Risk Analytics Market

Risk Analytics Market by Offering (GRC Software, ERM Software, Third-party Risk Management Tools, Consulting Services, Risk Advisory Services), Risk Type (Operational Risks, Financial Risks, Technology Risks), and Verticals - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

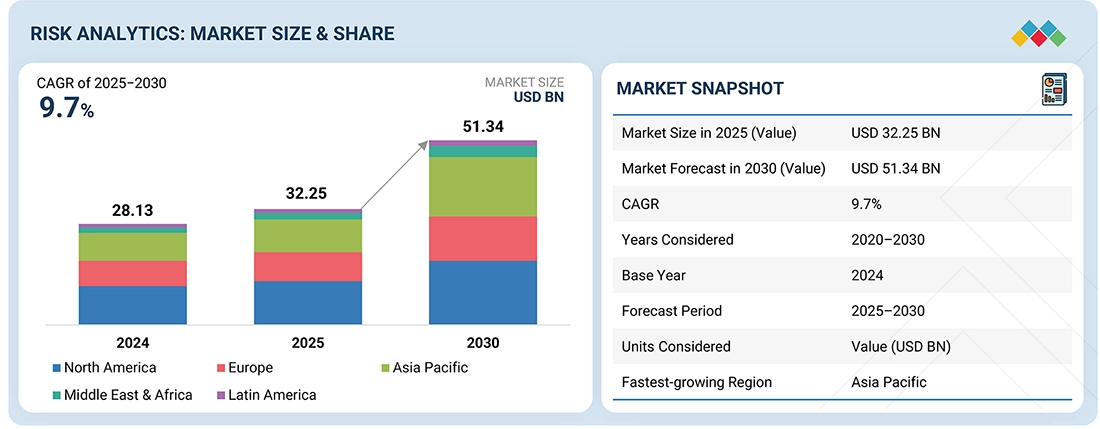

The risk analytics market is poised for significant growth, projected to increase from USD 32.25 billion in 2025 to USD 51.34 billion by 2030, reflecting a robust CAGR of 9.7%. This substantial expansion is driven by the rising complexity of emerging risks and the widespread adoption of advanced technology solutions. Organizations are planning to boost their spending on governance, risk management, and compliance (GRC) and environmental, social, and governance (ESG) software by over 35% in the next two years, indicating a stronger emphasis on enhancing risk management frameworks. Leading companies identify the development of a digital risk strategy as a top priority for the coming years. The increasing use of artificial intelligence (AI) and machine learning in risk assessment, along with the growth of cloud-based analytics tools, is changing how organizations identify and manage risks. As a result, the demand for digital risk strategies and risk advisory services is on the rise, bolstered by favorable regulations and government-supported digital-first initiatives.

KEY TAKEAWAYS

- By region, North America is projected to dominate the risk analytics market with market share of 37.70%.

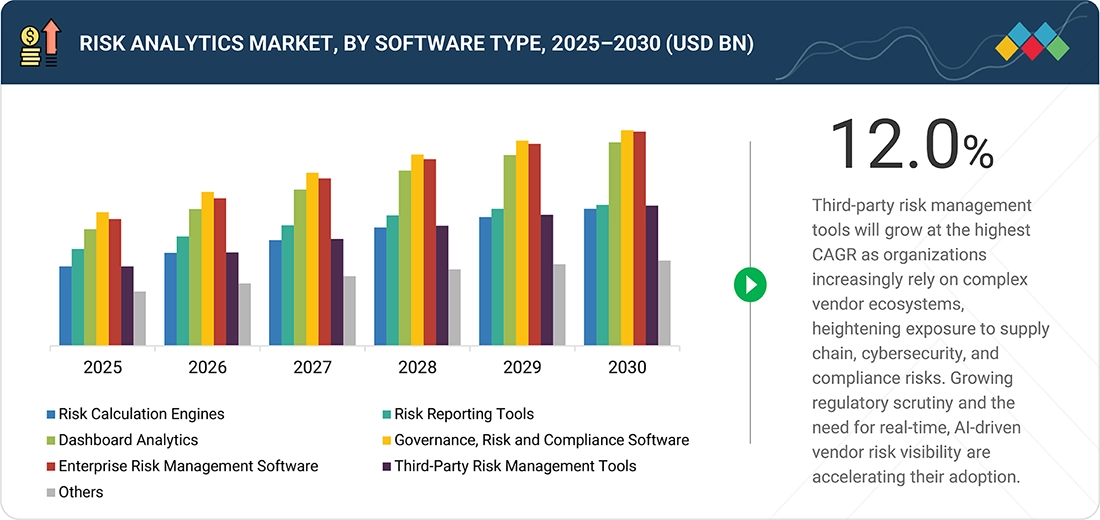

- Third-party risk management tools are expected to grow at the highest CAGR among software types during the forecast period.

- Technology risks are projected to witness the fastest growth among risk types, with a CAGR of 12.1% from 2025 to 2030

- By vertical, the BFSI vertical is estimated to largest market share, and grow at a CAGR of 8.8% during the forecast period

- Market leaders like Moody's Analytics, FIS, and Delloite are combining organic innovation with strategic partnerships and acquisitions to strengthen their portfolios. This dual approach enables faster product evolution, expanded ecosystem coverage, and sustained competitive advantage in a rapidly evolving market.

- Companies like Riskonnect, Archer, and Z2Data among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The risk analytics market has experienced significant growth, driven by the increasing need for data-driven decision-making and regulatory compliance across industries. As businesses face rising threats from cyberattacks, market volatility, and operational risks, the demand for advanced analytics tools has surged. Technologies such as AI, machine learning, and big data have enabled organizations to identify, assess, and mitigate risks more effectively. Additionally, the growing digital transformation of enterprises and the adoption of cloud-based solutions have accelerated market expansion. Financial services, healthcare, and manufacturing are key sectors fueling this growth. The need for real-time risk assessment and the integration of predictive analytics continues to be major drivers propelling the global risk analytics market forward.

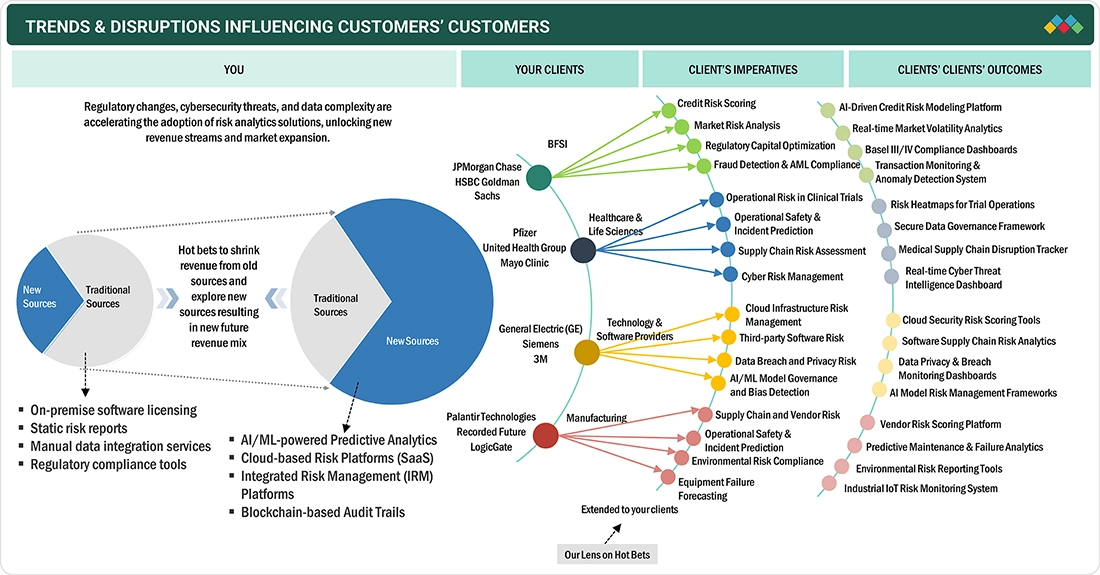

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The risk analytics landscape is rapidly evolving, shaped by technological innovation, shifting regulatory landscapes, and rising demand for real-time, data-driven decision-making. One major trend is the increasing use of AI and machine learning to identify emerging risks, detect anomalies, and generate predictive insights that enhance strategic planning and operational resilience. The adoption of big data analytics is enabling organizations to process vast volumes of structured and unstructured data, uncover hidden risk patterns, and make faster, more informed decisions. Cloud-based risk analytics platforms are also gaining traction, offering scalability, flexibility, and improved cost-efficiency while supporting remote and distributed teams. Regulatory developments, including ESG-related disclosure requirements and evolving financial risk mandates, are pushing businesses to adopt more sophisticated and transparent risk management frameworks. Furthermore, cybersecurity risk analytics is becoming critical as digital threats grow in complexity, driving demand for real-time threat detection and response tools. Finally, there is a growing emphasis on integrated risk management, where organizations adopt a holistic view of enterprise risk across silos, enabling a unified and strategic approach to risk mitigation and business continuity.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising regulatory scrutiny and data-driven governance frameworks are accelerating risk analytics adoption.

-

Rising Cyber Threats Drive Demand for Advanced Risk Analytics

Level

-

Data fragmentation and legacy infrastructure continue to hinder real-time risk intelligence.

-

High Implementation Costs and Technical Complexity

Level

-

Integration of risk analytics with enterprise-wide digital transformation initiatives is creating new value frontiers.

-

Surging adoption of proactively assessing and mitigating potential risks in supply chain operations

Level

-

Balancing automation with explainability in risk algorithms remains a critical hurdle.

-

Model Risk & Bias

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rising regulatory scrutiny and data-driven governance frameworks are accelerating risk analytics adoption.

Across industries, compliance mandates such as Basel III, SOX, and GDPR are pushing enterprises to embed advanced analytics for real-time risk visibility. CXOs are investing in platforms that automate compliance reporting, strengthen internal controls, and enable proactive mitigation, transforming risk from a reactive function into a strategic decision-enabler.

Data fragmentation and legacy infrastructure continue to hinder real-time risk intelligence.

Many enterprises operate with siloed data systems, making it difficult to achieve a unified view of risk exposure. Inconsistent data formats, outdated integration frameworks, and high transformation costs limit scalability. Without seamless interoperability, organizations struggle to derive actionable insights, undermining the effectiveness of analytics investments.

Integration of risk analytics with enterprise-wide digital transformation initiatives is creating new value frontiers.

As organizations modernize core systems and adopt cloud, IoT, and advanced analytics, the demand for embedded, interoperable risk analytics solutions is rising sharply. CXOs are seeking unified platforms that can align financial, operational, and cyber risk insights within a single digital ecosystem. This convergence not only enhances decision accuracy but also transforms risk management into a strategic growth enabler across industries.

Balancing automation with explainability in risk algorithms remains a critical hurdle.

While AI enhances speed and accuracy, lack of transparency in model decision-making creates compliance and trust barriers—especially in regulated sectors like BFSI and healthcare. Ensuring ethical AI governance, model auditability, and regulatory alignment is essential for organizations aiming to scale analytics responsibly and sustain stakeholder confidence.

Risk Analytics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

|

ICON faced decentralized third-party risk management with manual workflows across pharmaceutical and biotech operations. ProcessUnity delivered a centralized TPRM solution that streamlined due diligence, automated risk assessments, and standardized vendor evaluation processes. | ICON improved efficiency and consistency in third-party assessments while reducing compliance difficulties. ProcessUnity enabled better risk decisions, enhanced scalability, and reduced administrative overhead with improved visibility across the vendor ecosystem. |

|

Mastercard faced growing fourth-party vendor risks with thousands entering the network. Lacking visibility into risk controls and data security, MetricStream provided a comprehensive TPRM solution built on the platform running on AWS cloud. | MetricStream centralized and streamlined fourth-party risk management for Mastercard. The solution optimized compliance monitoring, enhanced visibility, and effectively mitigated risks across the payment ecosystem while maintaining robust vendor control. |

|

Piraeus Bank needed to adapt its risk analytics infrastructure to meet stringent regulations and enhance system interoperability. Quantifi offered a robust, lightweight XVA solution that integrated smoothly with internal systems and processes. | Quantifi enabled Piraeus Bank to fulfill current and future regulatory requirements. The solution enhanced risk control, reduced operational inefficiencies, optimized risk costs, and improved IT and operating models effectively. |

|

Fidelity Investments sought to strengthen operational resilience by improving visibility into business processes, dependencies, and vulnerabilities. Fusion Risk Management partnered with Fidelity to implement a comprehensive platform connecting people, processes, systems, and data for proactive risk planning. | Fusion Risk Management enhanced Fidelity's resilience with holistic visibility, streamlined processes, and improved team coordination. The platform empowered faster disruption response, reduced risk exposure, and strengthened continuity planning capabilities. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The risk analytics market ecosystem is shaped by a mix of vendors comprised of different software types and service types. This segmented ecosystem works collaboratively to enhance risk identification, assessment, and mitigation processes, leveraging advanced analytics, AI, and big data to deliver more informed decision-making.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Risk Analytics Market, By Offering

Third-party risk management tools are reshaping how organizations monitor vendor ecosystems. As supply chains and digital partnerships expand, these tools provide continuous assessment of supplier reliability, cybersecurity posture, and compliance performance, ensuring transparency and resilience across interconnected business networks.

Risk Analytics Market, By Risk Type

Technology risks are under sharper scrutiny as organizations contend with cyber threats, data breaches, and IT infrastructure vulnerabilities. Risk analytics platforms now integrate AI-driven monitoring, predictive threat modeling, and incident simulation, helping enterprises safeguard digital assets while maintaining regulatory readiness.

Risk Analytics Market, By Vertical

Healthcare and life sciences organizations are embracing risk analytics to protect patient data, maintain compliance, and manage clinical and operational risks. With increased digitization of medical records and R&D data, these institutions rely on analytics tools to detect anomalies, ensure data integrity, and build robust security frameworks across critical healthcare systems.

REGION

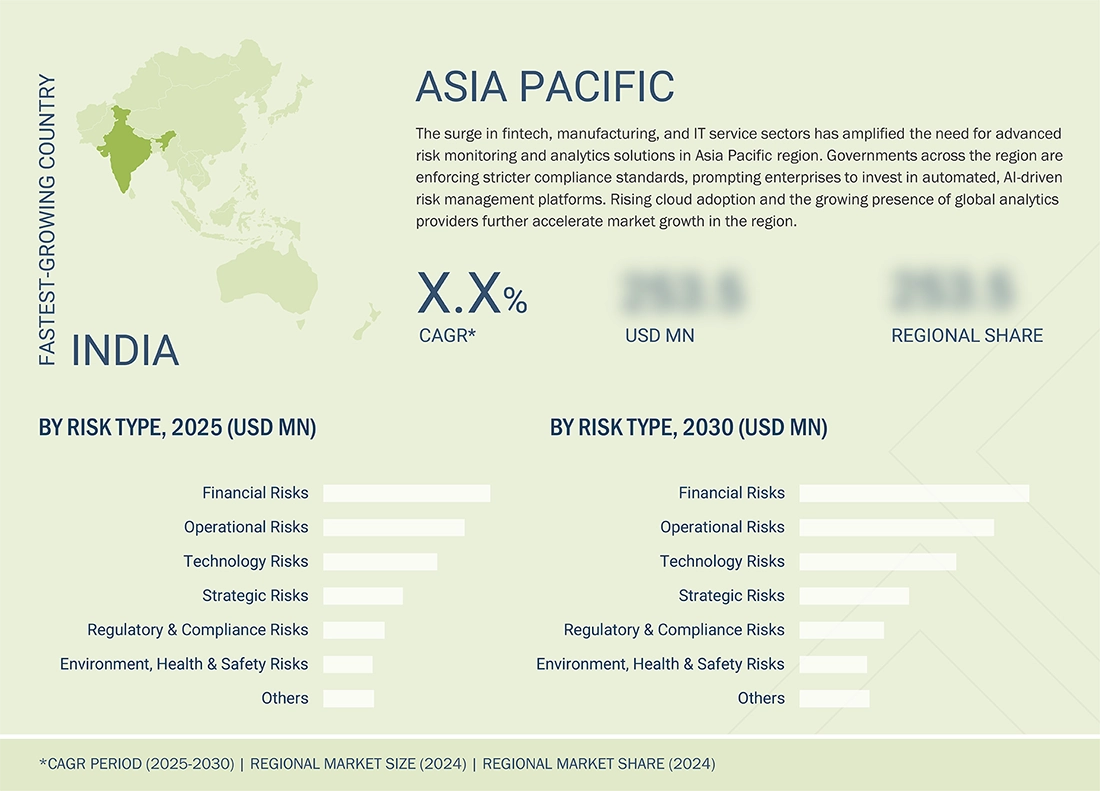

Asia Pacific to be fastest-growing region in global Risk Analytics Market during forecast period

The Asia Pacific risk analytics market is experiencing significant growth, fueled by increasing regulatory requirements, the growing need for actionable insights for informed business decisions, and the rising adoption of cloud-based solutions, especially among SMEs, due to their scalability and cost-effectiveness. Emerging economies in the region present numerous opportunities across various industry verticals.

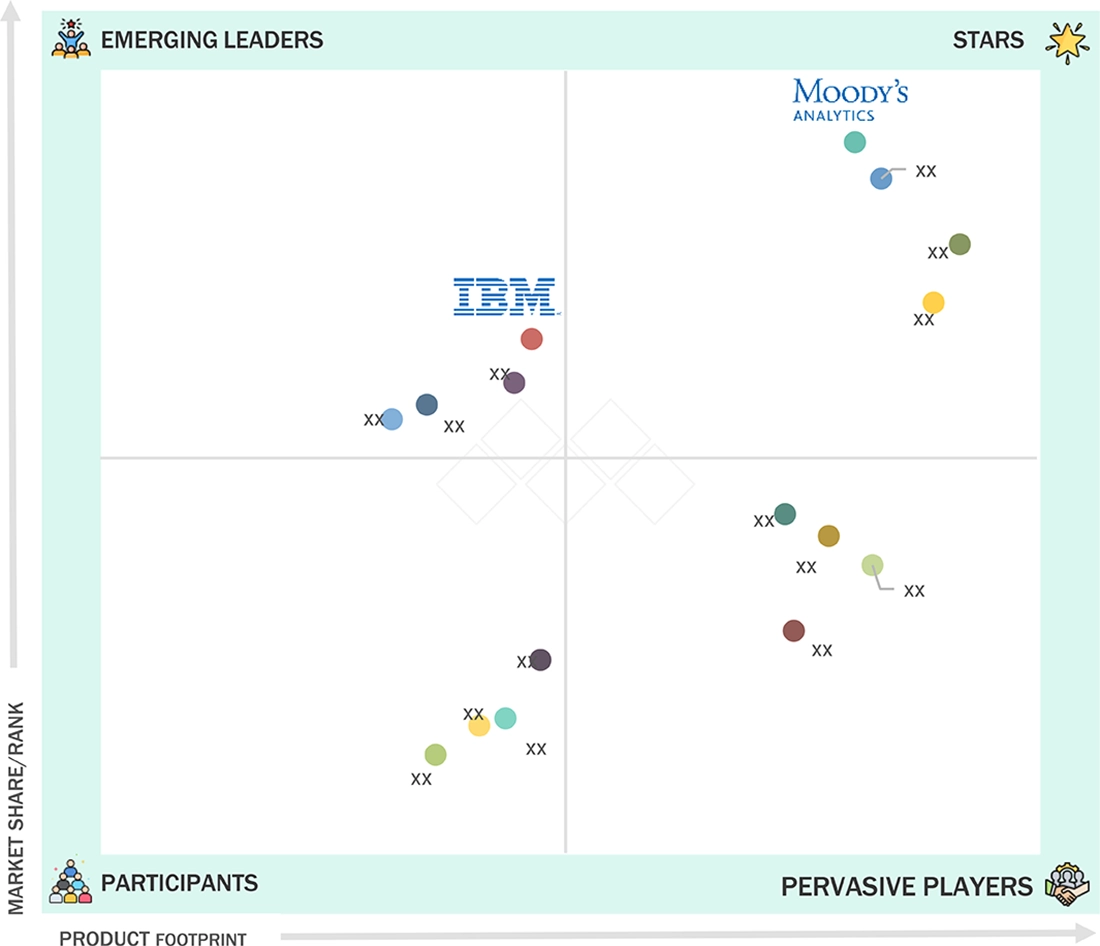

Risk Analytics Market: COMPANY EVALUATION MATRIX

In the Risk Analytics market matrix, Moody’s Analytics (Star) leads with its comprehensive suite of data-driven solutions that enable organizations to assess, quantify, and manage financial and operational risks with precision. Its advanced modeling capabilities, deep domain expertise, and integration of AI and predictive analytics strengthen its position as the trusted leader in risk intelligence and decision support. IBM (Emerging Leader) is gaining traction with its AI-powered risk analytics platforms that leverage machine learning and automation to enhance risk detection, scenario modeling, and regulatory compliance. Its innovative use of hybrid cloud and data integration technologies positions it as a fast-rising player driving modernization in the risk analytics landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 32.25 BN |

| Market Forecast in 2030 (value) | USD 51.34 BN |

| Growth Rate | 9.70% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Units Considered | USD Million |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

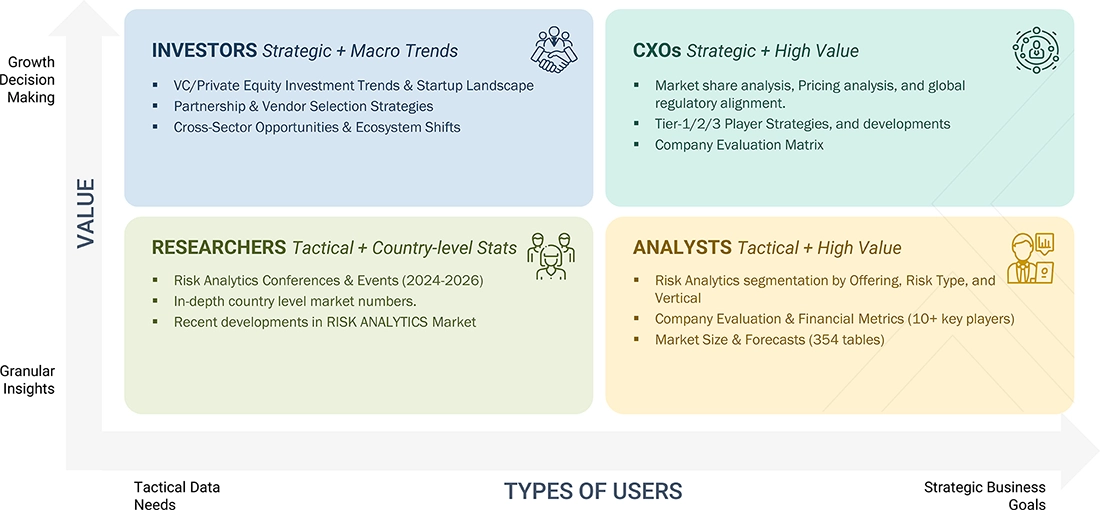

WHAT IS IN IT FOR YOU: Risk Analytics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Risk Analytics Vendor-KSA |

|

|

| Leading Risk Analytics Vendor |

|

|

RECENT DEVELOPMENTS

- March 2025 : Deloitte entered a strategic partnership with Mercans to develop and implement a best-in-class Quality Management and Risk Framework. Deloitte brings valuable expertise in enhancing internal controls, governance, and quality assurance. This move strengthens Mercans' ability to offer secure, compliant, and future-ready solutions for its clients, reinforcing its commitment to operational excellence and regulatory adherence.

- January 2025 : IBM and Telefónica Tech announced a collaboration agreement to develop and deliver security solutions that address security challenges posed by future cryptographically relevant quantum computers. Telefónica Tech plans to integrate IBM's quantum-safe technologies to strengthen proactive risk assessments and help organizations detect and fix cryptographic vulnerabilities in their systems.

- January 2025 : Aon partnered with Moody's to enhance its insurance and risk management services by integrating Moody's credit data and analytics. This collaboration enables Aon's clients to gain deeper insights into creditworthiness and potential exposures. Initially launched in Europe, the partnership aims for global expansion. ?

- January 2025 : Oracle announced the latest updates to its Oracle Risk Management and Compliance platform. The update introduced features like automated analysis of segregation of duties (SoD), fraud detection, and compliance monitoring. Pre-built algorithms were enhanced for continuous monitoring of high-risk areas such as financial transactions and sensitive configurations. New graphical dashboards were added to improve visibility into compliance processes.

- January 2025 : SAP and SNP SE expanded their partnership to accelerate customer transitions to RISE with SAP, focusing on efficient, low-risk migrations with minimal downtime. They are also exploring collaboration in data management for SAP S/4HANA Public Cloud. ?

Table of Contents

Methodology

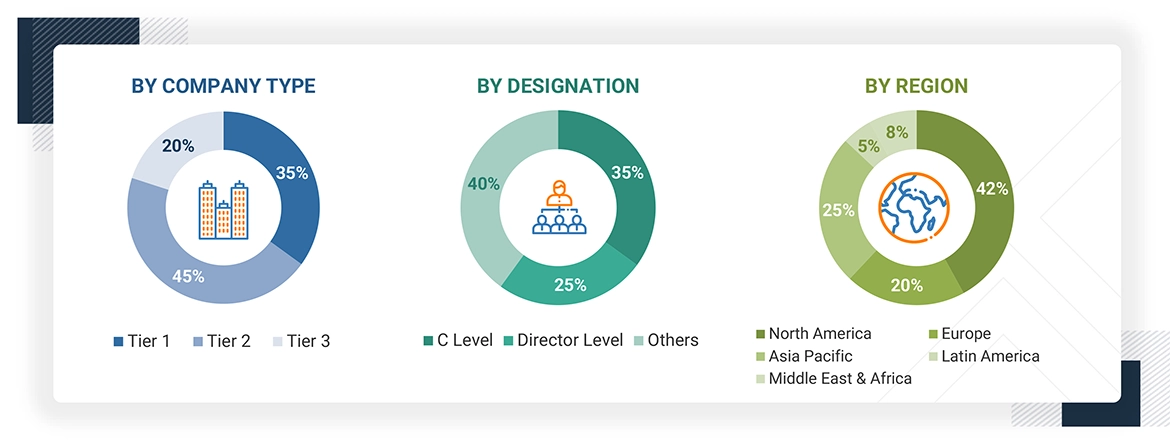

The research study on the risk analytics market utilized a wide range of sources, including secondary sources, directories, journals, and paid databases. Primary sources included industry experts from core and related sectors, preferred risk analytics providers, third-party service providers, consulting companies, end users, and other commercial enterprises. In-depth interviews with key industry participants and subject matter experts were conducted to collect and verify essential qualitative and quantitative information, as well as to evaluate the market's prospects.

Secondary Research

During the secondary research process, a variety of sources were utilized to gather information for the study. These sources included annual reports, press releases, investor presentations from companies, white papers, academic journals, certified publications, and articles authored by recognized experts. Additionally, directories and databases were consulted, along with insights obtained from AI conferences and relevant magazines. Data on risk analytics spending across different countries was collected from appropriate sources. Secondary research was employed to gather critical information about the industry's value chain and supply chain, helping to identify key players based on solutions, services, market classifications, and segmentations. This analysis focused on the offerings of major players, as well as industry trends concerning solutions, applications, verticals, and regions. Key developments were examined from both, market-oriented and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and risk analytics expertise; related key executives from risk analytics solution vendors, SIs, managed service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data from solutions and services, market breakdowns, market size estimates, market forecasts, and data triangulation. This primary research also provided an understanding of various trends related to technologies, applications, data types, service types, software types, verticals, and regions. Stakeholders from the demand side, such as chief information officers (CIOs), chief technology officers (CTOs), chief strategy officers (CSOs), and end users of risk analytics solutions, were interviewed to gain insight into the buyers' perspectives on suppliers, products, service providers, and their current use of risk analytics. This information will impact the overall risk analytics market.

Note: Tier 1 companies account for annual revenue of >USD 10 billion; tier 2 companies' revenue ranges

between USD 1 and 10 billion; and tier 3 companies' revenue ranges between USD 500 million–USD 1 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

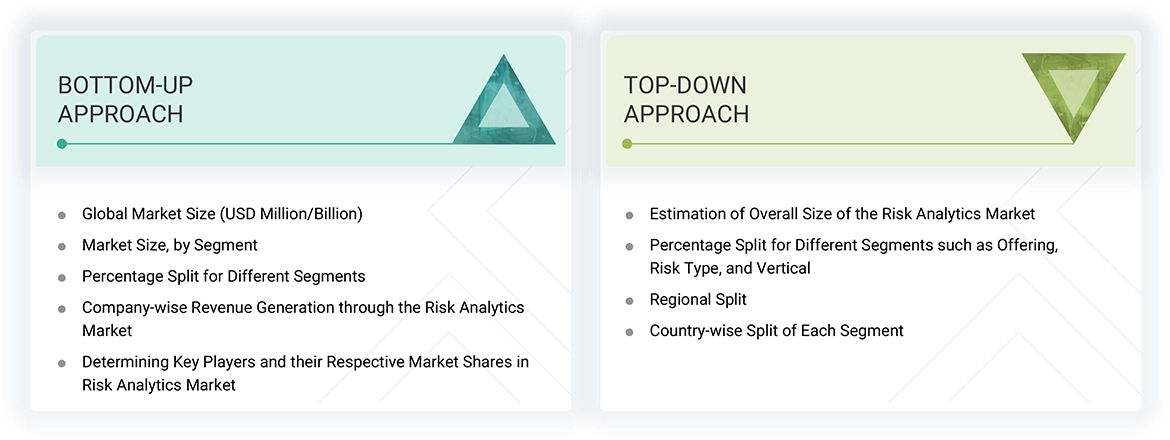

Market Size Estimation

Various methods were used to estimate and forecast the risk analytics market. The first method involves estimating the market size by summing the revenue generated by companies selling solutions and services.

Market Size Estimation Methodology: Top-down Approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the risk analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions according to software type, service type, risk type, and vertical. The aggregate of all the companies' revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both, primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology: Bottom-up Approach

In the bottom-up approach, the adoption rate of risk analytics solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of risk analytics solutions among industries, along with different use cases with respect to their regions, was identified and extrapolated. Use cases identified in different regions were given weightage for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the risk analytics market's regional penetration. Based on secondary research, the regional spending on information and communications technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major risk analytics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall risk analytics market size and segment size were determined and confirmed in the study.

Risk Analytics Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The risk analytics market comprises digital solutions that enable insurers to manage core processes such as policy administration, underwriting, claims management, and customer engagement. These platforms leverage cloud computing, automation, and data analytics to enhance operational efficiency, improve customer experiences, and support product innovation. They cater to insurers, brokers, and third-party service providers, facilitating seamless integration with ecosystems and regulatory compliance.

Stakeholders

- Risk analytics software providers

- Risk analytics service providers

- Third-party administrators

- Business analysts

- Cloud service providers

- Consulting service providers

- Enterprise end users

- Distributors and value-added resellers

- Government agencies

- Independent software vendors

- Managed service providers

- Market research and consulting firms

- Support & maintenance service providers

- System integrators/Migration service providers

- Technology providers

Report Objectives

- To define, describe, and forecast the risk analytics market by offering, risk type, and vertical

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the risk analytics market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size across five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the risk analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company's specific needs. The following customization options are available for the report.

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American risk analytics market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin American risk analytics market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Risk Analytics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Risk Analytics Market