Motor Control Centers Market by Type (Intelligent, Conventional), Voltage (Low, Medium), End-User, Standard, Component, Region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa) - Global Forecast to 2025

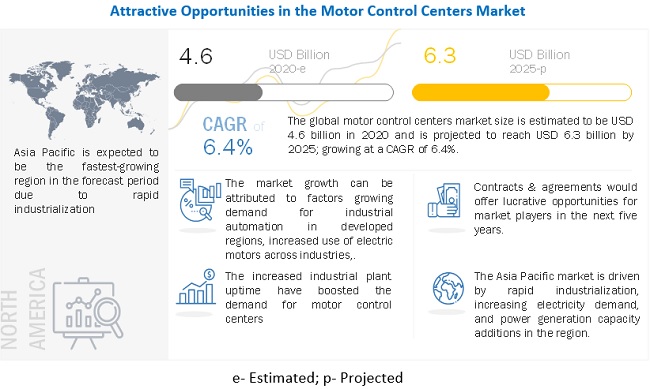

The global motor control centers market was valued at an estimated USD 4.6 billion in 2020 and is projected to reach USD 6.3 billion by 2025, at a CAGR of 6.4% during the forecast period. The growth is attributed to the growing demand for industrial automation in developed regions, increased use of electric motors in key industries, booming power sector, and augmented power generation capacities globally.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Motor Control Centers Market

The COVID-19 outbreak is profoundly affecting both the service and manufacturing sectors alike. With more and more countries resorting to nationwide lockdowns to prevent a further spike in the spread of the disease, the global economy has slowed down. In this context, the motor control centers market is expected to be affected in the short term owing to the shutting down of non-essential manufacturing sectors and other commercial sectors. The motor control centers used by the industrial and commercial end-users are expected to take the maximum hit in 2020. According to the World Bank, it is too early to gauge the depth and duration of this pandemic in the global economy; however, it is certain that the outbreak will have a short-term impact on all sections of the market.

Motor Control Centers Market Dynamics

Driver: Growing demand for automation in developed nations

Technological improvements have resulted in high levels of automation in manufacturing facilities. All the manufacturing plants are competing to meet efficiency and safety standards, attain optimum productivity, and maintain competitive product pricing. This has led to industries automating their operations through intelligent motor control equipment, such as motor control centers. This has further resulted in an increased demand for motor control centers in developed regions. Developed regions, such as North America and Europe, are currently emphasizing more on automation to decrease labor cost, and simultaneously enhance the efficiency of their manufacturing plants.

The motor control centers market is driven by the growing adoption of intelligent motor control centers that offer diagnostic capabilities, loss detection, and predictive maintenance features. The cement & manufacturing industries rely heavily on low voltage electrical motors. The motor control centers integrated with process control and smart motor devices can deliver better performance in energy-intensive applications. In the pharmaceutical industry, the entire plant system communicates through an Ethernet network integrated with motor control centers to control pumps and agitators used in the manufacturing process. In the chemical & petrochemical industry, electric motors are used to drive compressors, pumps, fans, agitators, extruders, packing machines, and conveyor belts. Companies/industries such as chemical, plastics & rubber, industrial gases, or fine chemicals involve continuous manufacturing process operations, where motor control centers provide an efficient solution for controlling electric motors throughout the complete chemical production facility from a centralized location. Hence, the introduction of automation in various industries is likely to drive the demand for motor control centers.

Restraints: Decreasing crude oil prices leading to reduced investments in the oil & gas industry

The oil & gas industry is one of the leading end-user industries of motor control centers. The recent downturn in crude oil prices has resulted in a steep fall in capital budgets, reducing the demand for industrial equipment. Though the crude oil prices witnessed a bit of an increase in 2017–2018, it is still decreasing in the current fiscal, that is, 2018–2019. This has left the oil & gas companies focusing more on improving operational efficiency with the same equipment instead of buying newer and more efficient products. Companies are working on streamlining operations by improving operational efficiency and working with fewer resources after the industry overcomes the current oil price situation.

The decline in crude oil prices can be attributed to the increasing oil supply from the US and OPEC countries, such as Saudi Arabia, and the lifting of sanctions against Iran in 2016. This has resulted in a decline in investments from the oil & gas industry, which is expected to act as a restraint for the motor control centers market.

Opportunities: Rising demand for smart and integrated motor control and protection devices

Generally, motor control centers are of 2 types, namely, conventional and intelligent motor control centers. Conventional motor control centers consist of components such as variable speed drives, relays, and circuit breakers for speed control and motor protection functions as per requirements. These devices are relatively simple and are based on conventional analog or electromechanical technology. However, the advancements in microprocessor technology have improved motor control and protection functions. With rising automation and technology upgrades in industries, the demand for smart devices, such as intelligent motor control centers, has increased. These intelligent devices have features such as faster response time, advanced diagnostics, precise control, and remote control and monitoring. Moreover, intelligent motor control centers minimize the number of components required, as many functions are integrated into a single intelligent device.

The use of such intelligent motor control centers leads to reduced downtime and higher efficiency, and it is mostly expected to decrease human intervention. Industries, such as oil & gas, water & wastewater, metal processing, cement, and food & beverage, have critical processes employing a large number of motors that demand precise control during operation. Intelligent motor control centers not only provide precise motor control but better protection and enhanced communication capabilities too. The current market trend is moving toward finding effective ways to increase integration between processes across industrial systems. Thus, the ongoing pursuit of such integration is expected to boost the growth of the motor control centers market.

Challenges: Heavy initial investments and higher cost compared to its counterparts

Installing motor control centers might be a relatively simple task, but at the same time, it requires high capital investment. This makes it difficult for the utilities and end-users to install them. Furthermore, the utilities, especially in the developing regions such as India, China, and Sri Lanka, face high expenses due to high Aggregate Technical & Commercial (AT&C) losses, which burdens them with more monetary losses. Small and medium scale industries also refrain from installing motor control centers because of the high investment required against a single panel operation. Thus, heavy initial investments and higher cost than its counterparts tend to be a challenge for the motor control centers market.

To know about the assumptions considered for the study, download the pdf brochure

The conventional motor control centers segment is expected to be the largest contributor to the motor control centers market, by type, during the forecast period

The motor control centers market, by type, is segmented into conventional motor control centers and intelligent motor control centers. The conventional motor control centers segment is projected to hold the largest market share by 2025. Growing demand for industrial automation in developed regions and advantages offered by conventional motor control centers such as high level of safety, easy expansion and modification, quick and smooth maintenance, and enhanced reliability and operability are the key factors driving the demand for the conventional motor control centers during the forecast period.

The low voltage segment is expected to be the fastest growing market during the forecast period

The motor control centers market, by voltage, is segmented into low voltage and medium voltage. Low voltage motor control centers are highly preferred because of their widespread adoption in various industries across the globe, which is likely to boost demand for the low voltage motor control centers during the forecast period.

The circuit breakers & fuses segment is expected to be the fastest growing motor control centers market, by component, during the forecast period

The motor control centers market has been categorized, on the basis of component, into busbars, circuit breakers & fuses, overload relays, variable speed drives, soft starters, and others (push buttons, indicator lights, metal cabinet sections, disconnecting switches, feeders, meters, pilot lamps, and terminal blocks). The growing power distribution & transmission industry and growth in the related and complementary markets, such as switchgears and transformers, are likely to boost the motor control centers market.

Adoption of increased efficiency and low power consuming electrical equipment around the globe are driving the IEC standard motor control center market, by standard, during the forecast period

The motor control centers market is typically segmented into IEC, NEMA and others (UL, IEEE, and NFPA) on the basis of standard. IEC is a widely used standard for motor control centers. The increasing acceptance of IEC standard across the globe is likely to drive the market growth for motor control centers.

The industrial segment is expected to lead in the motor control centers market during the forecast period

The motor control centers market, by end-user, is segmented into industrial and commercial. The global trend of motorized automation across industrial segments is expected to boost the market growth for motor control centers.

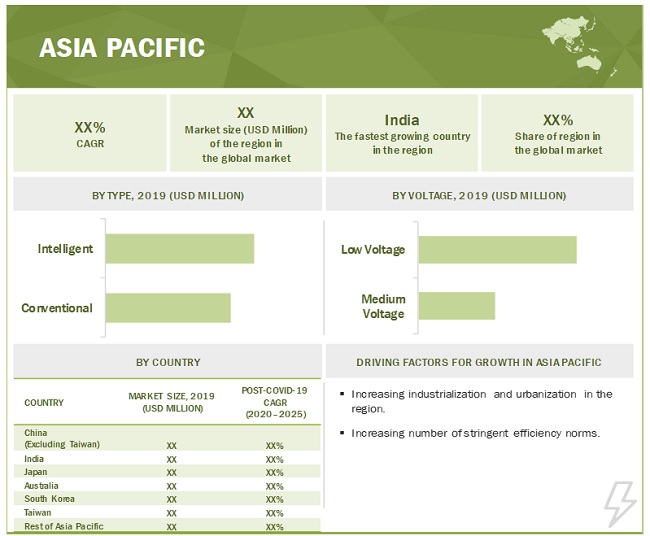

Asia Pacific is expected to be the largest motor control centers market during the forecast period

In this report, the motor control centers market has been analyzed with respect to 5 regions, namely, Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Asia Pacific is estimated to be the largest market from 2020 to 2025. It is expected to see high demand for motor control centers owing to the growing urbanization and industrialization in the region. Also, the increasing power generation capacity addition and electricity demand are further expected to boost the motor control centers market in the region.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, voltage, component, standard, end-user, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and the Middle East & Africa |

|

Companies covered |

Rockwell Automation (US), ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Eaton (Ireland), Fuji Electric (Japan), WEG (Brazil), Mitsubishi Electric (Japan), Larsen & Toubro (India), Vidhyut Electric (India), TES (UK), Rittal (Germany), Technical Controls (UK), Tesco Control (US), LSIS (South Korea), WEG (Brazil) |

This research report categorizes the motor control centers marker by type, voltage, component, standard, end-user, and region.

The motor control centers market, by type, has been segmented as follows:

- Conventional (by voltage (low and medium))

- Intelligent (by voltage (low and medium))

The motor control centers market, by voltage, has been segmented as follows:

- Low Voltage

- Medium Voltage

The motor control centers market, by standard, has been segmented as follows:

- NEMA (by voltage (low and medium))

- IEC (by voltage (low and medium))

- Others (UL, IEEE, and NFPA) (by voltage (low and medium))

The motor control centers market, by component, has been segmented as follows:

- Busbars (by voltage (low and medium))

- Circuit Breakers and Fuses (by voltage (low and medium))

- Overload Relays (by voltage (low and medium))

- Variable Speed Drives (by voltage (low and medium))

- Soft Starters (by voltage (low and medium))

- Others (pushbuttons, indicator lights, metal cabinet sections, disconnecting switches, feeders, meters, and pilot lamps) (by voltage (low and medium))

The motor control centers market, by end-user, has been segmented as follows:

-

Industrial (by voltage (low and medium))

- Oil & Gas

- Metals & Mining

- Utilities

- Chemical & Petrochemical

- Cement & Manufacturing

- Food & Beverage

- Others (pulp& paper, water & wastewater, automobile, and pharmaceutical)

- Commercial (by voltage (low and medium))

The motor control centers market, by region, has been segmented as follows:

- Asia Pacific

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In June 2019, Schneider Electric launched motor control centers with arc flash isolation design, which helps to prevent arc flash caused by extinguishing, originating, and containing the arc energy.

- In June 2019, Fuji Electric acquired the entire share of Consul Neowatt Power Solutions, which is a major power electronics manufacturer in the country. Consul Neowatt Power Solutions is among the leading manufacturers of uninterruptible power supply system in India.

- In April 2019, TES signed a contract with Irish Water for the provision of monitoring and control equipment associated with water & wastewater assets, including related civil engineering works.

- In January 2019, Rittal signed a contract to provide power distribution and motor control center systems for a replacement drives panel at a steel mill in the North of England.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What is the current size of the motor control centers market?

The current market size of global motor control centers market is USD 5.1 billion in 2019.

What is the major drivers for motor control centers market?

Growing demand for industrial automation in developed regions, increased use of electric motors in key industries, booming power sector, and augmented power generation capacities globally drive the motor control centers market.

Which is the fastest growing region during the forecasted period in motor control centers market?

Asia Pacific is the fastest growing region during the forecasted period owing to increasing urbanization, industrialization.

Which is the fastest growing segment, during the forecasted period in motor control centers market?

The circuit breaker & fuses, by component is the fastest growing segment during the forecasted period owing to growing power distribution & transmission industry and growth in the related and complementary markets, such as switchgears and transformers.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.3 MOTOR CONTROL CENTERS MARKET, BY VOLTAGE: INCLUSIONS VS. EXCLUSIONS

1.4 MOTOR CONTROL CENTERS MARKET, BY END USER: INCLUSIONS VS. EXCLUSIONS

1.5 MARKET SCOPE

1.5.1 MARKETS COVERED

1.5.2 REGIONAL SCOPE

1.5.3 YEARS CONSIDERED

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

1.9.1 DEMAND HAS NOT INCREASED AS EXPECTED

2 RESEARCH METHODOLOGY

2.1 SCOPE

2.2 MARKET SIZE ESTIMATION

2.2.1 DEMAND-SIDE ANALYSIS

2.2.1.1 Calculation

2.2.1.2 Assumptions

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.3 SUPPLY-SIDE ANALYSIS

2.3.3.1 Assumptions

2.3.3.2 Calculation

2.3.4 FORECAST

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

2.5 PRIMARY INSIGHTS

3 EXECUTIVE SUMMARY

3.1 PRE- AND POST-COVID-19 SCENARIO ANALYSIS

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN THE MOTOR CONTROL CENTERS MARKET

4.2 MOTOR CONTROL CENTERS MARKET, BY TYPE

4.3 MOTOR CONTROL CENTERS MARKET, BY VOLTAGE50

4.4 MOTOR CONTROL CENTERS MARKET, BY END-USER

4.5 MOTOR CONTROL CENTERS MARKET, BY STANDARD

4.6 MOTOR CONTROL CENTERS MARKET, BY COMPONENT

4.7 MOTOR CONTROL CENTERS MARKET, BY REGION

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

5.3 ROAD TO RECOVERY

5.4 COVID-19 ECONOMIC ASSESSMENT

5.5 MARKET DYNAMICS

5.5.1 DRIVERS

5.5.1.1 Growing demand for automation in developed nations

5.5.1.2 Increased demand for motor control centers in large manufacturing plants and other industries

5.5.1.3 Supportive government regulations promoting energy savings across industries

5.5.1.4 Industries aiming at high reliability and reducing plant downtime

5.5.2 RESTRAINTS

5.5.2.1 Decreasing crude oil prices leading to reduced investments in the oil & gas industry

5.5.3 OPPORTUNITIES

5.5.3.1 Replacement of old & aging infrastructure

5.5.3.2 Rising demand for smart and integrated motor control and protection devices

5.5.4 CHALLENGES

5.5.4.1 Heavy initial investments and higher cost compared to its counterparts

5.5.4.2 Motor control centers' maintenance complexities

5.5.4.3 Impact of COVID-19 on market

5.6 ADJACENT AND INTERCONNECTED MARKETS

6 MOTOR CONTROL CENTERS MARKET, BY TYPE

6.1 INTRODUCTION

6.1.1 BY LOW VOLTAGE

6.1.2 BY MEDIUM VOLTAGE

6.2 INTELLIGENT

6.2.1 INCREASE IN AUTOMATION IN DEVELOPED REGIONS IS EXPECTED TO INCREASE THE DEMAND FOR INTELLIGENT MOTOR CONTROL CENTERS

6.3 CONVENTIONAL

6.3.1 CONVENTIONAL MOTOR CONTROL CENTERS HELD A HIGHER MARKET SHARE IN 2019

7 MOTOR CONTROL CENTERS MARKET, BY VOLTAGE

7.1 INTRODUCTION

7.2 LOW VOLTAGE

7.2.1 INCREASING LOW VOLTAGE MOTORS FOR INDUSTRIAL USAGE ARE ENHANCING THE NEED FOR LOW VOLTAGE MOTOR CONTROL CENTERS

7.3 MEDIUM VOLTAGE

7.3.1 INCEPTION OF LARGE WATER TREATMENT PLANTS AND UTILITIES GLOBALLY IS LIKELY TO INCREASE DEMAND FOR MEDIUM VOLTAGE MOTOR CONTROL CENTERS

8 MOTOR CONTROL CENTERS MARKET, BY END USER

8.1 INTRODUCTION

8.1.1 BY LOW VOLTAGE

8.1.2 BY MEDIUM VOLTAGE

8.2 INDUSTRIAL

8.2.1 OIL & GAS

8.2.1.1 Oil & gas industry in North America is growing due to increased investments in the exploration & production operations corresponding to shale oil & gas

8.2.2 CHEMICALS & PETROCHEMICALS

8.2.2.1 Chemical industries in Asia Pacific region are increasing owing to availability of cheap labor

8.2.3 METALS & MINING

8.2.3.1 Growth in the metals & mining industry would positively impact the market

8.2.4 CEMENT & MANUFACTURING

8.2.4.1 Growth of cement industry is driven by the increased infrastructural projects worldwide

8.2.5 UTILITIES

8.2.5.1 Revamping aging infrastructure and increasing need for energy efficiency would drive the utilities segment of the market

8.2.6 FOOD & BEVERAGES

8.2.6.1 Food & beverages industry is majorly expected to grow in developed regions

8.2.7 WATER & WASTEWATER

8.2.7.1 Increasing need for treating wastewater for protecting water bodies is driving wastewater treatment plants around the globe

8.2.8 PUBLIC CONSTRUCTION

8.2.8.1 Increasing number of public constructions majorly in developing regions are expected to drive market

8.3 COMMERCIAL

8.3.1 INCREASING NUMBER OF COMMERCIAL BUILDINGS GLOBALLY ARE EXPECTED TO DRIVE THE MARKET

9 MOTOR CONTROL CENTERS MARKET, BY STANDARD

9.1 INTRODUCTION

9.2 IEC

9.2.1 DEMAND FOR INCREASED OVERALL EFFICIENCY IS EXPECTED TO DRIVE THE IEC STANDARD MARKET

9.3 NEMA

9.3.1 INCREASING INDUSTRIALIZATION IN DEVELOPING NATIONS IS EXPECTED TO BENEFIT NEMA STANDARDS’ SHARE IN MOTOR CONTROL CENTERS99

9.4 OTHERS

9.4.1 RISING REGIONAL REGULATIONS IN DEVELOPED REGIONS WOULD HELP OTHER STANDARDS TO GROW DURING THE FORECAST PERIOD

10 MOTOR CONTROL CENTERS MARKET, BY COMPONENT

10.1 INTRODUCTION

10.1.1 BY LOW VOLTAGE

10.1.2 BY MEDIUM VOLTAGE

10.2 BUSBARS

10.2.1 NEED FOR SIMPLER DESIGN LAYOUT OF MOTOR CONTROL CENTERS IS EXPECTED TO DRIVE THE SEGMENT DURING THE FORECAST PERIOD

10.3 CIRCUIT BREAKERS & FUSES

10.3.1 CIRCUIT BREAKER DE-ENERGIZES EQUIPMENT FOR SAFETY AND PRTECTION OF MOTOR CONTROL CENTERS AND CONNECTED APPARATUS

10.4 OVERLOAD RELAYS

10.4.1 RELAYS ARE SENSING DEVICES THAT OPERATE THE CIRCUIT BREAKER FOR SAFETY AND PROTECTION OF THE CONNECTED MOTORS

10.5 VARIABLE SPEED DRIVES

10.5.1 NEED FOR VARIABLE SPEED OUTPUT IS EXPECTED TO INCREASE THE REQUIREMENT FOR VARIABLE SPEED DRIVES IN MOTOR CONTROL CENTERS

10.6 SOFT STARTERS

10.6.1 SOFT STARTERS LIMIT CURRENT FOR SAFELY STARTING A MOTOR

10.7 OTHERS

10.7.1 SUPPORTING COMPONENTS ARE AN INTEGRAL PART OF MOTOR CONTROL CENTERS

11 MOTOR CONTROL CENTERS MARKET, BY REGION

11.1 INTRODUCTION

11.2 ASIA PACIFIC

11.2.1 BY END USER

11.2.1.1 By low voltage

11.2.2 BY VOLTAGE

11.2.3 BY TYPE

11.2.3.1 By low voltage

11.2.3.2 By medium voltage

11.2.4 BY COMPONENT

11.2.4.1 By low voltage

11.2.4.2 By medium voltage

11.2.5 BY COUNTRY

11.2.5.1 China

11.2.5.1.1 Strong economic growth and supportive government policies for the growing industrialization are expected to drive the Chinese market

11.2.5.2 India

11.2.5.2.1 Increased manufacturing and industrialization along with need for enhanced efficiency of the manufacturing plants are driving the motor control centers market during the forecast period

11.2.5.3 Australia

11.2.5.3.1 Australian mining activities are expected to drive the Australian market during the forecast period

11.2.5.4 Japan

11.2.5.4.1 Growing industrial production toward enhanced manufacturing practices are expected to drive the Japanese market

11.2.5.5 Taiwan

11.2.5.5.1 Growing manufacturing and commercial activities are driving the need for motor control centers in the country

11.2.5.6 South Korea

11.2.5.6.1 Improved shipbuilding and manufacturing industries would require a sizable quantity of motor control centers

11.2.5.7 Rest of Asia Pacific

11.2.5.7.1 Government plans to reduce carbon emissions are likely to help the motor control centers to grow in the region

11.3 NORTH AMERICA

11.3.1 BY END USER

11.3.1.1 By low voltage

11.3.1.2 By medium voltage

11.3.2 BY VOLTAGE

11.3.3 BY TYPE

11.3.3.1 By low voltage

11.3.3.2 By medium voltage

11.3.4 BY COMPONENT

11.3.4.1 By low voltage

11.3.4.2 By medium voltage

11.3.5 BY COUNTRY

11.3.5.1 US

11.3.5.1.1 Increasing automation in manufacturing plants and oil & gas exploration is expected to drive the US market

11.3.5.2 Canada

11.3.5.2.1 High growth in the construction and oil & gas industries is expected to drive the Canadian market

11.3.5.3 Mexico

11.3.5.3.1 Rising investments in the petroleum industry along with increased industrialization are driving the motor control centers market during the forecast period

11.3.5.4 Cuba

11.3.5.4.1 Investments in the mining operations would help in the growth of the Cuban market

11.4 EUROPE

11.4.1 BY END USER

11.4.1.1 By low voltage

11.4.1.2 By medium voltage

11.4.2 BY VOLTAGE

11.4.3 BY TYPE

11.4.3.1 By low voltage

11.4.3.2 By medium voltage

11.4.4 BY COMPONENT

11.4.4.1 By low voltage

11.4.4.2 By medium voltage

11.4.5 BY COUNTRY

11.4.5.1 Germany

11.4.5.1.1 Increasing automation and construction in the region would lead to an increased demand for motor control centers

11.4.5.2 UK

11.4.5.2.1 Need for processing wastewater for sustainability is expected to help the market grow

11.4.5.3 France

11.4.5.3.1 Refurbishment and addition of electricity T&D are expected to help in the growth of the market

11.4.5.4 Italy

11.4.5.4.1 Ongoing investments in the chemical industry would lead to a higher demand for motor control centers in the country

11.4.5.5 Spain

11.4.5.5.1 Increased automation in the chemical and pharmaceutical industries indicate growing need for motor control centers

11.4.5.6 Rest of Europe

11.4.5.6.1 Aimed reduction in carbon emissions is expected to drive the market

11.5 SOUTH AMERICA

11.5.1.1 By low voltage

11.5.1.2 By medium voltage

11.5.2 BY VOLTAGE

11.5.3 BY TYPE

11.5.3.1 By low voltage

11.5.3.2 By medium voltage

11.5.4 BY COMPONENT

11.5.4.1 By low voltage

11.5.4.2 By medium voltage

11.5.5 BY COUNTRY

11.5.5.1 Brazil

11.5.5.1.1 Augmented investments in the utilities and oil & gas sector are expected to drive the market in the country

11.5.5.2 Argentina

11.5.5.2.1 Enhancement of power generation sector of the country is expected to increase its need for motor control centers

11.5.5.3 Chile

11.5.5.3.1 Upcoming investments in mining sector would increase the demand for motor control centers in the country

11.5.5.4 Rest of South America

11.5.5.4.1 Developing utilities and investments are expected to drive the market in the region

11.6 MIDDLE EAST & AFRICA

11.6.1 BY END USER

11.6.1.1 By low voltage

11.6.1.2 By medium voltage

11.6.2 BY VOLTAGE

11.6.3 BY TYPE

11.6.3.1 By low voltage

11.6.3.2 By medium voltage

11.6.4 BY COMPONENT

11.6.4.1 By low voltage

11.6.4.2 By medium voltage

11.6.5 BY COUNTRY

11.6.5.1 Saudi Arabia

11.6.5.1.1 Oil & gas exploration and production, along with a growing number of wastewater plants, are likely to drive the market in the country

11.6.5.2 UAE

11.6.5.2.1 Augmented operations in the petroleum industry along with the construction industry are helping the motor control centers to grow during the forecast period

11.6.5.3 Turkey

11.6.5.3.1 Increased mining and export industries are likely to help the market to grow in the country

11.6.5.4 Algeria

11.6.5.4.1 Growth of Algeria’s petroleum industry is expected to increase the demand for motor control centers in future

11.6.5.5 Kuwait

11.6.5.5.1 Planned growth of oil exploration and export industries are driving the market during the forecast period

11.6.5.6 Qatar

11.6.5.6.1 Major construction projects are expected to drive the market

11.6.5.7 South Africa

11.6.5.7.1 Growing mining and manufacturing industries would drive the South African market

11.6.5.8 Rest of Middle East & Africa

11.6.5.8.1 Huge investments in oil & gas sector are expected to drive the market in the region

12 COMPETITIVE LANDSCAPE

12.1 OVERVIEW

12.2 COMPETITIVE LEADERSHIP MAPPING, 2019

12.2.1 VISIONARY LEADERS

12.2.2 INNOVATORS

12.2.3 DYNAMIC DIFFERENTIATORS

12.2.4 EMERGING

12.3 MARKET SHARE, 2019

12.4 COMPETITIVE SCENARIO

12.4.1 CONTRACTS & AGREEMENTS2

12.4.2 PRODUCT LAUNCHES

12.4.3 MERGERS & ACQUISITIONS

12.4.4 INVESTMENTS & EXPANSIONS

12.4.5 OTHERS

13 COMPANY PROFILES

13.1 ABB

13.1.1 BUSINESS OVERVIEW

13.1.2 PRODUCTS OFFERED

13.1.3 RECENT DEVELOPMENTS

13.1.4 MNM VIEW

13.2 RITTAL266

13.2.1 BUSINESS OVERVIEW

13.2.2 PRODUCTS OFFERED

13.2.3 RECENT DEVELOPMENTS

13.2.4 MNM VIEW

13.3 TES

13.3.1 BUSINESS OVERVIEW

13.3.2 PRODUCTS OFFERED

13.3.3 RECENT DEVELOPMENTS

13.3.4 MNM VIEW

13.4 TECHNICAL CONTROL SYSTEMS

13.4.1 BUSINESS OVERVIEW

13.4.2 PRODUCTS OFFERED

13.4.3 RECENT DEVELOPMENTS

13.5 LSIS

13.5.1 BUSINESS OVERVIEW

13.5.2 PRODUCTS OFFERED

13.5.3 MNM VIEW

13.6 WEG

13.6.1 BUSINESS OVERVIEW

13.6.2 PRODUCTS OFFERED

13.6.3 RECENT DEVELOPMENTS

13.6.4 MNM VIEW

13.7 TESCO CONTROLS

13.7.1 BUSINESS OVERVIEW

13.7.2 PRODUCTS OFFERED

13.8 ROCKWELL AUTOMATION

13.8.1 BUSINESS OVERVIEW

13.8.2 PRODUCTS OFFERED

13.8.3 RECENT DEVELOPMENTS

13.8.4 MNM VIEW

13.9 EATON

13.9.1 BUSINESS OVERVIEW

13.9.2 PRODUCTS OFFERED

13.9.3 RECENT DEVELOPMENTS

13.9.4 MNM VIEW

13.10 MITSUBISHI ELECTRIC

13.10.1 BUSINESS OVERVIEW

13.10.2 PRODUCTS OFFERED

13.10.3 RECENT DEVELOPMENTS

13.10.4 MNM VIEW

13.11 SIEMENS

13.11.1 BUSINESS OVERVIEW

13.11.2 PRODUCTS OFFERED

13.11.3 RECENT DEVELOPMENTS

13.11.4 MNM VIEW294

13.12 SCHNEIDER ELECTRIC

13.12.1 BUSINESS OVERVIEW

13.12.2 PRODUCTS OFFERED

13.12.3 RECENT DEVELOPMENTS

13.12.4 MNM VIEW

13.13 LARSEN & TOUBRO

13.13.1 BUSINESS OVERVIEW

13.13.2 PRODUCTS OFFERED

13.13.3 RECENT DEVELOPMENTS

13.13.4 MNM VIEW

13.14 FUJI ELECTRIC

13.14.1 BUSINESS OVERVIEW

13.14.2 PRODUCTS OFFERED

13.14.3 RECENT DEVELOPMENTS

13.14.4 MNM VIEW

13.15 VIDHYUT CONTROL

13.15.1 BUSINESS OVERVIEW

13.15.2 PRODUCTS OFFERED

14 ADJACENT & RELATED MARKETS

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 MOTOR CONTROL CENTERS INTERCONNECTED MARKETS

14.4 LOW VOLTAGE MOTOR CONTROL CENTERS MARKET

14.4.1 MARKET DEFINITION

14.4.2 LIMITATION

14.4.3 MARKET OVERVIEW

14.4.4 LOW VOLTAGE MARKET, BY APPLICATION

14.4.4.1 Conventional motor control centers

14.4.4.2 Intelligent motor control centers

14.4.5 LOW VOLTAGE MOTER CONTROL CENTERS MARKET, BY REGION

14.4.5.1 Asia Pacific

14.4.5.2 North America

14.4.5.3 Europe

14.4.5.4 South America

14.4.5.5 Middle East

15 APPENDIX

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTA319

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

LIST OF TABLES (341 TABLES)

TABLE 1 MOTOR CONTROL CENTERS MARKET SNAPSHOT

TABLE 2 ADJACENT AND INTERCONNECTED MARKETS (USD BILLION)

TABLE 3 MOTOR CONTROL CENTERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 4 PRE-COVID-19: LOW VOLTAGE MCC MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 5 POST-COVID-19:MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 6 LOW VOLTAGE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 7 POST-COVID-19:LOW VOLTAGE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 8 MEDIUM VOLTAGE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 9 POST-COVID-19:MEDIUM VOLTAGE MARKET SIZE,

TABLE 10 INTELLIGENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 POST-COVID-19:INTELLIGENT VOLTAGE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 CONVENTIONAL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 POST-COVID-19:CONVENTIONAL VOLTAGE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 14 MOTOR CONTROL CENTERS MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 15 PRE-COVID-19: LOW VOLTAGE MCC MARKET SIZE, BY VOLTAGE, 2020–2025 (USD MILLION)

TABLE 16 POST-COVID-19: LOW VOLTAGE MCC MARKET SIZE, BY VOLTAGE,2020–2025 (USD MILLION)

TABLE 17 LOW VOLTAGE: LOW VOLTAGE MCC MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 POST-COVID-19: LOW VOLTAGE:VOLTAGE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 19 MEDIUM VOLTAGE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 POST-COVID-19:MEDIUM VOLTAGE:VOLTAGE MARKET SIZE,

TABLE 21 MOTOR CONTROL CENTERS MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 22 PRE-COVID-19: LOW VOLTAGE MCC MARKET SIZE, BY END-USER, 2020–2025 (USD MILLION)

TABLE 23 POST-COVID-19: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 24 MOTOR CONTROL CENTERS MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 25 POST-COVID-19: MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 26 LOW VOLTAGE MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 27 POST-COVID-19: LOW VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 28 LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 29 POST-COVID-19: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 30 MEDIUM VOLTAGE MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 31 POST-COVID-19: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 32 MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 33 POST-COVID-19: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 34 INDUSTRIAL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 POST-COVID-19: INDUSTRIAL: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 36 OIL & GAS: MEDIUM VOLTAGE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 POST-COVID-19: OIL & GAS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 38 CHEMICAL & PETROCHEMICAL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 POST-COVID-19: CHEMICAL & PETROCHEMICAL: MEDIUM VOLTAGE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 40 METALS & MINING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 POST-COVID-19: METALS & MINING: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 42 CEMENT & MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 POST-COVID-19: CEMENT & MANUFACTURING: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 44 UTILITIES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 POST-COVID-19: UTILITIES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 46 FOOD & BEVERAGE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 POST-COVID-19: FOOD & BEVERAGE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 48 WATER & WASTEWATER: MEDIUM VOLTAGE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 POST-COVID-19: WATER & WASTEWATER: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 50 PUBLIC CONSTRUCTION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 POST-COVID-19: PUBLIC CONSTRUCTION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 52 COMMERCIAL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 POST-COVID-19: COMMERCIAL: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 54 MOTOR CONTROL CENTERS MARKET SIZE, BY STANDARD,

TABLE 55 PRE-COVID-19 MARKET SIZE, BY STANDARD,2020–2025 (USD MILLION)

TABLE 56 POST-COVID-19 MARKET SIZE, BY STANDARD,2020–2025 (USD MILLION)

TABLE 57 MOTOR CONTROL CENTERS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 58 PRE-COVID-19: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 59 POST-COVID-19:MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 60 LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 61 POST-COVID-19: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 62 MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 63 POST-COVID-19: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 64 BUSBARS: LOW VOLTAGE MCC MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 POST-COVID-19: BUSBARS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 66 CIRCUIT BREAKERS & FUSES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 POST-COVID-19: CIRCUIT BREAKERS & FUSES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 68 OVERLOAD RELAYS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 69 POST-COVID-19: OVERLOAD RELAYS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 70 VARIABLE SPEED DRIVES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 POST-COVID-19: VARIABLE SPEED DRIVES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 72 SOFT STARTERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 73 POST-COVID-19: SOFT STARTERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 74 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 POST-COVID-19: OTHERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 76 MOTOR CONTROL CENTERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 77 PRE-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 78 POST-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 80 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 81 ASIA PACIFIC:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 82 POST-COVID-19: ASIA PACIFIC:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 84 POST-COVID-19: ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 86 POST-COVID-19: ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 88 POST-COVID-19: ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 90 POST-COVID-19: ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 92 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY VOLTAGE,2020–2025 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 94 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 95 ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 96 POST-COVID-19: ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY VOLTAGE,2020–2025 (USD MILLION)

TABLE 97 ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 98 POST-COVID-19: ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 99 ASIA PACIFIC:MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 100 POST -COVID-19: ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 101 ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 102 POST -COVID-19: ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 103 ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 104 POST-COVID-19: ASIA PACIFIC: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 106 POST-COVID-19:ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 107 CHINA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 108 POST-COVID-19: CHINA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 109 CHINA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 110 POST-COVID-19: CHINA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 111 INDIA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 112 POST-COVID-19: INDIA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 113 INDIA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 114 POST-COVID-19:INDIA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 115 AUSTRALIA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 116 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 117 AUSTRALIA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 118 POST-COVID-19: AUSTRALIA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 119 JAPAN: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 120 POST-COVID-19: JAPAN: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 121 JAPAN:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 122 POST-COVID-19: JAPAN:MOTOR CONTROL CENTERS MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 123 TAIWAN: MOTOR CONTROL CENTERS MARKET SIZE, BY END-USER,

TABLE 124 POST-COVID-19: TAIWAN: MOTOR CONTROL CENTERS MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 125 TAIWAN:MOTOR CONTROL CENTERS MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 126 POST-COVID-19: TAIWAN:MOTOR CONTROL CENTERS MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 127 SOUTH KOREA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 128 POST-COVID-19: SOUTH KOREA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 129 SOUTH KOREA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 130 POST-COVID-19: SOUTH KOREA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 131 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 132 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 134 POST-COVID-19: REST OF ASIA PACIFIC:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 136 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 137 NORTH AMERICA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 138 POST-COVID-19: NORTH AMERICA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 139 NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 140 POST-COVID-19: NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 142 POST-COVID-19: NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 143 NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 144 POST-COVID-19: NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 145 NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 146 POST-COVID-19: NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 147 NORTH AMERICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 148 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY VOLTAGE,2020–2025 (USD MILLION)

TABLE 149 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 150 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 151 NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 152 POST-COVID-19: NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 153 NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY TYPE,2016–2019 (USD MILLION)

TABLE 154 POST-COVID-19: NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 155 NORTH AMERICA:MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 156 POST -COVID-19: NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 157 NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 158 POST -COVID-19: NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 159 NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 160 POST -COVID-19: NORTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET SIZE, BY COUNTRY , 2016–2019 (USD MILLION)

TABLE 162 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 163 US: MOTOR CONTROL CENTERS MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 164 POST-COVID-19: US: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 165 US:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 166 POST-COVID-19: US:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 167 CANADA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 168 POST-COVID-19: CANADA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 169 CANADA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 170 POST-COVID-19: CANADA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 171 MEXICO: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 172 POST-COVID-19: MEXICO: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 173 MEXICO:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 174 POST-COVID-19: MEXICO:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 175 CUBA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 176 POST-COVID-19: CUBA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 177 CUBA:MOTOR CONTROL CENTERS MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 178 POST-COVID-19: CUBA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 179 EUROPE: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 180 POST-COVID-19: EUROPE: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 181 EUROPE:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 182 POST-COVID-19: EUROPE:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 183 EUROPE: LOW VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 184 POST-COVID-19: EUROPE: LOW VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 185 EUROPE: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 186 POST-COVID-19: EUROPE: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 187 EUROPE: MEDIUM VOLTAGE MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 188 POST-COVID-19: EUROPE: MEDIUM VOLTAGE: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 189 EUROPE: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 190 POST-COVID-19: EUROPE: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 191 EUROPE: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 192 POST-COVID-19: EUROPE: MARKET SIZE, BY VOLTAGE,2020–2025 (USD MILLION)

TABLE 193 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 194 POST-COVID-19: EUROPE: MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 195 EUROPE: LOW VOLTAGE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 196 POST-COVID-19: EUROPE: LOW VOLTAGE MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 197 EUROPE: MEDIUM VOLTAGE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 198 POST-COVID-19: EUROPE: MOTOR CONTROL CENTERS MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 199 EUROPE:MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 200 POST -COVID-19: EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 201 EUROPE: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 202 POST -COVID-19: EUROPE: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 203 EUROPE: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 204 POST -COVID-19: EUROPE: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 205 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 206 POST -COVID-19 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 207 GERMANY: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 208 POST-COVID-19: GERMANY: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 209 GERMANY:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 210 POST-COVID-19: GERMANY:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 211 UK: MOTOR CONTROL CENTERS MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 212 POST-COVID-19: UK: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 213 UK:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 214 POST-COVID-19: UK:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 215 FRANCE: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 216 POST-COVID-19: FRANCE: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 217 FRANCE:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 218 POST-COVID-19: FRANCE:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 219 ITALY: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 220 POST-COVID-19: ITALY: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 221 ITALY:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 222 POST-COVID-19: ITALY:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 223 SPAIN: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 224 POST-COVID-19: SPAIN: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 225 SPAIN:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 226 POST-COVID-19: SPAIN:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 227 REST OF EUROPE: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 228 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 229 REST OF EUROPE:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 230 POST-COVID-19: REST OF EUROPE:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 231 SOUTH AMERICA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 232 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 233 SOUTH AMERICA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 234 POST-COVID-19: SOUTH AMERICA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 235 SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 236 POST-COVID-19: SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 237 SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 238 POST-COVID-19: SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 239 SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 240 POST-COVID-19: SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 241 SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 242 POST-COVID-19: SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 243 SOUTH AMERICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 244 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY VOLTAGE,2020–2025 (USD MILLION)

TABLE 245 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 246 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 247 SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY TYPE,2016–2019 (USD MILLION)

TABLE 248 POST-COVID-19: SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 249 SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY TYPE,2016–2019 (USD MILLION)

TABLE 250 POST-COVID-19: SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 251 SOUTH AMERICA:MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 252 POST -COVID-19: SOUTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 253 SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 254 POST -COVID-19: SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 255 SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 256 POST -COVID-19: SOUTH AMERICA: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 257 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 258 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 259 BRAZIL: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 260 POST-COVID-19: BRAZIL: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 261 BRAZIL:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 262 POST-COVID-19: BRAZIL:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 263 ARGENTINA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 264 POST-COVID-19: ARGENTINA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 265 ARGENTINA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 266 POST-COVID-19: ARGENTINA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 267 CHILE: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 268 POST-COVID-19: CHILE: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 269 CHILE:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 270 POST-COVID-19: CHILE:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 271 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 272 POST-COVID-19: REST OF SOUTH AMERICA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 273 REST OF SOUTH AMERICA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 274 POST-COVID-19: REST OF SOUTH AMERICA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 275 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 276 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 277 MIDDLE EAST & AFRICA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 278 POST-COVID-19: MIDDLE EAST & AFRICA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 279 MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 280 POST-COVID-19: MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 281 MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 282 POST-COVID-19: MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 283 MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 284 POST-COVID-19: MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 285 MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 286 POST-COVID-19: MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 287 MIDDLE EAST & AFRICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 288 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY VOLTAGE,2020–2025 (USD MILLION)

TABLE 289 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 290 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 291 MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY TYPE,2016–2019 (USD MILLION)

TABLE 292 POST-COVID-19: MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 293 MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MARKET SIZE, BY TYPE,2016–2019 (USD MILLION)

TABLE 294 POST-COVID-19: MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MOTOR CONTROL CENTERS MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

TABLE 295 MIDDLE EAST & AFRICA:MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 296 POST -COVID-19: ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 297 MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 298 POST -COVID-19: MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 299 MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 300 POST -COVID-19: MIDDLE EAST & AFRICA: MEDIUM VOLTAGE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 301 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 302 POST -COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 303 SAUDI ARABIA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 304 POST-COVID-19: SAUDI ARABIA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 305 SAUDI ARABIA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 306 POST-COVID-19: SAUDI ARABIA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 307 UAE: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 308 POST-COVID-19: UAE: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 309 UAE:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 310 POST-COVID-19: UAE:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 311 TURKEY: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 312 POST-COVID-19: TURKEY: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 313 TURKEY:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 314 POST-COVID-19: TURKEY:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 315 ALGERIA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 316 POST-COVID-19: ALGERIA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 317 ALGERIA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 318 POST-COVID-19: ALGERIA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 319 KUWAIT: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 320 POST-COVID-19: KUWAIT: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 321 KUWAIT:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 322 POST-COVID-19: KUWAIT:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 323 QATAR: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 324 POST-COVID-19: QATAR: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 325 QATAR:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 326 POST-COVID-19: QATAR:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 327 SOUTH AFRICA: MARKET SIZE, BY END-USER, 2016–2019 (USD MILLION)

TABLE 328 POST-COVID-19: SOUTH AFRICA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 329 SOUTH AFRICA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 330 POST-COVID-19: SOUTH AFRICA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 331 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER,2016–2019 (USD MILLION)

TABLE 332 POST-COVID-19: REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER,2020–2025 (USD MILLION)

TABLE 333 REST OF MIDDLE EAST & AFRICA:MARKET SIZE, BY INDUSTRIAL, 2016–2019 (USD MILLION)

TABLE 334 POST-COVID-19: REST OF MIDDLE EAST & AFRICA:MARKET SIZE, BY INDUSTRIAL, 2020–2025 (USD MILLION)

TABLE 335 CONVENTIONAL: LOW VOLTAGE MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 336 INTELLIGENT: LOW VOLTAGE MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 337 ASIA PACIFIC: LOW VOLTAGE MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 338 NORTH AMERICA: LOW VOLTAGE MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 339 EUROPE: LOW VOLTAGE MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 340 SOUTH AMERICA: LOW VOLTAGE MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 341 MIDDLE EAST & AFRICA: LOW VOLTAGE MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

LIST OF FIGURES (45 FIGURES)

FIGURE 1 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING THE DEMAND FOR THE MOTOR CONTROL CENTERS MARKET

FIGURE 2 INSTALLATION OF ELECTRIC MOTORS IS THE DETERMINING FACTOR FOR THE GLOBAL MARKET

FIGURE 3 RANKING OF KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

FIGURE 4 FIGURE 7 PRE- AND POST- COVID-19 SCENARIO ANALYSIS

FIGURE 5 LOW VOLTAGE SEGMENT IS EXPECTED TO HOLD THE LARGEST SHARE OF THE MARKET, BY VOLTAGE, DURING THE FORECAST PERIOD

FIGURE 6 IEC STANDARD SEGMENT IS EXPECTED TO LEAD THE MARKET, BY STANDARD, DURING THE FORECAST PERIOD

FIGURE 7 CONVENTIONAL SEGMENT IS EXPECTED TO LEAD THE MARKET, BY TYPE, DURING THE FORECAST PERIOD

FIGURE 8 ASIA PACIFIC DOMINATED THE MARKET IN 2019

FIGURE 9 GOVERNMENT INITIATIVES TO SAVE ENERGY ACROSS EVERY INDUSTRY AND RISE IN DEMAND FOR AUTOMATION IN DEVELOPED NATIONS ARE DRIVING MARKET, 2020–2025

FIGURE 10 CONVENTIONAL SEGMENT DOMINATED THE MARKET, BY TYPE, IN 2019

FIGURE 11 LOW VOLTAGE SEGMENT DOMINATED THE MARKET, BY VOLTAGE, IN 201946

FIGURE 12 INDUSTRIAL SEGMENT DOMINATED THE MARKET, BY END-USER, IN 2019

FIGURE 13 IEC STANDARD SEGMENT DOMINATED THE MARKET, BY STANDARD, IN 2019

FIGURE 14 BUSBARS SEGMENT DOMINATED THE MARKET, BY COMPONENT, IN 2019

FIGURE 15 ASIA PACIFIC MARKET IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 16 COVID-19 GLOBAL PROPAGATION

FIGURE 17 COVID-19 PROPAGATION IN SELECT COUNTRIES

FIGURE 18 RECOVERY ROAD FOR 2020

FIGURE 19 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

FIGURE 21 GROWING REVENUE TRENDS OF THE AUTOMATION PRODUCTS (MOTOR CONTROL CENTERS, VFDS, CONTACTORS, AND STARTERS) OF MAJOR COMPANIES

FIGURE 22 FALLING AVERAGE CRUDE OIL PRICES AROUND THE GLOBE SINCE 2014

FIGURE 23 MOTOR CONTROL CENTER MARKET (VALUE), BY TYPE, 2019

FIGURE 24 MOTOR CONTROL CENTER MARKET (VALUE), BY VOLTAGE, 2019

FIGURE 25 MOTOR CONTROL CENTER MARKET (VALUE), BY END-USER, 2019

FIGURE 26 MOTOR CONTROL CENTER MARKET (VALUE), BY STANDARD, 2019

FIGURE 27 MOTOR CONTROL CENTER MARKET (VALUE), BY COMPONENT, 2019

FIGURE 28 REGIONAL SNAPSHOT: ASIA PACIFIC MARKET IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 29 MOTOR CONTROL CENTERS MARKET SHARE (VALUE), BY REGION, 2019

FIGURE 30 ASIA PACIFIC: REGIONAL SNAPSHOT

FIGURE 31 NORTH AMERICA: REGIONAL SNAPSHOT

FIGURE 32 KEY DEVELOPMENTS IN THE MARKET, 2016–2020

FIGURE 33 MOTOR CONTROL CENTERS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 34 ABB LED THE MARKET IN 2019

FIGURE 35 ABB: COMPANY SNAPSHOT

FIGURE 36 LSIS COMPANY LTD.: COMPANY SNAPSHOT

FIGURE 37 WEG: COMPANY SNAPSHOT

FIGURE 38 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

FIGURE 39 EATON: COMPANY SNAPSHOT

FIGURE 40 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

FIGURE 41 SIEMENS: COMPANY SNAPSHOT

FIGURE 42 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

FIGURE 43 LARSEN & TOUBRO: COMPANY SNAPSHOT

FIGURE 44 FUJI ELECTRIC: COMPANY SNAPSHOT

FIGURE 45 LOW VOTAGE MOTOR CONTROL CENTERS MARKET, 2015–2022 (USD MILLION)

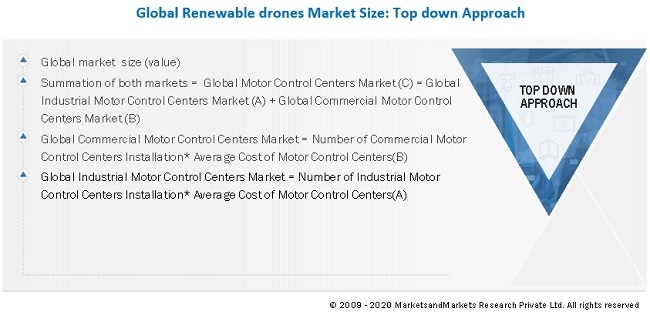

This study involved 4 major activities in estimating the current size of the motor control centers market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as UNCTAD data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and motor control centers’ journals to identify and collect information useful for a technical, market-oriented, and commercial study of the motor control centers market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

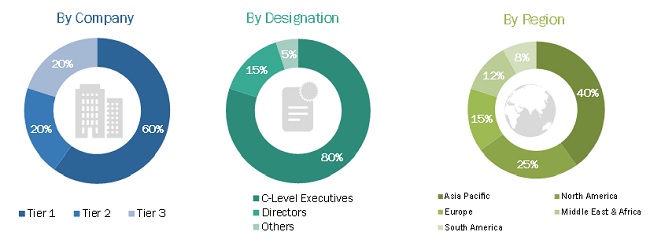

The motor control centers market comprises several stakeholders such as companies related to the oil & gas and metals & mining industries, consulting companies in the energy & power sector, power generation companies, government & research organizations, organizations, forums, alliances & associations, motor control centers’ providers, state & national utility authorities, motor control centers’ manufacturers, dealers & suppliers, and vendors. The demand side of the market is characterized by utilities and industrial companies, investments by key end-users such as oil & gas, metals & mining, food & beverage, cement & manufacturing, and others. Moreover, demand is also driven by rising investments in industrial projects across the globe. The supply side is characterized by the increasing demand for contracts & agreements and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global motor control centers market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the motor control centers sector.

Report Objectives

- To define, describe, and forecast the global motor control centers market on the basis of type, voltage, component, standard, end-user, and region

- To provide detailed information regarding the major factors influencing the growth of the motor control centers market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the motor control centers market with respect to individual growth trends, future prospects, and contributions of each segment to the market

- The impact of the COVID-19 pandemic on the motor control centers market has been analyzed for the estimation of the market size.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To benchmark players within the market using the proprietary Vendor DIVE framework, which analyzes the market players on various parameters within the broad categories of business and product strategies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the motor control centers market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Motor Control Centers Market