Revenue Cycle Management (RCM) Market Size, Growth, Share & Trends Analysis

Revenue Cycle Management (RCM) Market by Offering [Product (Front, Mid, Back-end Solutions), Outsourcing Service], Enterprise Size [Large, SMEs], Technology [AI, Non-AI], End User [Inpatient, Outpatient, Payer, Pharmacy] & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global revenue cycle management market, valued at US$58.27 billion in 2024, stood at US$65.49 billion in 2025 and is projected to advance at a resilient CAGR of 12.4% from 2024 to 2030, culminating in a forecasted valuation of US$117.50 billion by the end of the period. The market's rapid growth is mainly driven by rising healthcare costs, complex billing regulations, and the shift to value-based care models. Increasing adoption of electronic health records, the need for operational efficiency, and regulatory compliance are key factors. Additionally, healthcare providers aim to reduce claim denials, enhance cash flow, and lower administrative burdens. The integration of AI and automation technologies, along with the growing demand for outsourcing RCM services, further speeds up market expansion globally.

KEY TAKEAWAYS

-

BY REGIONThe North America revenue cycle management market dominated, with a share of 40.3% in 2024.

-

BY SOLUTION TYPEBy solution type, the integrated software segment is expected to witness highest growth during the forecast period.

-

BY OFFERINGBy offering, the outsourcing services segment held the largest share, accounting for around 60% of the market in 2024.

-

BY TECHNOLOGY MATURITYBy technology maturity, the AI RCM solutions segment is expected to grow at 14.2% CAGR from 2025 to 2030.

-

BY ENTERPRISE SIZEBy enterprise size, the large enterprises segment is expected to to dominate the market.

-

BY DELIVERY MODEBy delivery mode, the cloud-based models segment is expected to register the highest CAGR of 13.9%.

-

BY END USERBy end user, the healthcare providers segment is expected to hold the largest share of the market.

-

COMPETITIVE LANDSCAPEOracle, Optum, Inc., Epic Systems Corporation, Cognizant, and Experian Information Solutions, Inc. were identified as Star players in the sleep software market, as they have focused on innovation, broad industry coverage, and strong operational & financial strength.

The revenue cycle management (RCM) market is experiencing consistent growth, driven by the increasing adoption of value-based care models, the integration of RCM with electronic health records (EHRs), and a rising demand for outsourcing RCM services to specialized vendors. Additionally, advancements in predictive analytics and automation technologies are enabling healthcare providers to enhance cash flow, reduce claim denials, and achieve greater financial visibility.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The revenue cycle management (RCM) market is being reshaped by AI, cloud computing, and predictive analytics, which enable automation, interoperability, and real-time financial visibility. Healthcare providers, payers, and pharmacies are adopting intelligent billing, claims adjudication, and reimbursement platforms to improve accuracy and reduce revenue leakage. These technologies enhance operational performance, patient billing transparency, and data-driven forecasting, driving a shift toward value-based, digitally optimized revenue ecosystems across the healthcare continuum.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing regulatory requirements and government initiatives

-

Increasing patient volume and subsequent growth in health insurance

Level

-

High deployment costs

-

IT infrastructural constraints in emerging economies

Level

-

Increasing outsourcing services in emerging economies

-

Growing demand for AI and cloud-based deployment

Level

-

Issues related to data security and confidentiality

-

Reluctance to switch from conventional methods

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing regulatory requirements and government initiatives.

In the US, the Patient Protection and Affordable Care Act (PPACA) has prompted the restructuring of private insurance, Medicare, and Medicaid systems. Alongside these changes, the “Meaningful Use” rules of the American Recovery and Reinvestment Act (ARRA) and the Health Information Technology for Economic and Clinical Health Act (HITECH) have mandated the adoption of electronic medical/health records (EMR/EHR) to enhance data interoperability. This will facilitate data exchange among healthcare organizations, providers, and payers. Consequently, this is expected to promote the adoption of patient access solutions such as eligibility verification and medical necessity management. Under the Hospital Value-Based Purchasing (HVBP) Program, Medicare rewards hospitals with payments based on their performance on specific quality measures or their improvement in those areas. Such programs motivate healthcare providers to excel in their core and financial functions, thereby increasing the adoption of RCM solutions.

Restraint: High deployment costs

High deployment costs act as a major barrier in the revenue cycle management market, especially for small and medium-sized healthcare facilities with limited budgets. Implementing comprehensive RCM solutions requires significant upfront spending on software licenses, infrastructure upgrades, hardware, and integrating with existing systems. Additional costs include staff training, data migration, system customization, and ongoing maintenance. These financial hurdles often discourage smaller practices from adopting advanced RCM technologies, leading them to depend on manual processes or outdated systems. The long implementation times and uncertainty about return on investment further discourage healthcare providers from investing in advanced RCM platforms, which limits market growth.

Opportunity: Increasing outsourcing services in emerging economies

The growing use of RCM outsourcing services in emerging economies offers significant growth opportunities for the market. Countries like India, the Philippines, and Latin American nations provide cost-effective solutions with skilled healthcare billing professionals at competitive prices. Healthcare providers in developed countries are using these services to cut operational costs while keeping quality high. Emerging economies benefit from better telecommunications infrastructure, supportive government policies, and large English-speaking workforces. This trend allows healthcare organizations to concentrate on core clinical tasks while outsourcing complex billing and coding activities. Additionally, time zone differences enable 24/7 operations, speeding up claim processing and revenue collection, making outsourcing an appealing strategic choice for improving efficiency and profitability.

Challenge: Issues related to data security and confidentiality

Data security and confidentiality concerns pose critical challenges for the revenue cycle management market, as RCM systems handle sensitive patient information, including medical records, insurance details, and financial data. Cyberattacks, ransomware, and unauthorized access pose a significant threat to data integrity and patient privacy, potentially leading to regulatory penalties, legal liabilities, and reputational damage. Notable breaches, such as the Change Healthcare cyberattack in February 2024, which disrupted healthcare operations nationwide, and R1 RCM's data security incidents, highlight vulnerabilities in RCM infrastructure. These breaches exposed protected health information, causing significant financial losses and eroding trust among healthcare providers. Compliance with stringent regulations, such as HIPAA and GDPR, requires a substantial investment in cybersecurity measures, creating additional operational burdens and costs for RCM vendors and healthcare organizations alike.

revenue-cycle-management-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-enabled RCM platform integrating coding automation, predictive denial prevention, and payer analytics for hospitals and physician groups. | Improves cash flow visibility, reduces claim denials, and enhances revenue recovery through real-time analytics. |

|

Cloud-based RCM suite embedded with ERP and EHR data for unified billing, reimbursement, and contract management across health systems. | Enables financial transparency, streamlines charge capture, and supports scalability for multi-facility networks. |

|

Data-driven RCM solutions supporting pharmacy and specialty care networks with automated claims adjudication and reimbursement tracking. | Enhances payer connectivity, reduces processing delays, and optimizes reimbursement for high-cost therapies. |

|

Integrated RCM module within Epic EHR enabling real-time charge capture, patient cost estimation, and automated denial workflows. | Strengthens revenue integrity, enhances patient billing transparency, and reduces administrative overhead. |

|

Workflow-automation tools and AI-driven compliance modules supporting payer-provider coordination and audit readiness in RCM processes. | Increases accuracy of financial reporting, improves compliance outcomes, and accelerates reimbursement cycles. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The revenue cycle management (RCM) market exists within a vibrant ecosystem that includes healthcare providers, payers, pharmacies, clearinghouses, and technology vendors. Providers depend on RCM platforms for coding, billing, and claims automation, while payers utilize analytics for fraud detection, eligibility checks, and reimbursement precision. Pharmacies employ benefit management and claims reconciliation tools. Supporting this system are software developers, AI/ML vendors, and regulatory agencies that guarantee compliance, interoperability, and data security, collectively advancing a move toward seamless, value-based financial management in healthcare.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

REVENUE CYCLE MANAGEMENT MARKET, BY TECHNOLOGY MATURITY

In 2024, due to technology maturity, non-AI RCM solutions dominated the market with the largest share because of their established presence, proven reliability, and widespread adoption across healthcare facilities. These traditional systems include rule-based software, electronic health records integration, and conventional billing platforms that have been industry standards for years. Healthcare providers continue to prefer non-AI solutions because they are predictable, easier to implement, and familiar to staff. These systems provide enough functionality for standard billing, coding, and claims management without needing extensive data infrastructure or specialized expertise. Additionally, regulatory approval, lower costs compared to AI implementations, and concerns about AI accuracy in critical financial operations help maintain their market dominance.

REVENUE CYCLE MANAGEMENT MARKET, BY ENTERPRISE SIZE

By enterprise size, large enterprises held the largest share of the RCM market in 2024, driven by their substantial patient volumes, complex operational requirements, and greater financial resources for technology investments. These organizations, including multi-specialty hospitals, integrated delivery networks, and large healthcare systems, require comprehensive RCM solutions to manage extensive billing operations, multiple revenue streams, and diverse payer contracts. Large enterprises benefit from economies of scale, making sophisticated RCM implementations more cost-effective. They possess dedicated IT infrastructure, trained personnel, and the capability to integrate advanced technologies seamlessly. Additionally, these organizations face higher regulatory scrutiny and compliance demands, necessitating robust RCM systems for accurate reporting and audit readiness. Their ability to negotiate favorable vendor contracts and customize solutions further reinforces market dominance, though small and medium enterprises are gradually increasing adoption.

REVENUE CYCLE MANAGEMENT MARKET, BY SOLUTION TYPE

By solution type, Integrated RCM solutions held the largest market share because of their comprehensive approach to managing the entire revenue cycle from patient registration to final payment collection. These solutions combine multiple functions, including eligibility verification, coding, claims submission, denial management, payment posting, and reporting into single platforms. Healthcare providers prefer integrated solutions as they eliminate data silos, reduce system redundancies, and ensure smooth information flow across departments. The holistic approach reduces errors, speeds up reimbursement cycles, and provides real-time insight into financial performance. Integrated solutions also lower vendor management complexity and the costs of integrating multiple standalone systems.

REVENUE CYCLE MANAGEMENT MARKET, BY OFFERING

Outsourcing healthcare billing services has gained significant market share as providers strategically partner with specialized vendors to manage complex billing processes. Third-party Revenue Cycle Management (RCM) providers utilize economies of scale, processing large transaction volumes for multiple clients to achieve cost efficiencies that are not possible internally. These vendors stay updated with frequent regulatory changes, payer-specific requirements, and coding updates, thereby reducing compliance risks for healthcare facilities. Outsourcing also helps address workforce challenges, including staff shortages and high turnover in billing departments. Providers value performance-based pricing models that align vendor incentives with revenue performance goals. The ability to scale services up or down according to patient volume, along with quicker claim processing times, makes outsourcing increasingly attractive to various healthcare organizations.

REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE

By delivery mode, on-premise RCM solutions maintain a significant market presence as healthcare organizations prioritize data control, security, and regulatory compliance. These locally-hosted systems appeal to facilities requiring full ownership of sensitive patient and financial information within their own IT infrastructure. On-premise deployment offers greater customization capabilities, allowing healthcare providers to tailor workflows and functionalities to specific organizational needs without cloud vendor limitations. Large hospitals and academic medical centers with established IT departments and resources prefer on-premise solutions for seamless integration with legacy systems and existing hardware investments. These solutions eliminate ongoing subscription fees and provide independence from internet connectivity issues, ensuring uninterrupted operations.

REVENUE CYCLE MANAGEMENT MARKET, BY END USER

End users in healthcare providers form the largest segment in the RCM market, including hospitals, physician practices, ambulatory care centers, and specialty clinics that directly provide patient care. These organizations face increasing pressure to optimize revenue collection due to declining reimbursements, higher patient financial responsibility, and complex payer requirements. Healthcare providers invest significantly in RCM solutions to streamline administrative workflows, reduce claim denials, speed up payment cycles, and enhance cash flow management. They need comprehensive systems that cover patient scheduling, insurance verification, charge capture, coding accuracy, claims submission, and accounts receivable management. Rising operational costs and staffing issues make efficient revenue cycle management essential for financial sustainability.

REGION

Asia Pacific to be fastest-growing region in global revenue cycle management market during forecast period

The Asia Pacific region has emerged as the fastest-growing market for RCM solutions, driven by the rapid expansion of healthcare infrastructure, increasing patient volumes, and rising healthcare expenditures across emerging economies. Countries like China, India, Japan, and Australia are modernizing healthcare systems and adopting digital technologies to improve operational efficiency. Growing medical tourism, expanding insurance coverage, and government initiatives promoting healthcare digitization accelerate RCM adoption. The region's large population base, increasing chronic disease prevalence, and rising demand for quality healthcare services create substantial revenue cycle management needs. Additionally, cost-effective outsourcing destinations in India and the Philippines attract global healthcare providers seeking billing and coding services. Favorable regulatory reforms, increasing foreign investments in healthcare IT, and growing awareness about revenue optimization among Asian healthcare facilities contribute to robust market growth, positioning the Asia Pacific as a critical growth engine.

revenue-cycle-management-market: COMPANY EVALUATION MATRIX

In the revenue cycle management (RCM) market matrix, Oracle Health (Star) leads with a strong, cloud-based RCM portfolio seamlessly integrated within its ERP and EHR ecosystem. Leveraging Oracle Cloud Infrastructure and advanced analytics, the company enables unified financial workflows, predictive revenue forecasting, and compliance-driven automation for large health systems. Its deep interoperability across clinical and financial data positions it as a preferred enterprise-grade solution for digital transformation and value-based care alignment. athenahealth (Emerging Leader) is rapidly expanding its footprint with its cloud-native, AI-powered RCM platform designed for ambulatory and mid-sized provider networks. Offering intelligent claims processing, automated patient billing, and real-time denial management, athenahealth delivers scalable, modular solutions that improve revenue capture, reduce administrative overhead, and enhance cash flow visibility, solidifying its role as a key growth contender in the next generation of healthcare financial management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Optum, Inc. (US)

- Oracle (US)

- McKesson Corporation (US)

- Solventum (US)

- Epic Systems Corporation (US)

- R1 RCM Inc. (US)

- Experian Information Solutions, Inc. (Ireland)

- Conifer Health Solutions. (US)

- Veradigm LLC (US)

- eClinicalWorks (US)

- Cognizant (US)

- athenahealth, Inc. (US)

- The SSI Group, LLC (US)

- Huron Consulting Group Inc. (US)

- GeBBS (US)

- Medical Information Technology, Inc. (US)

- TruBridge (US)

- CareCloud, Inc. (US)

- MEDHOST (US)

- Greenway Health, LLC (US)

- FinThrive (US)

- Plutus Health (US)

- Omega Healthcare Management Services (India)

- Vee Healthtek, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 58.27 BN |

| Market Forecast in 2030 (Value) | USD 117.50 BN |

| Growth Rate | 12.4% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: revenue-cycle-management-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S. RCM Outsourcing Services Provider |

|

|

RECENT DEVELOPMENTS

- March 2025 : R1 RCM Inc. (US) and Palantir Technologies launched R37, an AI lab aimed at transforming healthcare financial operations. By integrating R1's revenue cycle expertise with Palantir's advanced AI tools, R37 seeks to automate processes like coding, billing, and denials management to enhance efficiency and cash flow for healthcare providers

- February 2025 : Experian Information Solutions, Inc. (Ireland) and ValidMind (US) partnered to enhance model risk management for financial institutions. By integrating ValidMind's automated model governance tools with Experian's Ascend Platform, the collaboration aims to streamline regulatory compliance and operational risk management processes

- January 2024 : Materion Beryllium & Composites (a subsidiary of Materion Corporation) partnered with Liquidmetal Technologies Inc. and other Certified Liquidmetal Partners to use their alloy production technologies to provide high-quality products and support services to their customers.

- November 2024 : Veradigm LLC (US) collaborated with Insiteflow (US) to integrate real-time payer insights into multiple EHR platforms, including Epic, to improve care coordination and clinical outcomes

- October 2024 : Oracle (US) has launched a new Patient Portal app that allows patients to securely manage their healthcare, including scheduling appointments, viewing medical records, and receiving reminders

- September 2024 : AvaSure (US) collaborated with Oracle (US) and NVIDIA Corporation (US) to create an AI-powered virtual concierge designed to improve patient care for hospitals. The solution will leverage AvaSure's platform, Oracle Cloud Infrastructure, and NVIDIA's AI technology to enhance efficiency in healthcare settings

Table of Contents

Methodology

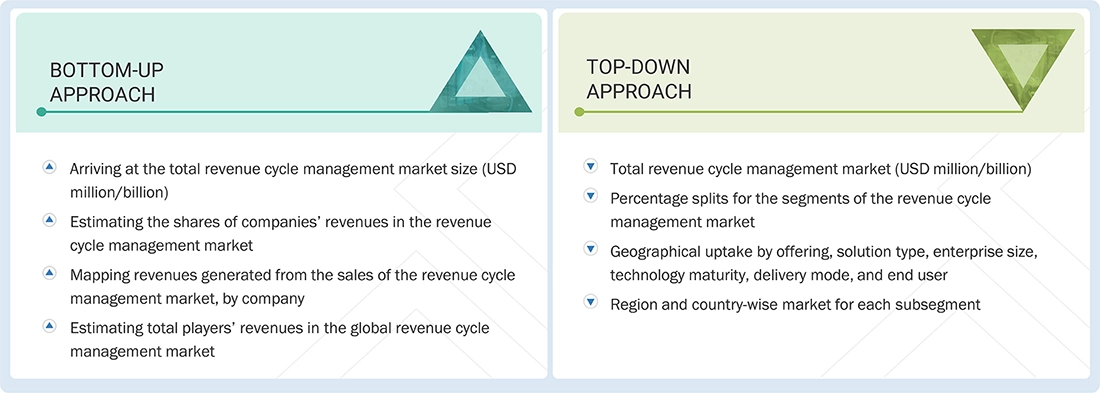

The study involved several key activities to estimate the current size of the revenue cycle management (RCM) market. Extensive secondary research was conducted to gather information on this market. The next step was to validate the findings, assumptions, and size estimates by consulting industry experts throughout the value chain through primary research. Various methods were employed, including top-down and bottom-up approaches, to estimate the overall market size. Following this, we utilized market segmentation and data triangulation techniques to determine the size of specific segments and subsegments within the RCM market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for companies providing RCM solutions is assessed using secondary data from both paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was employed to identify and collect information relevant to the comprehensive, technical, market-oriented, and commercial study of the RCM market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects. Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics, including drivers, restraints, opportunities, challenges, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of revenue cycle management services offered by various players, and understand key market dynamics, including drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

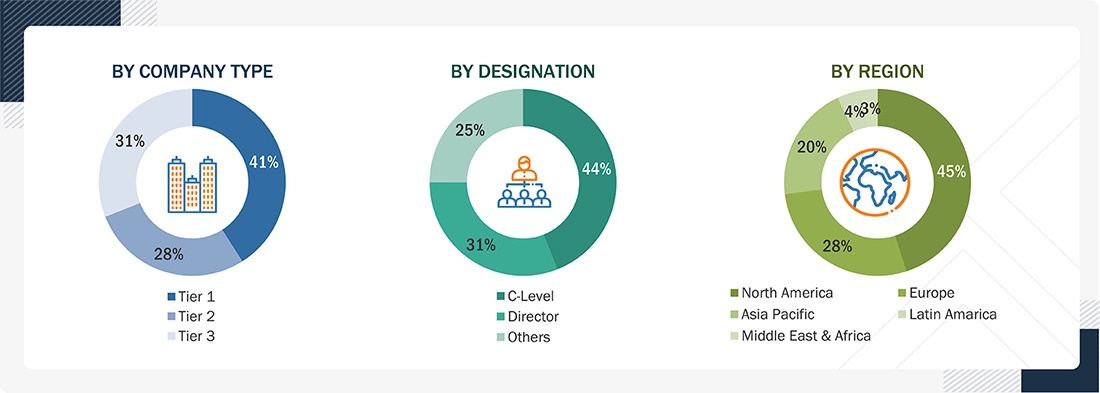

Breakdown of Primary Interviews

Note: Tiers are defined based on a company’s total revenue, as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (assessment of adoption and average spending on RCM solutions by end users) and the top-down approach (revenue share analysis of leading players).

Data Triangulation

After determining the overall market size, the market was segmented and subdivided using market size estimation processes. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the RCM market.

Market Definition

RCM market encompasses the technologies, platforms, and services that enable healthcare organizations to manage the financial lifecycle of patient care, from appointment scheduling and registration to claims submission, payment processing, and revenue reconciliation. RCM integrates clinical, administrative, and financial data to ensure accurate billing, regulatory compliance, and optimized reimbursement. The market encompasses software solutions for front-, mid-, and back-end processes, as well as outsourced services designed to reduce denials, enhance cash flow, and improve overall financial performance across healthcare providers and payers.

Stakeholders

- Healthcare Providers

- Healthcare Payers

- RCM Solution Vendors

- RCM Service Providers

- Healthcare IT Integrators & Consultants

- Regulatory Bodies & Government Agencies

- Investors & Venture Capital Firms

- Health Systems & Hospital Networks

- Medical Billing Companies

- EHR/EMR Vendors

- Cloud Service Providers

- Data Analytics & AI Technology Firms

- Clearinghouses

- Healthcare BPO Companies

- Compliance & Audit Firms

- Pharmaceutical & Life Sciences Companies

- Health Information Exchanges (HIEs)

- Academic & Research Institutions

- Professional Associations & Industry Bodies

- Patient Engagement Platform Providers

Report Objectives

- To define, describe, and forecast the global RCM market based on solution type, offering, technology maturity, enterprise size, delivery mode, end user, and region

- To provide detailed information regarding the factors influencing the growth of the market (such as the drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall RCM market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the RCM market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies in the market

- To track and analyze competitive developments such as product & service launches; expansions; partnerships, agreements, and collaborations; and acquisitions in the RCM market

- To benchmark players within the RCM market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe RCM market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific RCM market into Vietnam, Pakistan, New Zealand, and others

- Further breakdown of the Rest of Latin America RCM market into Argentina, Chile, Colombia, and others

- Further breakdown of the Rest of Middle East & Africa RCM market into Egypt, Nigeria, Israel, and others

Frequently Asked Questions (FAQ)

Who are the leading industry players in the revenue cycle management market?

The prominent players include Optum, Inc. (US), R1 RCM Inc. (US), Oracle (US), Medical Information Technology, Inc. (US), McKesson Corporation (US), Solventum (US), Experian Information Solutions, Inc. (Ireland), Conifer Health Solutions (US), Veradigm LLC (US), eClinicalWorks (US), Cognizant (US), athenahealth, Inc. (US), The SSI Group, LLC (US), Huron Consulting Group Inc. (US), AdvancedMD, Inc. (US), GeBBS (US), Epic Systems Corporation (US), TruBridge (US), CareCloud, Inc. (US), MEDHOST (US), AdvantEdge Healthcare Solutions (US), FinThrive (US), Plutus Health (US), Omega Healthcare Management Services (India), and Vee Healthtek, Inc. (US).

What offerings have been included in the revenue cycle management market report?

Products and Outsourcing Services.

Which geographical region dominates the revenue cycle management market?

The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024, while Asia Pacific is expected to witness the highest growth during the forecast period.

Which end-user segments have been included in the revenue cycle management market report?

Healthcare Providers and Healthcare Payers.

What is the total CAGR expected to be recorded for the revenue cycle management market during 2025–2030?

The market is expected to grow at a CAGR of 11.5% during the forecast period (2025−2030).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Revenue Cycle Management (RCM) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Revenue Cycle Management (RCM) Market

Jessica

Mar, 2022

Which are the major growth driving factors for the End User segment of the Global Revenue Cycle Management Market?.

Karen

Mar, 2022

How the healthcare providers segment holds the largest share of the Revenue Cycle Management Market?.

Nancy

Mar, 2022

Which are the fastest growing economies in the global Revenue Cycle Management Market?.