Narrowband IoT (NB-IoT) Chipset Market Size, Share & Industry Growth Analysis Report by Device (Smart Meters, Smart Parking), Deployment (Guard, In-Band, Stand-Alone), Vertical (Energy & Utilities, Infrastructure, Building Automation), and Region - Global Forecast to 2025

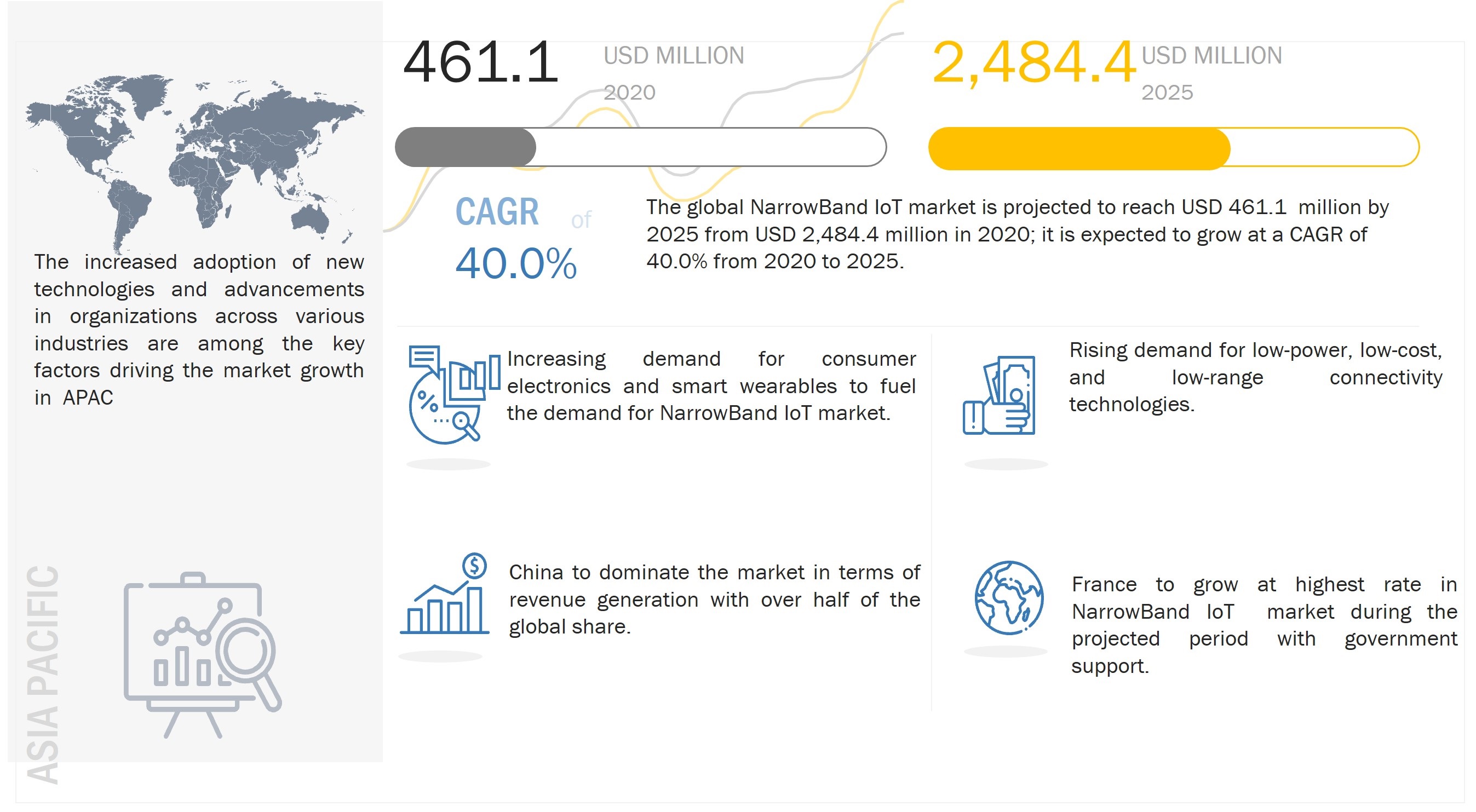

The global NarrowBand IoT chipset market size is projected to reach USD 2,484.4 million by 2025, gowing at a CAGR of 40.0% during the forecast period. NarrowBand Internet of Things (NB-IoT) is a cellular-grade technology that supports more complex cellular functions. This is advanced functionality comes at the expense of low power consumption. NB-IoT provides better network coverage for M2M communications, supports maximum connections, and lowers power consumption.

Several applications do not require high bandwidth but need permanent connectivity to send and receive small data packets. For this purpose, NB-IoT was created by the 3rd Generation Partnership Project (3GPP) for a wide range of new IoT devices and services.

Narrowband IoT (NB-IoT) Enterprise Application Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

There has been a significant rise in connected devices, leading to a growing demand for secure, stable, and robust connectivity. In many cases, connected devices are located in remote areas where cellular connectivity is not an optimal solution to transmit data continuously, and transmitters operate at high power, thereby draining their battery. NB-IoT overcomes these limitations as it provides improved outdoor and indoor coverage compared to existing wide-area technology. Lower data rate transmission helps reduce power consumption, thereby providing longer battery life. NB-IoT is based on either a Direct Sequence Spread Spectrum (DSSS) modulation, which can exist independently in unused 200 kHz bands, or the LTE base stations, which can allocate a resource block. Due to a simple waveform, modems running on NB-IoT consume less power while operating.

Additionally, simplified network topology and deployment make it ideal connectivity for LPWA technologies. Applications of NB-IoT include smart metering, smart parking, smart streetlights, smart cities, smart buildings, and others. Many operators have already launched NB-IoT services across the globe, while many hardware providers have launched multiple chipsets and modules that are compatible with NB-IoT technology.

NarrowBand IoT Chipset Market Dynamics:

Driver: Widening applications of NB-IoT technology

NB-IoT features excellent indoor, outdoor, and underground coverage and is well-suited for battery-operated applications that transmit data occasionally. These features have fuelled NB-IoT technology adoption in a wide range of applications.

Several key existing applications of NB-IoT technology include smart parking, management, smart irrigation systems, and smart metering. Presently, many companies are piloting and testing the deployment of NB-IoT technology in various emerging applications; these applications include condition monitoring and location monitoring in the industrial sector; smart grid in the energy and power sector; access control, building automation, fire detection, and video monitoring in the building automation industry; remote management and order replenishment in the home appliances industry; climate control, energy and water management, and safety and security application in the home automation industry; and fitness and performance monitoring in the wearables industry.

Restraint: Stringent competition from alternate technologies

- IoT integrates numerous long-range, short-range, and personal area wireless networks and technologies in various applications. Advancements in wireless network technologies have enabled rapid deployment of the LPWA wireless sensor network (WSN) at homes and offices. The LPWA network is introduced to deal with range-related limitations of low-power technologies such as Wi-Fi, Bluetooth, IEEE 802.11ah, and ZigBee. While ZigBee and IEEE 802.11ah can extend their coverage using meshing technologies, LPWA networks eliminate a lot of unnecessary overheads, such as forwarding and routing, associated with the use of meshing.

Opportunity: Smart cities to create substantial market opportunity

In smart cities, IoT infrastructure is deployed to handle devices and objects connected via any connectivity method. An application enablement platform enables smart cities to manage most of their IoT services via a single platform, thereby reducing the total service cost.

The authorities of many smart cities are now looking to expand the use of IoT to improve services such as waste management, water management, and quality, and energy consumption monitoring in public buildings. The popularity of implementing contextual analysis to provide real-time information to citizens and authorities is also growing, which in turn, is expected to create a market opportunity for the market.

Challenge: Long tail ecosystem consisting of chipsets, modules, devices, and application platforms

Unlike traditional communication networks, NB-IoT has an extended ecosystem, from chipsets, modules, and device providers to application platform providers; this makes the standardization of NB-IoT technology difficult, thereby posing a challenge to its commercialization.

However, many companies such as Ericsson (Sweden), Huawei (China), and Nokia Networks (Finland) have started developing NB-IoT products, including chips, modules, devices, and infrastructure vendors, along with telco vendors, operators, and vertical companies, to jointly build an edge-to-enterprise (E2E) ecosystem. In January 2020, Nordic Semiconductor unveiled its latest NB-IoT and LTE-M chipsets for complex IoT applications at the Consumer Electronics Show (CES) in 2020 in the US. In May 2020, MediaTek announced that its MT2625 NB-IoT chip had been validated for LwM2M over NIDD on SoftBank Corp.’s cellular network across Japan.

This achievement marks the first global commercial readiness of LwM2M over NIDD, a secure, ultra-efficient IoT communications technique that is being adopted by operators worldwide. The benefits of LwM2M over NIDD include security improvements, cost-efficient scalability, and reduced power consumption. Therefore, due to the long tail of ecosystem players, NB-IoT technology providers face a challenge in the large-scale adoption of this technology.

NarrowBand IoT Chipset Market Segment Insights:

Based on deployment type, the guard band segment to account for a large market share

Guard band allows the use of spectrum at channel edges of existing LTE carriers. The NB-IoT carrier can be deployed in the LTE guard band without affecting the capacity of the LTE carrier adjacent to it.

Guard band deployment is suitable when gaps are caused by the unused spectrum next to the LTE carrier, which NB-IoT can utilize. A guard band option allows the use of spectrum at the channel edges of existing LTE carriers. The guard-band deployment utilizes less mobile broadband capacity than the in-band deployment scenario. Multiple benefits such as no additional spectrum cost, antenna system reuse, RF module reuse, and better coexistence performance than in-band mode are the key factors supplementing the growth of guard band deployment in NB-IoT.

Based on device type, smart meters segment to create maximum market opportunity

Energy suppliers prefer smart meters to achieve specific and automated billing. A smart meter is an electronic device that measures energy consumption and enables two-way communications between consumers and the utility.

It records the energy consumption at frequent intervals, usually an hour, and communicates this information back to the utility for billing and monitoring purposes. Energy suppliers prefer smart meters to achieve specific and automated billing. Smart meters in the residential application are integrated with communication protocols to convey information regarding energy usage to the homeowner. In addition to helping consumers reduce their energy bills, these meters also contribute to the environment as they enable utility consumers to monitor their energy usage more precisely and make informed choices, thereby reducing the excessive consumption of resources.

Based on vertical demand to improve health outcomes through connected health is paving the way for NB-IoT in healthcare vertical

Healthcare holds growth opportunities for IoT and M2M. Remote patient monitoring, organization of healthcare workflow, management of medication, and medical asset tracking are a few applications in the healthcare industries addressed through the new M2M-enabled solutions.

Smart devices can be used in health monitoring systems that provide information about vital signs or any changes in health conditions. Patient health monitoring, hospital management, and wearables are the major applications of NB-IoT chipset in the healthcare vertical.

NarrowBand IoT Chipset Market Regional Insights:

North America is expected to witness the highest CAGR

The growing adoption of NB-IoT technology in the region and developed IT infrastructure is expected to boost the growth of this market in this region.

Moreover, with an established LTE-M network and the availability of dual-mode NB-IoT chipsets that offer CAT-M1 and CAT-NB1/NB2 connectivity is expected to complement the growth of NB-IoT chipsets in the region. Verizon (US), T-Mobile (US), AT&T (US), and Bell Canada (Canada) are expected to be the key service providers of NB-IoT services in the region.

Narrowband IoT (NB-IoT) Enterprise Application Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The increasing demand for low-cost LPWA technology with a wide coverage area is expected to be the primary factor driving the growth of the NB-IoT chipset market. The presence of major companies such as Qualcomm (US), Verizon (US), AT&T (US), and Intel (US) is also fueling the market growth in North America.

The US held the largest share of the NB-IoT chipset market in 2020. The US government offers a supportive environment for R&D of next-generation connectivity technologies, facilitating advancements in IoT applications. The US government has been investing significant amounts in the implementation of IoT across various sectors, such as infrastructure and utilities, under programs such as Smart America. The Smart America Project showcases how IoT can improve transportation, emergency services, healthcare, security, energy conservation, and manufacturing. This is expected to bring enormous opportunities for NB-IoT technology providers in North America. The market in Mexico is projected to witness the highest CAGR.

APAC accounted for the largest market size in the NB-IoT chipset market

The increased adoption of new technologies and advancements in organizations across various industries are among the key factors driving the market growth in this region. This region has become a global focal point for significant investments and business expansion opportunities.

In China, leading mobile operators such as China Mobile and China Unicom are using NB-IoT technologies to connect millions of devices across the country. Government regulations and the presence of leading NB-IoT players are prime factors for the growth of NB-IoT market in China. The strong presence of domestic NB-IoT chipset and module providers, such as Quectel, Cheerzing, ZTE (SANECHIPS), and HISILICOM, in the country, has paved the growth of the NB-IoT chipset market in China. Additionally, the presence of three big carriers—China Mobile, China Telecom, and China Unicom—offering NB-IoT services in most parts of the country has further accelerated the growth of the market in the country.

Key Market Players in NarrowBand IoT Chipset Industry

Some of the major players in the NarrowBand IoT market are Huawei (China), Qualcomm (US), Nordic Semiconductor (Norway), Samsung (South Korea), Intel Corporation (US), and MediaTek (Taiwan), among others. These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches further to expand their presence in the NarrowBand IoT market.

Huawei (China): Huawei has held the first position in the NB-IoT chipset market based on its product offering, R&D activity, and market strategy over the past two years. The company has R&D centers in 21 countries, including China, the US, Canada, the UK, India, Russia, and Turkey. Moreover, it has been continually improving its product offering and establishing partnerships with various service providers for carrying out field-trials for NB-IoT technology. The company is currently emphasizing improving its geographic footprint in the NB-IoT market by partnering with regional players.

Qualcomm (US): Qualcomm is among the key players operating in the market. Its strong expertise in cellular modem development and global presence differentiate Qualcomm from other players. The company offers three modems (MDM9206, 9205 LTE, and MDM 9207-1) in NB-IoT chipset space. Moreover, the company’s Snapdragon 1200 Wearable Platform is one of the most sophisticated and exclusive platforms developed for the development of NB-IoT solutions for wearables. Strong reliance on organic growth, as well as partnerships and collaborations with regional players, remain the key growth strategies for the company to expand its position in the NB-IoT chipset market

NarrowBand IoT Chipset Market Report Scope:

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 461.1 million |

| Revenue Forecast in 2025 | USD 2,484.4 million |

| Growth Rate | 40.0% |

|

Market Size Availability Years |

2017–2024 |

|

Base Year |

2018 |

|

Forecast Period |

2019–2024 |

|

Units |

Value in USD & volume in million units |

|

Segments Covered |

Deployment type, device, vertical |

|

Geographic Regions Covered |

North America, APAC, Europe, and RoW |

|

Companies Covered |

Huawei (China), Qualcomm (US), Intel (US), Nordic Semiconductor (Norway), Sanechips (China), Samsung (South Korea), MediaTek (Taiwan), Sercomm (Taiwan), Cheerzing (China), u-blox (Switzerland), Telit Communications (UK), Quectel (China), and Sequans Communications (France) |

This report categorizes the NB-IoT Chipset market based on deployment type, devices, vertical, and region.

NB-IoT Chipset Market, by Deployment:

- Stand-Alone

- Guard Band

- In-Band

NB-IoT Chipset Market, by Device:

- Smart Parking

- Smart Meters

- Trackers

- Alarms and Detectors

- Smart Streetlights

- Smart Appliances

- Wearable Devices

- Other Devices (connected healthcare devices and environment monitoring devices)

NB-IoT Chipset Market, by Vertical:

- Agriculture

- Automotive and Transportation

- Energy and Utilities

- Healthcare

- Manufacturing

- Safety and Security

- Infrastructure

- Building Automation

- Consumer Electronics

NB-IoT Chipset Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Narrowband IoT (NB-IoT) Enterprise Application Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

Connected device technology in the consumer electronics industry is expected to be a key enabler of market growth. The connected device technology in the consumer electronics industry is expected to be the key enabler of the market growth for smart home solutions. Therefore, the possibility of remotely monitoring air conditioning systems, lights, or white goods will help increase the convenience and quality of life along with energy efficiency, which is likely to appeal to many consumers. Smart TV, smart washing machine, smart dryer, smart refrigerator, smart ovens, and smart cooktops, among others, are likely to be the key devices that can be connected using NB-IoT technology.

- Addition/refinement in segmentation–Increase the depth or width of market segmentation.

-

NarrowBand IoT, by Device

- Smart Parking

- Smart Streetlights

- Smart Appliances

- Smart Meters

- Trackers

- Alarms & Detectors

- Wearable Devices

- Others

- Coverage of new market players and change in the market share of existing players of the NarrowBand IoT market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have a total of 20 players (10 major, 10 Startups/SME). Moreover, the share of companies operating in the NarrowBand IoT market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the NarrowBand IoT market.

Newer and improved representation of financial information: The latest edition of the report provides updated financial information in the context of the NarrowBand IoT market till 2019/2020 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to quickly analyze the present status of profiled companies in terms of their financial strength, profitability, critical revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2017 to 2020. This will assist in underrating the players in this market and their strategies to expand their global presence and increase market shares.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of startups /SME, which covers details about employees, financial status, the latest funding round and total funding.

- Inclusion of the impact of megatrends on the NarrowBand IoT market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in NarrowBand IoT market

- Inclusion of patent registrations to overview R&D activities in the NarrowBand IoT market.

- The startup evaluation matrix is added in this edition of the report, covering drone startups.

The new edition of the report consists of trends/disruptions in customer’s business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand the market dynamics for NarrowBand IoT.

Recent Developments in NarrowBand IoT Industry

- In June 2022, 1NCE doubled its NB-IoT footprint with expansion in the United States, Taiwan, Belgium, Denmark, Sweden, Norway, Croatia, Finland, and the Slovak Republic. This development has pushed the company among the leading providers of NB-IoT technology.

- In April 2021, Murata Manufacturing Co., Ltd. formed partnerships with Sony Semiconductor Israel, STMicroelectronics, and Truphone to commercialize and accelerate the adoption of NB-IoT with the development of highly integrated, miniaturized, low-power cellular IoT solutions featuring a low-power STM32L4 MCU and an ALT1250 M1/NB modem.

- In April 2020, Qualcomm launched a power-efficient NB2 IoT chipset that supports single-mode 3GPP Release 14 Cat. In December 2019, GUTERMANN, a global leader in leak detection solutions for the water industry, launched the world’s first water leak-detecting noise logger ZONESCAN NB-IoT. This will enable municipal authorities to monitor water distribution continuously.

Key Benefits of the Report/Reason to Buy

Target Audience

Frequently Asked Questions (FAQs):

What is the current size of the NarrowBand IoT Chipset Market?

The NarrowBand IoT market is projected to grow from USD 461.1 million in 2020 to USD 2,484.4 million by 2025, at a CAGR of 40.0% from 2020 to 2020.

Who are the winners in the NarrowBand IoT Chipset Market?

Huawei (China), Qualcomm (US), Nordic Semiconductor (Norway), Samsung (South Korea), Intel Corporation (US), and MediaTek (Taiwan).

What are some of the technological advancements in the market?

5G infrastructure is intended to cover end-to-end/point-to-point-based ecosystems. 5G will enable a fully connected world where the network is highly heterogeneous, covering both wireless and fixed access technologies. The 5G network is expected to offer a high data transfer rate, high device connection density, and minimum latency with real-time service delivery. As blockchain technology penetrates the manufacturing sector, various supply chain activities are streamlined. 5G offers low latency and high bandwidth, making the use of blockchain for keeping track of the supply chain much easier.

What are the factors driving the growth of the market?

Increasing adoption of IoT, growth in network-enabled devices, increasing participation of industry players, widening applications of NB-IoT technology, and demand for long-range connectivity, especially in smart metering and smart parking applications, are expected to drive the NB-IoT chipset market in the following years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 NB-IOT CHIPSET MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

FIGURE 2 NB-IOT CHIPSET MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size by top-down analysis (supply side)

FIGURE 3 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 5 NB-IOT CHIPSET MARKET: POST COVID-19

TABLE 1 MARKET, BY VALUE AND VOLUME, 2017–2025

FIGURE 6 SMART METERS HELD LARGEST SHARE OF MARKET IN 2019

FIGURE 7 GUARD-BAND DEPLOYMENT TO HOLD LARGEST SHARE OF MARKET BY 2019

FIGURE 8 NB-IOT CHIPSET MARKET FOR ENERGY & UTILITIES TO HOLD THE LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 9 APAC TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN NB-IOT CHIPSET MARKET

FIGURE 10 INCREASING DEMAND FOR LOW-POWERED WIDE-RANGE TECHNOLOGY FOR IOT APPLICATIONS TO DRIVE MARKET GROWTH FROM 2020 TO 2025

4.2 MARKET IN APAC, BY DEVICE AND COUNTRY

FIGURE 11 SMART METERS AND CHINA TO HOLD LARGEST SHARES OF MARKET IN APAC BY 2025

4.3 MARKET, BY VERTICAL

FIGURE 12 ENERGY AND UTILITIES TO HOLD LARGEST SHARE OF MARKET BY 2025 IN USD MILLION

4.4 MARKET, BY GEOGRAPHY

FIGURE 13 NORTH AMERICA TO REGISTER HIGHEST CAGR IN NB-IOT CHIPSET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

FIGURE 14 EVOLUTION OF NARROWBAND-IOT STANDARDIZATION

TABLE 2 TOP USE-CASES OF NB-IOT TECHNOLOGY, BY COUNTRY

5.2 MARKET DYNAMICS

FIGURE 15 WIDENING APPLICATIONS OF NB-IOT TECHNOLOGY DRIVES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for wearable devices due to COVID-19 outbreak

5.2.1.2 Growing adoption of IoT and rise in use of connected devices

5.2.1.3 Rising demand for low-power, low-cost, and long-range connectivity technologies

5.2.1.4 Increasing participation of industry players in development of NB-IoT

5.2.1.5 Widening applications of NB-IoT technology

5.2.2 RESTRAINTS

5.2.2.1 Stiff competition from other LPWA technologies

5.2.2.2 Privacy and security concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging smart cities and smart buildings

FIGURE 16 SMART CITY ECOSYSTEM

FIGURE 17 COUNTRIES WITH KEY SMART CITY PROJECTS

5.2.4 CHALLENGES

5.2.4.1 Long tail ecosystem consisting of chipsets, modules, devices, and application platforms

FIGURE 18 NB-IOT MARKET ECOSYSTEM

5.2.4.2 Limited to low-speed data transmission applications

5.2.4.3 Disruptions in logistics and supply chain due to COVID-19

5.3 CASE STUDIES

5.3.1 LAS VEGAS SMART CITY

5.3.2 CHINA MOBILE DEPLOYS ELECTRIC SMART METERING

5.3.3 U-BLOX BRINGS NB-IOT IN BRAZIL

5.3.4 UNIVERSITY OF ST. ANDREWS DEVELOPING NEW SMART TAGS TO TRACK SEALS USING NB-IOT

6 NB-IOT CHIPSET MARKET, BY DEPLOYMENT TYPE (Page No. - 53)

6.1 INTRODUCTION

TABLE 3 NB-IOT CHIPSET MARKET, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 4 MARKET, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

6.2 STAND-ALONE

6.2.1 STAND-ALONE DEPLOYMENT IS COSTLIER THAN OTHER NB-IOT DEPLOYMENT TYPES

TABLE 5 STAND-ALONE NB-IOT CHIPSET MARKET, BY VERTICAL, 2019 (USD THOUSAND)

TABLE 6 STAND-ALONE NB-IOT CHIPSET, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 7 STAND-ALONE NB-IOT CHIPSET, BY REGION, 2019 (USD MILLION)

TABLE 8 STAND-ALONE NB-IOT CHIPSET, BY REGION, 2020–2025 (USD MILLION)

6.3 GUARD BAND

6.3.1 GUARD BAND ALLOWS USE OF SPECTRUM AT CHANNEL EDGES OF EXISTING LTE CARRIERS

TABLE 9 GUARD BAND NB-IOT CHIPSET MARKET, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 10 GUARD BAND NB-IOT CHIPSET, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 11 GUARD BAND NB-IOT CHIPSET, BY REGION, 2017–2019 (USD MILLION)

TABLE 12 GUARD BAND NB-IOT CHIPSET, BY REGION, 2020–2025 (USD MILLION)

6.4 IN-BAND

6.4.1 IN-BAND DEPLOYMENT USES SAME SPECTRUM THAT IS USED IN LTE CARRIER

TABLE 13 IN-BAND NB-IOT CHIPSET MARKET, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 14 IN-BAND NB-IOT CHIPSET, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 15 IN-BAND NB-IOT CHIPSET, BY REGION, 2017–2019 (USD MILLION)

TABLE 16 IN-BAND NB-IOT CHIPSET, BY REGION, 2020–2025 (USD MILLION)

7 NB-IOT CHIPSET MARKET, BY DEVICE (Page No. - 61)

7.1 INTRODUCTION

TABLE 17 NB-IOT CHIPSET MARKET, BY DEVICE, 2017–2019 (USD MILLION)

TABLE 18 NB-IOT CHIPSET, BY DEVICE, 2020–2025 (USD MILLION)

7.2 SMART PARKING

7.2.1 SMART PARKING DEVICES ARE EMBEDDED WITH INTELLIGENT SENSORS AND SOFTWARE

TABLE 19 NB-IOT CHIPSET MARKET FOR SMART PARKING, BY REGION, 2017–2019 (USD MILLION)

TABLE 20 MARKET FOR SMART PARKING, BY REGION, 2020–2025 (USD MILLION)

7.3 SMART METERS

7.3.1 ENERGY SUPPLIERS PREFER SMART METERS TO ACHIEVE SPECIFIC AND AUTOMATED BILLING

TABLE 21 NB-IOT CHIPSET MARKET FOR SMART METERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 22 MARKET FOR SMART METERS, BY REGION, 2020–2025 (USD MILLION)

7.4 TRACKERS

7.4.1 NB-IOT APPLICATIONS FOR TRACKERS INCLUDE LOGISTIC TRACKING, ASSET TRACKING, AND PET TRACKING

TABLE 23 NB-IOT CHIPSET MARKET FOR TRACKERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 24 MARKET FOR TRACKERS, BY REGION, 2020–2025 (USD MILLION)

7.5 ALARMS AND DETECTORS

7.5.1 ALARMS AND DETECTORS ARE PLACED AT IDEAL LOCATIONS AT HOMES THAT CONSTANTLY COMMUNICATE WITH THE NB-IOT NETWORK

TABLE 25 NB-IOT CHIPSET MARKET FOR ALARMS AND DETECTORS, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 MARKET FOR ALARMS AND DETECTORS, BY REGION, 2020–2025 (USD MILLION)

7.6 SMART STREETLIGHTS

7.6.1 ADOPTION ON NB-IOT IN SMART STREETLIGHTS APPLICATION ALLOWS LARGE-SCALE NETWORK INTERCONNECTION

TABLE 27 NB-IOT CHIPSET MARKET FOR SMART STREETLIGHTS, BY REGION, 2017–2019 (USD MILLION)

TABLE 28 MARKET FOR SMART STREETLIGHTS, BY REGION, 2020–2025 (USD MILLION)

7.7 SMART APPLIANCES

7.7.1 SMART APPLIANCES ARE EQUIPPED WITH DIFFERENT SENSORS AND ARE EMBEDDED WITH CONNECTIVITY FEATURES

TABLE 29 NB-IOT CHIPSET MARKET FOR SMART APPLIANCES, BY REGION, 2017–2019 (USD MILLION)

TABLE 30 MARKET FOR SMART APPLIANCES, BY REGION, 2020–2025 (USD MILLION)

7.8 WEARABLE DEVICES

7.8.1 MOST WEARABLES THAT CONNECT THROUGH A NETWORK DEDICATED TO 3G/4G OR ARE TETHERED THROUGH A SMARTPHONE HAVE LIMITED CONNECTIVITY

TABLE 31 NB-IOT CHIPSET MARKET FOR WEARABLE DEVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 32 MARKET FOR WEARABLE DEVICES, BY REGION, 2020–2025 (USD MILLION)

7.9 OTHER DEVICES

TABLE 33 NB-IOT CHIPSET MARKET FOR OTHER DEVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 MARKET FOR OTHER DEVICES, BY REGION, 2020–2025 (USD MILLION)

7.10 IMPACT OF COVID-19

8 NB-IOT CHIPSET MARKET, BY VERTICAL (Page No. - 73)

8.1 INTRODUCTION

TABLE 35 NB-IOT CHIPSET MARKET, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 36 MARKET, BY VERTICAL, 2020–2025 (USD MILLION)

8.2 AGRICULTURE

8.2.1 KEY APPLICATIONS OF NB-IOT IN AGRICULTURE ARE IRRIGATION CONTROL, ENVIRONMENTAL SENSING, AND ANIMAL TRACKING

TABLE 37 NB-IOT CHIPSET MARKET FOR AGRICULTURE, BY APPLICATION, 2017–2019 (USD THOUSAND)

TABLE 38 MARKET FOR AGRICULTURE, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 39 MARKET FOR AGRICULTURE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 40 MARKET FOR AGRICULTURE, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 41 MARKET FOR AGRICULTURE, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 42 MARKET FOR AGRICULTURE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.3 AUTOMOTIVE AND TRANSPORTATION

8.3.1 NB-IOT IS EXPECTED TO ENABLE REAL-TIME COLLECTION OF MASSIVE DATA FROM VEHICLES

TABLE 43 NB-IOT CHIPSET MARKET FOR AUTOMOTIVE AND TRANSPORTATION, 2017–2019 (USD MILLION)

TABLE 44 MARKET FOR AUTOMOTIVE AND TRANSPORTATION, 2020–2025 (USD MILLION)

TABLE 45 MARKET FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2017–2019 (USD MILLION)

TABLE 46 MARKET FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 47 MARKET FOR AUTOMOTIVE AND TRANSPORTATION, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 48 MARKET FOR AUTOMOTIVE AND TRANSPORTATION, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.4 ENERGY AND UTILITIES

8.4.1 SMART METERING APPLICATION IS LEADING IN ENERGY AND UTILITIES VERTICAL

TABLE 49 NB-IOT CHIPSET MARKET FOR ENERGY AND UTILITIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 50 MARKET FOR ENERGY AND UTILITIES, BY REGION, 2020–2025 (USD MILLION)

TABLE 51 MARKET FOR ENERGY AND UTILITIES, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 52 MARKET FOR ENERGY AND UTILITIES, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.5 HEALTHCARE

8.5.1 DEMAND TO IMPROVE HEALTH OUTCOMES THROUGH CONNECTED HEALTH IS PAVING WAY FOR NB-IOT IN HEALTHCARE VERTICAL

TABLE 53 NB-IOT CHIPSET MARKET FOR HEALTHCARE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 54 MARKET FOR HEALTHCARE, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 55 MARKET FOR HEALTHCARE, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 56 MARKET FOR HEALTHCARE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.6 MANUFACTURING

8.6.1 NB-IOT IS LIKELY TO BE USED IN ASSET MONITORING, REAL-TIME COMMUNICATION, AND CONNECTED LOGISTICS APPLICATIONS

TABLE 57 NB-IOT CHIPSET MARKET FOR MANUFACTURING, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 58 MARKET FOR MANUFACTURING, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 59 MARKET FOR MANUFACTURING APPLICATION, BY DEPLOYMENT TYPE, 2017–2019(USD THOUSAND)

TABLE 60 MARKET FOR MANUFACTURING, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

8.7 SAFETY AND SECURITY

8.7.1 IOT-ENABLED SMART DEVICES CAN HELP GOVERNMENT ORGANIZATIONS TO ENSURE BETTER PUBLIC SAFETY

TABLE 61 NB-IOT CHIPSET MARKET FOR SAFETY AND SECURITY, BY REGION, 2017–2019 (USD MILLION)

TABLE 62 MARKET FOR SAFETY AND SECURITY, BY REGION, 2020–2025 (USD MILLION)

TABLE 63 MARKET FOR SAFETY AND SECURITY, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 64 MARKET FOR SAFETY AND SECURITY, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.8 INFRASTRUCTURE

8.8.1 SMART PARKING AND SMART STREETLIGHTS ARE TWO KEY APPLICATIONS THAT ARE COMMERCIALLY DEPLOYED ON NB-IOT TECHNOLOGY

TABLE 65 NB-IOT CHIPSET MARKET FOR INFRASTRUCTURE, BY REGION, 2017–2019 (USD MILLION)

TABLE 66 MARKET FOR INFRASTRUCTURE, BY REGION, 2020–2025 (USD MILLION)

TABLE 67 MARKET FOR INFRASTRUCTURE, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 68 MARKET FOR INFRASTRUCTURE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.9 BUILDING AUTOMATION

8.9.1 DEVELOPMENT OF SMART CITY PROJECTS ACROSS THE WORLD IS ESCALATING THE GROWTH OF NB-IOT IN BUILDING AUTOMATION

TABLE 69 NB-IOT CHIPSET MARKET FOR BUILDING AUTOMATION, BY TYPE, 2017–2019 (USD MILLION)

TABLE 70 MARKET FOR BUILDING AUTOMATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 71 MARKET FOR BUILDING AUTOMATION, BY REGION, 2017–2019 (USD MILLION)

TABLE 72 MARKET FOR BUILDING AUTOMATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 73 MARKET FOR BUILDING AUTOMATION, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 74 MARKET FOR BUILDING AUTOMATION, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.10 CONSUMER ELECTRONICS

8.10.1 CONNECTED DEVICE TECHNOLOGY IN CONSUMER ELECTRONICS INDUSTRY IS EXPECTED TO BE KEY ENABLER OF MARKET GROWTH

TABLE 75 NB-IOT CHIPSET MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2019 (USD MILLION)

TABLE 76 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2025 (USD MILLION)

TABLE 77 MARKET FOR CONSUMER ELECTRONICS, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 78 MARKET FOR CONSUMER ELECTRONICS, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

8.11 IMPACT OF COVID-19

9 GEOGRAPHIC ANALYSIS (Page No. - 92)

9.1 INTRODUCTION

FIGURE 19 GEOGRAPHIC OVERVIEW: NB-IOT CHIPSET MARKET

TABLE 79 MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 80 MARKET, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 20 SNAPSHOT OF NB-IOT CHIPSET MARKET IN NORTH AMERICA

TABLE 81 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 83 MARKET IN NORTH AMERICA, BY VERTICAL, 2017–2019 (USD THOUSAND)

TABLE 84 MARKET IN NORTH AMERICA, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 85 MARKET IN NORTH AMERICA, BY DEVICE, 2017–2019 (USD MILLION)

TABLE 86 MARKET IN NORTH AMERICA, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 88 MARKET IN NORTH AMERICA, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 89 MARKET IN NORTH AMERICA, BY DEPLOYMENT TYPE, 2017–2019 (MILLION UNITS)

TABLE 90 MARKET IN NORTH AMERICA, BY DEPLOYMENT TYPE, 2020–2025 (MILLION UNITS)

9.2.1 US

9.2.1.1 Presence of leading chipset and module manufacturers is likely to drive NB-IoT market in US

9.2.2 CANADA

9.2.2.1 Domestics telecom operators to play pivotal role in large scale adoption on NB-IoT services in Canada

9.2.3 MEXICO

9.2.3.1 Smart city projects in Mexico are driving growth of NB-IoT technology

9.3 EUROPE

FIGURE 21 SNAPSHOT OF NB-IOT CHIPSET MARKET IN EUROPE

TABLE 91 NB-IOT CHIPSET MARKET IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 92 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 93 MARKET IN EUROPE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 94 MARKET IN EUROPE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 95 MARKET IN EUROPE, BY DEVICE, 2017–2019 (USD MILLION)

TABLE 96 NB-IOT CHIPSET MARKET IN EUROPE, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 97 MARKET IN EUROPE, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 99 MARKET IN EUROPE, BY DEPLOYMENT TYPE, 2017–2019 (MILLION UNITS)

TABLE 100 MARKET IN EUROPE, BY DEPLOYMENT TYPE, 2020–2025 (MILLION UNITS)

9.3.1 GERMANY

9.3.1.1 Smart utility projects to drive NB-IoT market in Germany

9.3.2 UK

9.3.2.1 Smart city projects to drive growth of NB-IoT market in UK

9.3.3 FRANCE

9.3.3.1 Stiff competition from other LPWA technologies limits growth of NB-IoT technology in France

9.3.4 ITALY

9.3.4.1 Partnerships among leading players in NB-IoT ecosystem is supplementing growth of NB-IoT chipset market in Italy

9.3.5 SPAIN

9.3.5.1 Vodafone (UK) and Telefonica (Spain) are key NB-IoT service providers in Spain

9.3.6 REST OF EUROPE

9.4 APAC

FIGURE 22 SNAPSHOT OF NB-IOT CHIPSET MARKET IN APAC

TABLE 101 MARKET IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 102 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 103 MARKET IN APAC, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 104 MARKET IN APAC, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 105 MARKET IN APAC, BY DEVICE, 2017–2019 (USD MILLION)

TABLE 106 MARKET IN APAC, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 107 MARKET IN APAC, BY DEPLOYMENT TYPE, 2017–2019 (USD MILLION)

TABLE 108 MARKET IN APAC, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 109 MARKET IN APAC, BY DEPLOYMENT TYPE, 2017–2019 (MILLION UNITS)

TABLE 110 MARKET IN APAC, BY DEPLOYMENT TYPE, 2020–2025 (MILLION UNITS)

9.4.1 CHINA

9.4.1.1 Government regulations and presence of leading NB-IoT players are prime factors for growth of NB-IoT market in China

9.4.2 JAPAN

9.4.2.1 SoftBank, NTT DoCoMo, and KDDI are leading players of NB-IoT technology in Japan

9.4.3 SOUTH KOREA

9.4.3.1 Strong investments from local telecom players have resulted in adoption of NB-IoT in South Korea

9.4.4 INDIA

9.4.4.1 Smart metering applications and nation-wide smart city projects pose lucrative growth opportunities for NB-IoT technology in India

9.4.5 REST OF APAC

9.5 ROW

TABLE 111 NB-IOT CHIPSET MARKET IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 112 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 113 MARKET IN ROW, BY VERTICAL, 2017–2019 (USD THOUSAND)

TABLE 114 MARKET IN ROW, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 115 MARKET IN ROW, BY DEVICE, 2017–2019 (USD MILLION)

TABLE 116 MARKET IN ROW, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 117 MARKET IN ROW, BY DEPLOYMENT TYPE, 2017–2019 (MILLION UNITS)

TABLE 118 MARKET IN ROW, BY DEPLOYMENT TYPE, 2020–2025 (MILLION UNITS)

9.5.1 MIDDLE EAST AND AFRICA

9.5.1.1 Smart metering application is expected to play a crucial role in adoption of NB-IoT technology in MEA

9.5.2 SOUTH AMERICA

9.5.2.1 Brazil and Chile are leading adopters of NB-IoT in South America

9.6 IMPACT OF COVID-19

10 COMPETITIVE LANDSCAPE (Page No. - 118)

10.1 OVERVIEW

FIGURE 23 KEY DEVELOPMENTS IN NB-IOT CHIPSET MARKET (2016–2020)

10.2 MARKET PLAYER RANKING ANALYSIS (2019)

TABLE 119 RANKING OF KEY PLAYERS IN NB-IOT CHIPSET (2019)

10.3 COMPETITIVE LEADERSHIP MAPPING

FIGURE 24 NB-IOT CHIPSET MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

10.3.1 VISIONARY LEADERS

10.3.2 DYNAMIC DIFFERENTIATORS

10.3.3 INNOVATORS

10.3.4 EMERGING COMPANIES

10.4 COMPETITIVE SCENARIO

10.4.1 PRODUCT LAUNCHES

TABLE 120 PRODUCT LAUNCHES, (2017–2020)

10.4.2 PRODUCT DEVELOPMENTS

TABLE 121 PRODUCT DEVELOPMENTS, (2017–2019)

10.4.3 PARTNERSHIPS AND COLLABORATIONS

TABLE 122 PARTNERSHIPS AND COLLABORATIONS, (2018–2020)

11 COMPANY PROFILES (Page No. - 126)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, SWOT analysis, and MnM view)*

11.1.1 HUAWEI

FIGURE 25 HUAWEI: COMPANY SNAPSHOT

11.1.2 QUALCOMM

FIGURE 26 QUALCOMM: COMPANY SNAPSHOT

11.1.3 NORDIC SEMICONDUCTOR

FIGURE 27 NORDIC SEMICONDUCTOR: COMPANY SNAPSHOT

11.1.4 SAMSUNG ELECTRONICS

FIGURE 28 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

11.1.5 INTEL

FIGURE 29 INTEL: COMPANY SNAPSHOT

11.1.6 SANECHIPS TECHNOLOGY (ZTE MICROELECTRONICS)

11.1.7 MEDIATEK

FIGURE 30 MEDIATEK: COMPANY SNAPSHOT

11.1.8 ALTAIR SEMICONDUCTOR (A SONY GROUP COMPANY)

11.1.9 COMMSOLID (A GOODIX COMPANY)

11.1.10 RIOT MICRO

11.2 OTHER KEY PLAYERS

11.2.1 SIERRA WIRELESS

11.2.2 U-BLOX

11.2.3 SEQUANS COMMUNICATIONS

11.2.4 GCT SEMICONDUCTOR

11.2.5 XIAMEN CHEERZING IOT TECHNOLOGY

11.2.6 TELIT

11.2.7 QUECTEL WIRELESS SOLUTIONS

11.2.8 SIMCOM WIRELESS SOLUTIONS (A SUNSEA AIOT COMPANY)

11.2.9 GEMALTO

11.2.10 SERCOMM

*Details on Business overview, Products offered, Recent developments, SWOT analysis, and MnM view might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKET (Page No. - 159)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 LTE IOT MARKET

12.3.1 MARKET DEFINITION

TABLE 124 LTE-M: LTE IOT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 125 LTE IOT MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 126 PROFESSIONAL SERVICES: LTE IOT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 127 MANAGED SERVICES: LTE IOT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 128 NB-IOT: LTE IOT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.4 WIRELESS CONNECTIVITY MARKET

12.4.1 MARKET DEFINITION

TABLE 129 WIRELESS CONNECTIVITY MARKET, BY CONNECTIVITY TECHNOLOGY, 2013–2022 (USD MILLION)

TABLE 130 WIRELESS CONNECTIVITY MARKET, BY CONNECTIVITY TECHNOLOGY, 2013–2022 (MILLION UNITS)

TABLE 131 WI-FI MARKET , BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 132 BLUETOOTH MARKET , BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 133 BLUETOOTH SMART MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 134 FI/BLUETOOTH SMART MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 135 BLUETOOTH SMART/ANT+ MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 136 ZIGBEE MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 137 NFC MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 138 GNSS MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 139 ENOCEAN MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 140 ANT+ MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 141 CELLULAR MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 142 WHART MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

TABLE 143 OTHERS WIRELESS CONNECTIVITY MARKET, BY APPLICATION, 2013–2022 (USD MILLION)

13 APPENDIX (Page No. - 166)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

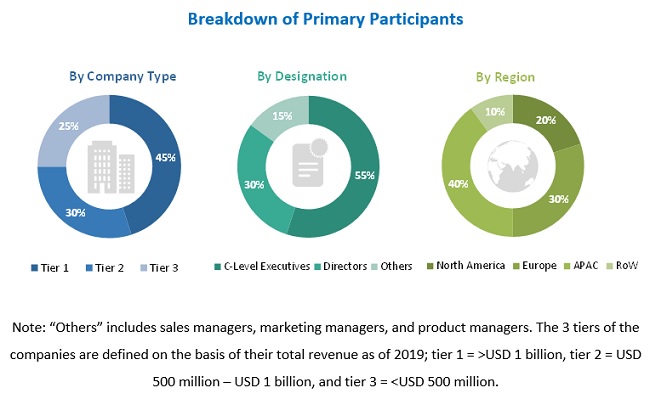

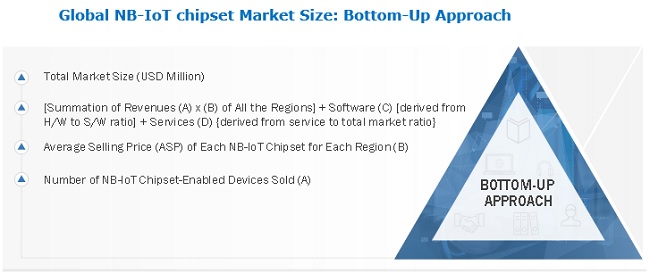

The study involved 4 major activities in estimating the current size of the NB-IoT chipset market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both, top-down and bottom-up approaches have been employed to estimate the complete market size. In the subsequent steps, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the NB-IoT chipset market begins with capturing data on revenues and unit shipment of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the NB-IoT chipset market. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the supply chain and value chain of the industry; total pool of key players; classification and segmentation of the market according to industry trends; geographic markets; and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to NB-IoT chipset market. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application users, and related executives from various key companies and organizations operating in the NB-IoT chipset ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the overall size of the NB-IoT chipset market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To describe, segment, and forecast the narrowband Internet of Things (NB-IoT) chipset market-in terms of value and volume-by deployment type, device, and vertical

- To forecast the market for various segments with respect to 4 main regions-North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges, the major factors influencing the growth of the NB-IoT chipset market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the NB-IoT chipset market for stakeholders and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze developments such as product launches, product developments, partnerships and collaborations, agreements, and market development in the NB-IoT Chipset market

- To analyze the market penetration of the NB-IoT chipset market through secondary and primary research, for both pre- and post-COVID-19 scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Market segmentation of various verticals across devices.

- Unit shipments of NB-IoT chipsets by region

- Comprehensive coverage of regulations followed in each region pertaining to IoT (North America, APAC, Europe, and RoW)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Narrowband IoT (NB-IoT) Chipset Market