Military Parachute Market by Application (Military, Cargo, Sports, Rescue, Recovery, Break Chutes), Type (Round, Ram-air, Square, Ring & Ribbon), Component (Canopy, Cords, Tapes, Webbings, Metal), Region (North America, Europe, Asia-Pacific, The Middle East, Latin America, Africa) - Global Forecasts to 2025-2034

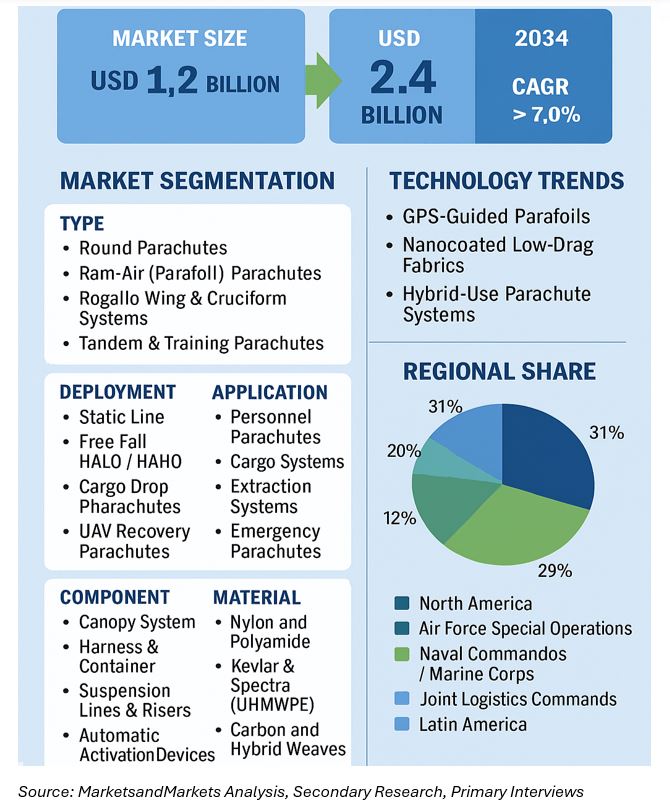

The military parachute market continues to demonstrate resilient growth, supported by modernization of airborne forces, rising defense budgets, and the operational need for precision airdrop systems. In 2025, the market is estimated at USD 1.2 billion and projected to reach approximately USD 2.4 billion by 2034, registering a compound annual growth rate (CAGR) of close to 7.0%.

Parachutes remain a critical enabler for airborne troop insertion, cargo resupply, and special mission support, allowing forces to operate independently of airfields. The transition from traditional round-canopy systems to steerable ram-air parachutes reflects the evolving nature of warfare, where agility, precision, and survivability dominate mission planning. Increasing emphasis on high-altitude low-opening (HALO) and high-altitude high-opening (HAHO) operations for stealth insertion has spurred demand for advanced canopy designs with GPS guidance and lightweight, high-strength fabrics.

From personnel systems to cargo and UAV recovery parachutes, technological advances in canopy aerodynamics, materials engineering, and digital activation mechanisms are reshaping market dynamics. Governments are also focusing on local manufacturing and maintenance infrastructure to ensure rapid availability, export capability, and self-reliance.

Market Dynamics

Key Growth Drivers

- Expanding Airborne Operations: Rising troop mobility requirements and special forces deployment are fuelling parachute procurement and replacement programs.

- Precision and Steerability: Growing use of GPS-guided systems and ram-air canopies enables pinpoint landing accuracy, reducing mission risk.

- Material Innovation: Lightweight synthetic fibers such as Kevlar, Spectra, and Dyneema improve strength-to-weight ratios and canopy durability.

- Modernization Initiatives: Airborne divisions across the U.S., France, India, China, and the U.K. are upgrading from legacy round canopies to high-performance tactical parachutes.

- Emergence of UAV and Payload Recovery Systems: Increasing use of recovery parachutes in UAV missions and loitering munitions.

Challenges

- Complex certification and safety-testing standards for new materials.

- Maintenance and recertification costs for large fleet operations.

- Limited trained rigging personnel in emerging markets.

Opportunities

- Autonomous Airdrop Systems: Integration of sensor-based and AI-controlled parachute release systems.

- Life-Extension & Re-certification Services: OEMs offering lifecycle programs for canopy inspection and reuse.

- Hybrid Fabric Development: Blending carbon fiber and nylon composites to improve canopy resilience.

- Localization & Offset Production: Opportunities for domestic assembly under Make in India and NATO offset programs.

Market Segmentation

By Type

-

Round Parachutes:

Traditional domed canopies used for mass troop drops and basic cargo delivery. Known for durability and simplicity, but limited in maneuverability. -

Ram-Air (Parafoil) Parachutes:

High-performance rectangular or elliptical canopies used for HALO/HAHO and special operations. Offer precise glide control and higher payload capability. -

Rogallo Wing & Cruciform Systems:

Deployed for low-altitude missions with higher directional control and stability. -

Tandem & Training Parachutes:

Used for dual operations (instructor–trainee or tandem insertion). Include reinforced harnesses and advanced control toggles.

By Deployment Mechanism

-

Static Line:

Dominant in large-scale airborne drops; automatically deploys at jump exit for rapid sequential operations. -

Free Fall / HALO / HAHO:

Manual or automatic activation for high-altitude, long-glide special missions. Supported by advanced oxygen systems and steering controls. -

Cargo Drop Parachutes:

Used for dropping heavy equipment, vehicles, and humanitarian supplies. Incorporate multiple canopy clusters for payload stability. -

UAV Recovery Parachutes:

Designed for controlled recovery of unmanned aerial vehicles, loitering munitions, or sensor pods.

By Application

- Personnel Parachutes: For airborne troop and commando operations.

- Cargo Systems: For military logistics and disaster relief operations.

- Extraction Systems: Used with aircraft cargo doors to extract payloads in flight.

- Emergency Parachutes: Installed in aircraft and ejection seats for crew escape.

- Training Systems: For routine jump instruction and certification.

By Material / Fabric

- Nylon and Polyamide: Traditional, cost-effective fabrics with good elasticity.

- Kevlar & Spectra (UHMWPE): Lightweight, abrasion-resistant, with improved tear strength and lower radar visibility.

- Carbon and Hybrid Weaves: Emerging materials offering low IR signature and high heat resistance.

By Component

- Canopy System: Main, reserve, and stabilizer canopies with deployment bags.

- Harness & Container: Adjustable load-bearing designs for comfort and quick release.

- Suspension Lines & Risers: Aramid or Dyneema-based lines with minimal stretch.

- Automatic Activation Devices (AADs): Microprocessor-based units that deploy reserve chutes at set altitude thresholds.

By End User

- Army Airborne Units: Primary consumers for troop deployment.

- Air Force Special Operations: HALO/HAHO missions and UAV payload recovery.

- Naval Commandos / Marine Corps: Amphibious and infiltration missions.

- Joint Logistics Commands: Cargo and relief operations.

Technology and Innovation Landscape

The evolution of the military parachute market is anchored in material science and intelligent deployment systems. Next-generation canopies feature nanocoated low-drag fabrics, integrated barometric sensors, and GPS-guided parafoils capable of gliding up to 40 km from release altitude.

Digital manufacturing and 3D simulation tools are being used to model airflow, reduce canopy stress points, and optimize suspension geometry. Maintenance automation through embedded RFID chips now allows real-time tracking of canopy cycles and wear profiles, extending operational life by up to 25%.

Manufacturers are also investing in multi-role parachute systems, capable of switching between personnel and cargo configurations with modular harness kits — reducing overall fleet redundancy.

Competitive Landscape

The market is moderately consolidated with key global and regional players competing across capability, reliability, and service life.

Leading Companies:

- Airborne Systems North America (U.S.)

- Safran Electronics & Defense (France)

- Mills Manufacturing Corporation (U.S.)

- FXC Corporation (U.S.)

- Butler Parachute Systems (U.S.)

- BAE Systems plc (U.K.)

- Ballenger International LLC (U.S.)

- Jiangsu Tianling (China)

- Aerodyne Research LLC (South Africa)

Strategic Developments:

- Safran’s GPS-guided EPCU-400 system optimized for HALO operations.

- Airborne Systems’ next-gen Hi-5 ram-air canopy adopted by NATO forces.

- India’s DRDO and Paras Aerospace developing indigenous combat and cargo parachutes under “Make in India.”

- U.S. Army’s precision aerial delivery system (JPADS 2K) integration for heavy payload drops.

Regulatory Framework

Military parachutes are subject to stringent certification under NATO STANAG 3377, FAA TSO-C23d, and respective national defense procurement standards. Each component undergoes fatigue testing, drop certification, and periodic recertification cycles. Export compliance is regulated under ITAR (U.S.), EU Dual-Use Regulation, and offset mandates in Asia and the Middle East.

Sustainability Perspective

Environmental accountability is gaining ground even in defense procurement. Manufacturers are focusing on:

- Recyclable or reusable canopy materials with low environmental toxicity.

- Lifecycle digitization for predictive maintenance and reduced wastage.

- Repairable modular harness systems that extend product life by 30–40%.

- Reduced aircraft idle emissions through efficient drop planning and lighter equipment loads.

These measures not only align with sustainability mandates but also improve fleet readiness and cost efficiency.

Regional Outlook

North America

The U.S. leads global demand due to large airborne forces and ongoing modernization programs. The U.S. Army’s Airborne & Special Operations Command (USASOC) and the 82nd Airborne Division remain key end-users. Canada is upgrading its training parachute inventory with low-velocity systems for Arctic deployments.

Europe

Europe hosts a mix of established suppliers (Safran, BAE Systems) and modernization programs within NATO. France and Germany focus on high-altitude insertion and UAV recovery systems, while Eastern European states are investing in indigenous manufacturing under EU defense cooperation.

Asia Pacific

Asia Pacific is the fastest-growing region, driven by expanding defense budgets in China, India, Japan, and South Korea. India’s DRDO, BEL, and Paras Defense are scaling indigenous R&D to reduce import dependence. China’s PLA continues to expand large-airdrop capabilities with indigenous ram-air systems.

Middle East & Africa

Countries like the UAE, Saudi Arabia, and Israel are investing in tactical parachutes for special-operations units. Africa’s demand is primarily humanitarian and training-oriented, supported by UN peacekeeping procurement.

Latin America

Brazil and Colombia are leading markets for troop and cargo parachute systems, emphasizing jungle warfare and disaster relief missions. Partnerships with Western OEMs under technology-transfer programs are expanding.

Market Outlook and Key Takeaways

The military parachute market is poised for steady expansion through 2034. Technological advancements, the spread of airborne mobility doctrines, and new hybrid-use parachutes (for UAV recovery and logistics) are defining the decade ahead.

Highlights:

- Market Size: USD 1.2 Bn (2025) → USD 2.4 Bn (2034)

- CAGR: ~7.0%

- Fastest-Growing Region: Asia Pacific

- Major Demand Drivers: Airborne force modernization, hybrid fabrics, GPS-guided systems

Stakeholders who focus on precision, modularity, sustainment, and local integration will gain strategic advantage in upcoming tenders and military modernization programs.

FAQs

1. What is the military parachute market size?

It is valued at approximately USD 1.2 billion in 2025 and projected to reach USD 2.4 billion by 2034.

2. Which types of parachutes are most in demand?

Ram-air and GPS-guided systems for special operations show the highest demand growth.

3. Who are the major manufacturers?

Key OEMs include Airborne Systems, Safran, Mills Manufacturing, BAE Systems, Butler Parachute, and FXC Corporation.

4. Which region is expected to grow fastest?

Asia Pacific, due to expanding airborne capabilities in India, China, and South Korea.

5. What technological trends are shaping the market?

Smart deployment mechanisms, GPS-guided precision landing, RFID-based maintenance tracking, and hybrid canopy materials.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Stakeholders

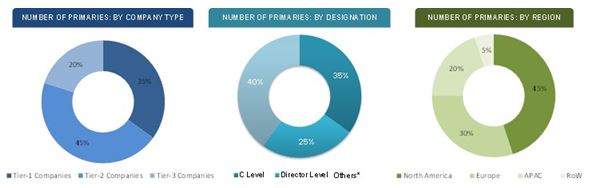

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Indicators

2.2.2.1 Increase in Deployment of Parachutes in Defense

2.2.2.2 Evolution of Parachutes in Sports

2.2.3 Supply Side Indicators

2.2.3.1 Global Competitiveness of Military Textiles Industry

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in Parachute Market

4.2 Parachute Market Growth: By Application

4.3 Parachute Market Growth: By Component

4.4 Parachute Market Growth: By Type

4.5 Region-Wise Parachute Market Share Analysis

4.6 Parachute Market Analysis

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Application

5.3.2 By Cargo Application

5.3.3 By Military Personnel Application

5.3.4 By Component

5.3.5 By Type

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Demand From Military Owing to Rising Conflicts

5.4.1.2 Airplane Recovery Parachute System

5.4.1.3 Advancements in Parachute Technology

5.4.1.4 Growth of Aero Sports

5.4.2 Restraints

5.4.2.1 Declining Defense Budgets

5.4.2.2 Standing Inventory of Parachutes With Defense

5.4.2.3 Government Procedures

5.4.3 Opportunities

5.4.3.1 Use of Parachutes for Unmanned Aerial Vehicles

5.4.4 Challenges

5.4.4.1 Need for Efficient Supply Chain

5.4.5 Winning Imperative

5.4.5.1 Development of Light Weight Parachutes

5.4.6 Cyclical Nature of Parachute Industry

5.4.6.1 Importance of Parachutes for the U.S. Military and Homeland Security

5.4.6.2 The Need is Increasing and Supply is Diminishing

5.4.6.3 The Nature of Military Procurement

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Technology Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threat From Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 Global Parachute Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Cargo Parachutes

7.3 Military Parachuting

7.4 Parachute Market for Sports

7.5 Rescue Parachute Market

7.6 Break Chutes

7.7 Aircraft Recovery With Parachutes

8 Global Parachute Market, By Type (Page No. - 62)

8.1 Introduction

8.2 Round Parachutes

8.3 Ram-Air Parachute

8.4 Square Or Parafoil Parachute

8.5 Ribbon and Ring Parachute

9 Global Parachute Market, By Component (Page No. - 68)

9.1 Introduction

9.2 Canopy

9.3 Cords

9.4 Tapes

9.5 Webbings

9.6 Metal

10 Global Parachute Market, By Region (Page No. - 73)

10.1 Introduction

10.2 North America

10.2.1 By Country

10.2.1.1 U.S.

10.2.1.1.1 By Application

10.2.1.1.2 By Type

10.2.1.2 Canada

10.2.1.2.1 By Application

10.2.1.2.2 By Type

10.2.2 By Application

10.2.3 By Type

10.2.4 By Component

10.3 Asia-Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.1.1 By Application

10.3.1.1.2 By Type

10.3.1.2 India

10.3.1.2.1 By Application

10.3.1.2.2 By Type

10.3.1.3 Australia

10.3.1.3.1 By Application

10.3.1.3.2 By Type

10.3.2 By Application

10.3.3 By Type

10.3.4 By Component

10.4 Europe

10.4.1 By Country

10.4.1.1 U.K.

10.4.1.1.1 By Application

10.4.1.1.2 By Type

10.4.1.2 Spain

10.4.1.2.1 By Application

10.4.1.2.2 By Type

10.4.1.3 Russia

10.4.1.3.1 By Application

10.4.1.3.2 By Type

10.4.1.4 Germany

10.4.1.4.1 By Application

10.4.1.4.2 By Type

10.4.2 By Application

10.4.3 By Type

10.4.4 By Component

10.5 The Middle East

10.5.1 By Country

10.5.1.1 Israel

10.5.1.1.1 By Application

10.5.1.1.2 By Type

10.5.1.2 Turkey

10.5.1.2.1 By Application

10.5.1.2.2 By Type

10.5.2 By Application

10.5.3 By Type

10.5.4 By Component

10.6 Rest of the World

10.6.1 By Country

10.6.1.1 Brazil

10.6.1.1.1 By Application

10.6.1.2 South Africa

10.6.1.2.1 By Application

10.6.2 By Application

10.6.3 By Component

10.6.4 By Type

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Major Market Players Operating in the Parachute Market

11.3 Companies’ Product/Service Matrix Mapping

11.4 Contracts

11.5 New Product Developments

12 Company Profiles (Page No. - 109)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 FXC Corporation

12.3 Cimsa Ingenieria De Sistemas, S.A.

12.4 Spekon

12.5 Zodiac Aerosafety

12.6 Mills Manufacturing

12.7 Cirrus Aircraft

12.8 Butler Parachute Systems Group, Inc.

12.9 NH Global SDN BHD

12.10 Parachute Systems

12.11 Airborne Systems

12.12 Atair Aerospace, Inc.

12.13 Ballenger International, LLC

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 127)

13.1 Discussion Guide

13.2 Introducing RT: Real Time Market Intelligence

13.3 Available Customizations

List of Tables (74 Tables)

Table 1 Increasing Demand From Military

Table 2 Standing Inventory of Parachutes With Defense

Table 3 Use of Parachutes for Unmanned Aerial Vehicles

Table 4 Parachute Supplier Environment

Table 5 Development of Light Weight Parachutes

Table 6 Lightweight Parachutes Caters to the Latest Trend in the Global Parachute Market

Table 7 Global Military Parachute Market, By Application, 2013–2020 (USD Million)

Table 8 Global Cargo Military Parachute Market, By Type, 2013–2020 (USD Million)

Table 9 Global Cargo Military Parachute Market, By Region, 2013–2020 (USD Million)

Table 10 Global Parachute Market for Military Application, By Type, 2013–2020 (USD Million)

Table 11 Global Parachute Market for Military Application, By Region, 2013–2020 (USD Million)

Table 12 Global Parachute Market for Sports, By Region, 2013–2020 (USD Million)

Table 13 Global Rescue Parachute Market, By Region, 2013–2020 (USD Million)

Table 14 Global Break Chutes Market, By Region, 2013–2020 (USD Million)

Table 15 Global Market for Aircraft Recovery Using Parachutes, By Region, 2013–2020 (USD Million)

Table 16 Global Military Parachute Market, By Type, 2013–2020 (USD Million)

Table 17 Global Round Parachute, By Region, 2013–2020 (USD Million)

Table 18 Global Ram-Air Parachute Market, By Geography, 2013–2020 (USD Million)

Table 19 Global Square Or Parafoil Parachute Market, By Region, 2013–2020 (USD Million)

Table 20 Global Ribbon and Ring Parachute Market, By Region, 2013–2020 (USD Million)

Table 21 Global Military Parachute Market, By Component, 2013–2020 (USD Million)

Table 22 Global Parachute Canopy Market, By Region, 2013–2020 (USD Million)

Table 23 Global Parachute Cords Market, By Region, 2013–2020 (USD Million)

Table 24 Global Parachute Tape Market, By Region, 2013–2020 (USD Million)

Table 25 Global Parachute Webbings Market, By Region, 2013–2020 (USD Million)

Table 26 Global Parachute Metal Market, By Region, 2013–2020 (USD Million)

Table 27 Global Military Parachute Market Size, By Region, 2013-2020 (USD Million)

Table 28 North America: Military Parachute Market Size, By Country, 2013-2020 (USD Million)

Table 29 North America: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 30 Military Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 31 North America: Parachute Market Size, By Component, 2013-2020 (USD Million)

Table 32 U.S.: Military Parachute MarketSize, By Application, 2013-2020 (USD Million)

Table 33 U.S.: Global Military Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 34 Canada: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 35 U.S.: Global Military Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 36 Asia-Pacific: Military Parachute Market Size, By Country, 2013-2020 (USD Million)

Table 37 Asia-Pacific: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 38 Asia-Pacific: Global Military Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 39 Asia Pacific: Military Parachute Market Size, By Component, 2013-2020 (USD Million)

Table 40 China: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 41 China: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 42 India: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 43 India: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 44 Australia: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 45 Australia: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 46 Europe: Military Parachute Market Size, By Country, 2013-2020 (USD Million)

Table 47 Europe: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 48 Europe: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 49 Europe: Military Parachute Market Size, By Component, 2013-2020 (USD Million)

Table 50 U.K.: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 51 U.K.: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 52 Spain: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 53 Spain: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 54 Russia: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 55 Russia: Global Military Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 56 Germany: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 57 Germany: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 58 The Middle East: Military Parachute Market Size, By Country, 2013-2020 (USD Million)

Table 59 The Middle East: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 60 The Middle East: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 61 The Middle East: Military Parachute Market Size, By Component, 2013-2020 (USD Million)

Table 62 Israel: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 63 Iserael: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 64 Turkey: Military Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 65 Turley: Global Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 66 Rest of the World: Military Parachute Market Size, By Country, 2013-2020 (USD Million)

Table 67 Rest of the World: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 68 Rest of the World: Parachute Market Size, By Component, 2013-2020 (USD Million)

Table 69 RoW Parachute Market Size, By Type, 2013-2020 (USD Million)

Table 70 Brazil: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 71 South Africa: Parachute Market Size, By Application, 2013-2020 (USD Million)

Table 72 Contracts, 2011–2015

Table 73 New Product Development, 2012–2015

Table 74 Guardian Parachute: U.S. Government Recent Contracts

List of Figures (57 Figures)

Figure 1 Markets Covered: Global Parachute Market

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 R&D Spending By Military Manufacturers (1996-2000)

Figure 5 Total Defense Parachute Industry Sales (1996-2000)

Figure 6 Sports Parachute Manufacturing Domestic and Foreign Markets (1996-2000)

Figure 7 Global Consumption of Technical Textiles By Region, 2000 to 2010

Figure 8 Technical Textiles Consumption, By % Share, By Region

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Market Size Estimation Methodology: Top-Down Approach

Figure 11 Data Triangulation Methodology

Figure 12 Global Military Parachute Market: Military Air Insertion

Figure 13 Global Parachute Market Snapshot (2015 vs 2020): Market for Military Parachutes Segment is Projected to Grow at the Highest Rate

Figure 14 North America Leads the Global Parachute Market, 2013-2020

Figure 15 Asia-Pacific to Witness Remarkable Growth During the Forecast Period

Figure 16 The U.S. to Be the Most Prospective Market to Invest in the Next Five Years

Figure 17 Troop Parachutes Fuel the Demand for Global Parachute Market

Figure 18 Attractive Opportunities in Parachute Market, 2015-2020

Figure 19 Military Application is Projected to Grow at the Highest Rate

Figure 20 Canopy Accounts for the Largest Share Among Components of the Parachute System

Figure 21 Round Parachutes Will Dominate the Parachute Market By 2020

Figure 22 North America Accounts for the Largest Share of the Parachute Market During the Forecast Period

Figure 23 Asia-Pacific Accounts for the Highest Growth Rate in the Global Parachute Market, 2015

Figure 24 Global Parachute Market: Military Air Insertion

Figure 25 Parachute Market, By Application

Figure 26 Parachute Market, By Cargo

Figure 27 Parachute Market, By Military Personnel

Figure 28 Parachute Market, By Component

Figure 29 Increasing Demand From Military is Driving the Parachute Market

Figure 30 Comparison of T-10 and T-11 Parachutes

Figure 31 Value Chain Analysis: Global Parachute Market

Figure 32 Supply Chain Analysis: Global Parachute Market

Figure 33 Porter’s Five Forces Analysis: Global Parachute Market

Figure 34 Overview of the Global Parachute Market

Figure 35 Overview of Parachute Market for Cargo, By Region

Figure 36 Overview of Military Parachuting Market

Figure 37 Overview of the Global Parachute Market, By Type

Figure 38 Overview of Round Parachute Market, By Region

Figure 39 Overview of Ram-Air Parachute Market, By Region

Figure 40 Overview of Square Or Parafoil Parachute Market, By Region

Figure 41 Overview of Ribbon and Ring Parachute Market, By Region

Figure 42 Overview of Parachute Market, By Component

Figure 43 Overview of Parachute Canopy Market, By Region

Figure 44 North America is Estimated to Capture the Largest Share of the Global Parachute Market in 2015

Figure 45 North America Snapshot: the U.S. Holds A Significant Share of the Parachute Market

Figure 46 Asia-Pacific Snapshot: China has A Potential Parachute Market in the Region From 2015 to 2020

Figure 47 Europe Snapshot: Russia has A Potential Parachute Market in The Region From 2015 to 2020

Figure 48 The Middle East Snapshot: Israel has A Potential Parachute Market in the Region From 2015 to 2020

Figure 49 Rest of the World Snapshot: Latin America has A Potential Parachute Market in the Region From 2015 to 2020

Figure 50 Major Market Players Operating in the Parachute Market

Figure 51 Companies’ Product/Service Matrix Mapping

Figure 52 Geographic Revenue Mix of Top 5 Market Players

Figure 53 Guardian Parachute: Supply Contracts With U.S. Government

Figure 54 Zodiac Aerosafety: Company Snapshot

Figure 55 Zodiac Aerosafety: SWOT Analysis

Figure 56 Mills Manufacturing: Supply Contracts With U.S. Government

Figure 57 Bulter Parachute Systems: Supply Contracts With U.S. Government

The market size estimations for the various segments and subsegments of this market were arrived at through extensive secondary research, corroboration with primaries, and further market triangulation with the help of statistical techniques using econometric tools.

To know about the assumptions considered for the study, download the pdf brochure

Several nations have engaged their RDT&E activities towards various emerging applications of parachutes, which strongly highlight the market dynamics of parachute industry. The forecast is towards potentially more airdrop applications with gliding and non-gliding parachute operations. The demand for troop parachutes and aerial delivery would become a necessity that drives the need to develop and produce more parachutes which are lightweight and have high load carrying capabilities.

In a nutshell, this research report is consolidated business intelligence on the military parachute market. It will also help the parachute industry, and its stakeholders to identify hot revenue pockets in this market.

Target Audience for this Report:

- Departments of Defense (DoDs)

- U.S. Department of Commerce

- Bureau of Industry and Security

- Parachute Manufacturers

- Component Manufactures

- Parachute Fabric Suppliers

- Space Systems

- Air Systems in Defense in Commercial Industry

Scope of the Report

This research report categorizes the military parachute market into the following segments and sub-segments:

Global Military Parachute Market, By Application

- Military

- Cargo

- Sports

- Rescue

- Recovery

- Break Chutes

Global Military Parachute Market, By Components

- Canopy

- Cords

- Tapes

- Webbings

- Metal

Global Military Parachute Market, By Type

- Round Parachute

- Ram-air Parachute

- Square or Parafoil Parachute

- Ring or Ribbon Parachute

Global Military Parachute Market, By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- Spain

- Russia

-

Asia-Pacific

- China

- India

- Australia

-

Middle East

- Israel

- Turkey

-

Latin America

- Brazil

-

Africa

- South Africa

Customizations Available for the Report:

With the given market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

-

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific market into Japan, Malaysia, and New Zealand, among others

-

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Military Parachute Market