Neurovascular Devices Market Size, Growth, Share & Trends Analysis

Neurovascular Devices Market by Disease Pathology (Cerebral Aneurysm (Embolic coils, Flow Diverters), Ischemic Stroke (Clot Retriever, Aspiration, Snare), Carotid Stenosis (Stent, Embolic Protection), Others), End User (Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

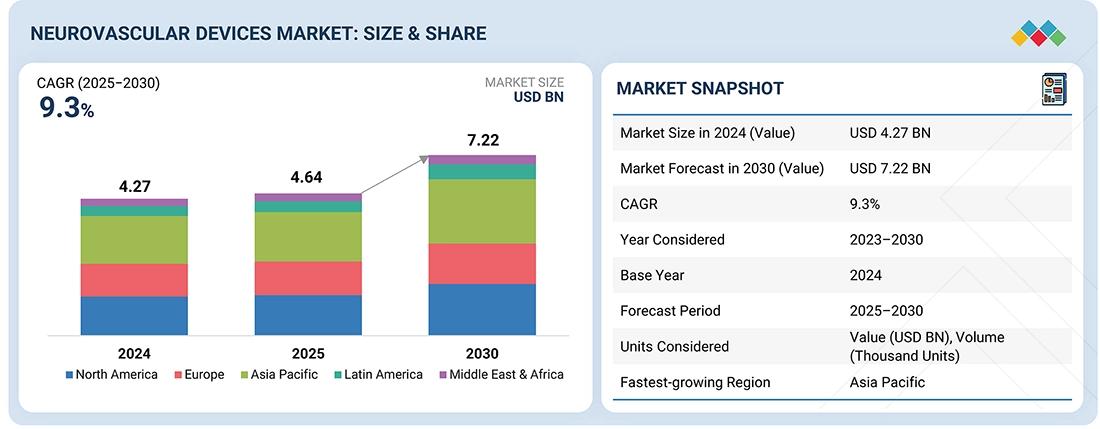

The global neurovascular devices market is projected to reach USD 7.22 billion in 2030 from USD 4.64 billion in 2025, at a CAGR of 9.3% during the forecast period. The market growth is primarily driven by the prevalence of neurovascular diseases, influenced by factors such as aging populations, hypertension, smoking, and sedentary lifestyles. This significantly boosts the demand for advanced tools for effective monitoring and treatment. As the incidence of conditions like stroke, brain aneurysms, and arteriovenous malformations rises, so does the need for timely diagnosis and minimally invasive procedures.

KEY TAKEAWAYS

-

BY DISEASE PATHOLOGYBased on disease pathology, the global neurovascular devices market is divided into five main segments: cerebral aneurysms, ischemic strokes, carotid artery stenosis, arteriovenous malformation & fistulas, and other disease pathologies. The cerebral aneurysm segment held the largest market share. The high incidence of cerebral aneurysms results from lifestyle, physiological, and genetic factors. Chronic hypertension, smoking, and atherosclerosis significantly contribute to weakening blood vessel walls, while lifestyle habits such as alcohol use and a sedentary lifestyle increase vascular stress. Age and gender are also important; middle-aged individuals and women face a higher risk. Additionally, those with a family history of aneurysms or certain genetic disorders are more likely to develop these conditions, highlighting genetics as a key underlying factor.

-

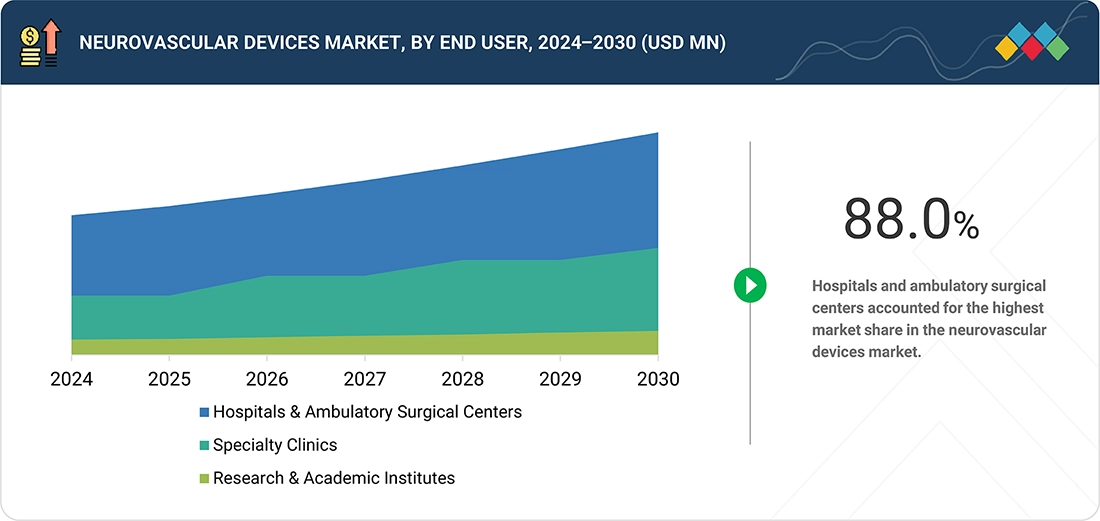

BY END USERBased on end user, the global neurovascular devices market is segmented by end user into the following categories: hospitals & surgical centers, ambulatory care centers, research laboratories, and academic institutes. Among these, the hospitals & surgical centers segment is expected to capture the largest market share. They have the latest diagnostic tools and a highly trained medical team to handle critical conditions like strokes, aneurysms, and vascular malformations. Hospitals & Surgical Centers provide quick, specialized care, which is often crucial in time-sensitive situations. Their ability to offer continuous monitoring, rehabilitation services, and manage complications ensures the best patient outcomes, making them the market leaders..

-

BY REGIONThe global neurovascular devices market is segmented into five key regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Among these, in 2024, North America held the largest market share in the neurovascular devices industry. North America remains the biggest market for neurovascular devices, driven by several region-specific factors. The region benefits from a well-developed healthcare infrastructure with widespread access to advanced medical technologies, enabling early diagnosis and effective treatment of neurovascular conditions like stroke, aneurysms, and arteriovenous malformations. The high prevalence of lifestyle-related risk factors—such as hypertension, obesity, and smoking—has increased the incidence of neurovascular diseases, boosting demand for treatment options. Additionally, North America hosts leading medical device manufacturers and research institutions, fostering ongoing innovation and quick adoption of new technologies. The availability of skilled healthcare professionals, including neurosurgeons and interventional radiologists, further supports the use of cutting-edge neurovascular procedures. Favorable reimbursement policies and strong awareness among patients and physicians regarding early intervention and minimally invasive treatments also drive higher procedure volumes.

-

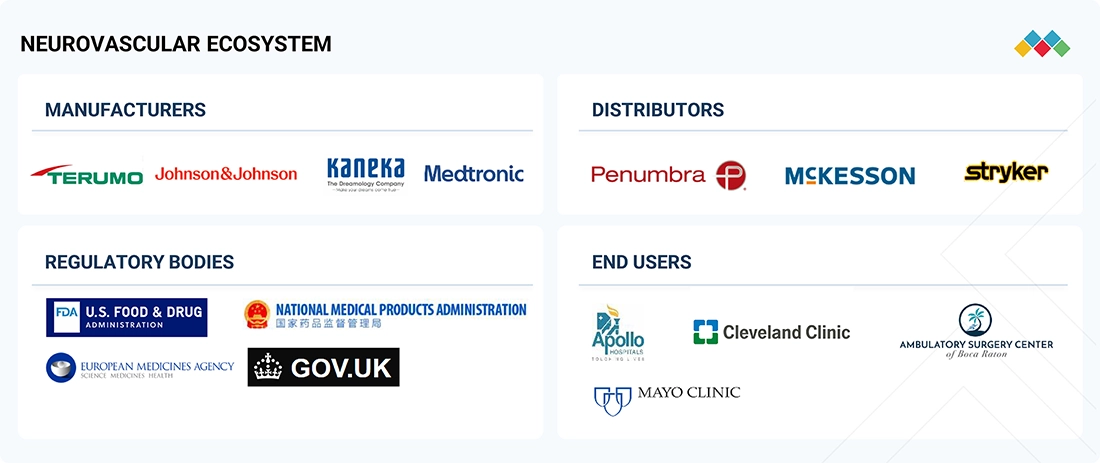

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including product launches, partnerships, and acquisitions. Leading companies such as Stryker (US), Medtronic (Ireland), Johnson & Johnson (US), Terumo Corporation (Japan), Penumbra (US), and others have strengthened their product portfolios and expanded their global presence to meet the rising demand for neurovascular devices. Continuous innovation in neurovascular devices and advancements in technology have helped these players maintain a competitive advantage in a rapidly evolving market.

The global neurovascular devices market is anticipated to grow during the forecast timeframe owing to the rising incidence of neurovascular diseases, such as stroke, brain aneurysms, and arteriovenous malformations, is significantly driving demand for advanced diagnostic and treatment solutions. At the same time, the expansion of healthcare infrastructure across emerging economies is enabling broader adoption of neurointerventional technologies, bridging gaps in specialized care.

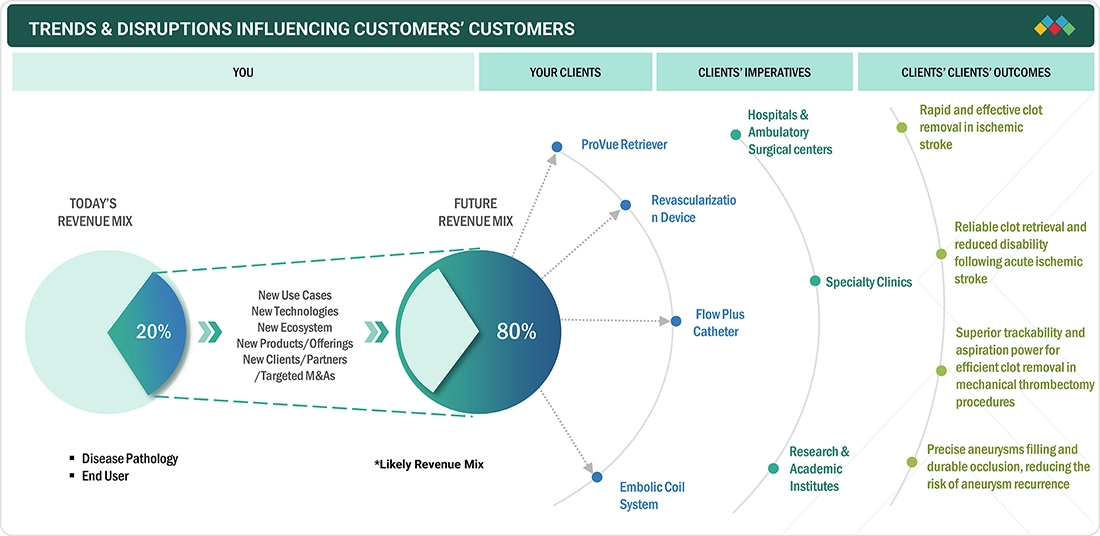

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The neurovascular devices market operates within a dynamic environment shaped by fierce competition, changing consumer needs, and regulatory challenges. Well-established companies and new entrants continually innovate to gain market share, which drives pricing pressures across different segments. At the same time, increasing costs for raw materials, sustainable packaging, and marketing push manufacturers to find a balance between affordability and profitability. Moreover, evolving health regulations, ingredient restrictions, and labeling standards across various regions influence product development and market entry strategies, prompting companies to reevaluate their pricing, positioning, and investment plans.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence of neurovascular diseases

-

Availability of medical reimbursements for neurovascular procedures

Level

-

Dearth of skilled neurosurgeons

-

High procedural cost of neurovascular surgeries and associated products

Level

-

Advancement of AI- and robot-assisted systems for next-generation neurointerventions

-

§Growing preference for minimally neurosurgical procedures

Level

-

Stringent regulatory approval process for medical devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Incidence of Neurovascular Diseases

The high prevalence of neurovascular conditions continues to drive the growth of the neurovascular devices market worldwide. According to the Brain Aneurysm Foundation (2024), an estimated 6.8 million people in the United States—about 1 in 50—live with an unruptured brain aneurysm. Each year, around 30,000 people in the U.S. experience a rupture, happening roughly every 18 minutes, with an annual rupture rate of 8 to 10 per 100,000 people. Globally, brain aneurysms cause nearly 500,000 deaths annually, with half of the victims being under 50 years old. Brain aneurysms are most common in individuals aged 35 to 60 but can also occur in children. Most develop after age 40. Women are more likely than men to have a brain aneurysm, with a ratio of about 3 to 2. Additionally, women over 55 face a higher risk of rupture—about 1.5 times greater than men. Based on this data, the growing prevalence and significant impact of brain aneurysms highlight the urgent need for advanced neurovascular devices that enable early detection, effective treatment, and better patient outcomes. Continued innovation and increased accessibility in this field are essential to reducing mortality and improving quality of life for affected individuals worldwide. The rising prevalence of neurovascular conditions, particularly brain aneurysms, affects millions across various age groups. The increasing incidence is driven by factors such as age, gender, and underlying health issues. As more people are impacted, demand for advanced neurovascular devices that enable early diagnosis, efficient treatment, and improved patient outcomes continues to grow..

Restraint: Dearth of skilled neurosurgeons

The limited number of neurosurgeons worldwide significantly restricts the neurovascular devices market, as the availability of skilled professionals directly influences the adoption and effective use of these advanced technologies. According to the Journal of Neurosurgery, 2022, in India, the neurosurgical workforce is notably inadequate. With a population exceeding 1.3 billion, the country has approximately 3,500 neurosurgeons, which translates to about one neurosurgeon per 370,000 people. This ratio is well below the recommended benchmark of one neurosurgeon per 100,000 individuals, needed to ensure adequate access to care. The shortage of neurosurgeons creates a major challenge for the neurovascular devices market. With too few specialists to meet the rising demand for complex neurovascular procedures, access to advanced treatments is limited. This scarcity decelerates the adoption of innovative neurovascular devices, restricting their use and overall market growth

Opportunity: Advancement of AI- and robot-assisted systems for next-generation neurointerventions.

The rapid progress of AI and robot-assisted systems presents a transformative opportunity for the neurovascular devices market. These next-generation technologies are changing how complex neurointerventions are done by improving precision, accuracy, and safety during procedures. AI algorithms help with preoperative planning, risk assessment, and real-time decision-making, while robotic systems offer highly controlled, minimally invasive navigation, reducing the chance of human error. Such innovations not only enhance patient outcomes by making treatments more effective and targeted but also boost procedural efficiency and shorten recovery times. Additionally, AI and robotic integration can help address limitations caused by the shortage of highly skilled neurosurgeons by providing decision support and enhancing surgical capabilities. The adoption of these advanced systems also creates opportunities for remote and tele-guided procedures, expanding access to specialized neurovascular care in underserved areas. Overall, these advancements are expected to speed up market growth, increase demand for sophisticated devices, and promote ongoing investment in research and development within the neurovascular sector..

Challenge: Stringent regulatory approval process for medical devices

The strict regulatory approval process for medical devices remains a major challenge for the neurovascular devices market. Neurovascular devices, being highly specialized and used in critical procedures, are subject to extensive safety and efficacy assessments, including lengthy clinical trials and comprehensive documentation. This rigorous approval process can greatly extend development timelines and costs, delaying the introduction of innovative solutions to the market. Additionally, navigating complex regulatory requirements across different regions presents further obstacles for manufacturers, limiting how quickly new technologies reach patients and restricting overall market growth.

Neurovascular Devices Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Neurovascular devices for ischemic and hemorrhagic stroke treatment, including stent retrievers, aspiration systems, and flow diverters. | Enables rapid clot removal, restores blood flow, minimizes brain damage, and improves recovery outcomes in stroke patients |

|

Neurovascular technologies including Solitaire™ stent retrievers, flow diverters, and embolization coils for stroke and aneurysm management. | Provides effective clot retrieval and aneurysm repair, reduces procedural time, and improves patient survival rates. |

|

Comprehensive portfolio for stroke care — embolic coils, stent retrievers, and access systems for both ischemic and hemorrhagic stroke management | Delivers reliable stroke intervention solutions, supports minimally invasive procedures, and enhances long-term neurological outcomes. |

|

Catheters, guidewires, and embolization devices for neurovascular access and aneurysm treatment. | Offers superior device flexibility and control, ensures precise navigation in complex brain vasculature, and supports safer neurointerventions. |

|

Aspiration-based thrombectomy systems and embolization devices for ischemic and hemorrhagic stroke. | Facilitates rapid clot removal with continuous aspiration, reduces the risk of re-occlusion, and enables faster neurological recovery |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The neurovascular devices market ecosystem includes device manufacturers, component suppliers, healthcare providers, regulatory authorities, and research institutions that collectively drive innovation and market growth. Manufacturers work with technology partners to develop advanced products such as stent retrievers, embolic coils, flow diverters, aspiration systems, and microcatheters, enhancing procedural accuracy and patient outcomes in stroke and aneurysm treatment. Hospitals, surgical centers, and specialty neurology clinics are the main end-users, increasing demand through the growing use of minimally invasive neurointerventional procedures. Regulatory agencies, including the FDA, oversee product safety and clinical effectiveness, affecting approval processes and marketing strategies. Strategic partnerships, government healthcare initiatives, and ongoing R&D investments further boost technological progress, while medical training centers and professional societies improve physician skills, encouraging broader clinical use and strengthening the overall neurovascular devices ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Neurovascular Devices Market, By Disease Pathology

By disease pathology, the global neurovascular devices market is divided into five main segments: cerebral aneurysms, ischemic strokes, carotid artery stenosis, arteriovenous malformation & fistulas, and other disease pathologies. The cerebral aneurysms segment held the largest market share. The high rate of cerebral aneurysms results from lifestyle, physiological, and genetic factors. Chronic hypertension, smoking, and atherosclerosis significantly weaken blood vessel walls, while lifestyle choices such as alcohol consumption and a sedentary lifestyle increase vascular stress. Age and gender are also important, with middle-aged individuals and women at higher risk. Additionally, those with a family history of aneurysms or specific genetic disorders are more likely to develop these conditions, making genetics a key underlying factor.

Neurovascular Devices Market, By End User

By end user, the global neurovascular devices market is segmented by end user into the following categories: hospitals & ambulatory surgical centers, specialty clinics, research & academic institutes. Among these, the hospitals & ambulatory surgical centers segment is expected to garner the highest share in the market. They have the latest diagnostic tools and experienced, well-trained medical teams to manage critical conditions like strokes, aneurysms, and vascular malformations. Hospitals and ambulatory surgical centers provide quick, specialized care, often essential in time-sensitive situations. Their ability to offer continuous monitoring, rehabilitation services, and handle complications ensures optimal patient outcomes and remains a major reason for their leading position within the market landscape.

REGION

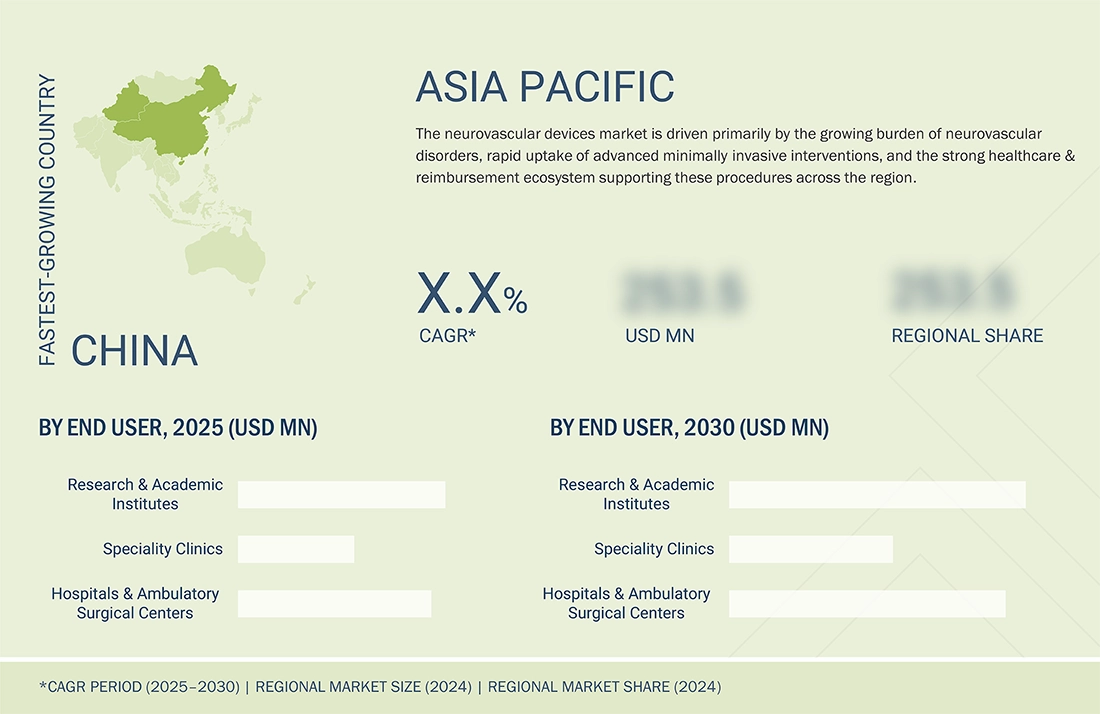

Asia Pacific to be fastest-growing region in global neurovascular devices market during forecast period

The global neurovascular devices market is divided into five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is expected to experience the fastest growth during the forecast period. Asia-Pacific is emerging as the quickest-growing area in the neurovascular devices market during this time, driven by rapid healthcare improvements and increasing awareness of neurological conditions. Rising rates of stroke and cerebral aneurysm, along with a growing aging population and lifestyle-related risk factors such as hypertension and diabetes, are boosting demand for advanced neurointerventional treatments. Governments in countries such as China, India, and Japan are heavily investing in upgrading hospital infrastructure and increasing access to minimally invasive neurosurgical care. Moreover, the availability of skilled medical professionals, expanding medical tourism, and collaborations between global device makers and local healthcare providers are speeding up the adoption of innovative neurovascular technologies, making Asia-Pacific a key growth center for the industry.

Neurovascular Devices Market: COMPANY EVALUATION MATRIX

The neurovascular devices market is dominated by Stryker (US), Medtronic (Ireland), Johnson & Johnson (US), Terumo Corporation (Japan), and Penumbra (US) due to their strong brand reputations, extensive product portfolios, and continuous innovation in the products. Stryker (US) and Medtronic (Ireland) lead the industry with high-quality neurovascular devices. Their dominance is reinforced by robust R&D, regulatory compliance, and comprehensive after-sales support, ensuring customer trust and market leadership.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.83 Billion |

| Market Forecast in 2030 (Value) | USD 7.22 Billion |

| Growth Rate | CAGR of 9.3% from 2025 to 2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type: Cerebral Aneurysms, Ischemic Strokes, Carotid Artery Stenosis, Arteriovenous Malformation & Fistulas, and Other Disease Pathologies By End User: Hospitals & Ambulatory Surgical Centers, Specialty Clinics, Research & Academic Institutes |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC countries |

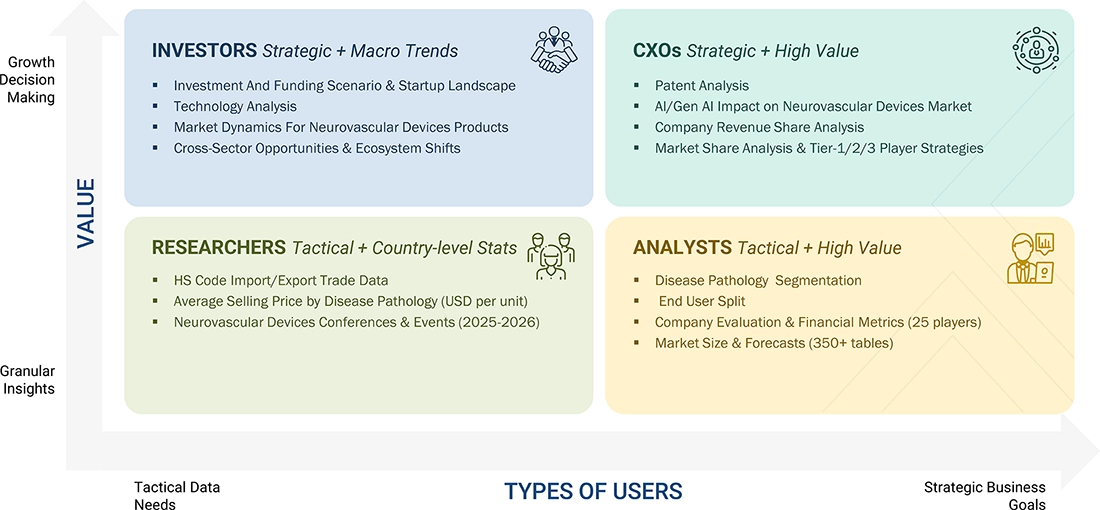

WHAT IS IN IT FOR YOU: Neurovascular Devices Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- September 2025 : Siemens Healthineers and Stryker entered a strategic partnership to develop a first-of-its-kind robotic system for neurovascular interventions. The collaboration combines Siemens’ expertise in imaging and robotics with Stryker’s leadership in neurovascular technologies, with the goal of enhancing precision in aneurysm treatment and improving timely access to stroke care.

- February 2025 : Stryker (US) acquired Inari Medical (US), a company specializing in innovative VTE clot removal solutions without thrombolytic drugs, to expand Stryker’s interventional endovascular portfolio, strengthening its peripheral vascular capabilities and positioning it strongly in the rapidly growing VTE treatment market.

- October 2024 : Terumo Corporation and NAMSA announced a strategic outsourcing partnership to expand the global regulatory approval and commercialization of Terumo's medical devices. This collaboration leverages NAMSA's clinical research, testing, and consulting services to streamline product development and bring innovative healthcare solutions to patients more efficiently.

- February 2024 : Medtronic inaugurated its newly expanded, state-of-the-art Engineering and Innovation Center (MEIC) in Hyderabad, India. This expansion is strategically aligned with Medtronic's goal of broadening its global R&D footprint.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising incidence of neurovascular diseases- Availability of medical reimbursements for neurovascular procedures- Expansion of healthcare infrastructure across emerging economies- Rising demand for effective neurovascular therapiesRESTRAINTS- Shortage of skilled neurosurgeons- High procedural cost of neurovascular surgeries and associated productsOPPORTUNITIES- Rising R&D activities for neurovascular therapies- Growing preference for minimally invasive neurosurgical proceduresCHALLENGES- Stringent regulatory approval process for medical devices

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISOVERVIEWTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- India- South Korea

- 5.7 REIMBURSEMENT SCENARIO

-

5.8 PRICING TREND ANALYSISAVERAGE SELLING PRICE OF NEUROVASCULAR DEVICES, BY KEY PLAYER, 2021 (USD)AVERAGE SELLING PRICE OF NEUROVASCULAR DEVICES, BY REGION/COUNTRY, 2021 (USD)

-

5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

-

5.11 ECOSYSTEM MAP

-

5.12 CASE STUDY ANALYSISSTENT-ASSISTED COILING (SAC) THERAPY FOR INTRACRANIAL ANEURYSMS

- 5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

-

5.14 STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS

- 5.15 KEY BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 CEREBRAL ANEURYSMSEMBOLIC COILS- Bare detachable coils- Coated detachable coilsFLOW DIVERSION DEVICES- Rising R&D activities to develop novel flow diversion devices to promote growthINTRACRANIAL STENTS- Increased efficacy of stent-assisted coiling for treatment of wide-necked intracranial aneurysms to boost adoptionMICROCATHETERS- Growing number of neurovascular procedures and favorable reimbursement scenarios to boost demandGUIDEWIRES- Growing utilization of nitinol guidewires for cerebral aneurysm procedures to boost growth

-

6.3 ISCHEMIC STROKESCLOT RETRIEVER DEVICES- Growing number of clinical trials for development of novel clot retriever stents to drive marketSUCTION & ASPIRATION DEVICES- Rapid commercialization of technologically advanced aspiration devices for ischemic stroke treatment to support marketVASCULAR SNARES- Limited procedural benefits in stroke treatment to limit adoption of vascular snaresMICROCATHETERS- High demand for minimally invasive treatment in ischemic strokes to boost adoption of microcathetersMICROGUIDEWIRES- Increasing innovations in guidewires to promote growthBALLOON CATHETERS- Growing recognition of benefits associated with balloon catheters to bolster demand

-

6.4 CAROTID ARTERY STENOSISCAROTID ARTERY STENTS- Growing adoption of carotid artery stents for carotid intervention procedures to support growthEMBOLIC PROTECTION DEVICES- Growing utilization of distal filters during carotid intervention procedures to promote growthBALLOON CATHETERS- Growing preference for balloon catheters to improve efficacy of carotid intervention procedures to augment growth

-

6.5 ARTERIOVENOUS MALFORMATION & FISTULASLIQUID EMBOLIC AGENTS- Development of novel liquid embolic agents offering high embolization of arteriovenous fistulas to support growthOCCLUSION BALLOON CATHETERS- Growing utilization of balloon catheters for AVM treatment to support growthMICROCATHETERS- Improved compatibility of microcatheters with embolic agents to boost demand

- 6.6 OTHER DISEASE PATHOLOGIES

- 7.1 INTRODUCTION

-

7.2 HOSPITALS AND SURGICAL CENTERSINCREASING VOLUME OF NEUROVASCULAR PROCEDURES DUE TO AVAILABILITY OF ADVANCED EQUIPMENT TO DRIVE MARKET

-

7.3 AMBULATORY CARE CENTERSOPERATIONAL AND ECONOMIC BENEFITS OFFERED BY ACCS TO DRIVE MARKET

-

7.4 RESEARCH LABORATORIES AND ACADEMIC INSTITUTESINCREASING COLLABORATIONS FOR DEVELOPMENT OF TECHNOLOGICALLY ADVANCED NEUROVASCULAR DEVICES TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Presence of established neurovascular device manufacturers to drive marketCANADA- Large target pool for ischemic stroke patients to drive market

-

8.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Increasing adoption of endovascular coils and stents to drive marketFRANCE- Growing preference for minimally invasive neurovascular procedures to drive marketUK- Rising government initiatives to increase accessibility of neurovascular procedures to drive marketITALY- Increasing thrombectomy treatment rates to drive demand for neurovascular devicesSPAIN- Rising number of clinical trials for interventional neurovascular procedures to support market growthREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Favorable reimbursement policy for adoption of neurovascular procedures to drive marketCHINA- Robust presence of neurovascular device manufacturers to drive marketINDIA- Supportive government initiatives to drive uptake for neurovascular devicesAUSTRALIA- Rising incidence of cerebrovascular disease to drive marketSOUTH KOREA- Health insurance coverage for neurovascular procedures to support market growthREST OF ASIA PACIFIC

-

8.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing awareness initiatives on stroke symptoms to drive marketMEXICO- Increasing incidence of neurovascular diseases to support market growthREST OF LATIN AMERICA

-

8.6 MIDDLE EAST & AFRICASHORTAGE OF NEUROSURGEONS AND POOR HEALTHCARE COVERAGE TO RESTRAIN MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

-

9.1 INTRODUCTIONSTRATEGIES ADOPTED BY KEY PLAYERS

- 9.2 REVENUE SHARE ANALYSIS

- 9.3 MARKET SHARE ANALYSIS

-

9.4 COMPETITIVE LEADERSHIP MAPPING: COMPANY EVALUATION QUADRANT (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.5 COMPETITIVE LEADERSHIP MAPPING: STARTUPS/SME EVALUATION QUADRANT (2022)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

9.6 NEUROVASCULAR DEVICES MARKET: FOOTPRINT ANALYSIS OF LEADING PLAYERSPRODUCT LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSSTRYKER- Business overview- Products offered- Recent developments- MnM viewMEDTRONIC- Business overview- Products offered- Recent developments- MnM viewJOHNSON & JOHNSON- Business overview- Products offered- Recent developments- MnM viewTERUMO CORPORATION- Business overview- Products offered- Recent developmentsPENUMBRA, INC.- Business overview- Products offered- Recent developments- DealsMICROPORT SCIENTIFIC CORPORATION- Business overview- Products offered- Recent developmentsBALT- Business overview- Products offered- Recent developmentsKANEKA CORPORATION- Business overview- Products offered- Recent developmentsPHENOX GMBH- Business overview- Products offered- Recent developmentsASAHI INTECC CO., LTD- Business overview- Products offered- Recent developmentsPERFLOW MEDICAL LTD.- Business overview- Products offered- Recent developmentsRAPID MEDICAL- Business overview- Products offered- Recent developmentsCERUS ENDOVASCULAR INC.- Business overview- Products offered- Recent developmentsACANDIS GMBH- Business overview- Products offered- Recent developmentsEVASC- Business overview- Products offered- Recent developmentsSENSOME- Business overview- Products offered- Recent developmentsLEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.- Business overview- Products offered- Recent developmentsIMPERATIVE CARE- Business overview- Products offered- Recent developmentsMEDIKIT CO., LTD.- Business overview- Products offered- Recent developmentsZYLOX-TONBRIDGE MEDICAL CO., LTD.- Business overview- Products offered- Recent developments

-

10.2 OTHER PLAYERSSILK ROAD MEDICAL, INC.ARTIO MEDICAL, INC.IVASCULAROXFORDENDOVASCULARNEUROVASC TECHNOLOGIES, INC.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2021–2027 (% GROWTH)

- TABLE 2 US: REIMBURSEMENT FOR INTERVENTIONAL NEUROLOGY PROCEDURES

- TABLE 3 NEUROVASCULAR DEVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 5 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 6 REIMBURSEMENT CODES FOR VARIOUS PROCEDURES (2021)

- TABLE 7 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2016–2020 (USD MILLION)

- TABLE 9 USAGE OF INTRACRANIAL STENTS FOR TREATMENT OF BROAD-NECKED INTRACRANIAL ANEURYSMS

- TABLE 10 NEUROVASCULAR DEVICES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATION SEGMENTS (%)

- TABLE 12 KEY BUYING CRITERIA FOR NEUROVASCULAR DEVICES

- TABLE 13 NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 14 NEUROVASCULAR DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 NEUROVASCULAR DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 16 NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 17 NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 19 CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 21 CEREBRAL ANEURYSMS MARKET FOR BARE DETACHABLE COILS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 CEREBRAL ANEURYSMS MARKET FOR COATED DETACHABLE COILS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 CEREBRAL ANEURYSMS MARKET FOR FLOW DIVERSION DEVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 CEREBRAL ANEURYSMS MARKET FOR INTRACRANIAL STENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 CEREBRAL ANEURYSMS MARKET FOR MICROCATHETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 CEREBRAL ANEURYSMS MARKET FOR GUIDEWIRES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKE, BY TYPE 2021–2028 (USD MILLION)

- TABLE 29 NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKE, BY END USER, 2021–2028 (USD MILLION

- TABLE 30 ISCHEMIC STROKES MARKET FOR CLOT RETRIEVER DEVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 ISCHEMIC STROKES MARKET FOR SUCTION & ASPIRATION DEVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 ISCHEMIC STROKES MARKET FOR VASCULAR SNARES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 ISCHEMIC STROKES MARKET FOR MICROCATHETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 ISCHEMIC STROKES MARKET FOR MICROGUIDEWIRES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 ISCHEMIC STROKES MARKET FOR BALLOON CATHETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS CAROTID ARTERY STENOSIS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 38 NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 39 CAROTID ARTERY STENOSIS MARKET FOR CAROTID ARTERY STENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 CAROTID ARTERY STENOSIS MARKET FOR EMBOLIC PROTECTION DEVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 CAROTID ARTERY STENOSIS MARKET FOR BALLOON CATHETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATION & FISTULAS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATION & FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 44 NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATION & FISTULAS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 ARTERIOVENOUS MALFORMATION & FISTULAS MARKET FOR LIQUID EMBOLIC AGENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 ARTERIOVENOUS MALFORMATION & FISTULAS MARKET FOR OCCLUSION BALLOON CATHETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 ARTERIOVENOUS MALFORMATION & FISTULAS MARKET FOR MICROCATHETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 NEUROVASCULAR DEVICES MARKET FOR OTHER DISEASE PATHOLOGIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NEUROVASCULAR DEVICES MARKET FOR OTHER DISEASE PATHOLOGIES, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 NEUROVASCULAR DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 51 NEUROVASCULAR DEVICES MARKET FOR HOSPITALS AND SURGICAL CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 NEUROVASCULAR DEVICES MARKET FOR AMBULATORY CARE CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 NEUROVASCULAR DEVICES MARKET FOR RESEARCH LABORATORIES AND ACADEMIC INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 NEUROVASCULAR DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: NEUROVASCULAR DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: NEUROVASCULAR DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 63 US: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 64 US: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 US: EMBOLIC COILS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 US: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 US: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 US: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 70 CANADA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 CANADA: EMBOLIC COILS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 CANADA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 CANADA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 EUROPE: NEUROVASCULAR DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 82 GERMANY: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 83 GERMANY: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 GERMANY: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 GERMANY: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 GERMANY: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 GERMANY: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 FRANCE: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 89 FRANCE: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 FRANCE: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 FRANCE: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 FRANCE: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 FRANCE: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 UK: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 95 UK: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 UK: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 UK: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 UK: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 UK: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 ITALY: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 101 ITALY: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 ITALY: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 ITALY: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 ITALY: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 ITALY: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 SPAIN: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 107 SPAIN: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 SPAIN: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 SPAIN: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 SPAIN: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 SPAIN: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 126 JAPAN: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 127 JAPAN: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 JAPAN: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 JAPAN: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 JAPAN: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 JAPAN: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 CHINA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 133 CHINA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 CHINA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 CHINA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 CHINA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 CHINA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 INDIA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 139 INDIA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 INDIA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 INDIA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 INDIA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 INDIA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 AUSTRALIA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 145 AUSTRALIA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 AUSTRALIA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 AUSTRALIA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 AUSTRALIA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 AUSTRALIA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 SOUTH KOREA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 151 SOUTH KOREA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 SOUTH KOREA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 SOUTH KOREA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 SOUTH KOREA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 SOUTH KOREA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 163 LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: NEUROVASCULAR DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 169 BRAZIL: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 170 BRAZIL: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 171 BRAZIL: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 BRAZIL: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 BRAZIL: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 BRAZIL: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 MEXICO: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 176 MEXICO: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 MEXICO: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 MEXICO: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 179 MEXICO: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 MEXICO: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 REST OF LATIN AMERICA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 182 REST OF LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 REST OF LATIN AMERICA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 REST OF LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 REST OF LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 186 REST OF LATIN AMERICA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS AND FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: NEUROVASCULAR DEVICES MARKET FOR CEREBRAL ANEURYSMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2021–2028 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CEREBRAL ANEURYSMS MARKET FOR EMBOLIC COILS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: NEUROVASCULAR DEVICES MARKET FOR CAROTID ARTERY STENOSIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATIONS & FISTULAS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: NEUROVASCULAR DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 COMPANY FOOTPRINT ANALYSIS

- TABLE 195 PRODUCT FOOTPRINT

- TABLE 196 REGIONAL FOOTPRINT

- TABLE 197 NEUROVASCULAR DEVICES MARKET: KEY PRODUCT LAUNCHES & APPROVALS (JANUARY 2019–MARCH 2023)

- TABLE 198 NEUROVASCULAR DEVICES MARKET: KEY DEALS (JANUARY 2019–MARCH 2023)

- TABLE 199 NEUROVASCULAR DEVICES MARKET: OTHER DEVELOPMENTS (JANUARY 2019–MARCH 2023)

- TABLE 200 STRYKER: BUSINESS OVERVIEW

- TABLE 201 MEDTRONIC: BUSINESS OVERVIEW

- TABLE 202 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- TABLE 203 TERUMO CORPORATION: BUSINESS OVERVIEW

- TABLE 204 PENUMBRA, INC.: BUSINESS OVERVIEW

- TABLE 205 MICROPORT SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- TABLE 206 BALT: BUSINESS OVERVIEW

- TABLE 207 KANEKA CORPORATION: BUSINESS OVERVIEW

- TABLE 208 PRODUCT LAUNCHES

- TABLE 209 PHENOX GMBH: BUSINESS OVERVIEW

- TABLE 210 ASAHI INTECC CO., LTD.: BUSINESS OVERVIEW

- TABLE 211 PERFLOW MEDICAL LTD.: BUSINESS OVERVIEW

- TABLE 212 RAPID MEDICAL: BUSINESS OVERVIEW

- TABLE 213 CERUS ENDOVASCULAR INC.: BUSINESS OVERVIEW

- TABLE 214 ACANDIS GMBH: BUSINESS OVERVIEW

- TABLE 215 ACANDIS GMBH: PRODUCTS OFFERED

- TABLE 216 EVASC: BUSINESS OVERVIEW

- TABLE 217 SENSOME: BUSINESS OVERVIEW

- TABLE 218 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: BUSINESS OVERVIEW

- TABLE 219 IMPERATIVE CARE: BUSINESS OVERVIEW

- TABLE 220 IMPERATIVE CARE: PRODUCT LAUNCHES AND APPROVALS

- TABLE 221 MEDIKIT CO., LTD.: BUSINESS OVERVIEW

- TABLE 222 ZYLOX-TONBRIDGE MEDICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 223 ZYLOX-TONBRIDGE MEDICAL CO., LTD.: PRODUCT LAUNCHES AND APPROVALS

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 NEUROVASCULAR DEVICES MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 MARKET SIZE ESTIMATION: NEUROVASCULAR DEVICES MARKET

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 HOSPITALS AND SURGICAL CENTERS SEGMENT TO CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN NEUROVASCULAR DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 10 AN INCREASE IN THE NUMBER OF DISEASES RELATED TO NEUROLOGICAL DISORDERS SUCH AS BRAIN/ CEREBRAL ANEURYSMS, STROKES, AND EPILEPSY, IS EXPECTED TO DRIVE THE MARKET GROWTH.

- FIGURE 11 CEREBRAL ANEURYSMS TO DOMINATE NEUROVASCULAR DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 12 CEREBRAL ANEURYSMS SEGMENT ACCOUNTED FOR HIGHEST MARKET SHARE IN US

- FIGURE 13 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 NEUROVASCULAR DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 PROPORTION OF GERIATRIC TO TOTAL WORLD POPULATION, BY COUNTRY, 2020 VS. 2030 (MILLION PEOPLE)

- FIGURE 16 NEUROVASCULAR DEVICES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED THROUGH REGULATION & DISTRIBUTION STAGES

- FIGURE 18 TOP PATENT APPLICANTS FOR ORTHOPEDIC DEVICES, JANUARY 2012–MARCH 2023

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 21 KEY BUYING CRITERIA FOR NEUROVASCULAR DEVICES

- FIGURE 22 NEUROVASCULAR DEVICES MARKET: NORTH AMERICA SNAPSHOT

- FIGURE 23 NEUROVASCULAR DEVICES MARKET: ASIA PACIFIC SNAPSHOT

- FIGURE 24 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS (2019−2023)

- FIGURE 25 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN NEUROVASCULAR DEVICES MARKET

- FIGURE 26 NEUROVASCULAR DEVICES MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 27 NEUROVASCULAR DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR KEY PLAYERS (2021)

- FIGURE 28 NEUROVASCULAR DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/STARTUPS (2022)

- FIGURE 29 STRYKER: COMPANY SNAPSHOT (2022)

- FIGURE 30 MEDTRONIC: COMPANY SNAPSHOT (2022)

- FIGURE 31 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2022)

- FIGURE 32 TERUMO CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 33 PENUMBRA, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 MICROPORT SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 35 KANEKA CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 36 ASAHI INTECC: COMPANY SNAPSHOT (2022)

- FIGURE 37 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD: COMPANY SNAPSHOT (2021)

- FIGURE 38 ZYLOX-TONBRIDGE MEDICAL CO., LTD.: COMPANY SNAPSHOT (2021)

Methodology

The study included four main activities to estimate the current size of the neurovascular devices market. First, extensive secondary research was performed to collect information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and market size estimates through primary research with industry experts across the value chain. We used both top-down and bottom-up approaches to develop a comprehensive estimate of the overall market size. Finally, we applied market segmentation and data triangulation techniques to assess the sizes of segments and subsegments within the market.

Secondary Research

The secondary research process involved extensively using various sources, including directories, databases like Bloomberg Business, Factiva, and D&B Hoovers, as well as white papers, annual reports, company house documents, investor presentations, and SEC filings. This research aimed to gather information valuable for a thorough, technical, market-focused, and commercial study of the neurovascular devices market. It also helped obtain key insights about industry leaders, market classification, and segmentation based on current industry trends, down to the smallest details. Additionally, a database of leading industry players was compiled through this secondary research.

Primary Research

In the primary research process, we conducted interviews with various sources from both the supply and demand sides to collect qualitative and quantitative information for this report. On the supply side, we spoke with industry experts, including CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from prominent companies and organizations involved in the neurovascular devices market. For the demand side, we engaged with industry experts, purchasing and sales managers, doctors, and personnel from research organizations. This primary research was crucial to validate market segmentation, identify key players in the industry, and gather insights on important industry trends and market dynamics.

A breakdown of the primary respondents for the neurovascular devices market is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the neurovascular devices market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the neurovascular devices market was determined from annual presentations by leading players and secondary data available in the public domain. The share of products and services within the overall neurovascular devices market was derived from secondary data and validated by primary participants to estimate the total market. Primary participants further confirmed the validity of these data numbers.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each stage, the assumptions and approaches were verified through industry experts contacted during primary research. Given the limitations of data available from secondary research, revenue estimates for individual companies—covering the overall neurovascular devices market and regional market assessments—were determined based on a detailed analysis of their product offerings, geographic reach or strength (whether direct or through distributors or suppliers), and the market shares of leading players in specific regions and countries.

Global Neurovascular Devices Market Size: Bottom-Up and Top-Down Approach

Data Triangulation

After determining the overall size from the market size estimation process described above, the total market was divided into multiple segments and subsegments. The data triangulation and market breakdown procedures explained below were applied, where applicable, to complete the overall market analysis and derive precise statistics for various market segments and subsegments. The data was triangulated by examining diverse factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up methods.

Market Definition

The neurovascular devices market includes medical technologies and tools designed for monitoring, managing, and treating neurovascular diseases. It encompasses devices used to treat brain aneurysms (such as embolic coils, flow diversion devices, intracranial stents, and others), ischemic strokes (like clot retriever devices, suction and aspiration tools, vascular snares, balloon catheters, and more), carotid artery stenosis (including carotid artery stents, embolic protection devices, and balloon catheters), arteriovenous malformations and fistulas (such as liquid embolic agents, occlusion balloon catheters, microcatheters), and other related conditions. Neurovascular devices are essential for accurate diagnosis, effective treatment, and comprehensive management of neurovascular disorders. By enabling timely interventions and enhancing procedural success, these technologies help reduce complications and promote better patient recovery. The market serves patients, healthcare professionals, and medical institutions, driven by continuous advancements in device technology, the rising prevalence of neurovascular disorders, and increasing demand for innovative, minimally invasive, and user-friendly treatment options.

Stakeholders

- Neurovascular devices’ manufacturing companies

- Contract manufacturers

- Distributors, suppliers, and channel partners of neurovascular devices

- Senior Management

- Finance Department

- Procurement Department

- Hospitals & Clinics

- E-commerce and Digital Platforms

- Academic & Research Institutes

- Trade Associations and Industry Bodies

- Regulatory Bodies and Government Agencies

- Business Research and Consulting Service Providers

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, segment, analyse, and forecast the global neurovascular devices market by disease pathology, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the neurovascular devices market in North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC countries

- To profile the key players in the neurovascular devices market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches & approvals in the neurovascular devices market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Neurovascular Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Neurovascular Devices Market

Lester

May, 2022

need data on advancements in the Neurovascular Devices market. outlook, size, share everything..

Jamie

May, 2022

Detailed US geo information of Neurovascular Devices Market with a vision to 2022 - 2026.

Douglas

Mar, 2022

In what way COVID19 is Impacting the global growth of the Neurovascular Devices Market?.