Plastic Caps and Closures Market by Product Type (Screw-on Caps, Dispensing Caps), Technology (Injection Molding, Compression Molding, Post-mold TE Band), Raw Material (PP, HDPE, LDPE), End-use (Beverage, Pharmaceutical), Region - Global Forecast to 2025

Updated on : April 17, 2024

Plastic Caps and Closures Market

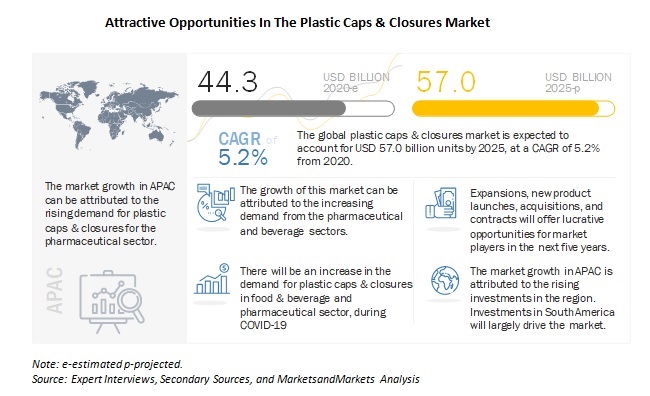

The plastic caps and closures market was valued at USD 44.3 billion in 2020 and is projected to reach USD 57.0 billion by 2025, growing at 5.2% cagr from 2020 to 2025. Increase in demand for bottled water, need for convenience, concerns about product safety & security, product differentiation & branding, and decreasing package sizes are driving the market for plastic caps & closures.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global plastic caps & closures market

The global plastic caps & closures market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the plastic caps & closures used for personal & home care, automotive, and chemicals will witness a significant decline in its demand. However, there will be an increase in the demand for plastic caps & closures in the food & beverage and pharmaceutical sectors during COVID-19.

- People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples and fresh food through online channels, which leads to an increase in the demand for plastic caps & closures. Governments of many affected countries, for instance, India, have asked the food industry players to ramp up production to avoid supply-side shocks and shortages and maintain uninterrupted supply. FMCG companies are responding by demanding more of these packaging products. For example, Britannia Industries has urged the Indian government to ensure interstate movements of suppliers of raw materials and packaging materials.

- The demand for plastic caps & closures in the pharmaceutical industry is expected to remain robust as hospitals, drugs, and PPE manufacturers are responding to the crisis. The demand for household essentials, healthcare, and medical goods is not expected to decrease dramatically, and retail distribution for these types of products through online delivery can be expected to increase. This, in turn, boosts the demand for plastic caps & closures for the timely delivery of raw materials and finished goods to their respective end-users.

Plastic Caps and Closures Market Dynamics

Driver: Need for convenience and concerns about product safety & security

Factors such as the need for convenience and better operability act as important drivers for plastic caps & closures. A plastic cap plays a key role in safeguarding the product from dust and other microbes. Plastic caps & closures are cost-effective as compared to metal caps & closures. Consumers are on the lookout for closures that are user-friendly, easy to open, and convenient to use.

The rising popularity of dispensing closures and pump closures in various product groups such as body care, skincare, beverages, and liquid food products is likely to spur the growth of the plastic caps & closures market, globally. The health and wellness trend is now shifting toward preventive healthcare, propelling the demand for FMCG products that target improved lifestyles. Plastic caps & closures that prevent contamination, tampering, and counterfeiting are becoming increasingly important to reassure consumers about the safety and authenticity of the products that they are buying.

Restraint: Development of substitutes

The growth of the plastic caps & closures market is threatened by an increase in the use of packages without closures, such as pouches and blister packages. These types of packaging offer various benefits to the packager, such as material cost reduction as compared to traditional methods of rigid packaging and sustainability issues. Many FMCG companies adopt the pouch packaging format as a packaging innovation tool to provide convenience to consumers. Several new easy-open and easy-reclose options are being added to the multitude of design possibilities across all end-use segments.

Other types of caps & closures, such as metal and cork, restrain the growth of the plastic caps & closures market. Innovations in the metal closures segment continue to be of growing interest and hold great potential for development. As a result, the gap between plastic and metal closures is expected to widen.

Opportunity: Emerging economies

Developing countries such as China, India, and Brazil are poised to witness high demand for plastic caps & closures in the next few years. The growth is driven mainly by favorable demographics and a rise in household incomes. Convenience and hygiene are becoming highly valued attributes as packaged food products take up a growing share of the consumer’s expenditure due to changing lifestyles.

Other emerging economies, such as Mexico, Turkey, South Africa, and Indonesia, are promising markets for plastic caps & closures owing to the growth of the FMCG sector in these countries. Cap manufacturers are adopting aggressive growth strategies in these countries by diversifying their product offerings and strengthening their distribution base.

Challenge: Mature markets in developed regions

In developed economies such as the US and Western Europe, the per capita consumption of plastic caps & closures is high, leaving limited further growth. The growing trend of consumption of healthy beverages, including juices and functional beverages among health-conscious consumers, has also led to the decline in the sales of carbonated soft drinks (CSDs) in a few mature markets. The demand for plastic caps & closures is associated with packaged product sales at the retail front. The declining soft drink sales in the last five years have hampered the growth of the beverage packaging sector, which is the largest end user. In other industries, such as food and personal care, the penetration of packaged product sales is high.

The demand for plastic caps & closures is relatively lower in developed markets due to the interdependency of the growth of the end-use sectors, especially in the beverage industry. Although improved consumption might drive this market in the next five years, this poses a challenge as the growth in consumption levels is expected to remain moderate.

The screw-on caps segment is projected to be the fastest-growing product type in the market during the forecast period.

A plastic screw closure is a well-engineered product that is screwed on and off on a container. These closures contain either continuous threads or lugs. It must be engineered and designed to be cost-effective, compatible with contents, easy to open; provide an effective seal; and should comply with the product, package, and environmental laws and regulations. In the beverages industry, plastic caps & closures are tamper-resistant, which further helps tackle the issues of counterfeiting. A tamper-evident band is a common tamper warning for screw caps of bottles.

The post-mold TE band segment projected to account for the largest share during the forecast period.

In the post-mold technology, slitting is a secondary operation to achieve tamper-evident plastic caps & closures. The molding and slitting of plastic caps & closures in the injection or compression molding machine are time-consuming and capital intensive. Therefore, the slitting of plastic caps & closures is a separate process as this process is cost-effective and time-effective against slitting in the molding machine.

The plastic segment is expected to be the fastest-growing container type during the forecast period in the plastic caps & closures market

In terms of value and volume, the plastic segment accounted for the largest share in 2019 and is projected to grow at a higher CAGR during the forecast period. Plastic containers are economical and lightweight. They are used primarily for packaging CSDs and bottled water owing to cost-effectiveness.

The PP segment is expected to lead and be the fastest-growing raw material during the forecast period in the plastic caps & closures market

The PP segment leads the market. PP is used widely owing to its high resistance to chemical corrosion property, making it an excellent choice for packaging for cleaning products, bleaches, and first-aid products, among others. It also offers excellent fatigue resistance and elasticity, securing it a well-deserved reputation for toughness and durability.

Pharmaceutical to be a promising end-use industry of the plastic caps & closures market.

It is very important to maintain the quality of pharmaceutical products during the manufacturing process. Pharmaceutical products can be contaminated through air particles, dust, and microorganisms. To avoid contamination, plastic caps & closures are used to seal the medicines in the pharmaceutical industry. The packaging of healthcare products is of utmost importance to protect the contents from air, dust, and moisture. An increase in chronic ailments, an increase in the aging population, and a rise in disposable income in developing nations drive the demand for healthcare products, thereby driving the need for plastic caps & closures.

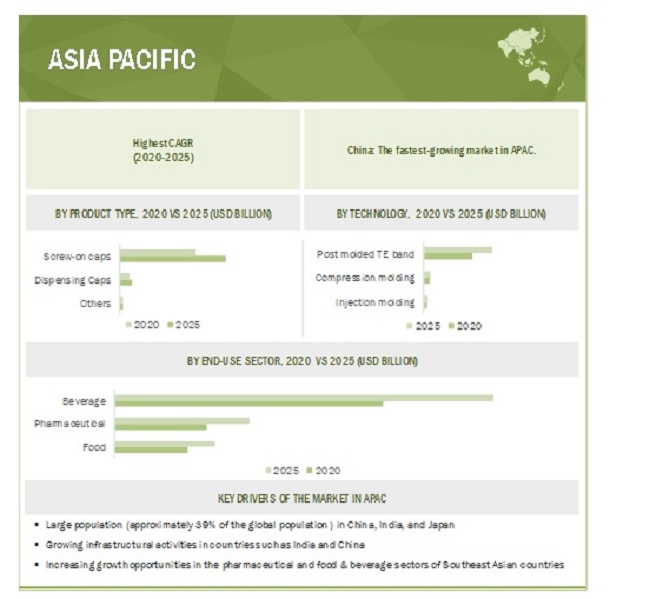

APAC is expected to account for the largest plastic caps & closures market share during the forecast period, in terms of value

The APAC plastic caps & closures market is segmented as China, Japan, India, South Korea, Australia, and the Rest of APAC. Moreover, APAC is projected to continue its dominance over the market until 2025. Increasing population, industrialization, and urbanization are augmenting the plastic caps & closures market growth. China’s emergence as a global manufacturing hub has increased the demand for plastic caps & closures. Cheap labor and easy availability of raw materials boost the production of these products in the region.

To know about the assumptions considered for the study, download the pdf brochure

Plastic Caps and Closures Market Players

Berry Group (US), Crown Holding (US), AptarGroup (US), Amcor (Australia), BERICAP (Germany), Coral Products (UK), Silgan Holdings (US), O.Berk Company, LLC (US), Guala Closures (Italy), United Caps (Luxembourg), Caps & Closures Pty Ltd. (Australia), Caprite Australia Pty Ltd. (Australia), Pano Cap (Canada) Limited (Canada), Plastic Closures Ltd. (UK), Cap & Seal Pvt. Ltd. (India), Phoenix Closures (US), Alupac India (India), Hicap Closures (China), MJS Packaging (US), J.L. Clark (US), TriMas (US), and Comar, LLC (US) are some of the players operating in the global plastic caps & closures market.

Plastic Caps and Closures Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 44.3 billion |

|

Revenue Forecast in 2025 |

USD 57.0 billion |

|

CAGR |

5.2% |

|

Years considered for the study |

2018–2025 |

|

Base year |

2018 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Billion), Volume (Billion Units) |

|

Segments |

Product Type, Container Type, Raw Material, Technology, and End-use Sector |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

Berry Group (US), Crown Holding (US), AptarGroup (US), Amcor (Australia), Coral Products (UK), BERICAP (Germany), Silgan Holdings (US), O.Berk Company, LLC (US), Guala Closures (Italy), United Caps (Luxembourg), Caps & Closures Pty Ltd. (Australia), Caprite Australia Pty Ltd. (Australia), Pano Cap (Canada) Limited (Canada), Plastic Closures Ltd. (UK), Cap & Seal Pvt. Ltd. (India), Phoenix Closures (US), Alupac India (India), Hicap Closures (China), MJS Packaging (US), J.L. Clark (US), TriMas (US), and Comar, LLC (US) |

This research report categorizes the plastic caps & closures market based on product type, container type, raw material, technology, end-use sector, and region.

Based on the product type:

- Screw-on caps

- Dispensing caps

- Others (double-wall closures, twist-on closures, and child-resistant closures)

Based on the container type:

- Plastic

- Glass

Based on the raw material:

- PP

- HDPE

- LDPE

- Others (PET and PVC)

Based on the technology:

- Post-mold TE band

- Compression molding

- Injection molding

Based on the end-use sector:

- Beverage

- Pharmaceutical

- Food

- Personal & homecare

- Others (automotive and chemical)

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In July 2019, Berry Global Group acquired RPC Group for approximately USD 6.5 billion. This acquisition helped create a leading global supplier of value-added protective solutions and one of the world’s largest plastic packaging companies. Also, the company has broadened its global footprint consisting of over 290 locations worldwide, including in North and South America, Europe, Asia, Africa, and Australia.

- In June 2019, Amcor acquired Bemis Company Inc. The combined company will now operate as Amcor Plc (Amcor). The acquisition of Bemis has brought additional scale, capabilities, and footprint that has strengthened Amcor’s industry-leading value proposition and generate significant value for shareholders.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SEGMENTATION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 PLASTIC CAPS & CLOSURES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION: PLASTIC CAPS & CLOSURES MARKET

FIGURE 3 PLASTIC CAPS & CLOSURES MARKET, BY REGION

FIGURE 4 PLASTIC CAPS & CLOSURES MARKET, BY PRODUCT TYPE

2.2.1 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH, BY SEGMENTS

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, BY END-USE SECTOR

FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 ASSUMPTIONS

2.4 LIMITATIONS

2.5 MARKET SHARE ESTIMATION

2.6 DATA TRIANGULATION

FIGURE 9 PLASTIC CAPS & CLOSURES MARKET: DATA TRIANGULATION

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 10 SCREW-ON CAPS SEGMENT TO DOMINATE THE MARKET THROUGH 2025

FIGURE 11 POST-MOLD TE BAND SEGMENT TO DOMINATE THE MARKET THROUGH 2025

FIGURE 12 PHARMACEUTICAL TO BE THE PREFERRED SECTOR TO INVEST IN THE NEXT FIVE YEARS

FIGURE 13 PP TO BE THE FASTEST-GROWING RAW MATERIAL SEGMENT

FIGURE 14 PLASTIC TO RECORD THE HIGHER CAGR BETWEEN 2020 AND 2025

FIGURE 15 APAC TO REMAIN THE LARGEST MARKET FOR PLASTIC CAPS & CLOSURES

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PLASTIC CAPS & CLOSURES MARKET

FIGURE 16 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 PLASTIC CAPS & CLOSURES MARKET, BY PRODUCT TYPE

FIGURE 17 SCREW-ON CAPS TO BE THE LARGEST AND FASTEST-GROWING SEGMENT

4.3 PLASTIC CAPS & CLOSURES MARKET, BY TECHNOLOGY

FIGURE 18 POST-MOLD TE BAND TECHNOLOGY TO GROW AT THE HIGHEST RATE

4.4 PLASTIC CAPS & CLOSURES MARKET, BY CONTAINER TYPE

FIGURE 19 PLASTIC SEGMENT TO CONTINUE DOMINATING THE MARKET

4.5 PLASTIC CAPS & CLOSURES MARKET, BY RAW MATERIAL

FIGURE 20 PP SEGMENT TO REMAIN LARGEST DURING FORECAST PERIOD

4.6 PLASTIC CAPS & CLOSURES MARKET, BY END-USE SECTOR

FIGURE 21 PHARMACEUTICAL SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2020 AND 2025

4.7 PLASTIC CAPS & CLOSURES MARKET, BY COUNTRY

FIGURE 22 PLASTIC CAPS & CLOSURES MARKET IN DEVELOPING COUNTRIES TO GROW AT A FASTER RATE THAN IN DEVELOPED COUNTRIES

4.8 APAC: PLASTIC CAPS & CLOSURES MARKET

FIGURE 23 CHINA TO LEAD THE PLASTIC CAPS & CLOSURES MARKET IN APAC

4.9 PLASTIC CAPS & CLOSURES MARKET: REGIONAL SNAPSHOT

FIGURE 24 CHINA TO REGISTER HIGHEST CAGR FOLLOWED BY INDIA

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 25 PLASTIC CAPS & CLOSURES VALUE CHAIN

5.3 MARKET DYNAMICS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE PLASTIC CAPS & CLOSURES MARKET

5.3.1 DRIVERS

5.3.1.1 Increase in demand for bottled water

5.3.1.2 Need for convenience and concerns about product safety & security

5.3.1.3 Product differentiation & branding and decreasing package sizes

5.3.2 RESTRAINTS

5.3.2.1 Development of substitutes

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging economies

5.3.4 CHALLENGES

5.3.4.1 Mature markets in developed regions

5.4 PORTER'S FIVE FORCES ANALYSIS

FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 COVID-19 IMPACT ON PLASTIC CAPS & CLOSURES MARKET

5.5.1 IMPACT OF COVID-19 ON PLASTIC PACKAGING

5.5.2 IMPACT OF COVID-19 ON END-USE SECTORS FOR PLASTIC CAPS & CLOSURES 62

5.5.2.1 Impact of COVID-19 on food & beverage industry

5.5.2.2 Impact of COVID-19 on pharmaceutical industry

5.5.2.3 Impact of COVID-19 on personal & homecare industry

5.5.3 IMPACT OF COVID-19 ON VARIOUS COUNTRIES

6 PLASTIC CAPS & CLOSURES MARKET, BY PRODUCT TYPE (Page No. - 65)

6.1 INTRODUCTION

FIGURE 28 SCREW-ON CAPS TO DOMINATE THE PLASTIC CAPS & CLOSURES MARKET THROUGH 2025

TABLE 1 PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 2 PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

6.2 SCREW-ON CAPS

6.3 DISPENSING CAPS

6.4 OTHERS

7 PLASTIC CAPS & CLOSURES MARKET, BY CONTAINER TYPE (Page No. - 68)

7.1 INTRODUCTION

FIGURE 29 PLASTIC TO BE LARGER SEGMENT IN PLASTIC CAPS & CLOSURES MARKET THROUGH 2025

TABLE 3 PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (USD BILLION)

TABLE 4 PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (BILLION UNITS)

7.2 PLASTIC

7.3 GLASS

8 PLASTIC CAPS & CLOSURES MARKET, BY TECHNOLOGY (Page No. - 71)

8.1 INTRODUCTION

FIGURE 30 PLASTIC SEGMENT TO BE THE LARGEST CONTAINER TYPE THROUGH 2025

TABLE 5 PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 6 PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

8.2 POST-MOLD TAMPER-EVIDENT (TE

8.3 COMPRESSION MOLDING

8.4 INJECTION MOLDING

9 PLASTIC CAPS & CLOSURES MARKET, BY RAW MATERIAL (Page No. - 75)

9.1 INTRODUCTION

FIGURE 31 PP TO BE THE MOST DOMINANT SEGMENT OF PLASTIC CAPS & CLOSURES MARKET IN 2020

TABLE 7 PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (USD BILLION)

TABLE 8 PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (BILLION UNITS)

9.2 PP (POLYPROPYLENE

TABLE 9 PP PROPERTIES

9.3 HDPE (HIGH-DENSITY POLYETHYLENE

TABLE 10 HDPE PROPERTIES

9.4 LDPE (LOW-DENSITY POLYETHYLENE

TABLE 11 LDPE PROPERTIES

9.5 OTHERS

10 PLASTIC CAPS & CLOSURES MARKET, BY END-USE SECTOR (Page No. - 79)

10.1 INTRODUCTION

FIGURE 32 BEVERAGE SEGMENT TO DOMINATE THE PLASTIC CAPS & CLOSURES MARKET THROUGH 2025

TABLE 12 PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 13 PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

10.2 BEVERAGE

10.3 FOOD

10.4 PHARMACEUTICAL

10.5 PERSONAL & HOMECARE

10.6 OTHERS

11 PLASTIC CAPS & CLOSURES MARKET, BY REGION (Page No. - 83)

11.1 INTRODUCTION

FIGURE 33 CHINA AND INDIA TO REGISTER HIGH GROWTH RATES BETWEEN 2020-2025

TABLE 14 PLASTIC CAPS & CLOSURES MARKET SIZE, BY REGION, 2018-2025 (USD BILLION)

TABLE 15 PLASTIC CAPS & CLOSURES MARKET SIZE, BY REGION, 2018-2025 (BILLION UNITS)

11.2 APAC

FIGURE 34 APAC: PLASTIC CAPS & CLOSURES MARKET SNAPSHOT

TABLE 16 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 17 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (BILLION UNITS)

TABLE 18 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 19 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 20 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 21 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 22 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (USD BILLION)

TABLE 23 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (BILLION UNITS)

TABLE 24 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (USD BILLION)

TABLE 25 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (BILLION UNITS)

TABLE 26 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 27 APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.2.1 CHINA

11.2.1.1 Rising demand for ready-to-eat foods, carbonated drinks, and medical emergencies due to COVID-19 offering growth opportunities

TABLE 28 CHINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 29 CHINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 30 CHINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 31 CHINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 32 CHINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 33 CHINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.2.2 INDIA

11.2.2.1 Rise in demand for plastic caps & closures owing to the growth of beverage and pharmaceutical sectors

TABLE 34 INDIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 35 INDIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 36 INDIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 37 INDIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 38 INDIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 39 INDIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.2.3 JAPAN

11.2.3.1 Growing concerns about quality of tap and treated water to boost demand for plastic caps & closures

TABLE 40 JAPAN: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 41 JAPAN: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 42 JAPAN: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 43 JAPAN: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 44 JAPAN: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 45 JAPAN: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.2.4 SOUTH KOREA

11.2.4.1 Increasing demand for packaged food to drive market

TABLE 46 SOUTH KOREA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 47 SOUTH KOREA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 48 SOUTH KOREA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 49 SOUTH KOREA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 50 SOUTH KOREA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 51 SOUTH KOREA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.2.5 AUSTRALIA

11.2.5.1 Shift toward convenient, safe, and sustainable packaging to drive the market

TABLE 52 AUSTRALIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 53 AUSTRALIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 54 AUSTRALIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 55 AUSTRALIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 56 AUSTRALIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 57 AUSTRALIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.2.6 REST OF APAC

TABLE 58 REST OF APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 59 REST OF APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 60 REST OF APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 61 REST OF APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 62 REST OF APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 63 REST OF APAC: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.3 EUROPE

FIGURE 35 PP SEGMENT ACCOUNTS FOR THE LARGEST MARKET SHARE IN EUROPE

TABLE 64 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 65 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (BILLION UNITS)

TABLE 66 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 67 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 68 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 69 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 70 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (USD BILLION)

TABLE 71 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (BILLION UNITS)

TABLE 72 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (USD BILLION)

TABLE 73 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (BILLION UNITS)

TABLE 74 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 75 EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.3.1 GERMANY

11.3.1.1 Demand for bottled water and carbonated drinks to grow over the forecast period

TABLE 76 GERMANY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 77 GERMANY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 78 GERMANY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 79 GERMANY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 80 GERMANY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 81 GERMANY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.3.2 UK

11.3.2.1 Rising food exports and demand for convenience food offering growth opportunities

TABLE 82 UK: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 83 UK: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 84 UK: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 85 UK: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 86 UK: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 87 UK: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.3.3 FRANCE

11.3.3.1 Rising demand for caps & closures from pharmaceutical sector

TABLE 88 FRANCE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 89 FRANCE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 90 FRANCE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 91 FRANCE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 92 FRANCE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 93 FRANCE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.3.4 ITALY

11.3.4.1 Rising demand for pharmaceutical products boosting market growth

TABLE 94 ITALY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 95 ITALY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 96 ITALY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 97 ITALY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY,2018-2025 (BILLION UNITS)

TABLE 98 ITALY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 99 ITALY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.3.5 RUSSIA

11.3.5.1 Increasing demand for still water to drive the demand for tamper-evident plastic caps

TABLE 100 RUSSIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 101 RUSSIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 102 RUSSIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 103 RUSSIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 104 RUSSIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 105 RUSSIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.3.6 REST OF EUROPE

TABLE 106 REST OF EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 107 REST OF EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 108 REST OF EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 109 REST OF EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 110 REST OF EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 111 REST OF EUROPE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.4 NORTH AMERICA

FIGURE 36 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SNAPSHOT

TABLE 112 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 113 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (BILLION UNITS)

TABLE 114 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 115 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 116 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 117 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 118 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (USD BILLION)

TABLE 119 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (BILLION UNITS)

TABLE 120 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (USD BILLION)

TABLE 121 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (BILLION UNITS)

TABLE 122 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 123 NORTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.4.1 US

11.4.1.1 Growing use of plastic closures by CSD and non-CSD manufacturing companies

TABLE 124 US: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 125 US: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 126 US: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 127 US: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY,2018-2025 (BILLION UNITS)

TABLE 128 US: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 129 US: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.4.2 CANADA

11.4.2.1 Increase in demand for convenient packaging to drive the plastic caps & closures market

TABLE 130 CANADA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 131 CANADA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 132 CANADA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 133 CANADA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 134 CANADA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 135 CANADA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.4.3 MEXICO

11.4.3.1 Growth potential of packaging industry due to increasing disposable income and rising population

TABLE 136 MEXICO: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 137 MEXICO: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 138 MEXICO: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 139 MEXICO: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 140 MEXICO: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 141 MEXICO: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.5 MIDDLE EAST & AFRICA

FIGURE 37 SAUDI ARABIA TO ACCOUNT FOR LARGEST MARKET SHARE IN MIDDLE EAST & AFRICA

TABLE 142 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 143 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (BILLION UNITS)

TABLE 144 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 145 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 146 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 147 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 148 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (USD BILLION)

TABLE 149 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (BILLION UNITS)

TABLE 150 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (USD BILLION)

TABLE 151 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (BILLION UNITS)

TABLE 152 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 153 MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.5.1 SAUDI ARABIA

11.5.1.1 Demand for bottled due to extremely hot and dry atmospheric conditions

TABLE 154 SAUDI ARABIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 155 SAUDI ARABIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 156 SAUDI ARABIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 157 SAUDI ARABIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 158 SAUDI ARABIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 159 SAUDI ARABIA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.5.2 UAE

11.5.2.1 Rising beverage and pharmaceutical sectors to fuel the demand for plastic caps & closures

TABLE 160 UAE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 161 UAE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 162 UAE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 163 UAE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 164 UAE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 165 UAE: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.5.3 TURKEY

11.5.3.1 Development of the packaging industry to drive market

TABLE 166 TURKEY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 167 TURKEY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 168 TURKEY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 169 TURKEY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 170 TURKEY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 171 TURKEY: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.5.4 SOUTH AFRICA

11.5.4.1 Changes in lifestyle and increase in consumption of packaged food to drive the demand for plastic caps & closures

TABLE 172 SOUTH AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 173 SOUTH AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 174 SOUTH AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 175 SOUTH AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 176 SOUTH AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 177 SOUTH AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 178 REST OF MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 179 REST OF MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 180 REST OF MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 181 REST OF MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 182 REST OF MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 183 REST OF MIDDLE EAST & AFRICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.6 SOUTH AMERICA

FIGURE 38 RAPID INDUSTRIALIZATION TO DRIVE THE PLASTIC CAPS & CLOSURES MARKET IN SOUTH AMERICA

TABLE 184 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 185 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018-2025 (BILLION UNITS)

TABLE 186 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 187 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 188 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 189 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 190 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (USD BILLION)

TABLE 191 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY CONTAINER TYPE, 2018-2025 (BILLION UNITS)

TABLE 192 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (USD BILLION)

TABLE 193 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2018-2025 (BILLION UNITS)

TABLE 194 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 195 SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.6.1 BRAZIL

11.6.1.1 Rise in awareness regarding healthcare issues and robust investment in the healthcare industry

TABLE 196 BRAZIL: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 197 BRAZIL: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 198 BRAZIL: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 199 BRAZIL: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 200 BRAZIL: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 201 BRAZIL: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.6.2 ARGENTINA

11.6.2.1 Growing CSD and non-CSD industry supporting market growth

TABLE 202 ARGENTINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 203 ARGENTINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 204 ARGENTINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 205 ARGENTINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 206 ARGENTINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 207 ARGENTINA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

11.6.3 REST OF SOUTH AMERICA

TABLE 208 REST OF SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 209 REST OF SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (BILLION UNITS)

TABLE 210 REST OF SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD BILLION)

TABLE 211 REST OF SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY TECHNOLOGY, 2018-2025 (BILLION UNITS)

TABLE 212 REST OF SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD BILLION)

TABLE 213 REST OF SOUTH AMERICA: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018-2025 (BILLION UNITS)

12 COMPETITIVE LANDSCAPE (Page No. - 155)

12.1 INTRODUCTION

FIGURE 39 MERGER & ACQUISITION WAS THE KEY GROWTH STRATEGY ADOPTED BETWEEN 2015 AND 2020

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 STAR

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE

12.2.4 EMERGING COMPANIES

FIGURE 40 PLASTICS CAPS & CLOSURES MARKET (GLOBAL

12.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 41 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PLASTIC CAPS AND CLOSURES MARKET

12.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 42 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PLASTIC CAPS AND CLOSURES MARKET

12.5 MARKET RANKING OF KEY PLAYERS

FIGURE 43 MARKET RANKING

12.6 COMPETITIVE SCENARIO

12.6.1 EXPANSIONS & INVESTMENTS

TABLE 214 EXPANSIONS & INVESTMENTS, 2016-2018

12.6.2 MERGERS & ACQUISITIONS

TABLE 215 MERGERS & ACQUISITIONS, 2015-2020

12.6.3 CONTRACTS & AGREEMENTS, JOINT VENTURES & PARTNERSHIPS, AND COLLABORATIONS 165

TABLE 216 CONTRACTS & AGREEMENTS, JOINT VENTURES & PARTNERSHIPS, AND COLLABORATIONS, 2015-2020 165

12.6.4 NEW PRODUCT LAUNCHES/DEVELOPMENT

TABLE 217 NEW PRODUCT LAUNCHES/DEVELOPMENT, 2015-2020

13 COMPANY PROFILES (Page No. - 168)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View

13.1 BERRY GLOBAL GROUP, INC.

FIGURE 44 BERRY GLOBAL: COMPANY SNAPSHOT

13.2 AMCOR PLC

FIGURE 45 AMCOR: COMPANY SNAPSHOT

13.3 CROWN HOLDINGS, INC.

FIGURE 46 CROWN HOLDINGS: COMPANY SNAPSHOT

13.4 SILGAN HOLDINGS

FIGURE 47 SILGAN HOLDINGS: COMPANY SNAPSHOT

13.5 BERICAP

13.6 APTARGROUP

FIGURE 48 APTARGROUP: COMPANY SNAPSHOT

13.7 CORAL PRODUCTS

FIGURE 49 CORAL PRODUCTS: COMPANY SNAPSHOT

13.8 O.BERK COMPANY, LLC

13.9 GUALA CLOSURES S.P.A

FIGURE 50 GUALA CLOSURES S.P.A: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

?

13.1 ADDITIONAL COMPANIES

13.10.1 UNITED CAPS

13.10.2 CAPS & CLOSURES PTY LTD

13.10.3 CAPRITE AUSTRALIA PTY. LTD

13.10.4 PANO CAP (CANADA

13.10.5 PLASTIC CLOSURES LIMITED

13.10.6 CAP & SEAL PVT. LTD

13.10.7 PHOENIX CLOSURES

13.10.8 ALUPAC INDIA

13.10.9 HICAP CLOSURES

13.10.10 MJS PACKAGING

13.10.11 J.L. CLARK

13.10.12 TRIMAS

13.10.13 COMAR, LLC

14 APPENDIX (Page No. - 197)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

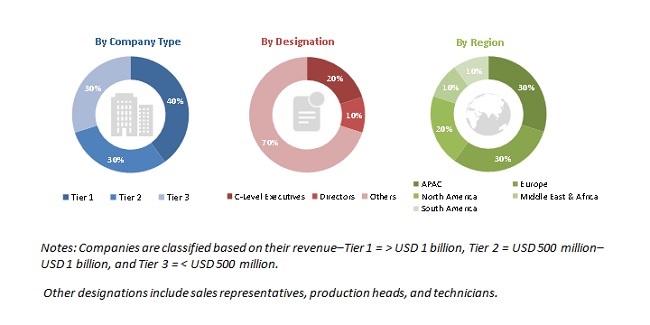

The study involved four major activities in estimating the current size of the plastic caps & closures market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the plastic caps & closures market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The plastic caps & closures market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use sector, such as beverage, pharmaceutical, food, personal & home care, and others. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Notes: Companies are classified based on their revenue–Tier 1 = > USD 1 billion, Tier 2 = USD 500 million– USD 1 billion, and Tier 3 = < USD 500 million.

Other designations include sales representatives, production heads, and technicians.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the plastic caps & closures market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the plastic caps & closures market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the plastic caps & closures market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the plastic caps & closures market

- To analyze and forecast the size of the market based on product type, container type, raw material, technology, and end-use sector

- To estimate and forecast the market size based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the plastic caps & closures market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the plastic caps & closures market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the plastic caps & closures market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Plastic Caps and Closures Market