OEM Insulation Market

OEM Insulation Market by Material Type (Mineral Wool, PU Foam, Flexible Elastomeric Foam, & Other Materials), Insulation Type (Thermal & Acoustic), End Use (Industrial & Commercial, Transportation and Consumer), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The energy efficiency requirement, strict mandatory regulations, and sustainability drives across various automotive, construction, aerospace, and electronics industries remain vital growth drivers in the OEM-insulation market (OEM insulation gains energy efficiency). OEMs have developed high-performance and highly effective insulation solutions in components incorporating sophisticated thermal management accompanied by noise reduction and improved regulatory compliance enforcement. Companies like Kingspan and Owens Corning supply advanced materials such as PIR and XPS insulation to OEMs for modular building systems, reducing energy consumption and installation time. In addition, high-performance materials such as aerogels are used in aerospace applications for thermal and fireproofing requirements. Boeing's partnership with insulation manufacturers reflects the trend wherein customized solutions make market growth. Regulatory support and innovation help fuel this trend forward.

KEY TAKEAWAYS

-

BY Material typeThe OEM insulation market comprises Mineral Wool, Polyurethane Foam (PUF), Flexible Elastomeric Foam (FEF), Other Insulations. The dominance of the polyurethane foam segment is driven by its superior thermal insulation properties, lightweight nature, and versatility across automotive, construction, and industrial applications demanding high energy efficiency and durability.

-

BY Insulation TypeInsulation type inlcudes Thermal Insulation, Acoustic Insulation. Growth in the acoustic and thermal insulation market is driven by rising demand for energy-efficient, noise-reducing solutions in vehicles, buildings, and industrial systems, supported by stricter environmental regulations and sustainability goals.

-

By End-use IndustryEnd-use industry includes Industrial & Commercial, Transportation, Consumer. The transportation segment is projected to hold the largest market share, driven by rising demand for lightweight, energy-efficient insulation materials that enhance thermal management, acoustic comfort, and overall vehicle performance in automotive and electric mobility applications.

-

BY REGIONOEM insulation market covers Europe, North America, Asia Pacific and Rest of the World. Europe is expected to hold the largest market share, supported by stringent energy efficiency regulations, strong adoption of sustainable building practices, and growing demand for high-performance insulation materials across automotive and industrial sectors.

The forecast for OEM insulation's rising market growth through the years can be underscored by the increasing regulatory pressures set to enhance energy efficiency and decrease emissions across sectors. The rising demand for advanced thermal management in the automotive, HVAC, and appliance sectors is leading OEMs to adopt high-performance insulation materials, thereby improving operational efficiency and fulfilling sustainability objectives. Demand for more lightweight and robust insulation solutions is yet more enhanced in electric vehicles and green technologies. OEM inducement in developing customized and application-specific insulation products is anticipated to satiate the thirst for know-how and market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end-user industries in the OEM insulation market is being shaped by rapid technological progress, stricter energy efficiency standards, and a growing focus on sustainable manufacturing. Increasing demand for high-performance insulation solutions across automotive, industrial, and construction sectors is driving innovation in lightweight, durable, and thermally efficient materials. OEMs are seeking advanced insulation systems that deliver superior thermal management, acoustic comfort, and safety while supporting the transition to electric and energy-efficient technologies. At the same time, evolving environmental regulations and consumer preferences for sustainable and recyclable materials are encouraging greater investment in eco-friendly production and circular economy practices. These shifts are redefining supply chain strategies, promoting cross-sector collaboration, and opening strong growth opportunities for material suppliers, system integrators, and OEMs across the global insulation industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technical advancement of HVAC equipment in the construction sector

-

Large number of public transport vehicles adopting air-conditioner technology

Level

-

Unorganized OEM insulation market in Asia Pacific countries is disrupting the value chain.

-

Stringent environmental regulations related to the manufacturing of PUF

Level

-

Stringent regulations mandating use of insulation materials for energy conservation

-

Substitution of legacy materials by eco-friendly flexible elastomeric foam

Level

-

Fluctuating raw material costs leading to pricing pressures on OEMs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technical advancement of HVAC equipment in the construction sector

The efficient advancement of HVAC equipment in the construction industry remains the significant trigger for the OEM insulation market, requiring high-level thermal efficiency insulation materials that will contribute to reduced net energy consumption and assuredly competent operation. Typically, a high-performance appliance installation absorbed in the advanced cooling and heating systems like variable refrigerant flow (VRF) systems, high-efficiency heat pumps, and advanced air handling big-systems, among a few others, work to help promise less leakage of heat while enhancing temperature control and subsiding noise transmission. Necessary among them are materials such as rigid foam, fiberglass, and mineral wool that are programmed to fulfill the requirements of a high-performance insulation system and provide durability for the future while satisfying industry regulations that continue to grow and change. An intelligent building or home that utilizes HVAC systems linked with IoT and automation systems requires a highly intricate and sophisticated insulation material for energy optimization and sustainability objectives. These HVAC systems are typically influenced by stringent energy codes and rules, such as those derived from ASHRAE and the European Union's Energy Performance of Buildings Directive. Thus, efficient advancement of HVAC equipment in the construction industry drives the OEM Insulation market forward.

Restraint: Stringent environmental regulations related to the manufacturing of PUF

In the OEM thermal insulation industry, there are limitations presented by enforcing more stringent environmental rules, which extend to polyurethane foam (PUF) manufacturing. PUF is favored owing to its top-ranking thermal insulation properties, but also being associated with much environmental harm in its manufacture for the use of chemicals like isocyanates and blowing agents, most of which have high GHG emissions and ozone depletion. European legislation such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) and the Kigali Amendment to the Montreal Protocol make sure there cannot be any harmful chemicals in the substance or use hydrofluorocarbon (HFC) blowing agents at any stage of foam production. In North America, the U.S. Environmental Protection Agency (EPA) made it difficult for high-GWP substances in PUF manufacturing by bringing in controls through the Significant New Alternatives Policy (SNAP) program. These regulations can further increase compliance costs for manufacturers by forcing them to seek other means of improving low-GWP blowing agents or to switch to more sustainable production technologies. While they may be necessary for protecting the environment, they also harbor challenges in the market by increasing production costs, complicating supply chains, and finally thwarting the adoption of PUF-based insulation in applications that tend to be price-sensitive.

Opportunity: Fluctuating raw material cost leading to pricing pressure on OEMs

The potent growth inhibitors for the OEM insulation materials market are the volatilities of the prices of raw materials used in making plastic foams, namely polyurethane and polystyrene. These are extracted from crude oil-based products; hence, they are highly volatile to the movement of the market for crude oil. The crude oil market's fluctuation depends upon the worldwide production volume, import-export scenarios, logistics, labor costs, trading fees, and tariffs. Besides the aforementioned factors, the Russia-Ukraine conflict and the Israel-Hamas war have continued to disrupt supply chains, cut down production capacity, and increase freight costs, increasing volatility in raw material prices. Moreover, an increase in the cost of polymers, elastomers, and other crude oil-based products directly increases the OEM insulation manufacturers' cost of production. They can either absorb such a hike or pass the costs to their customers, where it risks demand reduction. In addition, this is acute in very price-sensitive areas, such as the automotive industry and, to some extent, construction. The accumulated negative impacts of successive chain disruptions in the supply line, increased freight rates, and ongoing political tensions mean OEM insulation's growth remains fettered, complicating matters further for competitors striving to lower cost bases without succumbing to inflation.

Challenge: Substitution of legacy materials by eco-friendly FEF

It makes it challenging for consumers to genuinely appreciate all that OEM Insulation provides them, specifically for those consumers who need more information in decision-making. Instead, such a specialty use tends towards such favors by OEM Insulation. However, most of its positioning would, by all means, restrict this reach toward reaching a much larger pool and more likely consumers, but not actually. To effectively address and conquer this limitation, there will be a need to develop further and advance their educational and awareness content, as well as the various activities presented, depicting the numerous benefits and applications of OEM Insulation. To achieve that, strategic partnerships with other companies will help augment their presence in physical stores and online e-commerce platforms. Similarly, social media channels can help influence people to spread the word, or conversely, creating suitable and enjoyable educational material will educate and inform would-be consumers about the benefits of OEM Insulation. When well instituted and then appropriately executed, this system will provide consumers with the assistance they need to make well-informed and educated decisions that can guide them toward acquiring these modern, innovative, and beneficial textile products.

OEM Insulation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops advanced OEM insulation solutions for automotive, industrial, and building applications, integrating glass wool and mineral wool technologies to improve thermal and acoustic performance. | Enhances energy efficiency, reduces noise transmission, and ensures compliance with global sustainability and safety standards. |

|

Provides high-performance polyurethane-based insulation materials for electric vehicles, electronics, and industrial systems, supporting lightweight and durable design requirements. | Improves energy savings, increases material durability, and contributes to lightweighting initiatives for higher fuel and power efficiency. |

|

Manufactures OEM insulation products utilizing fiberglass and composite technologies for transportation, industrial equipment, and construction markets. | Delivers superior thermal control, vibration resistance, and long-lasting material performance under demanding environmental conditions. |

|

Produces stone wool insulation solutions engineered for high-temperature and acoustic applications across manufacturing, marine, and energy sectors. | Offers excellent fire resistance, dimensional stability, and sound absorption while supporting circular economy and sustainability goals. |

|

Provides mineral wool and glass wool insulation systems tailored for industrial and OEM applications, emphasizing energy conservation and emission reduction. | Ensures high thermal efficiency, reduces carbon footprint, and supports cost-effective, sustainable manufacturing processes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The OEM insulation ecosystem comprises raw material providers, manufacturers, distributors, and end-users associated with the automotive, construction, and aerospace sectors. All these participants need to work together with one another to address the issues of raw material cost volatility, supply chain interruptions, and mandates for sustainability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

OEM insulation market, By End-Use Industry

Transportation end use will grow fast in the insulation created by OEM. The drivers of this are the increasing demands of industries, regulatory pressures, and technological changes. The efficiency and lower emissions are leading this type of policy, where industries use insulation in their equipment to enhance thermal management, making their equipment less power-consuming and, therefore, globally, helping them to cope with the strict regulations on emissions pollution and sustainability. The emergence of EVs and HEVs will ignite the market realization in advanced insulation solutions, which are pivotal for controlling battery heat to secure safety operations and life. Another way to ensure passenger comfort is using sound-absorbing material to reduce noise, vibration, and harshness transmission in EVs when quieter electric motors have better soundproofing requirements. Lightweight insulation materials will likely replace heavier parts to reduce overall vehicle weight. The automotive, aerospace, and railway sectors are now the major users of lightweight insulation materials to improve fuel efficiency and operational performance. Urbanization and expansion of infrastructure, including metro rail and high-speed technology, among others, increased the demand for the application of OEM insulations that are safe, efficient, and comfort-oriented. Technological developments in insulation occur with aerogels and multiple-layer composites and are completed by high-performance insulation.

OEM insulation market , By material type

Over the forecast period, natural OEM Insulation will be the fastest-growing segment of the OEM Insulation market due to increased consumer demand for eco-friendly and sustainable products. These cotton, linen, and bamboo fibers render fabrics the best in humidity absorption and passability, which ensures excellent comfort during high-temperature conditions. Demand for natural OEM insulation has increased due to a change in consumer environmental consciousness, which has led to the request for more eco-friendly and renewable products. Technology in textiles concerning natural fibers has developed so much that these now compete with their synthetic counterparts in terms of durability and efficiency in cooling. An increasing interest in health and wellness, coupled with growing requirements for lightweight and skin-sensitive fabrics, is driving growth in this market segment. Incrementally, the sportswear, casual apparel, and home textile industries are incorporating natural OEM Insulation in reaction to consumer demand for comfort and sustainability. Also, favorable government policies to reduce carbon emissions promote this industry. The growth in disposable incomes and the shift in lifestyle trends in developing regions co-occur, making premium, natural-based OEM Insulation unavoidable. Combined with constantly improving manufacturing technologies, these factors call for natural OEM Insulation to expand the overall OEM Insulation market.

REGION

Asia Pacific region will register the fastest CAGR during the global OEM Insulation market forecast period.

Asia Pacific is predicted to have the highest CAGR in the global insulation market during the projected time frame. Rapid industrialization, urbanization, and significant infrastructure development are fueling this growth. The building boom in emerging economies, such as China, India, and many Southeast Asian countries, has increased the demand for insulation materials to provide energy efficiency and comply with strict building regulations. Also, industries and businesses are beginning to observe a trend in which there is an increase in the importance of saving energy in conjunction with sustainability principles. This indicates the line being taken by the already established markets. National governments in the Asia Pacific are trying to enforce policies and some incentives for supporting energy efficiency in the construction techniques applied together with insulation and using high-end materials for insulation purposes. The surging use of electric vehicles and renewable energy systems helps fuel the demand for thermal insulation solutions in the transport and energy sectors. The ever-increasing growth in industrial manufacturing size and cold chain logistics for the most sought-after temperature-controlled warehouse facilities, especially within the food and pharmaceutical sectors, boosted this market. Hence, insulations become a preferred location for developments in insulation technologies, anchored by raw material and labor economy, for production, making it easy to become a consumption hub. And that is why the location is entering a dynamic growth trajectory, putting it at the center of the global market in insulations.

OEM Insulation Market: COMPANY EVALUATION MATRIX

In the OEM insulation market, Saint-Gobain ISOVER (Star) holds a leading position with its advanced portfolio of glass wool and mineral wool solutions, renowned for exceptional thermal efficiency, acoustic insulation, and environmental sustainability. The company’s ongoing innovation and extensive global manufacturing network have reinforced its leadership across construction, automotive, and industrial applications. Huntsman Corporation (Emerging Leader) is rapidly strengthening its presence through high-performance polyurethane-based insulation systems tailored for automotive, refrigeration, and energy-efficient infrastructure markets. With its expertise in material science and focus on lightweight, durable, and energy-optimized solutions, Huntsman continues to drive innovation in next-generation OEM insulation technologies. Other prominent players are advancing their production capabilities and sustainability-driven product lines to capture emerging opportunities in this growing, efficiency-focused market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 16.94 BN |

| Market Forecast in 2030 | USD 24.80 BN |

| CAGR (2024–2030) | 5.50% |

| Years considered | 2020–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | The report defines, segments, and projects the OEM insulation market based on material type, insulation type, end-use industry and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles OEM insulation manufacturers, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions, partnerships, and new product launches. |

| Segments Covered | Material Type (Mineral Wool, Polyurethane Foam (PUF), Flexible Elastomeric Foam (FEF), Other Insulations) |

| Regional Scope | North America, Europe, Asia Pacific, and Rest of the World. |

WHAT IS IN IT FOR YOU: OEM Insulation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive Manufacturers | Benchmark insulation materials used in EV batteries, engines, and vehicle interiors to evaluate performance and cost efficiency. | Improves energy efficiency, reduces weight, and enhances vehicle performance. |

| Consumer & Industrial Manufacturers | Map insulation material options for appliances, machinery, and process equipment based on energy and sound performance. | Enhances product efficiency and supports supplier evaluation. |

| Commercial Equipment & Infrastructure Developers | Benchmark insulation performance in HVAC systems, refrigeration units, and building applications. | Increases energy efficiency and ensures compliance with green standards. |

RECENT DEVELOPMENTS

- June 2024 : Armacell announced the acquisition of the engineering business of E&M Industries, a well-established insulation fabrication business in Western Australia. This acquisition enables Armacell to transition from a material manufacturer to a complete solutions provider, enhancing its industrial insulation and energy-saving solutions in the region. By integrating E&M Industries' expertise in insulation jacketing, Armacell can offer more comprehensive and innovative products to OEM customers, fueling growth in the OEM insulation market.

- July 2023 : Kingspan Group acquired a majority stake in Steico, the world leader in wood-fiber insulation and wood-based building envelope products. Adding Steico’s suite of wood-based building envelope solutions to its portfolio enhanced Kingspan's ability to provide customers with a comprehensive range of insulation products. Steico’s bio-based solutions align with the growing demand for sustainable and energy-efficient building materials. This acquisition allows Kingspan to offer more environment-friendly options to meet sustainability and energy performance needs.

- August 2022 : Owens Corning acquired Natural Polymers, LLC, a spray polyurethane foam insulation manufacturer. This acquisition strengthens Owens Corning’s portfolio with sustainable solutions and expands its presence in higher-growth segments of the insulation market.

- August 2021 : Covestro AG collaborated with Votteler Lackfabrik GmbH & Co. KG (Germany), Merck KGaA (Germany), and Reichle Technologiezentrum GmbH (Germany) to produce car interior parts with seamless, intelligent surfaces using Covestro's direct coating technology. The coated component is made in two steps using a Polyurethane Reaction Injection Molding (PU-RIM) process.

Table of Contents

Methodology

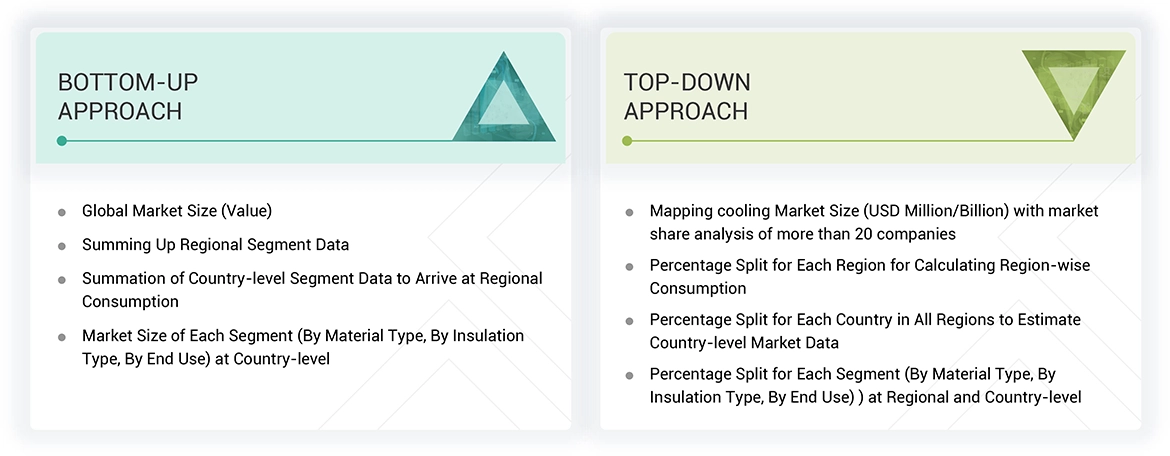

The study involved four major activities to estimate the current size of the global OEM insulation market. Comprehensive secondary research was conducted to gather information on the market, peer, and parent markets. The subsequent step involved validating these findings, assumptions, and dimensions with industry experts throughout the OEM insulation market value chain via primary research. The overall size of the OEM insulation market was estimated using both top-down and bottom-up approaches. Subsequently, market breakdown and data triangulation methods were employed to ascertain the dimensions of various segments and sub-segments.

Secondary Research

Secondary research was conducted to identify and gather data for this report on the OEM insulation market, referring to many secondary sources. These sources included Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet. Some other secondary sources in the study were annual reports, press releases, investor presentations of companies, white papers, certified publications, articles written by famous writers, regulatory organizations, trade directories, and databases. The study also included the market segmentation of the vendor offerings.

Primary Research

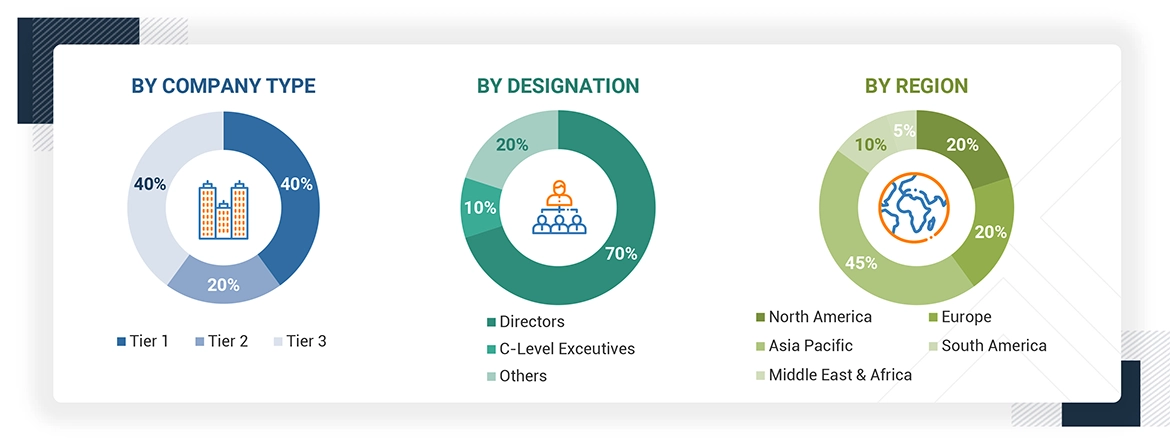

Qualitative and quantitative data were gathered through interviews with various primary sources in the OEM insulation market, both from the supply and demand sides. Primary sources from the supply side consisted of industry experts, including Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations involved in the OEM insulation industry. End-use industries' key executives constituted the primary demand-side respondents. Here is a segment of the list of significant profiles among the primary respondents:

Breakdown of Primary Interviews

Note: The three tiers of the companies were decided based on their revenues in 2023.

Tier 1 companies: overall revenue higher than USD 5,000 million, Tier 2 companies: revenue between USD 1,000 million and USD 5,000 million, and Tier 3 companies: revenue less than USD 1,000 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global OEM insulation market. These approaches were also used extensively to estimate the size of various market segments. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The value chain and market size of the OEM Insulation market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with key leaders, such as CEOs, directors, and marketing executives, for opinions.

OEM Insulation Market Size: Bottom-Up & Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the OEM insulation market. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

OEM Insulation, also known as Original Equipment Manufacturer Insulation, refers to specific insulating materials tailored to be incorporated directly into the final product during manufacturing. Modifying these materials according to the manufactured equipment's exact thermal, acoustic, and safety needs results in the optimal performance and satisfaction of the established standards in most industries. It is indispensable in aerospace, automotive, electronics, construction, and appliances. Improvement of energy efficiency, noise suppression, and vibration resistance offers the purpose of thermal shielding. The more common applications consist of HVAC, automotive compartments, and electronics boxes. Insulation is essential when considering usability safety, retained performance, and securing delicate components for a final user. OEM provides better efficiency in productivity, reliability, and life in the delivered final product engineered to satisfy the designer's and governing authorities' conditions.

Stakeholders

- Manufacturers, Suppliers, and Distributors of OEM Insulation

- Regulatory Bodies, Government Agencies, and NGOs

- Research & Development (R&D) Institutions

- Importers and Exporters of Insulation

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To define, analyze, and project the size of the OEM insulation market in terms of value based on material type, end-use, and region

- To project the size of the market and its segments concerning the regions, namely, North America, Europe, Asia Pacific, and Rest of the world

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze and forecast the OEM insulation market based on material type, Insulation type, end-use, and region

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the OEM insulation market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the OEM Insulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in OEM Insulation Market