2

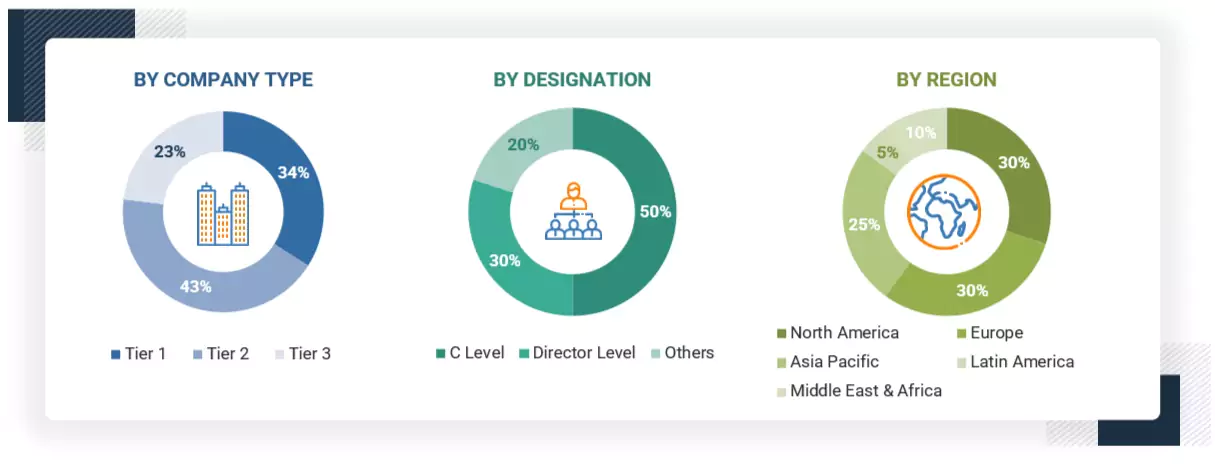

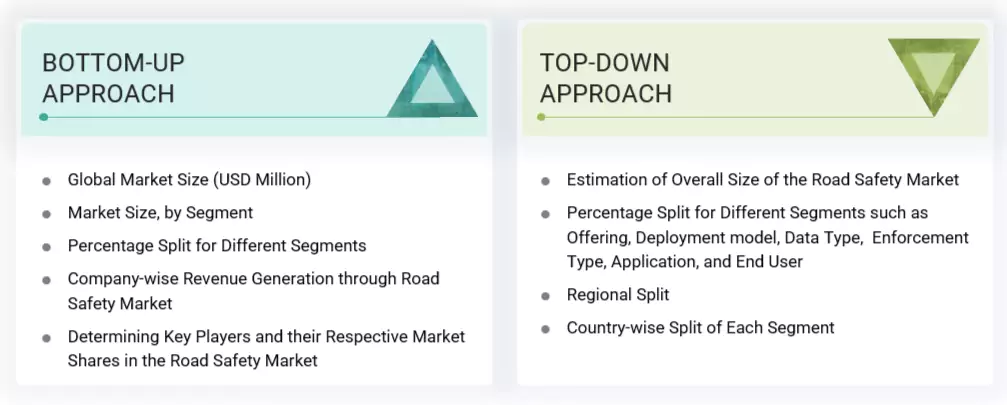

RESEARCH METHODOLOGY

42

5

MARKET OVERVIEW AND INDUSTRY TRENDS

Urbanization and tech integration revolutionize road safety, despite privacy and infrastructure challenges.

63

5.2.1.1

Urban surge fuels smart road safety revolution amid rising traffic risks

5.2.1.2

Commercial fleets push for safety-driven operational efficiency

5.2.1.3

Enforcement to improve compliance with governments

5.2.1.4

Adoption of digitalization and technologies in road safety market

5.2.1.5

Government initiatives for enhancing road safety

5.2.2.1

Lack of standardized and uniform technologies

5.2.2.2

Data privacy and surveillance concerns hinder adoption of road safety technologies

5.2.3.1

Improved intelligent transportation systems for road safety

5.2.3.2

Integration of AI and predictive analytics in traffic management systems

5.2.3.3

Evolving 5g technology and transformation of road safety systems

5.2.4.1

Infrastructure gaps and budget constraints limit road safety technology deployment

5.2.4.2

Digital reluctance and fragmentation in legacy fleet segments

5.3

IMPACT OF 2025 US TARIFF ON ROAD SAFETY MARKET

5.3.3

PRICE IMPACT ANALYSIS

5.3.3.1

Strategic shifts and emerging trends

5.3.4

IMPACT ON COUNTRY/REGION

5.3.5

IMPACT ON END-USE INDUSTRIES

5.3.5.1

Government and municipalities

5.3.5.2

Highway authorities

5.3.5.3

Law enforcement agencies

5.3.5.4

Private toll operators

5.3.5.5

Smart city integrator

5.3.5.6

Construction companies

5.4

EVOLUTION OF ROAD SAFETY SOLUTIONS

5.5

SUPPLY CHAIN ANALYSIS

5.6

IMPACT OF GENERATIVE AI ON ROAD SAFETY MARKET

5.6.1

TOP USE CASES & MARKET POTENTIAL

5.6.2

TRAFFIC INCIDENT REPORTING AND DOCUMENTATION

5.6.3

SYNTHETIC DATA GENERATION FOR TRAINING AI MODELS

5.6.4

PREDICTIVE VIOLATION & ACCIDENT RISK MODELING

5.6.5

AUTOMATED PUBLIC AWARENESS CAMPAIGNS

5.6.6

LAW ENFORCEMENT SUPPORT

5.6.7

INFRASTRUCTURE DESIGN & SIMULATION

5.7.1

ROAD SAFETY MARKET: SOLUTION TYPE

5.7.1.1

Enforcement solution

5.7.1.2

ALPR/ANPR (automatic number plate recognition)

5.7.1.3

Incident detection & response

5.7.1.4

Traffic monitoring & control

5.7.1.5

Pedestrian safety solutions

5.8

INVESTMENT LANDSCAPE AND FUNDING SCENARIO

5.9.1

USE CASE 1: SIEMENS HELPED YUNEX TRAFFIC WITH ADAPTIVE TRAFFIC CONTROL AND MANAGEMENT, HIGHWAY, AND TUNNEL AUTOMATION AS WELL AS SMART SOLUTIONS FOR V2X AND ROAD USER CHARGING (TOLLING)

5.9.2

USE CASE 2: MOTOROLA SOLUTIONS HELPED VICTORIA POLICE WITH NUMBER PLATE RECOGNITION WITH ANPR TECHNOLOGY

5.9.3

USE CASE 3: CONDUENT AND HAYDEN AI ANNOUNCED TECHNOLOGY PARTNERSHIP TO IMPROVE BUS LANE PERFORMANCE AND TRAFFIC SAFETY

5.9.4

USE CASE 4: SWARCO ROAD MARKING SYSTEMS AND ISAC GMBH MEASURED DETECTABILITY OF ROAD MARKINGS

5.9.5

CASE STUDY 6: DATA COLLECTION LIMITED ENHANCED ROAD INFRASTRUCTURE MANAGEMENT WITH TELEDYNE FLIR IMAGING SOLUTIONS

5.10.1.1

Artificial intelligence (AI)

5.10.1.2

Internet of things (IoT)

5.10.1.3

Geographic information systems (GIS)

5.10.1.4

Automatic number plate recognition (ANPR)

5.10.1.5

Vehicle-to-infrastructure (V2I) and vehicle-to-everything (V2X)

5.10.2

COMPLEMENTARY TECHNOLOGIES

5.10.2.1

Big data and analytics

5.10.3

ADJACENT TECHNOLOGIES

5.10.3.1

Advanced traffic management systems (ATMS)

5.10.3.2

Smart city solutions

5.11

TARIFF AND REGULATORY LANDSCAPE

5.11.1

TARIFF RELATED TO ROAD SAFETY SOLUTIONS

5.11.2

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.3.4

Middle East & Africa

5.12.1

EXPORT SCENARIO OF ELECTRICAL SIGNALING AND TRAFFIC CONTROL EQUIPMENT (HS CODE 853080)

5.12.2

IMPORT SCENARIO OF ELECTRICAL SIGNALING AND TRAFFIC CONTROL EQUIPMENT (HS CODE 853080)

5.13.2

PATENTS FILED, BY DOCUMENT TYPE

5.13.3

INNOVATION AND PATENT APPLICATIONS

5.14.1

AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

5.14.2

INDICATIVE PRICING, BY APPLICATION, 2025

5.15

KEY CONFERENCES AND EVENTS (2025–2026)

5.16

PORTER’S FIVE FORCES ANALYSIS

5.16.1

THREAT OF NEW ENTRANTS

5.16.2

THREAT OF SUBSTITUTES

5.16.3

BARGAINING POWER OF BUYERS

5.16.4

BARGAINING POWER OF SUPPLIERS

5.16.5

INTENSITY OF COMPETITIVE RIVALRY

5.17

TRENDS AND DISRUPTIONS IMPACTING BUYERS

5.18

KEY STAKEHOLDERS AND BUYING CRITERIA

5.18.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.19.1

ROAD SAFETY TECHNOLOGY ROADMAP TILL 2030

5.19.1.1

Short-term roadmap (2024–2026)

5.19.1.2

Mid-term roadmap (2026–2028)

5.19.1.3

Long-term roadmap (2028–2030)

5.20

PARTNERSHIP & ECOSYSTEM STRATEGIES

5.20.1

PARTNERSHIP & ECOSYSTEM STRATEGIES

5.21

STRATEGIC IMPERATIVES FOR STAKEHOLDERS

5.21.1

STRATEGIC IMPERATIVES FOR STAKEHOLDERS

6

ROAD SAFETY MARKET, BY OFFERING

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 44 Data Tables

119

6.1.1

OFFERING: ROAD SAFETY MARKET DRIVERS

6.2.1

ENABLING SAFER ROADS THROUGH END-TO-END INTELLIGENT TRAFFIC ENFORCEMENT AND MANAGEMENT SOLUTIONS

6.2.2.1

Enforcement solutions

6.2.2.3

Incident detection and response

6.2.2.4

Traffic monitoring & control

6.2.2.5

Pedestrian safety

6.3.1

OFFER PROFESSIONAL AND MANAGED SERVICES FOR INSTALLATION, COMMISSIONING, CALIBRATION, AND FUNCTIONAL TESTING OF CRITICAL ROAD SAFETY EQUIPMENT

6.3.2

PROFESSIONAL SERVICES

6.3.2.2

System integration

6.3.2.4

Road safety audits

6.3.3.1

Outsourced operations

6.3.3.2

System maintenance

6.3.3.3

Analytics-as-a-service

6.3.3.4

Back-office processing

7

ROAD SAFETY MARKET, BY DEPLOYMENT MODEL

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 10 Data Tables

155

7.1.1

DEPLOYMENT MODEL: ROAD SAFETY MARKET DRIVERS

7.2.1

ESTABLISHING LONG-TERM AND HIGH-ACCURACY ROAD SAFETY INFRASTRUCTURE AT CRITICAL TRAFFIC ZONES

7.3

MOBILE/TRAILER-MOUNTED SYSTEMS

7.3.1

DEPLOYING SEMI-PERMANENT AND RELOCATABLE TRAFFIC MONITORING UNITS FOR FLEXIBLE AND TARGETED COVERAGE

7.4

PORTABLE/TEMPORARY SOLUTIONS

7.4.1

UTILIZING LIGHTWEIGHT AND RAPIDLY DEPLOYABLE ENFORCEMENT TOOLS FOR SHORT-DURATION OR ON-DEMAND TRAFFIC SAFETY OPERATIONS

7.5

CLOUD-BASED PLATFORMS

7.5.1

IMPLEMENTING CENTRALIZED AND SCALABLE CLOUD-BASED PLATFORMS TO MANAGE, PROCESS, AND ANALYZE ROAD SAFETY DATA IN REAL-TIME

8

ROAD SAFETY MARKET, BY ENFORCEMENT TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 8 Data Tables

162

8.1.1

ENFORCEMENT TYPE: ROAD SAFETY MARKET DRIVERS

8.2

AUTOMATED ENFORCEMENT

8.2.1

DEPLOYING INTELLIGENT TECHNOLOGY-DRIVEN SYSTEMS TO ENABLE CONTINUOUS, UNBIASED, AND FULLY AUTOMATED ENFORCEMENT OF TRAFFIC VIOLATIONS ACROSS DIVERSE ENVIRONMENTS

8.3.1

CONDUCTING FIELD-LEVEL ENFORCEMENT OPERATIONS THROUGH HUMAN INTERVENTION TO ENSURE REGULATORY COMPLIANCE AND ADDRESS SITUATIONAL ROAD SAFETY CHALLENGES

8.4.1

ENSURE RELIABLE, FLEXIBLE, AND REAL-TIME AI DELIVERY WITH ADVANCED MODEL DEPLOYMENT AND SERVING FUNCTIONALITIES

9

ROAD SAFETY MARKET, BY DATA TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 8 Data Tables

168

9.1.1

DATA TYPE: ROAD SAFETY MARKET DRIVERS

9.2.1

HARNESSING REAL-TIME AND HIGH-RESOLUTION VISUAL EVIDENCE THROUGH AI-ENABLED CAMERA NETWORKS TO AUTOMATE VIOLATION DETECTION AND ENHANCE INCIDENT TRACEABILITY IN TRAFFIC ECOSYSTEMS

9.3.1

CONDUCTING DEPLOYING HIGH-PRECISION ROADWAY AND ROADSIDE SENSORS TO CAPTURE REAL-TIME VEHICLE AND TRAFFIC BEHAVIOR DATA FOR CONTINUOUS, NON-VISUAL MONITORING

9.4.1

AGGREGATING CROSS-DOMAIN AND MULTI-SOURCE DATASETS INTO SCALABLE PLATFORMS TO ENABLE PREDICTIVE ROAD SAFETY INTELLIGENCE, OPTIMIZE ENFORCEMENT STRATEGIES

10

ROAD SAFETY MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 20 Data Tables

174

10.1.1

APPLICATION: ROAD SAFETY MARKET DRIVERS

10.2

VIOLATION MANAGEMENT

10.2.1

IMPLEMENTING INTELLIGENT ROAD SAFETY SOLUTIONS TO AUTOMATE VIOLATION DETECTION AND STREAMLINE CITATION PROCESSING FOR SAFER ROAD NETWORKS

10.3

TRAFFIC OPTIMIZATION

10.3.1

USING DATA-DRIVEN CONTROL STRATEGIES AND REAL-TIME OPTIMIZATION TECHNOLOGIES WILL REDUCE CONGESTION AND ENHANCE MOBILITY ACROSS URBAN ROAD NETWORKS

10.4.1

DEPLOYING PREDICTIVE ANALYTICS AND ENVIRONMENTAL SENSING TECHNOLOGIES TO IDENTIFY RISK ZONES AND IMPLEMENT PROACTIVE MEASURES

10.5.1

ENABLING ACCELERATED INCIDENT DETECTION AND REAL-TIME COORDINATION OF EMERGENCY SERVICES TO REDUCE RESPONSE TIME

10.6

DRIVER BEHAVIOR MONITORING

10.6.1

LEVERAGING IN-VEHICLE ANALYTICS AND SENSOR FUSION TO TRACK AND CORRECT UNSAFE DRIVING BEHAVIORS FOR LONG-TERM BEHAVIORAL CHANGE AND CRASH REDUCTION

10.7

PUBLIC AWARENESS/TRAINING

10.7.1

PROMOTING ROAD SAFETY CULTURE THROUGH IMMERSIVE AWARENESS PROGRAMS AND STRUCTURED TRAINING

10.8

PEDESTRIAN & VRU PROTECTION

10.8.1

INTEGRATING SMART INFRASTRUCTURE AND DETECTION SYSTEMS TO SAFEGUARD PEDESTRIANS AND VULNERABLE ROAD USERS THROUGH REAL-TIME ALERTS

10.9

WORK ZONE SAFETY MANAGEMENT

10.9.1

ENHANCING SAFETY IN ACTIVE WORK ZONES BY DEPLOYING CONNECTED ENFORCEMENT SYSTEMS AND DYNAMIC WARNINGS TO PREVENT COLLISIONS AND PROTECT ROAD CREWS

10.10

INSURANCE RISK ASSESSMENT

10.10.1

UTILIZING BEHAVIORAL ANALYTICS AND TELEMATICS TO ACCURATELY ASSESS DRIVER RISK PROFILES AND INFORM DYNAMIC, USAGE-BASED INSURANCE AND SAFETY STRATEGIES

11

ROAD SAFETY MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 16 Data Tables

187

11.1.1

END USER: ROAD SAFETY MARKET DRIVERS

11.2

GOVERNMENT & MUNICIPALITIES

11.2.1

GOVERNMENTS AND MUNICIPALITIES LEAD ROAD SAFETY EFFORTS THROUGH FUNDING, REGULATION, AND SMART CITY INITIATIVES

11.3.1

HIGHWAY AUTHORITIES ADOPT SMART INFRASTRUCTURE TO ENSURE SAFETY ON HIGH-SPEED ROAD NETWORKS

11.4

LAW ENFORCEMENT AGENCIES

11.4.1

LAW ENFORCEMENT AGENCIES EMBRACE SURVEILLANCE AND ANALYTICS TO MONITOR AND CONTROL TRAFFIC VIOLATIONS

11.5

PRIVATE TOLL OPERATORS

11.5.1

TOLL OPERATORS INVEST IN INTELLIGENT SYSTEMS TO ENSURE SAFE, EFFICIENT, AND COMPLIANT ROAD USAGE

11.6

SMART CITY INTEGRATORS

11.6.1

SMART CITY INTEGRATORS EMBED ROAD SAFETY WITHIN BROADER URBAN DIGITAL INFRASTRUCTURE

11.7

CONSTRUCTION COMPANIES

11.7.1

CONSTRUCTION FIRMS IMPLEMENT SAFETY PROTOCOLS AND TECHNOLOGIES ACROSS ROAD DEVELOPMENT PHASES

12

ROAD SAFETY MARKET, BY REGION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 180 Data Tables

198

12.2.1

NORTH AMERICA: ROAD SAFETY MARKET DRIVERS

12.2.2

NORTH AMERICA: MACROECONOMIC OUTLOOK

12.2.3.1

Institutionalized cross-sector data integration and predictive enforcement to scale vision zero across diverse urban and rural mobility ecosystems

12.2.4.1

Align safety modernization with climate goals through municipal co-funding, open data mandates, and community-based AI enforcement

12.3.1

EUROPE: ROAD SAFETY MARKET DRIVERS

12.3.2

EUROPE: MACROECONOMIC OUTLOOK

12.3.3.1

UK’s nationwide deployment of AI-powered speed enforcement, smart crossings, and connected mobility zones to drive toward zero fatalities

12.3.4.1

Germany scaling road safety through V2X integration, dynamic lane controls, and urban zero-vision zones

12.3.5.1

France’s tech-driven road safety surge expanding autonomous radar networks, smart signage, and urban speed harmonization

12.3.6.1

Italy building safer streets through urban ITS deployment, smart crosswalks, and behavioral analytics to protect vulnerable road users

12.3.7.1

Spain’s smart enforcement strategy scaling intelligent cameras, real-time incident detection, and speed harmonization for safer mobility

12.4.1

ASIA PACIFIC: ROAD SAFETY MARKET DRIVER

12.4.2

ASIA PACIFIC: MACROECONOMIC OUTLOOK

12.4.3.1

China scales AI-driven enforcement in tier 2/3 cities

12.4.4.1

Japan deploying smart crosswalks with embedded led alerts and pedestrian protection systems

12.4.5.1

Accelerating road safety transformation through data-driven enforcement and public-private innovation

12.4.6

AUSTRALIA & NEW ZEALAND

12.4.6.1

Pioneering smart safety through predictive analytics and digital infrastructure for zero fatality roads

12.4.7.1

Unlocking scalable road safety through regional standards and smart mobility innovation

12.4.8.1

Korea driving Vision Zero through AI-powered pedestrian safety and urban intelligence

12.4.9

REST OF ASIA PACIFIC

12.5

MIDDLE EAST & AFRICA

12.5.1

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET DRIVERS

12.5.2

MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

12.5.3.1

Drive holistic integration of AI, infrastructure, and enforcement under Vision 2030 mobility goals

12.5.4

UNITED ARAB EMIRATES (UAE)

12.5.4.1

Expand interoperable urban safety platforms leveraging AI, V2X, and municipal data integration

12.5.5.1

Expansion of multi-layered safety programs integrating enforcement, education, and urban design in high-risk zones

12.5.6.1

Leveraging world cup infrastructure legacy to build scalable, high-compliance smart enforcement mode

12.5.7

REST OF MIDDLE EAST & AFRICA

12.6.1

LATIN AMERICA: ROAD SAFETY MARKET DRIVERS

12.6.2

LATIN AMERICA: MACROECONOMIC OUTLOOK

12.6.3.1

Modernizing legacy enforcement networks through regionalized, data-centric road safety platforms

12.6.4.1

Expansion of municipal safety intelligence systems to address VRU vulnerability and informal transit risks

12.6.5.1

Strengthening of data-driven enforcement and crash analytics amid institutional decentralization

12.6.6

REST OF LATIN AMERICA

13

COMPETITIVE LANDSCAPE

Uncover strategic shifts and market dominance in road safety tech from 2022 to 2025.

268

13.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025

13.3

REVENUE ANALYSIS, 2020–2024

13.4

MARKET SHARE ANALYSIS, 2024

13.4.1

MARKET RANKING ANALYSIS

13.5

PRODUCT COMPARATIVE ANALYSIS

13.5.1

PRODUCT COMPARATIVE ANALYSIS, BY HARDWARE (ROAD SAFETY)

13.5.1.1

TruSpeed Laser (Laser Technology)

13.5.1.2

Redflex RadarCam (Traffic Management Technologies)

13.5.1.3

Enforcer Portable System (Trifoil Group)

13.5.1.4

Camera-based Speed System (Syntell)

13.5.1.5

Gatso T-Series (Sensys Gatso Group)

13.5.2

PRODUCT COMPARATIVE ANALYSIS, BY SOFTWARE (ROAD SAFETY)

13.5.2.1

TRIPS platform (Fred Engineering)

13.5.2.2

Behavior AI (Humanising Autonomy)

13.5.2.3

SafeCam AI (Vebits AI)

13.5.2.4

SmartMobility Suite (Connected Wise)

13.5.2.5

LiveRoad Insights (LiveRoad Analytics)

13.6

COMPANY VALUATION AND FINANCIAL METRICS

13.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

13.7.5

COMPANY FOOTPRINT: KEY PLAYERS, 2024

13.7.5.1

Company footprint

13.7.5.2

Regional footprint

13.7.5.3

Offering footprint

13.7.5.4

Application footprint

13.7.5.5

End user footprint

13.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES (HARDWARE), 2024

13.8.1

PROGRESSIVE COMPANIES

13.8.2

RESPONSIVE COMPANIES

13.9

COMPANY EVALUATION MATRIX: STARTUPS/SMES (SOFTWARE), 2024

13.9.1

PROGRESSIVE COMPANIES

13.9.2

RESPONSIVE COMPANIES

13.9.5

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

13.9.5.1

Detailed list of key startups/SMEs

13.9.5.2

Competitive benchmarking of key startups/SMEs (hardware)

13.9.5.3

Competitive benchmarking of key startups/SMEs (software)

13.10

COMPETITIVE SCENARIO AND TRENDS

13.10.1

PRODUCT LAUNCHES AND ENHANCEMENTS

14

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

294

14.1.1.1

Business overview

14.1.1.2

Products/Solutions/Services offered

14.1.1.3

Recent developments

14.1.3

SENSYS GATSO GROUP

14.1.6

MOTOROLA SOLUTIONS

14.1.12

CUBIC CORPORATION

14.1.14

LASER TECHNOLOGIES

14.2.1

TRAFFIC MANAGEMENT TECHNOLOGIES

14.2.6

CLEARVIEW INTELLIGENCE

14.2.10

HUMANISING AUTONOMY

14.2.12

CONNECTED WISE LLC

14.2.14

LIVEROAD ANALYTICS

15

ADJACENT AND RELATED MARKETS

360

15.2

TRAFFIC MANAGEMENT MARKET - GLOBAL FORECAST TO 2029

15.2.2.1

Traffic management market, by offering

15.2.2.2

Traffic management market, by area of application

15.2.2.3

Traffic management market, by end user

15.2.2.4

Traffic management market, by region

15.3

SMART TRANSPORTATION MARKET - GLOBAL FORECAST TO 2029

15.3.2.1

Smart transportation market, by transportation mode

15.3.2.2

Smart transportation market, by roadway

15.3.2.3

Smart transportation market, by railway

15.3.2.4

Smart transportation market, by airway

15.3.2.5

Smart transportation market, by maritime

15.3.2.6

Smart transportation market, by region

16.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3

CUSTOMIZATION OPTIONS

TABLE 1

UNITED STATES DOLLAR EXCHANGE RATE, 2020–2024

TABLE 3

GLOBAL ROAD SAFETY MARKET SIZE AND GROWTH RATE, 2020–2024 (USD MILLION, Y-O-Y %)

TABLE 4

GLOBAL ROAD SAFETY MARKET SIZE AND GROWTH RATE, 2025–2030 (USD MILLION, Y-O-Y %)

TABLE 5

US: ADJUSTED RECIPROCAL TARIFF RATES

TABLE 6

EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

TABLE 7

ROAD SAFETY MARKET: ECOSYSTEM

TABLE 8

TARIFF RELATED TO ELECTRICAL SIGNALING, SAFETY, AND TRAFFIC CONTROL EQUIPMENT

TABLE 9

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

EXPORT DATA FOR HS CODE 853080 - ELECTRICAL SIGNALING AND TRAFFIC CONTROL EQUIPMENT, BY COUNTRY, 2020-2024 (USD MILLION)

TABLE 14

IMPORT DATA FOR HS CODE 853080 - ELECTRICAL SIGNALING AND TRAFFIC CONTROL EQUIPMENT, BY COUNTRY, 2020-2024 (USD MILLION)

TABLE 15

PATENTS FILED, 2016–2025

TABLE 16

LIST OF TOP PATENTS IN ROAD SAFETY MARKET, 2024-2025

TABLE 17

PRICING DATA OF ROAD SAFETY MARKET, BY OFFERING

TABLE 18

PRICING DATA OF ROAD SAFETY MARKET, BY APPLICATION

TABLE 19

ROAD SAFETY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

TABLE 20

ROAD SAFETY MARKET: PORTER’S FIVE FORCES MODEL

TABLE 21

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 22

KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 23

PARTNERSHIP TYPE AND STRATEGIC VALUE

TABLE 24

STRATEGIC IMPERATIVES FOR STAKEHOLDERS

TABLE 25

ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 26

ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 27

ROAD SAFETY MARKET, BY SOLUTION, 2020–2024 (USD MILLION)

TABLE 28

ROAD SAFETY MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 29

ROAD SAFETY MARKET, BY SOLUTION TYPE, 2020–2024 (USD MILLION)

TABLE 30

ROAD SAFETY MARKET, BY SOLUTION TYPE, 2025–2030 (USD MILLION)

TABLE 31

ENFORCEMENT SOLUTIONS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 32

ENFORCEMENT SOLUTIONS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 33

ALPR/ANPR: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 34

ALPR/ANPR: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 35

INCIDENT DETECTION AND RESPONSE: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 36

INCIDENT DETECTION AND RESPONSE: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 37

TRAFFIC MONITORING & CONTROL: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 38

TRAFFIC MONITORING & CONTROL: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 39

PEDESTRIAN SAFETY: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 40

PEDESTRIAN SAFETY: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 41

ROAD SAFETY MARKET, BY COMPONENT, 2020–2024 (USD MILLION)

TABLE 42

ROAD SAFETY MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 43

HARDWARE: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 44

HARDWARE: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 45

SOFTWARE: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 46

SOFTWARE: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 47

ROAD SAFETY MARKET, BY SERVICE, 2020–2024 (USD MILLION)

TABLE 48

ROAD SAFETY MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 49

PROFESSIONAL SERVICES: ROAD SAFETY MARKET, BY TYPE, 2020–2024 (USD MILLION)

TABLE 50

PROFESSIONAL SERVICES: ROAD SAFETY MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 51

CONSULTING: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 52

CONSULTING: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 53

SYSTEM INTEGRATION: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 54

SYSTEM INTEGRATION: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 55

TRAINING: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 56

TRAINING: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 57

ROAD SAFETY AUDITS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 58

ROAD SAFETY AUDITS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 59

MANAGED SERVICES: ROAD SAFETY MARKET, BY TYPE, 2020–2024 (USD MILLION)

TABLE 60

MANAGED SERVICES: ROAD SAFETY MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 61

OUTSOURCED OPERATIONS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 62

OUTSOURCED OPERATIONS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 63

SYSTEM MAINTENANCE: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 64

SYSTEM MAINTENANCE: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 65

ANALYTICS-AS-A-SERVICE: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 66

ANALYTICS-AS-A-SERVICE: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 67

BACK-OFFICE PROCESSING: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 68

BACK-OFFICE PROCESSING: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 69

ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2020–2024 (USD MILLION)

TABLE 70

ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2025–2030 (USD MILLION)

TABLE 71

FIXED INSTALLATIONS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 72

FIXED INSTALLATIONS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 73

MOBILE/TRAILER-MOUNTED SYSTEMS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 74

MOBILE/TRAILER-MOUNTED SYSTEMS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 75

PORTABLE/TEMPORARY SOLUTIONS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 76

PORTABLE/TEMPORARY SOLUTIONS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 77

CLOUD-BASED PLATFORMS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 78

CLOUD-BASED PLATFORMS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 79

ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2020–2024 (USD MILLION)

TABLE 80

ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2025–2030 (USD MILLION)

TABLE 81

AUTOMATED ENFORCEMENT: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 82

AUTOMATED ENFORCEMENT: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 83

MANUAL ENFORCEMENT: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 84

MANUAL ENFORCEMENT: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 85

HYBRID ENFORCEMENT: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 86

HYBRID ENFORCEMENT: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 87

ROAD SAFETY MARKET, BY DATA TYPE, 2020–2024 (USD MILLION)

TABLE 88

ROAD SAFETY MARKET, BY DATA TYPE, 2025–2030 (USD MILLION)

TABLE 89

VIDEO & IMAGE: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 90

VIDEO & IMAGE: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 91

SENSOR DATA: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 92

SENSOR DATA: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 93

INTEGRATED BIG DATA: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 94

INTEGRATED BIG DATA: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 95

ROAD SAFETY MARKET, BY APPLICATION, 2020–2024 (USD MILLION)

TABLE 96

ROAD SAFETY MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 97

VIOLATION MANAGEMENT: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 98

VIOLATION MANAGEMENT: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 99

TRAFFIC OPTIMIZATION: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 100

TRAFFIC OPTIMIZATION: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 101

ACCIDENT PREVENTION: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 102

ACCIDENT PREVENTION: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 103

EMERGENCY RESPONSE: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 104

EMERGENCY RESPONSE: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 105

DRIVER BEHAVIOR MONITORING: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 106

DRIVER BEHAVIOR MONITORING: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 107

PUBLIC AWARENESS/TRAINING: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 108

PUBLIC AWARENESS/TRAINING: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 109

PEDESTRIAN & VRU PROTECTION: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 110

PEDESTRIAN & VRU PROTECTION: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 111

WORK ZONE SAFETY MANAGEMENT: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 112

WORK ZONE SAFETY MANAGEMENT: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 113

INSURANCE RISK ASSESSMENT: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 114

INSURANCE RISK ASSESSMENT: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 115

ROAD SAFETY MARKET, BY END USER, 2020–2024 (USD MILLION)

TABLE 116

ROAD SAFETY MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 117

GOVERNMENT & MUNICIPALITIES: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 118

GOVERNMENT & MUNICIPALITIES: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 119

HIGHWAY AUTHORITIES: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 120

HIGHWAY AUTHORITIES: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 121

LAW ENFORCEMENT AGENCIES: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 122

LAW ENFORCEMENT AGENCIES: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 123

PRIVATE TOLL OPERATORS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 124

PRIVATE TOLL OPERATORS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 125

SMART CITY INTEGRATORS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 126

SMART CITY INTEGRATORS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 127

CONSTRUCTION COMPANIES: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 128

CONSTRUCTION COMPANIES: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 129

OTHER END USERS: ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 130

OTHER END USERS: ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 131

ROAD SAFETY MARKET, BY REGION, 2020–2024 (USD MILLION)

TABLE 132

ROAD SAFETY MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 133

NORTH AMERICA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 134

NORTH AMERICA: ROAD SAFETY MARKET, BY OFFERING,2025–2030 (USD MILLION)

TABLE 135

NORTH AMERICA: ROAD SAFETY MARKET, BY SOLUTION, 2020–2024 (USD MILLION)

TABLE 136

NORTH AMERICA: ROAD SAFETY MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 137

NORTH AMERICA: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2020–2024 (USD MILLION)

TABLE 138

NORTH AMERICA: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2025–2030 (USD MILLION)

TABLE 139

NORTH AMERICA: ROAD SAFETY MARKET, BY COMPONENT, 2020–2024 (USD MILLION)

TABLE 140

NORTH AMERICA: ROAD SAFETY MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 141

NORTH AMERICA: ROAD SAFETY MARKET, BY SERVICE, 2020–2024 (USD MILLION)

TABLE 142

NORTH AMERICA: ROAD SAFETY MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 143

NORTH AMERICA: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2020–2024 (USD MILLION)

TABLE 144

NORTH AMERICA: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2025–2030 (USD MILLION)

TABLE 145

NORTH AMERICA: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2020–2024 (USD MILLION)

TABLE 146

NORTH AMERICA: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2025–2030 (USD MILLION)

TABLE 147

NORTH AMERICA: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2020–2024 (USD MILLION)

TABLE 148

NORTH AMERICA: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL,2025–2030 (USD MILLION)

TABLE 149

NORTH AMERICA: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2020–2024 (USD MILLION)

TABLE 150

NORTH AMERICA: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2025–2030 (USD MILLION)

TABLE 151

NORTH AMERICA: ROAD SAFETY MARKET, BY DATA TYPE, 2020–2024 (USD MILLION)

TABLE 152

NORTH AMERICA: ROAD SAFETY MARKET, BY DATA TYPE, 2025–2030 (USD MILLION)

TABLE 153

NORTH AMERICA: ROAD SAFETY MARKET, BY APPLICATION, 2020–2024 (USD MILLION)

TABLE 154

NORTH AMERICA: ROAD SAFETY MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 155

NORTH AMERICA: ROAD SAFETY MARKET, BY END USER, 2020–2024 (USD MILLION)

TABLE 156

NORTH AMERICA: ROAD SAFETY MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 157

NORTH AMERICA: ROAD SAFETY MARKET, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 158

NORTH AMERICA: ROAD SAFETY MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 159

US: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 160

US: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 161

CANADA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 162

CANADA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 163

EUROPE: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 164

EUROPE: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 165

EUROPE: ROAD SAFETY MARKET, BY SOLUTION, 2020–2024 (USD MILLION)

TABLE 166

EUROPE: ROAD SAFETY MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 167

EUROPE: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2020–2024 (USD MILLION)

TABLE 168

EUROPE: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2025–2030 (USD MILLION)

TABLE 169

EUROPE: ROAD SAFETY MARKET, BY COMPONENT, 2020–2024 (USD MILLION)

TABLE 170

EUROPE: ROAD SAFETY MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 171

EUROPE: ROAD SAFETY MARKET, BY SERVICE, 2020–2024 (USD MILLION)

TABLE 172

EUROPE: ROAD SAFETY MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 173

EUROPE: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2020–2024 (USD MILLION)

TABLE 174

EUROPE: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2025–2030 (USD MILLION)

TABLE 175

EUROPE: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2020–2024 (USD MILLION)

TABLE 176

EUROPE: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2025–2030 (USD MILLION)

TABLE 177

EUROPE: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2020–2024 (USD MILLION)

TABLE 178

EUROPE: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2025–2030 (USD MILLION)

TABLE 179

EUROPE: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2020–2024 (USD MILLION)

TABLE 180

EUROPE: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2025–2030 (USD MILLION)

TABLE 181

EUROPE: ROAD SAFETY MARKET, BY DATA TYPE, 2020–2024 (USD MILLION)

TABLE 182

EUROPE: ROAD SAFETY MARKET, BY DATA TYPE, 2025–2030 (USD MILLION)

TABLE 183

EUROPE: ROAD SAFETY MARKET, BY APPLICATION, 2020–2024 (USD MILLION)

TABLE 184

EUROPE: ROAD SAFETY MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 185

EUROPE: ROAD SAFETY MARKET, BY END USER, 2020–2024 (USD MILLION)

TABLE 186

EUROPE: ROAD SAFETY MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 187

EUROPE: ROAD SAFETY MARKET, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 188

EUROPE: ROAD SAFETY MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 189

UK: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 190

UK: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 191

GERMANY: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 192

GERMANY: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 193

FRANCE: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 194

FRANCE: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 195

ITALY: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 196

ITALY: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 197

SPAIN: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 198

SPAIN: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 199

REST OF EUROPE: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 200

REST OF EUROPE: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 201

ASIA PACIFIC: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 202

ASIA PACIFIC: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 203

ASIA PACIFIC: ROAD SAFETY MARKET, BY SOLUTION, 2020–2024 (USD MILLION)

TABLE 204

ASIA PACIFIC: ROAD SAFETY MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 205

ASIA PACIFIC: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2020–2024 (USD MILLION)

TABLE 206

ASIA PACIFIC: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2025–2030 (USD MILLION)

TABLE 207

ASIA PACIFIC: ROAD SAFETY MARKET, BY COMPONENT, 2020–2024 (USD MILLION)

TABLE 208

ASIA PACIFIC: ROAD SAFETY MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 209

ASIA PACIFIC: ROAD SAFETY MARKET, BY SERVICE, 2020–2024 (USD MILLION)

TABLE 210

ASIA PACIFIC: ROAD SAFETY MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 211

ASIA PACIFIC: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2020–2024 (USD MILLION)

TABLE 212

ASIA PACIFIC: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2025–2030 (USD MILLION)

TABLE 213

ASIA PACIFIC: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2020–2024 (USD MILLION)

TABLE 214

ASIA PACIFIC: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2025–2030 (USD MILLION)

TABLE 215

ASIA PACIFIC: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2020–2024 (USD MILLION)

TABLE 216

ASIA PACIFIC: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2025–2030 (USD MILLION)

TABLE 217

ASIA PACIFIC: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2020–2024 (USD MILLION)

TABLE 218

ASIA PACIFIC: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2025–2030 (USD MILLION)

TABLE 219

ASIA PACIFIC: ROAD SAFETY MARKET, BY DATA TYPE, 2020–2024 (USD MILLION)

TABLE 220

ASIA PACIFIC: ROAD SAFETY MARKET, BY DATA TYPE, 2025–2030 (USD MILLION)

TABLE 221

ASIA PACIFIC: ROAD SAFETY MARKET, BY APPLICATION, 2020–2024 (USD MILLION)

TABLE 222

ASIA PACIFIC: ROAD SAFETY MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 223

ASIA PACIFIC: ROAD SAFETY MARKET, BY END USER, 2020–2024 (USD MILLION)

TABLE 224

ASIA PACIFIC: ROAD SAFETY MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 225

ASIA PACIFIC: ROAD SAFETY MARKET, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 226

ASIA PACIFIC: ROAD SAFETY MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 227

CHINA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 228

CHINA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 229

JAPAN: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 230

JAPAN: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 231

INDIA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 232

INDIA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 233

AUSTRALIA & NEW ZEALAND: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 234

AUSTRALIA & NEW ZEALAND: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 235

ASEAN: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 236

ASEAN: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 237

SOUTH KOREA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 238

SOUTH KOREA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 239

REST OF ASIA PACIFIC: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 240

REST OF ASIA PACIFIC: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 241

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 242

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 243

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY SOLUTION, 2020–2024 (USD MILLION)

TABLE 244

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 245

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2020–2024 (USD MILLION)

TABLE 246

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2025–2030 (USD MILLION)

TABLE 247

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY COMPONENT, 2020–2024 (USD MILLION)

TABLE 248

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 249

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY SERVICE, 2020–2024 (USD MILLION)

TABLE 250

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 251

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2020–2024 (USD MILLION)

TABLE 252

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2025–2030 (USD MILLION)

TABLE 253

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2020–2024 (USD MILLION)

TABLE 254

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2025–2030 (USD MILLION)

TABLE 255

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2020–2024 (USD MILLION)

TABLE 256

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2025–2030 (USD MILLION)

TABLE 257

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2020–2024 (USD MILLION)

TABLE 258

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2025–2030 (USD MILLION)

TABLE 259

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY DATA TYPE, 2020–2024 (USD MILLION)

TABLE 260

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY DATA TYPE, 2025–2030 (USD MILLION)

TABLE 261

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY APPLICATION, 2020–2024 (USD MILLION)

TABLE 262

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 263

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY END USER, 2020–2024 (USD MILLION)

TABLE 264

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 265

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 266

MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 267

SAUDI ARABIA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 268

SAUDI ARABIA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 269

UAE: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 270

UAE: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 271

SOUTH AFRICA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 272

SOUTH AFRICA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 273

QATAR: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 274

QATAR: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 275

REST OF MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 276

REST OF MIDDLE EAST & AFRICA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 277

LATIN AMERICA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 278

LATIN AMERICA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 279

LATIN AMERICA: ROAD SAFETY MARKET, BY SOLUTION, 2020–2024 (USD MILLION)

TABLE 280

LATIN AMERICA: ROAD SAFETY MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 281

LATIN AMERICA: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2020–2024 (USD MILLION)

TABLE 282

LATIN AMERICA: ROAD SAFETY MARKET, BY SOLUTION TYPE, 2025–2030 (USD MILLION)

TABLE 283

LATIN AMERICA: ROAD SAFETY MARKET, BY COMPONENT, 2020–2024 (USD MILLION)

TABLE 284

LATIN AMERICA: ROAD SAFETY MARKET, BY COMPONENT, 2025–2030 (USD MILLION)

TABLE 285

LATIN AMERICA: ROAD SAFETY MARKET, BY SERVICE, 2020–2024 (USD MILLION)

TABLE 286

LATIN AMERICA: ROAD SAFETY MARKET, BY SERVICE, 2025–2030 (USD MILLION)

TABLE 287

LATIN AMERICA: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2020–2024 (USD MILLION)

TABLE 288

LATIN AMERICA: ROAD SAFETY MARKET, BY PROFESSIONAL SERVICE, 2025–2030 (USD MILLION)

TABLE 289

LATIN AMERICA: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2020–2024 (USD MILLION)

TABLE 290

LATIN AMERICA: ROAD SAFETY MARKET, BY MANAGED SERVICE, 2025–2030 (USD MILLION)

TABLE 291

LATIN AMERICA: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2020–2024 (USD MILLION)

TABLE 292

LATIN AMERICA: ROAD SAFETY MARKET, BY DEPLOYMENT MODEL, 2025–2030 (USD MILLION)

TABLE 293

LATIN AMERICA: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE,2020–2024 (USD MILLION)

TABLE 294

LATIN AMERICA: ROAD SAFETY MARKET, BY ENFORCEMENT TYPE, 2025–2030 (USD MILLION)

TABLE 295

LATIN AMERICA: ROAD SAFETY MARKET, BY DATA TYPE, 2020–2024 (USD MILLION)

TABLE 296

LATIN AMERICA: ROAD SAFETY MARKET, BY DATA TYPE, 2025–2030 (USD MILLION)

TABLE 297

LATIN AMERICA: ROAD SAFETY MARKET, BY APPLICATION, 2020–2024 (USD MILLION)

TABLE 298

LATIN AMERICA: ROAD SAFETY MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 299

LATIN AMERICA: ROAD SAFETY MARKET, BY END USER, 2020–2024 (USD MILLION)

TABLE 300

LATIN AMERICA: ROAD SAFETY MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 301

LATIN AMERICA: ROAD SAFETY MARKET, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 302

LATIN AMERICA: ROAD SAFETY MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 303

BRAZIL: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 304

BRAZIL: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 305

MEXICO: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 306

MEXICO: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 307

ARGENTINA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 308

ARGENTINA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 309

REST OF LATIN AMERICA: ROAD SAFETY MARKET, BY OFFERING, 2020–2024 (USD MILLION)

TABLE 310

REST OF LATIN AMERICA: ROAD SAFETY MARKET, BY OFFERING, 2025–2030 (USD MILLION)

TABLE 311

OVERVIEW OF STRATEGIES ADOPTED BY KEY ROAD SAFETY VENDORS, 2022–2025

TABLE 312

ROAD SAFETY MARKET: DEGREE OF COMPETITION

TABLE 313

REGIONAL FOOTPRINT (13 COMPANIES), 2024

TABLE 314

OFFERING FOOTPRINT (13 COMPANIES), 2024

TABLE 315

APPLICATION FOOTPRINT (13 COMPANIES), 2024

TABLE 316

END USER FOOTPRINT (13 COMPANIES), 2024

TABLE 317

ROAD SAFETY MARKET: KEY STARTUPS/SMES, 2024

TABLE 318

ROAD SAFETY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (HARDWARE)

TABLE 319

ROAD SAFETY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (SOFTWARE)

TABLE 320

ROAD SAFETY MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2022–2025

TABLE 321

ROAD SAFETY MARKET: DEALS, 2022–2025

TABLE 322

JENOPTIK: COMPANY OVERVIEW

TABLE 323

JENOPTIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 324

JENOPTIK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 325

KAPSCH TRAFFICCOM: COMPANY OVERVIEW

TABLE 326

KAPSCH TRAFFICCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 327

KAPSCH TRAFFICCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 328

KAPSCH TRAFFICCOM: DEALS

TABLE 329

SENSYS GATSO GROUP: COMPANY OVERVIEW

TABLE 330

SENSYS GATSO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 331

SENSYS GATSO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 332

SENSYS GATSO GROUP: DEALS

TABLE 333

VERRA MOBILITY: COMPANY OVERVIEW

TABLE 334

VERRA MOBILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 335

VERRA MOBILITY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 336

VERRA MOBILITY: DEALS

TABLE 337

TELEDYNE FLIR: COMPANY OVERVIEW

TABLE 338

TELEDYNE FLIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 339

TELEDYNE FLIR: PRODUCT LAUNCH AND ENHANCEMENTS

TABLE 340

TELEDYNE FLIR: DEALS

TABLE 341

MOTOROLA SOLUTIONS: COMPANY OVERVIEW

TABLE 342

MOTOROLA SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 343

MOTOROLA SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 344

MOTOROLA SOLUTIONS: DEALS

TABLE 345

IDEMIA: COMPANY OVERVIEW

TABLE 346

IDEMIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 347

IDEMIA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 349

SWARCO: COMPANY OVERVIEW

TABLE 350

SWARCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 351

SWARCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 353

VITRONIC: COMPANY OVERVIEW

TABLE 354

VITRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 355

VITRONIC: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 356

SIEMENS: COMPANY OVERVIEW

TABLE 357

SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 359

CONDUENT: COMPANY OVERVIEW

TABLE 360

CONDUENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 361

CONDUENT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 362

CONDUENT: DEALS

TABLE 363

CUBIC CORPORATION: COMPANY OVERVIEW

TABLE 364

CUBIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 365

CUBIC: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 366

CUBIC CORPORATION: DEALS

TABLE 367

TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 368

TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 369

TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019–2023 (USD MILLION)

TABLE 370

TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024–2029 (USD MILLION)

TABLE 371

TRAFFIC MANAGEMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 372

TRAFFIC MANAGEMENT MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 373

TRAFFIC MANAGEMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 374

TRAFFIC MANAGEMENT MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 375

SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2018–2022 (USD MILLION)

TABLE 376

SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE,2023–2028 (USD MILLION)

TABLE 377

ROADWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 378

ROADWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 379

RAILWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 380

RAILWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 381

AIRWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 382

AIRWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 383

MARITIME: SMART TRANSPORTATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 384

MARITIME: SMART TRANSPORTATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 385

SMART TRANSPORTATION MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 386

SMART TRANSPORTATION MARKET, BY REGION, 2023–2028 (USD MILLION)

FIGURE 1

ROAD SAFETY MARKET: RESEARCH DESIGN

FIGURE 2

ROAD SAFETY MARKET: DATA TRIANGULATION

FIGURE 3

ROAD SAFETY MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 4

MARKET SIZE ESTIMATION METHODOLOGY — APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM SOLUTIONS AND SERVICES IN ROAD SAFETY MARKET

FIGURE 5

MARKET SIZE ESTIMATION METHODOLOGY — APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM KEY COMPANIES IN ROAD SAFETY MARKET

FIGURE 6

MARKET SIZE ESTIMATION METHODOLOGY — APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM BUSINESS UNITS (BUS) OF KEY VENDORS IN ROAD SAFETY MARKET

FIGURE 7

MARKET SIZE ESTIMATION METHODOLOGY — APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF ROAD SAFETY THROUGH OVERALL IT SPENDING ON ROAD SAFETY SOLUTIONS

FIGURE 8

AUTOMATED ENFORCEMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

FIGURE 9

VIDEO & IMAGE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

FIGURE 10

SOLUTIONS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

FIGURE 11

SMART CITY INTEGRATORS TO WITNESS HIGHEST GROWTH RATE IN END USER SEGMENT DURING FORECAST PERIOD

FIGURE 12

ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

FIGURE 13

ACCELERATING DIGITAL INFRASTRUCTURE AND ROAD SAFETY MANDATE ACROSS ASIA PACIFIC TO DRIVE ROAD SAFETY MARKET GROWTH

FIGURE 14

DRIVER BEHAVIOR MONITORING SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 15

VIDEO & IMAGE AND AUTOMATED ENFORCEMENT TO BE LARGEST SHAREHOLDERS IN NORTH AMERICAN ROAD SAFETY MARKET IN 2025

FIGURE 16

NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

FIGURE 17

DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ROAD SAFETY MARKET

FIGURE 18

ROAD SAFETY MARKET EVOLUTION

FIGURE 19

ROAD SAFETY MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 20

MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING ROAD SAFETY

FIGURE 21

KEY PLAYERS IN ROAD SAFETY MARKET ECOSYSTEM

FIGURE 22

ROAD SAFETY MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

FIGURE 23

ELECTRICAL SIGNALING AND TRAFFIC CONTROL EQUIPMENT EXPORT, BY KEY COUNTRY, 2020–2024 (USD MILLION)

FIGURE 24

ELECTRICAL SIGNALING AND TRAFFIC CONTROL EQUIPMENT IMPORT, BY KEY COUNTRY, 2020–2024 (USD MILLION)

FIGURE 25

NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2016–2025

FIGURE 26

REGIONAL ANALYSIS OF PATENTS GRANTED, 2016–2025

FIGURE 27

ROAD SAFETY MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 28

TRENDS IMPACTING CUSTOMERS: ROAD SAFETY MARKET

FIGURE 29

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

FIGURE 30

KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

FIGURE 31

SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 32

COMPONENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 33

INCIDENT DETECTION & RESPONSE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34

SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35

MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 36

TRAINING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37

ANALYTICS-AS-A-SERVICE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 38

CLOUD-BASED PLATFORMS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 39

AUTOMATED ENFORCEMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 40

INTEGRATED BIG DATA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 41

DRIVER BEHAVIOR MONITORING TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 42

SMART CITY INTEGRATORS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 43

NORTH AMERICA TO BE LARGEST REGIONAL MARKET DURING FORECAST PERIOD

FIGURE 44

INDIA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 45

NORTH AMERICA: MARKET SNAPSHOT

FIGURE 46

ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 47

TOP FIVE PUBLIC PLAYERS IN ROAD SAFETY MARKET, 2020–2024 (USD MILLION)

FIGURE 48

SHARE OF LEADING COMPANIES IN ROAD SAFETY MARKET, 2024

FIGURE 49

PRODUCT COMPARATIVE ANALYSIS (HARDWARE) (ROAD SAFETY)

FIGURE 50

PRODUCT COMPARATIVE ANALYSIS (SOFTWARE) (ROAD SAFETY)

FIGURE 51

FINANCIAL METRICS OF KEY VENDORS

FIGURE 52

YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

FIGURE 53

ROAD SAFETY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 54

COMPANY FOOTPRINT (13 COMPANIES), 2024

FIGURE 55

ROAD SAFETY MARKET: COMPANY EVALUATION MATRIX HARDWARE (STARTUPS/SMES), 2024

FIGURE 56

ROAD SAFETY MARKET: COMPANY EVALUATION MATRIX SOFTWARE (STARTUPS/SMES), 2024

FIGURE 57

JENOPTIK: COMPANY SNAPSHOT

FIGURE 58

KAPSCH TRAFFICCOM: COMPANY SNAPSHOT

FIGURE 59

SENSYS GATSO GROUP: COMPANY SNAPSHOT

FIGURE 60

MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

FIGURE 61

SIEMENS: COMPANY SNAPSHOT

FIGURE 62

CONDUENT: COMPANY SNAPSHOT

David

Sep, 2014

Interested in road safety market.

emrah

May, 2015

Interested in road safety market and related topics.

Maheswor

Jul, 2014

Interested in road safety market.

Jimmy

Jun, 2016

Interested in automation in ticket vending machine market.

Vincent

May, 2019

Collision avoidance (AEB - automatic emergency braking) market for heavy duty trucks and buses.

Daniel

May, 2019

Interested in road safety market.

Angelika

Apr, 2017

Understanding road safety market structure in Europe region.