Polybutadiene Market by Type (Solid Polybutadiene (High Cis, Low Cis, High Trans, High Vinyl), Liquid Polybutadiene), Application (Tires, Polymer modification, Industrial rubber, Chemical), and Region - Global Forecast to 2024

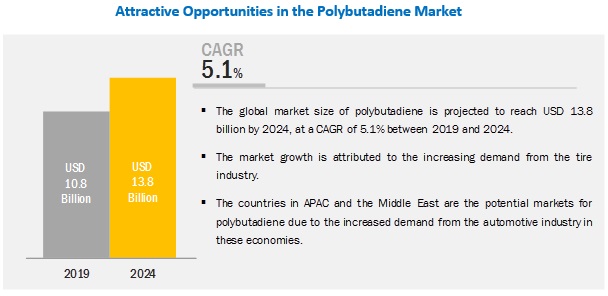

[146 Pages Report] The global polybutadiene market size is expected to be valued at USD 10.8 billion in 2019 and is projected to reach USD 13.8 billion by 2024, at a CAGR of 5.1% during the forecast period. The growth of the market is attributed to major applications of polybutadiene in tires, chemicals, polymer modification, industrial rubber goods.

By type, solid polybutadiene segment is expected to be the largest contributor in the polybutadiene market during the forecast period.

On the basis of type, the solid polybutadiene segment accounted for the largest share of the market in 2019. It is widely used in tire manufacturing. The use of solid polybutadiene rubber in other applications such as polymer modification, sporting goods, industrial rubber goods manufacturing, and footwear products is also driving its consumption. The growing demand for improved performance and low rolling-resistance tires is expected to provide growth opportunities for the polybutadiene market.

Tire application accounts for largest market size during forecast period

The tire industry is expanding due to the growing automotive industry. It accounted for the largest share of the overall polybutadiene market. Furthermore, this segment is estimated to grow significantly during the forecast period. Polybutadiene is widely used in tire manufacturing due to its toughness, good abrasion resistance, cold resistance, high tensile strength, high resilience, tear resistance, and durability.

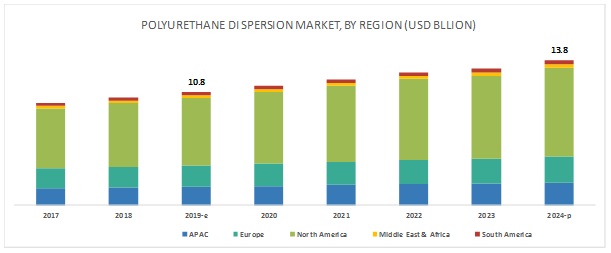

APAC is expected to account for the largest market size during the forecast period

APAC is estimated to account for the largest value share of the global polybutadiene market in 2019. The market is primarily driven by the strong demand from the automotive industry. China is expected to boost the demand for polybutadiene during the forecast period. Increasing disposable income, huge consumer base, rising urban population, low labor costs, and easy availability of raw materials are attracting global automobile manufacturers to shift their production facilities to the region, thus, creating a high demand for polybutadiene in this region.

Key Market Players

The major players in the polybutadiene market are ARLANXEO (Netherlands), JSR Corporation (Japan), UBE Industries Ltd. (Japan), SABIC (Saudi Arabia), LG Chem Ltd. (South Korea), Versalis SPA (Italy), PJSC SIBUR Holdings (Russia), Sinopec (China), and Kuraray Co. Ltd. (Japan). These companies adopted new product development, joint venture, and expansion as their major business strategies between January 2015 and August 2019 to earn a competitive advantage in the polybutadiene market.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2023 |

|

Forecast units |

Value(USD) and Volume(KT) |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, South America, and Middle East & Africa |

|

Companies covered |

ARALNXEO (Netherlands), UBE Industries Ltd (Japan), JSR Corporation (Japan), Kumho Petrochemical Co. Ltd (South Korea), Reliance Industries Ltd. (India), SABIC (Saudi Arabia), LG Chem Ltd (South Korea), Versalis SPA (Italy), PJSC SIBUR Holdings (Russia), Sinopec (China), and Kuraray Co. Ltd (Japan) |

This research report categorizes the polybutadiene market based on type, application, and region.

Polybutadiene Market, by Types:

- Solid Polybutadiene

- Liquid Polybutadiene

Polybutadiene Market, by Application:

- Tires

- Polymer Modification

- Industrial Rubber Manufacturing

- Chemicals

- Others (sporting goods and footwear)

Polybutadiene Market, by Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

In February 2019,SIBUR decided to launch an investment project aimed at enhancing polybutadiene rubber (Nd-BR) production efficiency at its Voronezh facility (Voronezhsintezkauchuk). The project aims for a large-scale upgrade to boost operational efficiency of the existing facility and ensure production of consistently high quality of products. This project will enable SIBUR to produce quality products with improved operational efficiency.

In July 2018, ARLANXEO executed modernization of the production facility of PBR rubber in Triunfo, Brazil. Post completion, the company will be able to produce advanced PBR types Nd-BR (neodymium butadiene rubber) by 2020. This expansion will help the company provide better products & services to its customers and will help in expanding its foothold in emerging market.

In January 2016, Versalis S.P.A expanded in Asia through its new distribution center and subsidiary Versalis Pacific Trading (Shanghai). This center has started the distribution of rubber process oils in the Asian synthetic rubber market, particularly in the tire segment.

Key Questions addressed by the report

- Which are the future revenue pockets in the polybutadiene market?

- Which key developments are expected to have a high impact on the market?

- Which products/technologies are expected to overpower the existing technologies?

- How the regulatory scenario further is expected to impact the market?

- What will be the future product mix in the polybutadiene market?

- What are the prime strategies of leaders in the market?

Frequently Asked Questions (FAQ):

What are the different types of polybutadiene?

Which is the leading application of polybutadiene market?

What are the opportunities for the market?

Growing demand for eco-friendly tires globally.

Which region dominate the polybutadiene market?

Which is the major restraining factor in the market?

What are the factors supporting the growth of polybutadiene market?

Who are the major manufacturers in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Polybutadiene: Market Segmentation

1.3.2 Years Considered For The Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Supply Side Approach: Regional Analysis

2.2.2 Supply Side Approach: Value Analysis

2.2.3 Demand-Side Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Polybutadiene Market

4.2 Solid Polybutadiene Market, By Application

4.3 Solid Polybutadiene Rubber Market, By Sub-Type

4.4 Global Polybutadiene Market, By Type and Leading Countries

4.5 Polybutadiene Market, By Country

4.6 Polybutadiene Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of the Tire Industry

5.2.1.2 Growth in Synthetic Rubber Industry

5.2.2 Restraints

5.2.2.1 Stringent Environmental Regulations

5.2.2.2 Health Concerns Regarding Exposure to Polybutadiene

5.2.3 Opportunities

5.2.3.1 Rapidly Increasing Demand From APAC

5.2.3.2 Demand for Eco-Friendly Tires

5.2.4 Challenges

5.2.4.1 Fluctuation in Raw Material Prices

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Growth Rate Forecast of Major Economies

5.4.2 Automotive Industry

5.4.3 Tire Industry

5.5 Polybutadiene Patent Analysis

6 Polybutadiene Market, By Type (Page No. - 48)

6.1 Introduction

6.2 High CIS Polybutadiene

6.3 Low CIS Polybutadiene

6.4 High Vinyl Polybutadiene

6.5 High Trans Polybutadiene

6.6 Liquid Polybutadiene Rubber

6.6.1 Liquid Polybutadiene Types

6.6.1.1 Liquid 1,4-Polybutadiene

6.6.1.2 Liquid 1,2-Polybutadiene

6.6.1.3 Hydroxyl-Terminated Polybutadiene (HTPB)

7 Polybutadiene Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Tires

7.2.1 Polybutadiene Mostly Used in Tires for Its Superior Abrasion Resistance, High Tensile Strength, and Durability

7.3 Polymer Modification

7.3.1 Polymer Modification is the Third-Largest End User of Polybutadiene

7.4 Industrial Rubber Manufacturing

7.4.1 High Abrasion Resistance, Load-Bearing Capacity and Wear & Tear Resistance Properties of Polybutadiene Suitable for use in Industrial Applications

7.5 Chemicals

7.5.1 Adhesive & Sealant is the Largest Application of Liquid Polybutadiene

7.6 Others

8 Polybutadiene Market, By Region (Page No. - 58)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Tire Application Driving the Growth of Polybutadiene Market

8.2.2 India

8.2.2.1 India to Witness Significant Growth in the Polybutadiene Market Owing to Rising Automotive and Polymer Modification Applications

8.2.3 Japan

8.2.3.1 Steady Growth in Tire and Polymer Modification to Support the Polybutadiene Market

8.2.4 Thailand

8.2.4.1 Thailand to Witness Significant Growth Owing to Growth in Tire Industry

8.2.5 Malaysia

8.2.5.1 Industrial Rubber Goods and Footwear to Drive the Demand of Polybutadiene

8.2.6 Indonesia

8.2.6.1 Export of Tire and Automobile to Support the Growth of Polybutadiene in the Country

8.2.7 South Korea

8.2.7.1 Rising Automotive Industry to Boost the Demand of Polybutadiene

8.2.8 Rest of APAC

8.3 Europe

8.3.1 Germany

8.3.1.1 Automotive Application Driving the Growth of the Polybutadiene Market

8.3.2 France

8.3.2.1 Increasing use of Polybutadiene in Tire, Chemical, and Polymer Modification to Boost the Market

8.3.3 UK

8.3.3.1 Rising Investment in R&D to Boost Demand of Polybutadiene in Automotive Industry

8.3.4 Italy

8.3.4.1 High Wear Resistance and Lower Rolling Resistance Properties to Drive the Demand for Polybutadiene in the Country

8.3.5 Turkey

8.3.5.1 Industrial Rubber Goods to Drive the Polybutadiene Market in Turkey

8.3.6 Russia

8.3.6.1 Boost in Domestic and Export Demand of Polybutadiene to Fuel the Growth of This Market

8.3.7 Rest of Europe

8.4 North America

8.4.1 US

8.4.1.1 Addition of New Tire Production Capacities to Drive the Demand of Polybutadiene in the Country

8.4.2 Canada

8.4.2.1 Rising Demand for Tire Coupled With Growing Automotive Industry to Fuel the Demand for Polybutadiene in Canada

8.4.3 Mexico

8.4.3.1 Burgeoning Automotive Market to Drive the Demand of Polybutadiene in Mexico

8.5 Middle East & Africa

8.5.1 Iran

8.5.1.1 Rising Disposable Income and Growing Middle-Class Population to Create Demand of Polybutadiene

8.5.2 Saudi Arabia

8.5.2.1 Availability of Raw Material and Low Tariffs to Support the Growth of Polybutadiene Market in the Country

8.5.3 South Africa

8.5.3.1 Tire is the Largest and Fastest-Growing Application of Polybutadiene in South Africa

8.5.4 UAE

8.5.4.1 Demand in Automotive Application to Boost the Polybutadiene Market

8.5.5 Rest of Middle Ease & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Rising Domestic Production of Tires to Support the Growth of Polybutadiene Market

8.6.2 Argentina

8.6.2.1 Tire Segment to Drive the Polybutadiene Market in Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 106)

9.1 Introduction

9.2 Competitive Leadership Mapping

9.2.1 Dynamics Differentiators

9.2.2 Innovators

9.2.3 Visionary Leaders

9.2.4 Emerging Companies

9.3 Competitive Scenario

9.3.1 Expansions

9.3.2 Acquisitions

9.3.3 Agreements & Joint Ventures

9.3.4 New Product Launches

10 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 ARALNXEO

10.2 JSR Corporation

10.3 UBE Industries, Ltd.

10.4 Kumho Petrochemical Co. Ltd.

10.5 The Goodyear Tire & Rubber Company

10.6 Saudi Arabia Basic Industries Corporation (SABIC)

10.7 Reliance Industries Limited

10.8 LG Chem Ltd.

10.9 Versalis S.P.A

10.10 PJSC SIBUR Holding

10.11 China Petroleum & Chemical Corporation (Sinopec)

10.12 Kuraray Co. Ltd.

10.13 Synthos S.A.

10.14 Other Key Market Players

10.14.1 Trinseo S.A.

10.14.2 Total Cray Valley

10.14.3 Zeon Corporation

10.14.4 Evonik Industries AG

10.14.5 Taiwan Synthetic Rubber Corporation (TSRC)

10.14.6 Nippon Soda Co. Ltd.

10.14.7 Firestone Polymers LLC

10.14.8 Mitsubishi Corporation

10.14.9 Shazand Petrochemical Corporation (ARPC)

10.14.10 Petrochina Company Ltd.

10.14.11 Nizhnekamskneftekhim

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 142)

11.1 Discussion Guide

11.2 Available Customizations

11.3 Related Reports

11.4 Author Details

List of Tables (109 Tables)

Table 1 Polybutadiene Market Snapshot (2019 Vs. 2024)

Table 2 Region Wise Tire Production

Table 3 Tire Manufacturers Focus Towards use of Eco-Friendly Materials

Table 4 Global Green Tires Market Size, By Country, 2015–2022 (Thousand Units)

Table 5 Trends and Forecast of GDP Growth Rates (%), 2019–2024

Table 6 Tires Market, By Region, 2014–2021 (Million Units)

Table 7 Geographic Analysis of Polybutadiene Patent Filings

Table 8 Polybutadiene Patent Filings By Company

Table 9 Polybutadiene Market, By Catalyst

Table 10 Polybutadiene Market Size, By Type, 2017–2024 (Kiloton)

Table 11 Polybutadiene Market Size, By Type, 2017–2024 (USD Million)

Table 12 Solid Polybutadiene Rubber Market Size, By Type, 2017–2024 (Kiloton)

Table 13 Solid Polybutadiene Rubber Market Size, By Type, 2017–2024 (USD Million)

Table 14 Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 15 Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 16 Polybutadiene Market Size, By Region, 2017–2024 (Kiloton)

Table 17 Polybutadiene Market Size, By Region, 2017–2024 (USD Million)

Table 18 APAC: Polybutadiene Market Size, By Country, 2017–2024 (Kiloton)

Table 19 APAC: Polybutadiene Market Size, By Country, 2017–2024 (USD Million)

Table 20 APAC: Solid Polybutadiene Market Size, By Type, 2017–2024 (Kiloton)

Table 21 APAC: Solid Polybutadiene Market Size, By Type, 2017–2024 (USD Million)

Table 22 APAC: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 23 APAC: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 24 China: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 25 China: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 26 India: Polybutadiene Demand–Supply (Kiloton)

Table 27 India: Butadiene Demand–Supply (Kiloton)

Table 28 India: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 29 India: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 30 Japan: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 31 Japan: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 32 Thailand: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 33 Thailand: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 34 Malaysia: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 35 Malaysia: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 36 Indonesia: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 37 Indonesia: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 38 South Korea: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 39 South Korea: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 40 Rest of APAC: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 41 Rest of APAC: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 42 Europe: Polybutadiene Market Size, By Country, 2017–2024 (Kiloton)

Table 43 Europe: Polybutadiene Market Size, By Country, 2017–2024 (USD Million)

Table 44 Europe: Solid Polybutadiene Market Size, By Type, 2017–2024 (Kiloton)

Table 45 Europe: Solid Polybutadiene Market Size, By Type, 2017–2024 (USD Million)

Table 46 Europe: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 47 Europe: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 48 Germany: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 49 Germany: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 50 France: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 51 France: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 52 UK: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 53 UK: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 54 Italy: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 55 Italy: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 56 Turkey: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 57 Turkey: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 58 Russia: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 59 Russia: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 60 Rest of Europe: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 61 Rest of Europe: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 62 North America: Polybutadiene Market Size, By Country, 2017–2024 (Kiloton)

Table 63 North America: Polybutadiene Market Size, By Country, 2017–2024 (USD Million)

Table 64 North America: Solid Polybutadiene Market Size, By Type, 2017–2024 (Kiloton)

Table 65 North America: Solid Polybutadiene Market Size, By Type, 2017–2024 (USD Million)

Table 66 North America: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 67 North America: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 68 US Tire Production, Vehicle Type, 2016–18 (Million Units)

Table 69 US: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 70 US: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 71 Canada: Tire Production Capacity, By Company

Table 72 Canada: Tire Shipments, By Replacement Tire, 2012–2018 (Million Units)

Table 73 Canada: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 74 Canada: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 75 Mexico: Tire Production Capacity, By Company

Table 76 Mexico: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 77 Mexico: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 78 Middle East & Africa: Polybutadiene Market Size, By Country, 2017–2024 (Kiloton)

Table 79 Middle East & Africa: Polybutadiene Market Size, By Country, 2017–2024 (USD Million)

Table 80 Middle East & Africa: Solid Polybutadiene Market Size, By Type, 2017–2024 (Kiloton)

Table 81 Middle East & Africa: Solid Polybutadiene Market Size, By Type, 2017–2024 (USD Million)

Table 82 Middle East & Africa: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 83 Middle East & Africa: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 84 Iran: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 85 Iran: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 86 Saudi Arabia: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 87 Saudi Arabia: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 88 South Africa: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 89 South Africa: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 90 UAE: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 91 UAE: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 92 Rest of Middle East & Africa: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 93 Rest of Middle East & Africa: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 94 South America: Polybutadiene Market Size, By Country, 2017–2024 (Kiloton)

Table 95 South America: Polybutadiene Market Size, By Country, 2017–2024 (USD Million)

Table 96 South America: Solid Polybutadiene Market Size, By Type, 2017–2024 (Kiloton)

Table 97 South America: Solid Polybutadiene Market Size, By Type, 2017–2024 (USD Million)

Table 98 South America: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 99 South America: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 100 Brazil: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 101 Brazil: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 102 Argentina: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 103 Argentina: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 104 Rest of South America: Polybutadiene Market Size, By Application, 2017–2024 (Kiloton)

Table 105 Rest of South America: Polybutadiene Market Size, By Application, 2017–2024 (USD Million)

Table 106 Expansions, 2015–2019

Table 107 Acquisitions, 2015–2019

Table 108 Agreements & Joint Ventures, 2015–2019

Table 109 New Product Launches, 2015–2019

List of Figures (40 Figures)

Figure 1 Polybutadiene Market: Research Design

Figure 2 Polybutadiene Market Size: Supply-Side Approach

Figure 3 Polybutadiene Market: Data Triangulation

Figure 4 Tires to be the Dominant Application of Polybutadiene Between 2019 and 2024

Figure 5 Solid Polybutadiene Rubber to Dominate the Polybutadiene Market Between 2019 and 2024

Figure 6 High CIS to Register the Highest Growth in the Solid Polybuatdiene Rubber Market

Figure 7 APAC to Remain the Dominant Polybuatdiene Market Till 2024

Figure 8 Polybutadiene Market to Grow at a Moderate CAGR Between 2019 and 2024

Figure 9 Tires to Dominate the Polybutadiene Overall Market, 2019-2024 (Kiloton)

Figure 10 High CIS to Dominate the Solid Polybutadiene Rubber Market, 2019-2024 (Kiloton)

Figure 11 China to Lead the Global Polybutadiene Market

Figure 12 China Projected to be the Fastest-Growing Market Between 2019 and 2024

Figure 13 APAC to be the Fastest-Growing Market Between 2019 and 2024

Figure 14 Overview of Factors Governing the Polybutadiene Market

Figure 15 Porter’s Five Forces Analysis

Figure 16 Regional Share in Vehicle Production, 2018

Figure 17 Top 10 Vehicle Producing Countries, 2018

Figure 18 Solid Polybutadiene Rubber Dominated Overall Polybutadiene Market, By Volume (2018)

Figure 19 Tires Application to Dominate the Polybutadiene Market Between 2019 and 2024

Figure 20 China and India to Witness the Significant Growth During the Forecast Period

Figure 21 APAC: Polybutadiene Market Snapshot

Figure 22 Europe: Polybutadiene Market Snapshot

Figure 23 North America Snapshot: the US to Lead the Polybutadiene Market

Figure 24 Middle East & Africa: Polybutadiene Market Snapshot

Figure 25 South America: Polybutadiene Market Snapshot

Figure 26 Companies Primarily Adopted Expansion as the Key Growth Strategy Between 2015 and 2019

Figure 27 Polybutadiene Market: Competitive Leadership Mapping, 2018

Figure 28 ARALNXEO: Company Snapshot

Figure 29 JSR Corporation: Company Snapshot

Figure 30 UBE Industries, Ltd.: Company Snapshot

Figure 31 Kumho Petrochemical Co. Ltd.: Company Snapshot

Figure 32 The Goodyear Tire & Rubber Company: Company Snapshot

Figure 33 SABIC: Company Snapshot

Figure 34 Reliance Industries Limited: Company Snapshot

Figure 35 LG Chem Ltd.: Company Snapshot

Figure 36 Versalis S.P.A.: Company Snapshot

Figure 37 PJSC SIBUR Holding: Company Snapshot

Figure 38 China Petroleum & Chemical Corporation (Sinopec): Company Snapshot

Figure 39 Kuraray Co. Ltd.: Company Snapshot

Figure 40 Synthos SA: Company Snapshot

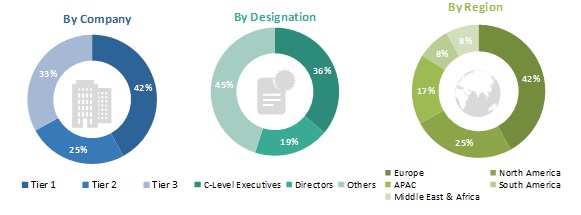

The study involved four major activities to estimate the current market size of polybutadiene. Exhaustive secondary research was done to collect information on market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg Business Week, Factiva, World Bank, and Industry Journals have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

The polybutadiene market comprises several stakeholders, such as raw material suppliers, product manufacturers, and regulatory organizations in the supply chain. The demand side is characterized the share of each application of polybutadiene was found out. The contribution and the subsequent market size of each application were calculated. Supply side characterized the market share of top 10 players and their contribution to the total market. Furthermore, the consumption of polybutadiene in each region was calculated. The regional revenue mix of the leading suppliers of the market was also considered while deriving the regional-level consumption. Following is the breakdown of primary respondents–

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the polybutadiene market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets have been identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the polybutadiene market.

Report Objectives

- To analyze and forecast the size of the global polybutadiene market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market on the basis of type and application

- To analyze and forecast the polybutadiene market on the basis of key regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments such as capacity expansions, new product developments, joint ventures, and mergers & acquisitions in the polybutadiene market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe into Norway, the Netherlands, and Denmark

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Polybutadiene Market