Nuclear Imaging Equipment Market by Product (SPECT (Hybrid SPECT, Standalone SPECT), Hybrid PET, & Planar Scintigraphy), Application (Oncology, Cardiology & Neurology) & End user (Hospitals, Imaging Centers) & Region - Global Forecast to 2025

Market Growth Outlook Summary

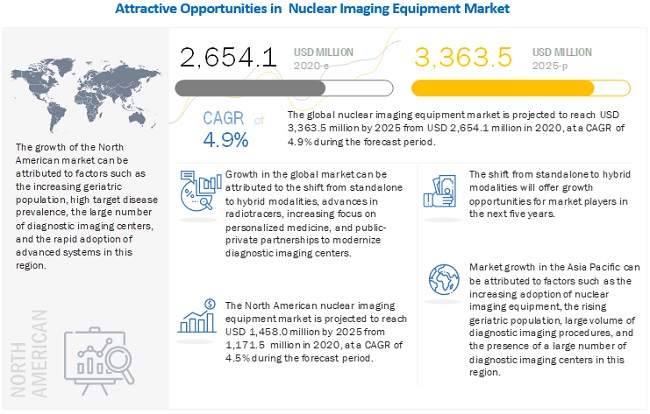

The global nuclear imaging equipment market growth forecasted to transform from $2.6 billion in 2020 to $3.4 billion by 2025, driven by a CAGR of 7.4%. The growth in this market is mainly driven by the the shift from standalone to hybrid modalities, advances in radiotracers, the increasing focus on personalized medicine, investments through public-private partnerships to modernize diagnostic imaging centers, and the increasing incidence and prevalence of cancer and cardiac ailments. However, the high cost of nuclear imaging equipment is expected to limit the growth of this market.

Nuclear Imaging Equipment Market Trends

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Nuclear Imaging Equipment Market

The COVID-19 outbreak has significantly impacted the availability of hospital resources worldwide. This has been primarily managed by dramatically reducing in-patient and outpatient services for other diseases and implementing infection prevention and control measures. Both diagnostic and therapeutic nuclear medicine procedures declined precipitously, with countries worldwide being affected by the pandemic.

Most of the nuclear medicine scans and therapies are carried out in outpatient departments as follow-up cases whereas new studies are usually dealt with in inpatient departments after going through COVID-19 screening. Nuclear medicine lacks portable SPECT and PET scanners, and there is a constant need to inject the patient with radiopharmaceuticals so the movement of the patient is not restricted. Hence it is very crucial for nuclear medical workers to have a thorough knowledge of precautionary measures to prevent COVID-19 transmission. A majority of heart patients who go through nuclear cardiology procedures are usually above 60 years of age and carry other extreme health risks such as diabetes, hypertension, and chronic renal and lung diseases. All of these factors make them highly vulnerable to developing COVID-19 and have led to a decrease in the number of nuclear imaging procedures. However, many healthcare experts believe that this reduction in the number of procedures is temporary.

Nuclear Imaging Equipment Market Dynamics

Drivers: Shift from standalone to hybrid modalities

With technological advancements in the field of imaging, there has been a significant evolution of hybrid systems in the past decade. The major advancement in this regard is that of combined PET modalities. The innovation of PET/CT modality has been so successful that the major imaging system manufacturers do not provide standalone PET systems any longer. Based on the success of the hybrid PET/CT systems, hybrid PET/MRI and SPECT/CT systems have also gained attention. These hybrid systems can provide precise images with better resolution compared to standalone systems. They can provide morphological as well as physiological information in just one examination. For instance, in the case of skeletal evaluation, a SPECT/CT system offers accurate localization along with improving the specificity of the information provided by CT. Due to advantages such as these, many hospitals are now replacing their standalone systems with hybrid systems. The rising popularity of hybrid modalities is likely to drive the growth of the nuclear imaging equipment market.

Restrains: High cost of imaging systems

Nuclear imaging systems are priced at a premium and require high investments for installations, which increases the procedural cost for patients as well. This affects the adoption rate of new systems, especially in emerging countries; most healthcare facilities in these countries, consequently, cannot afford such systems. In emerging countries like Brazil, the average cost of a PET system is between USD 400,000 and USD 600,000 while a SPECT system would cost between USD 250,000 and USD 400,000. These high costs, coupled with maintenance costs, are expected to hamper the market growth.

Healthcare facilities that purchase such costly systems often depend on third-party payers (such as Medicare, Medicaid, or private health insurance plans) to get reimbursements for the costs incurred in the diagnostic, screening, and therapeutic procedures performed using these systems. As a result, factors such as continuous cuts in reimbursements for diagnostic imaging scans and the increasing cost of nuclear imaging systems are preventing medium-sized and small healthcare facilities from investing in technologically advanced nuclear imaging modalities.

Opportunities: Growing demand for data integrated imaging systems

Data integrated imaging systems enable the processing and reconstruction of images, computer-assisted recognition of medical conditions, generation of 3D images, and the use of appropriate quality control systems. With the help of data integration, physicians can easily compare the scans to effectively observe the progression of the disease. To effectively devise a treatment plan, clinicians are demanding access to integrated, comprehensive data on the patient’s diagnostic history. In addition to data integration, there lies a huge opportunity on making data available through mobile technologies. This will help doctors to view and study scans wherever they are. Due to the advantages and convenience of integrated systems and a huge demand from clinicians, companies are focusing on developing systems with integrated technologies.

By product, the SPECT imaging systems segment is expected to account for the largest share of the Nuclear Imaging Equipment market in 2020

Based on product, the nuclear imaging equipment market is segmented into hybrid PET imaging systems, SPECT imaging systems, and planar scintigraphy imaging systems. The SPECT imaging systems segment is further categorized into standalone and hybrid imaging systems. The SPECT imaging systems segment is expected to the largest share in 2019. The large share of this segment can be attributed to high adoption of SPECT imaing systems on account of lower cost as compared to hybrid PET imaging systems.

By application, the oncology segment is expected to account for the largest share of the nuclear imaging equipment market in 2020

Based on application, the nuclear imaging equipment market is segmented into oncology, cardiology, neurology, and other applications. The oncology application segment is expected to register the highest CAGR during the forecast period. The major factors contributing to the growth of this segment include the rising incidence and prevalence of cancer across the globe, initiatives taken by public and private organizations to curb the rising cancer prevalence, and the development of advanced systems and radiotracers for oncology.

By end-user, the hospitals end-user segment is expected to account for the largest share of the Nuclear Imaging Equipment market in 2020

Based on end user, the nuclear imaging equipment market is segmented into hospitals, imaging centers, academic & research centers, and other end users. Hospitals accounted for the largest share of the global nuclear imaging equipment market in 2019. This can be attributed to factors such as the need to improve the efficiency of diagnostic imaging procedures and the rising number of diagnostic imaging procedures performed in hospitals.

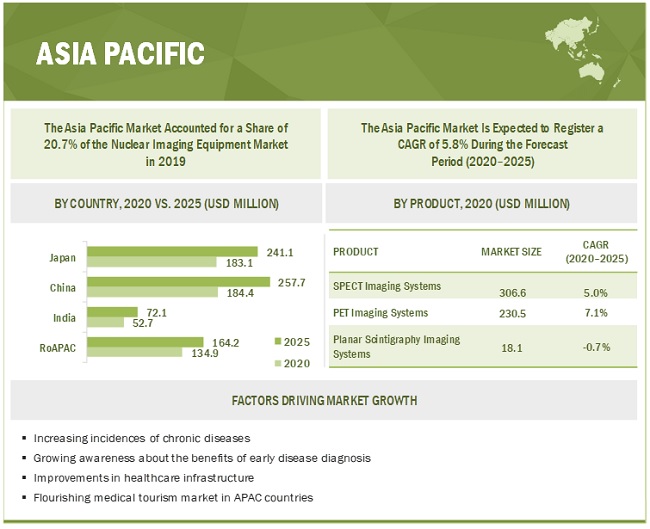

Asia Pacific to register highest growth rate during the forecast period

Geographically, North America is expected to dominate the global the nuclear imaging equipment market in 2019, while the Asia Pacific region is expected to register the highest CAGR during the forecast period. The high growth in this region can be attributed to the increasing incidence of chronic diseases, rising awareness on the benefits of early disease diagnosis, and improvement of healthcare systems in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Siemens Healthineers (Germany), Philips Healthcare (Netherlands), and GE Healthcare (US), are some of the leading players of the nuclear imaging equipment market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast unit |

Value (USD Billion) |

|

Segments covered |

Product,, Application, End User, and Region |

|

Geographies covered |

North America (US & Canada), Europe (EU3, Russia RoE), Asia Pacific (China, Japan, India, RoAPAC), and RoW |

|

Companies covered |

Major 14 players included, including Siemens Healthineers (Germany), GE Healthcare (US), Koninklijke Philips (Netherlands), Digirad Corporation (US), Neusoft Medical Systems Co., Ltd (US), Canon Medical Systems Corporation (Japan), SurgicEye GmbH (Germany), DDD-Diagnostic A/S (Denmark), CMR Naviscan Corporation (US), Mediso Ltd. (Hungary), Shimadzu Corporation (Japan), PerkinElmer (US), MILabs B.V. (Netherlands), and MR Solutions Ltd. (UK).

|

This research report categorizes the nuclear imaging equipment market based on product, application, end user, and region.

By Product

-

SPECT Imaging Systems

- Hybrid SPECT Imaging Systems

- Standalone SPECT Imaging Systems

- PET Imaging Systems

- Planar Scintigraphy Imaging SystemsA

By Application

- Oncology

- Cardiology

- Neurology

- Other Applications

By End-User

- Hospitals

- Imaging Centers

- Academic & Research Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- EU3

- Russia

- RoE

-

Asia Pacific

- China

- Japan

- India

- RoAPAC

- RoW

Recent Developments

- In 2019, Shimadzu Medical Systems (US) and Midwestern State University (MSU, US) to provide medical equipment along with a 10-year service plan for the University through the Shimadzu School of Radiologic Sciences.

- In 2018, Royal Philips (Netherlands) and Illawarra Shoalhaven Local Health District (Australia) and Nepean Blue Mountains Local Health District (Australia) entered into two 20-year agreements for Managed Equipment Services, where Philips has agreed to provide, upgrade, deliver, optimize, replace, and offer maintenance services for all major medical imaging solutions in Australia and the ASEAN Pacific region.

- In 2017, Siemens Healthineers (Germany) launched the Biograph Vision PET/CT system.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

FIGURE 1 NUCLEAR IMAGING EQUIPMENT MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 2 RESEARCH METHODOLOGY: NUCLEAR IMAGING EQUIPMENT MARKET

FIGURE 3 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.3 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 7 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

2.4 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19-SPECIFIC ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

FIGURE 9 NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 10 NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THE NUCLEAR IMAGING EQUIPMENT MARKET

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 NUCLEAR IMAGING EQUIPMENT OVERVIEW

FIGURE 13 GROWING POPULARITY OF HYBRID MODALITIES HAS DRIVEN THEIR ADOPTION

4.2 NORTH AMERICA: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT & COUNTRY (2019)

FIGURE 14 US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN NUCLEAR IMAGING EQUIPMENT IN 2019

4.3 NUCLEAR IMAGING EQUIPMENT MARKET SHARE, BY PRODUCT, 2020 VS. 2025

FIGURE 15 SPECT IMAGING SYSTEMS WILL CONTINUE TO DOMINATE THE MARKET IN 2025

4.4 NUCLEAR IMAGING EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 NUCLEAR IMAGING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rapidly growing geriatric population and the subsequent increase in the prevalence of associated diseases

TABLE 1 AGE-RELATED DISEASES AND ASSOCIATED DIAGNOSTIC MODALITIES

5.2.1.2 Shift from standalone to hybrid modalities

5.2.1.3 Increasing focus on personalized medicine

5.2.2 RESTRAINTS

5.2.2.1 High cost of diagnostic imaging systems

5.2.2.2 Declining reimbursements and increasing regulatory burden in the US

5.2.3 OPPORTUNITIES

5.2.3.1 High growth opportunities in emerging countries

5.2.3.2 Growing demand for data integrated imaging systems

5.2.4 CHALLENGES

5.2.4.1 Hospital budget cuts

5.3 PRICING ANALYSIS

TABLE 2 REGIONAL PRICING ANALYSIS OF KEY NUCLEAR IMAGING MODALITIES

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF BUYERS

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 IMPACT OF COVID-19 ON THE NUCLEAR IMAGING EQUIPMENT MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 19 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.6.1 RESEARCH & DEVELOPMENT

5.6.2 MANUFACTURING & ASSEMBLY

5.6.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

5.7 SUPPLY CHAIN ANALYSIS

5.7.1 PROMINENT COMPANIES

5.7.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.7.3 END USERS

FIGURE 20 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

FIGURE 21 ECOSYSTEM ANALYSIS OF THE NUCLEAR IMAGING EQUIPMENT MARKET

6 NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT (Page No. - 49)

6.1 INTRODUCTION

TABLE 3 NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 4 NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (UNITS)

6.2 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT) IMAGING SYSTEMS

TABLE 5 SPECT IMAGING SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 7 SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (UNITS)

TABLE 8 NORTH AMERICA: SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 9 EUROPE: SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 ASIA PACIFIC: SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.1 HYBRID SPECT IMAGING SYSTEMS

6.2.1.1 Growing preference for dual-modality hybrid systems to drive market growth

TABLE 11 HYBRID SPECT IMAGING SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 NORTH AMERICA: HYBRID SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 13 EUROPE: HYBRID SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 ASIA PACIFIC: HYBRID SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2 STANDALONE SPECT IMAGING SYSTEMS

6.2.2.1 Low cost of standalone SPECT imaging systems is a key factor driving market growth

TABLE 15 STANDALONE SPECT IMAGING SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 NORTH AMERICA: STANDALONE SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 EUROPE: STANDALONE SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 ASIA PACIFIC: STANDALONE SPECT IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3 HYBRID PET IMAGING SYSTEMS

6.3.1 HIGH COST OF HYBRID PET IMAGING SYSTEMS TO LIMIT MARKET GROWTH DURING THE FORECAST PERIOD

TABLE 19 HYBRID PET IMAGING SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 NORTH AMERICA: HYBRID PET IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 EUROPE: HYBRID PET IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 ASIA PACIFIC: HYBRID PET IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4 PLANAR SCINTIGRAPHY IMAGING SYSTEMS

6.4.1 LOW SPECIFICITY OF PLANAR SCINTIGRAPHY IMAGING SYSTEMS TO LIMIT MARKET GROWTH

TABLE 23 PLANAR SCINTIGRAPHY IMAGING SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 NORTH AMERICA: PLANAR SCINTIGRAPHY IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 25 EUROPE: PLANAR SCINTIGRAPHY IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 ASIA PACIFIC: PLANAR SCINTIGRAPHY IMAGING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7 NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION (Page No. - 61)

7.1 INTRODUCTION

TABLE 27 NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 28 SPECT IMAGING SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 29 HYBRID PET IMAGING SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 30 PLANAR SCINTIGRAPHY IMAGING SYSTEMS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.1.1 ONCOLOGY

7.1.1.1 Nuclear imaging systems can distinguish between benign and malignant tumors, which helps in precise diagnosis

TABLE 31 NUCLEAR IMAGING EQUIPMENT MARKET FOR ONCOLOGY, BY REGION, 2018–2025 (USD MILLION)

7.1.2 CARDIOLOGY

7.1.2.1 High prevalence of CVD is the major factor driving the growth of this segment

TABLE 32 NUCLEAR IMAGING EQUIPMENT MARKET FOR CARDIOLOGY, BY REGION, 2018–2025 (USD MILLION)

7.1.3 NEUROLOGY

7.1.3.1 Increasing demand for nuclear imaging in diagnosing neurological disorders is supporting the growth of this segment

TABLE 33 NUCLEAR IMAGING EQUIPMENT MARKET FOR NEUROLOGY, BY REGION, 2018–2025 (USD MILLION)

7.1.4 OTHER APPLICATIONS

TABLE 34 NUCLEAR IMAGING EQUIPMENT MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

8 NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER (Page No. - 67)

8.1 INTRODUCTION

TABLE 35 NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2 HOSPITALS

8.2.1 RISING TREND OF MODERNIZING IMAGING WORKFLOW IS DRIVING THE ADOPTION OF IMAGING SYSTEMS AMONG HOSPITALS

TABLE 36 NUCLEAR IMAGING EQUIPMENT MARKET FOR HOSPITALS, BY REGION, 2018–2025 (USD MILLION)

8.3 IMAGING CENTERS

8.3.1 GROWING NUMBER OF PRIVATE IMAGING CENTERS TO SUPPORT MARKET GROWTH

TABLE 37 NUCLEAR IMAGING EQUIPMENT MARKET FOR IMAGING CENTERS, BY REGION, 2018–2025 (USD MILLION)

8.4 ACADEMIC & RESEARCH CENTERS

8.4.1 INCREASING COLLABORATIONS BETWEEN NUCLEAR IMAGING COMPANIES AND ACADEMIA TO PROPEL MARKET GROWTH

TABLE 38 NUCLEAR IMAGING EQUIPMENT MARKET FOR ACADEMIC & RESEARCH CENTERS, BY REGION, 2018–2025 (USD MILLION)

8.5 OTHER END USERS

TABLE 39 NUCLEAR IMAGING EQUIPMENT MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

9 NUCLEAR IMAGING EQUIPMENT MARKET, BY REGION (Page No. - 72)

9.1 INTRODUCTION

TABLE 40 NUCLEAR IMAGING EQUIPMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

TABLE 41 NORTH AMERICA: NUCLEAR IMAGING EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 The US holds the largest share of the North American market

TABLE 46 US: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 47 US: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 US: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 49 US: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 A dearth of radiologists and long wait times for scans are the major challenges in the Canadian market

TABLE 50 CANADA: INDICATORS OF MARKET GROWTH

TABLE 51 CANADA: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 52 CANADA: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 CANADA: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 CANADA: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3 EUROPE

TABLE 55 EUROPE: NUCLEAR IMAGING EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 56 EUROPE: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 57 EUROPE: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.1 EU3

9.3.1.1 EU3 holds the largest share of the market in Europe

TABLE 60 GERMANY: INDICATORS OF MARKET GROWTH

TABLE 61 EU3: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 62 EU3: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 EU3: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 64 EU3: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.2 RUSSIA

9.3.2.1 Initiatives to improve healthcare to boost the market growth

TABLE 65 RUSSIA: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 66 RUSSIA: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 RUSSIA: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 RUSSIA: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.3 ROE

TABLE 69 ROE: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 70 ROE: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 ROE: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 72 ROE: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 22 APAC: NUCLEAR IMAGING EQUIPMENT MARKET SNAPSHOT

TABLE 73 ASIA PACIFIC: NUCLEAR IMAGING EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 ASIA PACIFIC: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 ASIA PACIFIC: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 ASIA PACIFIC: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Growing investments by key market players to drive market growth

TABLE 78 JAPAN: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 79 JAPAN: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 JAPAN: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 81 JAPAN: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing healthcare reforms and the rapidly growing aging population to drive market growth in China

TABLE 82 CHINA: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 83 CHINA: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 CHINA: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 85 CHINA: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Uncertainties in healthcare policies to restrain market growth in India

TABLE 86 INDIA: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 87 INDIA: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 INDIA: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 INDIA: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 90 ROAPAC: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 91 ROAPAC: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 ROAPAC: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 93 ROAPAC: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 94 ROW: NUCLEAR IMAGING EQUIPMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 95 ROW: SPECT IMAGING SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 ROW: NUCLEAR IMAGING EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 97 ROW: NUCLEAR IMAGING EQUIPMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 100)

10.1 OVERVIEW

FIGURE 23 KEY DEVELOPMENTS IN THE NUCLEAR IMAGING EQUIPMENT MARKET

10.2 MARKET SHARE ANALYSIS

FIGURE 24 NUCLEAR IMAGING EQUIPMENT MARKET SHARE ANALYSIS (2019)

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

10.3.4 EMERGING COMPANIES

FIGURE 25 NUCLEAR IMAGING EQUIPMENT MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

10.4 COMPETITIVE SCENARIO

10.4.1 PRODUCT LAUNCHES

TABLE 98 PRODUCT LAUNCHES (2017–2020)

10.4.2 ACQUISITIONS

TABLE 99 ACQUISITIONS (2017–2020)

10.4.3 AGREEMENTS, PARTNERSHIPS, & COLLABORATIONS

TABLE 100 AGREEMENTS, PARTNERSHIPS, & COLLABORATIONS (2017–2020)

11 COMPANY PROFILES (Page No. - 105)

(Business overview, Products offered, Recent developments)*

11.1 SIEMENS HEALTHINEERS

FIGURE 26 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2019)

11.2 GE HEALTHCARE

FIGURE 27 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

11.3 KONINKLIJKE PHILIPS N.V.

FIGURE 28 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2019)

11.4 DIGIRAD CORPORATION

11.5 NEUSOFT MEDICAL SYSTEMS CO., LTD.

11.6 CANON INC.

FIGURE 29 CANON INC.: COMPANY SNAPSHOT (2019)

11.7 SURGICEYE GMBH

11.8 DDD-DIAGNOSTIC A/S

11.9 CMR NAVISCAN CORPORATION

11.10 MEDISO LTD.

11.11 SHIMADZU CORPORATION

FIGURE 30 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2019)

11.12 PERKINELMER, INC.

FIGURE 31 PERKINELMER, INC.: COMPANY SNAPSHOT (2018)

11.13 MILABS B.V.

11.14 MR SOLUTIONS LTD.

*Business overview, Products offered, Recent developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 128)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

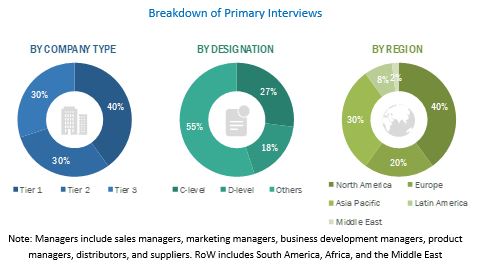

The study involved four major activities in estimating the current size for the nuclear imaging equipment market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research ;

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, to identify and collect information for the nuclear imaging equipment market study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The nuclear imaging equipment market comprises several stakeholders such as chromatography resins manufacturers, pre-packed column manufacturers, government and research organizations, chromatography resins distributors and suppliers, investment banks and private equity firms, and end users such as pharmaceutical and biotechnology companies, universities, and independent research organizations. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Mentioned below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the nuclear imaging equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall nuclear imaging equipment market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in nuclear imaging equipment industry

Report Objectives

- To define, describe, and forecast the global nuclear imaging equipment market based on product, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (RoW)2

- To profile the key players and comprehensively analyze their market shares and core competencies3

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements & collaborations, and approvals in the global nuclear imaging equipment market

Available Customizations

Product Analysis

- Product matrix, which gives a detailed comparison of the portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nuclear Imaging Equipment Market