Proppants Market by Type(Frac Sand, Resin-Coated Proppant, Ceramic Proppant), Application (Shale Gas, Tight Gas, Coalbedmethane & Others) and Region - Global Forecast to 2025

Updated on : August 25, 2025

Proppants Market

The global proppants market was valued at USD 7.8 billion in 2020 and is projected to reach USD 12.1 billion by 2025, growing at 9.1% cagr from 2020 to 2025. The improvements in fracturing technology and new drilling techniques, increasing proppants consumption per well, innovation in proppants technologies and the growing natural gas demand to ensure energy security is driving the proppants market during the forecast period. The improvement in the oil prices during the forecast period will also boost the demand of proppants between 2020 and 2025.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on the global proppants market

In 2020, the proppants market declined by 27% in terms of volume, which was due to the oil price crash triggered by the COVID-19 pandemic. The unprecedented demand shock in the oil industry in 2020 led to a historic drop in the oil prices, as governments around the world closed down businesses, issued stay-at home mandates, and restricted travel. Oil prices at the start of 2020 started strong, and by April, the impact of reduced economic activities around the world created an oversupply of oil in the international market, and oil prices plunged dramatically. Another factor that majorly contributed to the freefall of oil prices was the oil price war between Saudi Arabia and Russia, which was initiated at the start of March with both the countries failing to agree on the oil production levels. The Organization of the Petroleum Exporting Countries' (OPEC) failure to act swiftly to cut down oil production to mitigate the lower demand also made the oil prices reach their lowest levels in more than 20 years.

Frac Sand: the fastest-growing type of proppants in the type segment.

Frac sand is a widely used proppant. It is a naturally occurring proppant made from high purity sandstone. These proppants are mostly applicable under closure pressure of 6,000 psi. Frac sand holds a large share of the proppants market and is the preferred proppants at times when the oil prices declines and E&P operators have to reduce there production cost. The growing US shale gas and the development of new shale gas bains around the world are expected to drive the frac sand during the forecast period.

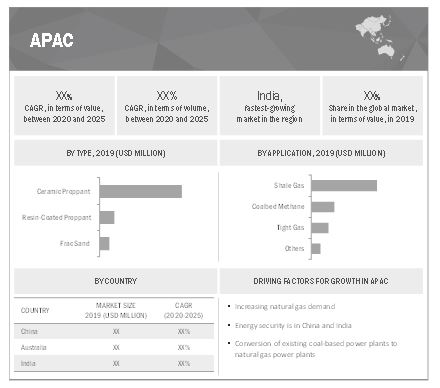

APAC estimated to be the fastest-growing market for proppants.

The domestic demand for natural gas will increase in major APAC economies due to the development of shale gas in the region. The extraction of shale gas is likely to enhance the region’s energy security by allowing the countries to become less dependent on external sources. However, the development of shale gas is at the initial stage. The increasing shale gas production in China with the country trying to replicate the US shale gas boom will majorly drive the proppants demand in APAC during the forecast period.

Proppants Market Dynamics

Driver: Improvements in fracturing technology and new drilling techniques

The combination of horizontal drilling and multistage fracturing technologies has completely changed the scenario for oil and gas production worldwide. Exploration and production companies are experimenting with more sand per stage into their horizontals that are drilled and completed, which is projected to accelerate with time. Since 2013, the average sand consumption per horizontal well has tripled and is still projected to increase through longer laterals and greater loadings per lateral foot. Technologies are developed to increase the use of natural sand/frac sand instead of ceramic sand, resulting in the high demand for proppants for drilling. The use of frac sand reduces the raw material cost by more than 50%. Hence, major shale plays are open to experiment and install new equipment and technologies that are encouraging the consumption of natural sand for fracturing.

Restraints: High cost of ceramic proppants makes it the least preferred proppants when oil prices crash

Ceramic proppants is an engineered product manufactured from sintered bauxite, kaolin, and magnesium silicate or mixtures of bauxite and kaolin using energy-intensive manufacturing process. This manufacturing process is complex as the proppants must have uniform size, shape, sphericity, and roundness to yield higher porosity and permeability of the proppants bed. Ceramic proppants has higher strength and crush resistance than frac sand, as it can withstand closure stresses up to 20,000 psi. Ceramic proppants is costlier than uncoated or resin-coated proppants as it is an engineered product wita more complex manufacturing process. The price of ceramic proppants is about 50% higher than that of frac sand.

Opportunity: Exploration of unconventional oil and gas reserves increasing

Countries such as the US, Canada, China, India, and Russia have been witnessing high demand for oil and gas since the last decade. Limited availability of conventional oil and gas, along with their high level of carbon emission, has led to the growth in the production of unconventional oil and gas such as shale oil & gas, tight oil & gas, and coalbed methane. Countries such as Brazil, Algeria, South Africa, Argentina, Mexico, and Australia have large proven reserves of unconventional oil and gas, which will significantly increase the demand for proppants in the future. However, the increasing protest from local communities and environmental organizations in some of the countries are a concern. Some countries are even banning hydraulic fracking.

Challenges: Water availability and contamination concerns

Hydraulic fracturing is the major application of proppants, and 98% to 99.5% of the fracturing fluid used for hydraulic fracturing is water. Companies usually use a variety of water sources such as rivers, lakes, groundwater, discharge water from industrial or city wastewater treatment plants, and re-used fracturing water. Temporary pipelines or trucks are used to carry the water to drilling locations. Companies attempt to use a mix of water sources depending on the region and the proximity of water sources. On average, 3 million gallons of water is required per well for hydraulic fracturing. However, this quantity varies widely across regions. It also depends on how many stages of fracturing are conducted at a well. There are two distinct problems with regard to water use in hydraulic fracturing. First, the limited availability of water for hydraulic fracturing, and second, concerns related to water contamination due to fracturing chemicals.

APAC estimated to be the fastest-growing market for proppants market

The domestic demand for natural gas will increase in major APAC economies due to the development of shale gas in the region. The extraction of shale gas is likely to enhance the region’s energy security by allowing the countries to become less dependent on external sources. However, the development of shale gas is at the initial stage. Countries are extracting shale gas using advanced technology from their shale gas reserves, majorly driven by China.

The extraction of shale gas is risky and entails a higher cost than the production of conventional gas. The extraction process is supposed to carry out in a sustainable, cost-effective, and socially responsive way. The APAC is the largest coalbed methane producing region in the world. China, India, Australia, Japan, and Indonesia, among other countries in the region, have high coalbed methane reserves. Coalbed methane production in the region is driven by the limited conventional natural gas reserves and high natural gas prices in the international market. Australia is the leading country in the region in terms of high commercial production of coalbed methane, as it has the world's largest coalbed methane reserves. These countries also have significant shale gas reserves. China is expected to have the largest shale gas reserves worldwide. The country has a large availability of raw materials, such as bauxite, alumina, and kaolin, from which ceramic proppants are manufactured. Hence, these proppants will hold a major share in the overall proppants market. The APAC proppants market is expected to be driven by China.

Proppants Market Players

The leading players in the proppants market are Carbo Ceramics Inc. (US), COVIA (US, JSC Borovichi Refractories Plant (Russia), U.S. Silica Holdings Inc. (US), Hi-Crush Inc. (US), Mineração Curimbaba (Brazil), Xinmi Wanli Industry Development Co., Ltd. (China), Atlas Sand Company, Llc (US), and HEXION (US).

Proppants Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Unit considered |

Value (USD Million), Volume (Million Tons) |

|

Segments |

Type, Application, Ceramic Proppants, and Region |

|

Regions |

APAC, North America, Europe, Middle East & North Africa and Rest of the World |

|

Companies |

The major players are, Carbo Ceramics Inc. (US), COVIA (US), JSC Borovichi Refractories Plant (Russia), U.S. Silica Holdings Inc. (US), Hi-Crush Inc. (US), Mineração Curimbaba (Brazil), Emerge Energy Services LP (US), Xinmi Wanli Industry Development Co., Ltd. (China), Atlas Sand Company, Llc (US), HEXION (US) and 15 other players. |

This research report categorizes the global proppants market on the basis of type, application, ceramic proppants and region.

Proppants Market on the basis of type:

- Frac Sand

- Resin-Coated Proppants

- Ceramic Proppants

Proppants Market on the basis of application:

- Shale Gas

- Tight Gas

- Coalbed Methane

- Others (tight oil, deep gas and subsea hydrates)

Proppants Market on the basis of ceramic proppants:

- High Strength Ceramic Proppants

- Intermediate Strength Ceramic Proppants

- Light Weight Ceramic Proppants

- Others (ultra-light weight proppants, ultra-strength proppants, and ultra-conductive proppants)

Proppants Market on the basis of region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & North Africa (MENA)

- Rest of the World

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In March 2020, COVIA completed the expansion of its Canoitas facility located in Mexico. The expansion will enable COVIA to add 350 tons of annual silica production capacity to support the growth of customers in Mexico.

- In March 2020, COVIA expanded the capacbilities of its facility in North America to serve coating & polymers end-markets and create a highly efficient modern facility and the project cost was approximately USD 45 million.

- In May 2019, Hi-Crush Inc. acquired Proppant Logistics LLC which owns Pronghorn Logistics LLC. The company provides end-to end logistic services for proppants.

Key Questions addressed by the report

- What was the market size of proppants and the estimated share of each region in 2020, in terms of volume and value?

- What will be the CAGR of the proppants market in all the key regions during the forecast period?

- What are the new revenue streams for the proppants market?

- What is the growth of ceramic proppants and its type during the forecast period?

- What is the estimated demand for proppants in various applications?

- Who are the major players in the market region wise?

- What is the impact of the COVID-19 pandemic on the proppants market?

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the proppants market?

The major drivers influencing the growth of proppants are the improvement in fracturing technology, increasing proppants consumption per well, innovation in proppants technologies and the growing natural gas demand. .

How is the proppnats market segmented in terms of type?

The proppants market is segmented into frac sand, resin-coated proppant and ceramic proppant.

How is proppants segmented in terms of ceramic proppant?

The proppants market in terms of ceramic proppant are segmented into high strength ceramic proppants, intermediate strength ceramic proppant, lightweight ceramic proppant and others.

How is the proppants market segmented in terms of applications?

The proppants market in terms of applications are segmented into shale gas, tight gas, coalbed methane and others.

What are the biggest restraints for proppants market?

The biggest restraints in the proppants market are the high cost of ceramic proppant and the price fluctuations in oil & gas sector impacting the demand for proppants.

What are the new opportunities in the proppants market?

The new opportunities in the proppants market are the exploration of unconventional oil & gas reserves are increasing and the incorporation of disruptive technologies such as IoT, microchips, sensors,and artificial intelligence in proppants.

Who are the major manufacturers of proppants?

The major manufacturers of proppants are Carbo Ceramics Inc. (US), COVIA (US, JSC Borovichi Refractories Plant (Russia), U.S. Silica Holdings Inc. (US), Hi-Crush Inc. (US), Mineração Curimbaba (Brazil), Xinmi Wanli Industry Development Co., Ltd. (China), Atlas Sand Company, Llc (US), and HEXION (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 MARKET SEGMENTATION DEFINITION, BY TYPE

TABLE 2 MARKET SEGMENTATION DEFINITION, BY APPLICATION

1.3 MARKET SCOPE

FIGURE 1 PROPPANTS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.3.3 INCLUSIONS AND EXCLUSIONS

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 PROPPANTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: BASED ON PROPPANTS DEMAND IN US (2018)

FIGURE 4 MARKET SIZE ESTIMATION: BASED ON FRAC SAND DEMAND IN US (2019)

FIGURE 5 MARKET SIZE ESTIMATION: BASED ON THE SHARES OF PROPPANTS TYPES IN NORTH AMERICA - 2019

2.3 DATA TRIANGULATION

FIGURE 6 PROPPANTS MARKET: DATA TRIANGULATION

2.3.1 ASSUMPTIONS

2.3.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 7 FRAC SAND SEGMENT HELD THE LARGEST SHARE, IN TERMS OF VOLUME, IN 2019

FIGURE 8 APAC TO BE THE FASTEST-GROWING PROPPANTS MARKET

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN PROPPANTS MARKET

FIGURE 9 EMERGING ECONOMIES TO OFFER MARKET GROWTH OPPORTUNITIES

4.2 NORTH AMERICA: PROPPANTS MARKET, BY COUNTRY AND TYPE

FIGURE 10 FRAC SAND SEGMENT AND US ACCOUNTED FOR LARGEST SHARES

4.3 PROPPANTS MARKET, BY TYPE

FIGURE 11 FRAC SAND TO DOMINATE THE OVERALL PROPPANTS MARKET, 2020–2025

4.4 PROPPANTS MARKET, BY APPLICATION

FIGURE 12 SHALE/TIGHT OIL TO DOMINATE THE OVERALL PROPPANTS MARKET, 2020–2025

4.5 PROPPANTS MARKET, BY COUNTRY

FIGURE 13 INDIA TO BE THE FASTEST-GROWING MARKET FOR PROPPANTS, IN TERMS OF VOLUME

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.1.1 COMPARISON OF PROPPANTS TYPES: BY SHAPE, STRENGTH, AND CONDUCTIVITY

FIGURE 14 CERAMIC PROPPANTS IS THE SUPERIOR TYPE OF PROPPANTS

TABLE 3 COMPARISON OF PROPPANTS TYPES, BY SHAPE, STRENGTH, AND CONDUCTIVITY

5.2 PROPPANTS SELECTION

FIGURE 15 PROPPANTS SELECTION CRITERIA

5.3 MARKET DYNAMICS

FIGURE 16 EXPANSION OF MATURED WELLS AND OIL PRICE WILL DRIVE DEMAND FOR CERAMIC AND RESIN-COATED PROPPANTS

5.3.1 DRIVERS

5.3.1.1 Improvements in fracturing technology and new drilling techniques

5.3.1.2 Increasing proppants consumption per well

5.3.1.3 Innovation in proppants technologies driving the demand in well drilling

5.3.1.4 Growing natural gas demand to ensure energy security

5.3.2 RESTRAINTS

5.3.2.1 High cost of ceramic proppants making them the least preferred proppants when oil prices crash

5.3.2.2 Price fluctuations in the oil & gas sector impacting demand for proppants

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing exploration of unconventional oil and gas reserves

5.3.3.2 Incorporation of disruptive technologies such as IoT, microchips, sensors, and AI in proppants

5.3.4 CHALLENGES

5.3.4.1 Water availability and contamination concerns

5.3.4.2 High transportation cost

5.4 PORTER'S FIVE FORCES

FIGURE 17 PORTER'S FIVE FORCES ANALYSIS OF PROPPANTS MARKET

5.4.1 THREAT OF SUBSTITUTES

5.4.2 THREAT OF NEW ENTRANTS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 COVID-19 IMPACT ON PROPPANTS MARKET

FIGURE 18 PRE- & POST-COVID-19 ANALYSIS OF PROPPANTS DEMAND

5.6 PROPPANTS TRADE ANALYSIS

FIGURE 19 PROPPANTS TRADE FLOW MAP

5.7 PROPPANTS ECOSYSTEM

FIGURE 20 PROPPANTS ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 HYDRAULIC FRACTURING TECHNOLOGY

5.8.2 HYDRAULIC FRACTURING FLUIDS

5.8.3 SMART MICROCHIP PROPPANTS TECHNOLOGY

5.8.4 AQUABOND - WATER REDUCTION TECHNOLOGY

5.9 YC, YCC SHIFT

FIGURE 21 ENERGY TRANSITION FROM OIL TO GAS AND ENERGY SECURITY WILL BRING CHANGE IN FUTURE REVENUE MIX

TABLE 4 LIST OF PLAYERS IN YC AND YCC WITH SHIFT

TABLE 5 KEY PROPPANTS MANUFACTURERS BY REGION

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS

5.11 AVERAGE SELLING PRICE ANALYSIS

FIGURE 23 FORECAST FACTORS OF PROPPANTS PRICE ANALYSIS TILL 2025

FIGURE 24 PROPPANTS PRICE FORECAST FOR NORTH AMERICA

FIGURE 25 PROPPANTS PRICE FORECAST FOR EUROPE

FIGURE 26 PROPPANTS PRICE FORECAST FOR APAC

FIGURE 27 PROPPANTS PRICE FORECAST FOR MENA

FIGURE 28 PROPPANTS PRICE FORECAST FOR REST OF WORLD

5.12 CASE STUDY ANALYSIS

5.12.1 NEW POLYMERIC PROPPANT INCREASES LIQUID PRODUCTION OF RUSSIAN OIL AND GAS COMPANY

5.12.2 FRAC SAND-CERAMIC PROPPANT ACHIEVED 34% HIGHER PRODUCTION THAN FRAC SAND ONLY COMPLETED WELLS

TABLE 6 WELL PARAMETERS AND RESULT

5.13 MACROECONOMIC FACTORS

5.13.1 AVERAGE CRUDE OIL PRICES

FIGURE 29 AVERAGE CRUDE OIL PRICES

5.13.2 NATURAL GAS PRODUCTION

FIGURE 30 WORLD NATURAL GAS PRODUCTION, BY REGION

5.13.3 PESTEL ANALYSIS

TABLE 7 PESTEL ANALYSIS OF TOP 4 ATTRACTIVE PROPPANTS MARKETS

5.14 PATENT ANALYSIS

5.14.1 METHODOLOGY

5.14.2 DOCUMENT TYPE

FIGURE 31 GRANTED PATENT HOLDS LARGEST SHARE OF TOTAL PATENT COUNT IN LAST 11 YEARS

FIGURE 32 PUBLICATION TRENDS - LAST 11 YEARS

5.14.3 INSIGHT

FIGURE 33 JURISDICTION ANALYSIS – TOP JURISDICTION BY DOCUMENT COUNT

5.14.4 TOP 10 COMPANIES

FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS

TABLE 8 LIST OF PATENTS BY HALLIBURTON ENERGY SERVICES INC.

TABLE 9 LIST OF PATENTS BY OREN TECHNOLOGIES LLC

TABLE 10 LIST OF PATENTS BY CARBO CERAMICS INC.

TABLE 11 LIST OF PATENTS BY SCHLUMBERGER TECHNOLOGY B.V.

TABLE 12 LIST OF PATENTS BY BASF SE

TABLE 13 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

5.14.5 ULTRA-LIGHTWEIGHT PROPPANTS (ULWP)

TABLE 14 FEW LISTED PATENTS ON ULWP

5.15 FORECASTING FACTORS IMPACTING GROWTH

5.16 RANGE SCENARIO

FIGURE 35 PROPPANT MARKET GROWTH RATE ANALYSIS (OPTIMISTIC, PESSIMISTIC AND REALISTIC SCENARIOS)

5.17 REGULATORY LANDSCAPE

5.17.1 US

5.17.1.1 Regulatory elements for shale gas production

5.17.1.2 Heterogeneity in shale gas regulation

5.17.2 ALGERIA

5.17.2.1 New hydrocarbon law

5.17.3 AUSTRALIA

5.17.3.1 Onshore regulation

5.17.3.2 Offshore regulation

5.17.4 MEXICO

5.17.5 CHINA

5.17.6 BRAZIL

5.17.7 INDIA

6 PROPPANTS MARKET, BY TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 36 CERAMIC PROPPANTS ACCOUNTED FOR THE LARGEST SHARE IN 2019 (BY VALUE)

TABLE 15 PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 16 PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

6.2 FRAC SAND

TABLE 17 FRAC SAND PROPPANT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 FRAC SAND PROPPANT MARKET SIZE, BY REGION, 2018–2025 (MILLION TON)

6.3 RESIN-COATED PROPPANT

TABLE 19 PROPERTIES OF RESINS USED TO COAT PROPPANTS

TABLE 20 RESIN-COATED PROPPANT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 RESIN-COATED PROPPANT MARKET SIZE, BY REGION, 2018–2025 (MILLION TON)

6.4 CERAMIC PROPPANT

TABLE 22 CERAMIC PROPPANT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 CERAMIC PROPPANT MARKET SIZE, BY REGION, 2018–2025 (MILLION TON)

6.4.1 HIGH STRENGTH CERAMIC PROPPANT

6.4.2 INTERMEDIATE STRENGTH CERAMIC PROPPANT

6.4.3 LIGHTWEIGHT CERAMIC PROPPANT

6.4.4 OTHER

TABLE 24 CERAMIC PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 25 CERAMIC PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

7 PROPPANTS MARKET, BY APPLICATION (Page No. - 84)

7.1 INTRODUCTION

FIGURE 37 SHALE/TIGHT OIL ACCOUNTED FOR LARGEST SHARE IN 2019 (USD MILLION)

TABLE 26 PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 27 PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

7.2 SHALE/TIGHT OIL

TABLE 28 PROPPANTS MARKET SIZE IN SHALE/TIGHT OIL, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 PROPPANTS MARKET SIZE IN SHALE/TIGHT OIL, BY REGION, 2018–2025 (MILLION TON)

7.3 SHALE/TIGHT GAS

TABLE 30 PROPPANTS MARKET SIZE IN SHALE/TIGHT GAS, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 PROPPANTS MARKET SIZE IN SHALE/TIGHT GAS, BY REGION, 2018–2025 (MILLION TON)

7.4 COALBED METHANE

TABLE 32 PROPPANTS MARKET SIZE IN COALBED METHANE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 PROPPANTS MARKET SIZE IN COALBED METHANE, BY REGION, 2018–2025 (MILLION TON)

7.5 OTHERS

TABLE 34 PROPPANTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 PROPPANTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (MILLION TON)

8 PROPPANTS MARKET, BY REGION (Page No. - 90)

8.1 INTRODUCTION

FIGURE 38 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 36 PROPPANTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 PROPPANTS MARKET SIZE, BY REGION, 2018–2025 (MILLION TON)

8.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: PROPPANTS MARKET SNAPSHOT

TABLE 38 NORTH AMERICA: PROPPANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: PROPPANTS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 40 NORTH AMERICA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 NORTH AMERICA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

TABLE 42 NORTH AMERICA: PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

8.2.1 US

TABLE 44 US: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 US: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.2.2 CANADA

TABLE 46 CANADA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 47 CANADA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.2.3 MEXICO

TABLE 48 MEXICO: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 MEXICO: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.3 APAC

FIGURE 40 APAC: PROPPANTS MARKET SNAPSHOT

TABLE 50 APAC: PROPPANTS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 51 APAC: PROPPANTS MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION TON)

TABLE 52 APAC: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 53 APAC: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025(MILLION TON)

TABLE 54 APAC: PROPPANTS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 55 APAC: PROPPANTS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

8.3.1 CHINA

TABLE 56 CHINA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 57 CHINA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (MILLION TON)

8.3.2 INDIA

TABLE 58 INDIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 59 INDIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (MILLION TON)

8.3.3 AUSTRALIA

TABLE 60 AUSTRALIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 61 AUSTRALIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025(MILLION TON)

8.3.4 INDONESIA

TABLE 62 INDONESIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 63 INDONESIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (MILLION TON)

8.3.5 MALAYSIA

TABLE 64 MALAYSIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 65 MALAYSIA: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (MILLION TON)

8.3.6 REST OF APAC

TABLE 66 REST OF APAC: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 67 REST OF APAC: PROPPANTS MARKET SIZE, BY TYPE, 2018-2025(MILLION TON)

8.4 EUROPE

TABLE 68 EUROPE: PROPPANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: PROPPANTS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 70 EUROPE: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 EUROPE: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

TABLE 72 EUROPE: PROPPANTS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 73 EUROPE: PROPPANTS MARKET SIZE, BY APPLICATION, 2018-2025(MILLION TON)

8.4.1 RUSSIA

TABLE 74 RUSSIA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 RUSSIA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.4.2 POLAND

TABLE 76 POLAND: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 POLAND: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.4.3 REST OF EUROPE

TABLE 78 REST OF EUROPE: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 REST OF EUROPE: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.5 MENA

TABLE 80 MENA: PROPPANTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 MENA: PROPPANTS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 82 MENA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 MENA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

TABLE 84 MENA: PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 85 MENA: PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

8.5.1 SAUDI ARABIA

TABLE 86 SAUDI ARABIA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 SAUDI ARABIA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.5.2 KUWAIT

TABLE 88 KUWAIT: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 KUWAIT: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.5.3 UAE

TABLE 90 UAE: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 UAE: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.5.4 OTHER GCC COUNTRIES

TABLE 92 OTHER GCC COUNTRIES: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 OTHER GCC COUNTRIES: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.5.5 ALGERIA

TABLE 94 ALGERIA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 ALGERIA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.5.6 REST OF MENA

TABLE 96 REST OF MENA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 REST OF MENA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.6 REST OF THE WORLD

TABLE 98 REST OF THE WORLD: PROPPANTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 99 REST OF THE WORLD: PROPPANTS MARKET SIZE, BY REGION, 2018–2025 (MILLION TON)

TABLE 100 REST OF THE WORLD: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 REST OF THE WORLD: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

TABLE 102 REST OF THE WORLD: PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 103 REST OF THE WORLD: PROPPANTS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

8.6.1 SOUTH AFRICAN REGION

TABLE 104 SOUTH AFRICAN REGION: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 SOUTH AFRICAN REGION: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

8.6.2 SOUTH AMERICA

TABLE 106 SOUTH AMERICA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 SOUTH AMERICA: PROPPANTS MARKET SIZE, BY TYPE, 2018–2025 (MILLION TON)

9 COMPETITIVE LANDSCAPE (Page No. - 123)

9.1 OVERVIEW

FIGURE 41 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

9.2 COMPETITIVE SCENARIO

9.2.1 EXPANSION

TABLE 108 EXPANSION, 2017–2020

9.2.2 MERGER & ACQUISITION

TABLE 109 MERGER & ACQUISITION, 2017–2020

9.2.3 DIVESTMENT

TABLE 110 DIVESTMENT, 2017–2020

9.3 MARKET STRUCTURE

9.4 COMPANY EVALUATION QUADRANT DEFINITION

9.4.1 STAR

9.4.2 EMERGING LEADER

9.4.3 PERVASIVE

9.4.4 PARTICIPANT

FIGURE 42 COMPANY EVALUATION QUADRANT, 2019

9.5 MARKET SHARE ANALYSIS

FIGURE 43 MARKET SHARE OF KEY PLAYERS, 2019 (BY VALUE)

FIGURE 44 MARKET COMPETITIVE IMPERATIVES

9.6 KEY PLAYER STRATEGIES

9.7 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 111 REVENUE ANALYSIS OF KEY PLAYERS

9.8 MARKET EVALUATION FRAMEWORK

FIGURE 45 MARKET EVALUATION FRAMEWORK: MARKET EXPANSION AND CONSOLIDATION BETWEEN 2018 AND 2020

9.9 STRENGTH OF PRODUCT PORTFOLIOS OF TOP PLAYERS

FIGURE 46 TOP FRAC SAND PRODUCERS HAVE WEAKER CERAMIC PRODUCT PORTFOLIO

10 COMPANY PROFILES (Page No. - 131)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 CARBO CERAMICS INC.

FIGURE 47 CARBO CERAMICS INC.: COMPANY SNAPSHOT

10.2 U.S. SILICA HOLDINGS, INC.

FIGURE 48 U.S. SILICA HOLDINGS, INC.: COMPANY SNAPSHOT

TABLE 112 REVENUE OF OIL & GAS PROPPANTS BUSINESS UNIT DECLINED BY 62% DUE TO COVID-19 IMPACT

10.3 MINERAÇÃO CURIMBABA

10.4 COVIA

FIGURE 49 COVIA: COMPANY SNAPSHOT

10.5 HI-CRUSH INC.

TABLE 113 LIST OF PRODUCTION FACILITIES WITH THEIR ANNUAL PRODUCTION CAPACITIES

FIGURE 50 HI-CRUSH INC.: COMPANY SNAPSHOT

TABLE 114 REVENUE OF FRAC SAND FOR HI-CRUSH INC. DECLINED BY 50% TILL JUNE 2020

10.6 XINMI WANLI INDUSTRY DEVELOPMENT CO., LTD.

10.7 EMERGE ENERGY SERVICES LP

FIGURE 51 EMERGE ENERGY SERVICES LP: COMPANY SNAPSHOT

10.8 ATLAS SAND COMPANY, LLC.

10.9 JOINT STOCK COMPANY BOROVICHI REFRACTORIES PLANT

10.1 HEXION

FIGURE 52 HEXION: COMPANY SNAPSHOT

10.11 SUN SPECIALTY PRODUCTS

10.12 ASHAPURA GROUP OF INDUSTRIES

FIGURE 53 ASHAPURA GROUP OF INDUSTRIES: COMPANY SNAPSHOT

10.13 BADGER MINING CORPORATION (BMC)

10.14 ADWAN CHEMICAL INDUSTRIES COMPANY (ACIC)

10.15 HENAN TIANXIANG NEW MATERIALS CO., LTD

10.16 CHANGQING PROPPANT

10.17 BAKER HUGHES

10.17.1 BUSINESS OVERVIEW

10.17.2 PRODUCTS OFFERED

10.18 FULTON TEC GROUP

10.19 FORES LLC

10.20 WELL PRO LLC

10.21 OTHER COMPANIES

10.21.1 PREFERRED SAND LLC

10.21.2 RAINBOW CERAMICS

10.21.3 CHINA CERAMIC PROPPANT

10.21.4 NIKA PETROTECH LLC

10.21.5 DELMON CORPORATION LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 160)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

Overview on Frac Sand Market

Frac sand, also known as silica sand, is a high-purity quartz sand that is used in hydraulic fracturing processes to extract oil and natural gas from shale rock formations. The frac sand market has been experiencing growth due to the increasing demand for oil and gas production worldwide.

Proppants are materials, including frac sand, used in hydraulic fracturing to hold open fissures in rocks and allow oil and natural gas to flow out. Frac sand is the most widely used proppant in hydraulic fracturing operations. Therefore, the frac sand market is an integral part of the proppants market.

As frac sand is the most commonly used proppant, the demand for frac sand has a significant impact on the overall proppants market. The growing demand for oil and gas production is driving the demand for frac sand, which is expected to increase the overall demand for proppants in the coming years.

Which are some futuristic growth use-cases of Frac Sand Market?

The increasing demand for oil and gas production is expected to drive the growth of the frac sand market in the coming years. In addition, the development of new technologies for oil and gas exploration, such as horizontal drilling and hydraulic fracturing, is expected to drive the demand for frac sand.

Who are the top players in Frac Sand Market?

Some of the top players in the frac sand market include US Silica, Fairmount Santrol Holdings Inc., Hi-Crush Partners LP, Emerge Energy Services LP, and Chieftain Sand.

Frac Sand Market Impact on Different Industries

The frac sand market is closely tied to the oil and gas industry, and its growth will have a direct impact on other industries that rely on oil and gas, such as transportation and manufacturing. In addition, the growing demand for frac sand is expected to create new opportunities for companies involved in the transportation, mining, and logistics industries.

Speak to our Analyst today to know more about Frac Sand Market!

The study involved four major activities for estimating the current size of the global proppants market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of proppants through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the proppants market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, edana.org, associations were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

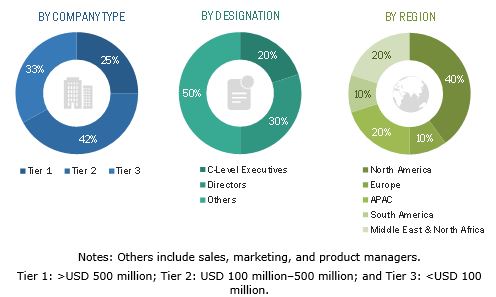

The proppants market comprises several stakeholders such as raw material suppliers, technology developers, proppants companies, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the oil & gas industry. The supply side is characterized by advancements in technology and oil & gas industry. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global proppants market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Bottom-up Approach

Top-Down Approach

The overall market size has been used in the top-down approach to estimate the sizes of other individual markets mentioned in the segmentation through percentage splits derived using secondary and primary sources.

For calculating each type of specific market segment, the size of the most appropriate immediate parent market has been considered for implementing the top-down approach. The bottom-up approach has also been implemented for data extracted from secondary research to validate the market sizes, in terms of value and volume, obtained for each segment.

The exact values of the overall parent and individual markets have been determined and confirmed through the data triangulation procedure and validation of data through primary interviews. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the global proppants market on the basis of type, application, ceramic proppants, and region

- To forecast the market size, in terms of value and volume, of the five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & North Africa (MENA), and Rest of the World.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their key developments such as new product launches, capacity expansions, mergers & acquisitions, and partnerships in the proppants market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Country Information:

- Proppants market analysis for additional countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Pricing Analysis:

- Detailed pricing analysis for each type of proppants

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Proppants Market