Perfusion Systems Market (Cardiopulmonary Perfusion, by Component (Heart-lung Machines, Oxygenators), Ex Vivo Organ Perfusion, Technique (Hypothermic, Normothermic), Cell Perfusion, by Type (Bioreactor, Microfluidic)) - Global Forecast to 2021

[152 Pages Report] The perfusion systems market is projected to reach USD 1,198.8 million by 2021 from USD 989.4 million in 2016, at a CAGR of 3.9% from 2016 to 2021. Growth in the perfusion systems market is driven by factors such as the increasing prevalence of cardiovascular and respiratory diseases, increasing initiatives by governments and NGOs to encourage organ donation, increasing investment in cell-based research, and rising activities in biologics manufacturing. However, the high cost of organ transplantation, ethical concerns regarding stem cell research activities, and the high cost of cell-based research are expected to restrain the growth of this market during the forecast period

Perfusion System Market Dynamics

Drivers

- Increasing prevalence of cardiovascular and respiratory diseases

- Rising number of organ transplantations

- Growth in Aging Population, Increasing Incidence of Multiple Organ Failures

- Government and NGO Initiatives to Encourage Organ Donation

- Increasing Investments in Cell-Based Research

- Increase in Biologic Manufacturing

Restraints

- High Cost of Organ Transplantation

- Ethical Concerns and High Cost of Cell-Based Research

Opportunities

- Increasing Pharmaceutical Research in Emerging Markets

- Rising Preference for Continuous Manufacturing

Challenges

- Organ Supply-Demand Gap

Increasing prevalence of cardiovascular and respiratory diseases

Cardiovascular diseases are among the leading causes of death globally. They account for about 9.4 million deaths every year. According to the WHO, in 2012, 17.5 million CVD-related deaths (31%) were reported across the globe; this number is expected to grow to more than 23.6 million by 2030. Their high prevalence is in part attributed to the rising prevalence of hypertension, a key risk factor for cardiovascular disease and strokes. In 2013, globally, it was estimated that about 1 billion people suffered from hypertension—a global prevalence of 40%. During the same year, the prevalence of hypertension among adults in Africa was 46% (highest worldwide), while in the Americas, the figure was 35% (the lowest) [Source: WHO]. Similarly, according to the WHO, chronic obstructive pulmonary disease (COPD) caused about 3 million deaths (5%) of the total deaths in 2015. COPD is expected to increase in the coming years due to increasing tobacco consumption and growing pollution.

Perfusion systems are used to bypass cardiopulmonary systems in order to treat patients with cardiac and respiratory diseases surgically. Perfusion systems such as heart-lung machines deliver oxygen and remove carbon dioxide in patients when the heart and lungs fail to carry out the process of blood oxygenation. With the increasing prevalence of cardiovascular and respiratory diseases across the globe, the use of perfusion systems is expected to rise in the coming years.

The following are the major objectives of the study

- To define, describe, and forecast the perfusion systems market on the basis of type and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions, namely, North America, Europe, Asia, and the Rest of the World (RoW)2

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, expansions, and R&D activities in the perfusion systems market

During this research study, major players operating in the perfusion systems market in various regions have been identified, and their offerings, and their have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as American Board of Cardiovascular Perfusion (ABCP), Federation of Asian Perfusion Societies (FAPS), the Society of Perfusionist's of Great Britain & Ireland, American Academy of Cardiovascular Perfusion (AACP), American Heart Association (AHA), Swiss Society of Perfusion, United Network for Organ Sharing (UNOS), American Society of Transplant Surgeons (ASTS), International Society for Organ Preservation (ISOP), Association of Organ Procurement Organizations (AOPO), the Australasian Society of Cardio-Vascular Perfusionists, Incorporated (ASCVP), American Society of ExtraCorporeal Technology, (AmSECT), World Heart Federation, European Board of Cardiovascular, Perfusion (EBCP), International Society for Heart & Lung, Transplantation (ISHLT), and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The perfusion systems market is consolidated in nature. Major players in this market include Getinge AB (Sweden), Medtronic, plc (Ireland), LivaNova (UK), Terumo Corporation (Japan), Nipro Corporation (Japan), XENIOS AG (Germany), Repligen Corporation (US), Spectrum Laboratories, Inc. (US), Merck KGaA (Germany), Harvard Bioscience, Inc (US), ALA Scientific Instruments, Inc. (US), Lifeline Scientific, Inc. (US), and XVIVO Perfusion AB (Sweden). Partnerships, Collaborations, Joint Ventures, Agreements, and Mergers & Acquisitions were the key strategies adopted by players to grow and expand their presence in the perfusion systems market.

Major Market Developments:

- In January 2015, Medtronic acquired Covidien plc. (Ireland), a manufacturer of healthcare products for use in clinical and home settings worldwide. This acquisition aims to strengthen Medtronic’s customer base and resolve healthcare challenges with constant product development and imbibing new technologies.

- In October 2015, Sorin merged with Cyberonics Inc (US) to form a global medical technology company—LivaNova PLC (U.K.).

- In February 2014, Sorin acquired Bioengineering Laboratories S.p.A. (BEL), a manufacturer of cardiac surgery cannulas. This acquisition is expected to strengthen Sorin’s position in the cardiovascular cannulas market segment.

- In September 2016, Terumo partnered with CytoSorbents Corporation (US), a manufacturer of the CytoSorb extracorporeal blood purification adsorber. Under this partnership, Terumo commercialized the CytoSorb extracorporeal blood purification adsorber for cardiac surgery applications in France, Sweden, Denmark, Norway, Finland, and Iceland.

Target Audience:

- Perfusion systems and related devices Manufacturers

- Healthcare Institutions (Hospitals, Cardiac Centers, and Surgical Centers)

- Perfusion systems and related devices Distributors and Suppliers

- Contract Manufacturing Organizations (CMOs)

- Business research and consulting service providers

Scope of the Report

This report categorizes the perfusion systems market into the following segments and subsegments.

Perfusion System Market, by Application

- Cardiopulmonary Perfusion Systems

- Cell Perfusion Systems

- EX Vivo Organ Perfusion

Cardiopulmonary Perfusion Systems Market, By Component

- Oxygenators

- Heart-Lung Machines

- Perfusion Pumps

- Cannulas

- Monitoring Systems

-

Other Components

- Arterial Filters

- Reservoirs

- Data Management Systems

- Cardioplegia Delivery Systems

- Heat Exchangers

- Accessories

Cell Perfusion Systems Market, By Type

- Bioreactor Perfusion Systems

- Microfluidic Perfusion Systems

- Gravity Or Pressure-Driven Perfusion Systems

- Small-Mammal Organ Perfusion Systems

EX Vivo Organ Perfusion Market, By Technique

- Hypothermic Machine Perfusion Cardiac Centers

- Normothermic Machine Perfusion

Global Perfusion Systems Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- Europe-5

- RoE (Rest of Europe)

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia-Pacific

- Rest of the World (LATAM, the Middle East, and Africa)

Critical Questions which the report answers:

- Which are the key players in the market and how intense is the competition?

- What are new technological developments in the market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5)

Further Split of the Rest of the World Perfusion Systems Market

Perfusion systems market size and growth rate estimates ofLATAM, Middle East and Africa

The perfusion systems market is projected to reach USD 1,198.8 million by 2021 from USD 989.4 million in 2016, at a CAGR of 3.9% from 2016 to 2021. The market is mainly driven by factors such as increasing prevalence of cardiovascular and respiratory diseases, increasing initiatives by governments and NGOs to encourage organ donation, increasing investment in cell-based research, and rising activities in biologics manufacturing.

Perfusion is the passage of fluid through the circulatory system or lymphatic system to an organ or tissue. Perfusion systems are used to temporarily replace the functions of the heart and lungs during cardiac and thoracic surgery procedures. Also, perfusion systems are used for transporting organs and for perfusing cell systems.

On the basis of application, the perfusion systems market is segmented into cardiopulmonary perfusion systems, cell perfusion systems, and ex vivo organ perfusion. The cardiopulmonary perfusion systems segment accounted for the largest share of the global perfusion systems market in 2016. The large share of this segment can be attributed to the increasing prevalence of cardiovascular & respiratory diseases and the increasing number of organ transplant procedures, worldwide.

On the basis of component, the cardiopulmonary perfusion systems market is segmented into heart-lung machines, oxygenators, reservoirs, arterial filters, pumps, monitoring systems, data management systems, heater-coolers, cannulas, and accessories. The oxygenators segment is expected to account for the largest share of the global cardiopulmonary perfusion systems market in 2016. The large share of this segment can be majorly attributed to the rising incidence of cardiopulmonary failure.

On the basis of technique, the ex vivo organ perfusion market is segmented into hypothermic machine perfusion and normothermic machine perfusion. The hypothermic machine perfusion segment accounted for the largest share of the ex vivo organ perfusion market. High growth in this segment can be attributed to the advantages offered by hypothermic machine perfusion, such as better long-term graft survival rates, decreased vasospasm, and ability to provide metabolic support.

On the basis of type, the cell perfusion systems market is segmented into bioreactor perfusion systems, microfluidic perfusion systems, gravity or pressure-driven perfusion systems, and small-mammal organ perfusion systems. The bioreactor perfusion systems segment accounted for the largest share of the cell perfusion systems market in 2016. This can be attributed to the rising demand for biological products and constant need to increase product yield & reduce production costs are factors driving the adoption of bioreactor perfusion systems.

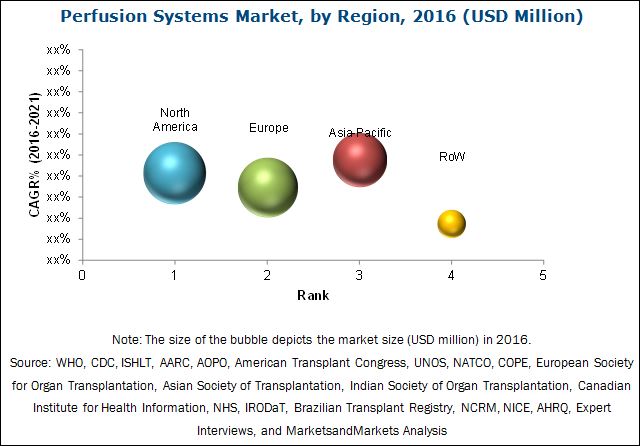

The market is dominated by North America, followed by Europe, Asia, and the Rest of the World. North America is expected to dominate the market in 2016. Asia is expected to grow at a highest CAGR during the forecast period. Factors such as growth in geriatric population, increase in organ donations, growing biotechnology industry, and increase in pharmaceutical and biotechnology R&D activities in the region are expected to drive market growth in Asia.

Hypothermic machine perfusion form the fastest growing end user segment of ex vivo perfusion systems

Hypothermic machine perfusion

Hypothermic machine perfusion (HMP) was developed to increase the preservation time and quality of preservation of transplantable organs. HMP is a dynamic method of preservation as it relies on activating the residual metabolism within the organ. This technique involves continuous perfusion of the preservation solution through the organ, which provides nutrients and sometimes oxygen, carries away toxic metabolites, and delivers buffers which absorb the build-up of lactic acid in the organ. The hypothermia induced in the technique results in reduced cellular activity and helps improve the ability of the organ to effectively cope with any further effects of the ischemia-reperfusion injury (IRI). The HMP technique is approved clinically for the preservation of kidneys. Several clinical studies have been undertaken to demonstrate the effectiveness of this technique in preserving “marginal” organs of higher risk (such as from older donors, donors with morbidities, donors with a history of smoking, and donation after cardiac death).

Normothermic machine perfusion

The principle of normothermic perfusion is based on recreating the physiologic environment by maintaining normal organ temperature and providing essential substrates for cellular metabolism, oxygenation, and nutrition. The temperature- and pressure-controlled pulsatile perfusion of oxygenated blood improves the cellular energy load, reduces tissue injury, and improves the post-transplantation graft function. Although the theoretical advantages of normothermic donor perfusion have been recognized for over a century, the technology to preserve and transport organs has been recently developed. Several clinical studies have been undertaken to demonstrate the effectiveness of this technique as a method for preservation of organs before transplantation. For instance, PROCEED II was a prospective, multicenter, international trial conducted from 2009 to 2013. The trial compared Organ Care System (a normothermic machine perfusion system developed by Transmedics, Inc.) to the SCS technique to preserve donor hearts for transplantation. The results of the study indicated that the normothermic donor heart perfusion during transportation resulted in reduced cold ischemic times as compared to SCS. Moreover, it indicated that normothermic perfusion helps in increasing the retrieval time boundaries of organs, which increases the donor pool. The study also demonstrated that the normothermic machine perfusion technique allows the implanting surgeon to assess the quality of the donor organ.

Critical questions the report answers:

- Which application market will dominate in future?

- Emerging countries have immense opportunities for the growth of perfusion systems, will this scenario continue?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Organ transplantation is an expensive therapy; apart from the charges associated with organ procurement and transplantation, there are significant costs associated with the recipient’s aftercare and anti-rejection medication. In addition, costs may include travel, lodging, and meals, whenever the patient comes to the transplant center for evaluation or follow-ups. Payment for expensive drugs further escalates the overall cost of transplants. For patients with low family incomes, this poses a significant burden and forces them to look for lower-cost alternatives. As perfusion systems find significant applications in organ transplantation, any such shift—from organ transplantation to the next viable alternative—will directly impact the market for perfusion systems as well.

Key players in the Perfusion Systems Market include Getinge AB (Sweden), Medtronic plc (Ireland), LivaNova PLC (UK), Terumo Corporation (Japan), and XENIOS AG (Germany), Lifeline Scientific, Inc. (US) and XVIVO Perfusion AB (Sweden), Repligen Corporation (U.S.), Spectrum Laboratories, Inc. (U.S.), Merck KGaA (Germany), Harvard Bioscience, Inc. (US), and ALA Scientific Instruments, Inc. (US).

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Research

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Insights From Primary Sources

2.2.2.3 Key Industry Insights

2.3 Market Size Estimation Methodology

2.4 Market Data Validation and Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 29)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 33)

4.1 Perfusion Systems: Market Overview

4.2 Geographic Analysis: Perfusion Systems Market, By Type (2016)

4.3 Cell Perfusion Systems Market, By Type, 2016 vs 2021

4.4 Geographic Snapshot of the Market

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Prevalence of Cardiovascular and Respiratory Diseases

5.2.1.2 Rising Number of Organ Transplantations

5.2.1.2.1 Growth in Aging Population, Increasing Incidence of Multiple Organ Failures

5.2.1.2.2 Government and NGO Initiatives to Encourage Organ Donation

5.2.1.3 Increasing Investments in Cell-Based Research

5.2.1.4 Increase in Biologic Manufacturing

5.2.2 Restraints

5.2.2.1 High Cost of Organ Transplantation

5.2.2.2 Ethical Concerns and High Cost of Cell-Based Research

5.2.3 Opportunities

5.2.3.1 Increasing Pharmaceutical Research in Emerging Markets

5.2.3.2 Rising Preference for Continuous Manufacturing

5.2.4 Challenge

5.2.4.1 Organ Supply-Demand Gap

6 Cardiopulmonary Perfusion Systems Market, By Component (Page No. - 43)

6.1 Introduction

6.2 Oxygenators

6.3 Heart-Lung Machines

6.4 Perfusion Pumps

6.5 Cannulas

6.6 Monitoring Systems

6.7 Other Components

6.7.1 Arterial Filters

6.7.2 Reservoirs

6.7.3 Data Management Systems

6.7.4 Cardioplegia Delivery Systems

6.7.5 Heat Exchangers

6.7.6 Accessories

7 Cell Perfusion Systems Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Bioreactor Perfusion Systems

7.3 Microfluidic Perfusion Systems

7.4 Gravity Or Pressure-Driven Perfusion Systems

7.5 Small-Mammal Organ Perfusion Systems

8 EX Vivo Organ Perfusion Market, By Technique (Page No. - 53)

8.1 Introduction

8.2 Hypothermic Machine Perfusion

8.3 Normothermic Machine Perfusion

9 Global Perfusion Systems Market, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.1.1 Rise in Cardiovascular Disease Prevalence

9.2.1.2 Technological Advancements in Organ Preservation

9.2.1.3 Increasing Organ Transplants

9.2.1.4 Introduction of the 21st Century Cures Act

9.2.1.5 Favorable Scenario for Cell Research, Growing Research Funding

9.2.1.6 Growth of the Pharmaceutical and Biotechnology Sector

9.2.2 Canada

9.2.2.1 Increasing Incidences of Heart Diseases

9.2.2.2 Favorable Reimbursement Scenario for Living Donors Within Some Provinces

9.2.2.3 Increasing Investment in Regenerative Medicine Research Projects

9.3 Europe

9.3.1 Rapidly Aging Population, High Prevalence of Cardiovascular Diseases in Europe

9.3.2 Europe-5

9.3.2.1 Changes in Organ Donation Laws in Wales

9.3.2.2 Strong Academic and Research Base in Germany

9.3.2.3 Funding for Research in the U.K.

9.3.2.4 Increasing Cancer Research in France

9.3.2.5 Italy: Growing Biotech Industry to Aid Market Growth

9.3.3 RoE

9.3.3.1 Strong Presence of Pharmaceutical and Biotechnology Companies

9.3.3.2 Increasing Research in Denmark and Sweden

9.4 Asia-Pacific

9.4.1 Increasing Aging Population, Rise in Cardiovascular Surgery

9.4.2 Japan

9.4.2.1 Rising Organ Donations and Transplants

9.4.2.2 Rise in Vaccine Production in Japan

9.4.2.3 Regenerative Medicine and Biomedical & Medical Research in Japan

9.4.3 China

9.4.3.1 Regulatory Framework for Voluntary Organ Donations

9.4.3.2 Increasing Government Interest in Biomedical and Biotechnology Industries

9.4.3.3 Growth of the Pharmaceutical and Biotechnology R&D Industry and Cros Sector

9.4.4 India

9.4.4.1 Religious Beliefs and Lack of Healthcare Infrastructure in India

9.4.4.2 Growing Pharmaceutical and Biotechnology Industry, Government Initiatives

9.4.5 Rest of Asia-Pacific

9.4.5.1 Taiwan: Increasing Government Support for Academic and Commercial R&D

9.4.5.2 Establishment of R&D Centers in Singapore

9.4.5.3 Korea-U.S. Free Trade Agreement (Korus)

9.5 Rest of the World

9.5.1 Campaigns to Encourage Organ Donation in Brazil

9.5.2 Flourishing Biotechnology and Pharmaceutical Markets in Brazil

9.5.3 Significant Developments in the Pharmaceutical Market in Africa

9.5.4 Favorable Regulatory Environment in Saudi Arabia, Iran, and Israel

10 Competitive Landscape (Page No. - 97)

10.1 Introduction

10.1.1 Vanguards

10.1.2 Innovator

10.1.3 Dynamic

10.1.4 Emerging

10.2 Competitive Benchmarking

10.2.1 Product Offerings

10.2.2 Business Strategy

*Top 13 Companies Analyzed for This Studies are - Getinge AB (Sweden), Medtronic PLC (Ireland), Terumo Corporation (Japan), Livanova PLC (U.K.), Xenios AG (Germany), Repligen Corporation (U.S.), Spectrum Laboratories, Inc. (U.S.), Merck KGaA (Germany), Nipro Corporation (Japan), Harvard Bioscience, Inc. (U.S.), ALA Scientific Instruments, Inc. (U.S.), Lifeline Scientific, Inc. (U.S.), and Xvivo Perfusion AB (Sweden).

11 Company Profile (Page No. - 101)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Getinge AB

11.2 Medtronic PLC

11.3 Livanova PLC

11.4 Terumo Corporation

11.5 Nipro Corporation

11.6 Xenios AG (Acquired By Fresenius Medical Care AG & Co. KGaA)

11.7 Repligen Corporation

11.8 Spectrum Laboratories, Inc.

11.9 Merck KGaA

11.10 Harvard Bioscience, Inc.

11.11 ALA Scientific Instruments, Inc.

11.12 Lifeline Scientific, Inc. (Organ Recovery Systems, Inc.)

11.13 Xvivo Perfusion AB

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 144)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.3.1 Features and Benefits of RT

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (74 Tables)

Table 1 Biomanufacturing Projects Announced in 2015 and 2016

Table 2 Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 3 Oxygenators Market Size, By Region, 2014-2021 (USD Million)

Table 4 Heart-Lung Machines Market Size, By Region, 2014-2021 (USD Million)

Table 5 Perfusion Pumps Market Size, By Region, 2014-2021 (USD Million)

Table 6 Cannulas Market Size, By Region, 2014-2021 (USD Million)

Table 7 Monitoring Systems Market Size, By Region, 2014-2021 (USD Million)

Table 8 Other Components Market Size, By Region, 2014-2021 (USD Million)

Table 9 Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 10 Bioreactor Perfusion Systems Market Size, By Region, 2014-2021 (USD Million)

Table 11 Microfluidic Perfusion Systems Market Size, By Region, 2014-2021 (USD Million)

Table 12 Gravity Or Pressure-Driven Perfusion Systems Market Size, By Region, 2014-2021 (USD Million)

Table 13 Small-Mammal Organ Perfusion Systems Market Size, By Region, 2014-2021 (USD Million)

Table 14 EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 15 Advantages and Disadvantages of the HMP Technique

Table 16 Hypothermic Machine Perfusion Market Size, By Region, 2014-2021 (USD Million)

Table 17 Normothermic Machine Perfusion Market Size, By Region, 2014-2021 (USD Million)

Table 18 Global Perfusion System Market Size, By Region, 2014-2021 (USD Million)

Table 19 Global Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 20 North America: Perfusion System Market Size, By Country, 2014-2021 (USD Million)

Table 21 North America: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 22 North America: Cardiopulmonary Market Size, By Component, 2014-2021 (USD Million)

Table 23 North America: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 24 North America: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 25 Number of Organ Transplants in the U.S. (2014-2016)

Table 26 U.S.: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 27 U.S.: Cardiopulmonary Market Size, By Component, 2014-2021 (USD Million)

Table 28 U.S.: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 29 U.S.: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 30 Canada: Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 31 Canada: Cardiopulmonary Market Size, By Component, 2014-2021 (USD Million)

Table 32 Canada: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 33 Canada: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 34 Europe: Perfusion System Market Size, By Region, 2014-2021 (USD Million)

Table 35 Europe: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 36 Europe: Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 37 Europe: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 38 Europe: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 39 Europe-5: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 40 Europe-5: Cardiopulmonary Market Size, By Component, 2014-2021 (USD Million)

Table 41 Europe-5: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 42 Europe-5: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 43 Indicative List: Companies Headquartered in RoE Countries

Table 44 RoE: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 45 RoE: Cardiopulmonary Market Size, By Component, 2014-2021 (USD Million)

Table 46 RoE: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 47 RoE: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 48 Asia-Pacific: Perfusion System Market Size, By Country, 2014-2021 (USD Million)

Table 49 Asia-Pacific: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 50 Asia-Pacific: Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 52 Asia-Pacific: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 53 Number of Organ Donations and Transplants in Japan (2013-2016)

Table 54 Japan: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 55 Japan: Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 56 Japan: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 57 Japan: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 58 China: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 59 China: Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 60 China: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 61 China: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 62 India: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 63 India: Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 64 India: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 65 India: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 66 RoAPAC: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 67 RoAPAC: Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 68 RoAPAC: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 69 RoAPAC: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

Table 70 Number of Organ Donations (2008 vs 2015)

Table 71 RoW: Perfusion System Market Size, By Type, 2014-2021 (USD Million)

Table 72 RoW: Cardiopulmonary Perfusion Systems Market Size, By Component, 2014-2021 (USD Million)

Table 73 RoW: Cell Perfusion Systems Market Size, By Type, 2014-2021 (USD Million)

Table 74 RoW: EX Vivo Organ Perfusion Market Size, By Technique, 2014-2021 (USD Million)

List of Figures (61 Figures)

Figure 1 Perfusion Systems Market Segmentation

Figure 2 Perfusion Systems Market: Research Methodology Steps

Figure 3 Sampling Frame: Primary Research

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Perfusion System Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Perfusion System Market Size Estimation Methodology: Top-Down Approach

Figure 7 Research Design

Figure 8 Data Triangulation Methodology

Figure 9 Perfusion Systems Market, By Type: Cardiopulmonary Perfusion Systems Segment Accounted for the Largest Market Share in 2016

Figure 10 Cardiopulmonary Perfusion Systems Market Size, By Component, 2016 vs 2021

Figure 11 EX Vivo Organ Perfusion Market Size (USD Million), By Technique, 2016 vs 2021

Figure 12 Cell Perfusion Systems Market Size, By Type, 2016 vs 2021

Figure 13 Geographic Snapshot of the Market

Figure 14 North America Accounted for the Largest Share of the Perfusion Systems Market in 2016

Figure 15 Cardiopulmonary Perfusion Segment Dominated the Perfusion Systems Market in 2016

Figure 16 Bioreactor Perfusion Systems Will Continue to Dominate the Cell Perfusion Systems Market in 2021

Figure 17 North America to Register the Highest CAGR During the Forecast Period

Figure 18 Global Market Share, By Region (2016–2021)

Figure 19 North America: Market Snapshot

Figure 20 NIH Spending on Stem Cell Research, 2013-2016 (USD Billion)

Figure 21 Number of New Biotechnology and Pharmaceutical Companies, 2014-2016

Figure 22 Europe: Perfusion System Market Snapshot

Figure 23 APAC: Perfusion System Market Snapshot

Figure 24 RoW: Perfusion System Market Snapshot

Figure 25 Dive Chart

Figure 26 Getinge AB: Company Snapshot (2016)

Figure 27 Getinge AB: Product Offering Scorecard

Figure 28 Getinge AB: Business Strategy Scorecard

Figure 29 Medtronic PLC: Company Snapshot (2016)

Figure 30 Medtronic PLC: Product Offering Scorecard

Figure 31 Medtronic PLC: Business Strategy Scorecard

Figure 32 Livanova PLC: Company Snapshot (2015)

Figure 33 Livanova PLC: Product Offering Scorecard

Figure 34 Livanova PLC: Business Strategy Scorecard

Figure 35 Terumo Corporation: Company Snapshot (2015)

Figure 36 Terumo Corporation: Product Offering Scorecard

Figure 37 Terumo Corporation: Business Strategy Scorecard

Figure 38 Nipro Corporation: Company Snapshot (2015)

Figure 39 Nipro Corporation: Product Offering Scorecard

Figure 40 Nipro Corporation: Business Strategy Scorecard

Figure 41 Xenios AG: Product Offering Scorecard

Figure 42 Xenios AG: Business Strategy Scorecard

Figure 43 Repligen Corporation: Company Snapshot (2015)

Figure 44 Repligen Corporation: Product Offering Scorecard

Figure 45 Repligen Corporation: Business Strategy Scorecard

Figure 46 Spectrum Laboratories, Inc.: Product Offering Scorecard

Figure 47 Spectrum Laboratories, Inc.: Business Strategy Scorecard

Figure 48 Merck KGaA: Company Snapshot (2015)

Figure 49 Merck KGaA: Product Offering Scorecard

Figure 50 Merck KGaA: Business Strategy Scorecard

Figure 51 Harvard Bioscience, Inc.: Company Snapshot (2015)

Figure 52 Harvard Bioscience, Inc.: Product Offering Scorecard

Figure 53 Harvard Bioscience, Inc.: Business Strategy Scorecard

Figure 54 ALA Scientific Instruments, Inc.: Product Offering Scorecard

Figure 55 ALA Scientific Instruments, Inc.: Business Strategy Scorecard

Figure 56 Lifeline Scientific, Inc.: Company Snapshot (2015)

Figure 57 Lifeline Scientific, Inc.: Product Offering Scorecard

Figure 58 Lifeline Scientific, Inc.: Business Strategy Scorecard

Figure 59 Xvivo Perfusion AB: Company Snapshot (2015)

Figure 60 Xvivo Perfusion AB: Product Offering Scorecard

Figure 61 Xvivo Perfusion AB: Business Strategy Scorecard

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Perfusion Systems Market