Polyacrylamide Market by Type (Anionic, Cationic, Non-Ionic), Application (Water Treatment, Pulp & Paper, Enhanced Oil Recovery, Mineral Processing), Region - Global Forecast to 2021

[130 Pages Report] The polyacrylamide market is estimated to reach USD 3.85 Billion by 2021, at a CAGR of 6.8% between 2016 and 2021. The growth of the market can be attributed to the adoption of polyacrylamide in applications, such as water treatment and enhanced oil recovery. The base year considered for the study is 2015 while the forecast period is between 2016 and 2021.

The main objective of the study is to define, describe, and forecast the polyacrylamide market on the basis of type, application, and region. The report includes detailed information about the major factors, such as drivers, restraints, opportunities, and industry specific challenges influencing the growth of the market. The report strategically analyzes the market segments with respect to individual growth trends, growth prospects, and contribution to the total market. The market size of polyacrylamide is estimated, both in terms of volume and value, across regions, such as Asia-Pacific, Europe, North America, Middle East & Africa and South America.

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the polyacrylamide market and estimate the size of various other dependent submarkets. Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Securities and Exchange Commission (SEC), and other government and private websites have also been used to identify and collect information useful for this technical, market-oriented, and commercial study of the polyacrylamide market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the polyacrylamide industry includes raw material manufacturers, such as SNF Floerger Group (France), China National Petroleum Corporation (China), Kemira Oyj (Finland), BASF SE (Germany), and Mitsui Chemicals (Japan), polyacrylamide manufacturers, such as SNF Floerger Group (France), Kemira Oyj (Finland), BASF SE (Germany), China National Petroleum Corporation (China), and Anhui Jucheng Fine Chemicals (China). The products manufactured by these companies are used in different applications, such as water treatment, enhanced oil recovery, pulp & paper production, mineral processing, agriculture, personal care, and construction.

Key Target Audience:

- Acrylamides Manufacturers

- Manufacturers of Polyacrylamide Material

- Traders, Distributors, and Suppliers of Polyacrylamide

- Regional Manufacturers Associations and General Polyacrylamide Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

Study answers several questions for the stakeholders, primarily which market segments to focus in next two-to-five years for prioritizing the efforts and investments.

Scope of the Report:

This research report categorizes the polyacrylamide market on the basis of type, application, and region.

On the basis of Type:

- Anionic

- Cationic

- Non-ionic

- Others

On the basis of Application:

- Water Treatment

- Enhanced Oil Recovery

- Pulp & Paper

- Mineral processing

- Others

On the basis of Region:

- Asia-Pacific

- Europe

- North America

- Middle East, Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

End-Use Industry Analysis

- Application matrix that gives a detailed analysis of polyacrylamides applications in each application

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company information

- Detailed analysis and profiling of additional market players (up to 5)

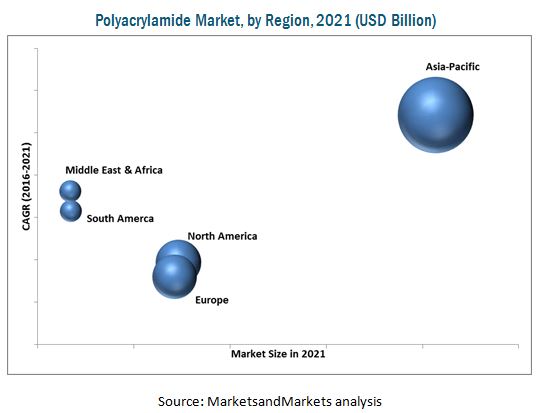

The polyacrylamide market is estimated to reach USD 3.85 Billion by 2021, at a CAGR of 6.8% from 2016 to 2021. The rapid industrialization and growing oil & gas industry in Asia-Pacific and the rising demand for polyacrylamide for enhanced oil recovery are the major factors expected to drive the growth of the polyacrylamide market.

Polyacrylamides are used in various applications, such as water treatment, enhanced oil recovery, pulp & paper, and mineral processing. Water treatment was the largest segment of the market, owing to the increasing demand for polyacrylamide from the water treatment industry.

The global polyacrylamide market has been segmented based on types, such as anionic, cationic, and non-ionic, among others. The anionic and cationic segments together accounted for a share of over 85% of total demand for polyacrylamides in 2015. Cationic polyacrylamide is projected to be the fastest-growing segment during the forecast period, due to the increasing usage of cationic polyacrylamide in various applications in diverse industries, such as additives in building & construction, color removal and desalination in wastewater treatment, and cell separation in biotechnological broths.

The report has analyzed the polyacrylamide market in regions, namely, Asia-Pacific, North America, Europe, Middle East & Africa, and South America. Asia-Pacific dominated the global polyacrylamide market, owing to the rising demand for polyacrylamide in this region. This demand is mainly driven by its use in the enhanced oil recovery industry in China, Japan, and India. North America was the second-largest market of polyacrylamide in 2015, due its increasing demand in water treatment in the region.

The high capital expenditure required to establish polyacrylamide manufacturing facility may restrain the growth of the polyacrylamide market in near future. This creates high level of entry barriers for new entrants in the polyacrylamide market.

SNF Floerger Group (France), Kemira Oyj (Finland), BASF SE (Germany), China National Petroleum Corporation (China), and Anhui Jucheng Fine Chemicals (China) are the leading companies in the polyacrylamide market. These companies are expected to account for a significant market share in the near future. Other major manufacturers of polyacrylamide include Daqing Petrochemical Company (China.), Anhui Tiarun Chemical (China), and Beijing Hengju Oilfield Chemical Agent Co., Ltd. (China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Market

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

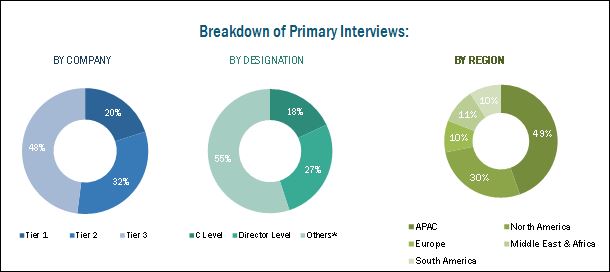

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Significant Opportunities in the Polyacrylamide Market

4.2 Asia-Pacific: Polyacrylamide Market, By Application & Country, 2015

4.3 Polyacrylamide Market Attractiveness

4.4 Polyacrylamide Market Share, By Type

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Demand for Enhanced Oil Recovery

5.3.1.2 Rising Awareness of Wastewater Management

5.3.1.3 Growing Population and Rapid Urbanization in the Asian Countries

5.3.2 Restraints

5.3.2.1 Volatility of Raw Material Price

5.3.2.2 Alternative Water Treatment Technologies

5.3.3 Opportunities

5.3.3.1 Development of Bio-Based Polyacrylamide at Competitive Prices

5.3.3.2 New Environmental and Governmental Regulations

5.3.4 Challeneges

5.3.4.1 Residual Monomer Content in Polyacrylamide

5.3.4.2 Anti-Dumping Duties on Chinese Manufacturers

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Polyacrylamide Market, By Application (Page No. - 44)

7.1 Introduction

7.1.1 Water Treatment

7.1.2 Enhanced Oil Recovery

7.1.3 Pulp & Paper Production

7.1.4 Mineral Processing

7.1.5 Others

8 Polyacrylamide Market, By Type (Page No. - 49)

8.1 Introduction

8.1.1 Anionic Polyacrylamide

8.1.2 Cationic Polyacrylamide

8.1.3 Non-Ionic Polyacrylamide

8.1.4 Others

9 Polyacrylamide Market, By Region (Page No. - 53)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Italy

9.3.5 Spain

9.3.6 Russia

9.3.7 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.4.5 Rest of Asia-Pacific

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 United Arab Emirates

9.5.3 South Africa

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Rest of South America

10 Competitive Landscape (Page No. - 97)

10.1 Overview

10.2 Market Share Analysis: Polyacrylamide

10.3 Competitive Situations and Trends

10.4 Competitive Benchmarking of Development Strategies

10.4.1 Expansions

10.4.2 Agreements

10.4.3 New Product Launches

11 Company Profiles (Page No. - 101)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

11.1 SNF Floerger Group

11.2 Kemira Oyj

11.3 BASF SE

11.4 Anhui Jucheng Fine Chemicals Co.Ltd

11.5 Petrochina Daqing Refining & Chemical Company

11.6 Anhui Tianrun Chemicals Co.,Ltd

11.7 Beijing Hengju Chemical Group Corporation

11.8 Jiangsu Feymer Technology Co Ltd

11.9 Mitsubishi Rayon Co Ltd

11.10 Shadong Polymer Biochemicals Co. Ltd.

11.11 Xitao Polymer Co Ltd

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 120)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (98 Tables)

Table 1 Polyacrylamide Market, By Type

Table 2 Polyacrylamide Market, By Application

Table 3 Polyacrylamide Market, By Region

Table 4 Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 5 Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 6 Polyacrylamide Market Size, By Type, 20142021 (USD Million)

Table 7 Polyacrylamide Market Size, By Type, 20142021 (Kiloton)

Table 8 Polyacrylamide Market Size, By Region, 20142021 (USD Million)

Table 9 Polyacrylamide Market Size, By Region, 20142021 (Kiloton)

Table 10 North America: Polyacrylamide Market Size, By Country, 20142021 (USD Million)

Table 11 North America: Polyacrylamide Market Size, By Country, 20142021 (Kiloton)

Table 12 North America: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 13 North America: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 14 North America: Polyacrylamide Market Size, By Type, 20142021 (USD Million)

Table 15 North America: Polyacrylamide Market Size, By Type, 20142021 (Kilotons)

Table 16 U.S.: Economic Outlook, 2015

Table 17 U.S.: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 18 U.S.: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 19 Canada: Economic Outlook, 2015

Table 20 Canada: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 21 Canada: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 22 Mexico: Economic Outlook, 2015

Table 23 Mexico: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 24 Mexico: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 25 Europe: Polyacrylamide Market Size, By Country, 20142021 (USD Million)

Table 26 Europe: Polyacrylamide Market Size, By Country, 20142021 (Kiloton)

Table 27 Europe: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 28 Europe: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 29 Europe: Polyacrylamide Market Size, By Type, 20142021 (USD Million)

Table 30 Europe: Polyacrylamide Market Size, By Type, 20142021 (Kiloton)

Table 31 Germany: Economic Outlook, 2015

Table 32 Germany: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 33 Germany: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 34 U.K.: Economic Outlook, 2015

Table 35 U.K.: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 36 U.K.: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 37 France: Economic Outlook, 2015

Table 38 France: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 39 France: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 40 Italy: Economic Outlook, 2015

Table 41 Italy: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 42 Italy: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 43 Spain: Economic Outlook, 2015

Table 44 Spain: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 45 Spain: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 46 Russia : Economic Outlook, 2015

Table 47 Russia: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 48 Russia: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 49 Rest of Europe: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 50 Rest of Europe: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 51 Asia-Pacific: Polyacrylamide Market Size, By Country, 2014-2021 (USD Million)

Table 52 Asia-Pacific: Polyacrylamide Market Size, By Country, 2014-2021 (Kiloton)

Table 53 Asia-Pacific: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 54 Asia-Pacific: Polyacrylamide Market Size, By Application, 2014-2021 (Kiloton)

Table 55 Asia-Pacific: Polyacrylamide Market Size, By Type, 2014-2021 (USD Million)

Table 56 Asia-Pacific: Polyacrylamide Market Size, By Type, 2014-2021 (Kiloton)

Table 57 China: Economic Outlook, 2015

Table 58 China: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 59 China: Polyacrylamide Market Size, By Application, 2014-2020 (Kiloton)

Table 60 Japan: Economic Outlook, 2015

Table 61 Japan: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 62 Japan: Polyacrylamide Market Size, By Application, 2014-2021 (Kiloton)

Table 63 South Korea: Economic Outlook, 2015

Table 64 South Korea: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 65 South Korea: Polyacrylamide Market Size, By Application, 2014-2021 (Kiloton)

Table 66 India: Economic Outlook, 2015

Table 67 India: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 68 India: Polyacrylamide Market Size, By Application, 2014-2021 (Kiloton)

Table 69 Rest of Asia-Pacific: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 70 Rest of Asia-Pacific: Polyacrylamide Market Size, By Application, 2014-2021 (Kiloton)

Table 71 Middle East & Africa: Polyacrylamide Market Size, By Country, 2014-2021 (USD Million)

Table 72 Middle East & Africa: Polyacrylamide Market Size, By Country, 2014-2021 (Kiloton)

Table 73 Middle East & Africa: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 74 Middle East & Africa: Polyacrylamide Market Size, By Application, 2014-2020 (Kiloton)

Table 75 Middle East & Africa: Polyacrylamide Market Size, By Type, 2014-2021 (USD Million)

Table 76 Middle East & Africa: Polyacrylamide Market Size, By Type, 2014-2021 (Kiloton)

Table 77 Saudi Arabia: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 78 Saudi Arabia: Polyacrylamide Market Size, By Application, 2014-2021 (Kiloton)

Table 79 UAE: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 80 UAE: Polyacrylamide Market Size, By Application, 2014-2020 (Kiloton)

Table 81 South Africa: Economic Outlook, 2015

Table 82 South Africa: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 83 South Africa: Polyacrylamide Market Size, By Application, 2014-2021 (Kiloton)

Table 84 Rest of Middle East & Africa: Polyacrylamide Market Size, By Application, 2014-2021 (USD Million)

Table 85 Rest of Middle East & Africa: Polyacrylamide Market Size, By Application, 2014-2020 (Kiloton)

Table 86 South America: Polyacrylamide Market Size, By Country, 20142021 (USD Million)

Table 87 South America: Polyacrylamide Market Size, By Country, 20142021 (Kiloton)

Table 88 South America: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 89 South America: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 90 South America: Polyacrylamide Market Size, By Type, 20142021 (USD Million)

Table 91 South America: Polyacrylamide Market Size, By Type, 20142021 (Kiloton)

Table 92 Brazil: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 93 Brazil: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 94 Rest of South America: Polyacrylamide Market Size, By Application, 20142021 (USD Million)

Table 95 Rest of South America: Polyacrylamide Market Size, By Application, 20142021 (Kiloton)

Table 96 Expansions: 20122016

Table 97 Agreements: 20122016

Table 98 New Product Launches: 20122016

List of Figures (34 Figures)

Figure 1 Polyacrylamide Market Segmentation

Figure 2 Polyacrylamide Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Polyacrylamide Market: Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Cationic is to Be the Largest and Fastest-Growing Type of Polyacrylamide Through 2021

Figure 8 Water Treatment to Be the Fastest-Growing Application During the Forecast Period

Figure 9 Asia-Pacific to Be the Fastest-Growing Polyacrylamide Market Between 2016 and 2021

Figure 10 Water Treatment Industry to Dominate the Polyacrylamide Market

Figure 11 Enhanced Oil Recovery Accounted for the Largest Share of the Polyacrylamide Market in Asia-Pacific

Figure 12 China Accounted for the Largest Market Share of the Polyacrylamide Market in 2015

Figure 13 Anionic Polyacrylamide to Dominate the Polyacrylamide Market Through 2021

Figure 14 Factors Affecting the Polyacrylamide Market

Figure 15 Enhanced Oil Recovery Chemicals Demand 2013-2020 (USD Million)

Figure 16 Overview of Polyacrylamide Value Chain

Figure 17 Porters Five Forces Analysis

Figure 18 Water Treatment Application is Projected to Capture the Largest Market Share, By 2021 (Kiloton)

Figure 19 Anionic Polyacrylamide Projected to Account for the Largest Market Share, 2016-2021, in Terms of Volume

Figure 20 Regional Snapshot (2015): Rapidly Growing Markets are Emerging as New Hotspots

Figure 21 North American Market Snapshot: Mexico is Projected to Be the Fastest Growing Market, 20162021

Figure 22 European Market Snapshot: Germany is Projected to Be the Largest Market, 20162021

Figure 23 Asia-Pacific Market Snapshot: India to Be the Fastest Growing Market, 2016-2021

Figure 24 Companies Adopted Expansions as the Key Growth Strategy

Figure 25 SNF Floerger Group Dominated the Polyacrylamide Market, 2015

Figure 26 Market Share: Expansion is the Key Strategy

Figure 27 SNF Floerger Group: Company Snapshot

Figure 28 SNF Floerger Group : SWOT Analysis

Figure 29 Kemira Oyj: Company Snapshot

Figure 30 Kemira: SWOT Analysis

Figure 31 BASF SE: Company Snapshot

Figure 32 BASF : SWOT Analysis

Figure 33 Anhui Jucheng Fine Chemicals Co Ltd: SWOT Analysis

Figure 34 Petrochina Daqing Refining & Chemical Company: SWOT Analysis

Growth opportunities and latent adjacency in Polyacrylamide Market