–2022 (USD Million)

Table 17 Micro PLC Market for Water & Wastewater Industry, By Region, 2013–2022 (USD Million)

Table 18 Micro PLC Market, By Region, 2013–2022 (USD Million)

Table 19 Nano PLC Market, By Offering, 2013–2022 (USD Million)

Table 20 Nano PLC Market, By Industry, 2013–2022 (USD Million)

Table 21 Nano PLC Market for Automotive Industry, By Region, 2013–2022 (USD Million)

Table 22 Nano PLC Market for Chemicals & Fertilizers Industry, By Region, 2013–2022 (USD Million)

Table 23 Nano PLC Market for Food & Beverages Industry, By Region, 2013–2022 (USD Million)

Table 24 Nano PLC Market for Home & Building Automation, By Region, 2013–2022 (USD Million)

Table 25 Nano PLC Market for Metals & Mining Industry, By Region, 2013–2022 (USD Million)

Table 26 Nano PLC Market for Oil & Gas Industry, By Region, 2013–2022 (USD Million)

Table 27 Nano PLC Market for Pharmaceuticals Industry, By Region, 2013–2022 (USD Million)

Table 28 Nano PLC Market for Pulp & Paper Industry, By Region, 2013–2022 (USD Million)

Table 29 Nano PLC Market for Power Industry, By Region, 2013–2022 (USD Million)

Table 30 Nano PLC Market for Water & Wastewater Industry, By Region, 2013–2022 (USD Million)

Table 31 Nano PLC Market, By Region, 2013–2022 (USD Million)

Table 32 Micro and Nano PLC Market, By Offering, 2013–2022 (USD Million)

Table 33 Market, By Architecture, 2013–2022 (USD Million)

Table 34 Market, By Industry, 2013–2022 (USD Million)

Table 35 Market for Automotive Industry, By Type, 2013–2022 (USD Million)

Table 36 Market for Automotive Industry, By Region, 2013–2022 (USD Million)

Table 37 Market for Chemicals and Fertilizers Industry, By Type, 2013–2022 (USD Million)

Table 38 Market for Chemicals and Fertilizers Industry, By Region, 2013–2022 (USD Million)

Table 39 Market for Food & Beverages Industry, By Type, 2013–2022 (USD Million)

Table 40 Micro and Nano PLC Market for Food & Beverages Industry, By Region, 2013–2022 (USD Million)

Table 41 Market for Home & Building Automation Industry, By Type, 2013–2022 (USD Million)

Table 42 Market for Home & Building Automation Industry, By Region, 2013–2022 (USD Million)

Table 43 Market for Metal & Mining Industry, By Type, 2013–2022 (USD Million)

Table 44 Market for Metal & Mining Industry, By Region, 2013–2022 (USD Million)

Table 45 Market for Oil & Gas Industry, By Type, 2013–2022 (USD Million)

Table 46 Market for Oil & Gas Industry, By Region, 2013–2022 (USD Million)

Table 47 Micro and Nano PLC Market for Pharmaceuticals Industry, By Type, 2013–2022 (USD Million)

Table 48 Market for Pharmaceuticals Industry, By Region, 2013–2022 (USD Million)

Table 49 Market for Pulp & Paper Industry, By Type, 2013–2022 (USD Million)

Table 50 Market for Pulp & Paper Industry, By Region, 2013–2022 (USD Million)

Table 51 Market for Power Industry, By Type, 2013–2022 (USD Million)

Table 52 Market for Power Industry, By Region, 2013–2022 (USD Million)

Table 53 Market for Water & Wastewater Industry, By Type, 2013–2022 (USD Million)

Table 54 Market for Water & Wastewater Industry, By Region, 2013–2022 (USD Million)

Table 55 Micro and Nano PLC Market, By Region, 2013–2022 (USD Million)

Table 56 Market in North America, By Country, 2013–2022 (USD Million)

Table 57 Market in North America, By Type, 2013–2022 (USD Million)

Table 58 Market in North America, By Industry, 2013–2022 (USD Million)

Table 59 Market in Europe, By Country, 2013–2022 (USD Million)

Table 60 Market in Europe, By Type, 2013–2022 (USD Million)

Table 61 Market in Europe, By Industry, 2013–2022 (USD Million)

Table 62 Micro and Nano PLC Market in APAC, By Country, 2013–2022 (USD Million)

Table 63 Market in APAC, By Type, 2013–2022 (USD Million)

Table 64 Market in APAC, By Industry, 2013–2022 (USD Million)

Table 65 Market in RoW, By Region, 2013–2022 (USD Million)

Table 66 Market in RoW, By Type, 2013–2022 (USD Million)

Table 67 Market in RoW, By Industry, 2013–2022 (USD Million)

Table 68 Ranking of Top Five Players: Market, 2015

Table 69 New Product Launches and Developments, 2014–2016

Table 70 Acquisitions, Partnerships, and Collaborations, 2014–2016

Table 71 Expansions, 2014–2016

List of Figures (75 Figures)

Figure 1 Market: Research Design

Figure 2 Bottom-Up Approach to Arrive at the Market Size

Figure 3 Top-Down Approach to Arrive at the Market Size

Figure 4 Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Micro and Nano PLC Market Segmentation

Figure 7 Micro PLC to Hold the Largest Share of the Market in 2016

Figure 8 Hardware Segment Expected to Lead the Market During the Forecast Period

Figure 9 Modular PLC Market to Hold the Largest Share and Grow at the Highest Rate Between 2016 and 2022

Figure 10 Market for the Food & Beverages Industry Expected to Grow at A High Rate Between 2016 and 2022

Figure 11 North America to Hold the Largest Market Share in 2016

Figure 12 Attractive Growth Opportunities in the Market Between 2016 and 2022

Figure 13 Nano PLC Market Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 14 Hardware Segment Expected to Lead the Market During the Forecast Period

Figure 15 Modular PLC to Hold the Largest Share of the Market in 2016

Figure 16 Automotive Industry Expected to Hold the Largest Share of the Global Market in 2016

Figure 17 U.S. to Hold the Largest Share of the Market in 2016

Figure 18 Market Segmentation, By Geography

Figure 19 Droc: Micro and Nano PLC Market

Figure 20 Oil Prices (USD Per Barrel): 2014 to 2016

Figure 21 Value Chain Analysis: Major Value is Added During the Manufacturing and System Integration Stages

Figure 22 Market: Porter’s Five Forces Analysis, 2016

Figure 23 Bargaining Power of Buyers Expected to Have A High Impact

Figure 24 Low Switching Cost for Consumers Leading to Medium Impact of Competition

Figure 25 Low Performance of Pc-Based Control Leading to Low Impact of Threat of Substitutes

Figure 26 High Consumer Adoption Leading to High Impact of Bargaining Power of Buyers

Figure 27 Less Product Differentiation Leading to Medium Impact of Bargaining Power of Suppliers

Figure 28 Requirement of Robust R&D Unit Leading to Medium Impact of Threat of New Entrants

Figure 29 Market Segmentation, By Type

Figure 30 Automotive Industry Held the Largest Market for the Micro PLC Market During Forecast Period

Figure 31 APAC Expected to Grow at the Highest Rate in the Micro PLC Market for the Metal & Mining Industry During Forecast Period

Figure 32 North America Held the Largest Share of the Micro PLC Market in 2015

Figure 33 North America Expected to Hold the Largest Size of the Nano PLC Market for Food & Beverages Industry During the Forecast Period

Figure 34 APAC to Grow at the Highest Rate in the Nano PLC Market for Pulp & Paper Industry Between 2016 and 2022

Figure 35 Micro and Nano PLC Market Segmentation, By Offering

Figure 36 Hardware Expected to Hold A Large Size of the Market Between 2016 and 2022

Figure 37 Market Segmentation, By Hardware

Figure 38 Operating Cycle of CPU

Figure 39 Market Segmentation, By Hardware

Figure 40 Market Segmentation, By Service

Figure 41 Market Segmentation, By Architecture

Figure 42 Modular PLC Expected to Lead the Global Market Between 2016 and 2022

Figure 43 Architecture of Fixed PLC

Figure 44 Architecture of Modular PLC

Figure 45 Market Segmentation, By Industry

Figure 46 APAC Expected to Hold the Largest Size of the Market for Automotive Industry During Forecast Period

Figure 47 Nano PLC Market Expected to Grow at the Highest Rate in the Food & Beverages Industry Between 2016 and 2022

Figure 48 Nano PLC to Grow at A High Rate in the Market for Home and Building Automation Industry Between 2016 and 2022

Figure 49 APAC to Hold the Largest Market for the Micro and Nano PLC in Metal & Mining Industry in 2016

Figure 50 Micro PLC Dominated Pharmaceuticals Industry During Forecast Period

Figure 51 APAC Expected to Dominate the Market for Power Industry During Forecast Period

Figure 52 Market in China to Grow at the Highest Rate During the Forecast Period

Figure 53 Snapshot of Micro and Nano PLC Market in North America: Demand to Be Driven By the Increasing Factory Automation in the Region

Figure 54 U.S. to Dominate the North American Market During the Forecast Period

Figure 55 Germany Projected to Grow at the Highest Rate in the European Market Between 2016 and 2022

Figure 56 Snapshot of the Market in Asia-Pacific: China Expected to Drive the Growth of the Market

Figure 57 China Dominated the APAC Market in 2015

Figure 58 Middle East Expected to Lead the Market in RoW Between 2016 and 2022

Figure 59 Companies Adopted New Product Launches & Developments as A Key Growth Strategy Between 2014 and 2016

Figure 60 Battle for Market Share: New Product Launches & Developments Were the Key Strategies

Figure 61 Geographic Revenue Mix of the Top 5 Players (2015)

Figure 62 ABB Ltd.: Company Snapshot

Figure 63 ABB Ltd.: SWOT Analysis

Figure 64 Mitsubishi Electric Corp.: Company Snapshot

Figure 65 Mitsubishi Electric Corp.: SWOT Analysis

Figure 66 Rockwell Automation Inc.: Company Snapshot

Figure 67 Rockwell Automation Inc.: SWOT Analysis

Figure 68 Schneider Electric SE : Company Snapshot

Figure 69 Schneider Electric SE : SWOT Analysis

Figure 70 Siemens AG : Company Snapshot

Figure 71 Siemens AG: SWOT Analysis

Figure 72 Robert Bosch GmbH: Company Snapshot

Figure 73 General Electric Company: Company Snapshot

Figure 74 IDEC Corp.: Company Snapshot

Figure 75 Omron Corporation: Company Snapshot

Research Methodology:

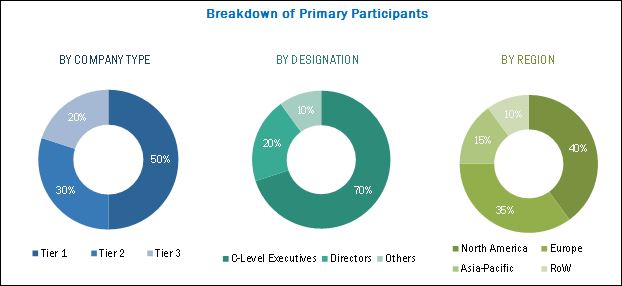

The research methodology used to estimate and forecast the micro and nano PLC market begins with capturing data on key vendor revenues through secondary research such as IEEE journals, automation world magazines, manufacturing automation magazine, and leading players’ newsletters. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through the primary research by conducting extensive interviews of people holding key positions such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The micro and nano PLC ecosystem comprises component providers, OEMs, system integrators, software providers, and distributors. The players involved in the development of micro and nano PLC include Siemens AG (Germany), Schneider Electric SE (France), Rockwell Automation Incorporation (U.S.), Mitsubishi Electric Corporation, and Omron Corp. (Japan), among others as well as associations such as Institute of Electrical and Electronics Engineers (IEEE) and International Society of Automation (ISA).

Major Market Developments:

- In May 2016, Rockwell Automation Inc. launched CompactLogix 5380 in the Logix series. The Allen-Bradley CompactLogix 5380 controller improves I/O response time as fast as 0.2 milliseconds which help to increase the production in the manufacturing industry.

- In May 2016, IDEC Corp. launched Microsmart FC6A, a micro PLC with up to 520 I/O. It has fast processing speed, high-capacity programing and data memory, and the ability to handle up to 126 analog I/O. this product is well suited for oil & gas, chemicals, solar, packaging, and food and beverages industries.

- In February 2015, Siemens AG expanded its portfolio of advanced controllers in the SIMATIC S7-1500 family with the addition of two particularly compact controllers, namely, SIMATICS7-1511C and S7-1512C. These two controllers combine CPU with inputs and outputs in one enclosure.

Target Audience of the Report:

- Associations, organizations, forums, and alliances

- Component manufacturers

- Distributors and traders

- Original equipment manufacturers

- Process industries such as oil and gas, power, chemical, and pharmaceuticals, among others

- Research organizations and consulting companies

- Semiconductor product designers and fabricators

- Software and service providers

- System integrators

- Technology investors

- Technology solution providers

Scope of the Report:

This research report categorizes the global micro and nano PLC market on the basis of type, offering, architecture, industry, and geography.

Market, by Type:

- Micro PLC

- Nano PLC

Market, by Offering:

- Hardware

- Software

- Services

Market, by Architecture:

- Fixed PLC

- Modular

Micro and Nano PLC Market, by Industry:

- Automotive

- Chemicals & Fertilizers

- Food &Beverages

- Home & Building Automation

- Metals & Mining

- Oil & Gas

- Pharmaceuticals

- Pulp & Paper

- Power

- Water & Wastewater

Market, by Geography:

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers:

- What are new application areas which the micro and nano PLC manufacturers are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Micro and Nano PLC Market