Minimally Invasive Surgery Market: Growth, Size, Share, and Trends

Minimally Invasive Surgery Market by Type (Surgical Device, Imaging System, Electrosurgical Device, Endoscopy Device, Medical Robotics), Application (Urological, Vascular, Oncological), End User (Hospital, Clinic, ASC) Region-Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The minimally invasive surgery market is expected to reach USD 199.30 billion by 2030, from USD 94.45 billion in 2025, with a CAGR of 16.1%. Market growth is driven by the increasing shift from open surgeries to minimally invasive procedures due to benefits such as reduced pain, shorter hospital stays, faster recovery, and lower complication rates.

KEY TAKEAWAYS

-

By ProductThe minimally invasive surgery market is segmented by product into surgical devices, imaging & visualization systems, electrosurgical devices, endoscopy devices, and medical robotics. In 2024, the surgical devices segment accounted for the largest share due to its essential role in minimally invasive procedures and continuous product innovation.

-

By ApplicationThe minimally invasive surgery market is segmented by application into cardiothoracic surgery, vascular surgery, neurological surgery, ENT & respiratory surgery, cosmetic surgery, gastrointestinal & abdominal surgery, gynecological surgery, urological surgery, orthopedic surgery, oncology surgery, dental surgery, and other surgeries. In 2024, the gastrointestinal & abdominal surgery segment held the largest share, subject to the high global burden of Gl diseases and increased surgical volumes.

-

By End UserThe minimally invasive surgery market is segmented by end user into hospitals, ambulatory surgery centers, clinics, emergency & trauma centers, and other end users. In 2024, the hospitals segment held a major share due to their advanced infrastructure, skilled healthcare professionals, and comprehensive capabilities to handle high patient volumes.

-

By RegionAsia Pacific is expected to record the fastest growth, with a CAGR of 16.5%, driven by its rapidly aging population, rising prevalence of chronic diseases, and increasing adoption of advanced surgical technologies. Healthcare infrastructure advancements, substantial government investment, and improved awareness of minimally invasive procedures further accelerate adoption across emerging economies.

-

Competitive LandscapeKey market players have adopted both organic and inorganic strategies, including product launches, partnerships, and acquisitions. For instance, Boston Scientific Corporation (US), Zimmer Biomet Holdings Inc. (US), and Medtronic (Ireland) have expanded their portfolios and entered collaborations to strengthen their offerings and meet the increasing demand for advanced minimally invasive surgery products.

The growth of the minimally invasive surgery market is fueled by the increasing preference for faster recovery, less postoperative pain, and shorter hospital stays among patients and providers. Technological advancements like robotic-assisted systems, AI-enabled imaging, and 3D visualization are further improving surgical precision and outcomes. Opportunities are arising from the growing geriatric population needing chronic disease management, rising outpatient surgical volume, and the increasing demand for MIS procedures in outpatient settings.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The minimally invasive surgery market is undergoing significant disruption as technological advances transform surgical practices and customer business models. Robot-assisted surgery and AI-driven platforms provide greater precision, consistency, and efficiency, leading to fewer complications and shorter recovery times, directly boosting patient satisfaction and hospital reputation. Real-time imaging and digital surgical ecosystems are improving intraoperative decision-making, encouraging adoption among healthcare providers aiming for better outcomes. Moreover, the increasing preference for outpatient and same-day procedures is reshaping reimbursement models and prompting hospitals to adopt cost-effective, advanced minimally invasive technologies. These trends motivate providers, device manufacturers, and healthcare facilities to reevaluate investments, improve workflows, and meet the demands of value-based care.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of minimally invasive procedures over open surgeries

-

Increasing geriatric population and rising number of surgeries

Level

-

High system costs, long investment cycles, and low ROIs

Level

-

Rapid adoption of advanced robotics in ambulatory surgical centers

-

High growth potential in emerging markets

Level

-

Changing regulatory landscape in medical devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of minimally invasive procedures over open surgeries

The increasing adoption of minimally invasive procedures over traditional open surgeries is a key factor driving the growth of the minimally invasive surgery market. Minimally invasive techniques, such as laparoscopy, endoscopy, and robot-assisted surgery, are becoming more popular because they provide better clinical outcomes with less physical trauma. These procedures involve smaller incisions, which lead to less postoperative pain, quicker recovery, minimal scarring, and a lower risk of complications like infections and blood loss.

Restraint: High system costs, long investment cycles, and low ROIs

The high cost of robotic surgical systems significantly limits the growth of the minimally invasive surgery market, particularly in cost-sensitive and publicly funded healthcare settings. A single robotic platform, such as the da Vinci Surgical System, has an initial cost ranging from USD 0.5 million to USD 2.5 million, depending on the model, configuration, and location. Additionally, there are substantial indirect expenses, such as an annual service fee that can reach up to USD 190,000, along with recurring costs for instruments and accessories, which range from USD 600 to USD 3,500 per procedure. These expenses can significantly impact operating margins, especially for mid-sized hospitals.

Opportunity:Rapid adoption of advanced robotics in ambulatory surgical centers

The rapid adoption of advanced robotics in ambulatory surgical centers (ASCs) presents a major growth opportunity for the minimally invasive surgery market. ASCs provide a cost-effective and efficient alternative to traditional hospital-based procedures, with costs generally 35% to 50% lower, making them a preferred choice for governments, insurers, and patients seeking to lower healthcare expenses while maintaining quality care. The migration of surgeries from hospital operating rooms to ASCs has been driven by the need for cost savings and operational improvements. This trend is further boosted by the integration of orthopedic robotics and related technologies designed to meet the precision needs of minimally invasive surgeries.

Challenge: Changing regulatory landscape in medical devices

The evolving regulatory landscape in the medical device industry presents a significant obstacle to the growth of the minimally invasive surgery market. The transition from the EU Medical Device Directive (MDD) to the more rigorous Medical Device Regulation (MDR) has heightened compliance complexity, demanding extensive documentation, clinical assessments, and stricter oversight. This shift has resulted in longer product approval times and higher regulatory expenses, which hinder innovation and postpone the market entry of new technologies. Additionally, countries like the US, China, and India are tightening their regulations, focusing on post-market surveillance, real-world evidence, and patient safety. For global companies, complying with diverse and changing regulatory requirements greatly increases operational challenges and requires greater financial and human resources.

Minimally Invasive Surgery Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides advanced laparoscopic, endoscopic, and robot-assisted surgery platforms with energy devices, surgical staplers, and visualization technologies for multiple specialties | Improves precision and safety, reduces operative complications, shortens hospital stay, and enhances patient recovery outcomes |

|

Offers surgical instruments, stapling devices, energy systems, and orthopedic minimally invasive solutions through Ethicon and DePuy Synthes | Enables surgeons to perform complex procedures with minimal incisions, reduces blood loss, lowers infection risk, and delivers consistent procedural efficiency |

|

Develops minimally invasive surgery instruments, visualization systems, and orthopedic implants with navigation and robotic assistance | Enhances surgical accuracy, reduces invasiveness in orthopedic and spine procedures, and improves long-term patient mobility and outcomes |

|

Specializes in minimally invasive surgery devices for interventional cardiology, urology, endoscopy, and neuromodulation | Provides minimally invasive alternatives to open surgery, reduces recovery time, and expands treatment options for chronic and complex diseases |

|

Offers advanced imaging and intraoperative solutions supporting minimally invasive surgery, including hybrid OR technologies, surgical navigation, and 3D visualization systems | Improves surgical planning, enhances visualization, and supports precision interventions while reducing operative risks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The minimally invasive surgery market ecosystem comprises a diverse range of stakeholders and interconnected components that promote innovation, adoption, and market expansion. At its core are manufacturers of surgical instruments, endoscopy devices, electrosurgical units, imaging systems, and medical robotics, who collaborate with technology providers to enhance precision and procedural efficiency. These products serve various clinical areas including cardiothoracic, vascular, ENT, dental, and gynecological surgeries. Healthcare providers such as hospitals, clinics, ambulatory surgery centers, and emergency & trauma centers are primary end users, influencing purchasing decisions based on patient outcomes, procedural duration, and recovery advantages. Regulatory agencies, reimbursement organizations, and training institutions also play crucial roles by ensuring compliance, encouraging adoption, and supporting skill development. Furthermore, collaborations between MedTech companies, healthcare organizations, and research institutions foster innovation and evidence-based practices. Overall, the MIS market ecosystem is a collaborative, technology-driven environment dedicated to improving patient care while minimizing invasiveness.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Minimally Invasive Surgery Market, By Product

Based on product, the global minimally invasive surgery market is segmented into surgical devices, imaging and visualization systems, electrosurgical devices, endoscopy devices, and medical robotics. Imaging and visualization systems are projected to grow at the fastest rate because of their essential role in improving surgical precision, safety, and outcomes. These systems offer real-time, high-definition visualization, allowing surgeons to navigate complex anatomies more accurately while reducing tissue damage.

Minimally Invasive Surgery Market, By Application

Based on application, the minimally invasive surgery market is segmented into cardiothoracic surgery, vascular surgery, neurological surgery, ENT and respiratory surgery, cosmetic surgery, gastrointestinal and abdominal surgery, gynecological surgery, urological surgery, orthopedic surgery, oncology surgery, dental surgery, and other applications. The urological surgery segment is expected to grow at the fastest rate during the forecast period. This growth is driven by the increasing global burden of urological conditions such as prostate and bladder cancers, as well as complex renal calculi.

Minimally Invasive Surgery Market, By End User

Based on end user, the minimally invasive surgery market is segmented into hospitals, ambulatory surgery centers, clinics, emergency and trauma centers, and other end users. ASCs are expected to witness the fastest growth in the minimally invasive surgery market due to their cost efficiency, streamlined operations, and patient preference for outpatient care. These centers offer procedures at 45–60% lower costs than hospital outpatient departments, driven by reduced overhead, lower fixed expenses, and shorter patient stays.

REGION

Asia Pacific to be fastest-growing region in minimally invasive surgery market during forecast period

Asia Pacific is expected to experience the fastest growth during the forecast period, primarily due to increasing government spending on healthcare, rising income levels, a large patient population, and the growing prevalence of chronic diseases. The expansion of healthcare infrastructure, increased investments in advanced surgical technologies, and improved patient awareness of minimally invasive surgery benefits are further driving market growth. Government-supported health reforms and favorable reimbursement policies also enhance access to minimally invasive surgery procedures in urban and rural hospitals.

Minimally Invasive Surgery Market: COMPANY EVALUATION MATRIX

In the company evaluation matrix for the minimally invasive surgery market, Medtronic (Star) leads with a strong global presence and a comprehensive portfolio of surgical devices, endoscopes, and other products. FUJIFILM Corporation (Emerging Leader) is gaining traction with innovative imaging and visualization systems tailored for various applications, positioning itself for rapid growth. Siemens Healthineers AG stands out for its diverse, extensive portfolio worldwide. The company continuously engages in organic strategies to maintain its market position. Zimmer Biomet and Intuitive Surgical, Inc. are notable for offering minimally invasive surgery products, such as robotic systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 81.65 BN |

| Market Forecast in 2030 (Value) | USD 199.30 BN |

| Growth Rate (2025–2030) | 16.1% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Unit Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product: Surgical Devices, Imaging & Visualization Systems, Electrosurgical Devices, Endoscopy Devices, and Medical Robotics By Application: Gastrointestinal & Abdominal Surgery, Cardiothoracic Surgery, Orthopedic Surgery, Vascular Surgery, Gynecological Surgery, Oncological Surgery, Neurological Surgery, Urological Surgery, ENT & Respiratory Surgery, Cosmetic Surgery, Dental Surgery, and Other Applications By End User: Hospitals, Ambulatory Surgery Centers, Clinics, Emergency and Trauma Centers, Other End Users |

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Minimally Invasive Surgery Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of top MIS products: Surgical Devices, Imaging & Visualization Systems, Electrosurgical Devices, Endoscopy Devices, and Medical Robotics | Identify interconnections and supply chain blind spots; Detect customer migration trends across industries. |

| Company Information | Key players: Stryker Corporation (US), Boston Scientific Corporation (US), Medtronic (Ireland), FUJIFILM Corporation (Japan), Zimmer Biomet (US), Johnson & Johnson (US), and other key players | Insights on revenue shifts towards emerging therapeutic applications and device innovations. |

| Geographic Analysis | Detailed analysis on Rest of APAC was provided to one of the top players. | Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- March 2025 : Boston Scientific Corporation has entered into a definitive agreement to acquire SoniVie Ltd., expanding its portfolio with the TIVUS Intravascular Ultrasound System and strengthening its position in the rapidly growing minimally invasive surgery market.

- January 2025 : Boston Scientific Corporation has announced a definitive agreement to acquire Bolt Medical, Inc., adding its advanced laser-based intravascular lithotripsy (IVL) platform to improve treatment options for coronary and peripheral artery disease and expand its cardiovascular portfolio.

- February 2024 : Zimmer Biomet Holdings, Inc. received 510(k) approval from the US FDA for its ROSA Shoulder System, expanding its robotic-assisted surgery lineup to include shoulder replacement procedures and strengthening its position in orthopedic innovation.

- November 2023 : Medtronic plc has obtained FDA approval for its minimally invasive Symplicity Spyral Renal Denervation System for hypertension treatment and is preparing to begin immediate commercialization in target markets.

Table of Contents

Methodology

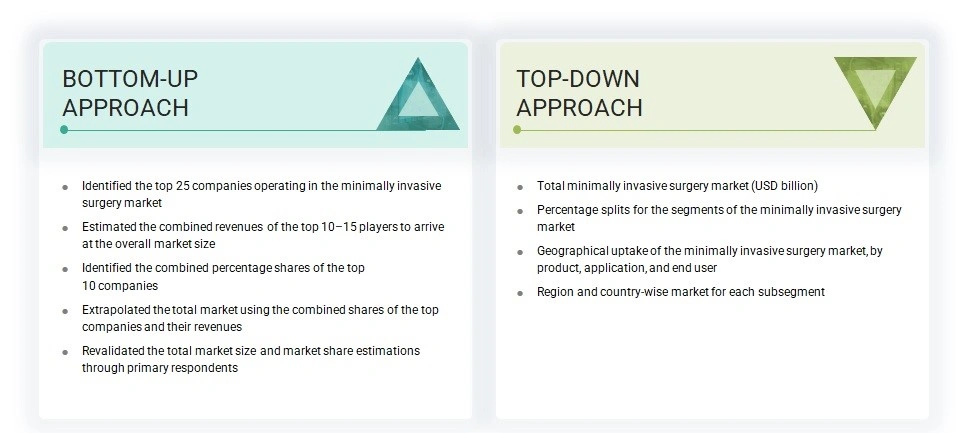

The study involved key activities in estimating the current size of the minimally invasive surgery market. Extensive secondary research was conducted to gather information on the industry. The next step was to validate these findings, assumptions, and market size with industry experts across the value chain through primary research. Different methods, such as top-down and bottom-up approaches, were used to estimate the overall market size. Subsequently, market segmentation and data triangulation techniques were applied to determine the size of various segments and subsegments within the MIS market.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global minimally invasive surgery market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from various companies and organizations in the minimally invasive surgery market. On the demand side, primary sources include ambulatory surgical centers, hospitals, clinics, and other end users. The primary research was conducted to validate market segmentation, identify key players, and gather insights on important industry trends and market dynamics.

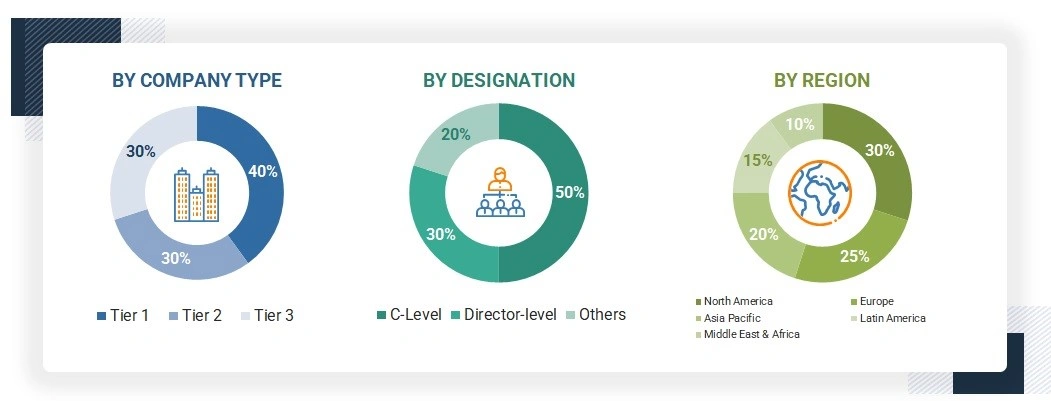

A breakdown of the primary respondents is provided below:

*C-level primaries include CEOs, CFOs, COOs, and VPs.

Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were estimated based on revenue mapping of leading product manufacturers and OEMs active in the worldwide minimally invasive surgery market. All major product manufacturers were identified at the global and/or country or regional level. Revenue mapping for the respective business segments or sub-segments was performed for the key players. Also, the global minimally invasive surgery market was split into various segments and sub-segments based on:

- List of major players operating in the product market at the regional and/or country level

- Product mapping of various minimally invasive surgery manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from minimally invasive surgery (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global minimally invasive surgery market

The data mentioned above was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After determining the overall size of the global minimally invasive surgery market using the methodology mentioned above, the market was divided into several segments and subsegments. Data triangulation and market breakdown techniques were used, where applicable, to complete the overall market analysis and obtain precise market value data for the key segments and subsegments. The extrapolated market data was then triangulated by examining various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Minimally invasive surgery (MIS) is a procedure that causes little to no trauma or injury to a patient. MIS is performed through a cannula using lasers, endoscopes, or laparoscopes. It involves less bleeding, reduced anesthesia, less pain, and minimal scarring compared to other procedures. The surgical instruments used to make tiny incisions and carry out MIS are minimally invasive. The primary products used for minimally invasive surgery are surgical tools, imaging and visualization systems, electrosurgical devices, endoscopy devices, and medical robotics.

Stakeholders

- Manufacturers and Distributors of Minimally Invasive Surgical Instruments

- Healthcare Institutions (Hospitals and Clinics)

- Ambulatory Surgery Centers (ASCs)

- Healthcare Institutions (hospitals and outpatient clinics)

- Research Institutions

- Research and Consulting Firms

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

- Academic Medical Centers and Universities

- Market Research and Consulting Firms

- Clinical Research Organizations

- Research Laboratories and Academic Institutes

- Minimally Invasive Surgical Instrument Service Providers

Report Objectives

- To describe, analyze, and forecast the minimally invasive surgery market by product, application, end user, and region

- To describe and forecast the minimally invasive surgery market in key regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies2 in the minimally invasive surgery market

- To analyze competitive developments such as partnerships, agreements & acquisitions, product launches, product approvals, and expansions in the minimally invasive surgery market

- To analyze the impact of AI/Gen AI on the minimally invasive surgery market in terms of its capabilities, potential, use cases, and future

Available customizations:

With the given market data, MarketsandMarkets offers customizations to meet your company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of European minimally invasive surgery market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific minimally invasive surgery market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin American minimally invasive surgery market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asian minimally invasive surgery market into Malaysia, Singapore, Australia, New Zealand, and others

Competitive Landscape Assessment

- Market share analysis, by region (North America and Europe), which provides market shares of the top 3–5 key players in the minimally invasive surgery market

- Competitive leadership mapping for established players in the US

Key Questions Addressed by the Report

Which are the top industry players in the global minimally invasive surgery market?

The prominent players in this market are Medtronic (Ireland), Johnson & Johnson (US), Stryker (US), Boston Scientific Corporation (US), Siemens Healthineers AG (Germany), Abbott (US), GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), Intuitive Surgical Operations, Inc. (US), and FUJIFILM Corporation (Japan).

What are some of the major drivers for this market?

Increasing number of hospitals and surgeries, rising adoption of minimally invasive surgery (MIS) over open surgeries, and advantages of robot-assisted surgery & training in rehabilitation therapy are key factors driving market growth.

Which end users have been included in the global minimally invasive surgery market?

The report includes the following end-user segments: Hospitals, Clinics, Emergency & Trauma Centers, Ambulatory Surgery Centers, and Other End Users.

Which type of application of minimally invasive surgery is holding the highest market share in the minimally invasive surgery market?

The gastrointestinal & abdominal surgery segment holds the highest market share in the minimally invasive surgery market.

Which region is lucrative for the minimally invasive surgery market?

The Asia Pacific region is expected to witness the highest CAGR during the forecast period, making it a lucrative market for minimally invasive surgery.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Minimally Invasive Surgery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Minimally Invasive Surgery Market