Photoinitiator Market by Type ( Free Radical & Cationic), End-use Industry ( Adhesives, Ink, Coating), and Region ( North America, Europe, APAC, Middle East & Africa, South America) - Global Forecast to 2026

Photoinitiator Market

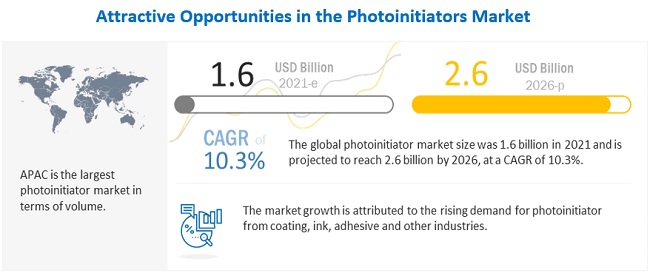

The global photoinitiator market was valued at USD 1.6 billion in 2021 and is projected to reach USD 2.6 billion by 2026, growing at a cagr 10.3% from 2021 to 2026. Photoinitiators are demanded in various applications and multiple end-use industries including adhesives, ink, coating, and others; due to their advantages properties such as resistance to various chemicals, and excellent curability. However, the global pandemic disease COVID-19 has disrupted the operations of various end-use industries which has decrease the demand for photoinitiators in 2020.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global photoinitiator market

China is a manufacturing hub and a major supplier of these raw materials, photoinitiators, and UV curable materials. The outbreak of coronavirus in China has affected the supplies of these raw materials and photoinitiators. Also, the break in the supplies of such raw materials has reduced the production of photoinitiators. Due to the lockdown, the production and transportation of raw materials have significantly declined, affecting the business of photoinitiator manufacturers.

Photoinitiator Market Dynamics

Drivers: Promising growth of end-use industries

In the next five years, the adhesive, coating, ink, and paint industries are expected to attain an average growth rate of nearly 8% globally. Increasing advancements in technologies, adoption of automation, and increasing demand for customized products are fuelling the growth of adhesives, coating, and paint industries. This is expected to boost the demand for photoinitiators. New use cases are developed in 3D printing, where newly developed photoinitiators and monomers/oligomers demonstrate application in 3D bio-printing. Photoinitiators can also be used in the dental, packaging, food, and other industries.

Eco-friendly substitute for VOCs

Volatile organic compounds are complex and include hydrocarbons, alkenes, alkanes, nitrogenous hydrocarbons, polycyclic aromatic compounds, and oxygenated hydrocarbons. Many of these compounds can cause direct or indirect adverse effects on human bodies. Various compounds present in VOCs are insoluble in water and hence remain present in the water sources. Unlike Volatile Organic Compounds (VOC), photoinitiators can be dissolved in water with oligomers, causing little or no environmental effects on the application

Restaints: Safety concerns and highet costs

The manufacturing of photoinitiators requires the use of chemicals that are hazardous to human health. These chemicals are placed in the ‘Dangerous Goods’ category and are carcinogenic, mutagenic, and toxic to reproduction. Due to safety concerns, these chemicals have been banned in Europe; although, presently, many of the countries in APAC has not placed any such restrictions on their usage. Many countries have laid out strict regulations regarding the use of these chemicals, which is affecting the demand for photoinitiators, especially in North America, and Europe.

The procurement of equipment and handling of chemicals attract a high cost. Also, due to higher legislations as to the use of these chemicals, research and development become costly, affecting the launch of new products in the photoinitiators for various end-use applications

Opportunities: Development of non-hazardous photoinitiators for application in the dental industry

With recent developments in photoinitiator composition, formulas—such as camphorquinone, which can be safely used in dental applications—have been developed. This would give way to new use cases and the development of photoinitiators. Innovations in these products would assist in developing efficient curable resins and boost the range of products to be cured across the end-use sectors, such as industrial paint shops

Increasing demand for water-soluble additives

There is an increasing demand for water-soluble additives and products in the adhesives and coatings markets. As VOCs are insoluble in water, there are great chances of replacing them with photoinitiators in the coming years, especially in the ink and coating industries. Undissolved chemical compounds in water can cause health issues to human beings, and hence, many companies are avoiding the use of such toxic substances. Since photoinitiators provide good properties in water solution, they can be employed in most solvent mediums.

Challenges: Finishing defects due to uneven exposure to light

Photoinitiators, after being exposed to light, absorb it and create free radicals. These free radicals react with oligomers and monomers to form cross-linking. After the formation of cross-linkage, the liquid resin system gets converted to cured and dry products. However, the light is not always evenly spread. This affects the reaction time of photoinitiators. This causes less generation of free radicals and crosslinking, which reduces the efficiency of photoinitiators

Development of weaker radicals due to oxygen reaction in thick film coats

Photoinitiators can often react with oxygen in the atmosphere. In this process, the mechanical properties of photoinitiators are formed incrementally. During the process of free radical photopolymerization, photoinitiators often react with atmospheric oxygen, which hampers radical inhibition. After reacting to oxygen, photoinitiators form a chemical compound, which still acts as free radicals but reacts at a much slower rate. As a result of the slow reaction of free radicals, the cross-linking process gets affected

Increasing use of free radical photoinitiators in the industry

Free radical photoinitiators are widely preferred in various applications due to their efficiency in the curing process. After absorbing UV light, these photoinitiators form free radicals, which form cross-linking with monomers and oligomers. In this way, free radical photoinitiators convert the liquid resin system into cured and dry products. These photoinitiators are used for various applications, such as adhesives, coating on plastic, wood coating, metal coating, UV curable inks, electronics, composites, and many more.

Less acceptance of cationic photoinitiators as compared to free radical

Cationic photoinitiators are generally iodonium or sulfonium salts that release strong acids after absorbing UV light. The released acid helps to initiate polymerization reaction and remains active, which is known as dark cure. Cationic photoinitiators offer various advantages, such as no oxygen inhibition, very low shrinkage, excellent adhesion, and improved coating properties. These photoinitiators are mainly used in metal coating, graphic arts, coating over plastic, and many more.

The uncertain economy after COVID-19

The growth of the photoinitiators market was negatively affected by the outbreak of the COVID-19 pandemic. Major market players are from APAC and Europe, which were among the worst-affected regions due to the virus outbreak. The companies witnessed revenue decline in the range of 7%-10% in 2020 compared to the previous year. The declining revenues discouraged new entrants in the photoinitiators market and adopters of photoinitiators in their work process.

To know about the assumptions considered for the study, download the pdf brochure

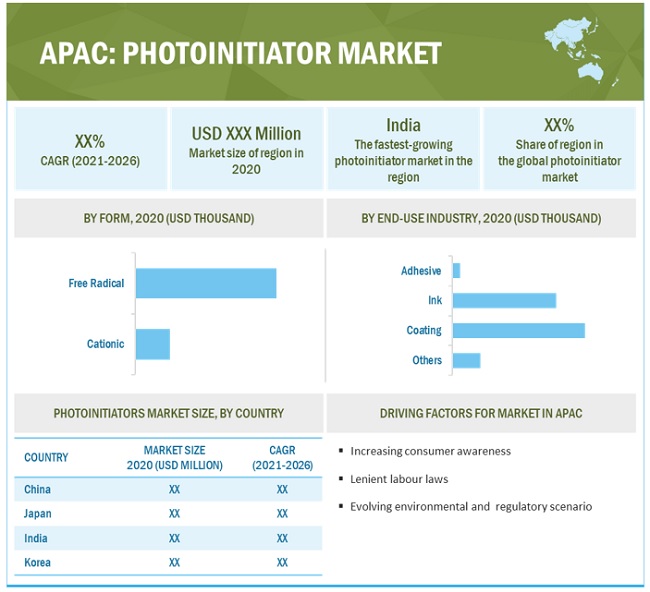

APAC is the largest market in terms of manufacturing and supplying photoinitiators. In terms of volume, it accounts for a share of 46.3% of the global photoinitiators market, followed by Europe.

APAC is home to many manufacturers that are actively participating in development activities, especially in new product launches. With manufacturing units of most of the MNCs set up in Asia, it holds the biggest share and will continue so in the future.

Photoinitiator Market Players

The key players in the global photoinitiators market are:

- IGM Resins (China)

- Zhejiang Yangfan Materials (China)

- TCI Chemicals (Japan)

- Rahn AG (Switzerland)

- Lambson (UK)

- Tianjin Jiuri New Materials Co. Ltd (China)

- Changzhou Tronly New Electronic Materials Co. Ltd. (China)

- New Sun Poly Tec Co Ltd (China)

- Environ Speciality Chemicals Ltd. (India)

- ADEKA Corporation (Japan)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the photoinitiators industry. The study includes an in-depth competitive analysis of these key players in the photoinitiators market, with their company profiles, recent developments, and key market strategies.

Photoinitiator Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.6 billion |

|

Revenue Forecast in 2026 |

USD 2.6 billion |

|

CAGR |

10.3% |

|

Years considered for the study |

2017–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

By Type, End-use Industry and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

IGM Resins (The Netherlands), Zhejiang Yangfan Material Co., Ltd. (China), Tianjin Jiuri New Materials Co., Ltd. (China), ADEKA Corporation (Japan), and Lambson Ltd. (UK), are some of the key players in the photoinitiator market. Other players include Evonik Industries AG (Germany), Rahn AG (Switzerland), and Changzhou Tronly New Electronic Material Co., Ltd. (China), TCI Chemicals (Japan), Environ Speciality Chemicals (India). |

This research report categorizes the photoinitiator market based on type, end-use industry, and region.

By Type:

- Free Radical

- Cationic

By End-use Industry:

- Adhesives

- Ink

- Coating

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- South America

Recent Developments

- In April 2021, Eutec Chemical Co., Ltd. formed an agreement with Eustar Functional Material Technology, Inc. to introduce additives for blue light absorbers, nucleating systems, especially for the automotive and electronic industries.

- In August 2020, IGM Resins has expanded its business by opening a new photoinitiator manufacturing plant in Anqing, China. This expansion is helping the company to increase its geographical presence in the photoinitiators market of the APAC region.

- In October 2019, Lambson Ltd. announced the completion of the acquisition of Lambson Ltd. by Arkema.

Frequently Asked Questions (FAQ):

How big is the Photoinitiator Market?

Photoinitiator Market worth $2.6 billion by 2026.

What is the growth rate of Photoinitiator Market?

Photoinitiator Market grows at a CAGR of 10.3% during the forecast period.

What are the factors influencing the growth of the photoinitiator market?

High demand from end-use industries due to superior performance and no VOC emission

Which is the fastest-growing region-level market for photoinitiators?

APAC is the fastest-growing photoinitiators market due to the presence of major photoinitiators manufacturers and the burgeoning growth of various end-use industries.

What are the factors contributing to the final price of photoinitiators?

Raw material plays a vital role in the costs along with the end use industry it is used for.

What are the challenges in the photoinitiators market?

Low acceptance rate in industries and emerging economies.

Which type of photoinitiator holds the largest market share?

Free radical photoinitiator, in terms of value hold the largest share due to wide applications in multiple end-use industries.

How is the photoinitiators market aligned?

The market is well established and growing at a moderate pace. It is a potential market and many manufactures are planning business strategies to include photoinitiator based UV curing technologies in their manufacturing process

Who are the major manufacturers?

IGM Resins (China), Zhejiang Yangfan Materials (China), TCI Chemicals (Japan) Rahn AG (Switzerland), Lambson (UK), Tianjin Jiuri New Materials Co. Ltd (China) are a few of the key players in the photoinitiators market.

What are the major end use industry for photoinitiators?

The major end-use industry of photoinitiators coating, ink and adhesive.

What is the biggest restraint in the photoinitiators market?

Low acceptance rate in emerging economies is the biggest restraint. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 PHOTOINITIATOR MARKET SEGMENTATION

1.3.1 REGIONS COVERED FOR THE PHOTOINITIATOR MARKET

1.3.2 YEARS CONSIDERED IN THE REPORT

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 PHOTOINITIATOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.4 DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 PHOTOINITIATOR MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 PHOTOINITIATOR MARKET – FORECAST TO 2026, RISK ASSESSMENT

TABLE 1 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 6 FREE RADICAL SEGMENT, BY TYPE, DOMINATED THE PHOTOINITIATOR MARKET IN 2020

FIGURE 7 COATINGS SEGMENT LED THE PHOTOINITIATOR MARKET IN 2020, BY END-USE INDUSTRY

FIGURE 8 ASIA PACIFIC IS PROJECTED TO BE THE LARGEST AND FASTEST-GROWING PHOTOINITIATOR MARKET BY 2026

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PHOTOINITIATOR MARKET

FIGURE 9 SIGNIFICANT GROWTH EXPECTED IN THE PHOTOINITIATOR MARKET BETWEEN 2021 AND 2026

4.2 PHOTOINITIATOR MARKET, BY END-USE INDUSTRY AND REGION

FIGURE 10 ASIA PACIFIC AND COATING INDUSTRY DOMINATED THE PHOTOINITIATOR MARKET IN 2020

4.3 PHOTOINITIATOR MARKET, BY TYPE

FIGURE 11 FREE RADICAL SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE PHOTOINITIATOR MARKET IN 2020

4.4 PHOTOINITIATOR MARKET, BY COUNTRY

FIGURE 12 INDIA TO BE FASTEST-GROWING PHOTOINITIATOR MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES THE IN PHOTOINITIATOR MARKET

5.2.1 DRIVERS

5.2.1.1 Promising growth of end-use industries

5.2.1.2 Eco-friendly substitute for VOCs

5.2.1.3 Better properties

5.2.2 RESTRAINTS

5.2.2.1 Safety concerns

5.2.2.2 Higher cost

5.2.2.3 Economic slowdown due to COVID-19

5.2.3 OPPORTUNITIES

5.2.3.1 Development of non-hazardous photoinitiators for application in the dental industry

5.2.3.2 Increasing demand for water-soluble additives

5.2.3.3 Growth of UV curable inks

5.2.4 CHALLENGES

5.2.4.1 Finishing defects due to uneven exposure to light

5.2.4.2 Development of weaker radicals due to oxygen reaction in thick film coats

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 14 PHOTOINITIATOR MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 PHOTOINITIATOR MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 15 VALUE CHAIN ANALYSIS

5.5 SUPPLY CHAIN ANALYSIS

5.6 IMPACT OF COVID-19 ON PHOTOINITIATOR VALUE CHAIN

5.6.1 RAW MATERIALS

5.6.2 PHOTOINITIATOR MANUFACTURERS

5.6.3 APPLICATIONS

5.7 TECHNOLOGY ANALYSIS

5.8 PRICING ANALYSIS

5.9 AVERAGE SELLING PRICE

TABLE 3 PHOTOINITIATORS AVERAGE SELLING PRICE, BY REGION

5.10 PATENT ANALYSIS

5.10.1 INTRODUCTION

5.10.2 METHODOLOGY

5.10.3 DOCUMENT TYPE

FIGURE 16 PATENT DOCUMENTATION, 2010-2020

FIGURE 17 PUBLICATION TRENDS, 2010-2020

5.10.4 INSIGHT

FIGURE 18 PATENT JURISDICTION ANALYSIS, 2020

5.10.5 TOP APPLICANTS OF PATENTS

FIGURE 19 TOP APPLICANTS OF PATENTS

5.10.6 LIST OF PATENTS BY BASF SE

5.10.7 LIST OF PATENTS BY COLOPLAST

5.10.8 LIST OF PATENTS BY CHANGZHOU TRONLY ADVANCED ELECTRONIC MAT CO., LTD.

5.10.9 LIST OF PATENTS BY AFGA GRAPHICS NV

5.10.10 LIST OF PATENTS BY SUN CHEMICAL CORPORATION

5.10.11 TOP 10 PATENT OWNERS (US) IN THE LAST 10 YEARS

5.11 TARIFF AND REGULATIONS

5.12 KEY MARKETS FOR IMPORTS/EXPORTS

5.12.1 US

5.12.2 GERMANY

5.12.3 CHINA

5.12.4 INDIA

5.13 COVID-19 IMPACT ON THE MARKET

5.14 ECOSYSTEM: PHOTOINITIATOR MARKET

5.15 CASE STUDY ANALYSIS

5.16 PHOTOINITIATOR YC AND YCC SHIFT

6 PHOTOINITIATOR MARKET, BY TYPE (Page No. - 59)

6.1 INTRODUCTION

FIGURE 20 FREE RADICAL TYPE SEGMENT PROJECTED TO DOMINATE THE PHOTOINITIATOR MARKET BY 2026

TABLE 4 PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 5 PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

6.2 FREE RADICAL PHOTOINITIATORS

FIGURE 21 APAC IS PROJECTED TO BE THE LARGEST MARKET FOR FREE RADICAL PHOTOINITIATORS

TABLE 6 FREE RADICAL PHOTOINITIATOR MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 7 FREE RADICAL PHOTOINITIATOR MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.3 CATIONIC PHOTOINITIATORS

FIGURE 22 APAC IS PROJECTED TO BE THE LARGEST MARKET FOR CATIONIC PHOTOINITIATORS BY 2026

TABLE 8 CATIONIC PHOTOINITIATOR MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 9 CATIONIC PHOTOINITIATOR MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7 PHOTOINITIATOR MARKET, BY END-USE INDUSTRY (Page No. - 64)

7.1 INTRODUCTION

FIGURE 23 COATINGS SEGMENT ESTIMATED TO BE THE LARGEST END-USE INDUSTRY IN 2021

TABLE 10 PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 11 PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

7.2 ADHESIVES

FIGURE 24 ASIA PACIFIC MARKET FOR ADHESIVES IS PROJECTED TO BE THE LARGEST INDUSTRY BY 2026

TABLE 12 PHOTOINITIATOR MARKET SIZE FOR ADHESIVES, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 PHOTOINITIATOR MARKET SIZE FOR ADHESIVES, BY REGION, 2019–2026 (KILOTON)

7.3 INK

FIGURE 25 ASIA PACIFIC IS ESTIMATED TO DRIVE THE PHOTOINITIATOR MARKET IN THE INK INDUSTRY IN 2021

TABLE 14 PHOTOINITIATOR MARKET SIZE FOR INKS, BY REGION, 2019–2026 (USD MILLION)

TABLE 15 PHOTOINITIATOR MARKET SIZE FOR INKS, BY REGION, 2019–2026 (KILOTON)

7.4 COATING

FIGURE 26 APAC IS ESTIMATED TO DOMINATE THE PHOTOINITIATOR MARKET IN THE COATING INDUSTRY IN 2021

TABLE 16 PHOTOINITIATOR MARKET SIZE FOR COATINGS, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 PHOTOINITIATOR MARKET SIZE FOR COATINGS, BY REGION, 2019–2026 (KILOTON)

7.5 OTHER END-USE INDUSTRIES

FIGURE 27 ASIA PACIFIC IS PROJECTED TO ACHIEVE THE HIGHEST GROWTH IN OTHER END-USE INDUSTRIES BY 2026

TABLE 18 PHOTOINITIATOR MARKET SIZE FOR OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 PHOTOINITIATOR MARKET SIZE FOR OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

8 PHOTOINITIATOR MARKET, BY REGION (Page No. - 72)

8.1 INTRODUCTION

FIGURE 28 INDIA TO BE THE FASTEST-GROWING PHOTOINITIATOR MARKET

TABLE 20 PHOTOINITIATOR MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 PHOTOINITIATOR MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: PHOTOINITIATOR MARKET SNAPSHOT

TABLE 22 NORTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 23 NORTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 24 NORTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 26 NORTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 27 NORTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.2.1 US

TABLE 28 US: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 29 US: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.2.2 CANADA

TABLE 30 CANADA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 31 CANADA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.2.3 MEXICO

TABLE 32 MEXICO: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 33 MEXICO: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.3 EUROPE

FIGURE 30 EUROPE: PHOTOINITIATOR MARKET SNAPSHOT

TABLE 34 EUROPE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 35 EUROPE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 36 EUROPE: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 37 EUROPE: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 38 EUROPE: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 39 EUROPE: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.3.1 GERMANY

TABLE 40 GERMANY: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 41 GERMANY: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.3.2 UK

TABLE 42 UK: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 43 UK: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.3.3 FRANCE

TABLE 44 FRANCE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 45 FRANCE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.3.4 ITALY

TABLE 46 ITALY: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 47 ITALY: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.3.5 REST OF EUROPE

TABLE 48 REST OF EUROPE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 49 REST OF EUROPE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.4 ASIA PACIFIC

FIGURE 31 APAC: PHOTOINITIATOR MARKET SNAPSHOT

TABLE 50 APAC: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 51 APAC: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 52 APAC: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 APAC: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 54 APAC: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 55 APAC: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.4.1 CHINA

TABLE 56 CHINA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 57 CHINA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.4.2 JAPAN

TABLE 58 JAPAN: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 59 JAPAN: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.4.3 INDIA

TABLE 60 INDIA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 61 INDIA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.4.4 KOREA

TABLE 62 KOREA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 63 SOUTH KOREA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.4.5 REST OF APAC

TABLE 64 REST OF APAC: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 65 REST OF APAC: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.5 SOUTH AMERICA

TABLE 66 SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 67 SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 68 SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 70 SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 71 SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.5.1 BRAZIL

TABLE 72 BRAZIL: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 73 BRAZIL: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.5.2 ARGENTINA

TABLE 74 ARGENTINA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 75 ARGENTINA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.5.3 REST OF SOUTH AMERICA

TABLE 76 REST OF SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 77 REST OF SOUTH AMERICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.6 MIDDLE EAST & AFRICA (MEA)

TABLE 78 MEA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 79 MEA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 80 MEA: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 MEA: PHOTOINITIATOR MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 82 MEA: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 83 MEA: PHOTOINITIATOR MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.6.1 UAE

TABLE 84 UAE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 85 UAE: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.6.2 TURKEY

TABLE 86 TURKEY: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 87 TURKEY: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.6.3 SAUDI ARABIA

TABLE 88 SAUDI ARABIA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 89 SAUDI ARABIA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.6.4 SOUTH AFRICA

TABLE 90 SOUTH AFRICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 91 SOUTH AFRICA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.6.5 REST OF MEA

TABLE 92 REST OF MEA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 93 REST OF MEA: PHOTOINITIATOR MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 105)

9.1 OVERVIEW

FIGURE 32 GROWTH STRATEGIES ADOPTED BETWEEN 2016 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 33 IGM RESINS LED THE PHOTOINITIATOR MARKET IN 2020

TABLE 94 DEGREE OF COMPETITION: COMPETITIVE

9.3 MARKET RANKING

FIGURE 34 MARKET RANKING OF KEY PLAYERS

9.4 COMPANY EVALUATION MATRIX

9.4.1 VISIONARY LEADERS

9.4.2 DYNAMIC DIFFERENTIATORS

9.4.3 EMERGING COMPANIES

9.4.4 INNOVATORS

FIGURE 35 PHOTOINITIATOR MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

9.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 95 COMPANY PRODUCT FOOTPRINT

TABLE 96 COMPANY APPLICATION FOOTPRINT

TABLE 97 COMPANY REGION FOOTPRINT

9.6 MARKET EVALUATION FRAMEWORK

TABLE 98 PHOTOINITIATOR MARKET: NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2020

TABLE 99 PHOTOINITIATOR MARKET: DEALS, 2018-2021

TABLE 100 PHOTOINITIATOR MARKET: OTHER DEVELOPMENTS, 2020

9.7 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 101 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2018–2020 (USD MILLION)

FIGURE 36 STRENGTH OF PRODUCT PORTFOLIOS

FIGURE 37 BUSINESS STRATEGY EXCELLENCE

9.8 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.8.1 PROGRESSIVE COMPANIES

9.8.2 RESPONSIVE COMPANIES

9.8.3 DYNAMIC COMPANIES

9.8.4 STARTING BLOCKS

FIGURE 38 PHOTOINITIATOR MARKET (START-UPS/SMES): COMPETITIVE LEADERSHIP MAPPING, 2020

10 COMPANY PROFILES (Page No. - 119)

(Business Overview, Products Offered, New Product Launches, Other Developments, SWOT Analysis, Winning, Imperatives, Strategic Choices Made, Weakness and Competitive Threats, and MnM View)*

10.1 KEY PLAYERS

10.1.1 IGM RESINS

TABLE 102 IGM RESINS: BUSINESS OVERVIEW

FIGURE 39 IGM RESINS: SWOT ANALYSIS

10.1.2 ZHEJIANG YANGFAN MATERIAL CO., LTD.

TABLE 103 ZHEJIANG YANGFAN MATERIAL CO., LTD.: BUSINESS OVERVIEW

FIGURE 40 ZHEJIANG YANGFAN MATERIAL CO., LTD.: COMPANY SNAPSHOT

FIGURE 41 ZHEJIANG YANGFAN MATERIALS CO., LTD.: SWOT ANALYSIS

10.1.3 TCI CHEMICALS PVT., LTD.

TABLE 104 TCI CHEMICALS PVT., LTD.: BUSINESS OVERVIEW

FIGURE 42 TCI CHEMICALS PVT., LTD.: SWOT ANALYSIS

10.1.4 RAHN AG

TABLE 105 RAHN AG: BUSINESS OVERVIEW

FIGURE 43 RAHN AG: SWOT ANALYSIS

10.1.5 LAMBSON LTD.

TABLE 106 LAMBSON LTD.: BUSINESS OVERVIEW

FIGURE 44 LAMBSON LTD.: SWOT ANALYSIS

10.1.6 TIANJIN JIURI NEW MATERIALS CO., LTD.

TABLE 107 TIANJIN JIJURI NEW MATERIALS CO., LTD.: BUSINESS OVERVIEW

FIGURE 45 TIANJIN JIJURI NEW MATERIALS CO., LTD.: COMPANY SNAPSHOT

10.1.7 CHANGZHOU TRONLY NEW ELECTRONIC MATERIALS CO., LTD.

TABLE 108 CHANGZHOU TRONLY NEW ELECTRONIC MATERIALS CO., LTD.: BUSINESS OVERVIEW

FIGURE 46 CHANGZHOU TRONLY NEW ELECTRONIC MATERIALS CO., LTD.: COMPANY SNAPSHOT

10.1.8 EUTEC CHEMICAL CO., LTD.

TABLE 109 EUTEC CHEMICAL CO., LTD.: BUSINESS OVERVIEW

10.1.9 NEWSUN POLY. TECH. CO., LTD.

TABLE 110 NEWSUN POLY. TEC. CO., LTD.: BUSINESS OVERVIEW

10.1.10 EVONIK INDUSTRIES AG

TABLE 111 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

FIGURE 47 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

10.1.11 ADEKA CORPORATION

TABLE 112 ADEKA CORPORATION: BUSINESS OVERVIEW

FIGURE 48 ADEKA CORPORATION: COMPANY SNAPSHOT

10.1.12 KUROGANE KASEI CO., LTD.

TABLE 113 KUROGANE KASEI CO., LTD.: BUSINESS OVERVIEW

10.1.13 ENVIRON SPECIALITY CHEMICALS PVT. CO., LTD.

TABLE 114 ENVIRON SPECIALITY CHEMICALS PVT. LTD.: BUSINESS OVERVIEW

10.1.14 SONGWON INDUSTRIAL CO., LTD.

TABLE 115 SONGWON INDUSTRIAL CO., LTD.: BUSINESS OVERVIEW

FIGURE 49 SONGWON INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

10.1.15 POLYNAISSE RESOURCES CHEMICALS CO., LTD.

TABLE 116 POLYNAISSE RESOURCES CHEMICALS CO., LTD.: BUSINESS OVERVIEW 10.2 OTHER PLAYERS

10.2.1 HAMPFORD RESEARCH INC.

10.2.2 SAREX OVERSEAS

10.2.3 DOUBLE BOND CHEMICAL IND., CO., LTD.

10.2.4 SPECTRA PHOTOPOLYMERS

10.2.5 PL INDUSTRIES

10.2.6 JENKEM TECHNOLOGY USA

10.2.7 OTTO CHEMIE PVT., LTD.

10.2.8 VASANT CHEMICALS PVT., LTD.

10.2.9 K-TECH INDIA LIMITED

10.2.10 LAWRENCE INDUSTRIES

*Details on Business Overview, Products Offered, New Product Launches, Other Developments, SWOT Analysis, Winning, Imperatives, Strategic Choices Made, Weakness and Competitive Threats, and MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 162)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

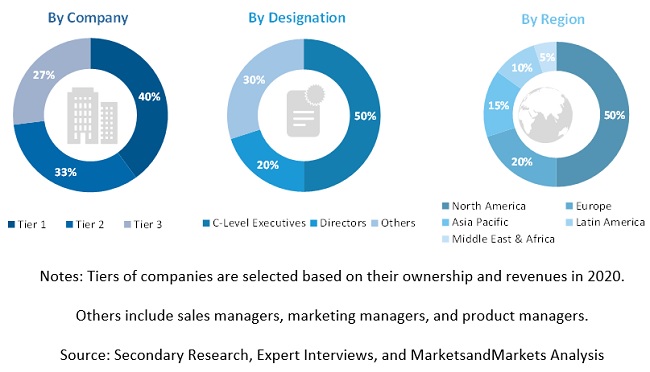

The study involves two major activities in estimating the current size of the photoinitiator market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The photoinitiator market comprises several stakeholders, such as raw material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the adhesives, ink, coating, and other end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total photoinitiator market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall photoinitiator market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the adhesives, ink, coating, and other end-use industries.

Report Objectives

- To analyze and forecast the global photoinitiatore market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on by type, and by application

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC photoinitiator market

- Further breakdown of Rest of European photoinitiator market

- Further breakdown of Rest of North American photoinitiator market

- Further breakdown of Rest of MEA photoinitiator market

- Further breakdown of Rest of Latin American photoinitiator market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Photoinitiator Market